EDEXCEL IAL BUSINESS THEME 2

1/269

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

270 Terms

What are the different methods of Internal finance?

1) Owner's capital: personal savings

2) Retained profit

3) Sale of assets

What are the different methods of External finance?

1) Family & Friends

2) Banks

3) Peer to Peer lending

4) Business Angels

5) Crowd Funding

6) Other Businesses

What is the difference between a source and method of finance?

Source of finance = Who gives you the money (e.g. a bank, your own savings).

Method of finance = The way you get the money (e.g. as a loan, an overdraft, or selling shares).

what method of finance would be most appropriate for a limited business?

Selling shares (equity finance) - limited companies can raise large amounts by selling shares. They might also use bank loans for long-term finance, especially if they have assets to secure the loan.

Example:

A private limited company (Ltd) wants to expand by opening a new store. It could sell more shares to raise the money, or take out a bank loan if it doesn't want to give up ownership.

What method of finance would be most appropriate for an unlimited business?

Personal savings or bank loan - because unlimited businesses can't sell shares, and banks may offer loans if the owner provides security.

Example:

A sole trader needs money to buy equipment. They might use their own savings or get a loan from the bank, but they're personally responsible if it can't be repaid.

why is a business plan important when obtaining finance?

A business plan shows the lender or investor how the business will succeed and repay the money. It includes forecasts, goals, and strategies, which help build trust and reduce risk for the lender.

Example:

A start-up uses a business plan to convince a bank that their café will make enough profit to repay a loan.

break even formula

Break even = Fixed costs / contribution per unit

Net Cashflow formula

cash inflows - cash outflows

Budget variance formula

Variance = Actual Value - Projected Value

contribution formula

sales price per unit - variable costs per unit

margin of safety formula

current sales minus the breakeven point, divided by current sales.

Current Ratio formula

current assets/current liabilities

Acid test ration formula

current assets - inventories / current liabilities

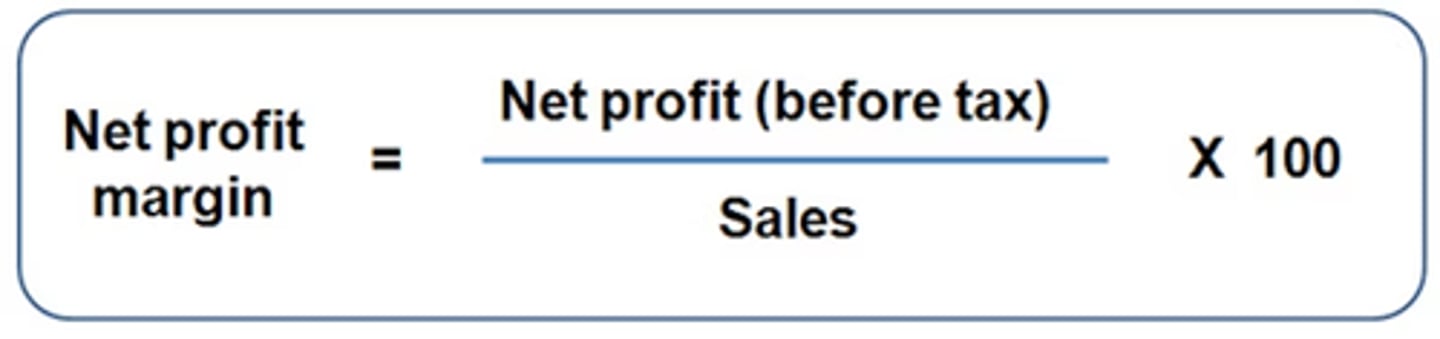

net profit margin formula a level business

Net Profit ⁄ Total Revenue x 100

closing balance formula

closing balance = net cash flow + opening balance.

Acid test ratio formula

closing balance formula

closing balance = net cash flow + opening balance.

net current assets formula

current assets - current liabilities

net profit margin formula

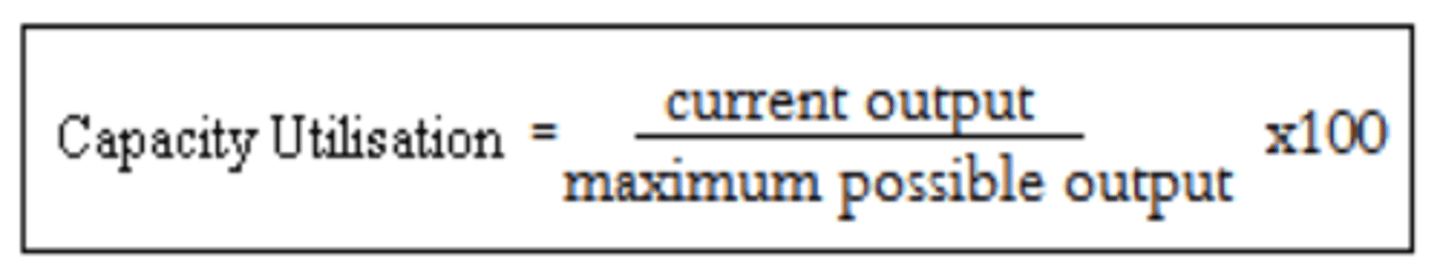

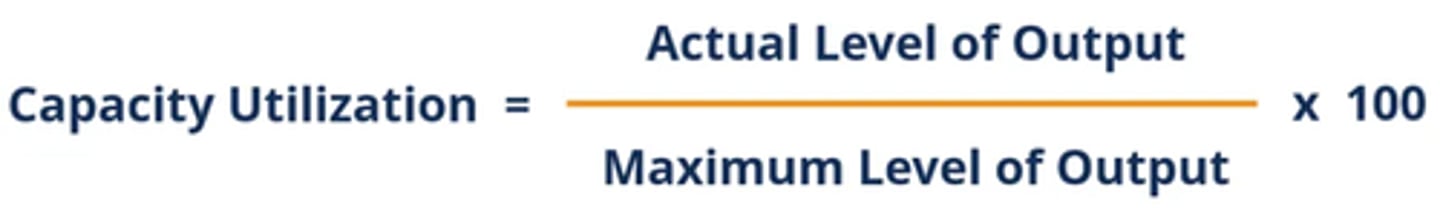

capacity utilisation formula

what are the uses of a cash-flow forecast?

Predicts cash inflows/outflows

Spots cash shortages

Aids planning & budgeting

Helps get loans/investment

Plans for seasonal changes

Informs decisions (e.g. spending)

What are the limitations of a cash flow forecast?

Only estimates - may be wrong

Doesn't show profit

Can miss hidden costs

Affected by external changes

Needs regular updates

Risk of human error/bias

opening balance formula

Opening Balance = Closing Balance of previous period

What is the purpose of a sales forecast?

Estimate future revenue

Help with planning (e.g. production, staffing, stock)

Support financial forecasting (e.g. budgeting, cash flow)

Identify seasonal trends or changes in demand

Assist in setting targets and measuring performance

Help with resource allocation and investment decisions

What are the factors affecting the sales forecasts?

Consumer Trends – changes in tastes, fashion, lifestyle

Economic Variables – inflation, interest rates, unemployment

Actions of Competitors – pricing, promotions, new products

Market Research Data – quality and reliability of data used

Advertising & Promotion – level and effectiveness of marketing

Seasonality – time of year affects demand

Business Capacity – ability to meet potential demand

External Shocks – e.g. pandemics, war, supply chain issues

New Product Launches – can boost or disrupt existing sales

What are the difficulties affecting sales forecasting?

Unexpected external factors – e.g. economic shocks, weather, political events

Changing consumer trends – tastes and preferences can shift quickly

Inaccurate or limited data – poor-quality market research = unreliable forecasts

New competitors or products – can disrupt market predictions

Technological change – may make products outdated faster than expected

Short product life cycles – hard to predict sales for new or trendy items

Over-reliance on past data – past trends don’t always repeat

how to calculate sales volume?

Sales Volume = Total Sales Revenue ÷ Selling Price per Unit

how to calculate sales revenue?

Sales Revenue = Sales Volume × Selling Price per Unit

how to calculate fixed costs?

Fixed Costs = Total Costs - Variable Costs

how to calculate variable costs?

Variable Costs = Cost per Unit × Number of Units Sold

how to calculate total costs?

Total Costs = Fixed Costs + Variable Costs

What is the calculation for contribution per unit?

Contribution per Unit = Selling Price - Variable Cost per Unit

How do you calculate break-even point?

Break-Even Point = Fixed Costs ÷ Contribution per Unit

How would you calculate margin of safety?

Margin of Safety = Actual Sales – Break-Even Sales

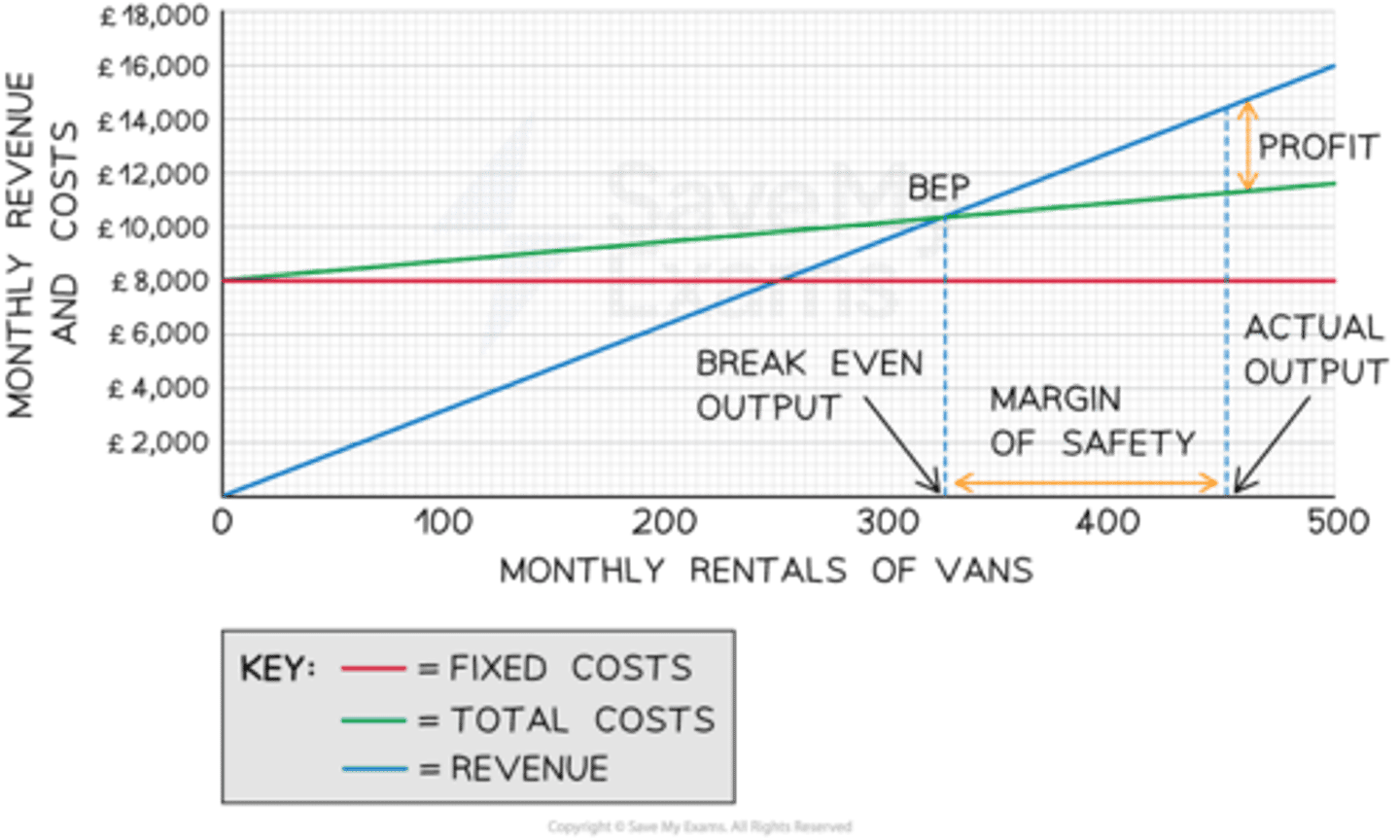

how to interpret a break even chart?

Break-even point - Where Total Revenue = Total Costs – no profit, no loss

Margin of safety - Gap between actual output and break-even output

Profit area - Where Total Revenue > Total Costs – above break-even point

Loss area - Where Total Costs > Total Revenue – below break-even point

Fixed costs - Horizontal line – stays the same regardless of output

Total costs line - Starts at fixed costs, rises with output

Total revenue line - Starts at zero, rises with output – steeper than total costs if making profit

what are the limitations of break-even analysis?

Assumes all output is sold – no allowance for unsold stock

Costs may change – variable and fixed costs aren’t always constant

Selling price might vary – discounts or competition can affect revenue

Oversimplifies reality – doesn’t account for multiple products or changing conditions

Based on estimates – figures may not be accurate or up to date

Ignores external factors – e.g. economic changes, consumer trends

labour productivity

output /number of employees

Capital productivity

output/ number of machines

Working capital (net current assets)

current assets – current liabilities

Operating profit margin

operating profit/revenue X100

Gross profit margin

gross profit/revenue X100

Net profit

Operating – finance costs(tax +interest)

Operating profit

Gross profit – expenses

Gross profit

Sales revenue- cost of goods sold

Total contribution

Contribution per unit X sales volume

Unit costs

Total costs/output

Total costs

Fixed costs + total variable costs

Variable cost per unit

Total variable costs/output

Total variable costs

Total output X unit variable cost

Sales revenue

Total sales volume X selling price

% change in Income

% change in demand/ YED

YED

% change in demand/ % change in income

% change

Difference/original X 100

% change in quantity demanded

PED X % change in price

% change in price

% change in demand/PED

PED

% change in demand/ % change in price

Added Value

Selling price – cost of production

Market Share

Company sales/total market sales X 100

What is the purpose of the budgets?

To set financial targets, control spending, monitor performance, support decision-making, motivate staff, and coordinate business activities.

What are the different types of budgets?

Expenditure budget – forecasts costs.

Profit budget – forecasts expected profit (revenue minus costs).

Revenue budget – forecasts income.

What is varience analysis?

Variance analysis compares budgeted figures to actual results to identify differences (variances), helping assess performance and control finances.

what are the difficulties of budgeting?

Inaccurate data – budgets rely on forecasts, which may be wrong.

External changes – e.g. economic shifts can make budgets outdated.

Time-consuming – can take time to prepare and monitor.

Restrictive – may limit flexibility or creativity.

Conflict – can cause tension between departments over resources.

What is statement of comprehensive income?

A financial statement showing a business's revenues, costs, and profits over a period, used to assess financial performance.

What are ways to improve profitability?

Increase revenue – e.g. raise prices or boost sales.

Reduce costs – e.g. lower production or overhead expenses.

Improve efficiency – e.g. streamline operations or use technology.

what is the distinction between cash and profit?

Cash is the money available to a business at a given time.Profit is the financial gain when revenue exceeds costs over a period.A business can be profitable but still run out of cash.

How can a business be profitable but still run out of cash?

Delayed payments from customers (trade receivables).

Large upfront costs not yet covered by income.

Too much stock tying up cash.

Loan repayments or asset purchases using cash, not shown in profit.

What is the statement of financial position?

A snapshot of a business's assets, liabilities, and equity at a specific point in time. It shows what the business owns and owes.

what is current ratio?

A liquidity ratio that shows a business’s ability to pay short-term debts.Formula:

Current Assets ÷ Current Liabilities.

A ratio of around 1.5–2 is usually considered healthy.

what is acid test ratio?

A stricter liquidity ratio that excludes stock from current assets.

Formula: (Current Assets – Inventory) ÷ Current Liabilities.

It shows if a business can pay short-term debts without relying on selling stock.

A ratio of 1 or above is typically seen as healthy.

what are ways to improve liquidity?

Reduce stock levels to free up cash.

Speed up customer payments (reduce trade receivables).

Delay payments to suppliers (extend trade payables).

Inject more capital (e.g. owner investment or loans).

Sell unused assets to generate cash.

What is working capital and why is it important?

Working capital = Current Assets – Current Liabilities.It shows the cash available for day-to-day operations.It’s important because it helps a business pay short-term debts and keep running smoothly.

what are the internal and external causes of business failiure?

Internal causes:

Poor cash flow management

Inadequate planning or strategy

Ineffective leadership

High costs or low productivity

External causes:

Economic downturns

Increased competition

Changes in consumer trends

New laws or regulations

What's the difference between cash flow and profit problems causing business failure?

Cash flow problems = not enough cash to pay bills, even if profitable.

Profit problems = costs are higher than revenue, leading to losses.Cash flow issues can cause immediate failure; profit issues often lead to long-term decline.

what are the financial and non-financial factors causes of business failiure?

What are the financial and non-financial causes of business failure?

Financial causes:

Poor cash flow

Low profits or consistent losses

Too much debt

Inadequate funding

Non-financial causes:

Poor management or leadership

Lack of market research

Bad customer service

Failure to adapt to change or innovation

What are the methods of production?

Job production – one-off, custom products (e.g. wedding cake).

Batch production – groups of identical items made together (e.g. bakery goods).

Flow production – continuous, on an assembly line (e.g. cars).

Cell production – teams work on parts of the production process (boosts flexibility and motivation).

How do you calculate productivity?

Productivity = Output per period ÷ Number of inputs (e.g. workers).

It measures how efficiently resources are used to produce goods or services.

What are the factors influencing productivity?

Worker motivation – more motivated = more output.

Training and skills – better skills improve efficiency.

Technology – automation and tools speed up production.

Workplace organisation – efficient layouts reduce time wasted.

Management quality – good leadership boosts performance.

What is the link between productivity and competitiveness?

Higher productivity lowers unit costs, allowing a business to offer lower prices or higher quality—making it more competitive in the market.

What are the factors influencing efficiency?

Training & skills – skilled workers work faster and make fewer errors.

Technology – automation and tools reduce time and waste.

Motivation – engaged employees tend to work more efficiently.

Organisation – clear processes and layouts save time.

Quality of management – effective leaders improve workflow and reduce waste.

what is the difference between labour and capital intensive production?

Labour-intensive: relies more on human workers than machines (e.g. hand-made goods).

Capital-intensive: relies more on machinery and technology than people (e.g. car manufacturing).Each has different cost structures, flexibility, and efficiency.

What are the pros and cons of labour-intensive production?

Pros:

More flexible and adaptable

Can produce high-quality, customised products

Creates jobs

Cons:

Higher labour costs

Risk of human error

Slower production speed

What is the calculation for capacity utilisation?

What are the implications of under- and over-utilisation of capacity?

Under-utilisation:

Higher unit costs (wasted resources)

Low staff morale

Poor return on investment

Over-utilisation:

Pressure on staff → burnout or errors

Reduced quality or customer service

No room for unexpected demand or maintenance

What are the ways of improving capacity utilisation?

Increase demand – e.g. through marketing or promotions

Outsource production during busy periods

Use spare capacity for new products or services

Rent out unused space/equipment

Reduce capacity – e.g. close underused facilities

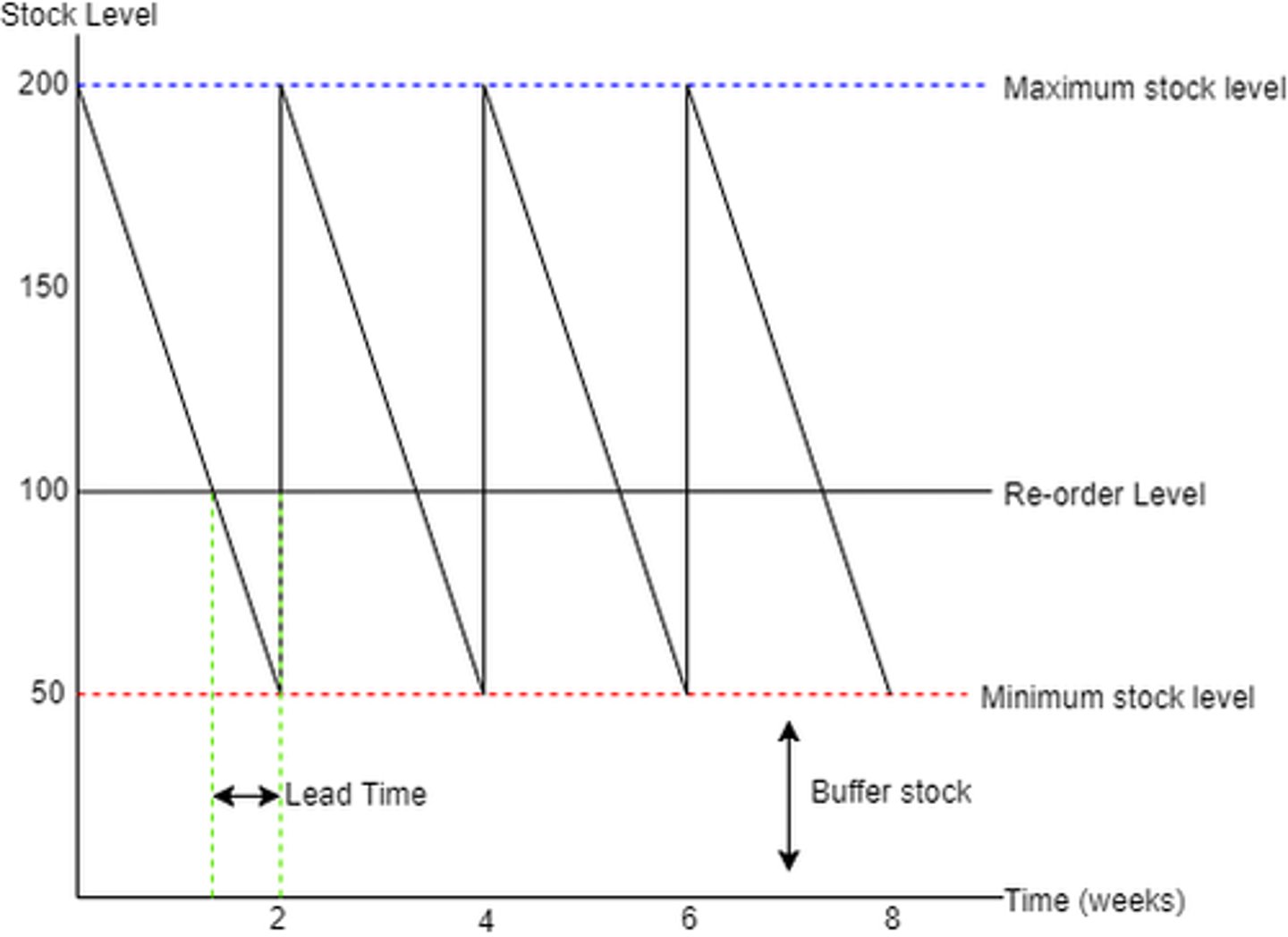

How does a stock control digram look like?

What are the implications of poor stock control?

Too much stock → high storage costs, waste, and cash tied up

Too little stock → stockouts, lost sales, and unhappy customers

Inaccurate records → production delays and inefficiency

Risk of obsolescence or damage

What is Just In Time (JIT)?

A stock control method where materials and stock are delivered only when needed, reducing storage costs and waste.

What are the advantages of Just In Time (JIT)?

Lower storage and handling costs

Less waste and risk of obsolescence

Improved cash flow

Encourages efficiency and lean production

What are the disadvantages of Just In Time (JIT)?

High reliance on suppliers

No buffer stock for delays or demand spikes

Risk of production stoppages

Less flexibility with sudden large orders

What is waste minimisation and why is it important?

Waste minimisation means reducing the amount of materials, time, or resources wasted in production.It’s important because it:

Lowers costs

Improves efficiency

Reduces environmental impact

Supports lean production and sustainability

What is lean production?

Lean production is an approach focused on reducing waste and improving efficiency without sacrificing quality.It includes methods like JIT, Kaizen, and continuous improvement.

How can a competitive advantage be gained from lean production?

Lower costs → allows competitive pricing

Better efficiency → faster delivery and fewer delays

Higher quality → improves customer satisfaction

Flexibility → quicker response to market changes

Improved reputation → attracts more customers

What is the difference between quality control and quality assurance?

Quality Control: Checking products for faults after production.

Quality Assurance: Ensuring quality is built into the process to prevent faults from happening.

What are the advantages and disadvantages of Quality Control?

Advantages:

Faults are caught before reaching customers

No need to train all staff on quality methods

Disadvantages:

Wasteful (defective products already made)

Doesn't prevent problems, just finds them

Can lower staff responsibility for quality

What are the advantages and disadvantages of Quality Assurance?

Advantages:

Prevents faults, reduces waste

Builds customer trust in consistent quality

Involves employees, improving motivation

Disadvantages:

Can be time-consuming to implement

Requires staff training and commitment

May slow down production initially

What are the key concepts of Total Quality Management (TQM)?

Continuous improvement – always finding ways to improve

Customer focus – meeting or exceeding customer expectations

Employee involvement – all staff responsible for quality

Right first time – aiming for zero defects

Quality chains – everyone is a customer and a supplier within the business

Fact-based decision making – using data to improve processes

What is meant by continuous improvement (Kaizen)?

Kaizen means making small, regular improvements to processes, involving all employees.It focuses on increasing efficiency, reducing waste, and improving quality over time.

What are the benefits of Kaizen (continuous improvement)?

Encourages a culture of teamwork and improvement

Improves efficiency and reduces waste

Boosts employee involvement and motivation

Enhances product quality over time

What are the drawbacks of Kaizen?

Can be time-consuming to implement

May face resistance to change from staff

Small changes may not be enough in fast-changing markets

Requires ongoing commitment and management support

What is the difference between quality management and Kaizen?

Quality management is the broader process of maintaining and improving quality across the business (e.g. TQM, QA, QC).

Kaizen is a specific approach within quality management that focuses on continuous, small improvements involving all employees.