Working Capital Management and Inventory Management

1/25

Earn XP

Description and Tags

These flashcards cover essential vocabulary terms and definitions regarding Working Capital Management and Inventory Management.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

26 Terms

Current Assets

Cash, marketable securities, receivables, and inventories that a company owns.

Current Liabilities

Obligations such as bills payable, bank overdrafts, and outstanding expenses that a company must pay.

Gross Working Capital

Total current assets of a company.

Net Working Capital

Current Assets - Current Liabilities.

Liquidity

How quickly and easily an asset can be converted into cash without significantly affecting its market price. It is a measure of how readily an asset can be bought or sold in the market

Hedging Approach

A financing strategy where long-term funds are used to finance fixed current assets while short-term funds finance temporary working capital.

-More Risky, expects you to fully use the short term funds, not ideal in emergency

-Low Cost

Take the lowest number in table, that’s perm. capital, temporary adds up to the total

Conservative Approach

A financing method suggesting long-term funds only, to cover all current asset needs, using short-term funds only for emergencies.

Trade-off Approach

Financing strategy that balances between hedging and conservative approaches based on average fund requirements.

The average of Total Min fund required, and max fund required.

Find the middle of min and max, and temporary adds it up.

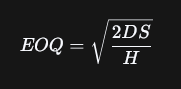

Economic Order Quantity (EOQ)

The optimal order quantity a company should purchase to minimize total inventory costs. A firm should place neither too large nor too small orders.

Carrying Cost

The cost associated with storing unsold goods, including storage and capital costs.

Ordering Cost

Fixed costs related to placing and receiving inventory orders.

Cash Management

The process of managing a company's cash flow to ensure sufficient cash for operations.

Motive for Cash Management

Transaction Motive: The need to hold cash to meet day-to-day operating expenses. Ex - Salaries, bills, suppliers

Precautionary Motive: To handle unexpected emergencies. Ex - Sudden expenses, repairs, a fire.

Speculative Motive: To take advantage of profitable opportunities (discounts, investments)

Functions of Cash Management

Cash Planning & Budgeting

Forecasting cash inflows and outflows to avoid shortages.

Managing Cash Flows

Accelerating collections (e.g., early payment discounts).

Delaying payments (without harming supplier relations).

Optimal Cash Balance Maintenance

Ensuring enough liquidity without excessive idle cash.

Short-Term Investments

Investing surplus cash in liquid securities (T-bills, money market funds).

Bank Relationship Management

Negotiating favorable terms (lower fees, overdraft facilities).

Risk Management

Protecting against fraud, currency fluctuations, and interest rate risks.

Fluctuations in working capital

Change in sales

Policy changes

Changes in Technology

Compensating Cash Balance

A minimum cash balance maintained to compensate banks for services.

Inventory Management

The supervision of non-capitalized assets, or inventory, to ensure the right amount of stock is maintained.

Factors Influencing Working Capital Requirement

Nature of Business

Production Cycle

Business Cycle (upward and downward phase)

Credit Policy

Availability of raw material

Dividend policy

Depreciation policy

Operating efficiency

Estimating Working Capital Requirement (Numerical)

Working Capital = Current Assets – Current Liabilities.

Need for working capital

Conversion of cash to inventory

inventory to receivables

receivables to cash

and Repeat

Inventory ABC System

A - largest investment and number of items are least.

B - least investment and number of items are highest.

C - in the middle

Reorder point

Lead Time x average daily usage of inventory + safety Stock (extra inventories when actual time or usage is unexpected)

Reorder level

Maximum consumption x Maximum reorder period

Max level of stock

Reorder level + reorder quantity – (Minimum usage * minimum reorder period)

Min level of stock

Reorder level – (Normal usage * average reorder period)

Objectives of Cash Management

Meeting Payments Schedule

Importance of sufficient cash

• Prevents insolvency

• Prompt payment helps in maintaining good relations with trade

creditors and suppliers of raw material.

• Cash discount can be availed if payment is made within due date

• Strong credit rating

• Meet unanticipated cash need during emergencies

Minimising funds committed to cash balances

– Ideal cash is non-earning asset

– Important to determine the factors affecting cash balance