FINAL EXAM ALL KEY TERMS ECON FUNDIES

1/58

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

59 Terms

Measurement of economic activities *** review/ask re: specific definition

measurement of variables in the economy, i.e. GDP, distribution of income (income approach), economic output (exp. approach), production activities (supply side — product approach)

GDP

gross domestic product, the most common measure of economic activity. It is the total monetary value of all finished goods and services produced within a country’s borders in a specific time period.

Production Approach

focuses on production activities in economy, or the “supply side” (ex: how GDP is the market value of all final goods, services, and inventories newly produced within a country during a given period of time)

Expenditure Approach

focuses on use of economic output in economy — “demand side” ex: spending by households, firms and governments (and other countries)

Income Approach

focused on the distribution of income in economy

calculating growth rates *** REVIEW/ASK

market exchange rates*** REVIEW/ASK

the prices when one currency buys another

Aggregate production function

Total Factor Productivity

expresses improvements in technologies or economic conditions that allow capital and labor to be used more effectively

Marginal benefit of capital** REVIEW/ASK

the additional return or profit an economy earns from investing one more unit of capital.

rental rate of capital

GDP per capita

measurement tool used to assess the standard of living across different countries (in monetary terms, regarding the production of goods/services and income)

labor force

the sum of employed, unemployed, and those actively seeking a job individuals that are over the age of 16

cyclical unemployment

Unemployment may be caused by shocks and some rigidities in labor markets that cause employment and GDP to differ from full employment. Also known as the difference between actual employment and the natural rate of employment

frictional unemployment

This type of unemployment results from a matching process between workers and firms. An individual will be unemployed if the additional benefit from an extra day searching for “the” job is greater than the marginal cost. Similarly, a firm may wait before closing a job vacancy by comparing marginal benefits and costs. Search frictions relate to job turnovers and matching issues (time of job announcements, interviews, hiring, paperwork, etc.)

structural unemployment

The unemployment cause derives from the discrepancy between the skills demanded by firms and the skills that workers supply. Because the sectoral mix of economies changes over time, the contraction of some sectors releases workers who should flow to other expanding sectors. However, the innovative sectors may require skills that the recently laid-off workers do not have, which causes structural unemployment.

seasonal unemployment

Finally, seasonal unemployment relates to changes in economic activities because of seasonal changes (agriculture, construction, tourism, etc.)

natural rate of unemployment

The natural rate of unemployment is the unemployment rate that is consistent with “full” employment. The natural unemployment rate, u∗, derives from frictional, seasonal, and structural reasons

flexible wages —> triple check w/ ppl

wages that can quickly adjust up or down in response to changes in labor market conditions, like supply and demand, productivity, or economic shocks (e.g., recessions)

sticky wages

Sticky wages are the tendency for nominal wages to resist downward adjustments even when economic conditions, such as a recession, would otherwise cause them to fall. This stickiness is driven by factors like long-term labor contracts, minimum wage laws, and employee morale, which can lead to firms choosing layoffs over pay cuts to reduce costs during a downturn, thus prolonging unemployment

inflation rate —> NEED TO ADD

the percentage increase in the average price of a basket of goods and services over a specific time —> usually indicates a decrease in purchasing power, where money is worth less

price index / price indicies

a tool to measure the average price level of a group of goods and services relative to a base year

nominal wage

wage can be expressed in nominal terms or in real terms. The nominal wage is the workers’ compensation for time and effort in monetary terms – e.g., the wage might be $25/hour

real wage

expresses the worker’s compensation for

time and effort in terms of goods and services – e.g., an hour of work may be equivalent to a certain number of a specific good or comparable to a number of baskets of goods/services using the price level.

nominal interest

measure that allows us to compare different asset and liability alternatives. It provides a measure to evaluate the relative change in an asset/liability value over time.

real interest

illustrates how the purchasing power in goods and services grows. is the true cost of borrowing or return on saving, and reveals the actual change in purchasing power

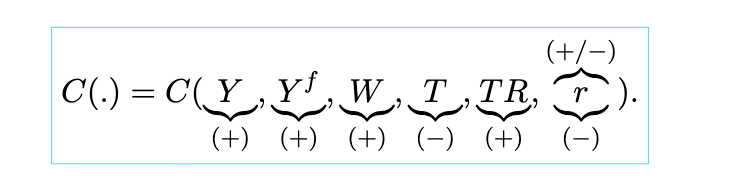

aggregate consumption

the aggregation of households’ consumption choices that rely on households’ current income, their expected future income, their current wealth of assets and liabilities, fiscal policies, and their incentives to lend and borrow and their ability to consume.

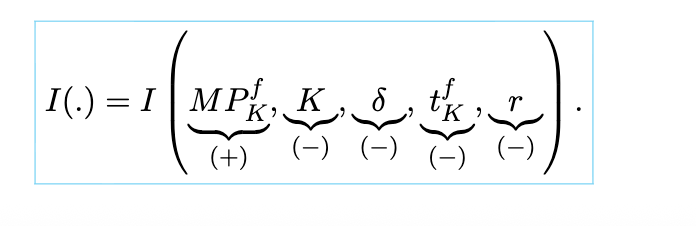

aggregate investment

a function of expected capital good returns, the current capital stock, the depreciation rate, and the real interest rate.

aggregate government spending —> **NEED TO REVIEW

given, the total spending by all levels of government (federal, state, local) on final goods and services, like infrastructure, defense, and public employee salaries.

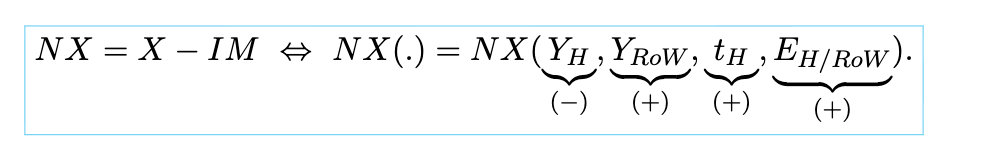

exports

goods and services produced domestically and sold to foreign countries

imports

goods and services produced abroad and bought by domestic residents, representing an outflow of money from the economy

net exports

sum of exports and imports (usually exports - imports)

Keynesian cross

Also known as the aggregate expenditure-output model —> derives equilibrium GDP when the price level is constant.

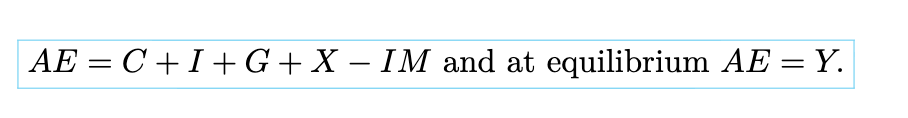

aggregate expenditure function **Check I don’t need to give a verbal definition of this

AE = C + I + G + NX

autonomous spending

Vertical intercept of the Keynesian Cross, where AS, which is spending independent of aggregate income, and m identifies the slope of the aggregate expenditure function related to changes in aggregate income

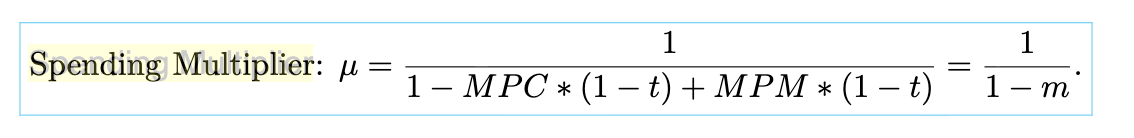

spending multiplier

illustrates how an additional dollar in expenditures can increase real GDP by more than one dollar —> calculated using marginal propensities and the tax rate

leakages

“leakages” of saving (reducing the marginal propensity of consumption), taxation (larger tax rates and less disposable income), and imports (affecting the negative effect of the marginal propensity of imports)

output gap

the difference between (short-run) GDP and full-employment GDP

recessionary gap

When actual GDP is below potential GDP, Y < Y* —> when actual unemployment exceeds the natural rate of unemployment

inflationary gap

When actual aggregate expenditures and GDP exceed the potential GDP, Y > Y*

Business cycle

short-term fluctuations in aggregate economic activity, employment/unemployment, and interest rates around their long-term trends. In order to understand them, an analysis of supply shocks or demand shocks is needed. They can be caused by either the economy’s demand side or supply side.

aggregate demand (AD)

illustrates the relationship between the economy's price level (index) and the economy's total expenditure for goods and service. It is a negative function of the price level because changes in the price level affect the real interest rate.

aggregate supply (AS)

illustrates the relationship between the economy's price level (index) and the economy's total production of goods and services. There are three types: short-run, medium-run and long-run.

SRAS

Also known as short-run aggregate supply, it follows from the aggregate demand at a constant price level.

MRAS

Known as the medium-run aggregate supply, it follows from price changes, expectations, and firms' actual labor costs.

LRAS

Known as long-run aggregate supply follows from a market-clearing in the labor market and is independent of the price level.

AD-AS model

a way of illustrating national income determination and changes in the price level

money

an asset that serves as a medium of exchange and is used to make payments

monetary base

the sum of currency in the hands of the public and the amount of bank reserves

money supply

The sum of currency in the hands of the public and amount of bank deposits

reserve requirement

the minimum amount of reserves, as a percentage of a bank's deposits, that a central bank mandates a financial institution must hold and not lend out

money creation

the process where the total money supply of a country increases, primarily through commercial banks issuing new loans in a fractional reserve system, and by central banks creating reserves.

money multiplier

The money multiplier expresses the number of dollars of money supply that can be created from each dollar of the monetary base

policy rate —> **CHECK

the key short-term interest rate set by a country's central bank (like the Fed Funds Rate in the U.S.) to steer overall economic activity, influencing borrowing costs for banks, consumers, and businesses to manage inflation, employment, and growth

money neutrality in the long-run

when changes in money supply only affect nominal variables like prices and wages but have no lasting impact on real economic variables (interest rates, output, employment)

monetary stabilization

single vs. dual mandate

single mandate: when central banks are restricted to addressing price stability, dual-mandate when central banks can weigh option of addressing price stability OR economic stability

Philips Curve

a macroeconomic model showing an inverse relationship between unemployment and inflation: low unemployment typically means higher inflation (as wages rise with high demand for labor), and high unemployment means lower inflation

bank runs

a self-fulfilling crisis event that happens when many depositors simultaneously withdraw funds due to fear the bank is insolvent, even if it's solvent.