Economics 4.5 - Role of the state in the macroeconomy

1/28

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

29 Terms

What are the reasons for public expenditure?

Used for macroeconomic management to control AD and achieve macroeconomic objectives, aims for equity and equality by providing services to those who would otherwise not receive them and can also correct market failure through providing public goods and fixing externalities.

What are the types of public expenditure?

Capital government expenditure is spending on investment goods such as new road, schools, hospitals which will be consumed in over a year.

General government final consumption is spending on goods and services that will be consumed within the year, such as public-sector salaries.

Transfer payments are government payments for which there is no corresponding output, where money is taken from one group and given to another, such as pensions and benefits.

Money is also spent on interest payments for national debt.

The current government expenditure is general government final consumption + transfer payments + interest payments.

The major areas of expenditure are: defence (6%), protection (4%), education (12%), pensions (20%), welfare (15%), transport (2%), healthcare (18%), interest repayment on debt (7%).

What are the impacts of public expenditure on productivity and growth?

Free market economists argue that government spending is wasteful and causes inefficiency. However, the government is able to enjoy economies of scale when it provides goods, and this improves productivity.

They also provide the infrastructure necessary for the economy to run.

Education creates the human capital necessary for growth whilst healthcare systems reduces the number of days workers lose from illness. The government may also undertake research and development to improve business productivity in the long run.

By spending, the government can create a multiplier effect which can be focused on areas of the country with high unemployment, creating growth.

What are the impacts of public expenditure on level of taxation and equality?

Level of taxation - Where government spending is high, levels of tax must be high for it to be sustainable, which can have a disincentive effect such as disincentivising working due to people earning less, or brain drain where high skilled workers move to countries with lower tax rates.

Equality - Spending should increase equality as it leads to redistribution and helps to provide a minimum standard of living for the poorest in society. It ensures everyone has access to basic goods, such as healthcare and education, which help give people a fair start in life.

What are the impacts of public expenditure on living standards?

Living standards - Government spending can cause improvements in living standards by correcting market failure and providing public goods, which improve social welfare.

Expenditure is also important as it reduces absolute poverty by proving benefits and basic goods, such as education and healthcare. In developing countries, governments don’t have the resources for this, leading to malnutrition, poor water etc.

Argued that governments will be inefficient at providing goods and services due to having no incentive to be efficiency, meaning overall output is reduced and living standards fall.

Can be argued that government suffers from the principal agent problem, since they make decisions on behalf of the people and individuals may have spent the money differently, resulting in a loss of welfare and so decreased living standards. However, the political system means that, atleast to some extent does society decide where government spending goes.

What are the impacts of public expenditure on crowding out?

Crowding out - In order to spend money above their tax revenue, the government has to borrow from individuals and businesses. However, the amount of money in the economy available to borrow is constant, so the government will therefore compete with the private sector for finance which causes higher interest rates. This will discourage firms from investing and individuals from buying on credit.

The limited number of resources in the economy means that for every resource used in government spending, there are less available for the private sector. The result is that government borrowing crowds out private sector borrowing and spending and may lead to no real increase on AD.

What are the UK governments aims on tax, and what are the different types of tax?

The UK government’s current aims include keeping the burden of tax low, improving incentives, using equitable tax, correcting market failure and taxing spending rather than income

Progressive tax - Where those who are on higher incomes pay a higher marginal rate of tax - They pay a higher percentage of their income on tax. Direct taxes tend to be progressive, such as income tax.

Regressive tax is where the proportion of income paid in tax falls as the income of the taxpayer rises. Most regressive taxes are where everyone pays the same rate, such as VAT.

Proportional tax - Where the proportion of income paid on tax remains the same whilst the income of the taxpayer increases, for example Mongolia has an income tax of 10%.

What are the impacts of tax changes on work incentives?

It is argued that high marginal tax rates will discourage individuals from working. Free market economists argue that the supply of labour is relatively elastic and a reduction in marginal taxes on income will lead to increased work as individuals work longer hours and more people join the workforce.

High taxes on high income earners could encourage them to move abroad and taxes on the poor may lead to a poverty trap.

However, there is no hard evidence linking income tax and incentives. Nordic countries have high taxes and welfare benefits but similar rates of growth compared to lower tax countries.

Could also be argued that higher tax encourages people to work longer hours to maintain their income, so increases incentive to work.

What are the impacts of tax changes on tax revenues?

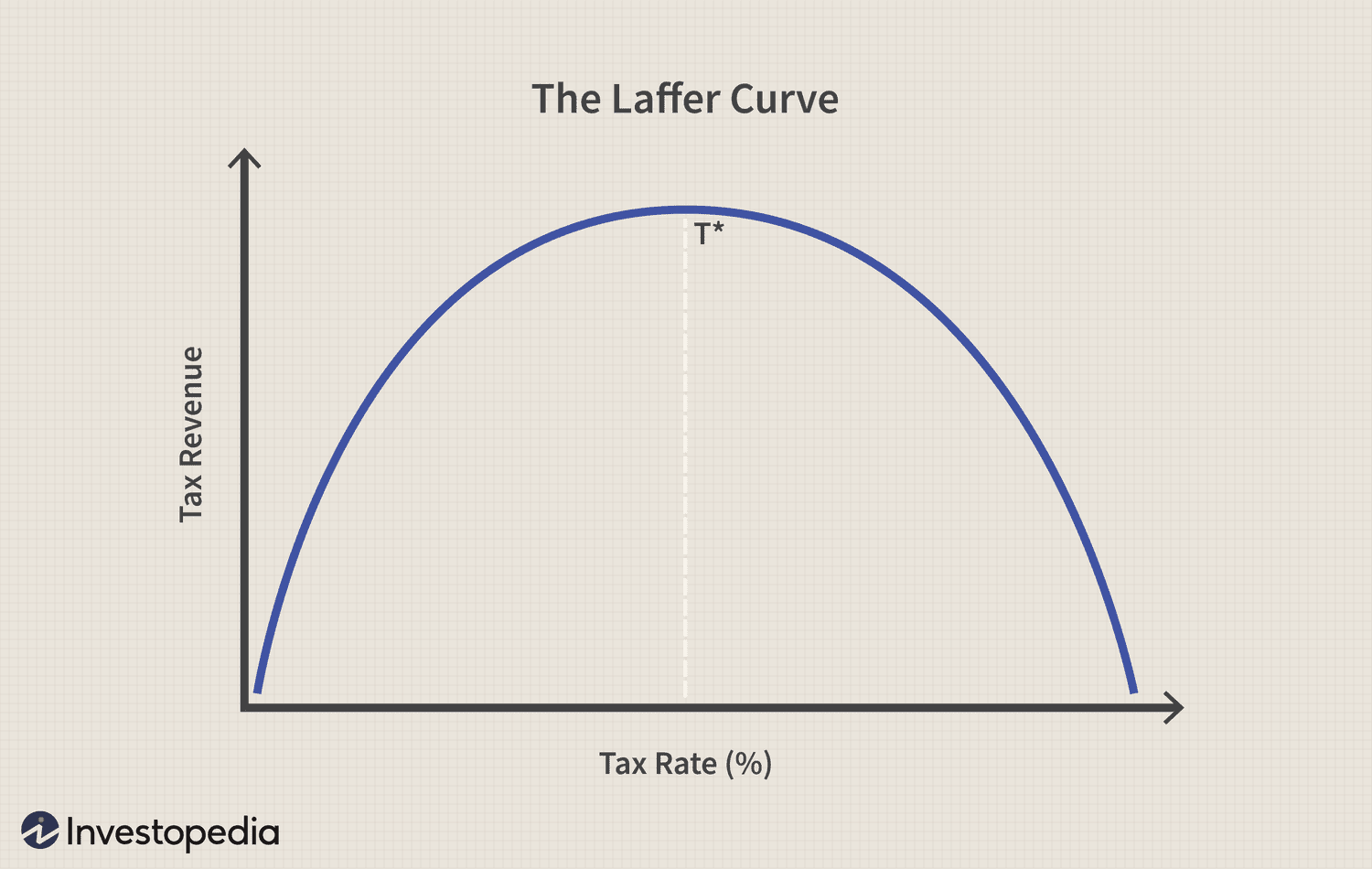

The laffer curve shows how a change in the tax rate changes tax revenue. At a low rate, low revenue is collected. At a high rate, motivation and drive falls so there will be a fall in output and increased incentive to use tax avoidance. Could also see higher earners leaving the country - Brain drain. The optimal level is in the middle.

• Revenue on indirect taxes can be uncertain as they depend on consumer spending patterns.

What is the laffer curve?

What are the impacts of tax changes on income distribution?

Income distribution - A progressive tax system increases equality through income distribution as money is proportionally taken from the rich more than the poor. A regressive on decreases income equality. Inheritance taxes and high corporation taxes are the most progressive forms of taxation.

One issue is that progressive taxation could lead to decreased incentives to work, especially for high earners. As high earners are more easily able to move across countries, they may relocate to reduce their tax.

What are the impacts of tax changes on real output and unemployment?

Real output and employment - Some taxes affect AD whilst others affect AS. A rise in direct taxes reduces disposable income, which decreases spending and AD. Could also decrease business profits and therefore investment.

Higher indirect taxes and corporation tax increases costs for forms, decreasing SRAS.

Could also be argued that high income taxes cause a disincentive to work, reducing LRAS as the most skilled workers go overseas and more people become inactive.

What are the impacts of tax changes on the price level, trade balance and FDI?

Price level - As shown, taxes can change LRAS, SRAS and AD, therefore impacting the price level.

Indirect taxes, particularly VAT, increase the costs of production for firms, leading to cost-push inflation

Trade balance - A rise in taxes decreases income and therefore consumption, meaning people spend less on imports. Imports have been found to be highly income elastic. Therefore, the trade balance improves in the short run.

However, in the long run, lower AD reduces businesses investment, reducing productivity and therefore reducing competitiveness, meaning exports decrease.

FDI - Low taxes on profit and investment encourages businesses to invest.

However, this could lead to a race to the bottom, where countries continually lower taxes in order to encourage investment, eventually resulting in a fall in revenue for all countries.

What are automatic stabilisers and discretionary fiscal policy?

Automatic stabilisers are mechanisms which reduce the impact of changes in the economy on national income; Government spending and taxation are automatic stabilisers. In a recession, benefits increase as more people are unemployed and so the benefits are a stabiliser as it means that the overall fall in AD is reduced, preventing too much change in the economy.

These stabilisers can’t prevent fluctuations, but reduce the size of these problems. Can also have their own problems, for example increased benefits spending can reduce incentive to work and therefore increasing unemployment.

Discretionary fiscal policy is the deliberate manipulation of government expenditure and taxes to influence the economy.

What is the difference between national and fiscal deficit?

National debt is the sum of all government debts build up over many years whilst a fiscal deficit is when the government spends more than it receives in taxation that year. Can either be measured in money terms, or as a percentage of GDP.

What are structural and cyclical deficits?

A cyclical deficit is that part of the deficit that occurs because government spending and tax fluctuates around the trade cycle. For example, during a recession, spending is higher and tax revenue is lower, creating a larger deficit.

At the peak of a boom, there is no cyclical deficit - any deficit at this point is a structural deficit. The structural deficit is the fiscal deficit which occurs when the cyclical deficit is 0, long term and not related to the state of the economy.

The actual deficit is the structural + cyclical deficit.

Governments can have structural deficits, balances and surpluses. A structural surplus occurs when at the peak of the boom, there is a fiscal surplus. A structural balance occurs when at the peak of a boom, the fiscal balance is 0.

If the government has a structural deficit, it is likely that national debt will grow over time as the government has to consistently borrow money to finance spending.

What are factors influencing the size of fiscal deficits?

One factor is the trade cycle. During a downturn, government tax revenue decreases whilst spending increases so the deficit increases.

Unforeseen events, such as natural disasters, leading to huge increases in spending increasing the deficit.

Interest rates also play a role. If interest rates on government debt increases, the government pays a higher amount in interest repayments and this is likely to increase the deficit, due to increased borrowing.

Privatisation provide one-off payments to the government which will decrease the deficit in the short term.

Government aims are important in the size of the deficit, as this will influence their fiscal policy. For example, austerity would help to decrease the deficit, but attempting to increase AD would worsen it.

What are factors influencing the size of national debt?

If the government is continuously running a deficit, national debt will increase over time.

Ageing populations tend to contribute to a high national debt since the government runs a structural deficit in order to fund their pensions and care, leading to higher national debt.

What is the significance of fiscal deficits and national debt (Interest rates and interest repayments)?

High levels of borrowing may raise interest rates in the economy since an increase in the demand for money will increase the price of money. This could cause crowding out of the economy. However, this may not always happen as the government may borrow from overseas.

Countries have to spend a large amount of money on servicing their national debt through interest repayments, which has a high opportunity cost. For example, the UK spends £70bn per year to service its debts. A primary budget deficit is the actual budget deficit but doesn’t include interest repayments on the national debt. A current budget deficit is where government revenues are less than current expenditure, and the government has to borrow money to finance day to day spending. This is problematic as it means that future generations are forced to pay the bill for today’s expenditure. However, if the deficit is due to capital expenditure, the future generation benefits from increased spending so can be justified.

What is the significance of fiscal deficits and national debt (Inflation, credit rating, benefit over time)?

High fiscal deficits can cause inflation. If the government increases spending and there is no fall in private sector spending, AD rises and this can be inflationary. More dangerously, if the government is unable to borrow money, they may print more, which can cause hyperinflation as shown by Zimbabwe in 2008.

High levels of debt tend to result in a reduced credit rating for the government. This means that money borrowed in the future may be at a higher interest rate. However, in reality, it won’t likely be the size of the deficit influencing the level of risk involved with the lending of money, but the current economic/political state.

On the other hand, borrowing can benefit growth if it is used for capital spending as it will improve the supply side of the economy and reduce the deficit in the long term. On top of this, the budget deficit can be used as a tool for short term demand management - Keynsians argue a deficit is acceptable to use to stimulate demand during recessions.

How does the government use macroeconomic policies?

Governments can use fiscal, monetary, SSP, exchange rate policies, as well as direct controls in order to achieve goals. Direct controls are government interventions that directly influence specific aspects of production, pricing, or distribution of goods and services. These include minimum/max prices/wages, quotas on imports, limits on currency or regulation e.g maximum interest rates.

How are these policies used to reduce fiscal deficits and national debt?

To decrease the national debt, the UK government has been using an austerity policy since 2010, designed to reduce national debt. These can include policies such as increasing taxes, or decreasing spending. However, these limit growth, reduce living standards and income equality.

On the other hand, an alternative is in the form of demand stimulus by high spending, which will cause economic growth and increase tax revenue. This allows for budget surpluses, and eventually a reduction of national debt.

Another approach is to rely on automatic stabilisers to allow the economy to grow so fiscal deficit/national debt will reduce as a percentage of GDP. This is the approach used by the US after the financial crisis, and helped them recover fairly quickly.

How are these policies used to reduce poverty and inequality (Progressive tax and benefits/transfer payments)?

To solve this, the government can use a progressive tax system. This can be specifically enforced on inheritance and income tax, as inheritance and income are the biggest causes of inequality. However, difficult to enforce due to tax avoidance. Also, may have unintended consequences, for example reduction in incentives and the laffer curve. For example, the USA has a progressive tax system but the welfare system isn’t effective at redistributing income. In countries like Finland, the tax system is less progressive but they collect a lot of tax revenue which they are effective at redistributing.

Can also use expenditure in the form of benefits and transfer payments. Social Security and national insurance benefits now represent 30% of government UK spending. Universal benefits are available to everyone meeting the criteria, whereas means tested benefits are only available to people who have sufficiently low income/wealth. However, some argue benefits reduce incentive to work, especially if they receive a similar amount on benefits to what they could in work.

How are these policies used to reduce poverty and inequality (Providing goods and services, wage differentials, improvements in education, trickle down)?

Governments can also provide goods and services which give people equal opportunities and access to services which they may not be able to afford, such as healthcare, education and housing. This ensures an equal start in life. However, there is a high opportunity cost.

Could also to attempt to reduce wage differentials. A national min wage improves the impact of the poor, whilst a max wage reduces the income of the rich, However, min wages cause real wage unemployment and max wages lead to a loss of skilled workers. Equal pay legislation also prevents inequality between genders and ethnic groups.

Improvements in access to education and training opportunities gives opportunities to children from poorer backgrounds. The government attempted to address this by offering additional funding through the pupil premium scheme and easier access to universities through contextual.

Free markets economists use the concept of trickle down, arguing that increase the incomes of the rich increases the incomes of the poor. The rich create jobs by spending their money and employing others and reducing their income would reduce employment and lower living standards.

How are these policies used to change interest rates and the supply of money, and international competitiveness?

Changes in interest rate and supply of money - The central bank can change interest rates and monetary supply. They may do this for domestic reasons, such as to control inflation, or due to global issues such as a low exchange rate. A fall in the bank rate is likely to increase the supply of money because it will mean higher demand for loans.

The general consensus is that central banks should allow inflation caused by SSP but manage demand side inflation.

International competitiveness - The government can improve competitiveness by taking action to increase any factors which can affect competitiveness.

Supply side measures will improve productivity, such as through taxation and deregulation. This can encourage competition, forcing firms to be more efficient and thus competitive within the global market. This can place an emphasis on quality products.

Exchange rate policies can be used, and they may control inflation and macroeconomic stability. For example, China devalues their currency to reduce export prices.

How can macroeconomic policies be used to combat the effect of negative shocks?

Macroeconomic policies can be used to combat the effects of negative shocks to the economy. One example could be a commodity price shock ,for example where oil prices greatly increase. The government could use expansionary policy to reduce the impact of a fall in GDP or use deflationary policy to reduce the impact on inflation. Another examplee is using expansionary policy to increase AD after a financial crisis. For example, following Brexit, interest rates were lowered to improve confidence but then raised to deal with inflation caused by the falling value of the pound.

What are problems facing policy makers?

Inaccurate information - Short term information, such as GDP figures, are often inaccurate and so may mean that the government is unable to see if there are problems within the economy. Trying to cut down on tax evasion and avoidance is difficult if the government doesn’t have the knowledge of the level of avoidance, who is doing it and the best way to avoid it The BoE makes its decisions based on past data, but it is possible trends are changing and so is inaccurate of where the economy is heading. Furthermore, doing full cost-benefit analyses can be time consuming and costly and is impractical for the government to gain every single bit of information they need.

Risks and uncertainties - The government can’t accurately predict the future and so is difficult for them to know whether extra spending is necessary. They also don’t know the impacts of their decisions as consumers often react unexpectedly.

External shocks - The government is unable to control and prepare for these, the best they can do is lessen the impact. Since every situation is different, it may also be difficult to know the best way to solve the problem

What is transfer pricing and how can it be used by TNCs?

Transfer pricing is a way for firms to engage in tax avoidance, occurs if a firm produces a good in one country and then transfers it to another to make it into another good which it then sells.

If taxes are higher in the first than second country, they can set a low price on the product in the first country. The overall aim is to increase profit made in the low tax country and decrease it in the high tax country to reduce their tax bill.

What are TNCs and how do they effect the economy?

TNCs can bring huge gains to revenue through the creation of jobs, tax revenue raised, the knowledge they bring and the investment they undertake.

However, they can have a negative economic and social impact by destroying local culture, affecting the environment and withdrawing more in profits than the inject through investment.

Some developing don’t allow TNCs to set up unless they set up a joint company with a local partner.