Accounting Principles Exam 1

1/111

Earn XP

Description and Tags

ACCTIS 300

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

112 Terms

FASB

Finaical Accounting Standards Board

FASB purpose

makes the accounting rules

GAAP

Generally Accepted Accounting Principles

GAAP

rules, standards, and guidelines companies need to follow for financial accounting (scorekeeping)

SEC

Securities Exchange Commission

SEC

enforces financial accounting rules

objective of financial accounting

provide information useful to external users, especially investors and creditors

revenue recognition principle

revenue is recognized when earned, not necessarily when cash is received

expense recognition (matching principle)

expenses should be recognized in the period in which they help product revenues

going concern assumption

company should report accounting information that reflect the presumption that it will stay in business forever

time period assumption

allows the life of a company to be divided into artificial time periods

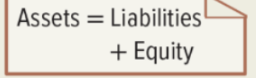

the accounting equation

assets= liabilities+equity

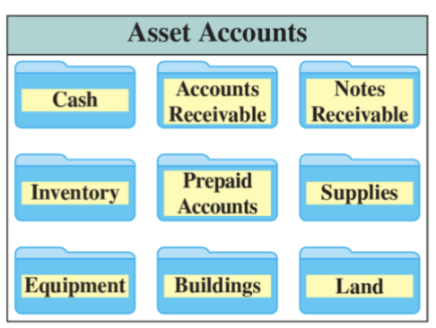

assets

resources a company owns or controls

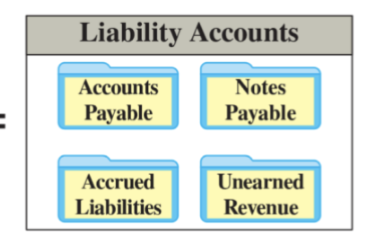

liabilities

creditors claims against assets

debt, money a business owes, “payable”

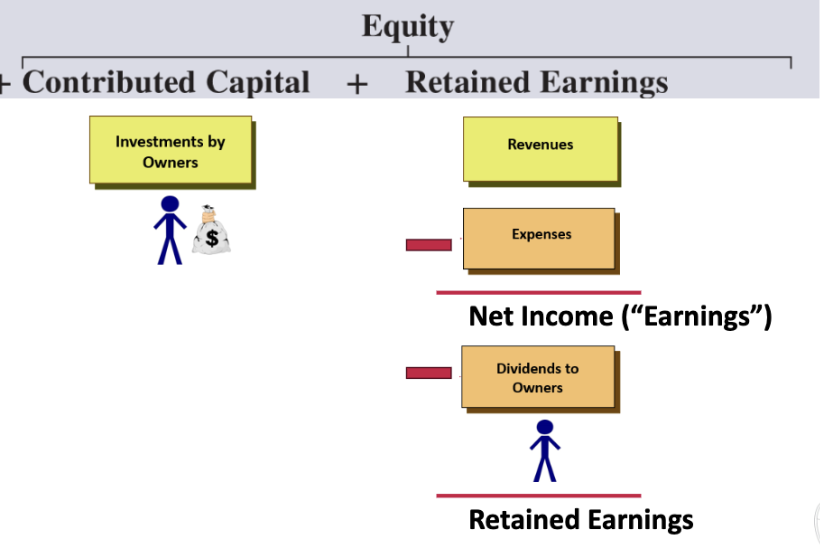

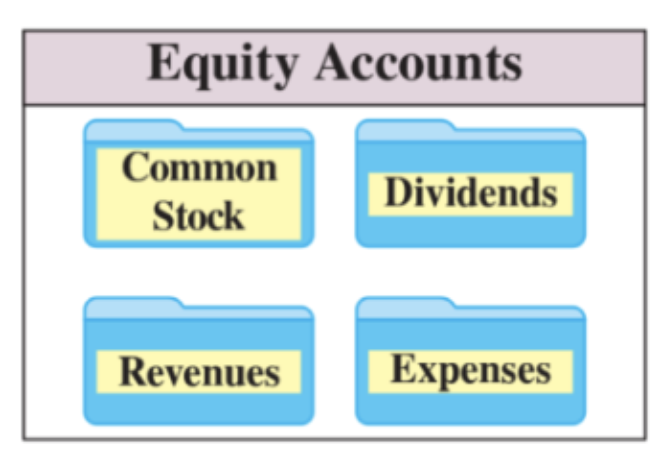

equity

the owners’ claim on assets, “net assets”

equity makeup

what does investment by owner increase

assets, equity

what do dividends do to equity

decrease

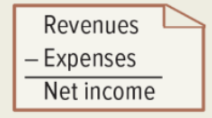

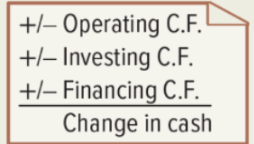

income statement

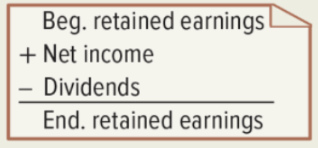

statement of retained earnings

balance sheet

statement of cash flows

account

a record of increases and decreases in a specific asset, liability, equity, revenue, or expense item

asset accounts

liability accounts

equity accounts

depreciation

as equipment gets worn down, its cost is gradually reported as an expense

creditor

individuals and organizations that have rights to receive payments from a company in the form of assets or services

accrued liability

amounts owed, but not yet paid

wages payable, taxes payable, interest payable

how do dividends effect balance sheet

decrease assets and equity

increase in assets

debit

decrease in assets

credit

decrease in liabilities

debit

increase in liabilities

credit

decrease in equity

debit

increase in equity

credit

normal balance for assets

debit

normal balance for liabilities

credit

normal balance for equity

credit

3 steps in preparing the trial balance

list each amount title an its amount from the general ledger

add the totals of your debit and credit columns

verify that debits=credits

adjusting entry

a journal entry made at the end of an accounting period to reflect a transaction/event that has not been recorded yet

3 step process for adjusting entries

determine what the current account balance equals

determine what the current account balance should equal

record an adjusting entry to get from step 1 to step 2

deferred expenses

advance payments of future expenses (prepaid assets)

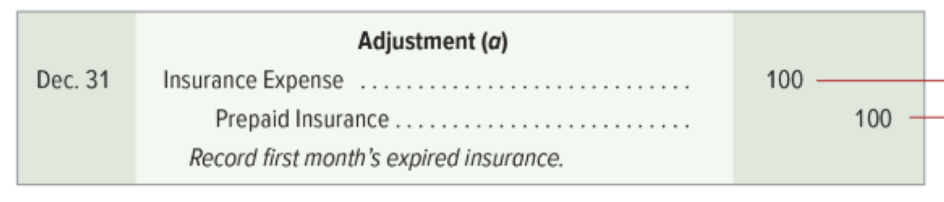

prepaid insurance adjustment

supplies adjustment

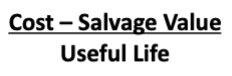

depreciation expense formula

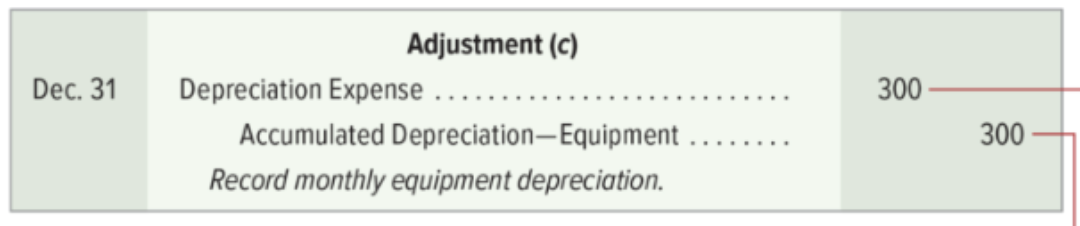

depreciation adjustment

accumulated depreciation

sum of all the depreciation expense recorded for a depreciable asset

unearned revenue

debit cash, credit unearned revenue

accrued expenses

an expense that the business has incurred but has not yet paid

salaries expense, interest expense

creates an accrued liability

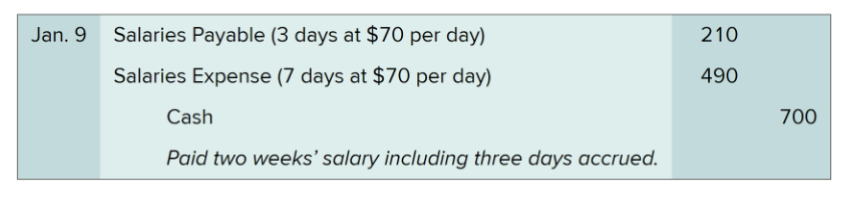

accrued salaries expenses

not an adjusting entry

formula for recording accrued interest

principal x rate x time

accrued revenues

a revenue that has been earned but for which the revenue has been unrecorded and cash has not yet been collected

creates an asset

purpose of closing entries

close temporary accounts to zero, update retained earnings

temporary accounts

revenues and gains

expenses and losses

income summary

dividends

permanent accounts

assets

liabilities

stockholders’ equity

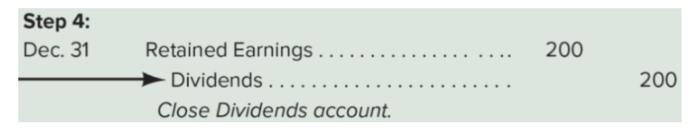

close dividends

debit retained earnings, credit dividends

close income summary

revenue added, expenses subtracted. income summary into retained earnings

debit income summary, credit retained earnings

classified balance sheet

balance sheet that places each asset and each liability into a specific category

current

within one year

long term

more than one year

current assets

accounts receivable

long term assets

long term investments, plant assets, intangible assets

current liabilities

accounts payable, salaries payable, interest payable, unearned revenue

long term liabilities

notes payable

gross profit

net sales-cost of goods sold

periodic inventory system

physical count of inventory, outdated

perpetual inventory system

keeps a running computerized record of merchandise inventory

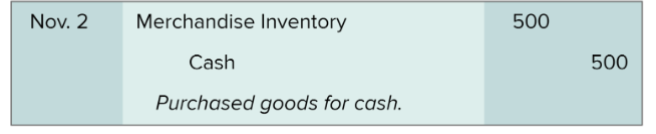

purchase of merchandise

if on credit, accounts payable instead of cash

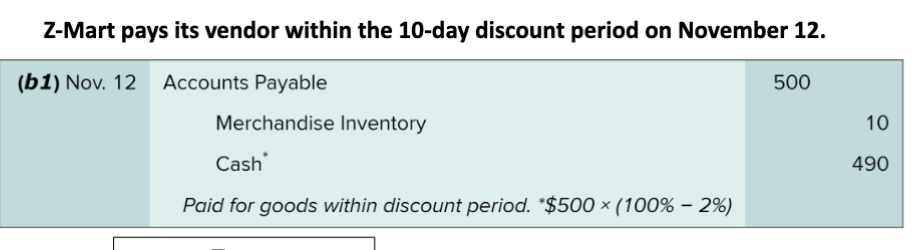

merchandise purchase with discount

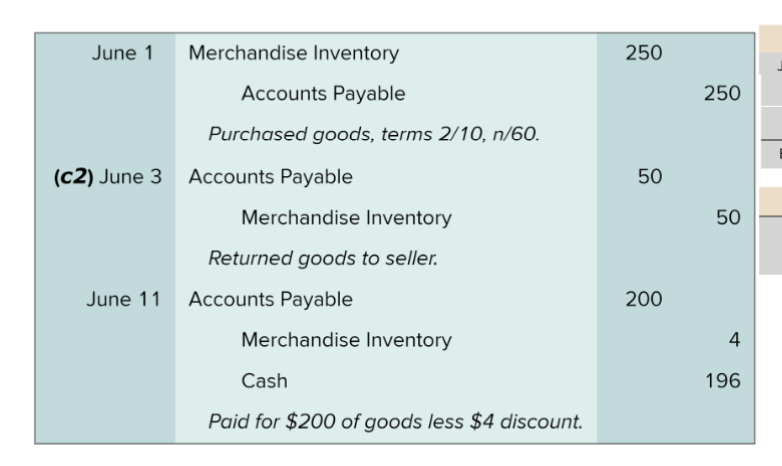

purchase allowance

purchase return

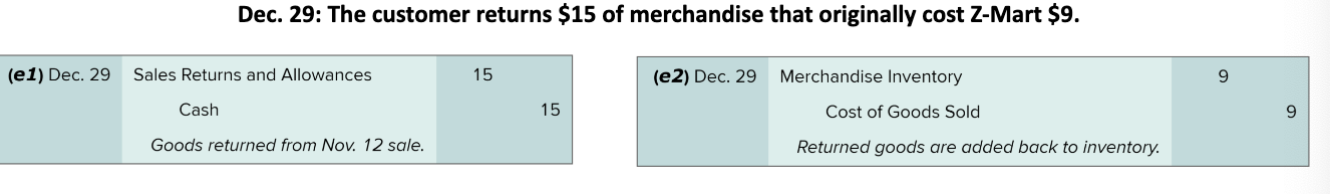

return on sale of merchandise

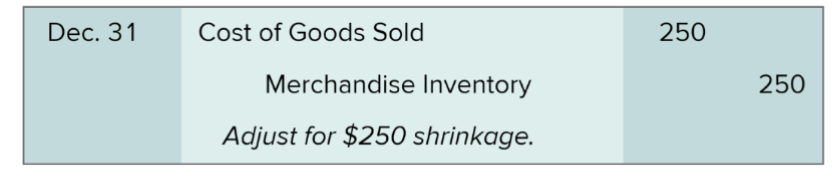

inventory shrinkage

debit cost of goods sold, credit merchandise inventory

First In, First Out (FIFO) Method

an inventory costing method in which the first costs into inventory are the first costs out to cost of goods sold. ending inventory is based on the costs of the most recent purchases

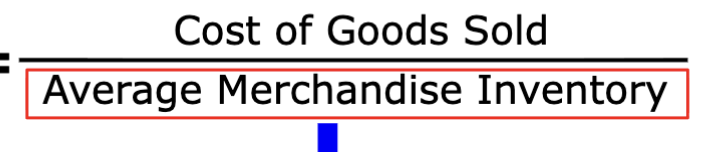

inventory turnover

measures the number of times a company sells its average level of merchandise inventory during a period, high rate is ideal indicates ease in selling inventory

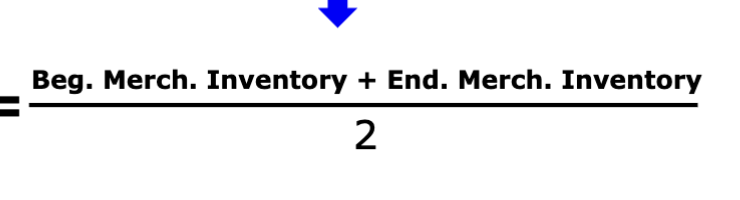

average merchandise inventory

days’ sales in inventory

measures the average number of days that inventory is held by a company, lower is preferable indicates company can sell inventory quickly

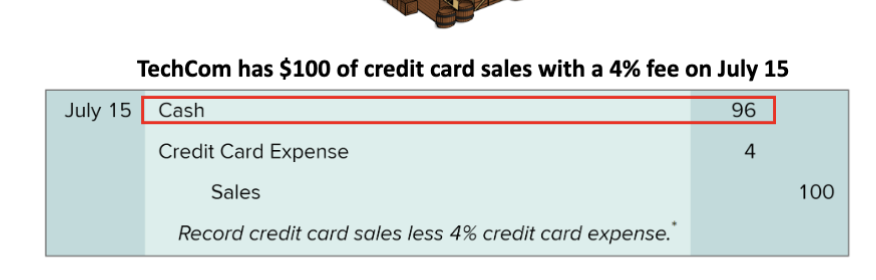

sales on bank credit cards

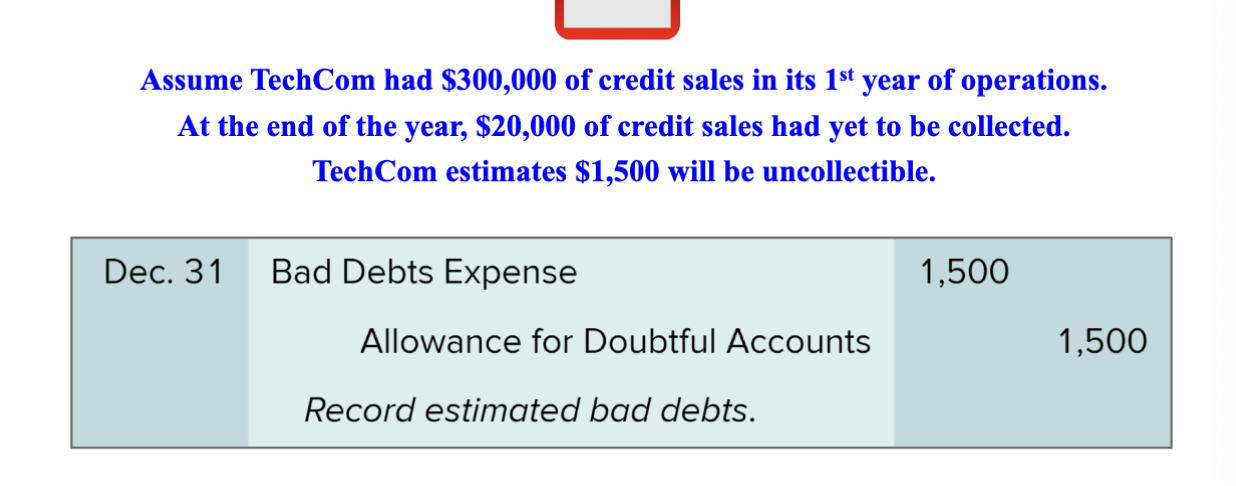

bad debts expense

the cost to the seller of extending credit, arises from failure to collect from credit customers

allowance method

company estimates bad debts expense instead of waiting to see which customers the company will not collect from

allowance for doubtful accounts

a contra asset account, related to accounts receivable, that holds the estimated amount of uncollectible accounts

bad debts expense estimate journal

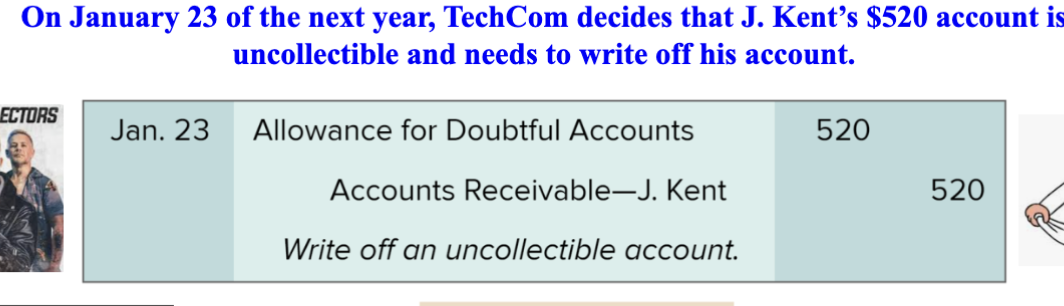

write off a bad debt

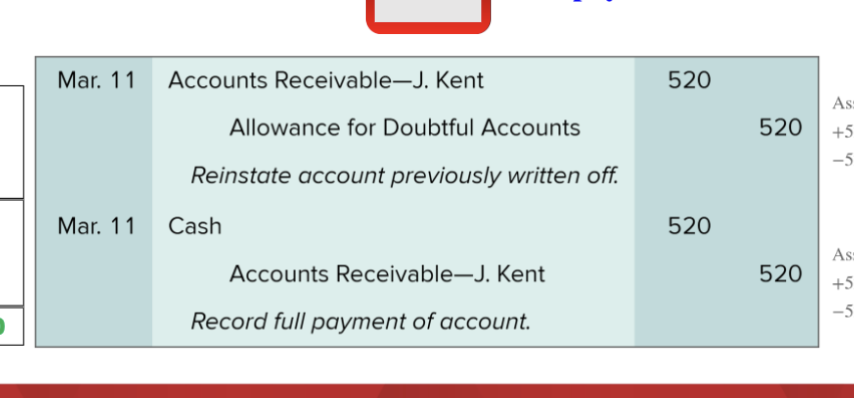

recovering a written off bad debt

aging of receivables method

method of estimating uncollectible receivables by determining the balance of the allowance for bad debts account based on the age of individual accounts receivable

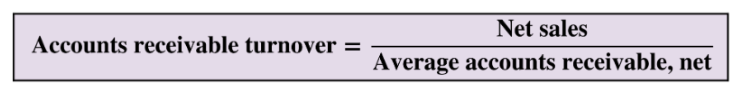

accounts receivable turnover

measures the number of times the business collects the average accounts receivable balance in a year

accounts receivable turnover formula

days’ sales in receivables

tells how many days it takes to collect the average level of accounts receivable

days’ sales in receivables formula

365 days/accounts receivable turnover ratio

plant asset cost

purchase price

taxes

purchase commissions

any amounts paid to get asset ready for its intended use

capitalized costs

produce future benefits

expensed costs

produce benefits only in current period

straight line depreciation

allocates equal amount of depreciation each year, for partial years (number of months/12)

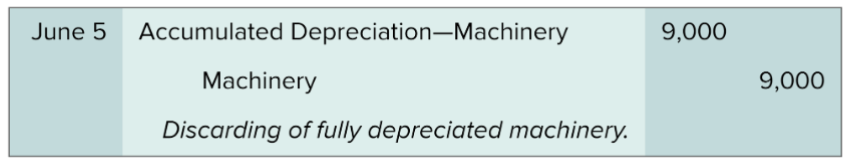

discarding plant asset full depreciation

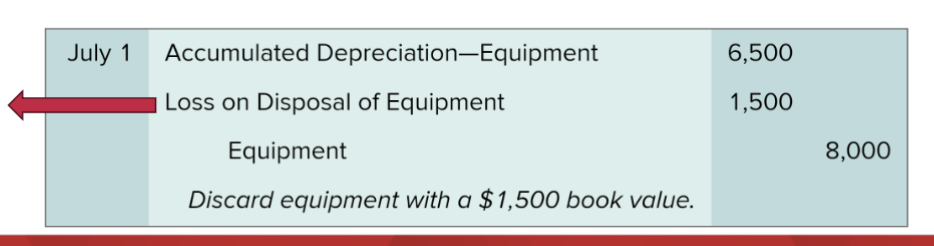

discarding plant asset, not fully depreciated

loss on disposal

treat it like an expense

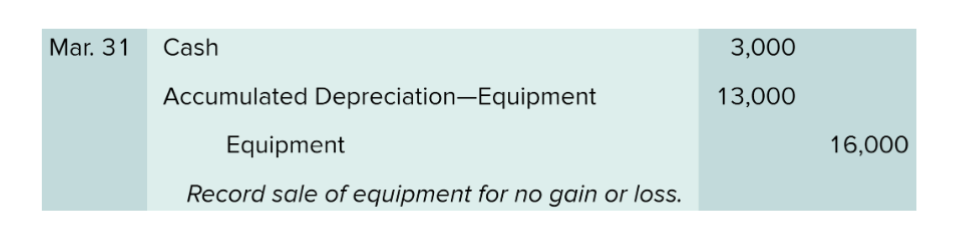

selling a plant asset at book value

steps for disposal of a plant asset

bring depreciation up to date

remove asset and accumulated depreciation

record cash received

record gain or loss on disposal

intangible asset

an asset with no physical form that is valuable because of the special right it carries or competitive advantages

patents, trademark, franchises, licenses