Financial econometrics - theory

1/581

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

582 Terms

advantage of cash

liquidity

disadvantage of cash

subject to inflation/devaluation

advantage of having percentage of GDP when talking about volume of trade

global GDP is growing, it is better to standardized somehow

using the dollar is subject to inflation so this will result in skewed results

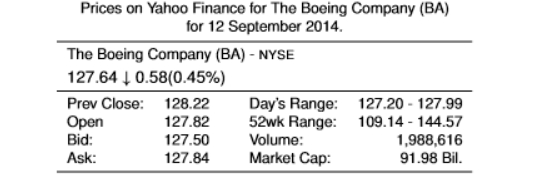

What do these numbers mean?

127.64 is the last price the share was slod at

0.58 is the different in the current trade and the previous close (it is lower)

the first trading price of the day was 127.82

we mainly use the closing price for empirical work

what does a smaller bid-ask spread result in?

high levels of liquidity

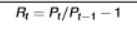

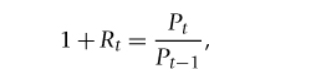

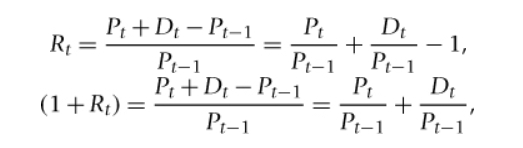

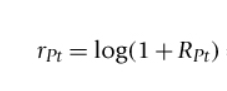

formula for 1-period simple return

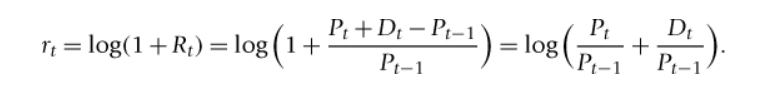

formula for 1-period log return

formula for k-period simple return

the operator on the right hand side is the product operator

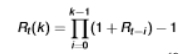

formula for k-period log return

we simply aggregate the log returns which we can’t do with simple returns as we have to compound it ourselves

simply the sum of the single period log returns over the period

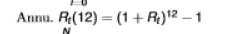

formula for annualised simple return

useful when we have two returns measured in different frequencies

assume monthly returns will persist for 12 months

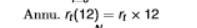

formula for annualised log return

useful when we have two returns measured in different frequencies

assume monthly returns will persist for 12 months

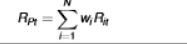

formula for portfolio simple return

simple is preferred to log as it is additive

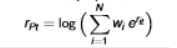

formula for annualized log return

is a dollar return scale-free?

no

examples of price-weighted indices

dow jones industrial average index (dow jones/DJIA) (US)

Nikkei 225 index (Nikkei/NKX) (Tokyo)

examples of value-weighted indices

Deutscher Aktien Index (DAX) (Germany)

Financial Times Stock Exchange 100 Index (FTSE) (UK)

Hang Seng Index (Hang Seng/HSX) (Hong Kong)

Standard and Poors Composite 500 (S&P 500)

stylised facts about financial data

heavy tails (measured by kurtosis (4th movement))

asymmetry (measured by skewness (3rd movement))

we use t-distribution for financial data

volatility clustering

departure from normality

long-range dependence (2nd order dependence)

log price of an asset is typically an integrated process

some series of the log prices of assets keep co-movement in long run but some trending variables can have spurious (not genuine) relationships

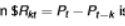

details about heavy tails in financial data

the density of asset returns has heavier tails than normal

there is excessively high proportion of extreme values

distribution is still centred/symmetric but the probability of extreme values is higher than normal

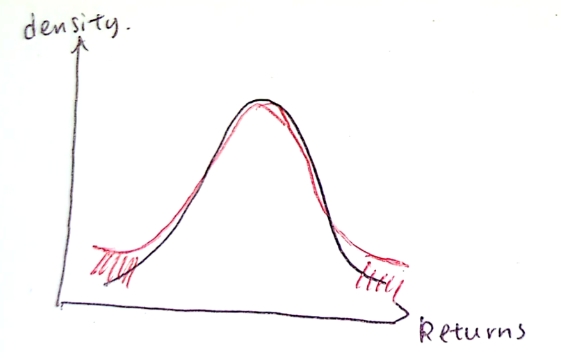

details about asymmetry in financial data

the density of asset returns is slightly negatively skewed

there is higher proportion of negative returns than positive returns

more likely to get a negative return than a positive return

earnings could be positively skewed (skewed to the right)

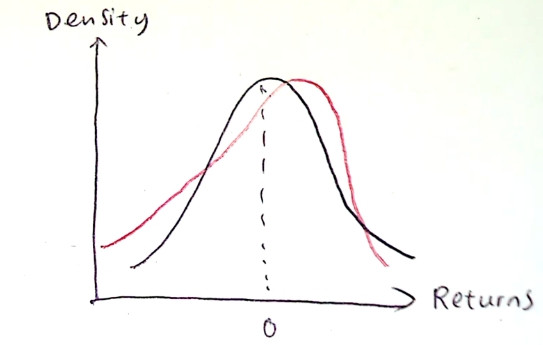

details about volatility clustering in financial data

large changes in log price comes in clusters

this issue has been extensively studied in ARCH (autoregressive conditional heteroskedasticity) literature

periods of high volatility tend to follow high volatility periods

periods of low volatility tend to follow each other

we observe period of low volatility, periods of high volatility, periods of low volatility, etc.

details about departure from normality in financial data

high frequency asset returns show obvious departure from normality

the distribution of asset returns at other frequencies also tends to be non-normal

details about long-range dependence in financial data

one observes strong serial correlation in variance (not mean) of returns

r²t or IrtI is strongly autocorrelated

this feature may help explain volatility clustering

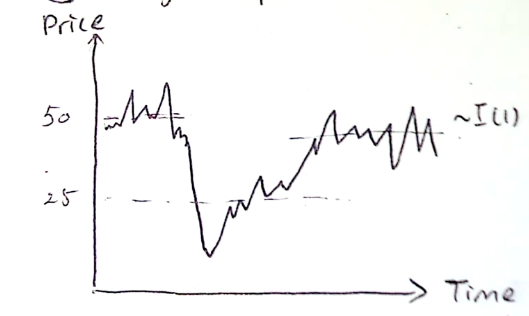

details about log price of an asset being an integrated process in financial data

many such series appear to have upward trends

such series commonly have unit roots, which affect inference

mean and variance are not constant over time

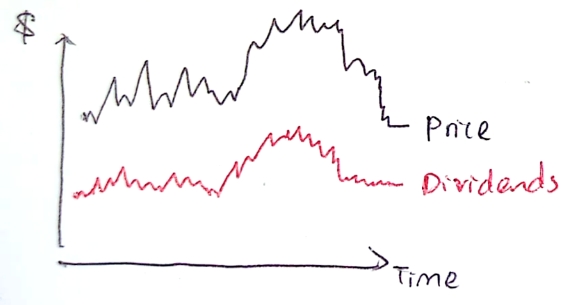

graphical representation of co-movement of prices and dividends

not moving at the same level but their movements are very similar

if they are both I(1) processes, we could model them together to make a stationary process

could model how they would move in the long-run

if prices are exponential, what do we expect log prices to be?

linear, growing at a constant rate

if log prices are linear, we expect log returns to be constant

Pt - Pt-1 = some constant

do we expect returns to follow a leptokurtic or platykurtic distribution?

leptokurtic

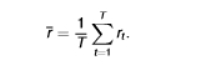

formula for mean

1st moment - where is the distribution centred?

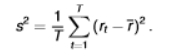

formula for variance

2nd moment - how spread out is the distribution?

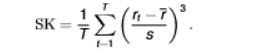

formula for skewness

3rd moment - is the distribution symmetric?

SK < 0 = negatively skewed, SK >0 = positively skewed

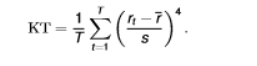

formula for kurtosis

4th moment - the tail behaviour of the distribution

we compare this to the value KT = 3 as this is the kurtosis value of a normal distribution

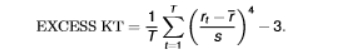

formula for excess kurtosis

distribution with positive excess kurtosis is leptokurtic

distribution with negative excess kurtosis is platykurtic

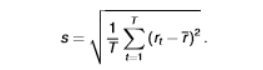

formula for volatility

also the formula for sample standard deviation which is the square root of the sample variance

variance will be non-zero and positive (as it is squared)

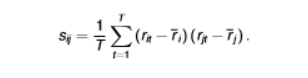

formula for sample covariance

we use this when we have two time-series

formula for sample correlation

value will range between -1 and 1

if the correlation = 0, the assets are linearly independent

when there are large outliers, is the median or the mean preferred?

the median

if we used the mean, the outlier would skew the mean calculation

which percentiles of distribution are important in finance?

the 1st and 5th percentiles to measure the value at risk

why do we need to calculate VaR?

the financial system can become less stable when huge losses are suffered by financial institutions in the system

we measure the potential loss faced by banks to reflect financial sector stability

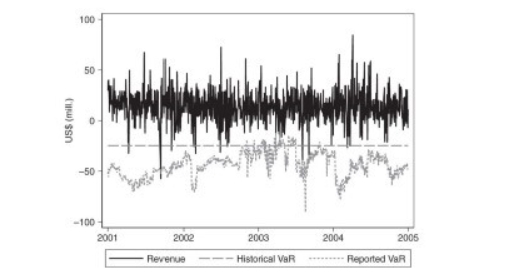

example of value-at-risk

the 1% value at risk for the next h periods conditional on information at time T is the 1st percentile of expected trading revenue (which can be a gain or a loss) at the end of the next h periods

if the daily 1% value at risk is $30 million, there is a 1% chance the bank will lose $30 million or more after 1 day

although $30 million is a loss, by convention, the value at risk is quoted as a positive number

historical simulation for computing VaR

the historical method simply computes the percentiles of the empirical distribution from historical data

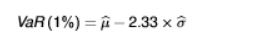

the variance method for computing VaR

the method assumes that returns are normally distributed

we use 2.33 as it is a one-sided test (calculating the loss so just looking at the left tail of the distribution)

where ɥ and σ are the sample mean and standard of the returns (respectively)

monte carlo simulation for computing value-at-risk

involves simulating a model for returns several times and constructing simulated percentiles

using a model to make forecasts of future values of the asset or portfolio and then assessing the uncertainty in the forecast

what does 1% VaR mean?

you would hope 1% falls below your prediction

if below 1% falls below your prediction, you are very conservative

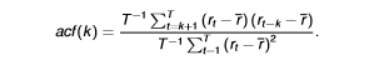

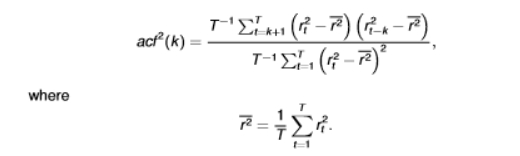

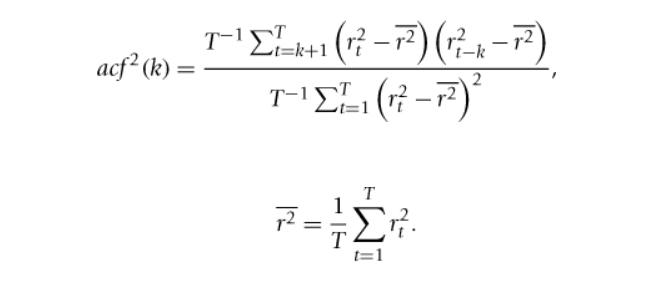

autocorrelation formula

it is similar to the correlation formula

only applied to one variable and its own lag, instead of two variables

the numerator represents the autocovariance of returns k periods apart

the denominator represents the variance of returns

if EMH is true, what does it imply?

the current price of an asset reflects all relevant information available on the market

the current price provides no information regarding future asset movements

future returns are completely unpredictable, given information on past returns

traders cannot systematically use newly arriving information to make a profit

conditional on all previous information, returns are completely random

what does zero autocorrelation imply?

returns exhibit no predictability

EMH exists

future movements in returns are unpredictable in terms of their own past history

foreign exchange rate is considered to be efficient as the autocorrelation ~ 0

if returns exhibit positive/negative autocorrelation, what does this imply?

this pattern can be exploited to predict future behaviour

EMH is violated

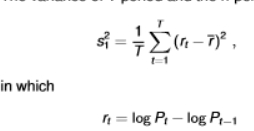

variance ratio of 1-period

alternative way to examine the EMH

we are comparing the variance ratio on returns over different time horizons

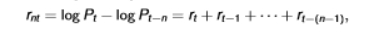

variance of n-period returns

nr(~) = sample mean of the n-period returns rnt

alternative way to examine the EMH

we are comparing the variance ratio on returns over different time horizons

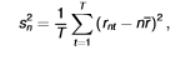

how do we construct the variance ratio?

we first impose that the variances rt, rt-1, rt-2,…, are the same and do not depend on t

we are imposing the assumption of homoskedasticity for this to work

if there is no autocorrelation, what does the variance of n-periods equal to?

the variance of n-period returns should equal n times the variance of the 1-period returns

the ratio is known as the variance ratio

significant values for the variance ratio

= 1 means no autocorrelation

>1 = positive autocorrelation

<1 = negative correlation

if we have VRn = 0.99, we would have to conduct a hypothesis test as we can’t assume there is no autocorrelation just because the value is close to 1

limitations of autocorrelation

not a universal measure of predictability

can capture, at most, linear predictability of mean returns

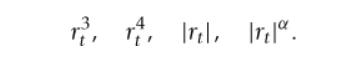

possible for us to extend the concept of autocorrelation to measure predictability of higher moments such as variance, skewness, or kurtosis

autocorrelation in squared returns formula

characteristics of autocorrelation in squared returns

we can have negligible acf(k) and sizeable acf²(k)

this is case, the mean is not predictable but the variance is

this does not violate the EMH as it is only concerned with the expected value of returns, and not their variance (or higher moments)

in fact, many functions of returns can display predictability, in terms of autocorrelations

why do we need to use financial econometrics?

hope to help regulators and policy markers to be better equipped to assist in monitoring markets toward the goal of financial stability

also to guide the smooth functioning of financial markets in the face of crisis

distinguishing feature is that there is an abundance of financial data

how can foreign exchange be seen as a cash investment?

the exchange rate is simply the price of one currency in terms of another

the use of summary estimates of prices

we are increasing the number of observations

does not always increase the efficiency or improve understanding

the effect of a dividend payment

to lower the share price by the amount of the dividend

the closing price of the previous day is greater than the opening price of the following day

process of adjustment does not mean that historical prices reflect the actual prices at which trades took place

adjustment for a 2-for-1 stock split

a company replaces each existing share by two shares

the price of the share is immediately halved

makes the shares look more affordable, even though the market capitalization of the company has not changed

to make the prices before and after the split comparable, all historical prices need to be divided by 2 and the historical volume series needs to be multiplied by 2

disadvantages of dollar returns

not scale-free

does not measure the return relative to the initial investment

depends on the unit in which prices and dividends are quoted

simple gross return formula

rearranged the simple return formula

useful to represent the value at time t of investing $1 at time t-1

are simple returns additive when computing multi-period returns?

no

due to the multiplicative effect of period-by-period returns

whereas log returns are continuously compounded returns

what is the significance of e=2.17828 for log returns?

represents the value of an account at the end of year that started with $1 and paid 100% interest per year but the interest compounded continuously over time

how many trading days are there?

approximately 252 (due to public holidays/leap year)

are continuously compounded returns similar to simple returns?

only if the return is small

generally the case for monthly and daily returns

simple and gross returns with dividend payments formulae

Dt/Pt-1 = dividend yield

log returns with dividend payments formula

log return on a portfolio

= Rpt when Rpt is small

Rpt = portfolio rate of return which is equal to the weighted average of the returns to the assets

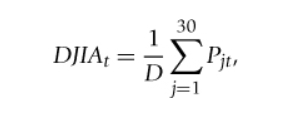

formula for Dow Jones index

D = Dow Jones divisor

advantages and disadvantages of price weighting

+ simplicity

- stocks with the highest price have a greater relative impact on the index than they perhaps should

- the price-weighted index overemphasised market movements during the period of the dot com bubble, as well as the speed of the recovery form the 2008 global financial crisis

disadvantage of value weighting

securities whose prices have risen the most (or fallen the most) have a greater (or lower) weight in the index

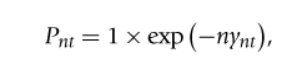

price of zero-coupon bond

the right hand side is the discounted present value of the principal

-nynt= discount rate

yield on a zero-coupon bond

the yield is inversely proportional to the natural logarithm of the price of the bond

-1/n = constant

features of yield curves

at any point in time when the yield curve is observed, all the maturities may not be represented

this is particularly true at longer maturities where the number of observations yields is much sparser than at the short end of the maturity spectrum

the yields at longer maturities tend to be less volatile than the yields at the shorter end of the maturity spectrum

the shape of the yield curve is determined by the demand and supply of the bonds of various maturities, market expectations, and risk assessments

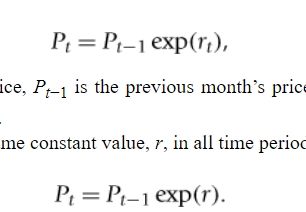

formula for exponential pattern in stock prices

Pt = current equity price

Pt-1 = previous month price

rt = rate of the increase between month t-1 and month t

the second equation shows if we restrict rt to take the same constant value

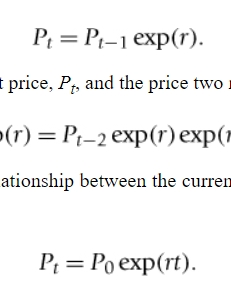

general formula for the relationship between the current price and the price t months earlier

rt = how many months between the two prices

the second equation is derived when we take the natural logarithms

what is the effect of measuring returns over very short periods of time?

any tendency of prices to drift upward is virtually imperceptible as the effect is so small and is swamped by the apparent volatility of returns

returns generally focus on short-run effects whereas price movements can trend noticeably upward/downward over extended periods of time

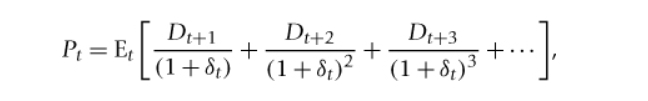

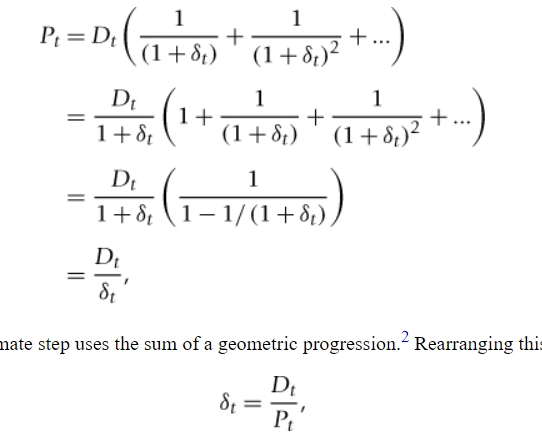

the present value model formula

where dt = discount rate (on denominator)

the price of an equity is equal to the discounted future stream of dividend payments

results in deriving the yield curve (last line)

the relationship between equity prices and dividends is upward exponentially trending, with stronger intermittent downturns for equity prices

can change the property by combining two or more series

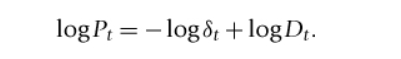

natural logarithms equation of the present value model

reveals the linear relationship between logPt and logDt

3 important properties of yields of zero-coupon bonds

yields are increasing over time, so they exhibit some form of trending behaviour

the variance of the yields tends to grow as the levels of the yields increase (levels effect)

yields of different maturities follow one another closely

important distinguishing feature of transactions data

the time interval between trades is not regularly/equally spaced

if high-frequency data are used, there will be period where no trades occur and the price won’t change

an example when the sample mean is an inappropriate summary measure

when the data are trending

how does positive/negative skewness change the shape of the distribution?

positive skewness = heavier right tail

negative skewness = heavier left tail

properties of correlation

has the same sign as the covariance

lies in the range -1</= cjj </= 1

not unit dependent as the measurement units are scaled out

VaR example

if the daily 1% h-period VaR is $30mil, there is a 1% chance that the bank will lose $30mil or more

difference of the VaR computed from the variance method and the historical method

the value computed from the variance method is slightly lower than that computed by historical returns as the assumption of normality ignores the slightly fatter tails exhibited by the empirical distribution of daily trading revenues

ways to use sample statistics to test the efficient market hypothesis

test asset returns for predictability

compare the variance of asset returns over different time horizons

autocorrelation of returns reveal information about the temporal dependence properties of the levels of returns

reveals information about the autocorrelation properties of the squared levels of returns

if the squared level of returns are predictable, does this violate EMH?

as long as the level of returns are not predictable, this does not violate EMH

EMH is only concerned with the expected value of the level of returns

various power transformations of returns computed by autocorrelation

first one = skewness

second one = kurtosis

third one = the absolute magnitude of returns (alternative measure of the presence of autocorrelation of variance)

last one = general power transformation

if a = 0.5, this is the autocorrelation of the standard deviation

what does the presence of stronger autocorrelation in squared returns than returns themselves suggest?

it suggests that other transformations of returns may reveal even stronger autocorrelation patterns

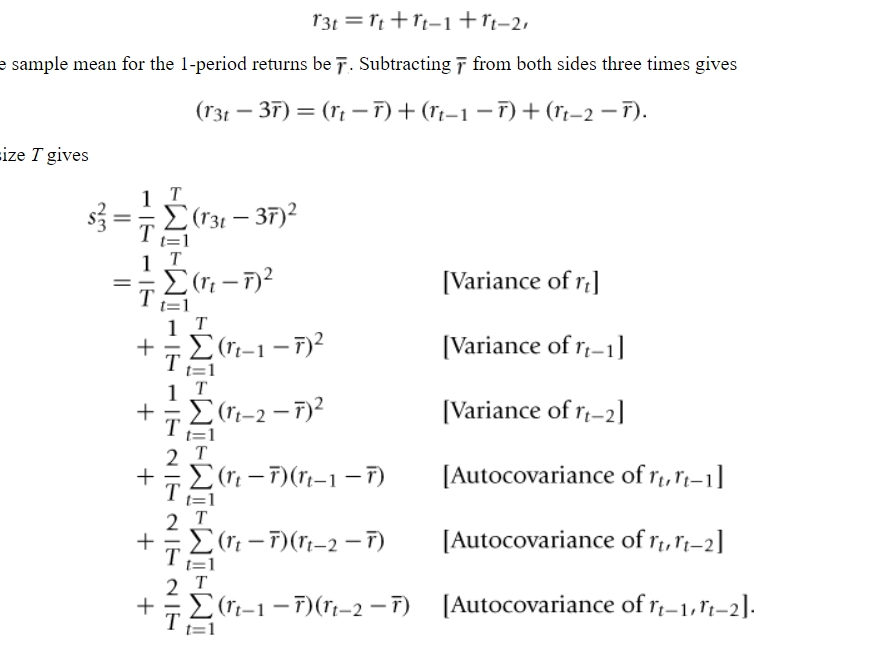

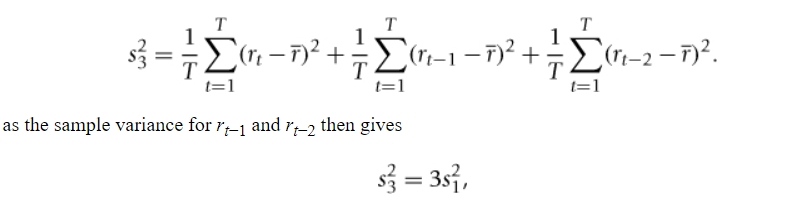

proof that a variance ratio of 1 means no autocorrelation

we are using an n=3 period return

sum of the three 1-period returns in the first equation

r(-) = sample mean for the 1-period return

we square both sides and average over a sample size T which gives what we see in the picture

in the case of zero sample autocovariances, what does the variance ratio relationship simplify to?

the second equation shows if we assume the sample variance for rt is the same as the sample variance for rt-1 and rt-2

there is no sample autocorrelation in the n=3 period return

this falls under the covariance stationarity assumption

does regression always capture causal relationships?

no

for example, we could find an increase in ice cream sales and an increase in crime rates (spurious relationship)

predictive regression, ie yt = monthly indicators

being in december doesn’t explain migration but having the december indicator can help us to predict net migration in that month

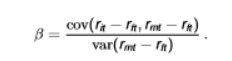

CAPM formula (in terms of beta risk)

describes the risk characteristics of an asset in terms of B-risk

rit - rft = the return on asset i relative to the risk-free rate rft (excess return)

rmt - rft = market return relative to the risk-free rate

we can use the treasury bill rate as rft and S&P 500 returns as rmt

the numerator is the covariance between the excess returns on the asset and the market and the denominator is the variance of the market

the expression is the same as the slope estimate for simple linear regression where cov(y,x)/var(x)

what is the support of beta in the CAPM?

it is on the real line

covariance is unbounded

variance is non-negative and unbounded

the relative magnitudes of the covariance and variance are unclear to us so beta could take any value from -∞ to ∞

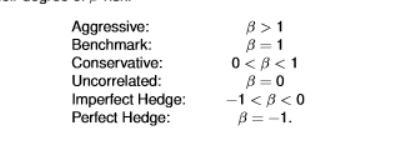

how are individual stocks or portfolio stocks classified?

in terms of their degree of B-risk

moving in the same direction as market = aggressive, benchmark, conservative

moving in the opposite direction as the market = imperfect hedge, perfect hedge

when beta is positive, it follows the same direction as the market (benchmark)

when beta is negative, it moves in the opposite direction as the market (hedge)

B= 0 when there is no covariance so the numerator is zero (the assets are independent)

ie if rit = rft

the denominator cannot be zero as this means it is constant

the covariance between a variable and some constant is always zero

with which type of beta risk do we earn the market return?

benchmark

beta = 1

with which beta-risk do we earn the risk-free return?

uncorrelated

B = 0

this means that it is independent of the market

how do we estimate beta?

we use the linear regression model

the disturbance term ut captures additional movements in the dependent variable not predicted by CAPM

if we did not include this, we would assume the regression is perfect; no unobservables at all

we assume zero conditional mean, that is E[ut Irmt - rft] = 0 (we have removed the market factor already)

we prefer a positive alpha (we want to earn that little bit extra compared to the market

two unknowns:

the intercept parameter a captures the average abnormal returns to the asset given the relative risks

the slope parameters B corresponds to the asset’s beta-risk

rit - rft = the excess return on asset (dependent variable)

a = captures the abnormal return to the asset over and above the asset’s exposure to the excess return on the market

if a>0, the asset earns higher (abnormal) returns in excess of the return predicted by CAPM

if a<0, the asset earns lower (abnormal) returns in excess of the return predicted by CAPM

b = beta risk

rmt - rft = excess return on market (explanatory variable)

ut = captures additional movements in the dependent variable not captured by CAPM

![<ul><li><p>we use the linear regression model</p></li><li><p>the disturbance term ut captures additional movements in the dependent variable not predicted by CAPM</p></li><li><p>if we did not include this, we would assume the regression is perfect; no unobservables at all</p></li><li><p>we assume zero conditional mean, that is E[ut Irmt - rft] = 0 (we have removed the market factor already)</p></li><li><p>we prefer a positive alpha (we want to earn that little bit extra compared to the market</p></li><li><p>two unknowns:</p></li><li><p>the intercept parameter a captures the average abnormal returns to the asset given the relative risks</p></li><li><p>the slope parameters B corresponds to the asset’s beta-risk</p></li><li><p>rit - rft = the excess return on asset (dependent variable)</p></li><li><p>a = captures the abnormal return to the asset over and above the asset’s exposure to the excess return on the market</p></li><li><p>if a>0, the asset earns higher (abnormal) returns in excess of the return predicted by CAPM </p></li><li><p>if a<0, the asset earns lower (abnormal) returns in excess of the return predicted by CAPM</p></li><li><p>b = beta risk</p></li><li><p>rmt - rft = excess return on market (explanatory variable)</p></li><li><p>ut = captures additional movements in the dependent variable not captured by CAPM</p></li></ul><p></p>](https://knowt-user-attachments.s3.amazonaws.com/8d275808-323a-44d3-86ac-f951ea0332dc.jpg)