2.1.2 Inflation

1/18

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

19 Terms

INFLATION

the general increase of prices in the economy which erodes the purchasing power of money

low inflation generally considered to be better than high

DEFLATION

the fall of prices and indicates a slowdown in the rate of growth of output in the economy

DISINFLATION

reduction in the rate of inflation

prices are still rising but they’re not rising by as much

INFLATION- CALCULATION E.G.

e.g. If the level of inflation is 10%, what will £500 worth of goods in year 1 cost in year 2?

110%x 500= £550

e.g. If the level of inflation is 50%, what will £1000 worth of goods in year 2 in cost year 1?

150%=1000

100%=666.67

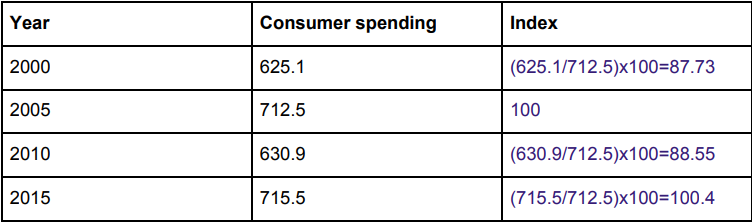

INDICES

nominal figures must be changed into real figures to make comparisons

done by choosing 1 yr for the base yr and adjusting all other figures into equivalent figures

In Britain, the most well-known indices are RPI and CPI

the base figure is given an index figure of 100 and all the figures before or after that time are then compared to that figure

(new figure/base figure) x100

INDICES- CALCULATIONS E.G.

if the base year is 2005, work out the index of consumer spending for the following data:

CONSUMER PRICE INDEX (CNI)

the Office for National Statistics (ONS) collects prices on 710 g and s from 20,000 shops and the prices are updated every month, w/ collectors visiting the same retailers to monitor identical goods

new items are added to the list every year, such as nail varnish, whilst others are taken away, including organic carrots

all these prices are combined using info on the average household spending pattern to produce an overall price index

the average household spending is worked out through the Living Costs and Food Survey, where around 5,500 families keep diaries of what they spend over a fortnight

takes into account how much is spent on each item i.e. we spend more on petrol than on postage stamps so an increase in petrol will have a bigger impact on rate of inflation

CPI- LIMITATIONS

impossible for the figure to take into account every single good that is sold in the country so CPI is not totally representative

diff households spend different amounts on each good and so therefore the CPI only measures an average rate of inflation

doesn’t include the price of housing- since this has tended to rise more than the price of other goods, the data may be lower than it should be

CPI is more recent than RPI- difficult to make comparisons with historical data

some argue that all inflation indices overestimate inflation because they don’t take into account the fact that g and s have improved in quality so will be more expensive

RETAIL PRICE INDEX (RPI)

includes housing costs such as mortgage and interest payments and council tax, whereas CPI doesn’t

CPI takes into account the fact that when prices rise people will switch to product that has gone up by less- so CPI is generally lower than RPI

RPI excludes the top 4% of income earners and low income pensioners as they are not 'average' households whilst CPI covers all households and all incomes

no longer considered as the best method and has had its national statistic status removed, although the Office for National Statistics still calculates it every month

CAUSES OF INFLATION

demand pull

cost push

growth of money supply

CAUSE OF INFLATION- DEMAND PULL

prices in a market are determined by demand and supply and a shift in either will cause price to change

inflation can therefore be caused by an increase in AD, total demand for g and s in the economy

if any factor which increases AD was to increase, then inflation would increase

CAUSE OF INFLATION- COST PUSH

a decrease in AS may push prices up

when businesses find their costs have risen, they will put up prices to maintain their profit margins

this can be caused by any factor which decreases AS

CAUSE OF INFLATION- GROWTH OF MONEY SUPPLY

another potential cause of inflation is there being too much money in the economy

if people have access to money they will want to spend it but if there is no increase in the amount of g and s supplied, then prices will have to rise

the gov can also increase the amount of money that they print and decisions to increase gov borrowing can also increase the money supply

EFFECTS OF INFLATION

consumers

firms

govs

workers

EFFECTS OF INFLATION- CONSUMERS

if incomes don’t rise with inflation then they will have less to spend- could cause a fall in living standards

debtors can repay loans at a price which is of cheaper value, but those who are owed money lose because the money they get back is of cheaper value- consumers who have saved will lose out as their money is worth less

inflation has psychological effects on consumers: if prices are rising, they may feel less confident, even if their income is rising in line with inflation- may cause them to decrease their spending

EFFECTS OF INFLATION- FIRMS

if inflation in UK is higher than other countries, British goods will be more expensive

will become less competitive and make them more difficult to export and affect balance of payments

deflation isn't good as it encourages people to postpone their purchases as they wait for the price to fall

people will be more likely to save as the value of their money will rise in the future and they will be prevented from borrowing as deflation means the real value of their debt increases

can lead to a fall in demand for goods, leading to a fall in firms' profit, and in business confidence which can lead to a long term lower investment

inflation/deflation/disinflation is difficult to predict- means that firms cannot plan for the future

EFFECTS OF INFLATION- GOVERNMENT

if gov fails to change excise taxes (taxes at a set amount) in line with inflation then real gov revenue will fall

but if they fail to change personal income tax allowances (amount a worker can earn tax free) then real gov revenue will increase and taxpayers will have less money

EFFECTS OF INFLATION- WORKERS

if workers don’t receive yearly pay rises of the rate of inflation, their living standard will decrease

those in weaker unions tend to be most affected as they are unable to win wage rises in line with inflation

deflation could cause some staff to lose their jobs as there is a lack of demand meaning firms see a fall in profit and have to decrease staff to cut costs

EFFECTS OF INFLATION- WORKERS (INDEXATION)

some of these costs can be reduced if inflation is anticipated, which will allow groups to plan for the future

can be done through indexation, so wages or taxes are increased in line with inflation

e.g. workers negotiating with employers for wage rises in line with the predicted CPI or RPI

but indexation may in itself further inflation because wage increases will reflect past increases