Portfolio Management - 1. Performance evaluation measures & process

1/37

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

38 Terms

What is the arithmetic average return?

Simple average of two returns

What does arithmetic average assume?

Rebalancing at the beginning of each period OR no reinvestment of interest income

What does Time-weighted rate of return (TWRR or rN) measure?

The managers’ ability to increase the dollars invested in the fund

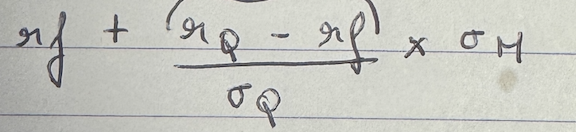

What is the formula of TWRR?

What is the Money-weighted rate of return (MWRR)?

Average return achieved on all cash-flows, both in and out-flows

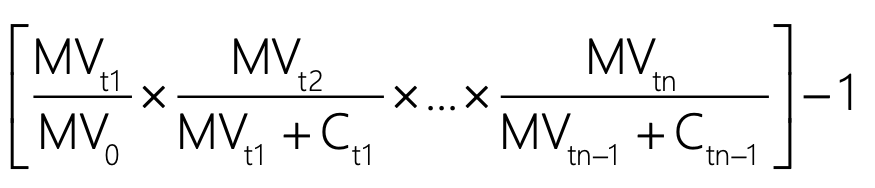

What is the formula of MWRR?

Pros of TWRR?

Comparable across fund managers, indexes, and benchmarks

Provides historical record

Easy to understand and compute formula

Cons of TWRR?

Conflicts with current dollar/euro amount invested in the fund

Ignores cash inflows and cash outflows

Pros of MWRR?

Directly related to current dollars in the investment account

Personalised return calculation

Cons of MWRR?

Highly sensitive to the timing of cash flows

Calculation is complicated

Not comparable across fund managers or market indexes

What is used in order to compare rates of return with other investment funds?

Benchmark

What is benchmark(ing) according to Merriam-Webster Dictionary?

Standard or point of reference in measuring or judging quality, value, etc.

What is benchmark(ing) according to Wikipedia?

Process of comparing one’s business processes and performance metrics to industry bests and/or best practices from other industries

What is benchmark(ing) according to CFA institute?

Collection of securities or risk factors and associated weights that represent the persistent and prominent investment characteristics of an asset category or managers’s investment process

A valid benchmark must respect … elements

6

A valid benchmark is:

Unambiguous, replicable, measurable, appropriate, pre-specified, owned

How many types of benchmarks are there?

4

What are the types of benchmarks?

Managers universes, broad market indexes/benchmark (MIB), style indexes, factor model based

Which is the unsuitable benchmark?

Manager universes

Which benchmark is the most used in practice?

Broad market indexes (S&P 500, FTSE 100, CAC 40, etc.)

What is manager universes?

Uses the median manager (fund) from a broad universe of managers (funds) as a performance evaluation benchmark

What is a style index?

Represent specific portions of an asset category, growth vs. value stocks

Which of the following statements about manager universe (peer group) benchmarking is correct?

Peer group benchmarks are based on the average performance of similar managers, are published with a lag, and are considered poor practice compared with financial market indices.

Traditional performance metrics such as raw returns and benchmarking are insufficient because:

They ignore the amount of risk a manager takes to generate returns

Risk-adjusted performance measures were developed primarily to:

Account for the level of risk managers accept when making investment decisions

Which of the following is NOT considered a risk-adjusted performance measure?

Time-weighted rate of return

Which group consists entirely of risk-adjusted performance measures?

Sharpe, M², Sortino, Jensen, Treynor

The need for risk-adjusted measures arises because:

Managers often take different levels of risk, making raw return comparisons misleading

What is the efficient frontier?

Set of portfolios that offers the highest expected return for a given level of risk or the lowest risk for a given level of expected return

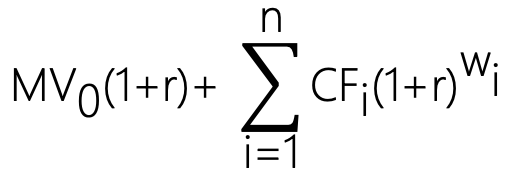

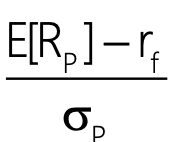

What is the formula for Sharpe measure?

What does the Sharpe measures?

The reward or excess return per unit fo risk or return volatility

The higher the Sharpe ratio is:

the better the performance

What is the formula of Expected Sharpe ratio ?

The Sharpe ratio is used:

to rank portfolio performance, BUT its numerical value is not easy to interpret

The M² is used:

to measure total volatility as a measure of risk, BUT has an easy interpretation

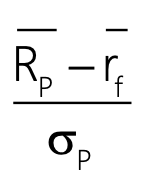

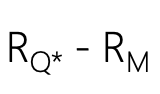

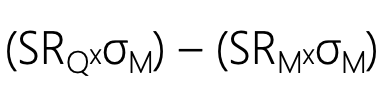

What is the formula of M² ?

What is the other formula of M² using another ratio?

What is the formula of rQ*/rK*?