4.5.2 Taxation

1/10

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

11 Terms

Distinction between progressive, proportional & regressive taxes

Progressive tax = where higher income households pay a higher percentage of their income in tax than lower income households

Regressive tax = where higher income households pay a lower percentage of their income in tax than lower income households

Proportional tax = where both higher & lower income households pay same percentage of their income in tax

Definition of FDI

Foreign Direct Investment

Financial investment from other countries

either buy an existing business

or sets up a new business

ie. Mercedes buys a car parts company in Tunisia = FDI into Tunisia

ie. Apple establishes new factory in China = FDI into China

The economic effects of changes in direct & indirect tax rates on other variables: incentives to work

Which tax would effect this: income tax - direct tax

How would it effect:

Income tax increases → less disposable income → less incentive to work

Disincentivise to work due to big jumps in tax rates: earning a bit more money → in a new threshold for taxation → charged for higher taxes from income

To improve this:

can have more tax rates / increase tax thresholds to not loose so much each time your income increases

Note: average UK person wage = £30000/year

The economic effects of changes in direct & indirect tax rates on other variables: income distribution

Which tax would effect this: income tax - direct tax

How would it effect:

Progressive income tax helps to redistribute income from high income earners to low → decrease income inequality

To further decrease income inequality, can add another band beyond 45% so can tax more from rich / lower wages which requires to pay 45% so more ppl can pay this tax → more tax revenue

The economic effects of changes in direct & indirect tax rates on other variables: Real output & employment

Which tax would effect this:

income tax - direct tax

corporation tax - direct tax

1) Income tax increases → disposable income decreases → consumption decreases → AD decreases → real output (GDP) decreases → income decreases → production from firms decreases → demand for labour decreases → employment increases

2) corporation tax increases → profits firms decreases → less money spent on capital goods → investment decreases →…(same as above)

The economic effects of changes in direct & indirect tax rates on other variables: The Price Level

Which tax would effect this:

income tax - direct tax

VAT - indirect tax

Increase VAT (now 20%) → tax on g&s on producer increases → cost of production on firms increases → SRAS decreases & profits decreases → in order to preserve their profit levels, firms raise the prices they charge consumers → general increase in price level → increase in rate of inflation → cost-push inflation (same chain of reasoning as cost-push inflation)

Decrease in income tax → disposable income increases → c increases → AD increases → price level increases → demand-pull inflation (same chain of reasoning as demand-pull inflation)

The economic effects of changes in direct & indirect tax rates on other variables: The Trade Balance

Which tax would effect this:

Tariff (ie. US puts tariffs on China)

Imports more expensive → imports decreases → (X-M) increases →AD

increases Imports more expensive → consume goods made locally → consumption increases in US economy → AD in US increases → either

GDP increases for US → production increases → employment increases

Inflation increases → some imports are not avoidable to buy (ie. laptops) → cost of living increases even further

The economic effects of changes in direct & indirect tax rates on other variables: FDI Flows

Which tax would effect this:

Corporation tax

Government cuts corporation tax in our country → firms in our country have more profits → increase FDI flow into our country as our country seems more profitable to invest in → (Ireland has lots of FDI as corporation tax is lowest - 13% compared to 25% in UK) (→ ) more firms choose to base themselves in UK (→) more firms paying UK corporation tax (→) revenue from corporation tax could increase

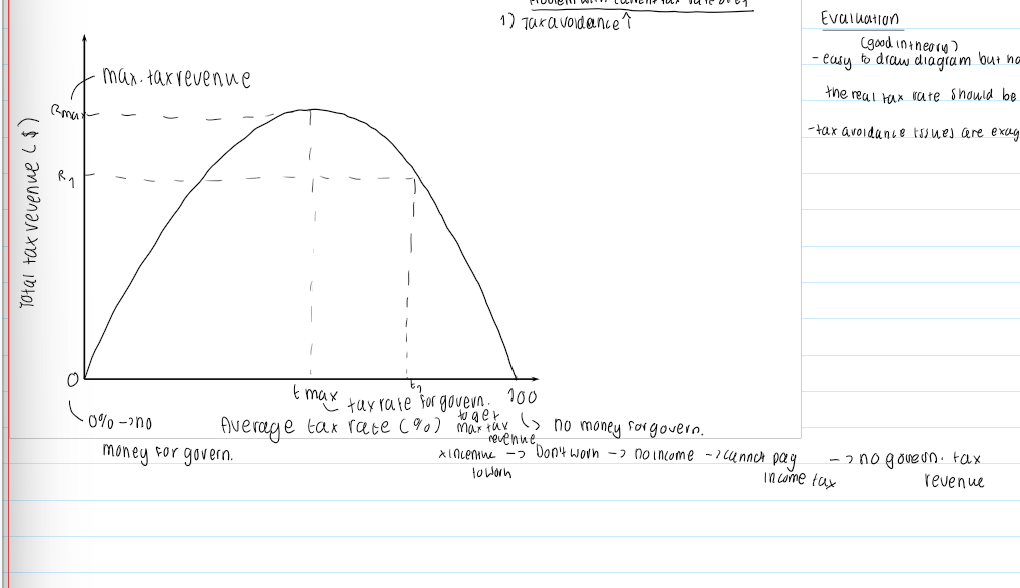

The Laffer Curve (Theory)

Theory argues that: If income tax rates go beyond a certain point → more tax avoidance - ie. avoid extra work, leave country, employing accountants to decrease tax paid → less tax revenue

At 100% rate of income tax:

No incentive to work → doesn’t work → no income → cannot pay income tax → no tax revenue for government at 100% rate of income tax

Evaluation for The Laffer Curve Theory

easy to draw diagram & understand in theory but hard for government to calculate in real-life on what the real tax rate should be to maximise tax revenue

tax avoidance issues are exaggerated

harder to employ accountant than you think → need to pay them → tax avoidance might not be a problem after all

Additional notes

Fiscal drag = in recent years income tax allowances are no longer put up by inflation - raise around £40-£60 more for UK government = stealth tax

people discouraged from working hard if their income is on boundary

UK & most countries: income tax is a progressive tax but some countries it’s proportional tax (flat rate)

VAT is a regressive tax

VAT = tax on consumer spending

Lower income spend a higher proportional of their income on consumption & have less to save

Therefore VAT takes up a bigger percentage of their income