2.6 macro objectives and policies

1/25

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

26 Terms

conflicting macroeconomic objectives

-economic growth and inflation

-economic growth and reducing inequality

-economic growth and environmental protection

-economic growth and BoP equilibrium

-unemployment and inflation

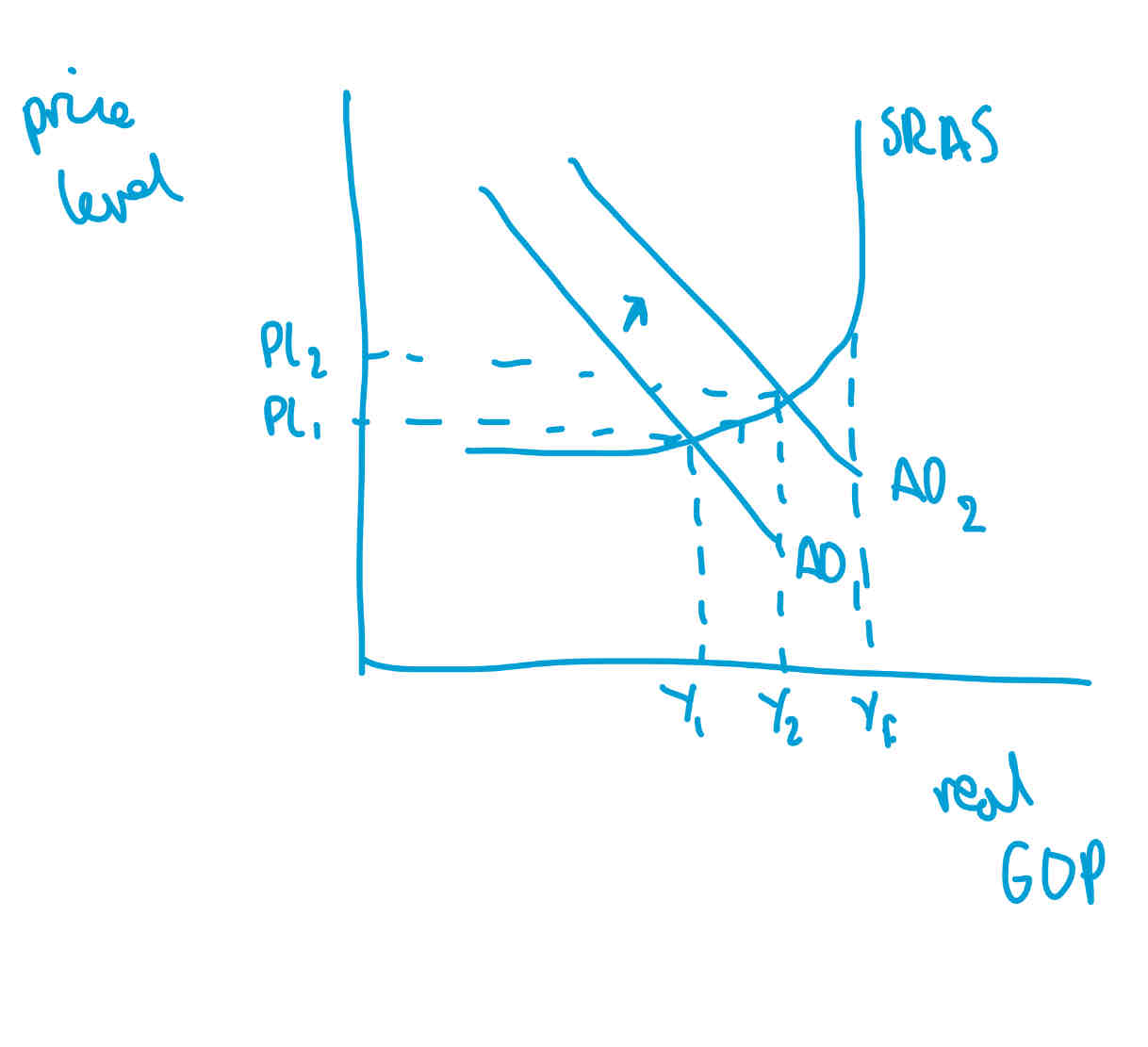

when is there a conflict between economic growth and inflation

short run:

an increase in GDP will cause demand pull inflation due to an increase in AD

may worsen BoP, as demand for exports increases, but unemployment decreases

when is there not a conflict between economic growth and inflation (SR)

if inflation was already below 2%, then an increase would bring it closer to BoEs target

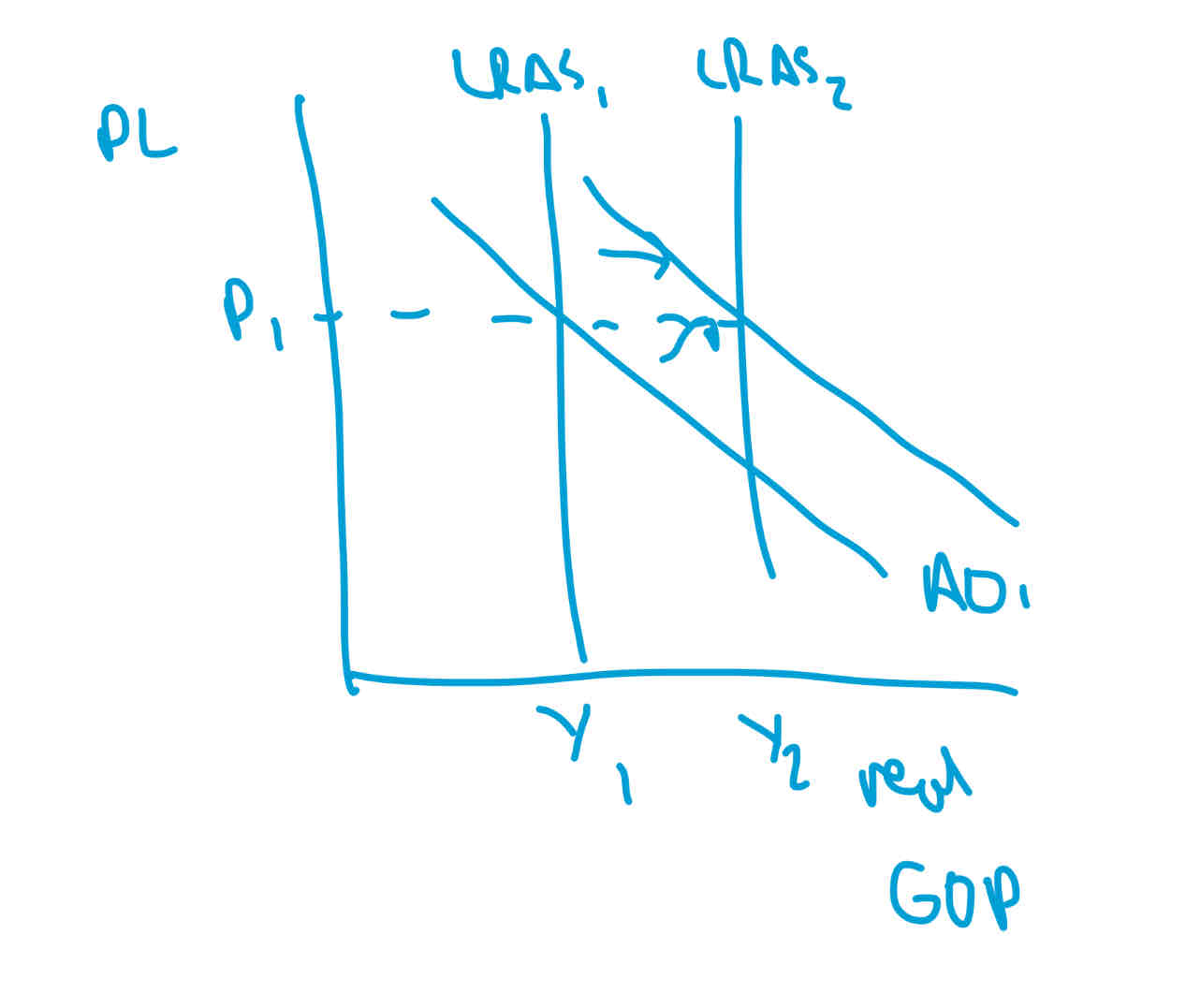

when is there not a conflict between economic growth and inflation (LR)

if an increase in real GDP happens without inflation, then the productive potential of the economy can increase, by improving quantity or quality of FoPs

if supply and demand increase at the same rate inflation wont happen

policies to reduce this conflict

-subsidise new technologies for firms

-policies to increase free trade of capital

-net immigration

-education/ training

-improve infrastrucutre

ways in which economic growth and reducing inequality don’t conflict

public services such as education, infrastructure and healthcare are improved

ways in which economic growth and reducing inequality conflict

short run growth increases inflation, which has the greatest effect on poorer people

privatisation of public services increases inequalities, as shareholders and senior executives benefit rather than workers

CEO to worker pay ratio has increased in the UK to 109 for FTSE 100 Jan 2024

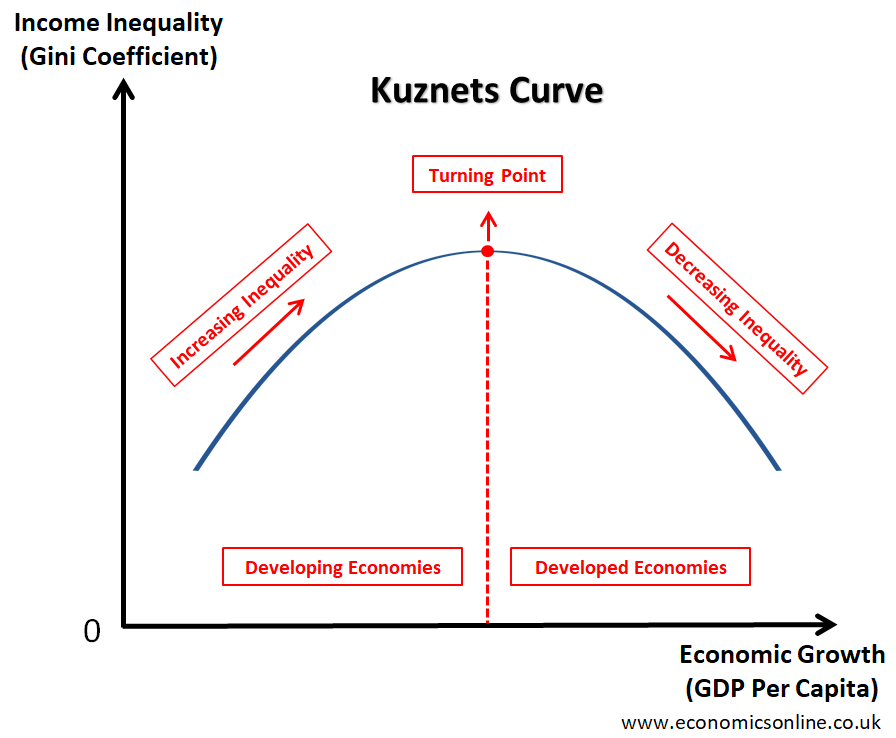

diagram for conflict between economic growth and environmental protection

kuznets curve

eval of kuznets curve

considers environmental degradation on a country scale, but post-industrial countries are likely shifting emissions abroad

why does economic growth and BoP conflict

as disposable income increases, demand for imports increases, increasing MPM, increasing current account deficit

why does economic growth and BoP not conflict

may lead to an increase in production and quality of UK goods, reducing the trade imbalance

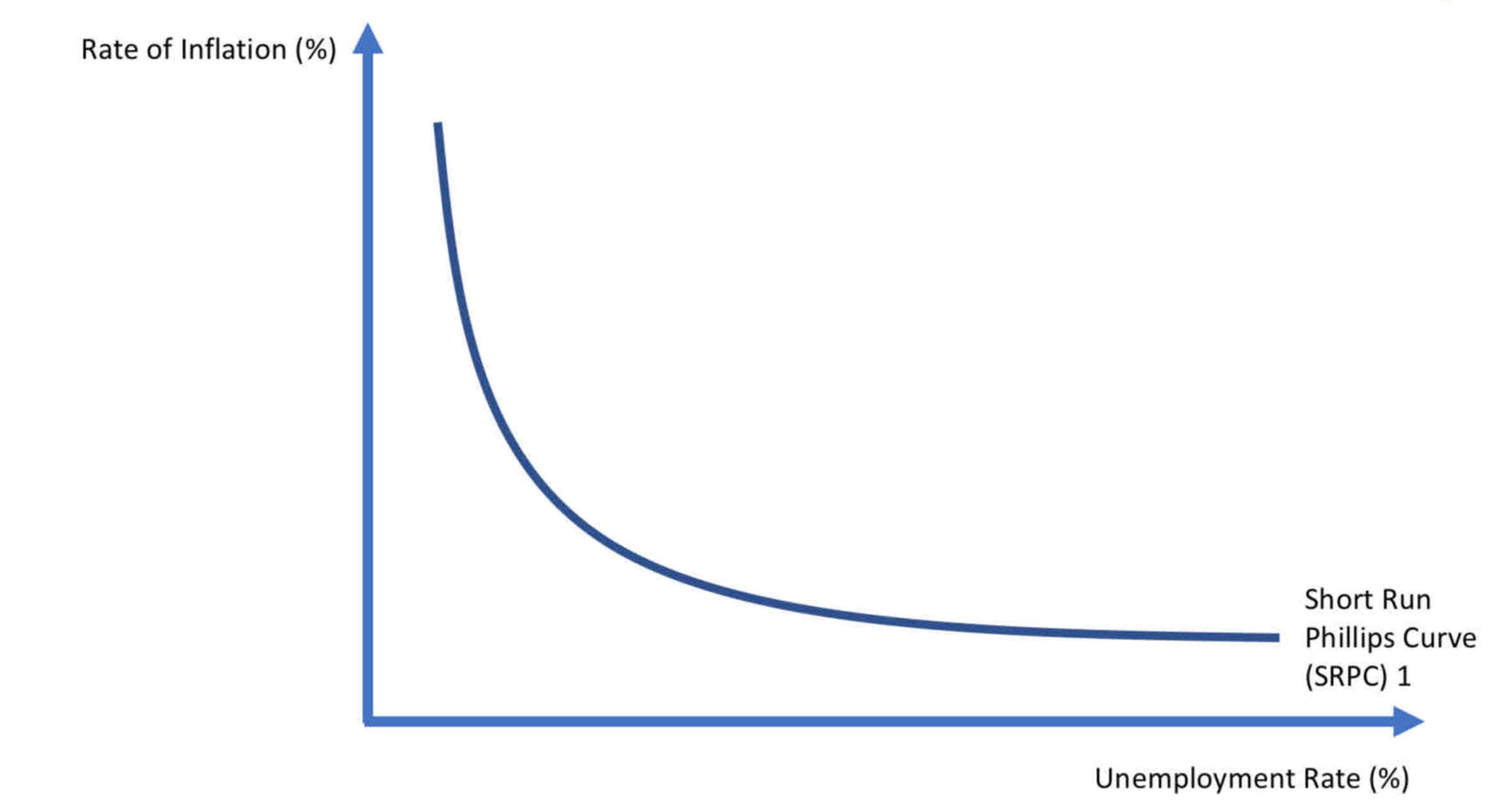

Short run Philips curve

What is the Phillips curve

Possible inverse relationship between unemployment rate and rate of inflation

Explain the Phillips curve

An increase in government spending generates growth and increases the derived demand for labour

Unemployment falls

Firms must compete for fewer workers by raising nominal wages

Workers have greater bargaining power to demand nominal wage rises

Wage costs rise

Firms pass on the costs of increased wages to consumers, creating cost push inflation

a decrease in unemployment would increase consumption increasing AD

This would cause demand pull inflation

Example of when the Phillips Curve was not accurate

In the US in the 1970s which experiences high unemployment and high inflation at the same time due to high oil prices

Evaluation of the Phillips curve

-Stagflation: low growth, high unemployment, high inflation, eg in the 1970s due to high oil prices

Why are wages sticky down

Trade unions

Minimum wage

Efficiency wage hypothesis

Why is raising interest rates unpopular

Trade unions want lower interest rates for higher employment

Businesses want lower interest rates for investments

Government wants lower interest rates to reduce interest payments

Supply side policies

-funding for infrastructure

-funding for education

-relax migration

-trade deal with EU

Demand side policy

Fiscal or monetary

Example of monetary policy

Changes to interest rates of quantitative easing

Example of fiscal policy

Changes in tax rates of government spending

Does demand side or supply side generally lead to more conflicts

Demand side

Factors to consider with conflicting MEPOs

other MEPOs

Short run vs long run

Classical vs Keynesian

If there is spare capacity in the economy

How does raising interest rates impact AD

BoE raises interest rates

Banks raise interest rates

Borrowing is discouraged, saving is encouraged

Consumption decreases

Investment decreased

Mortgages are more expensive, so demand decreases, so house prices decrease

Investors move money to savings accounts, so share value decreases

Negative wealth affect, further decreases consumption

Hot money flows increase, due to high savings rate, worsening BoP