module 7 - taxes

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

18 Terms

tax revenue

the total amount of money a firm receives from selling its goods or services

price x quantity sold

accounting profit

total money a firm makes after subtracting ONLY explicit costs

explicit costs

direct, recorded costs

implicit costs

opportunity costs of using resources the firm already owns, rather than spending money directly

not paid out in cash

can be time, wages, rent, supplies, etc

economic profit

measure of profit that takes into account both explicit and implicit costs

total cost

sum of all costs in a firm incurs in the production of goods and services

implicit and explicit costs

variable cost

the costs tat change with the level of output

more a firm producers, the higher this cost

cost per unit x number of units produced

fixed cost

the costs that do not change with the level of production

rent

salaries

insurance

property taxes

equipment

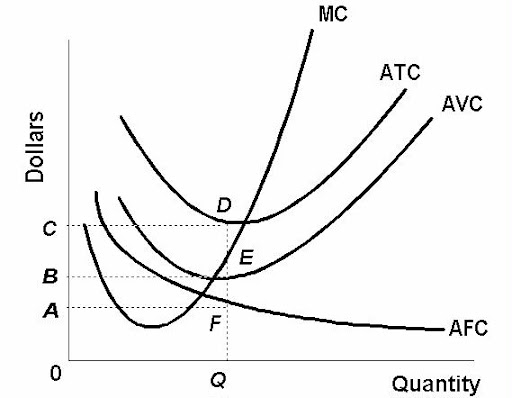

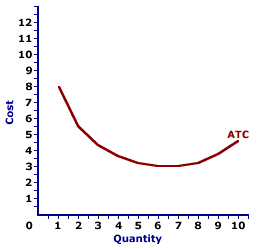

average total cost (ATC)

the total cost per unit of output

total cost/quantity

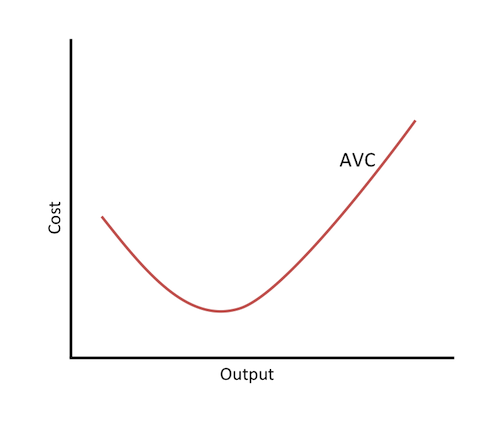

average variable cost

the variable cost per unit of output

variable cost/quantity

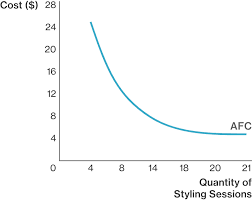

average fixed cost

the fixed cost per unit of output

total fixed cost (TFC)/quantity

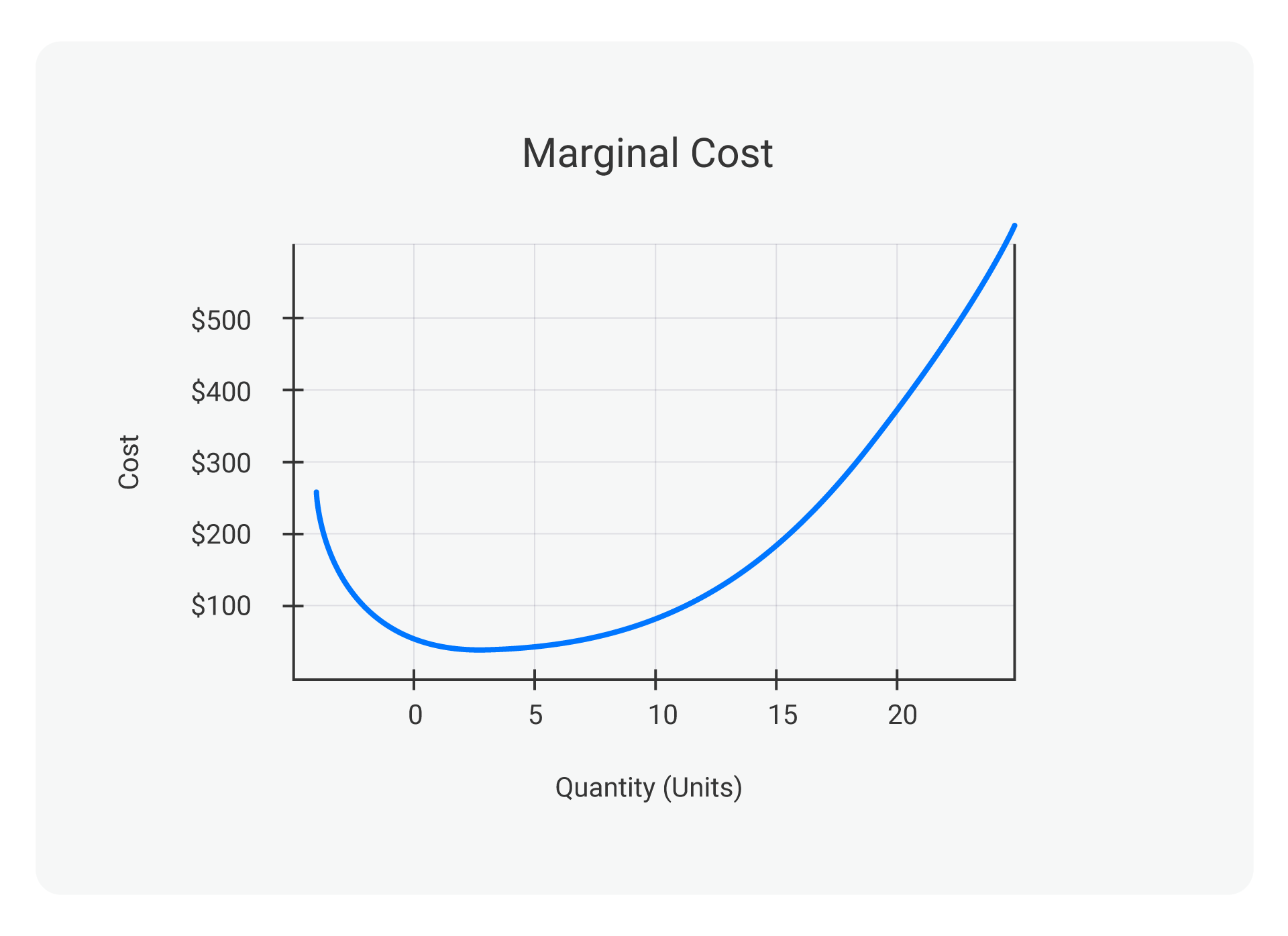

marginal cost (mc)

fundamental concept in economics that refer to the additional cost incurred by producing one more unit of a good or service

formula: change in total cost/change in quantity produced

decreasing (marginal) returns - law of diminishing marginal returns

fundamental economic principal that describes what happens to output when you continuously add more of one input to production while holding all other inputs constant

hiring more workers (place can become too cramped with too many people)

decreasing returns to scale

a situation in which a proportional increase in all inputs leads to less than proportional increase in output

long run

occurs when a firm expands its production capacity; changing all its factors of production proportionally

increasing returns to scale

long run production phenomenon where a proportional increase in all inputs leads to a more than proportional increase in output

specialization and division of labor

technological advantages

bulk purchasing and discounts

managerial efficiencies

constant returns to scale

occur in the long run when a proportional increase in all inputs leads to an equally proportional increase in output

goal of firms

maximize profits (total revenue minus total cost)

all costs on a graph together