Exam 3 review - International buisness

1/112

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

113 Terms

Floating exchange rate regime

When the foreign exchange market determines the relative value of a currency

Pegged exchange rate

The value of the currency is fixed relative to a reference currency, such as the U.S. dollar

Managed float system

The value of the currency is determined by market forces, but managed by the government

Fixed exchange rate

European Monetary System

Gold par value

The amount of currency needed to purchase one ounce of gold

$1 in grains of fine gold

$1 = 23.22 grains of fine gold

One ounce in grains

One ounce = 480 grains

Gold price in dollars

$20.67 (480/23.22)

Balance-of-trade equilibrium

When the income its residents earn from exports is equal to the money its residents pay to other countries for imports

Example of trade surplus and deficit

e.g. Japan - trade surplus, US - trade deficit

Inflation effects on money supply

Inflow of gold to Japan, outflow from US → money supply: Japan↑, US↓ → product price (inflation): Japan↑, US↓ → demand: Japanese products↓, US products↑ → Japan trade deficit, US trade surplus → outflow of gold from Japan, inflow to US

International Monetary Fund (IMF)

Tasked with maintaining order in the international monetary system

World Bank

To promote general economic development

Bretton Woods System

System of fixed exchange rates policed by the IMF

Commitment of Bretton Woods

Commitment not to use devaluation as a weapon of competitive trade policy

Role of the World Bank

Initially established to help reconstruct the war-torn economies of Europe

World Bank lending

Later, moved to lending to third-world nations for development

World Bank funding

Lends money by raising money through bond sales and through subscriptions from wealthy members

Case for Floating Exchange Rates

Monetary policy autonomy

Automatic trade balance adjustments

Automatic appreciation or depreciation of currencies makes a balance of exports and imports

Economic recovery

Automatic depreciation of currencies increases the exports and help overcome the economic crisis. (e.g. Iceland, S.Korea)

Case for Fixed Exchange Rates

Monetary discipline

Speculation in Fixed Exchange Rates

Speculation

Uncertainty in Fixed Exchange Rates

Uncertainty

Lack of connection in Fixed Exchange Rates

Lack of connection between trade balance and exchange rates

Currency crisis

A speculative attack on the exchange value, e.g. Brazil in 2002.

Banking crisis

A loss of confidence in the banking system, e.g. Iceland in 2008.

Foreign debt crisis

Inability to serve foreign debt obligation, e.g. Greece, Ireland, and Portugal in 2010.

Currency management

Combination of government intervention and speculative activity can drive the foreign exchange market.

Business strategy

Companies should pursue strategies that will increase their strategic flexibility in the face of unpredictable exchange rate movements.

Benefits of the Global Capital Market

Borrowers benefit from fund availability and lower interest rates; investors gain investment opportunities and diversification of risks.

Borrower's perspective

Lower cost of capital in the global capital market compared to domestic capital markets.

Global Capital Market Risks

Individual nations may be more vulnerable to speculative capital flows which could destabilize national economies.

Hot money vs. patient money

A concept by Martin Feldstein describing the difference between speculative capital and long-term investment.

Eurocurrency

A currency banked outside its country of origin, e.g. Eurodollars, Euro-yen, Euro-pound, and Euro-euro.

Eurodollars

Dollars banked outside the US, accounting for two-thirds of all Eurocurrencies.

Drawbacks of the Eurocurrency Market

Borrowing funds internationally can expose a company to foreign exchange risk.

Bonds

An important means of financing, with the most common being fixed-rate bonds that receive a fixed set of cash payoffs.

Foreign bonds

Bonds sold outside the borrower's country and denominated in the currency of the country in which they are issued.

Samurai bonds

A type of foreign bond issued in Japan, denominated in yen.

Eurobonds

Bonds placed in countries other than the origin country of the denominating currency.

Attractions of the Eurobond Market

An absence of regulatory interference and less stringent disclosure requirements than in most domestic bond markets.

National Equity Markets

Difficult to take capital out of a country and invest it elsewhere due to regulatory barriers.

Regulatory barriers

Obstacles that make it difficult for a company to attract significant equity capital from foreign investors.

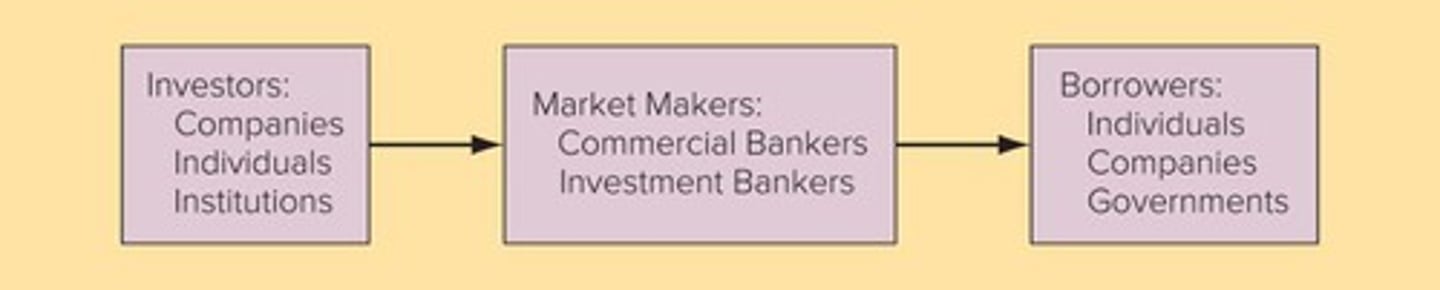

Market makers

Financial service companies that connect investors and borrowers, either directly (investment banks) or indirectly (commercial banks).

Investment banks

Financial institutions that assist in connecting investors with borrowers directly.

Commercial banks

Financial institutions that connect investors with borrowers indirectly.

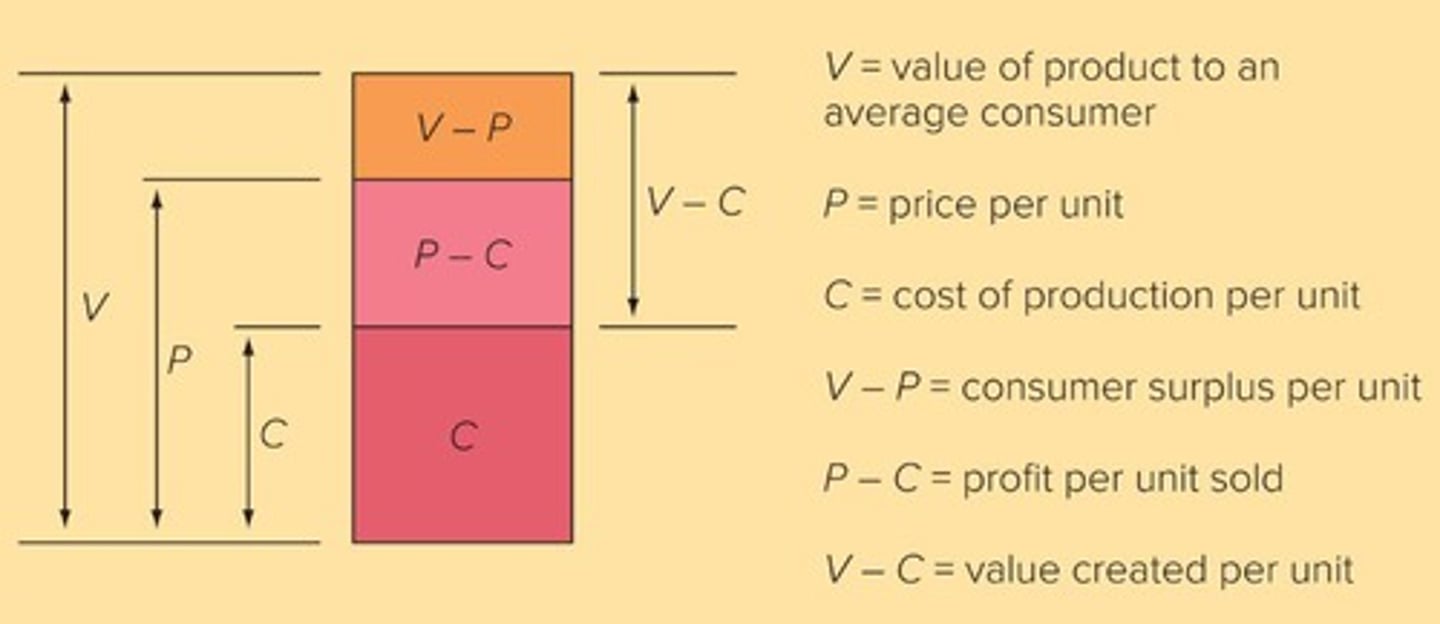

Value Creation

Measured by the difference between a firm's costs of production and the quality that consumers perceive in its products.

Value

The perceived quality of a firm's products.

Cost

The expenses incurred in the production of a product.

Strategic Positioning

A firm's explicit choice of strategic emphasis regarding value creation (differentiation) and low cost.

Efficiency Frontier

A concept that represents the maximum output achievable with a given set of inputs.

Location Economies

The economies that arise from performing a value creation activity in the optimal location for that activity.

Experience Effects

The phenomenon where costs decline by some quantity each time cumulative output doubles.

Experience Curve

The graphical representation of the relationship between cumulative output and cost reduction.

Economies of Scale

Reductions in unit cost achieved by producing a large volume of a product.

Global Standardization Strategy

A strategy that aims to pursue a low-cost strategy on a global scale, concentrating production, marketing, R&D, and supply chain activities in a few favorable locations.

Localization Strategy

A strategy most appropriate when there are substantial differences across nations regarding consumer tastes and preferences.

Cost Pressures

The need for a firm to reduce costs in order to remain competitive.

Pressures for Local Responsiveness

The demand for a firm to adapt its products and services to meet local market needs.

Customer Tastes and Preferences

The specific desires and requirements of consumers in different markets.

Manufacturing Delegation

The process of assigning manufacturing and production functions to foreign subsidiaries.

ClearVision

An example of a firm that has achieved location economies.

4th Airframe's Production Cost

80% of the 2nd airframe's production cost.

8th Airframe's Production Cost

80% of the 4th airframe's production cost.

16th Airframe's Production Cost

80% of the 8th airframe's production cost.

Bargaining Power with Suppliers

The ability of a firm to negotiate favorable terms with suppliers, exemplified by firms like Walmart.

Substantial Differences

Significant variations in consumer preferences and tastes across different nations.

Customization

The modification of products to meet local market needs, which can limit cost reductions associated with mass production.

Vertical Differentiation

Centralization and Decentralization in organizational structure.

Arguments for Centralization

Facilitates coordination and integration of operations, ensures decisions align with objectives, empowers top managers for change, and avoids activity duplication.

Global Standardization Strategy

High pressure for centralization.

Localization Strategy

High pressure for decentralization.

International Strategy

Centralization over core competencies, decentralization over foreign subsidiary decisions, e.g. Microsoft.

Transnational Strategy

Involves both centralization and decentralization.

Worldwide Area Structure

Favored by firms with low diversification and domestic structures based on functions.

Worldwide Product Divisional Structure

Favored by diversified firms with domestic structures based on product divisions, helps overcome coordination problems.

Global Matrix Structure

Horizontal differentiation along product division and geographic area, involves dual decision making, often clumsy and bureaucratic.

Personal Control

Most widely used in small firms, structures relationships between managers at different levels in multinational enterprises.

Bureaucratic Controls

Important controls in subunits are budgets and capital spending rules, approval or denial for capital spending requests.

Need for Coordination

Lowest in localization strategy firms, higher in international companies, higher still in global companies, and highest in transnational companies.

Performance Ambiguity

Occurs with high interdependence between subunits within the organization.

Costs of Control

Defined as time top management spends monitoring and evaluating subunits' performance, greater when performance ambiguity is higher.

International Strategy

Firms create value by transferring core competencies from home to foreign subsidiaries, with centralized control over core competencies.

Localization Strategy

Focuses on local responsiveness, with decentralized operating decisions to self-contained country subsidiaries.

Unfreezing the Organization

Bing bang theory, incremental change is often no change.

Moving to the New State

Requires actions.

Refreezing the Organization

Requires a new culture and management education system.

Attractiveness of a Country

Balance of benefits, costs, and risks as a potential market.

Long-run Profit Potential

Includes market size, present wealth of consumers, and economic growth rate.

Political stability

A favorable condition for foreign market entry indicating a low risk environment.

Economic system

The structure of economic activity in a country, which can be free market, mixed, or command.

Private-sector debt

The total amount of debt held by private sector entities, with lower levels being more favorable for market entry.

Inflation

The rate at which the general level of prices for goods and services rises, with lower rates being more favorable for market entry.

First-mover advantages

Benefits gained by entering a foreign market early, such as establishing a strong brand name and creating switching costs.

First-mover disadvantages

Drawbacks of entering a foreign market early, including pioneering costs and the need to educate customers about new products.

Scale of entry

The extent of investment and commitment a firm makes when entering a foreign market, which can be significant or small-scale.

Licensing

An entry mode that allows a firm to produce and sell products in a foreign market under certain conditions, but limits control over operations.

Joint Ventures

A business arrangement where two or more parties agree to pool their resources for a specific goal, sharing costs and risks.

Turnkey Projects

A type of entry mode where a firm designs and constructs a facility and hands it over to the client when it is ready for operation.