Theme 1 - Microeconomics

1/144

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

145 Terms

Model

simplified representation of reality to provide insight into economic decision

Ceteris parabus

All other things being equal

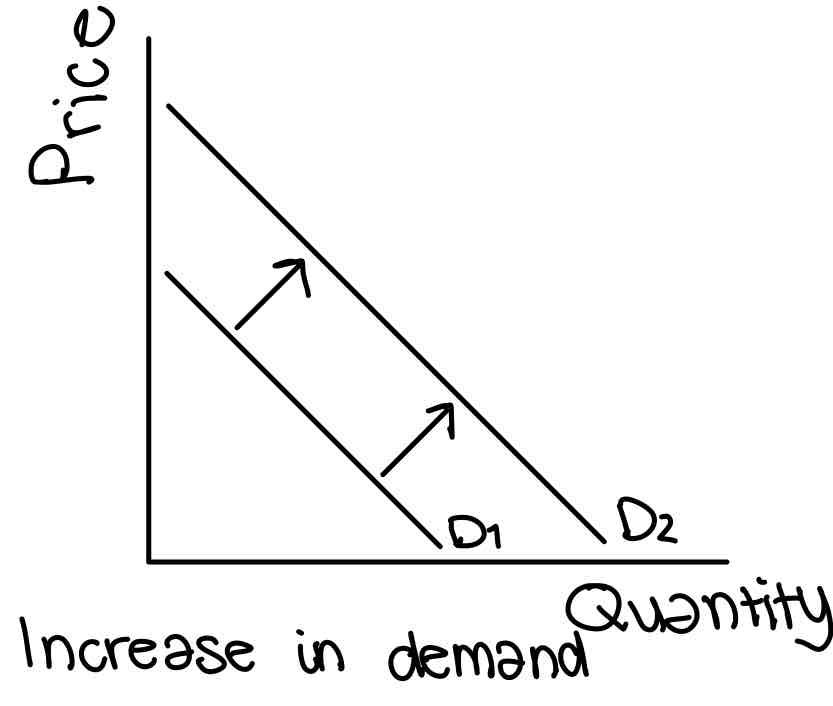

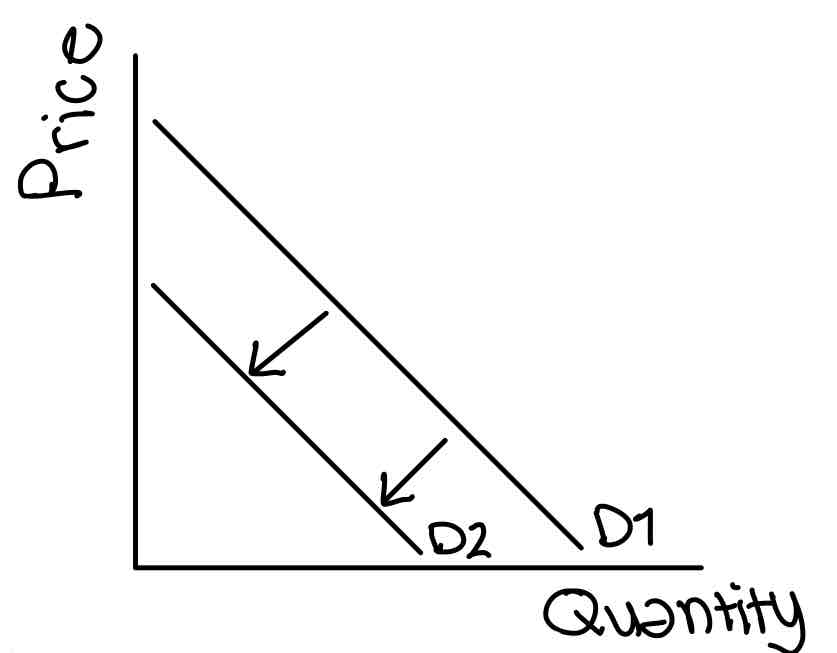

Demand

The quantity of a good or service that consumers are able and willing to buy at a given price

Law of demand

There is an inverse relationship between the quantity demanded of a good and its own price

Demand is downwards sloping because…

Income effect (price of goods falls, purchasing power of income increases)

Substitution effect (price of goods falls, consumers switch away from expensive substitutes)

Law of diminishing marginal utility (each extra unit provides less satisfaction than the prior one)

Normal good

As income rises quantity demanded also rises

Inferior good

As income rises quantity demanded falls

Complementary goods

Good that is consumed with another good as they’re joint in demand

Substitute good

Good that is consumed instead of another good as they’re competitive in demand

The law of supply

The quantity demanded of a good or service that a producer is willing and able to supply at a given price level

The supply curve is upward sloping because…

Higher prices and supply expansion (rise in the market price brings expansion of supply-producers responding to profit motive)

Lower prices and supply contraction (if market prices fall, we expect a contradiction of supply and less incentive to produce at lower prices)

Joint supply

Increase or decrease in the supply of one good leads to an increase or decrease in supply of a by-product

Competitive supply

The same resources could be switched between the production of different goods

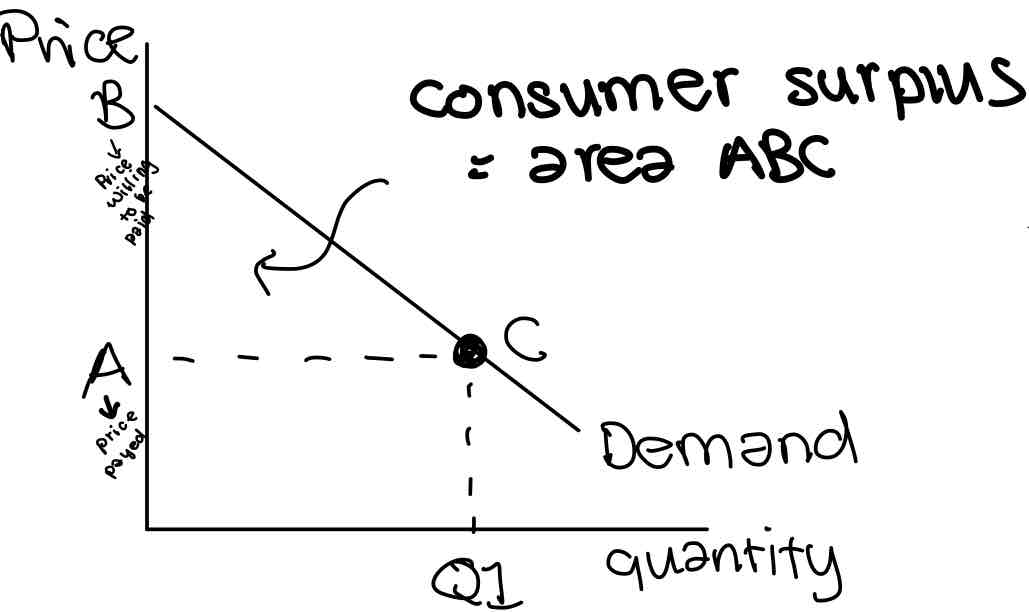

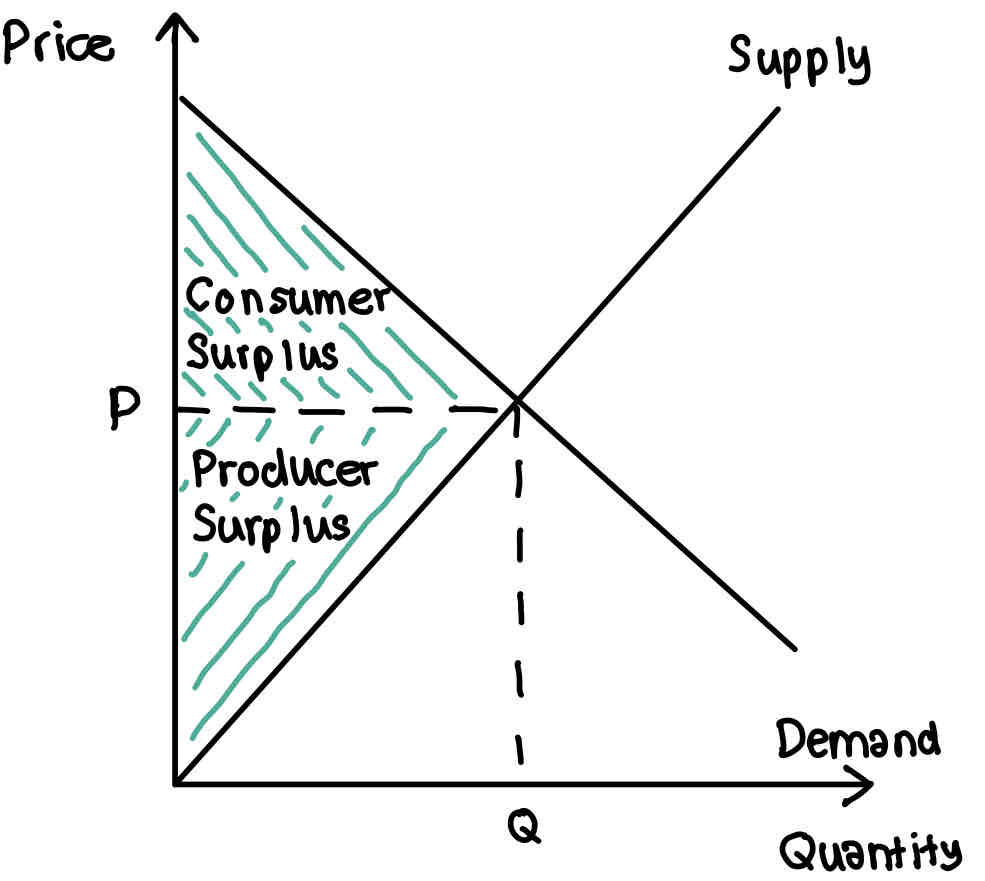

Consumer surplus

Total difference between the total amount that consumers are willing and able to pay for a good or service and the total amount they actually pay

Effective demand

Quantity of a good or service that consumers are willing and able to buy at a given period of time

Effective supply

Quantity of a good or service that producers are able and willing to sell at a given price

Disposable income

Income left over after taxes and benefits are deducted

Discretionary income

Income left over after taxes, benefits and essential bills have been deducted

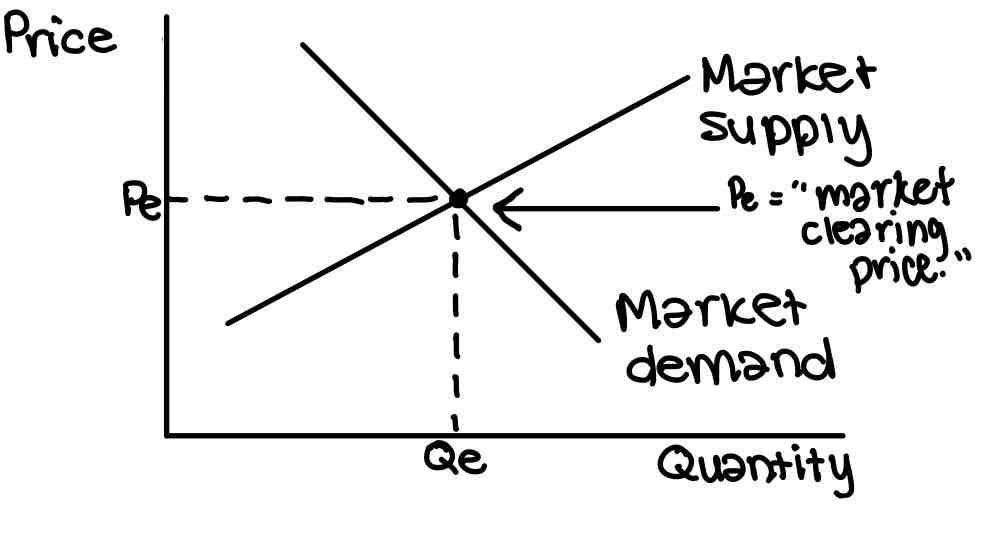

Equilibrium

State of balance met between demand and supply

Total revenue =

Market price x quantity sold

Price mechanism

The way price responds to a change in demand or supply for a product or factor input so that a new equilibrium position is reached in a market

Signalling

Changes in prices provides information to producers and consumers about changes in market conditions

Incentives

Changes in prices act as an incentive to producers to change their output levels and improve their profits

Rationing

Shortage of a product, prices will rise and deter customers from buying the product

Free market economy

Resources are owned by private individuals and resources are allocated by the price mechanism

Command economy

Economy where resources are owned and allocated by the government

Mixed economy

Resources are owned by the government and private individuals. Resources are allocated by government orders and the price mechanism.

Free market economy example

Hong Kong

Mixed economy example

France

Command economy example

North Korea

Producer surplus

Total amount that a producer profits from producing and selling a quantity of a good at the market price

Advantages of Free market economy

Efficiency (greater competitiveness resulting in allocative efficiency)

Choice (firms producer whatever consumer are prepared to buy)

Innovations (firms produce new goods and improve products to get ahead of competitors)

Disadvantages of free market economy

Inequality (people who become wealthier ad people who become poor)

Monopoly power (firms may have more as they’re higher in the market so they charge higher prices)

Too high demerit goods (high levels of cigarettes, gambling and alcohol)

Non-rivalry

Persons use of the good will not reduce the amount available for others

Non-excludable

Once good is provided, no one can be excluded from using it

Division of labor

where the production process is broken down into a sequence of stages with specific workers assigned to different tasks

Advantages of division of labour

Workers become specialists at their task

Workers don’t waste time moving between tasks

Firms are more efficient and profitable

Disadvantages of diving of labour

Repetitive work reduces productivity

People move to less boring jobs so theres higher training costs.

Some workers receive little training and are unable to find alternative jobs

Occupational immobility

No skills to move into a new job

Structural unemployment

In a job with a specific skill but it closes down leading to struggles to get a job as they don’t have the skills

Specialisation

Country’s/businesses decide to concentrate on a particular product or task

Advantages of specialisation

High labour productivity and business profits

Specialisation creates surplus output that can be traded internationally

Lower prices give consumer great real purchasing power

Disadvantages of specialisation

World prices for a product might fall leading to declining revenues

Risk of over-specialising and structural unemployment

Might lead to over-extraction of a country’s natural resources

4 functions of money

Unit of account

Store of value

Medium of exchange

Standard of different payment

Unit of account

A nominal unit of measure used to value/cost products, assets, debts, incomes and spending

Store of value

An asset that holds value over time

Medium of exchange

Money is any asset widely acceptable as medium of exchange. It facilitates transactions between buyer and seller

Standard of different payment

Accepted way in each market to settle debt

Digital money

Any means of payment that exists purely in electronic form

Digital money is more popular because…

Convenience

Globalisation

Security

COVID-19

Elasticity

Measures how much one variable responds to changes in another variable

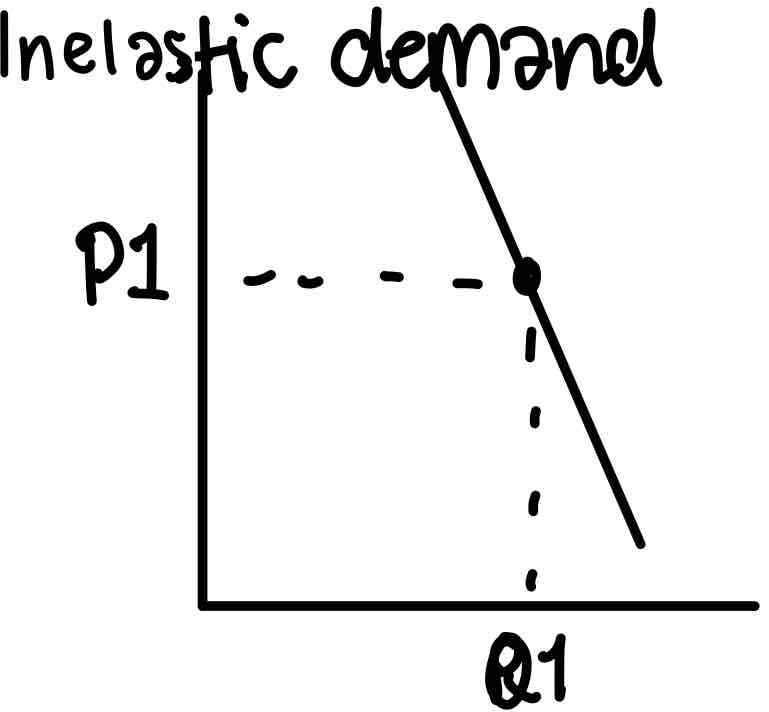

Inelastic demand

Quantity demanded is not very responsive to a change in price

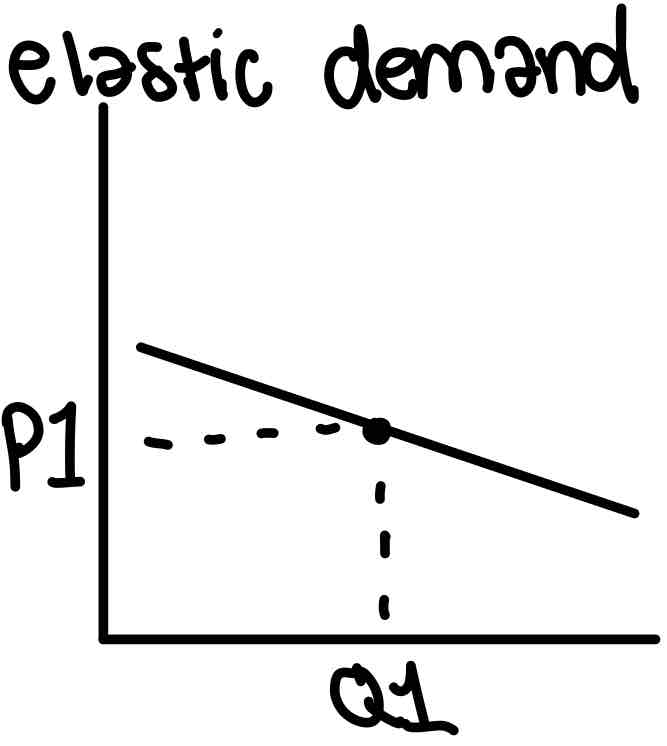

Elastic demand

Quantity demanded is very responsive to a change in price

Determinants of price elasticity of demand

H - habits forming, brand loyalty

I - income/expenditure

T - time the buyer has

S - substitutes for this good

PED =

% change in QD / % change in P

Income elasticity of demand

the responsiveness of quantity demanded due to a change in the real income

Elasticity value

1+

Inelasticity value

More than 0, less than 1

Cross elasticity of demand

Responsiveness of the quantity demanded for one good due to a change in the price of another

XED =

% change in QD (good A) / % change in P (good B)

Substitutes carry a positive/negative XED?

POSITIVE, price of B goes up so demand for A will go up

Complements carry a positive/negative XED?

NEGATIVE, price of B goes up, demand for A goes down

When XED=0

There is no relationship between the goods

PES =

% change in QS / % change in P

PES is always positive/negative?

Positive

Short-run PES

Period of time where at least one factor of production is fixed. Technology is also fixed

Long-run PES

Period of time where all factors of production can be varied. Technology is fixed.

Production lag (PSSST)

Longer production lag so more price inelastic

Stocks (PSSST)

Larger stocks so more price elastic

Spare capacity (PSSST)

Large spare capacity so more price inelastic

Sustainability of factors of production (PSSST)

More sustainability means more price elastic

Time (PSST)

Short run=price inelastic, long run=price elastic

PES is important because…

Opportunity to make sales if demand in a market rices

Quickly move resources out of a market id demand drops

Affects decision whether to buy or rent equipment and what type of contracts to offer

Bounded rationality

Idea that cognitive, decision-making capacity of humans cannot be fully rational because of the number of limits we face

Limits faced when being rational

information failure - may not be enough information, or its unreliable, or not all possibilities/consequences have been considered

The amount of time that we have to make our decisions

The limits of the humans brain to process every piece of information and consider every possibility

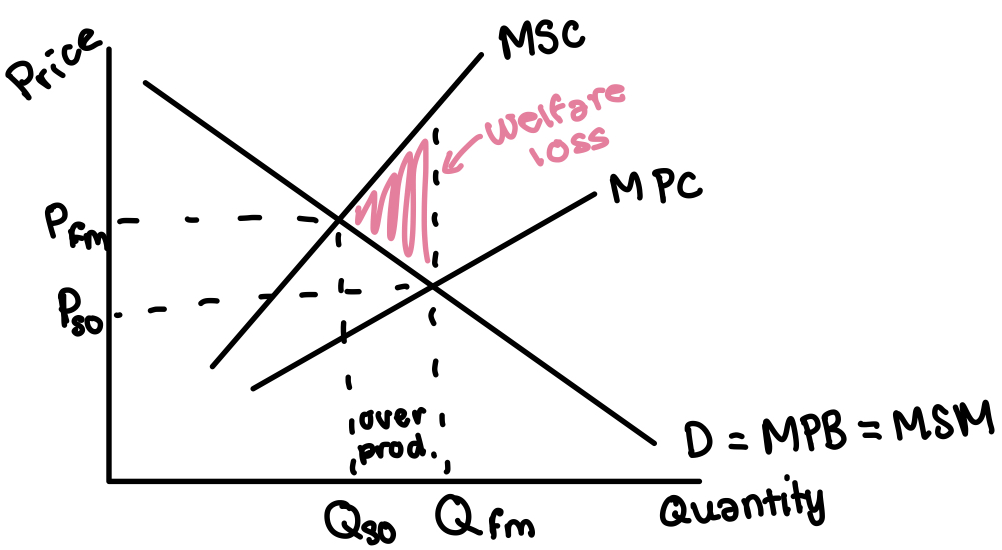

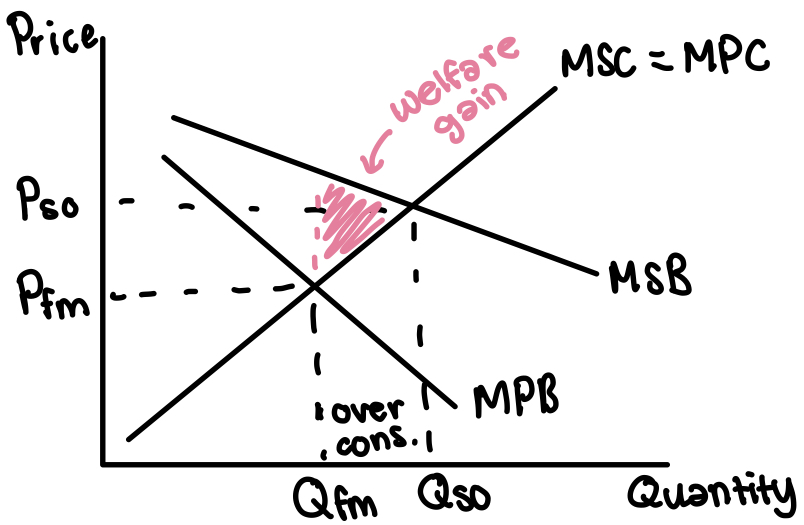

Market failure

Markets failing to allocate resources efficiently or a situation where the free market mechanism doesn’t lead to a socially optimal allocation of resources

Evidence of market failure

the free market fails to produce a desirable good or service

Persistent shortages or surpluses

Over consumption/production compared to the socially optimal level

Under consumption/production compared to the socially optimal level

Inequitable allocation of resources

Reasons fro market failure

Negative externalities - factory pollution

Positive externalities - goods and services under consumed

Over consumption/production of de-merit goods

Under consumption/production of merit goods

Information failures - causing people to make suboptimal choices

Failing to provide sufficient quantity of public goods

Monopoly leads to economic efficiency

Immobility of factor of inputs - stops labour market working efficiently

3 types of rationality in market failure

Consideration of the influence of others behaviour : social norms, herd behaviour, peer pressure

Habitual behaviour and inertia : addiction to substances or reluctant to change banks

Consumer weakness at computation / bounded rationality : consumers not being willing or able to make comparisons between princes and different goods on offer

Private goods

Excludable - once its provided it’s possible to stop other individuals from using them

Rivalrous - consumption of the good by on person reduced the amount available for consumption by others

Public goods

Non-excludable - once the good has been provided no one can be prevented from enjoying its benefits

Non-rivalrous - one person consuming the good wont reduce the amount available for another person

Quasi-public goods

Mix of public and private (a playground, congested roads, toll bridge)

Free rider problem

Private firms cannot force consumers to pay for suing public goods due to non-excludability. So they wont make profit from them so the free-market wont provide public goods leading to market failure.

Social cost =

Private cost + external cost (negative externality)

Social benefit =

Private benefit + external benefit (positive externality)

Externalities

Third party or spill-over effects arising from the production or consumption of a good or service.

Third party

An individual / entity not involved in an economic transaction but is affected y the activity of buyer / seller

Negative externality of…

Production

Positive externality of…

Consumption

Incidence of tax

The way in which the burden of paying a sales tax is divided between buyers and sellers

Indirect tax

A tax on expenditure on goods and services

Burden tax

Measures economic effect of the tax measured by the difference between real income or utilities after imposing the tax

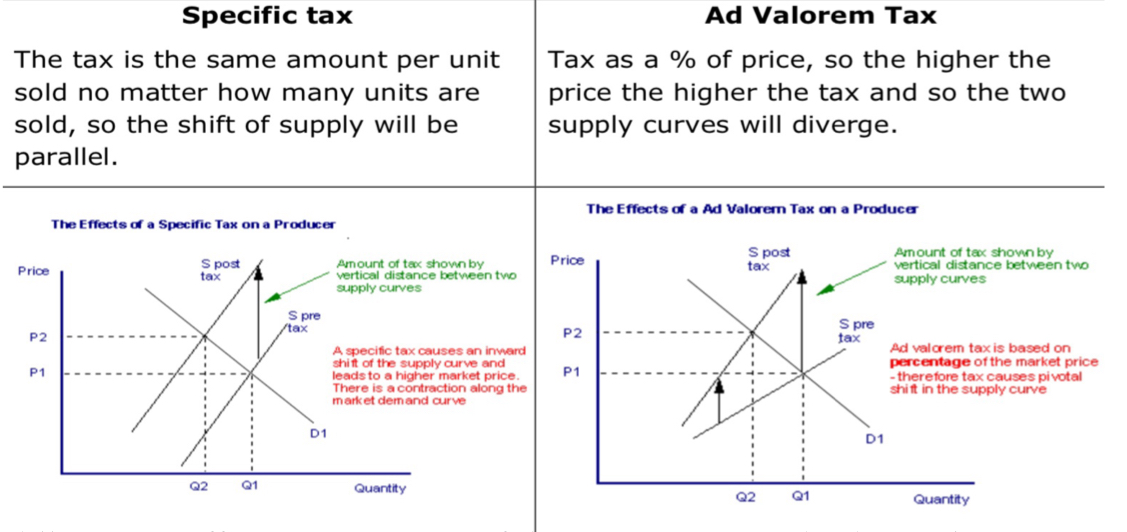

2 types of indirect tax

Specific per unit tax

Ad valorem tax (percentage)

specific tax

The tax is the same amount per unit sold no matter how many units are sold so the sift of supply is parallel

Ad valorem tax

Tax is a % of the price so the high the price the higher the tax so the two supply curves diverge

Allocative efficiency

A state of the economy in which production is aligned with the preferences of consumers and producers

Productive efficiency

The ability of a firm to produce goods or services at the lowest possible cost, given the level of of output and the available technology

Economic efficiency

Every resource is optimally allocated to serve each individual or entity in the best way

Subsidy

A payment from the government to a producer to lower their costs of production and encourage them to produce more

Why do governments intervene by giving subsidies

To encourage economic growth. Subsidies can stimulate economic growth by supporting key inductions. (Market failure correction)