Chapter 15: Working capital management

1/23

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

24 Terms

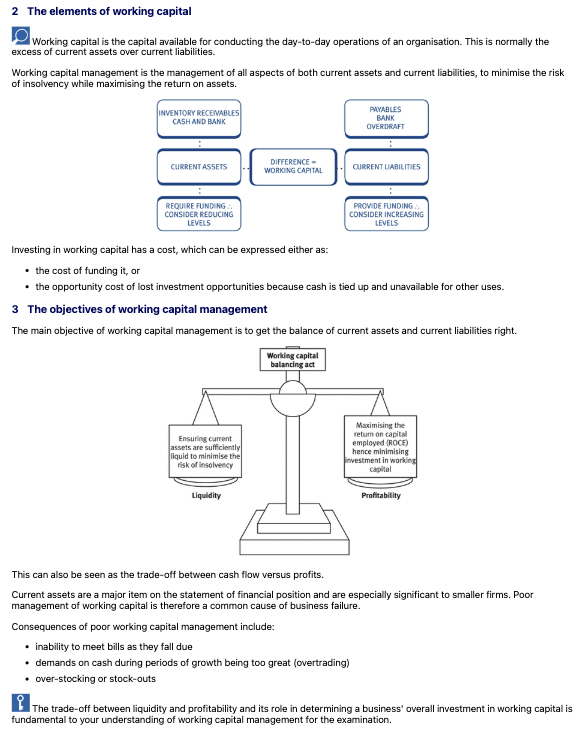

What is working capital?

What is the main goal of working capital management?

How is working capital calculated?

What are the two main costs of investing in working capital?

What is the trade-off in working capital management?

What are consequences of poor working capital management?

What is the key trade-off in working capital investment?

Why is cash flow as important as profit?

Give two examples of the cash flow vs profit timing difference.

What is liquidity in the context of working capital management?

What are the main sources of liquidity?

Give examples of the profitability vs liquidity trade-off.

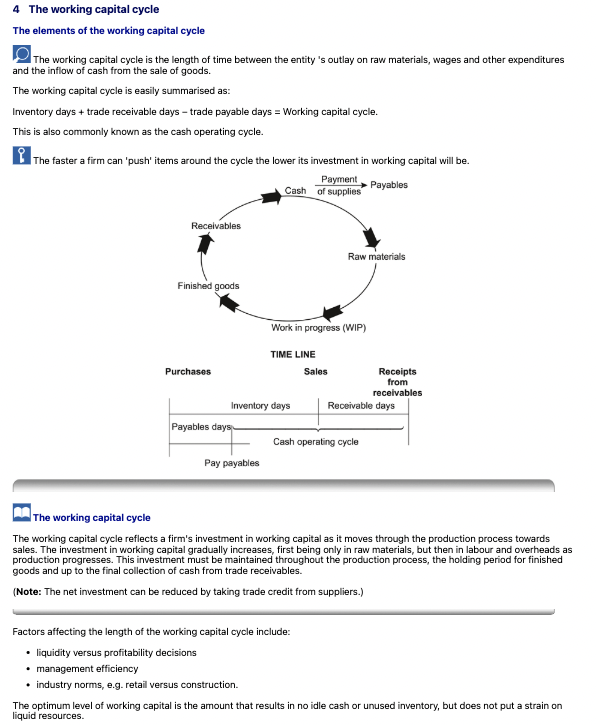

What is the working capital cycle?

What is the formula for the working capital cycle?

What does a shorter working capital cycle indicate?

What does the working capital cycle represent in terms of investment?

How can a firm reduce its net working capital investment?

What are the factors that impact working capital cycle?

What factors influence the length of the working capital cycle?

Why might shortening the working capital cycle be risky?

Why do supermarkets tend to have very short or negative working capital cycles?

Why do construction firms usually have long working capital cycles?

What causes an increase in the cash needed to fund the working capital cycle?

What happens if activity/sales stay constant but the cycle length increases?

What happens if the cycle length stays constant but sales increase?

What are five factors that influence the amount of working capital a business requires?

Why do manufacturing companies often require more working capital than retail companies?

How does selling perishable goods affect working capital levels?

Why is budgeting for working capital important?

What must businesses do in conditions of uncertainty regarding working capital?

List the six factors affecting working capital investment levels.

How does the credit policy of suppliers impact working capital investment?

What are the three working capital management policies?

What characterises an aggressive working capital policy?

What characterises a conservative working capital policy?

What is a moderate working capital policy?

List 3 benefits of an aggressive working capital approach.

List 3 benefits of a conservative working capital approach.

What is the trade-off between aggressive and conservative working capital policies?

What are the two components of working capital investment under the traditional approach?

What is the main trade-off when using short-term finance?

What are the two key risks of using short-term finance?

Under an aggressive working capital policy, how is funding typically structured?

Under a conservative working capital policy, how is funding typically structured?

Under a moderate working capital policy, how is funding typically structured?

What is overtrading and why is it risky?

What are the typical indicators of overtrading and how can it be resolved?

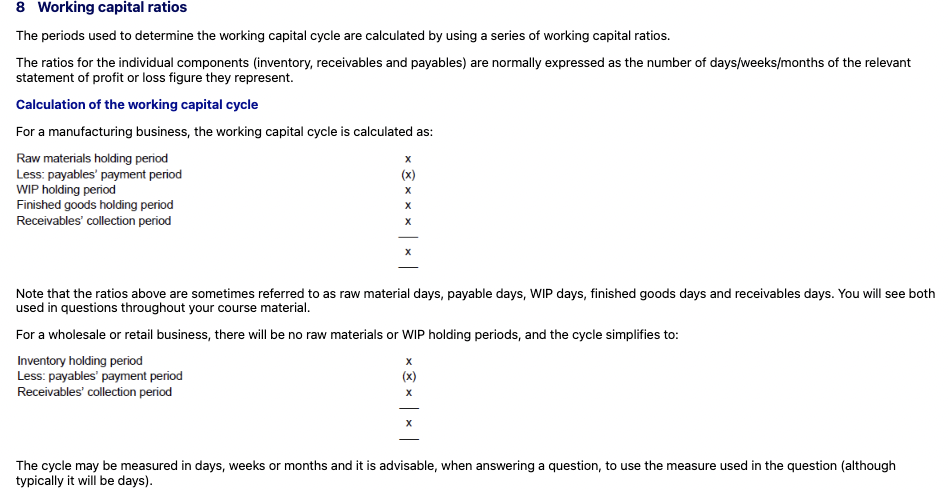

How is the working capital cycle calculated for manufacturing and retail/wholesale businesses?

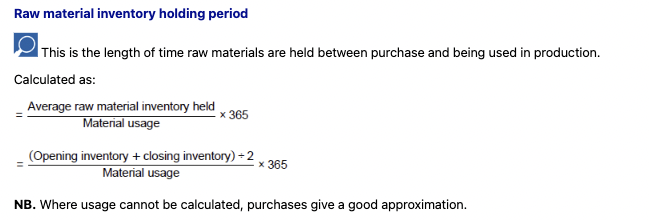

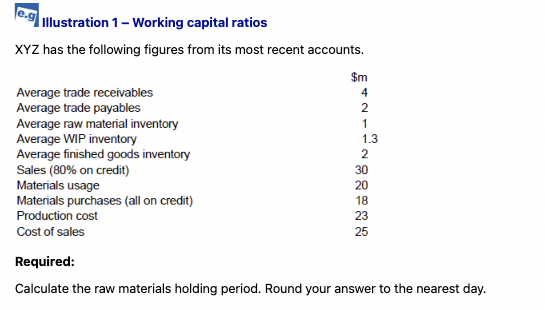

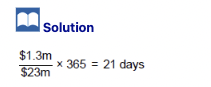

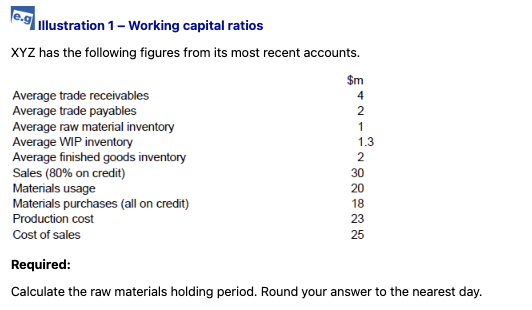

How is the raw material inventory holding period calculated?

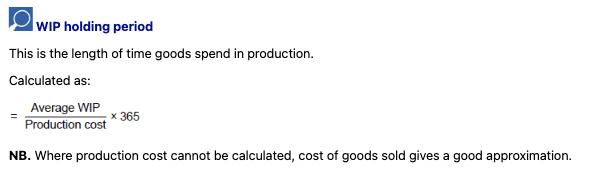

How do you calculate the WIP holding period?

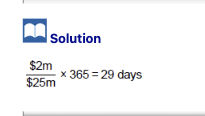

How do you calculate the finished goods inventory holding period?

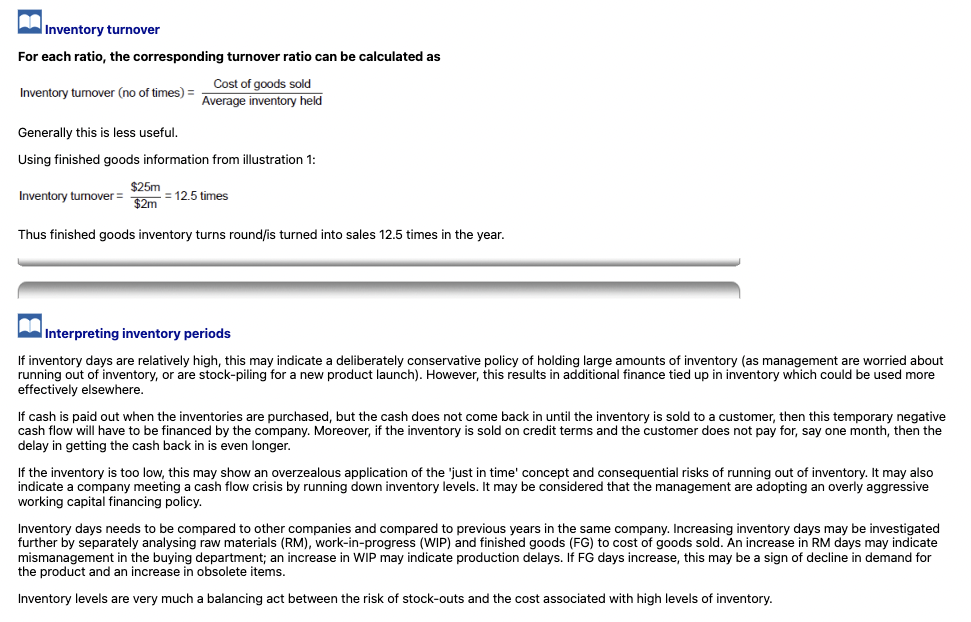

How is inventory turnover calculated?

What does an inventory turnover of 12.5 times mean?

What can high inventory days indicate?

What risks are associated with high inventory days?

What may low inventory levels indicate?

Why should inventory ratios be compared over time or with peers?

How are trade receivables days calculated?

What does the trade receivables collection period measure?

Why is a shorter receivables collection period better?

What factors influence receivables levels besides credit control?

What is the formula for calculating trade payables days?

What does the trade payables days ratio represent?

Using the information from illustration 1, calculate the trade payable days. Round your answer to the nearest day.

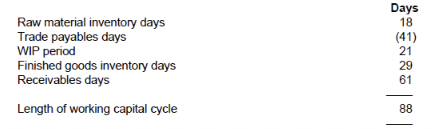

What should be used when calculating trade payables days: total purchases or cost of sales?

What adjustment might be needed for sales tax in trade payables calculations?

What is the typical method for averaging trade payables in ratio calculations?

Why compare receivables days with payables days?

What is the advantage of longer payables days?

What are risks of increasing trade payables days?

What is the key when interpreting trade payable ratios?

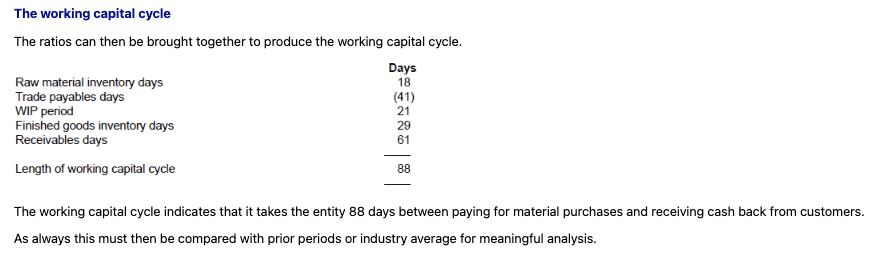

What is the formula for the length of the working capital cycle?

Given the data, what is the working capital cycle length?

What does a working capital cycle of 88 days mean?

Why is it important to compare the working capital cycle length to previous periods or industry averages?

What is the multiple used in working capital ratios for days, months, and weeks?

When comparing ratios across two financial statements, what is a valid simplification?

How can you convert a working capital period ratio into a turnover ratio?

What must be done when using ratios to appraise performance?

What are five limitations of using ratios?

Name one way to reduce the raw materials inventory holding period.

How can a business obtain more finance from suppliers?

How can a company reduce work-in-progress (WIP)?

What is a method to reduce finished goods inventory?

How can a business reduce receivables days?

What is debt factoring and its main disadvantage?

What does the working capital cycle measure?