Micro L15 - L19

1/77

Earn XP

Description and Tags

Last two lectures on Game theory, then all of information economics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

78 Terms

What are some of the examples of bargaining and negotiating in the real world

How to maximise welfare, best policy - bargaining ask a different question - how do we divide it up

What are some of the modern day examples

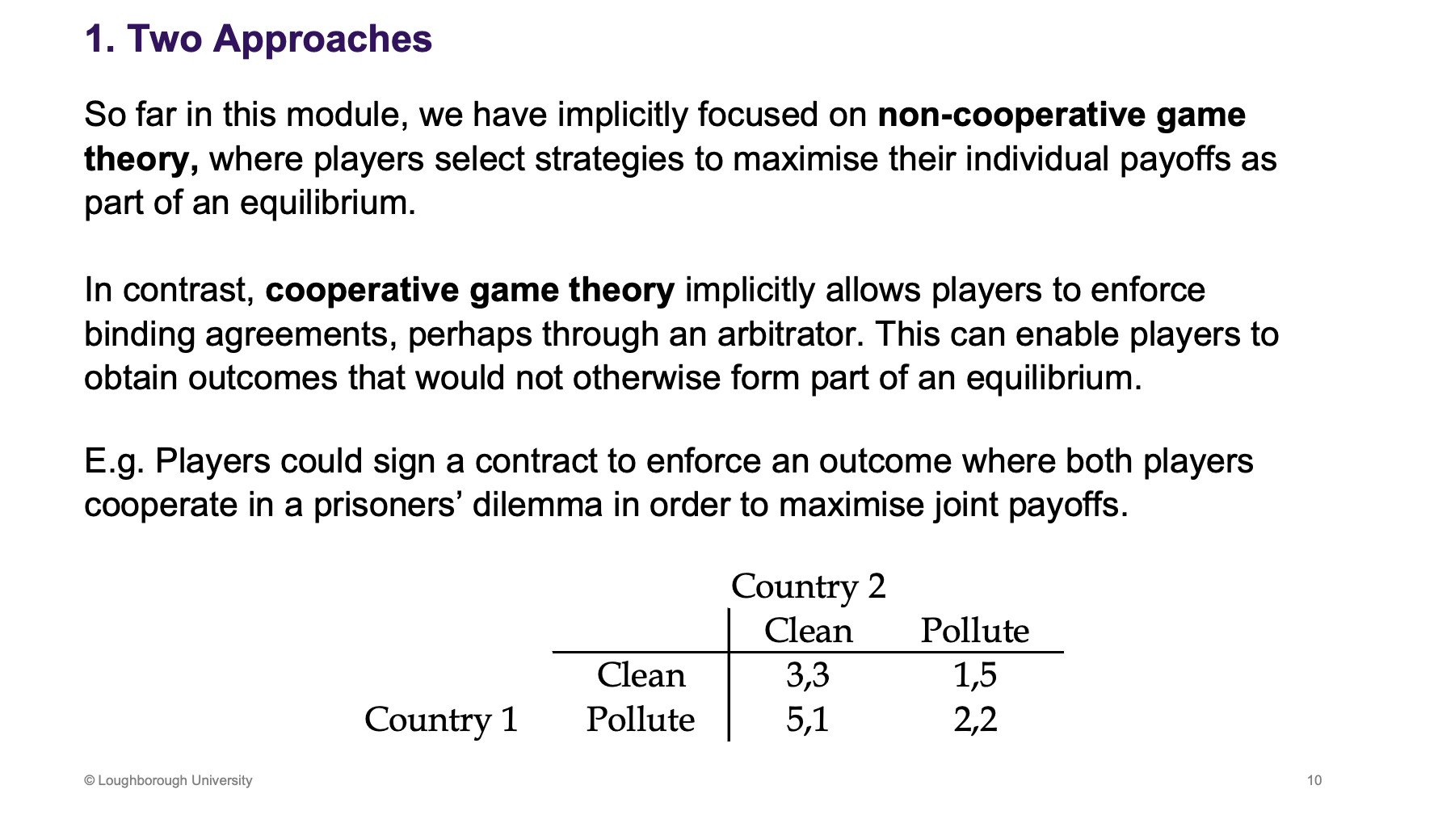

What are the two types of game theory’s

Non cooperating and cooperating game theory

What is the difference between cooperating and non cooperating game theory

This is the most common type of game theory - non cooperative game theory

Cooperation game theory - very different to equilibrium ideas, they assume people can form a contract which wouldn’t happen in a Nash equilibrium. If we could sign an agreement, end up with a better payoff, commit and obtain it.

What is the main difference between the two and what does cooperative apporaches allow us to do

Both ways of thinking are useful.

Axiomatic - axioms, features the outcome should have (we believe)

These are the foundational statements that are accepted as true without proof and serve as the starting point for all further reasoning. Axioms often state the basic properties or restrictions of the undefined terms, giving them meaning.

An axiomatic analysis is a method of study, primarily used in mathematics and logic, that involves building a body of knowledge from the ground up using a small set of fundamental, unproven starting statements.

What is the cooperative game set up, number of individuals, utility

If they work together they generate some value and lead to a higher outcome. Monetary transfer, side payment, what level of payment and who will pay who is what we are trying to find out

What is the disagreement vector and bargaining set. How do we consider monetary transfers

D - default outcome, what we get if we don’t agree

V - is the possible outcomes

Side payments (transfer utility), is t in the utility function - can be negative or positive depends on who is paying who and who is receiving the payment

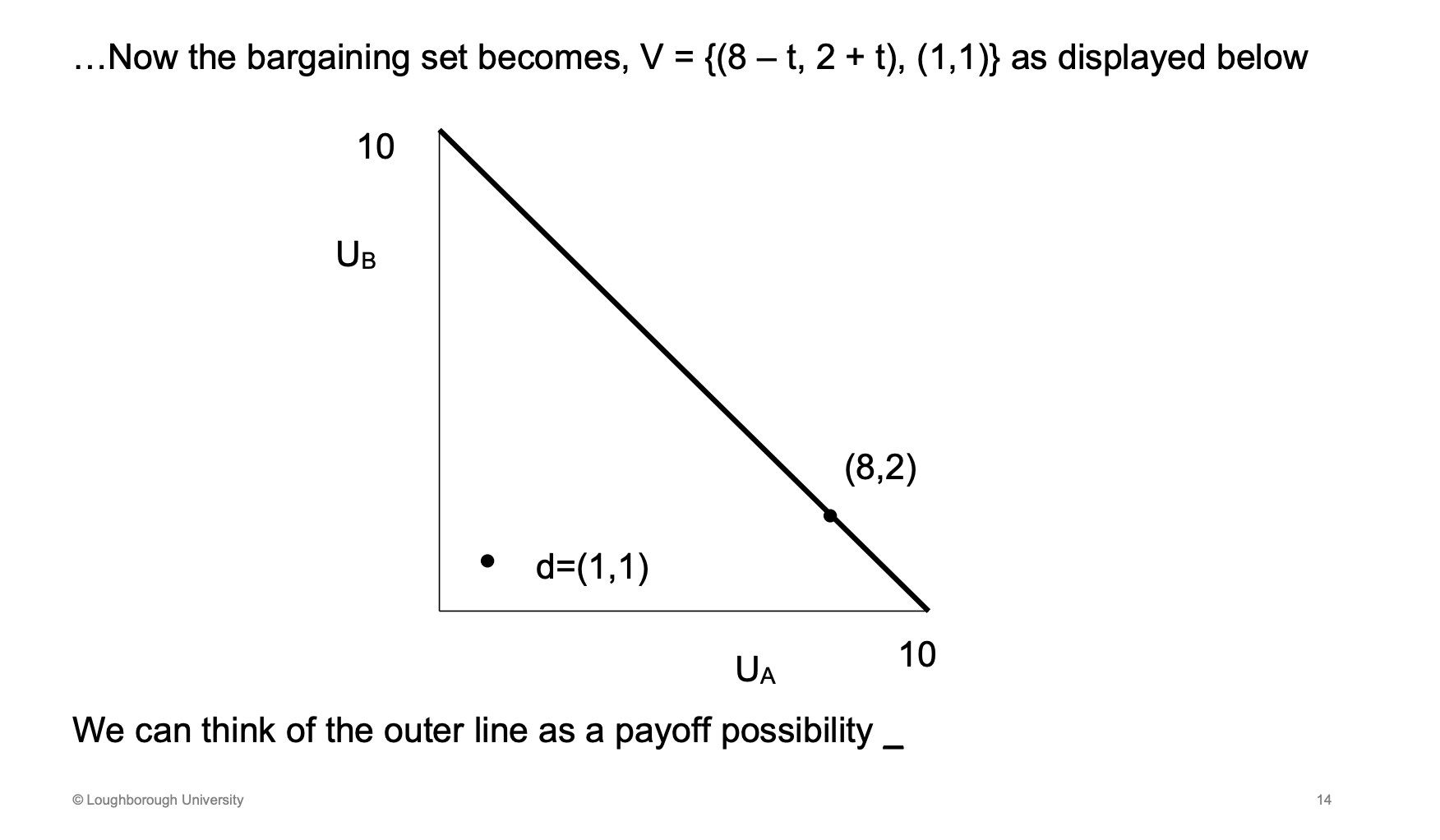

Based on the last flashcards set up, draw the relevant diagram

Frontier

Side payments will shift the point along the line. D isn't efficient

What is the equation for joint value, what is the efficient outcome and what is a surplus

Sum them together which removes the t, positive/negatives cancel out

Surplus - net utility, netting the disagreement payoffs, adding the outcome of working together. Value what is create over and above the default outcome

What are the questions we are after when looking at bargaining

What is the solution nash thought would happen and what approach would he use? Also what are the two porperties within this

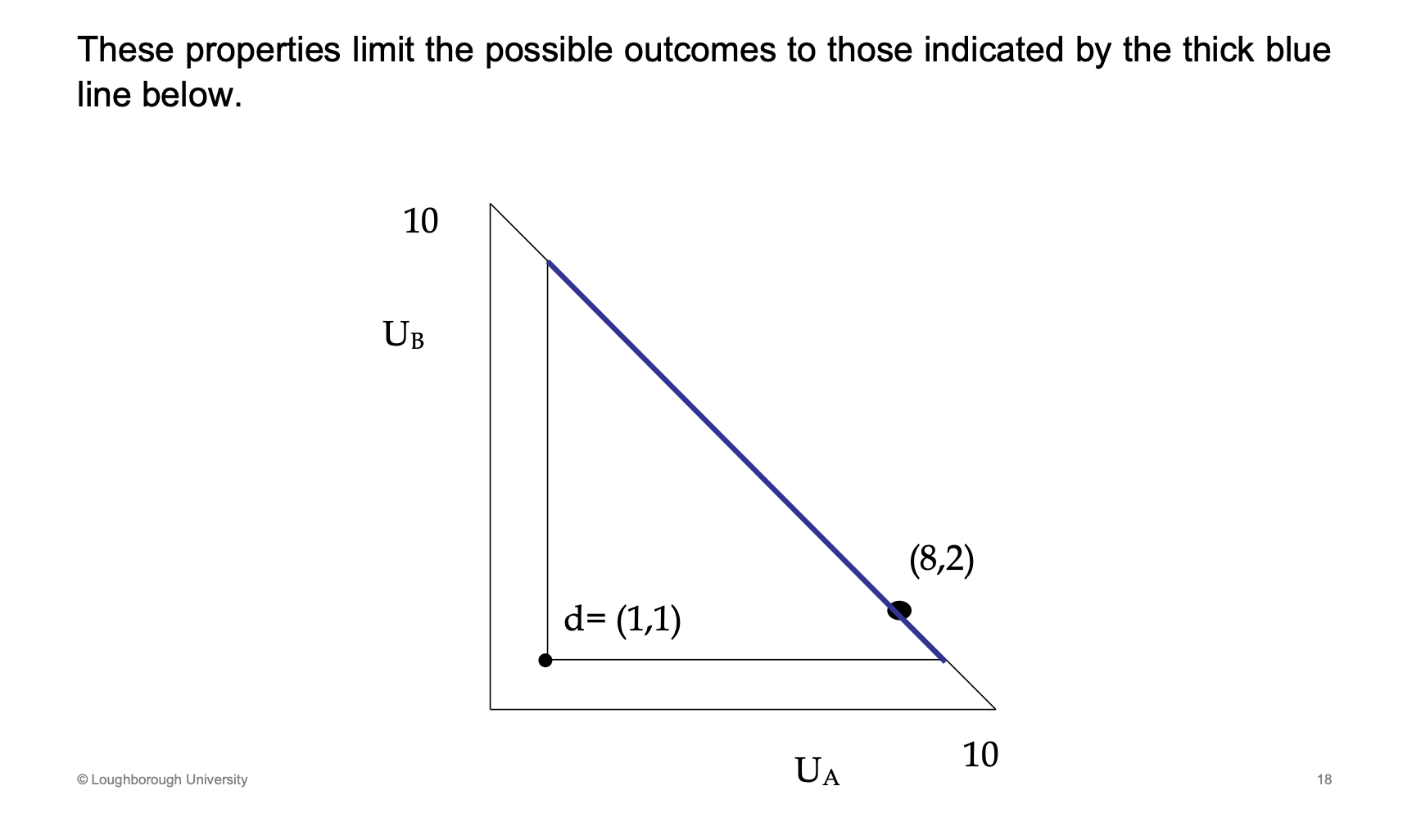

With the two properties, what happens to the diagram

Will be on the frontier, to be rational wont be at the ends which is less than what they started at in the default outcome. So only on the blue part

What are the other three technical properties nash though the model should exhibit

What was the outcome of all these properties

Anything that satisifies these 5 features

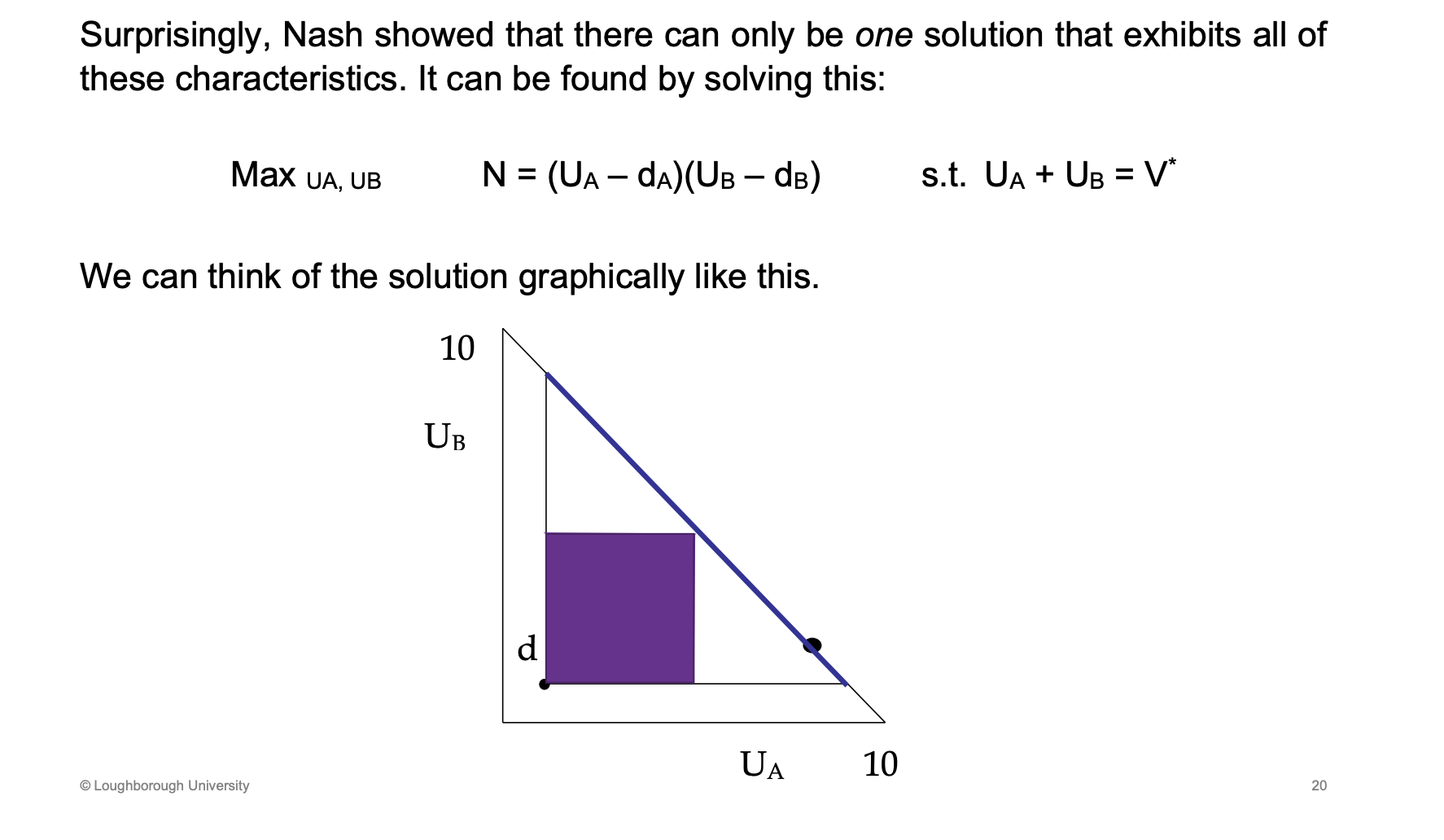

Maximise the Nash product, the N= equation, this is the difference in the player utility net the disagreement. Subject to being efficient (must be on the frontier). The purple box is a representation of the Nash product equation about. On the X axis it is Ua - d (d is the distance from the Y axis to d and then d to Ua is the net utility)

Height is D ad width is U

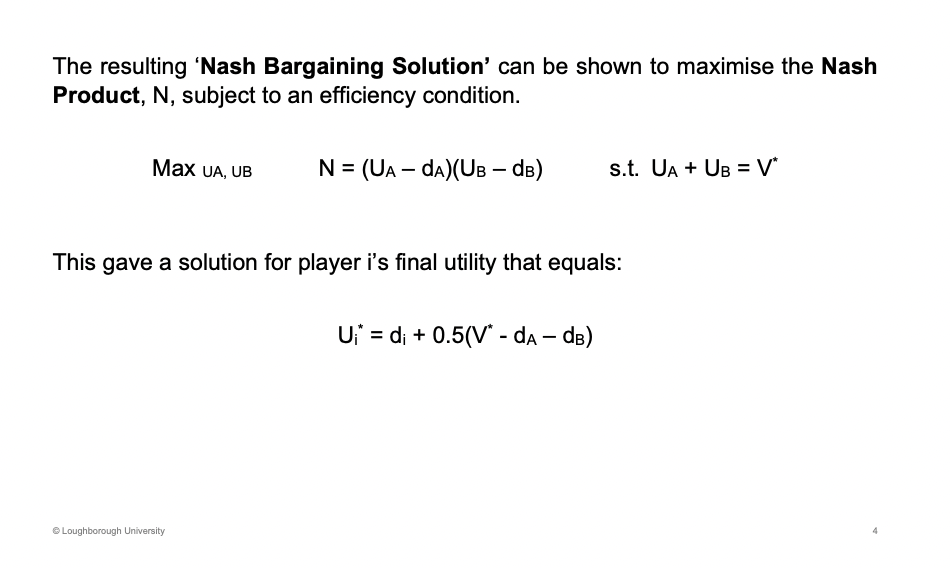

What is the mathematical solution for player i and how does disagreement payoff come into this equation

Disagreement payoff plus half the marginal surplus.

What is the prodecure to find the nash bargaining solution

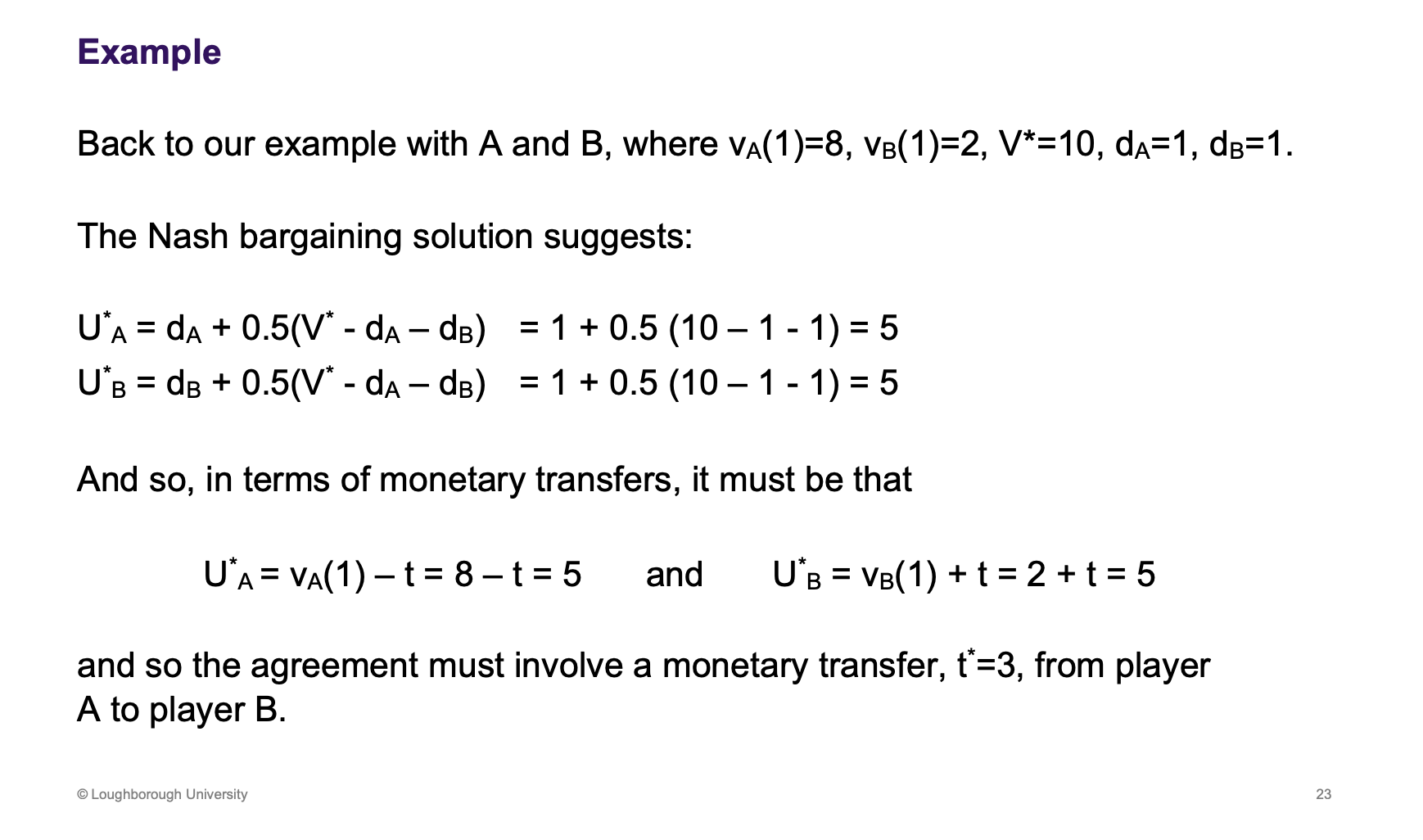

Answer this example

V* is the efficient outcome

Both players are symmetric, the outcomes arent though. The transfer of 3

How is the solution maximised and depict this on the diagram

Answer this question

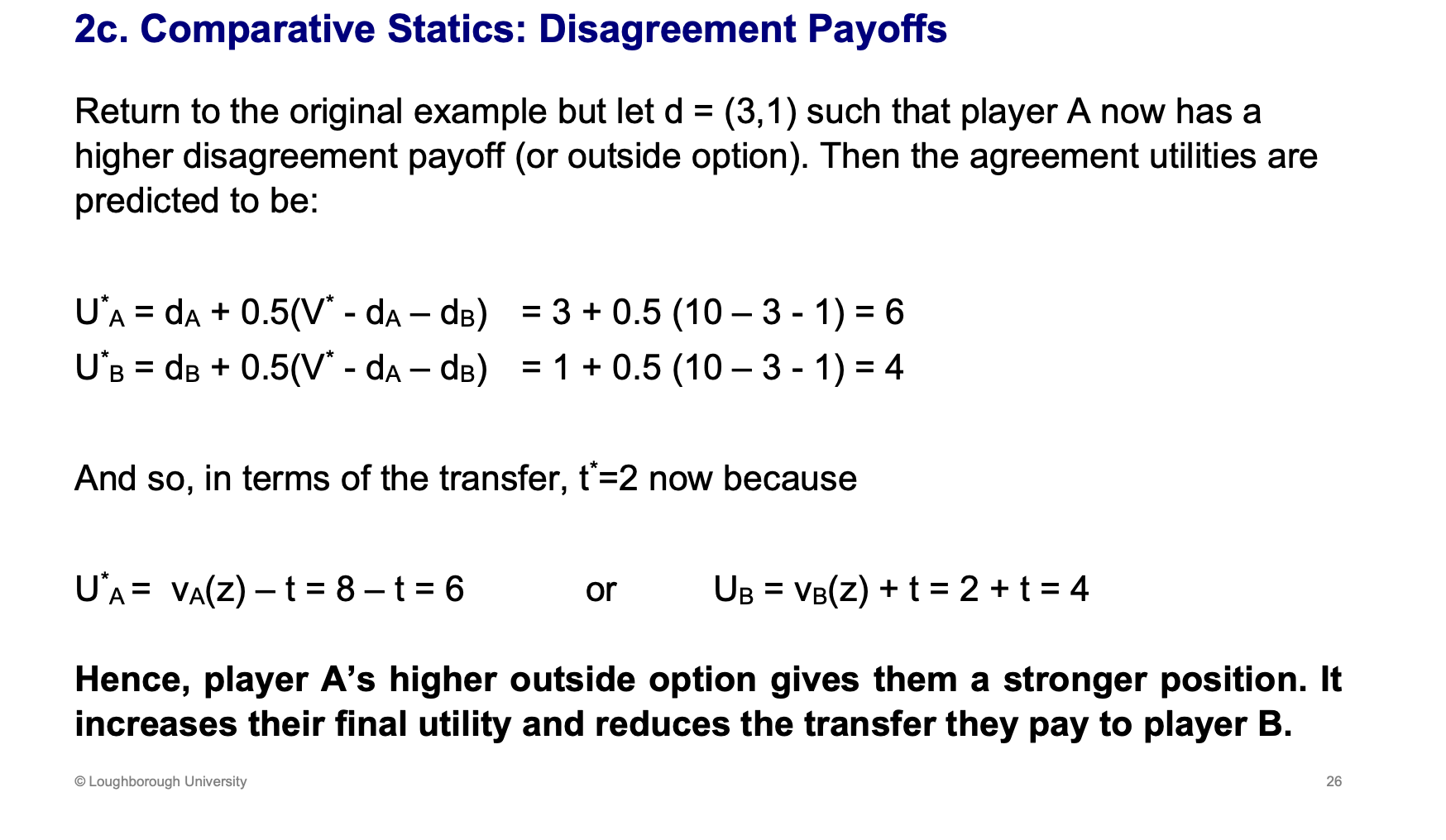

Calculate the disagreement payoffs for the original example

D used to be (1,1)

Higher disgareement, leaves one player better off

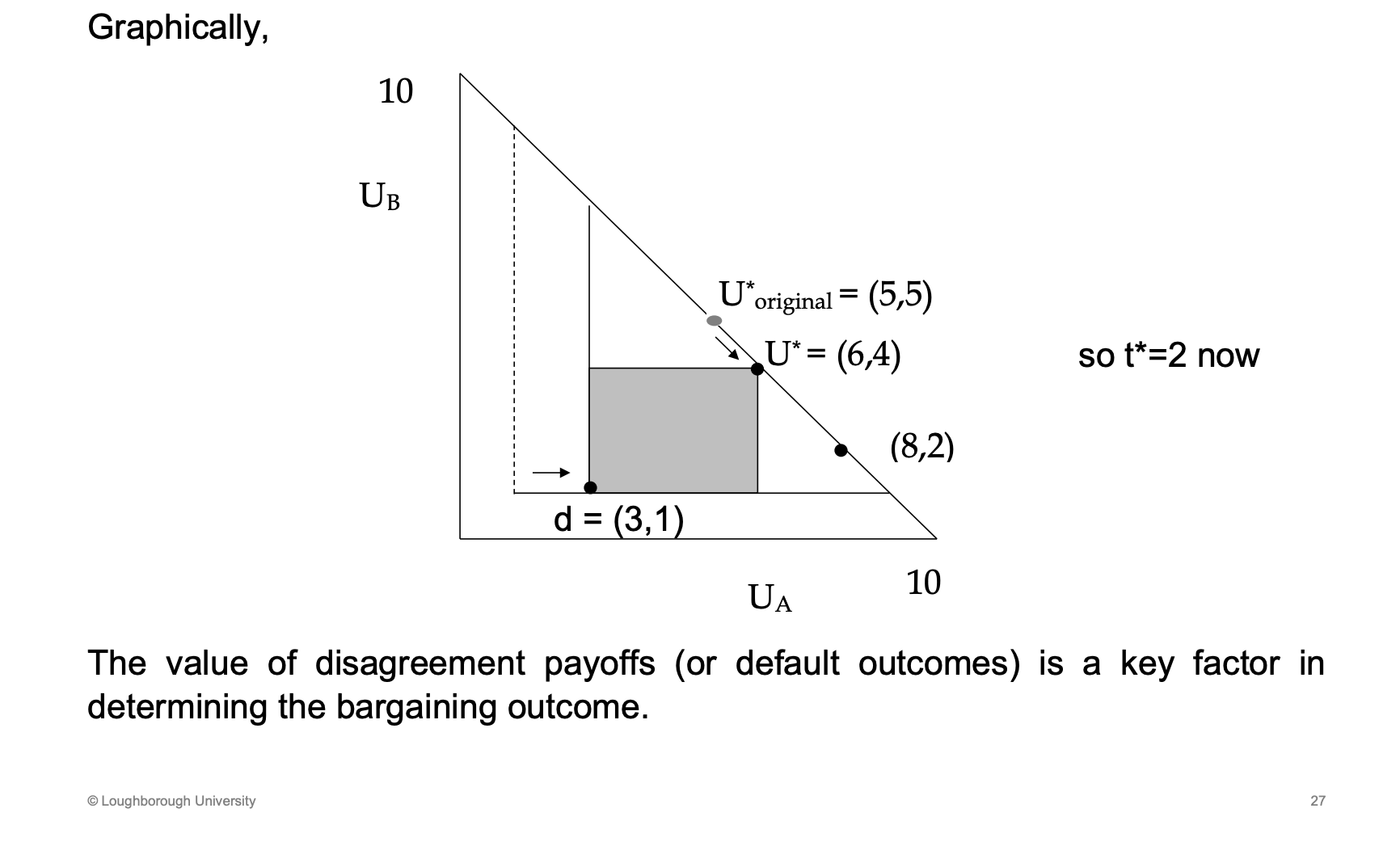

Show it graphically as well

How can this be applied to a real worth situation

What is the evaulation of the nash bargainning solution

In the Nash bargaining solution, what is the nash product and what is the solution for players i final utility.

How do agents divide a surplus in real life

Bargaining, how the surplus is divided between agents.

What is the intra household bargaining

If the Benefits money get paid to the mother or father, outcome is completely different - Example. Mother is much more likely to spend on the children.

Explain the two approaches to game theory

Cooperative outcomes have 5 assumptions

Applying non cooperative outcome to the bargaining we faced last lecture

What is the common theme within the non cooperating approach

These are the common assumptions, kept simple by only two players, can be more players.

Longer the negotiation is, the worse the payoff is, "time is money" - losing business, also inflation example, worth more today

What is one structure which fits this and an example of it

Wage debates is an example of this

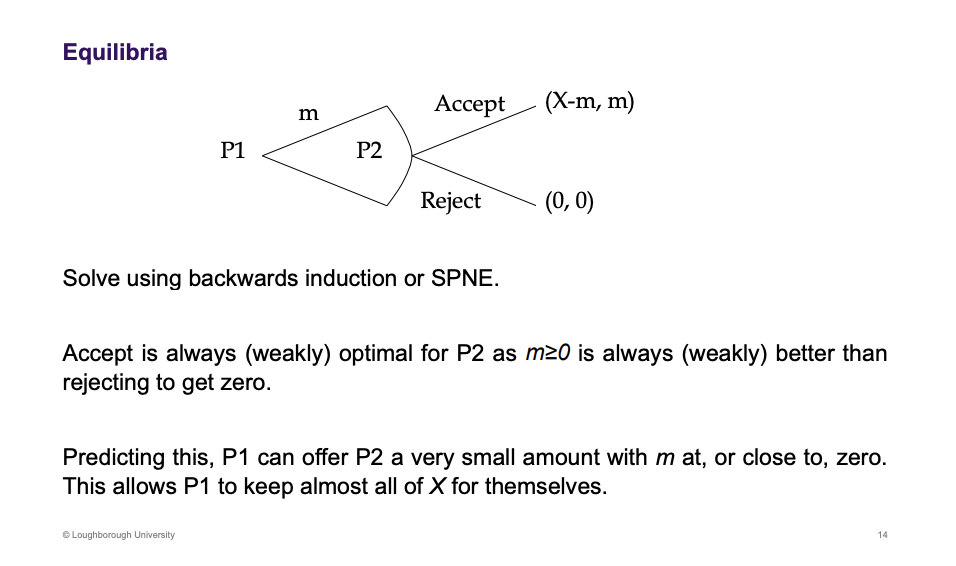

Describe the ultimatum game

Offer m of how much of x they will receive. No counter offering. If they don’t agree, payoffs 0,0. Extreme assumptions from the beginning where we said the longer the negotiation takes, the lower the payoff is

Put the ultimatum game into a tree diagram and solve for backwards induction

How does turning M into increments change the SPNE

The structure of the game

Nothing lower than 0.00p.

Based on player two being indifferent at 0.00. Player one pretty much keeps everything

Player one has a massive advantage, through playing first. Structure of the arrangement is very powerful

What happens if M isn’t in increments and how does going first impact the power of bargaining

This version of the eqm is important for the rest of the lecture

As you go first you are able to bargain for a greater share

Only one unique equilibrium, this occurs as you want to always offer them a little less.

No stable outcome as player one wants to offer less than less.

What happens if we allow a counter offer, e.g. two period alternating game

More realistic, second model, compare to the ultimatum model. Two periods.

M2 is the share of x that goes to player 2.

The roles reverse in the second period, time is a factor so discounting will need to be included

What is the outcome of this two period game

Ultimatum game shifted to period 2.

What happens in period 1 of the two period game and what is the outcome dependent on

1 is worth less in period 2 due to discounting, so they will work it out and try and get a better return in period 1.

Disagreement payoff, similar to cooperation game

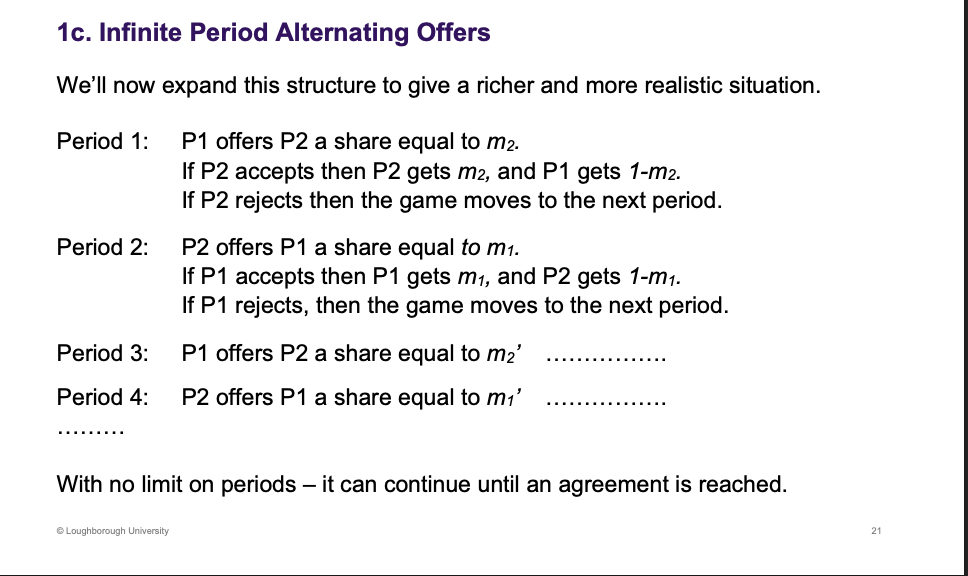

What happens in an infinite period alternative offer

Cant use backwards induction as there is no end value, final period to start from.

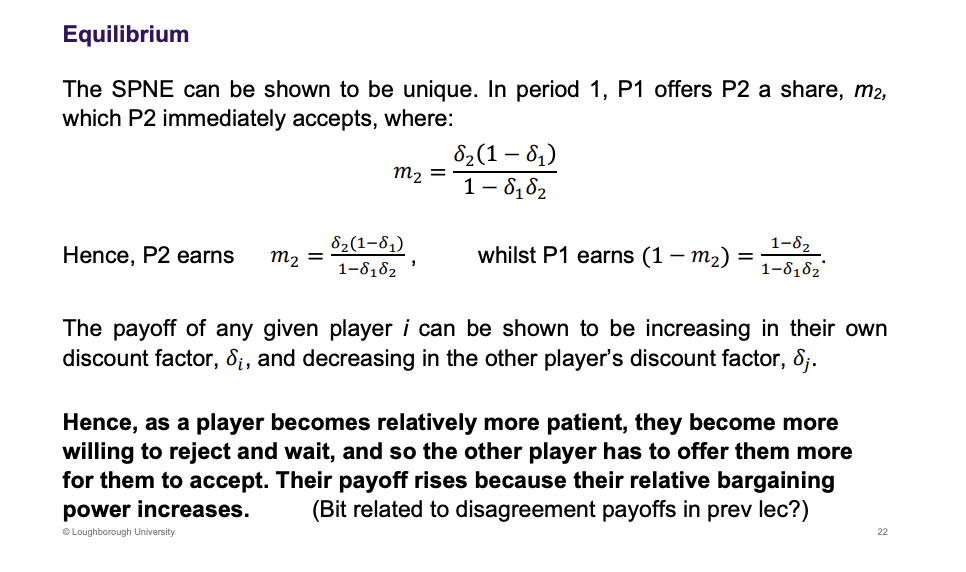

What is the SPNE under infinite periods

Rationality assumptions, leads to it ending straight away.

What matters is the relative patience, if you have a higher patience, you will receive a higher payoff in the future. Example - got a deadline for a payment (which is a weakness in this game)

What happens if we consider both players to have the same patience

Delta lies inbetween 0 and 1

Same patience, same delta. Player one still earns more as they go first.

If 0, Player one gets to keep all of the surplus. This happens as when delta is equal to 0, they don’t care about the future, only care about present, leads us back to the ultimatum game.

What happens when delta tends to 1, what does this mean and how does it impact the game

Details not needed

When high level of patience, leads to a 50/50 outcome

What is the evaluation of cooperative and non cooperative apporaches

Non cooperative - lots of structure and assumptions

Negotiating doesn't typically occur instantly, which the game indicates should happen.

What are the differences between coop and non coop

Factors

Coop

Disagreements payoffs

Relative bargaining power (we assumed equal power, in addition material for last weeks lectures there is an example where they aren't equal)

Non Coop

Relative patience (discount factors)

Position/structure of the bargaining (who goes first, is a counter offer allowed)

What is asymmetric information and why might one agent have more information than the other

Gather information

Allowing some players to have great information, contradicts the assumptions of perfect information and create the concepts of private information (greater than other people)

What are the two cases of asymmetric information

Can be spilt into two camps

Moral hazard is action

Adverse selection, not with an action, characteristics of a player (honest or dishonest)

Where can asymmetric information be seen in real life examples

Can be applied to all sort of situations, will be really useful

What is the set up for a product quality game in a monopoly situation, what is s, what is ch and cl. How do they choose. What information do we have about the consumer.

Similar to adverse selection

Sell a single good, and a monopolist. Choose the level of quality, endogenous (determined in the model, chosen by the firm). Only two quality levels with higher costs for the better quality product.

Utility function = net pay off from purchasing. Theta s is the willingness to pay minus the price

What type of game do the monopolist and consumer interact in

What are the payoffs for the consumer and monopoly/ total welafre and the difference welfare in high and low quality

Net utility is the consumer surplus

Monopoly (remember only one unit)

S is 0 if the quality is low. In a society we want high quality products as it increases welfare

What is a search good and how do this impact the information to the consumer

Lottery is an example of a search good

what is the outcome with full information, what is the optimal quality and price

Firm higher quality, and the firm can sell at the maximised price. If you choose low quality and the consumer wouldn't buy it.

What is a experience good and how would this impact the information for consumers

Second hand cars, food, haircuts

What is the outcome with asymmetric information and the quality and price level selected

Zero for the product

Firms incentive to give you a low quality product, it will save costs and still receive the high price. The buyer can expect for the firm to cheat and the buyer will only be willing to pay for a low quality good. If s=0

If you’re willingness to pay goes to 0, what is the possible equilibirum and the welfare outcome compare to full information

What is the impact of repeated games and what is a trigger strategy

Or indefinite

Previously a have been looking at a one shot game, now we are looking at a repeated game.

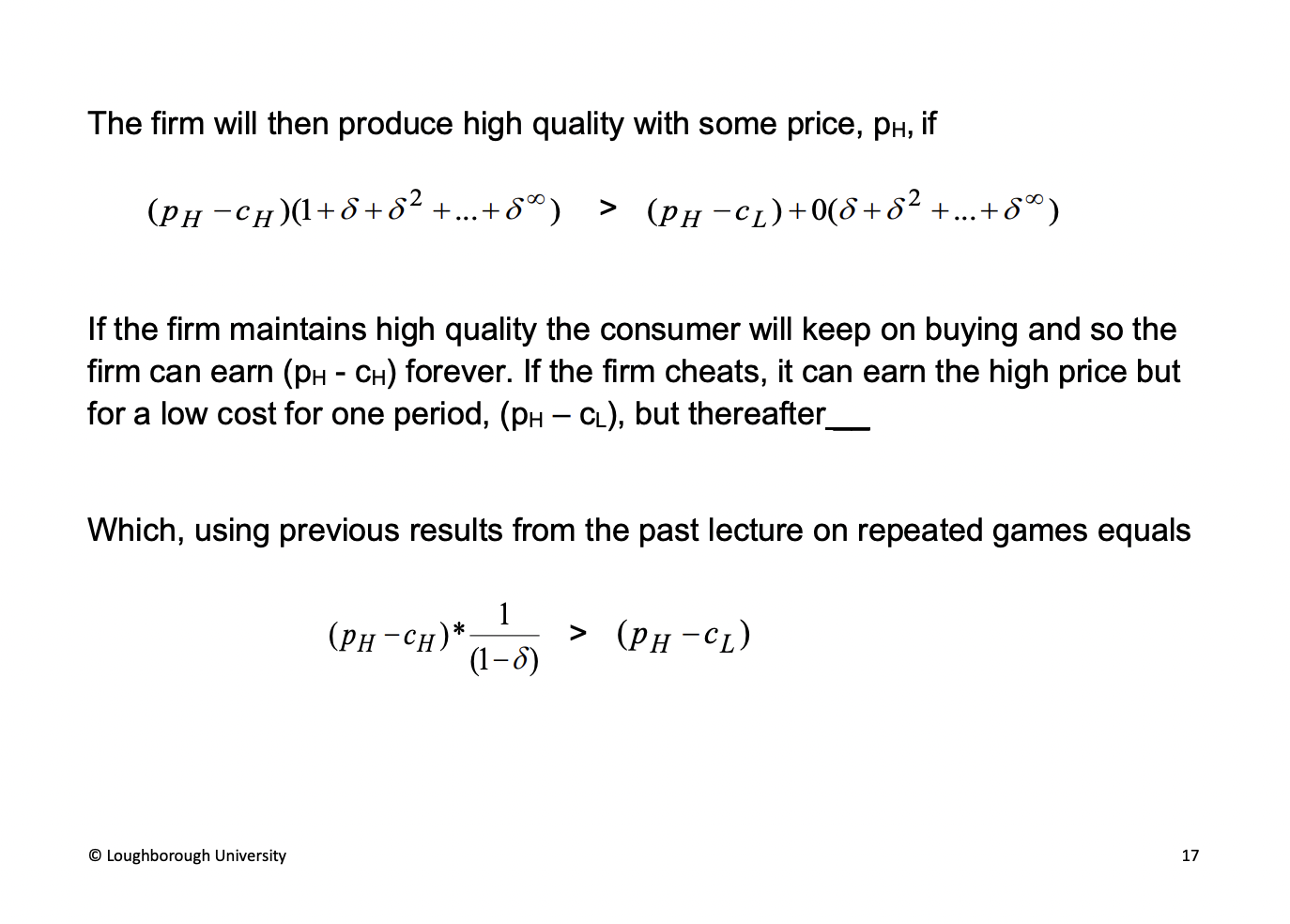

In the trigger strategy, what is the equation for trade to continue between high and low quality? Also, what is the equation for repeated games

The consumer never buys

Food example, the RHS, serving you rubbish food once, consumer pays the high price once and never returns back

We use the discount rate here.

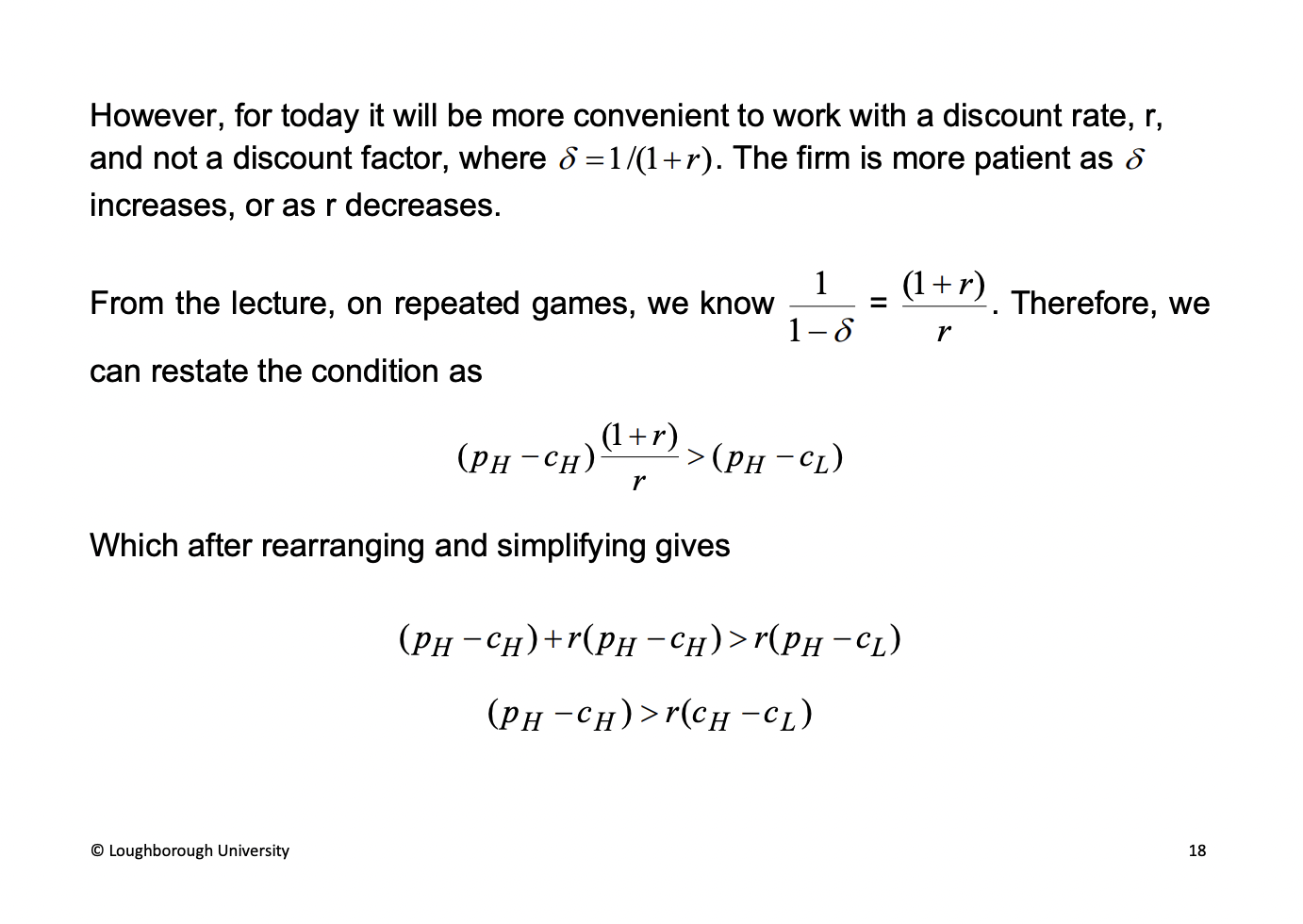

What is r, compared to the discount factor. And what is the equation between the two of them. How do this impact the repeated game condition and put it into its simplest form.

R is positive. The assumption states ph-ch has to be positive and therefore the monopolist needs to make some profit. If r increase the payoff will need to also increase otherwise there is an incentive to cheat and give you a terrible meal. As r increase the patience falls, the profit over the future is lower

What is the condition for a sustained high quality product, how does this imapct the incentive to cheat. How does patience impact the premium need not to cheat. What is the implication of on shot games.

Cheating, (ch-cl)>0, are greater

If we only use something once, a holiday resort, they have little incentive to give a high quality.

What are the technical details to prove it is SPNE

Some examples of moral hazard

Define what is private information, moral hazard and adverse selection

Where there is private information, only known by some individuals.

Characteristics of the player (dishonest or truthful)

How do we have endogenous product quality in the moral hazard example

In the market situation, the firm chose the quality (endogenous), the consumers didn’t know that. The quality is inside of the model. The option to choose low quality would destroy the market

Go through the adverse selection model set up, what is exogneous and fixed. How does quality play a part. What is the risk attitude of the consumer

Quality is exogenous - outside the model, quality is not being chosen, no control, its fixed

Different types of firms - "type' terminology

Net utility function is U = theta(s) - p, wants to buy one unit

What is the outcome with full information

Search good, a sensible equilibrium would be that the high quality firms can sell it at theta the maximum willingness to spend of the consumer

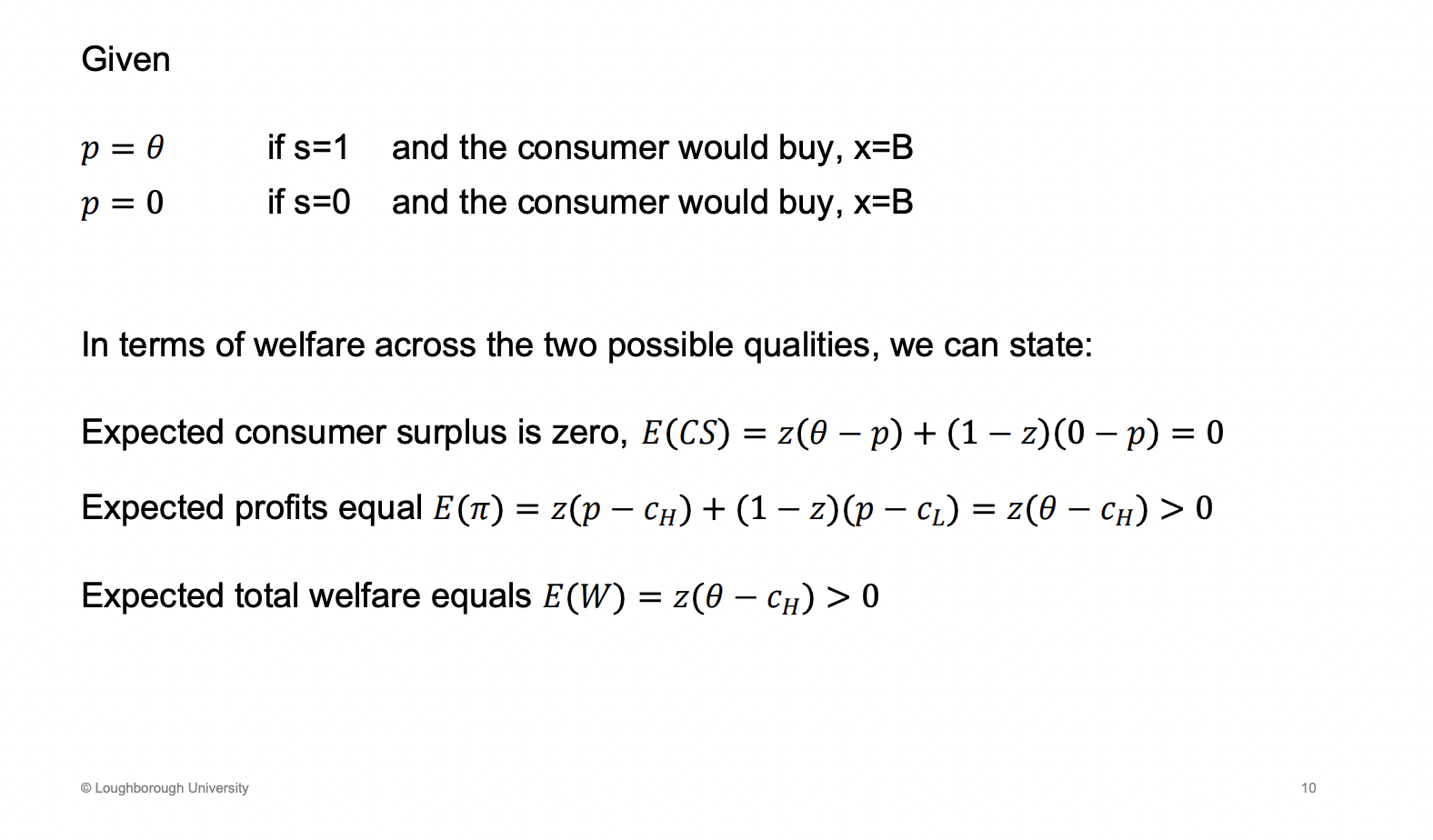

Given the outcomes in full information, what is the welfare, CS profit and total

Working out the welfare resulting from the choices, has to be expected now as the is uncertainty around the quality here, randomness of what quality they get.

Consumer will always be 0, as it is charge the maximise price of their willingness to pay, no consumer surplus, price = willingness to pay

Profits, no profit from low quality, high quality charge theta and costs are less than theta from the assumptions earlier.

Z - probability of getting high quality

What happens as we switch to a asymmetric information outcome, what good are we now looking at and what are some examples

Experience goods - know utility after they purchase.

Example is pets (animals), Wine is another example where the owners don't know the quality until they try the good

As the quality is now private information what happens to the consumer, what does it know about z. What is the condition for the consumer to buy

Expected prob of high quality

Average quality is z, willingness to buy is theta * z - price. Will buy the good if the average price is lower than the price

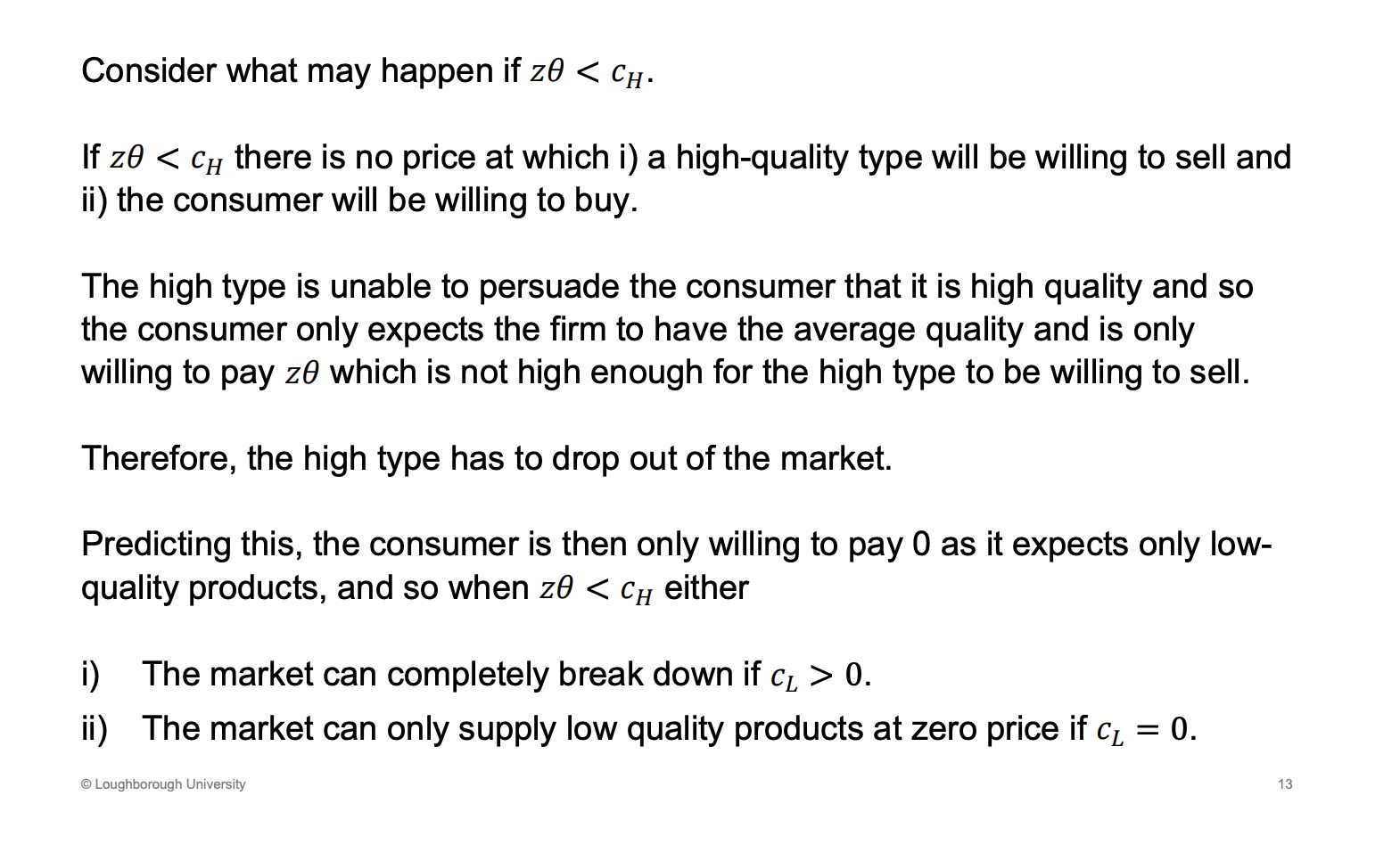

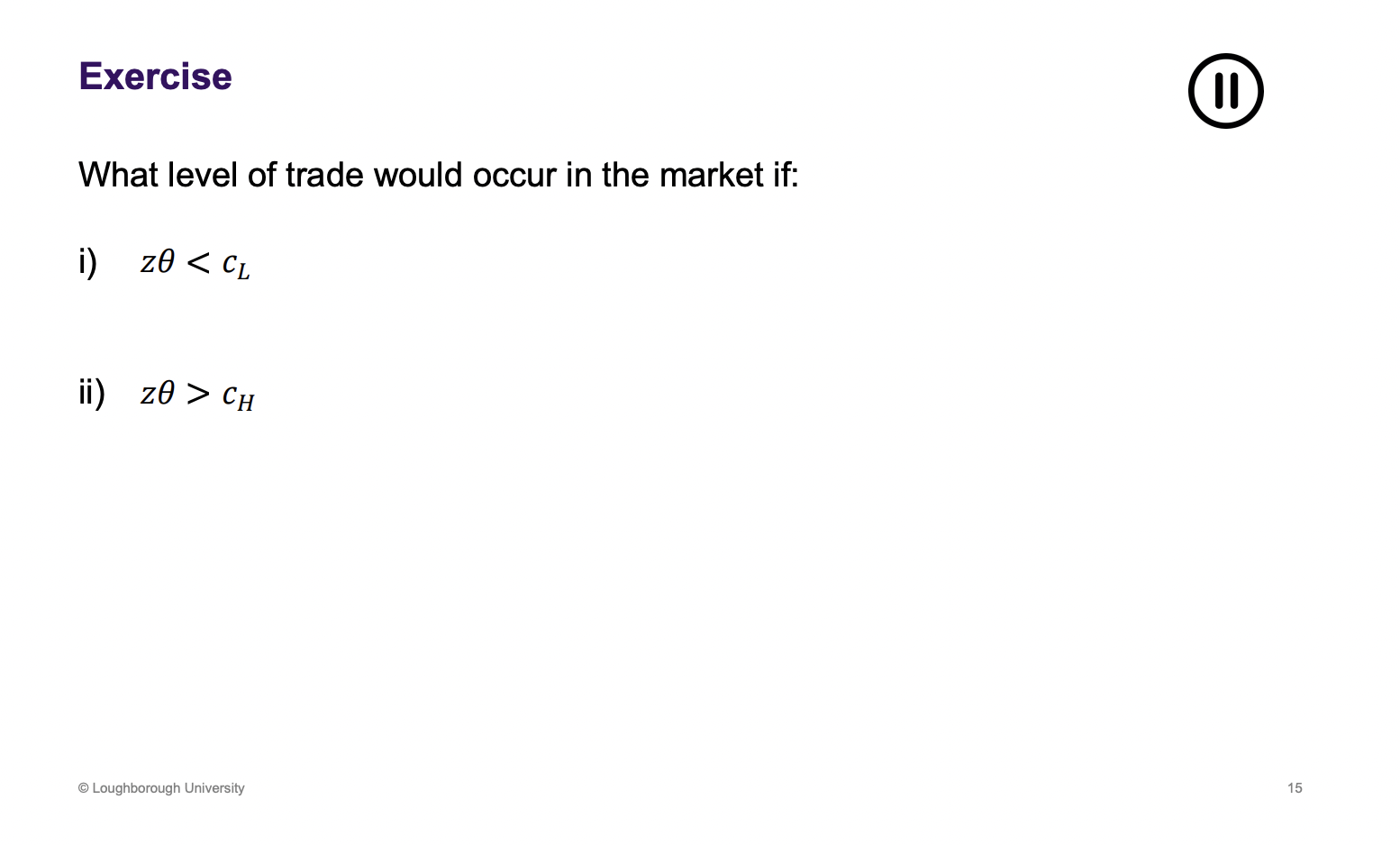

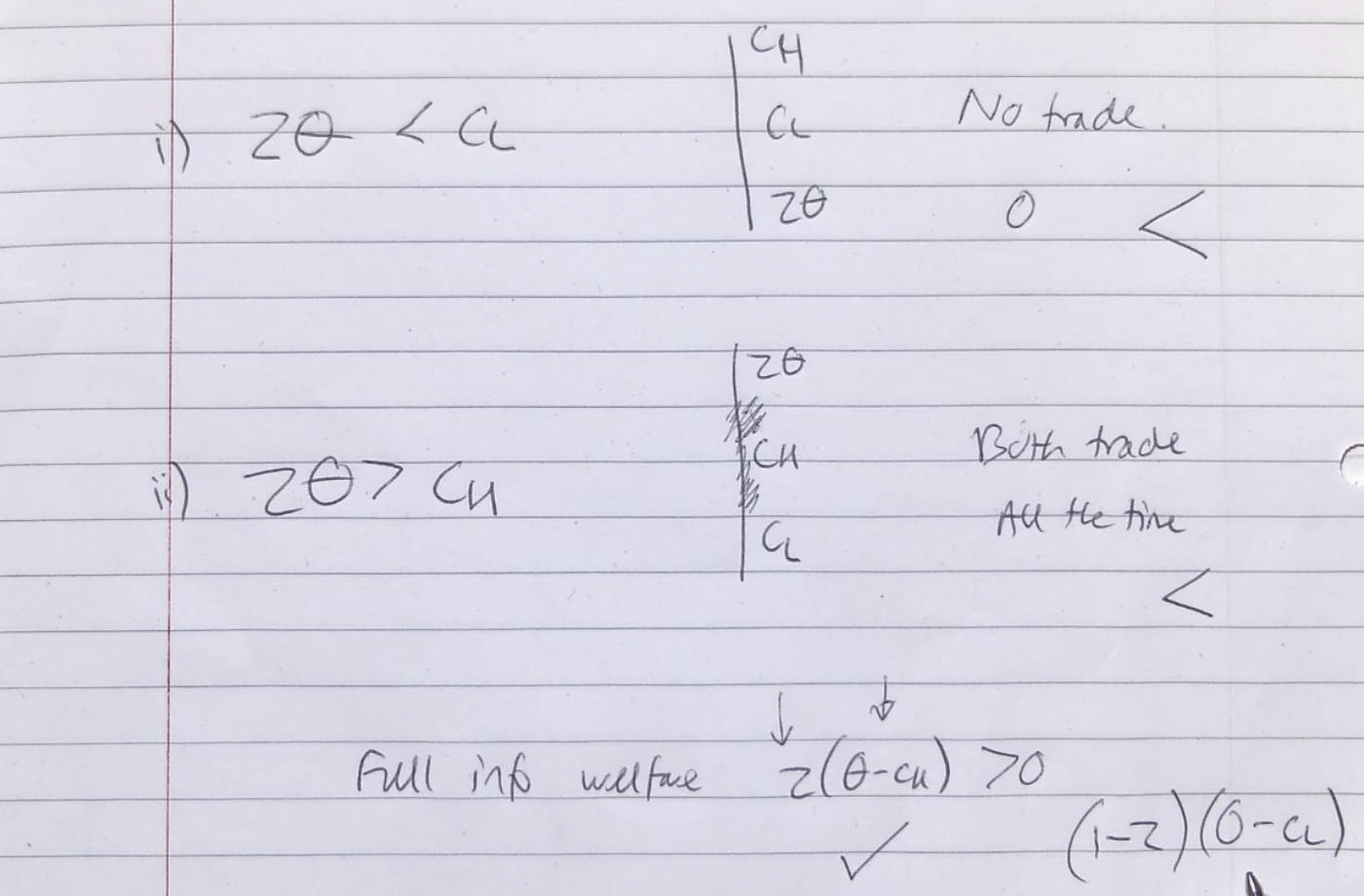

WHat happens when Z theta < Ch and Z theta < CL

Ch - marginal cost of the high quality goods.

A firm will drop out of the market if they can't sell the product

If a firm is willing to sell, a consumer will think there marginal costs are low and it will be a low quality product

If the costs of the marginal low quality product is greater than 0, no market

If both Z theta < Ch and Z theta < CL occurs what happens and how does this compare to a market with full information

Bad quality drivers out good quality

Lemons - adverse selection outcome

For each of these cases, is expected value welfare higher or lower than under full information

If Marginal cost of low quality is higher than willing to pay, would result in no market, no trade at all, both seller have marginal costs bigger than what the consumer is willing to pay, no price which will cover the costs. No welfare

If Marginal cost of high quality is lower than willing to pay, would result in a market where both low and high quality marginal costs are lower than the marginal costs. Less welfare than full information trading under both higher and low quality (1-z)(0-cl), in full information a consumer should only buy high quality. In this situation there is a chance you buy a low quality situation.

Welfare full information is all about having higher quality, if no high quality no trade 3.

Go through the set up of continuous quality, what is a unit mass, how is quality determined.

Continuous quality rather than high or low quality.

Unit mass - lots of lots of little consumers, what they add up to doesn’t matter. In aggregate they add up to 1.

Set theta to a number.

Lots of sellers, one product, differ in quality, costs are based on quality. High quality, higher costs.

Similar to car second hand market

Uniform distribution between 0-2, equally likely to have a car between quality 0-2.

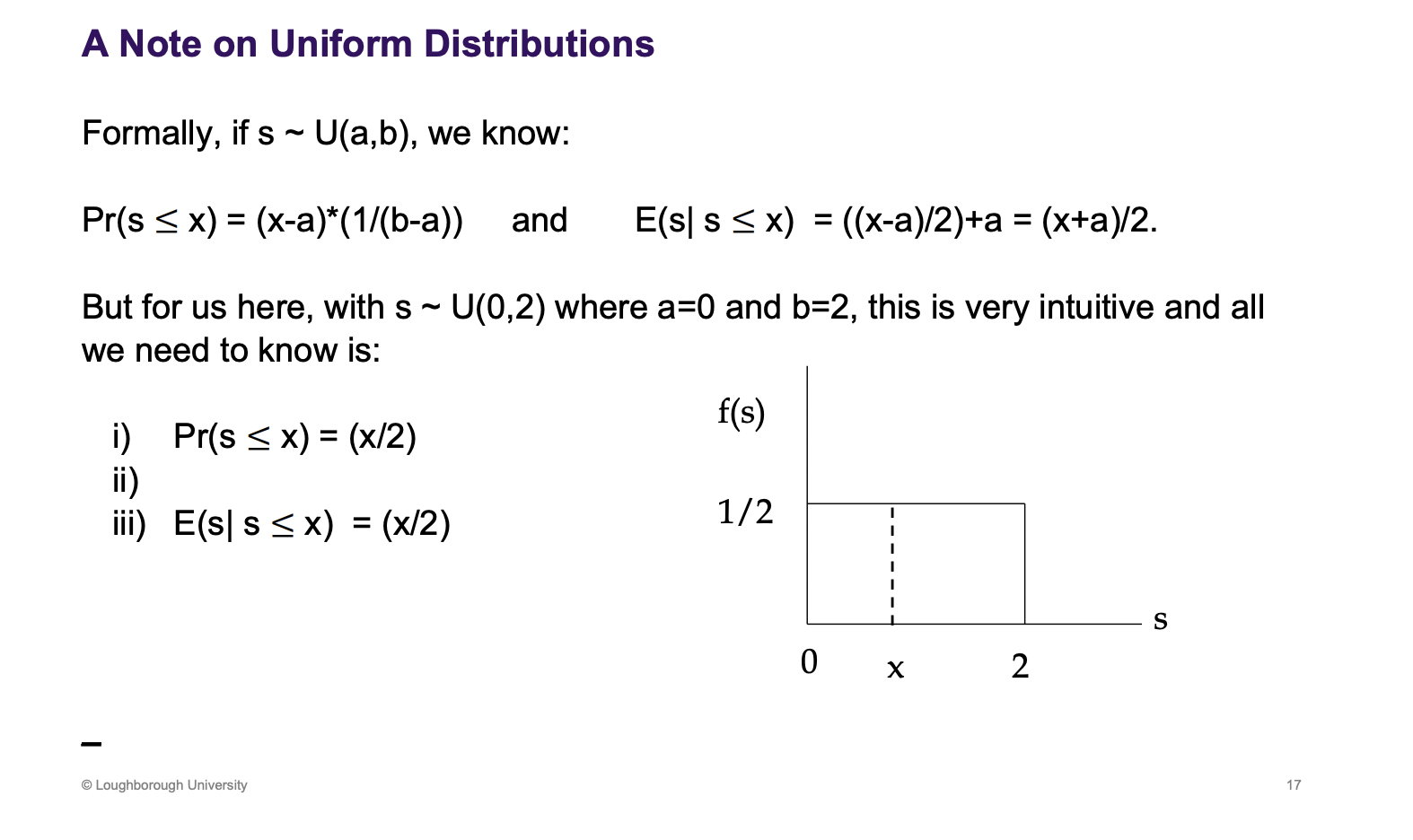

What is the two outcomes of uniform distributions

This makes sense - each quality level is equally likely under a uniform distribution

X here is the possible quality

Quality between 0 and 2, f(s) is the prob distribution, the area has to equal up to 1. The two results, are important. i) the probability that the quality of the car is less than or equal to x, is going to be x/2. This happens because some quality level is x, the probability of being less than that on the graph is the area, x *1/2. iii) means that if I have a pool of cars and I know all of them have a quality less than x, what if I pick one, what would I expected the quality to be.

X is the quality level, iii) means the expected quality conditional of the quality being less than x.

What level will a seller be willing to sell there car, what is the supply curve, what happens to the average quality, what is the condition for buyer to buy and what is the tradin equilibrium

S = marginal cost

Proportion p/2 of seller who will put cars onto the market, as p increase more cars will put cars onto the market. Just swap x for p. The supply curve is p/2

As p increase more sellers will put there cars onto the market as it is covering more peoples marginal cost .

Expected quality of a (car)seller who is willing to put there car when the price is less than mc

Of the cars on the market, the qaulity won't be the average as not everyone has put their cars onto the market. It will be the sellers who have a low quality cars with a low enough marginal cost

(3/2)*u is the willingness to pay, which should be greater than the price (optimal behaviour)

S=(p/2) - sellers decide whether they want to supply the cars or not

3/2 mew > P - willingness to pay should be greater than the price

For the trading equilibrium to hold what must p be equal to and why

Only the lowest quality supliers can trade, at zero price

Buyers will enter the market, all the cars are there, he is cautious and doesn’t want to buy a banger, so the willingness to pay falls as he factors this in. As this falls the best cars leave, the quality of the pool falls and the willingness to pay falls again and this continues.

Quality falls as higher quality cars leave and the willingness to pay falls, this keeps on going until the price hits 0. Welfare losses

Compare this outcome to full information

What is a real world example of adverse selection

Health insurance: It is the other way around, buyers have all the information (level of health). If I offr insurance, he could be healthy or really unhealthy and pay a large amount out. I need to be catious and offer a large premium. As the premium is large, the health people leave and the pool gets more uhealthy and this process continues until you get the most unhealthy people

What are some of the other examples

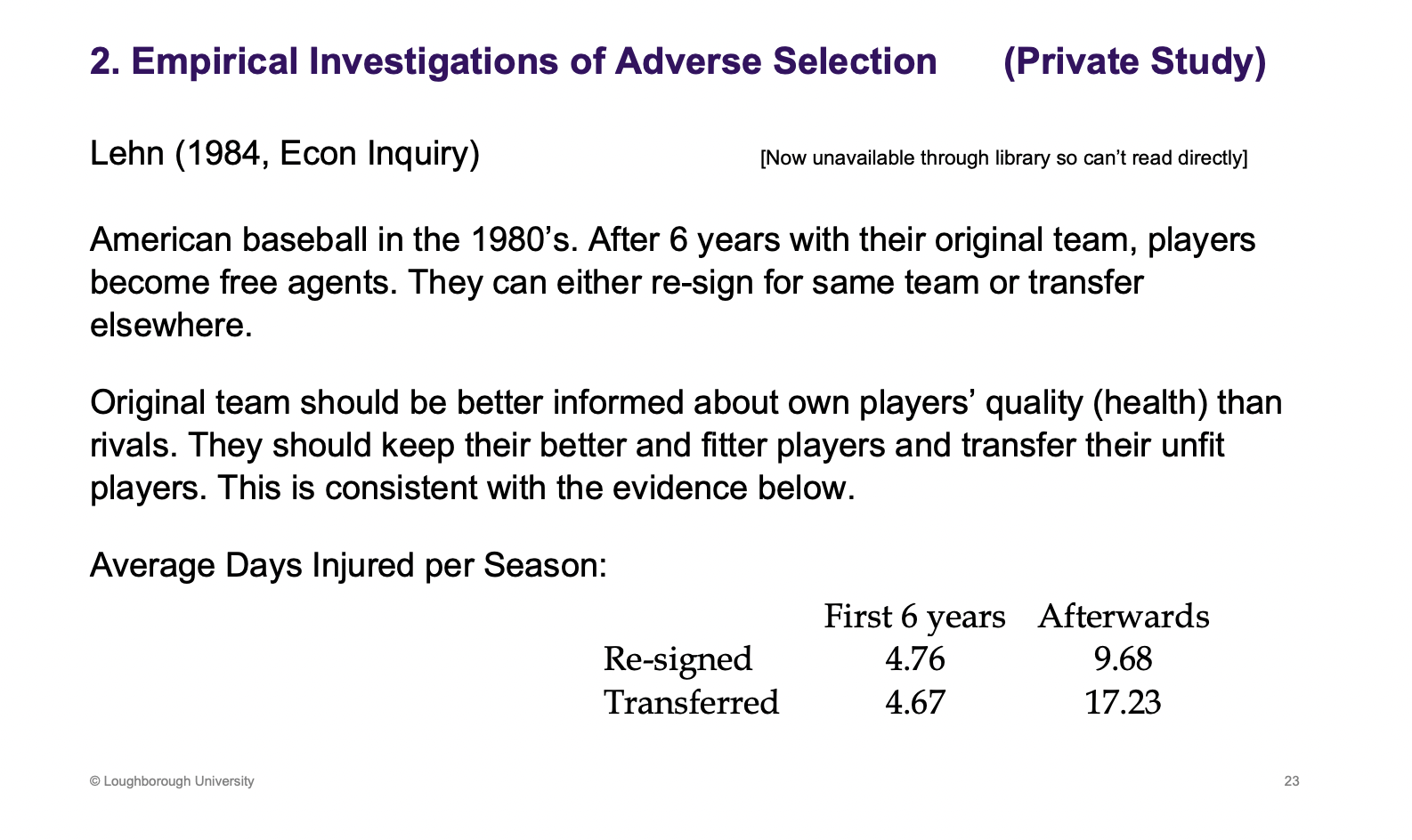

What is Lehn emprical evidence and what year was it

Clubs sign young players, have to sign 6 years. Re signed after the 6 years or sold.

Idea: Teams can work out who is more likely to get injured

Chezum and Wimmer (1997) found evidence of adverse selection in horse auctions; breeders retained superior racehorses and sold lower-quality ones, confirmed when retained horses significantly outperformed sold ones. Similarly, Mérel et al. (2021) found French winemakers sold lower-quality lots on the bulk market while keeping higher-quality wine for themselves.