deca-pfl

0.0(0)

Card Sorting

1/166

Last updated 5:26 PM on 12/6/22

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

167 Terms

1

New cards

personal loan

a form of installment credit. Unlike a credit card, they deliver a one-time payment of cash to borrowers. Then, borrowers pay back that amount plus interest in regular, monthly installments over the lifetime of the loan, known as its term.

2

New cards

equal credit opportunity act

prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age, because an applicant receives income from a public assistance program, or because an applicant has in good faith exercised any right under the Consumer Credit Protection Act.

3

New cards

proper notice of rejection letter

a letter informing a person of being turned down (as for a job, school enrollment, etc.) : a letter saying that something a person has written, made, etc., has been turned down (as for publication)

4

New cards

a secured line of credit

you use an asset as collateral for the line of credit. For example, the asset could be your car or your home. If you don't pay back what you owe, the lender can take possession of that asset. The advantage is that you can get a lower interest rate than with an unsecured line of credit.

5

New cards

non-essential expenses

not absolutely necessary spending

6

New cards

fixed expenses

such as rent, stay the same from month to month.

7

New cards

essential expenses

things you need to spend money on

8

New cards

variable expenses

a corporate expense that changes in proportion to how much a company produces or sells.

9

New cards

pay stub

it provides a record of their wages, helps them understand their taxes, contributions, and deductions,

10

New cards

gross pay

what employees earn before taxes, benefits and other payroll deductions are withheld from their wages.

11

New cards

net pay

12

New cards

tax-exempt income

income from any source which the Federal, state, or local government does not include when implementing its income tax.

13

New cards

overtime income earned-

hours worked over 40 in a workweek at a rate not less than time and one-half their regular rates of pay.

14

New cards

net worth income

net worth measures your total assets minus your total debt

15

New cards

debt

something, typically money, that is owed or due.

16

New cards

What is the main purpose of a resume

present your qualities

17

New cards

the major reason people fail to reach their goals is

give up too soon.

18

New cards

debit card

a card issued by a bank allowing the holder to transfer money electronically to another bank account when making a purchase. a payment card that deducts money directly from a consumer's checking account when it is used.

19

New cards

credit card

a financial tool offered by a bank as a type of loan

20

New cards

interest account

the amount of money a bank or financial institution pays a depositor for holding their money with the bank.

21

New cards

savings account

a bank account that earns interest.

22

New cards

expense account

an arrangement under which sums of money spent in the course of business by an employee are later reimbursed by their employer.

23

New cards

checking account

an account at a bank against which checks can be drawn by the account depositor.

24

New cards

credit account

an arrangement in which a bank, store, etc., allows a customer to buy things with a credit card and pay for them later : charge account

25

New cards

Brokerage firms

a middleman who connects buyers and sellers to complete a transaction for stock shares, bonds, options, and other financial instruments.

26

New cards

conflict of interest

a situation in which a person is in a position to derive personal benefit from actions or decisions made in their official capacity.

27

New cards

financial advisor

a professional who provides expertise for clients' decisions around money matters, personal finances, and investments.

28

New cards

dividend

a sum of money paid regularly (typically quarterly) by a company to its shareholders out of its profits (or reserves).

29

New cards

underwriter

is any party, usually a member of a financial organization, that evaluates and assumes another party’s risk in mortgages, insurance, loans, or investments for a fee in the form of a commission, premium, spread, or interest.

30

New cards

annuity

a contract that requires regular payments for more than one full year to the person entitled to receive the payments

31

New cards

beneficiary

the person or entity you name in a life insurance policy to receive the death benefit.

32

New cards

diversification strategies

the practice of introducing a new product into your supply chain

33

New cards

equity

the value of the shares issued by a company.

34

New cards

credit

the ability to borrow money or access goods or services with the understanding that you'll pay later.

35

New cards

collateral

something pledged as security for repayment of a loan, to be forfeited in the event of a default.

36

New cards

statement balance

typically shows what you owe on your credit card at the end of your last billing cycle.

37

New cards

interest

Interest is the monetary charge for the privilege of borrowing money.

38

New cards

industry recruiter

We source candidate for you, screen them based on the qualifications you set, and schedule qualified interviews for you.

39

New cards

admissions director

manage the application process with the admissions team.

40

New cards

guidance counselor

a person who gives help and advice to students about educational and personal decisions

41

New cards

curriculum planner

creating a practical plan of action and a list of learning objectives for any subject.

42

New cards

coupon-paying bond

the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity.

43

New cards

investors

a person or organization that puts money into financial plans, property, etc. with the expectation of achieving a profit.

44

New cards

strategy and implementation business plan

outlines the steps your team should take when accomplishing a shared goal or objective.

45

New cards

financial business plan

consists of five budgets that detail the minimum requirements for starting your business, the investments you will need to make and how you plan to finance them.

46

New cards

management business plan

outlines your ownership structure, the management team, and staffing requirements.

47

New cards

market analysis in business plan

a thorough assessment of a market within a specific industry.

48

New cards

business plan

a document that defines in detail a company's objectives and how it plans to achieve its goals

49

New cards

good 'til canceled order restriction

a buy or sell order that remains active until it is either executed or until the investor cancels it.

50

New cards

all or none order restriction

an order type with the instruction to fill the order completely or cancel it; partial fills are not allowed.

51

New cards

day order order restriction

limit orders to buy or sell securities that are only good for the remainder of the trading day on which are placed

52

New cards

fill or kill order restriction

an order to buy or sell a stock that must be executed immediately in its entirety;

53

New cards

mutual fund

a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt.

54

New cards

diversified options

a management strategy that blends different investments in a single portfolio.

55

New cards

low risk

not likely to result in failure, harm, or injury

56

New cards

moderate growth

designed to balance the dual mandate of capital growth and capital protection.

57

New cards

funds prospector

58

New cards

statements of retained earnings

a financial statement prepared by corporations that details changes in the volume of retained earnings over some period.

59

New cards

stock tickers

a report of the price of certain securities, updated continuously throughout the trading session by the various stock market exchanges.

60

New cards

the shareholders' meeting

a report of the price of certain securities, updated continuously throughout the trading session by the various stock market exchanges.

61

New cards

stock

a security that represents the ownership of a fraction of the issuing corporation.

62

New cards

stock table

typically list most of the actively traded public companies in the U.S. and include summaries of how a company's stock performed the previous trading day

63

New cards

company's abbreviated name in the table are followed by the

ticker symbol

64

New cards

trademark

can be any word, phrase, symbol, design, or a combination of these things that identifies your goods or services.

65

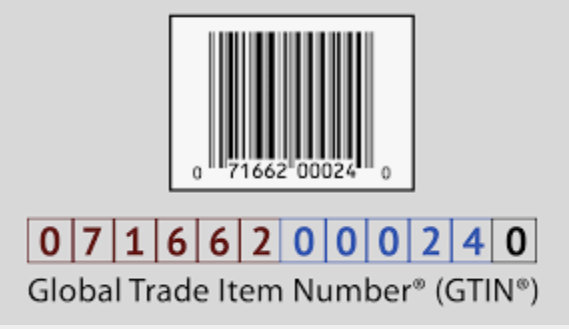

New cards

trade number

uniquely identify all of its trade items.

66

New cards

personal injury insurance

also known as no-fault insurance, helps cover expenses like medical bills, lost wages or funeral costs after a car accident, no matter who is at fault. Requirements for this coverage vary from state to state.

67

New cards

collision insurance

helps pay to repair or replace your vehicle if it's damaged or destroyed in an accident with another car, regardless of who is at fault.

68

New cards

comprehensive insurance

a coverage that helps pay to replace or repair your vehicle if it's stolen or damaged in an incident that's not a collision.

69

New cards

liability insurence

protects you financially if you're responsible for someone else's injuries or property damage. Also is a broad term that describes types of coverages to help protect you or your business if someone files a lawsuit or reports a claim against your company.

70

New cards

Individuals who are nearing retirement often invest funds for the purpose of

generating a fixed income.

71

New cards

diversifying assets

the practice of spreading your investments around so that your exposure to any one type of asset is limited.

72

New cards

generating a fixed income

a conservative strategy where returns are generated from low-risk securities that pay predictable interest.

73

New cards

taking a financial risk

the possibility of losing money on an investment or business venture.

74

New cards

what is the decision-making process

includes the following steps: define, identify, assess, consider, implement, and evaluate.

75

New cards

debtor-creditor relationships

A debtor is a person or other legal entity who owes money or services to another person or company. This party to whom the debt is owed is called the creditor. The money or service that the debtor owes to the creditor is called the debt or the obligation.

76

New cards

financial ratios

used to calculate a company's financial status or production against other firms.

77

New cards

liquidity ratios

are an important class of financial metrics used to determine a debtor's ability to pay off current debt obligations without raising external capital.

78

New cards

asset management ratios

measure the ability of assets to generate revenues or earnings

79

New cards

debt ratios

metric that measures a company's total debt, as a percentage of its total assets.

80

New cards

profitability ratios

are a class of financial metrics that are used to assess a business's ability to generate earnings relative to its revenue, operating costs, balance sheet assets, or shareholders' equity over time, using data from a specific point in time.

81

New cards

what is insiders trading

the illegal practice of trading on the stock exchange to one's own advantage through having access to confidential information.

82

New cards

loan products

one of the various types of consumer mortgage and home equity loan products offered to customers by Lender from time to time.

83

New cards

collateral

an item of value pledged to secure a loan.

84

New cards

financing

buying and selling, taking out a loan, maintaining accounts, investing, moving money from one account to another, refinancing and asset, going public.

85

New cards

income

money received, especially on a regular basis, for work or through investments.

86

New cards

interest

the monetary charge for the privilege of borrowing money.

87

New cards

endorsement

a clause in an insurance policy detailing an exemption from or change in coverage.

88

New cards

online bill paying

an electronic payment service offered by many banks,

89

New cards

manual bill paying

any payment in which the vendor has to manually contribute to the process, whether that means taking cash and giving change, taking credit card details over the phone, or offering up an invoice and reconciling the resulting payment.

90

New cards

direct withdrawal paying

collect payments from your account when they are due

91

New cards

present value

the value right now of some amount of money in the future. For example, if you are promised $110 in one year, the present value is the current value of that $110 today.

92

New cards

what is the correct way to write out the numerical dollar amount on the check?

"Forty-five dollars and 75/100"

93

New cards

comprehensive insurance

is a coverage that helps pay to replace or repair your vehicle if it's stolen or damaged in an incident that's not a collision.

94

New cards

Adjustable life insurance

a permanent life insurance policy that gives policyholders the flexibility to change the premiums and death benefits.

95

New cards

gap insurance

covers the difference between what a vehicle is currently worth (which your standard insurance will pay) and the amount you actually owe on it.

96

New cards

uninsured motorist insurence

protects drivers and families who are injured in car accidents caused by uninsured drivers.

97

New cards

What is the best way for a college student with a credit card charging 2.5% annual interest to establish a good credit history and avoid paying additional interest?

Use the credit card to pay for routine expenses and pay the balance in full each month

98

New cards

corporate finance

concerned with how businesses fund their operations in order to maximize profits and minimize costs.

99

New cards

accounting

the action or process of keeping financial accounts.

"an investigation into suspected false accounting"

"an investigation into suspected false accounting"

100

New cards

securities and investments

financial instruments that hold value and can be traded between parties.