exam 2 - Reimbursement (Financing Health Care Delivery II)

1/28

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

29 Terms

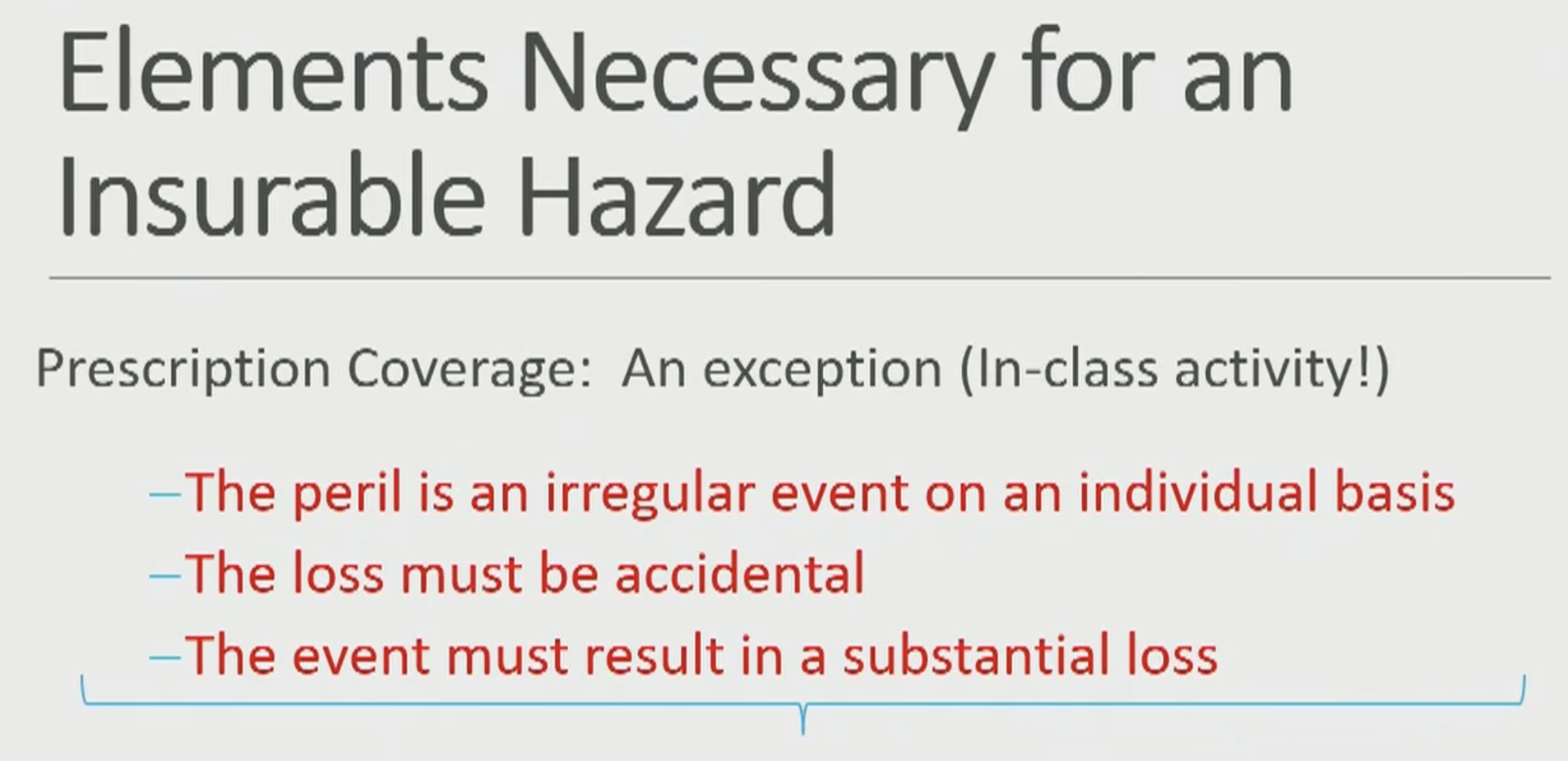

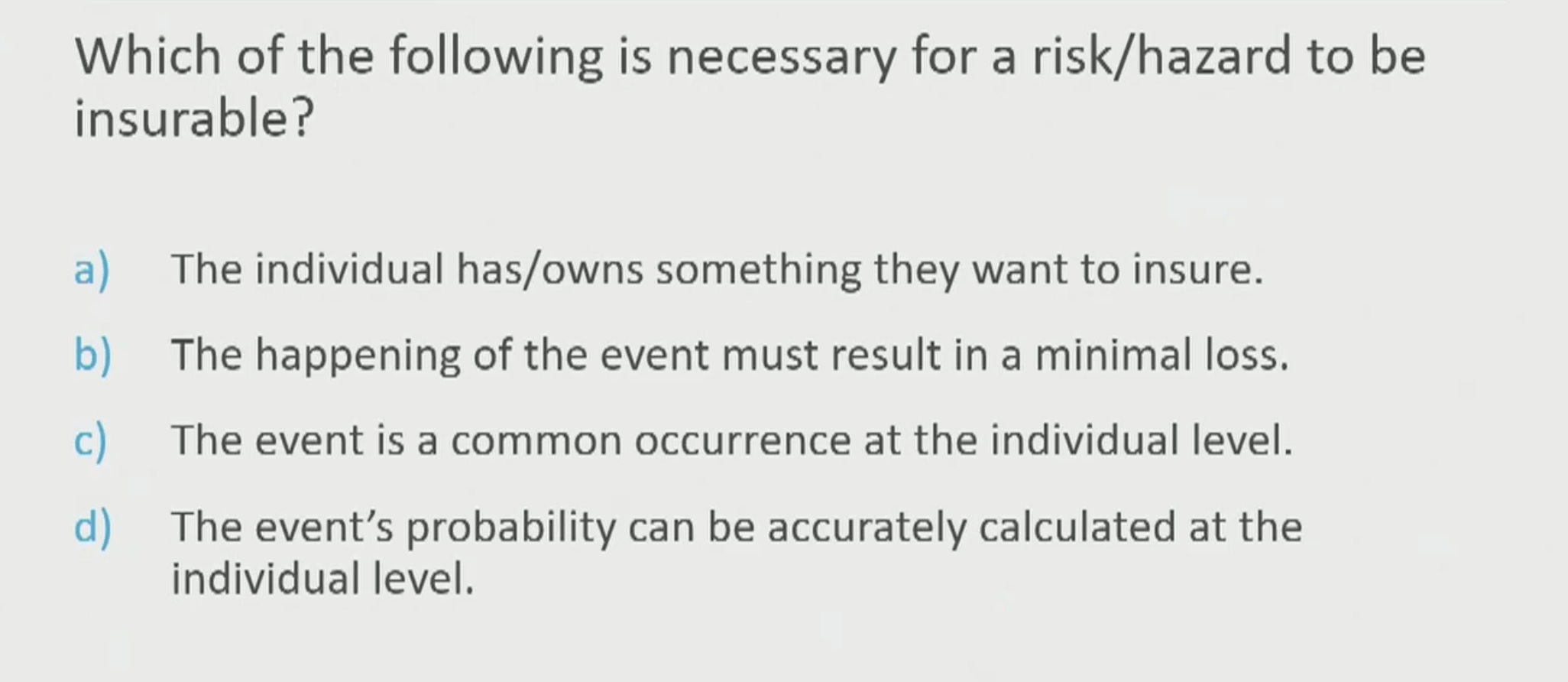

Elements necessary for insurable hazard

Prescription coverage: an exception

A

In addition to being essential and expensive, health care is ___.

In addition to being essential and expensive, health care is uncertain.

➢ We don’t know if &/or when we are going to get sick

➢ Most of us are willing to pay a certain known amount in advance to avoid having to pay a huge amount if we get sick

◦ Insurance companies allow us to do that by taking a risk

• If a lot of people get sick, insurance companies lose $

• If not many people get sick, they make $

Cost of health care for a group of people for a given period (e.g., for the next month) / number of people in the group =

Cost of running an insurance company and some profit =

Cost of health care for a group of people for a given period (e.g., for the next month) / number of people in the group = Average Expected Cost

Cost of running an insurance company and some profit = amount charged to each insured person every month (a premium)

Premiums and sponsors:

◦ If you have a job

◦ ___ will probably pay some or all of your premium

◦ If you are on Medicare or Medicaid

◦ the ___ (___) pays your premium

Premiums and sponsors:

◦ If you have a job

◦ employer will probably pay some or all of your premium

◦ If you are on Medicare or Medicaid

◦ the government (taxpayers) pays your premium

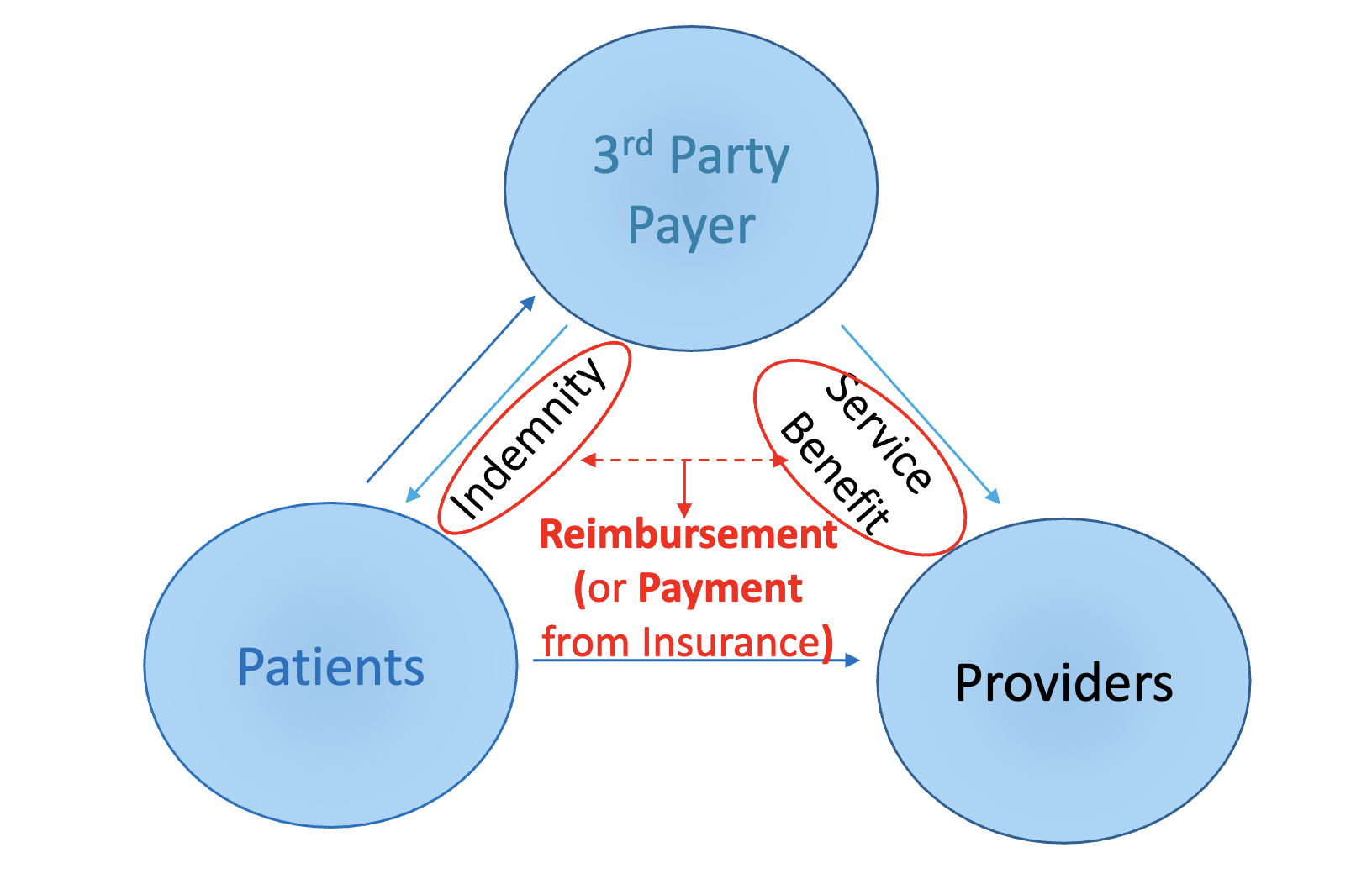

When you use health care, the insurer ___ the provider

When you use health care, the insurer reimburses the provider

If insured, you probably still have to pay something for health care when you use your insurance (= ?). These can be increased.

◦ If uninsured, then you take all the risk.

◦ The sponsor (government or employer): can bypass an insurer and just put the money in the bank and pay providers out of that account. ➢ The sponsor becomes the insurer. (= ?)

◦ If insured, you probably still have to pay something for health care when you use your insurance (= cost-sharing). These can be increased.

◦ If uninsured, then you take all the risk.

◦ The sponsor (government or employer): can bypass an insurer and just put the money in the bank and pay providers out of that account. ➢ The sponsor becomes the insurer. (= self-insured)

Cost-sharing:

◦ Deductible -

◦ Co-insurance -

◦ Co-payment -

Cost-sharing: What the insured patient must still pay for covered services (E.g., deductible, co-insurance, co-payment, difference between generic and brand). Often referred to as patient payment, self-pay, direct-pay, out-of-pocket.

◦ Deductible - amount insured has to pay for covered services before benefits become active (e.g., $100 per year)

◦ Co-insurance - insured has to pay a percent of the reimbursement (e.g., 20%)

◦ Co-payment - flat amount insured has to pay for each utilization event (e.g. , $5 per prescription)

Between indemnity and service benefit?

reimbursement (payment from insurance)

majority of money for health care goes where?

Hospitals

Physicians and clinical

Directionality

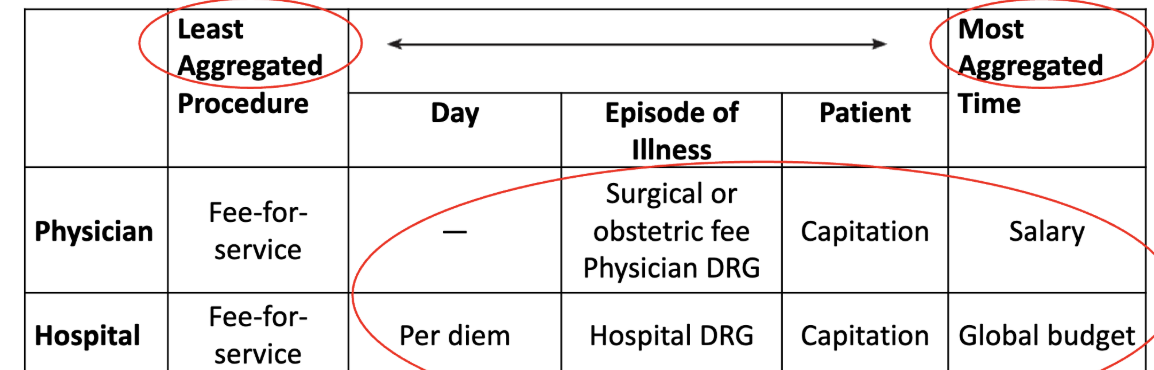

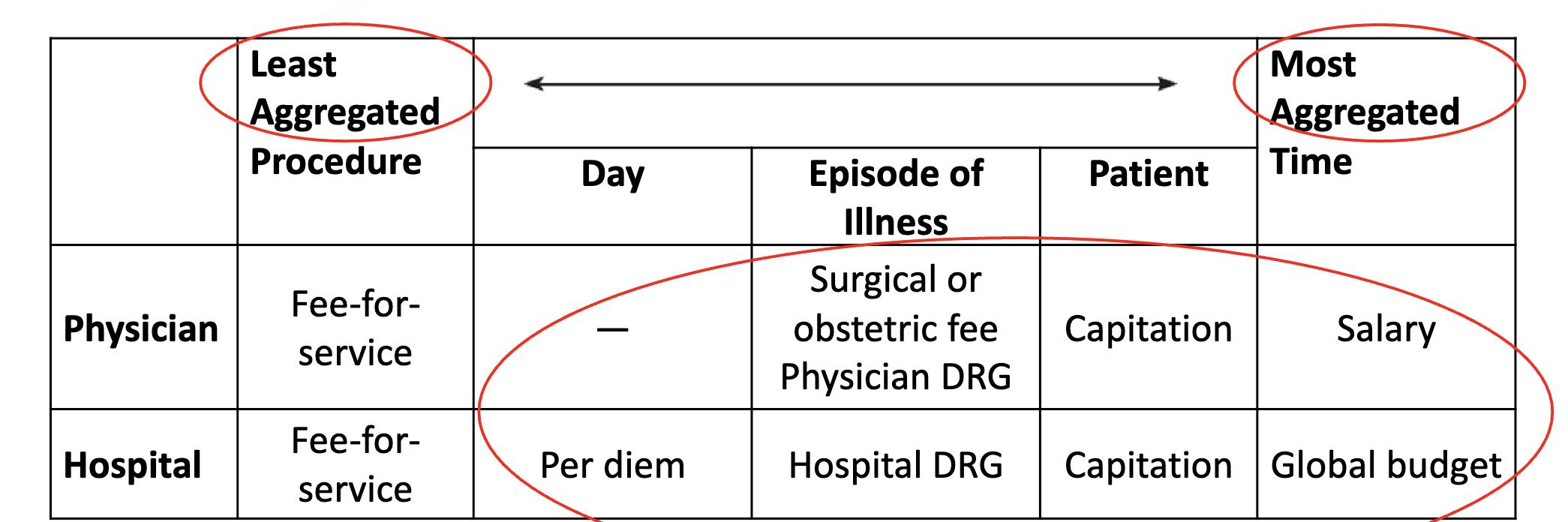

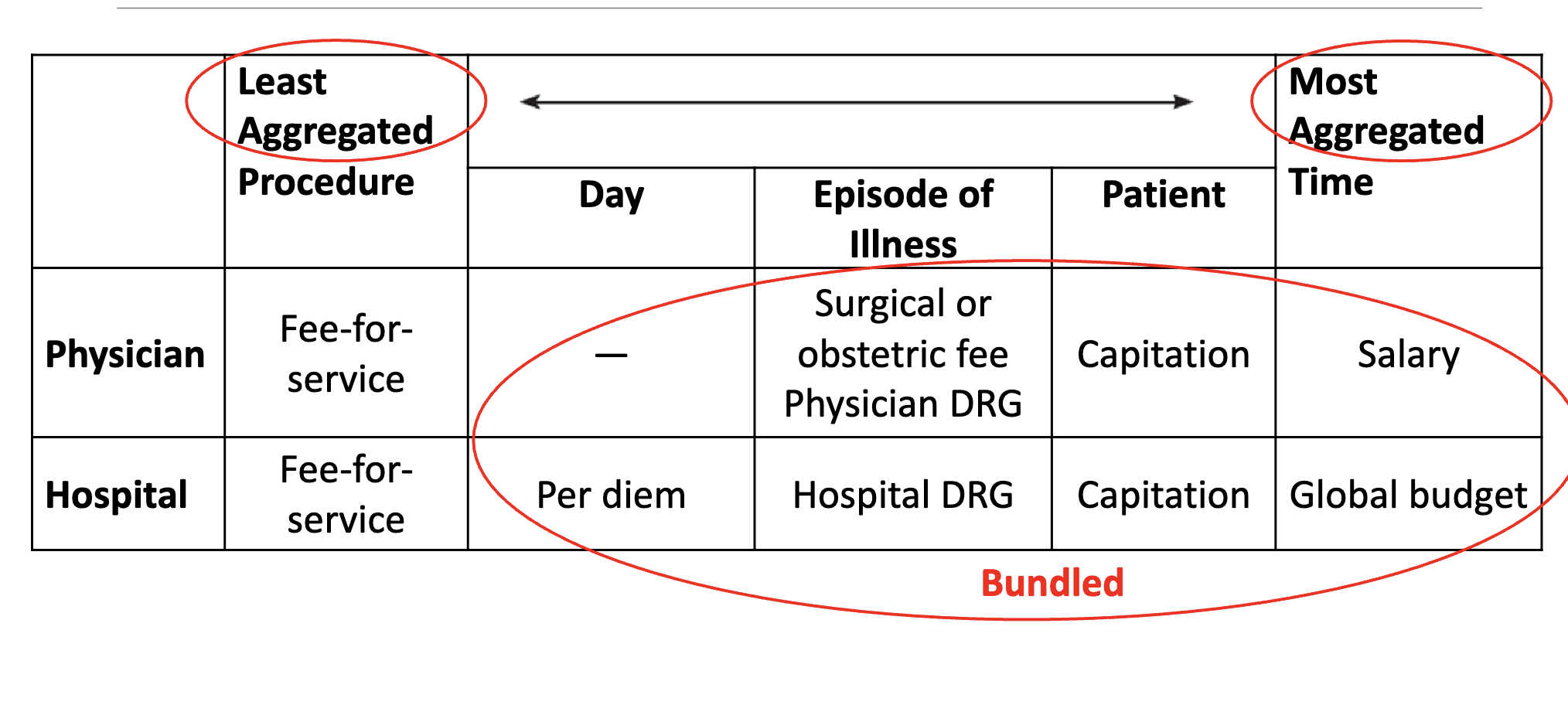

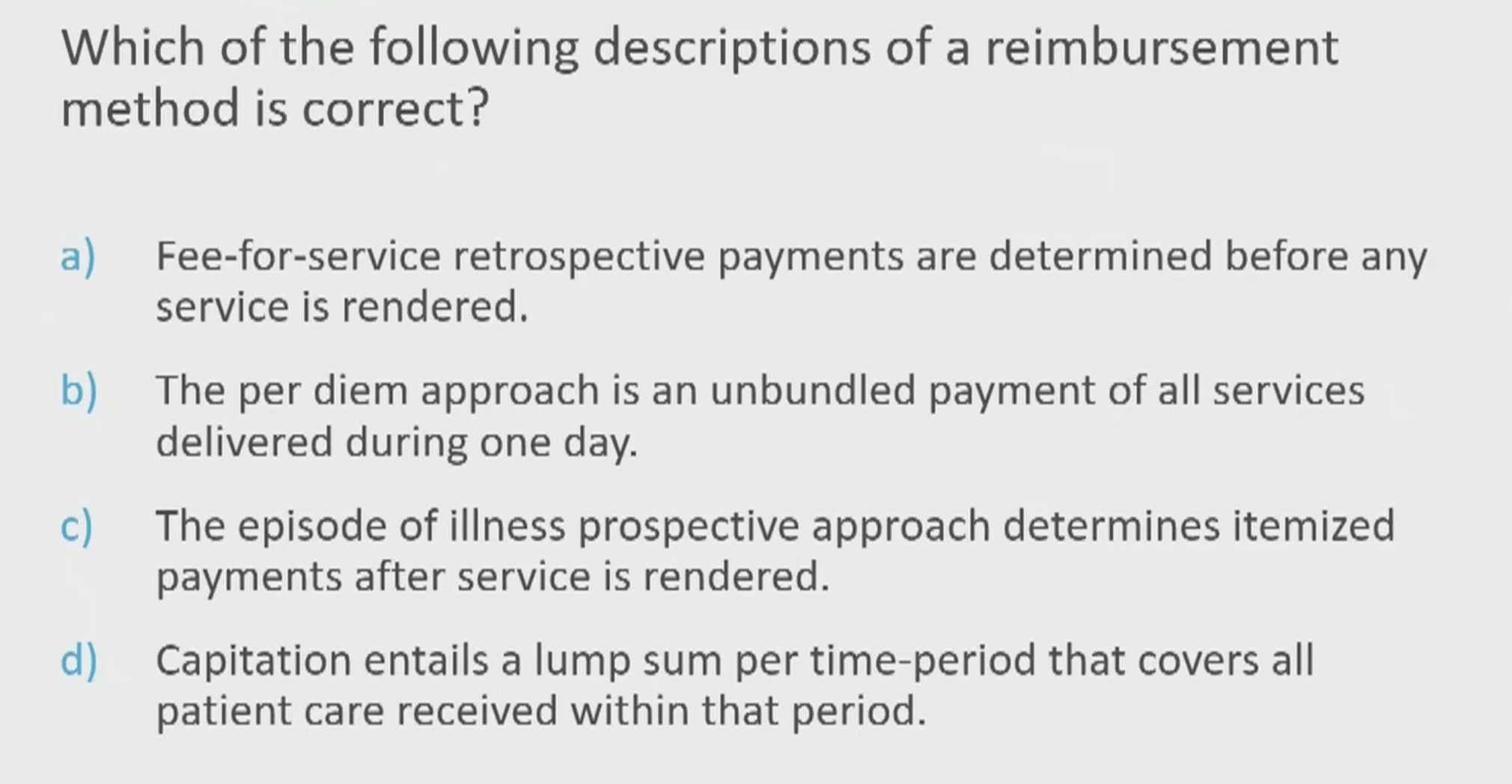

Retrospective vs Prospective

Retrospective - after service

Prospective - before service

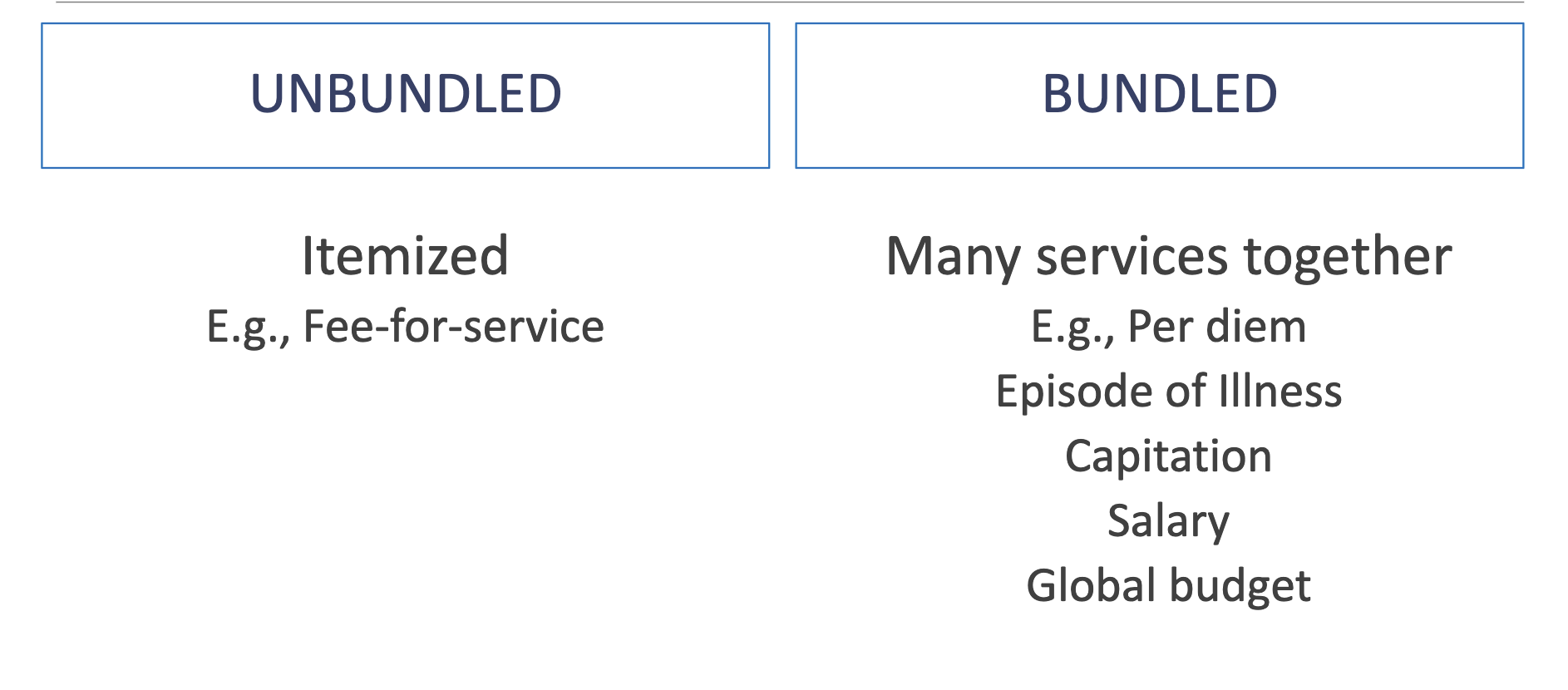

• Fee-for-Service –

• Per Diem –

• Episode of Illness –

• Capitation –

• Fee-for-Service – one fee for each service

• Per Diem – sum of all services delivered to a patient during one day

• Episode of Illness – sum of all services delivered during one illness • E.g., surgical fees & DRGs

• Capitation – one payment is made for each patient’s’ care during a month or year • E.g., PMPM = per member per month

Grouping of payment

Unbundled vs Bundled

more aggregated = ?

more aggregated = more bundled

DRG

diagnoses related group

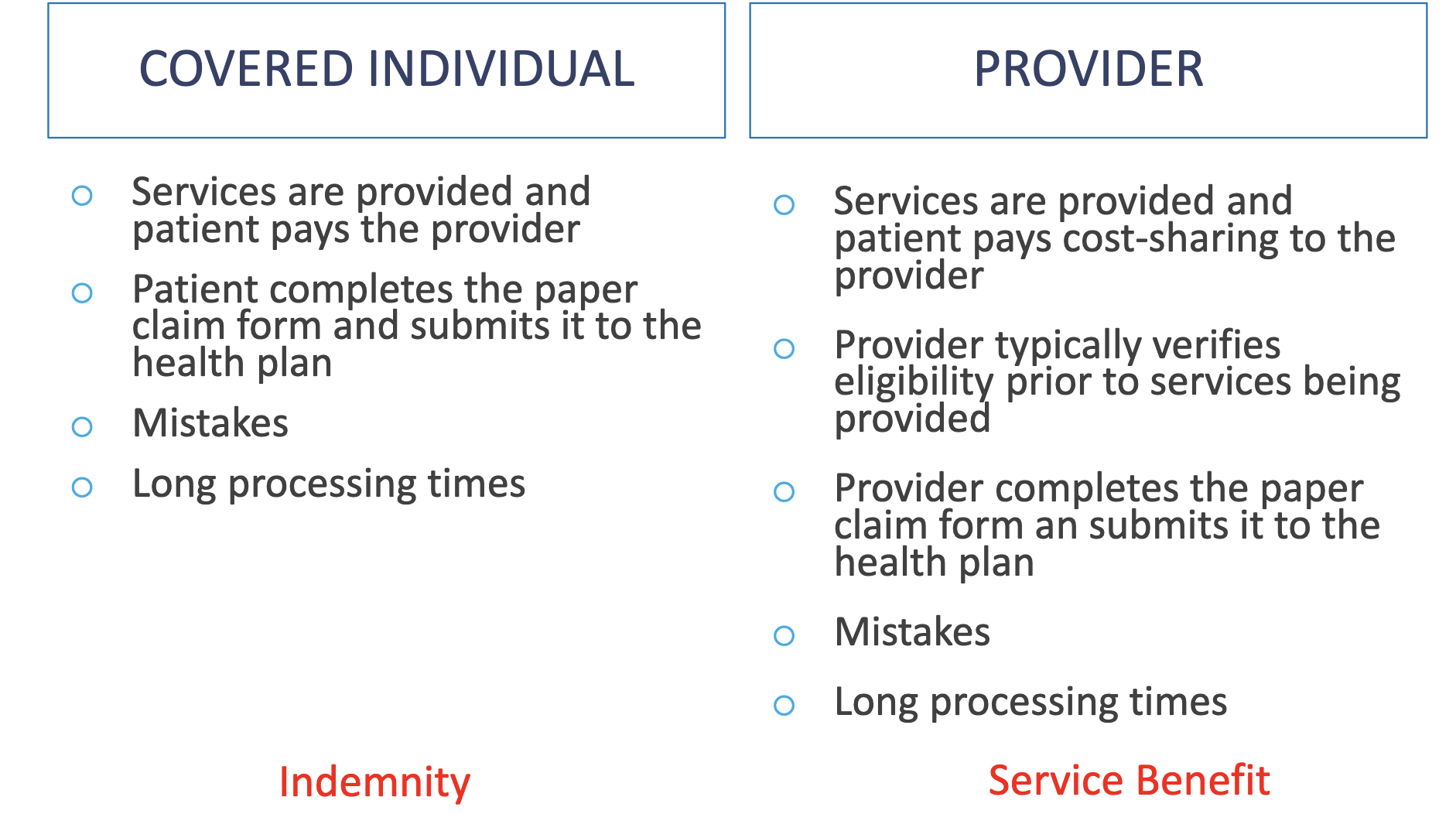

Paper submission by

Covered individual vs Provider

Electronic Submission

Claims are completed and submitted electronically (typically by the provider) Requires certain level of standardization (i.e., coding of products/services) -> ?

Reduces likelihood of ? and ?

Can reduce administrative costs and reduce time until reimbursement

Electronic Submission

Claims are completed and submitted electronically (typically by the provider) Requires certain level of standardization (i.e., coding of products/services) -> service benefit

Reduces likelihood of incomplete claims and legibility errors

Can reduce administrative costs and reduce time until reimbursement

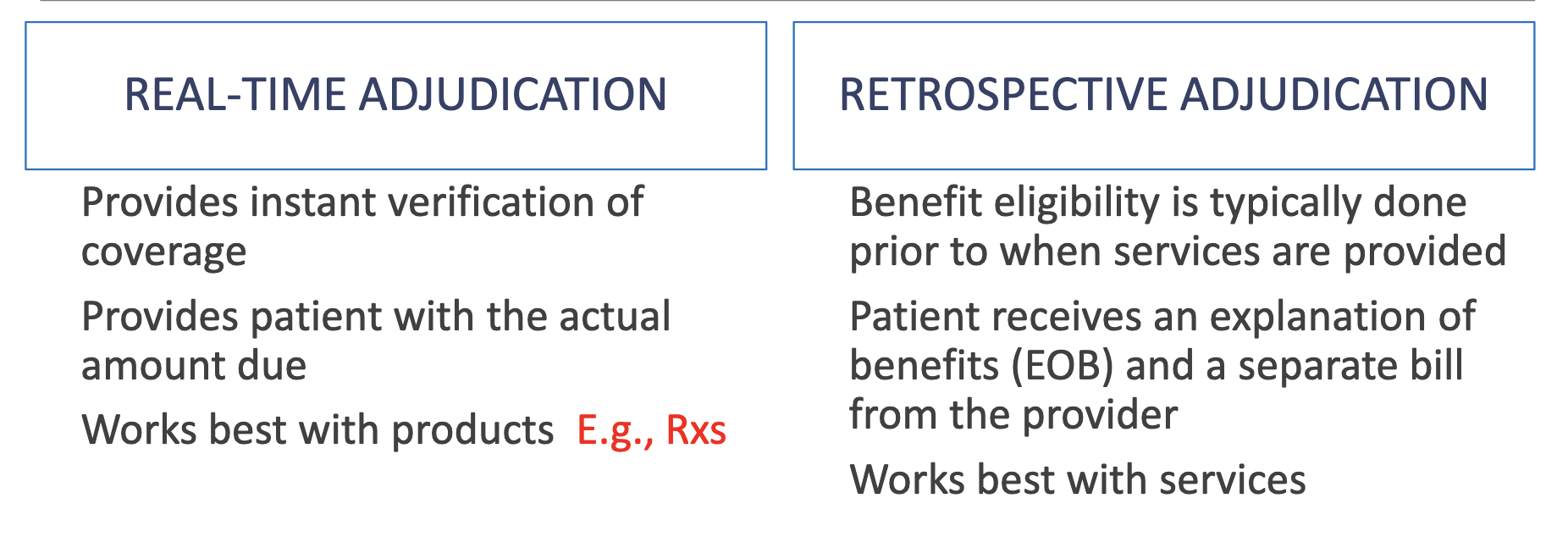

claims adjudication

After a medical claim is submitted, the insurance company determines their financial responsibility for the payment to the provider. This process is referred to as claims adjudication. The insurance company can decide to pay the claim in full, deny the claim, or to reduce the amount paid to the provider.

Adjudication of Claims

Real time vs Retrospective

• Medicare & most private plans:

• Uninsured individuals:

• HMOs:

• Supplemental pay-for-performance (P4P) –

• Hospital claims are often submitted electronically by the hospital; claim submission varies for places of care other than hospitals (may be electronic or paper claims submitted by either the provider or the patient

• Medicare & most private plans: Mix of fee-for-service & episode of illness approaches, DRG

• Uninsured individuals: Fee-for-service

• HMOs: Capitation

• Supplemental pay-for-performance (P4P) – bonus payment if a specified high level of performance on certain measures (e.g., patient satisfaction, cost reduction) is met.

• Hospital claims are often submitted electronically by the hospital; claim submission varies for places of care other than hospitals (may be electronic or paper claims submitted by either the provider or the patient

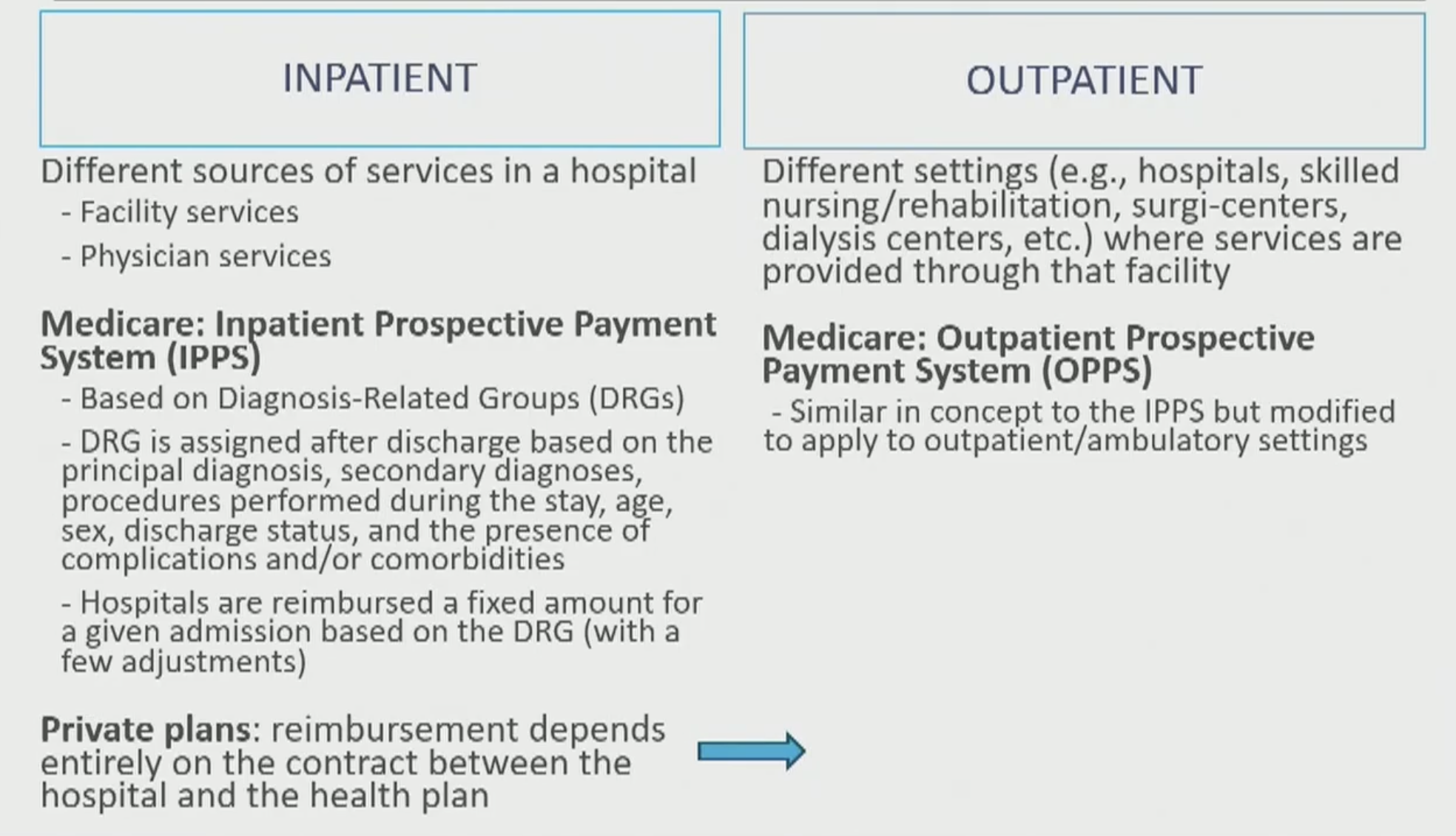

Facility based services

Inpatient vs Outpatient

• Private plans: largely fee-for-service (except for HMOs or highly managed plans) -

• Physician services:

• Supplemental pay-for-performance (P4P) -

• Private plans: largely fee-for-service (except for HMOs or highly managed plans)

• Physician services: Billed using Current Procedural Terminology (CPT) codes to identify what services were provided, Provided in a hospital as part of hospital care (e.g., anesthesiologist during a surgery, pathologist to review of samples, cardiologist review of an EKG, etc.) are often billed separately from the facility charges

• Supplemental pay-for-performance (P4P): Claims are mostly submitted by the provider for generalist visits; more likely to see patient submission of claims for specialist visits

Medicare:

• Medicare uses the resource-based relative value system (RBRVS) to attach relative value units (RVUs) to each service provided (e.g., diagnostic colonoscopy, office visit with a new patient, etc.)

• RVUs are used to weigh the base reimbursement fee by the amount of work/effort required by the provider

• There are also factors used to adjust the reimbursement based on other factors (e.g., malpractice fees, regional labor/wage variations, etc.)

Medicare: Standardized payment

• Medicare uses the resource-based relative value system (RBRVS) to attach relative value units (RVUs) to each service provided (e.g., diagnostic colonoscopy, office visit with a new patient, etc.)

• RVUs are used to weigh the base reimbursement fee by the amount of work/effort required by the provider

• There are also factors used to adjust the reimbursement based on other factors (e.g., malpractice fees, regional labor/wage variations, etc.)

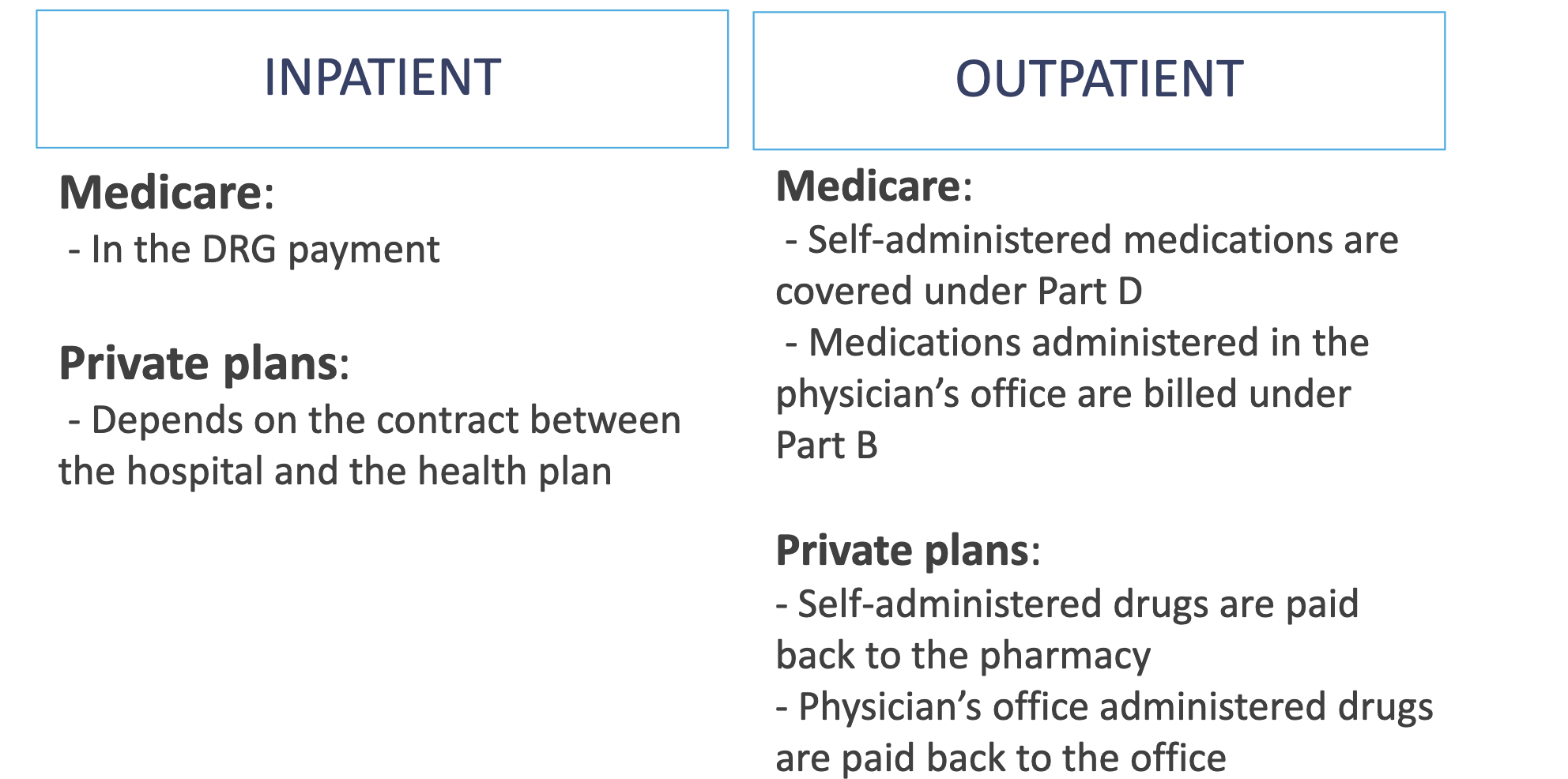

Medications, Fee-for-service approach

Inpatient vs Outpatient

Majority of Rx drug coverage comes from what?

copayments

For pharmacy services

Inpatient pharmacy services:

Outpatient pharmacy services:

Fee-for-service approach

1. Dispensing services – ?

2. Dispensing-related value-added services - ?

3. Non-dispensing-related value-added services - ?

Fee-for-service approach

1. Dispensing services – included in the dispensing fee

2. Dispensing-related value-added services

- Refill monitoring, communicating with other professionals, drug product selection - all included in dispensing fee

- Non-required services (calendar packaging for increased adherence, flavoring services, etc.) - may be billed to the patient

3. Non-dispensing-related value-added services

- E.g., drug therapy monitoring, Part D plan selection, education, etc.

- May be billable to the patient, to the plan (but depends on the plan), or to Medicare

- Outpatient Medication Therapy Management (MTM) referral clinics may bill for services provided “incident to” a physician referral

- Claims may be submitted directly to the health plan or “indirectly” to the plan through the physician office (e.g., a pharmacist in a group medical practice with a collaborative practice agreement)

- Pharmacist-exclusive CPT codes exist for initial MTM visits, subsequent visits, and additional time (in 15-minute increments) to bill Medicare Part D plans

D