AP Macroeconomics Exam Review

1/222

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

223 Terms

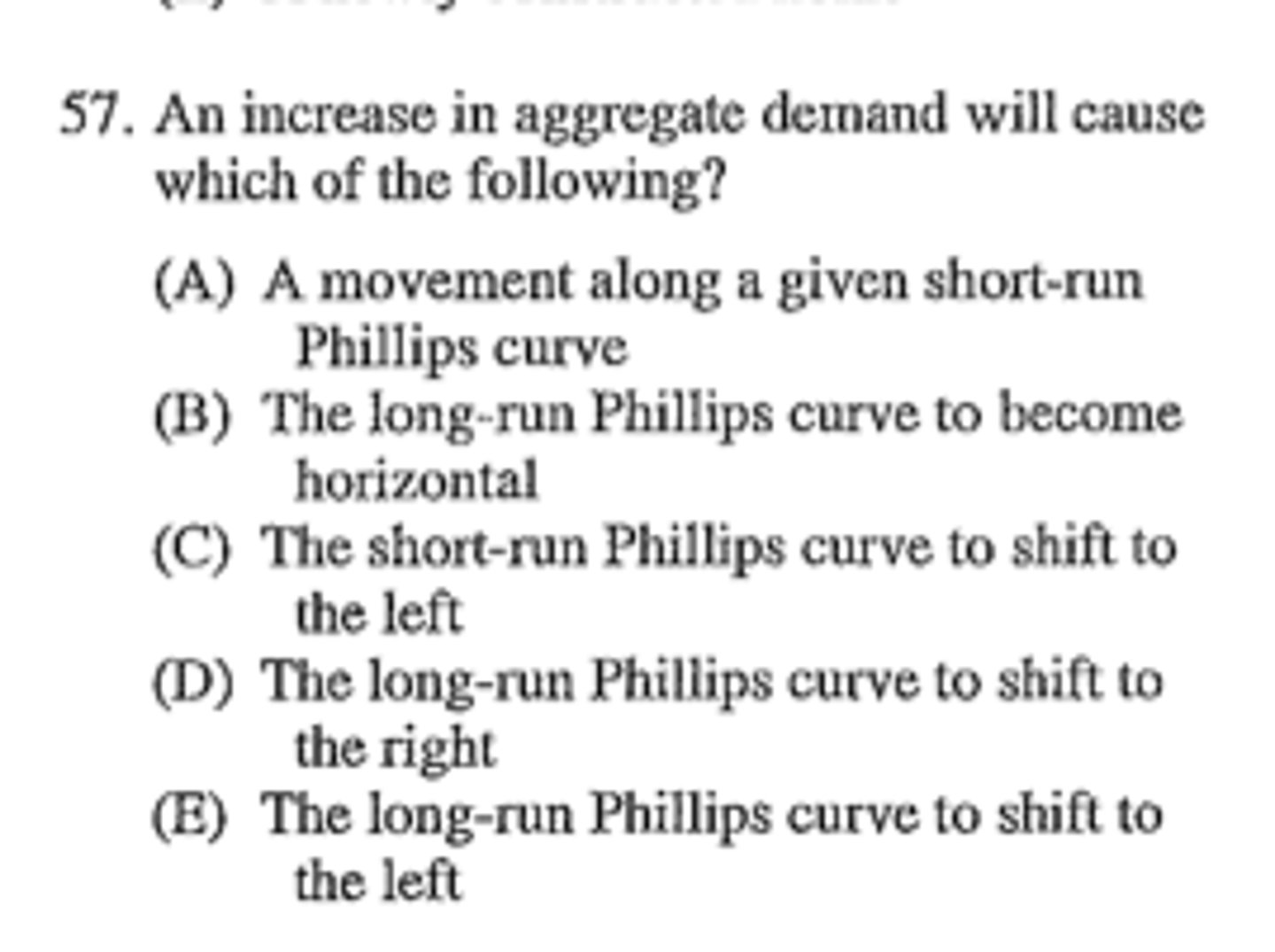

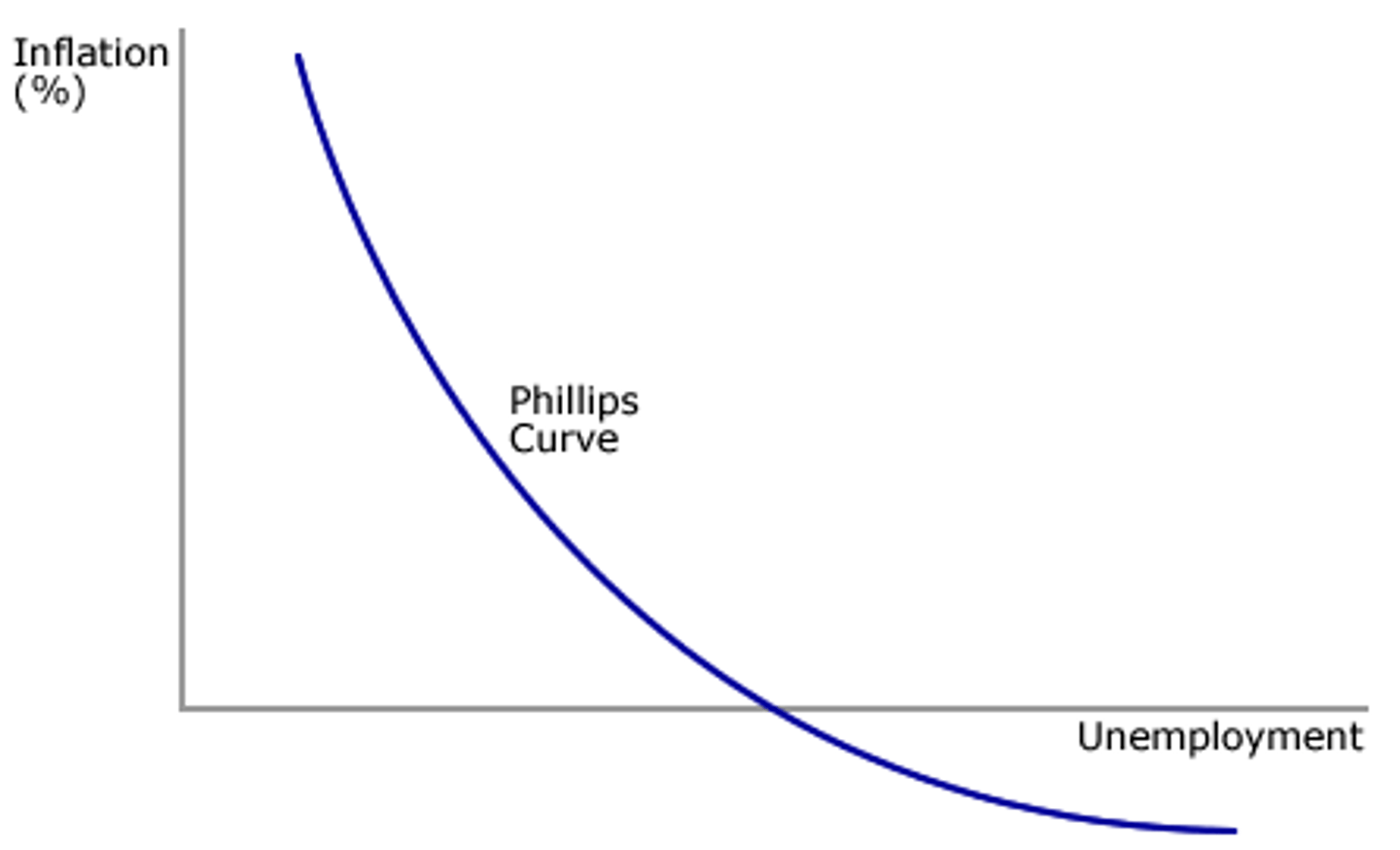

Movement on Short-Run Phillips Curve

Shift in AD (graph movement is in opposite direction)

Shift of Short-Run Phillips Curve

Shift in SRAS (shift is in opposite direction)

Factors of Production

1. Land

2. Labor

3. Capital

4. Technology

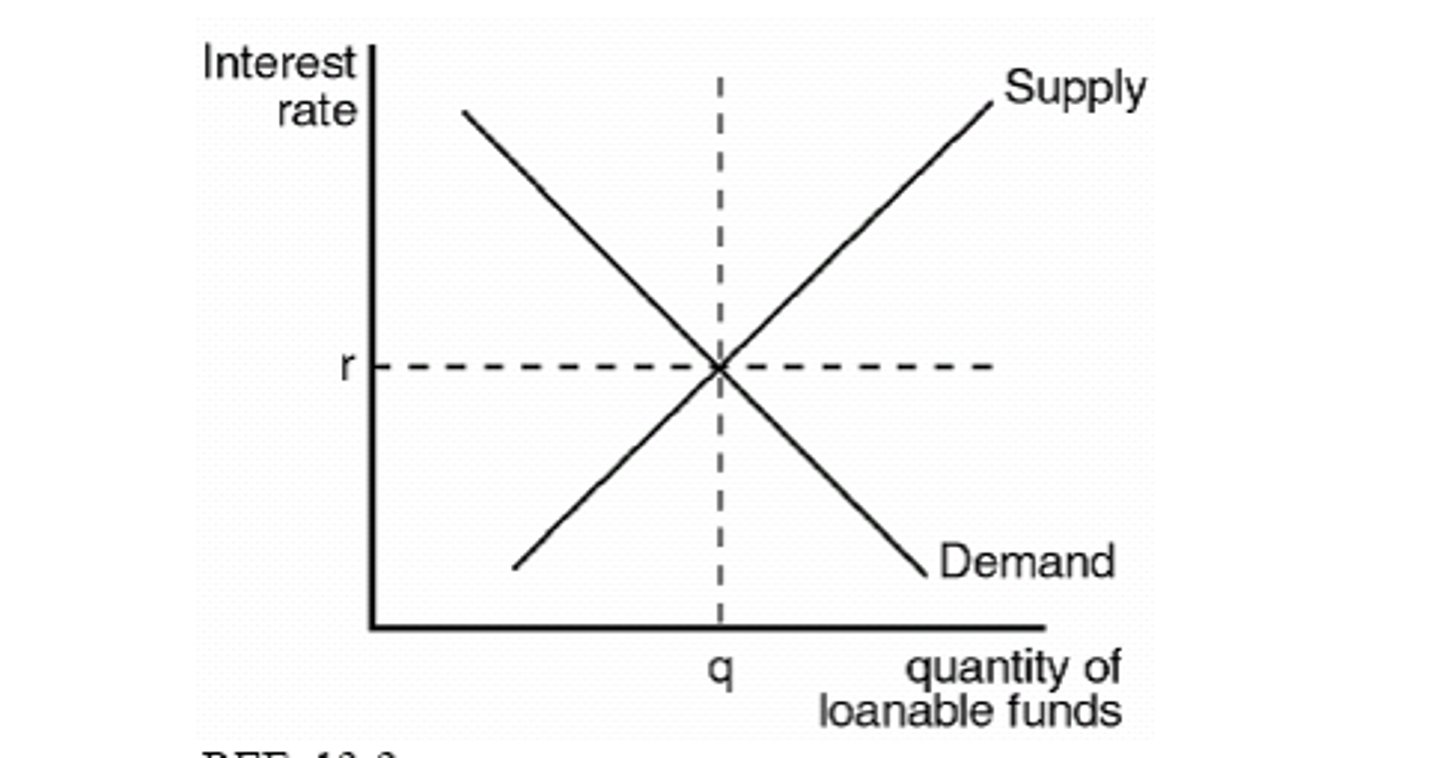

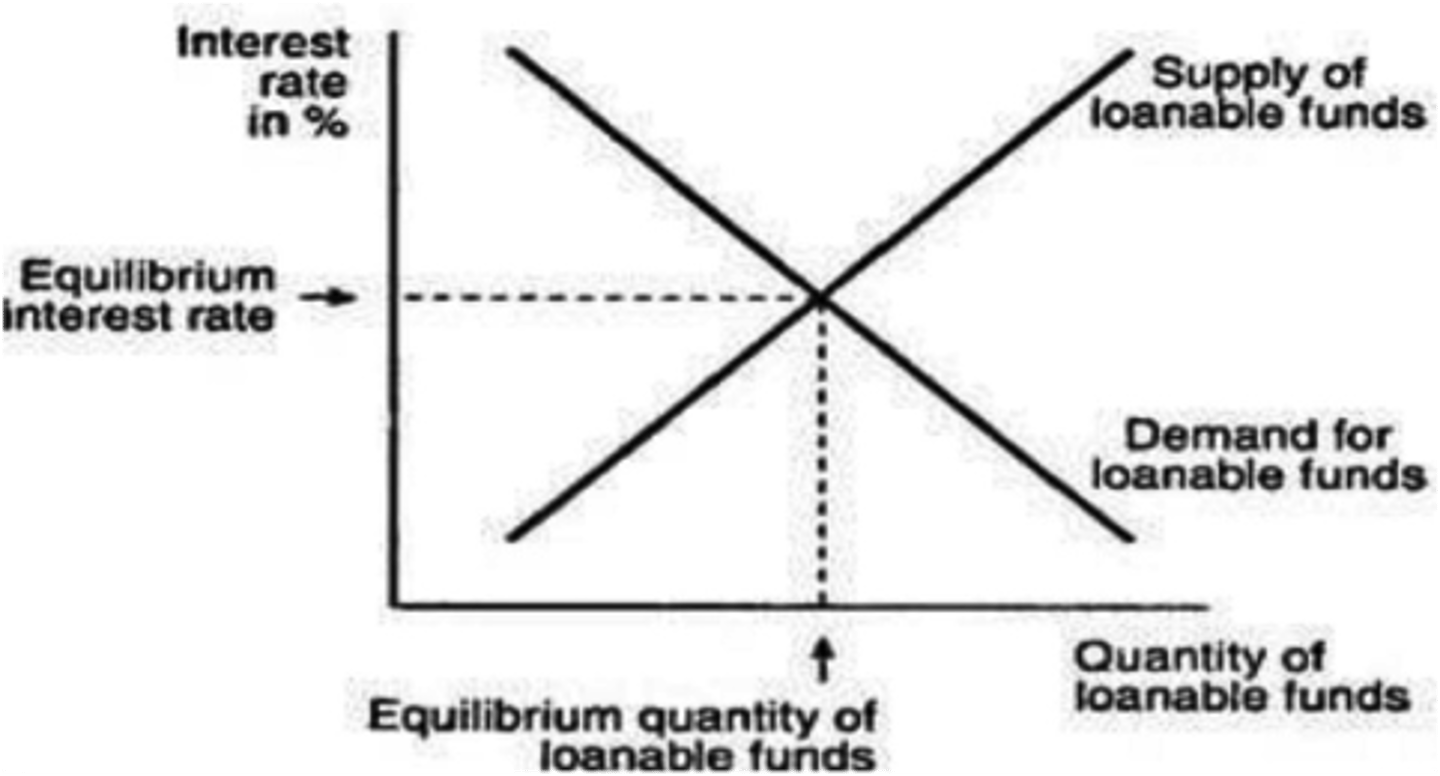

Shifters of Demand for Loanable Funds

1. Incentive to Invest

2. Contractionary Fiscal Policy (to the right)

Shifters of Supply of Loanable Funds

1. Incentive to Save

2. Monetary Policy

3. Expansionary Fiscal Policy (to the left)

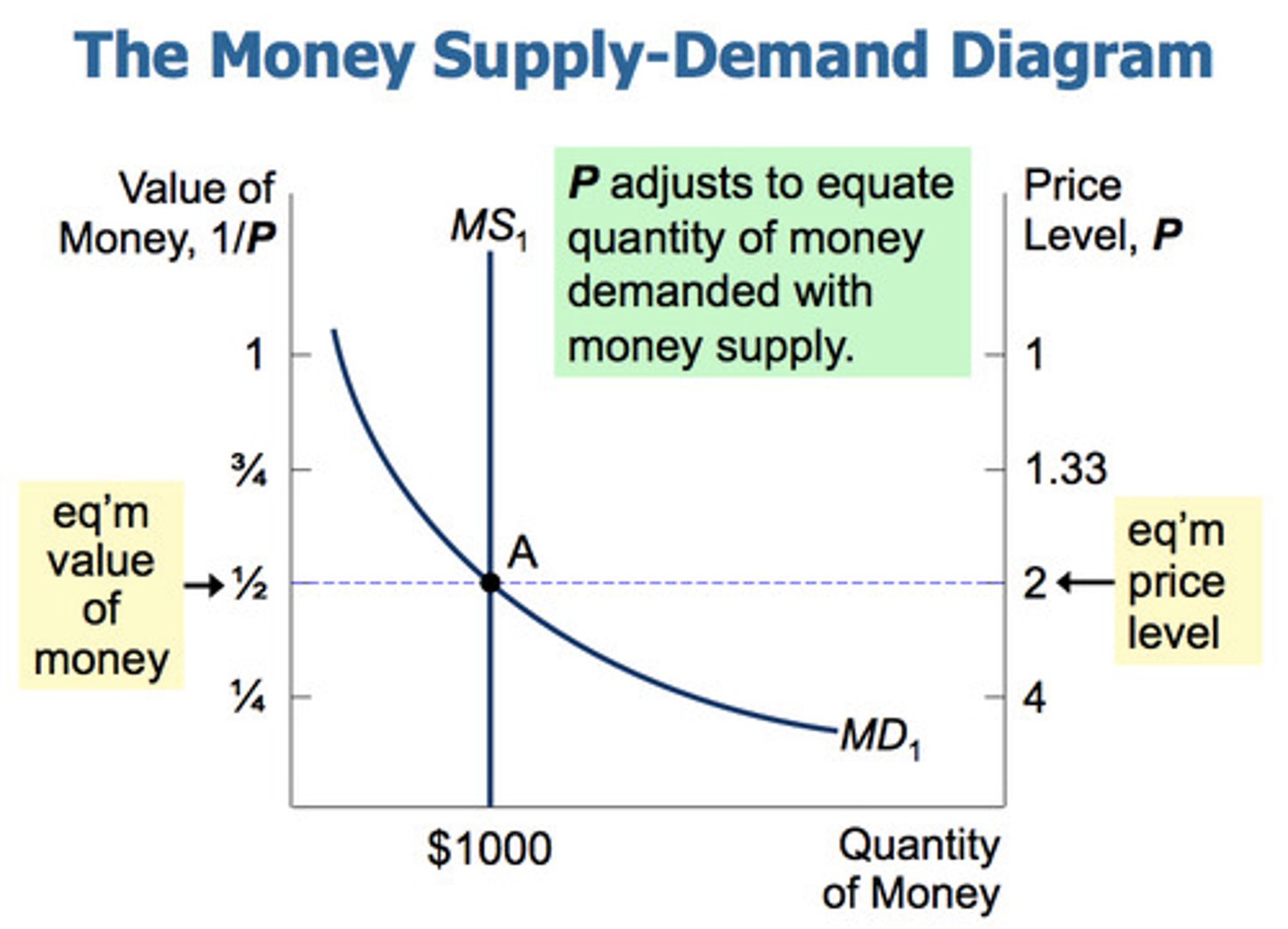

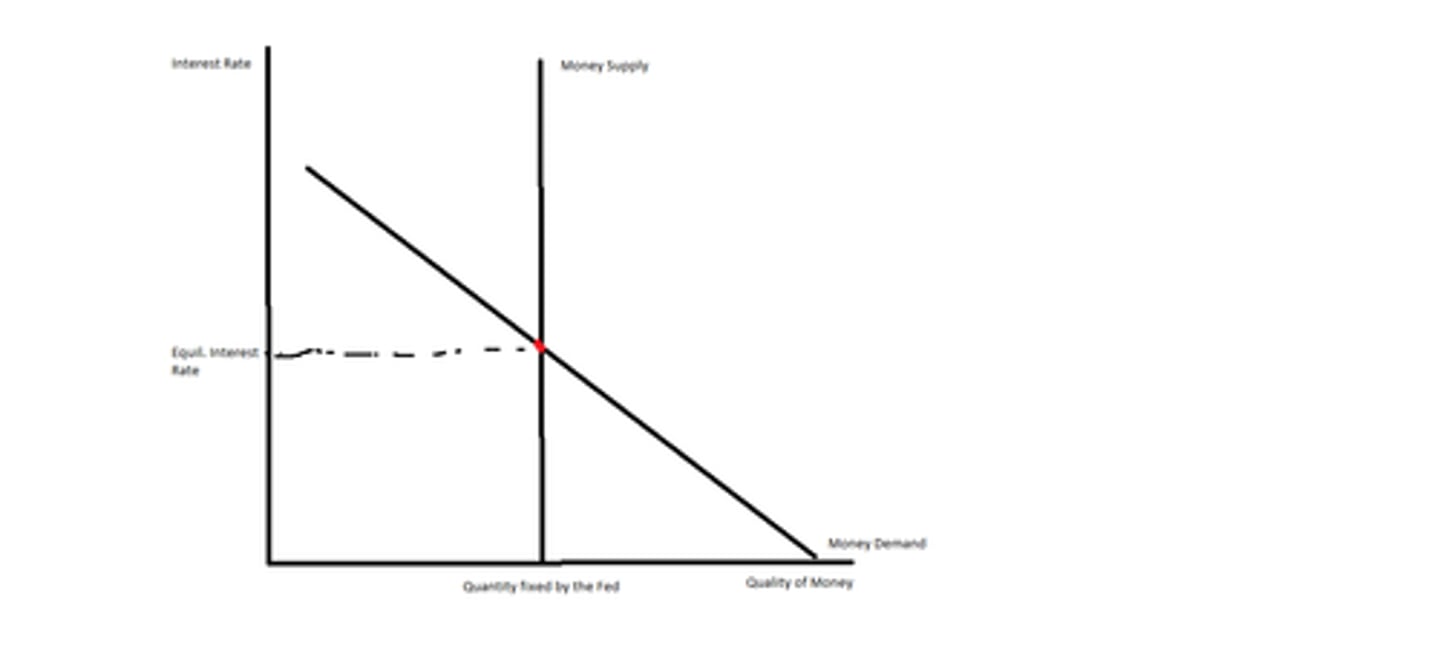

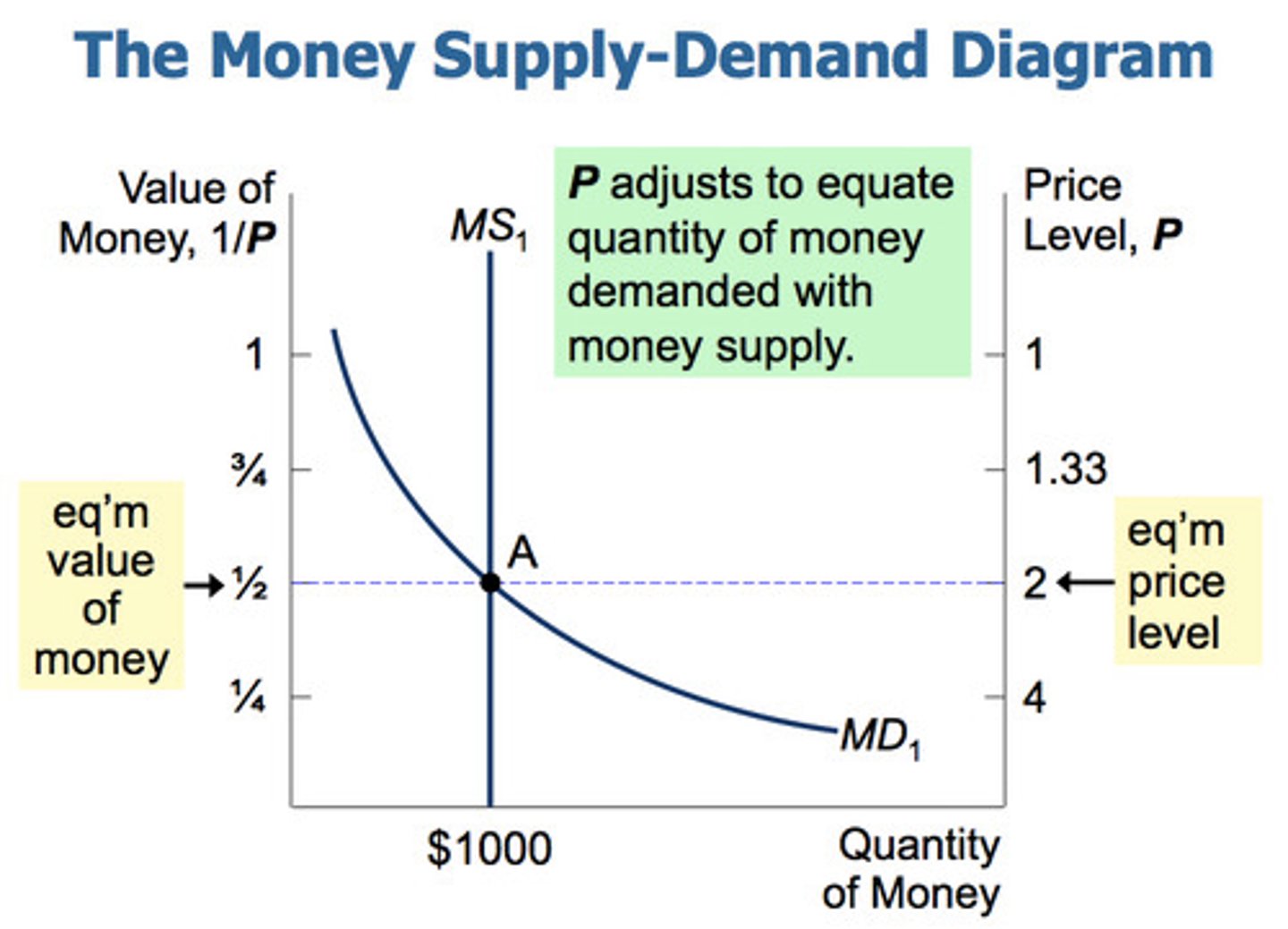

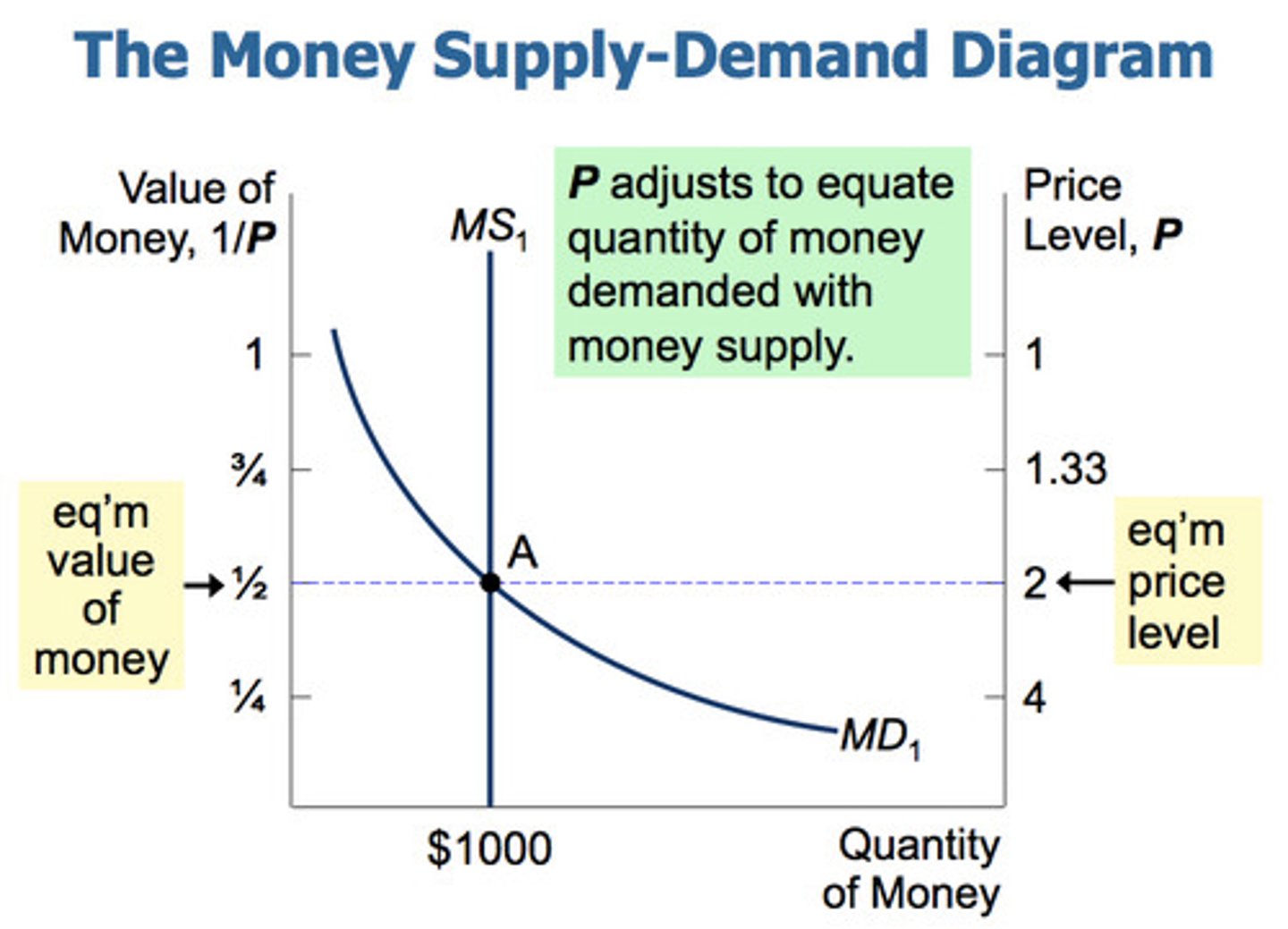

Shifters of Money Supply

Monetary Policy

Federal Reserve Bank

Shifters of Money Demand

1. Price Level

2. Income

3. Fiscal Policy

Shifters of Long-Run Aggregate Supply

Factors of Production

Shifters of Short-Run Aggregate Supply

1. Factors of Production (LRAS)

2. Input Costs

3. Supply Shock

Shifters of Aggregate Demand

1. GDP (or its components)

2. Monetary Policy

3. Fiscal Policy

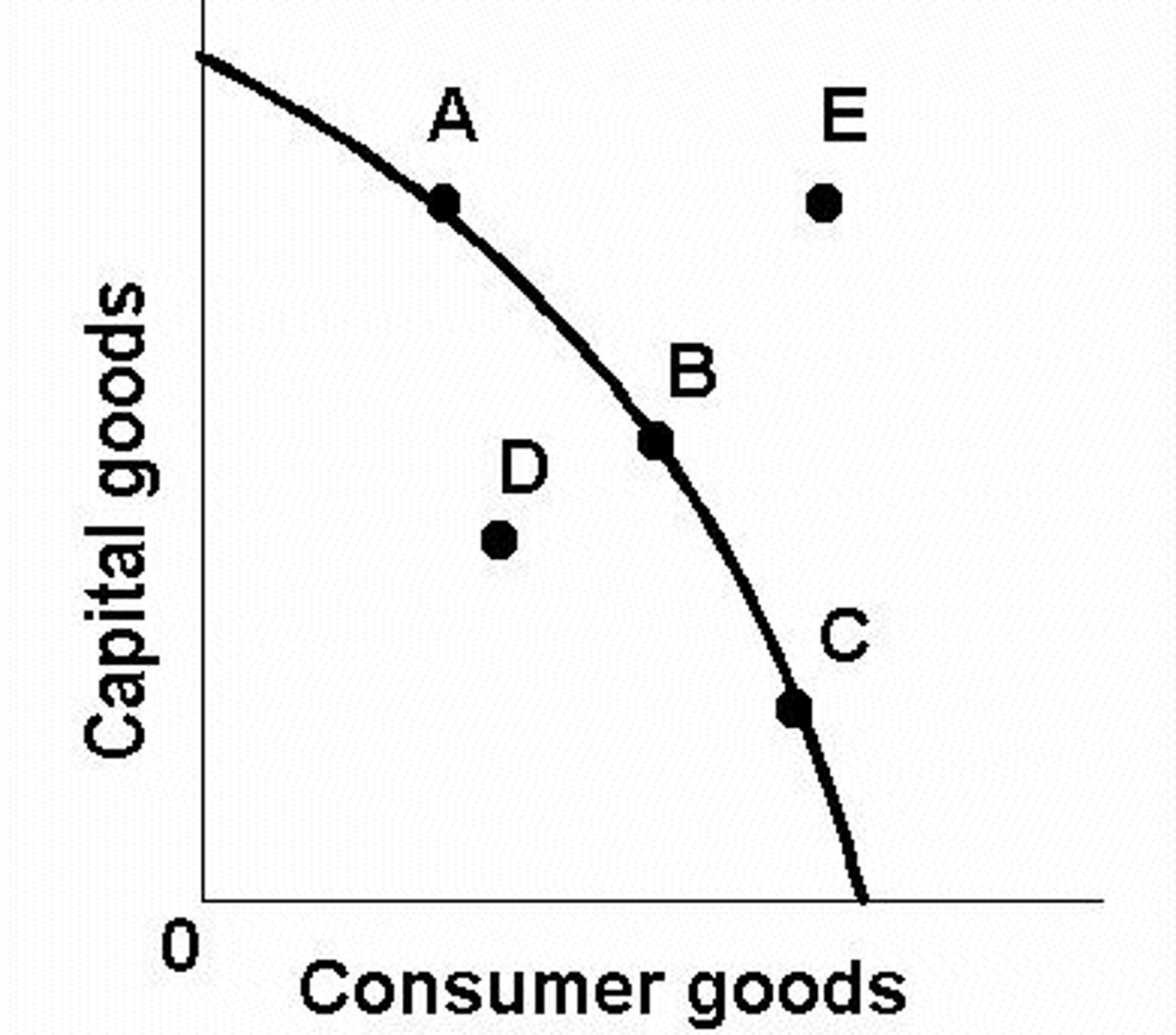

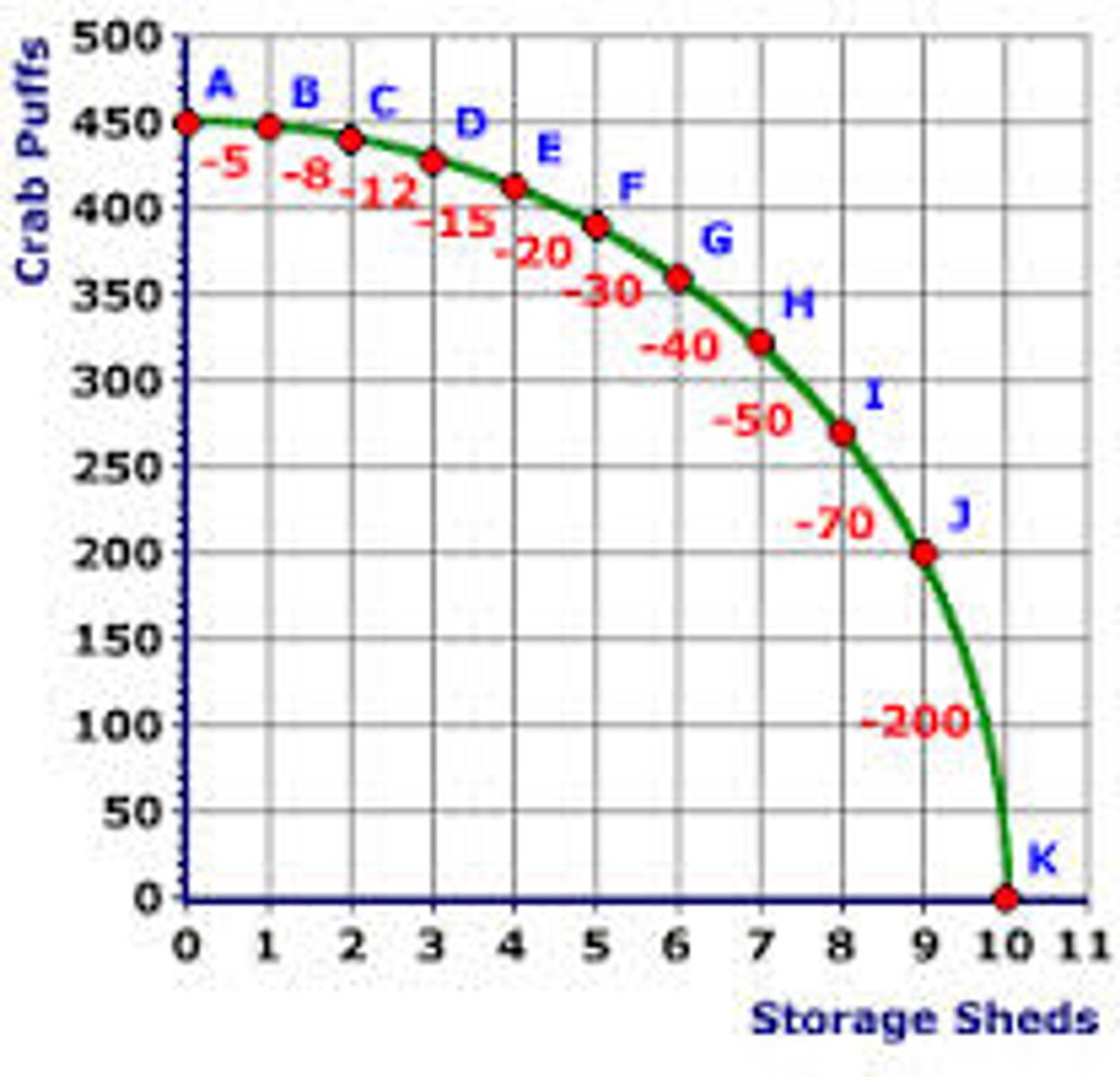

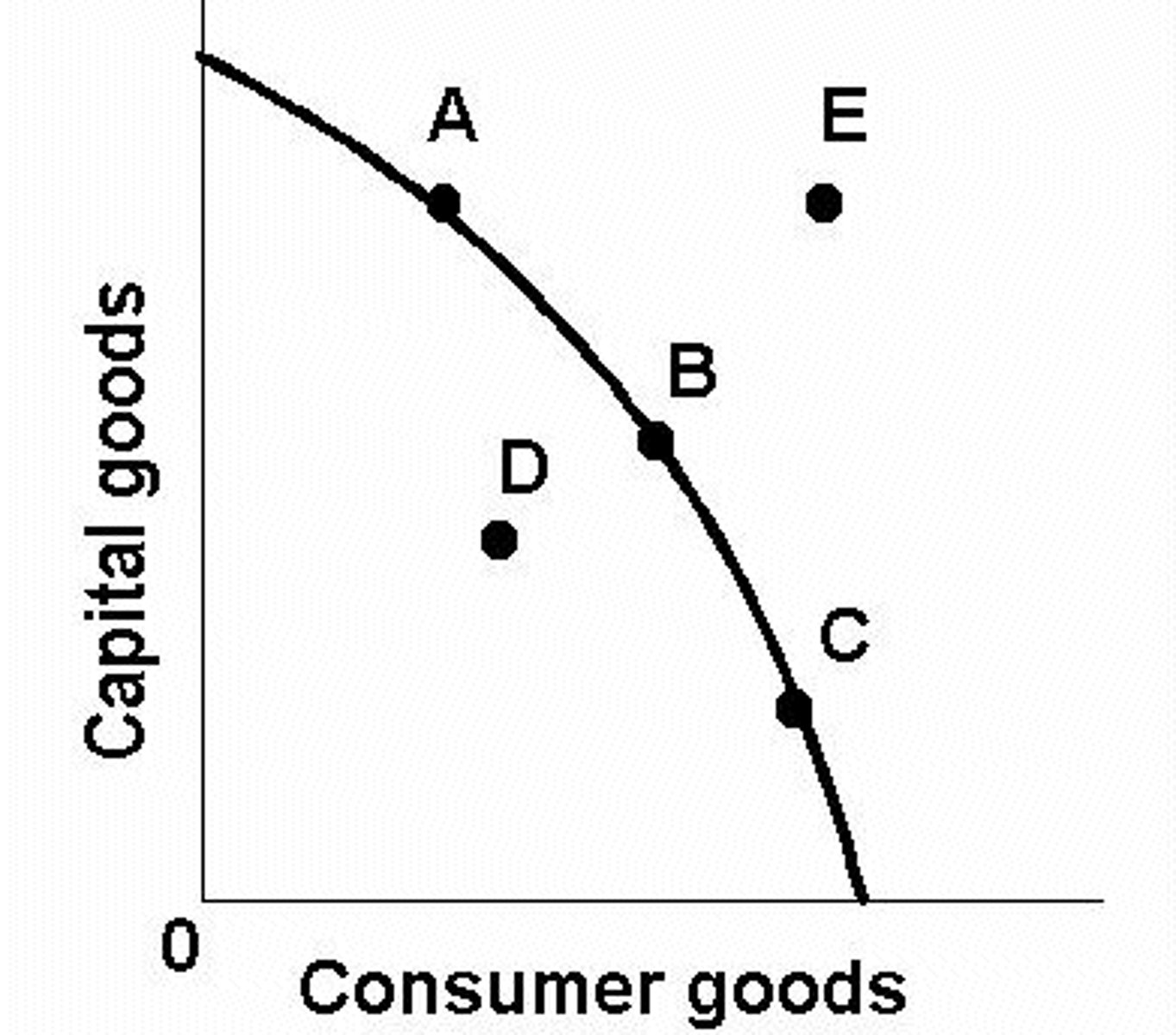

PPC Graph

Illustrates the production possibilities of 2 products based on amount of resources available

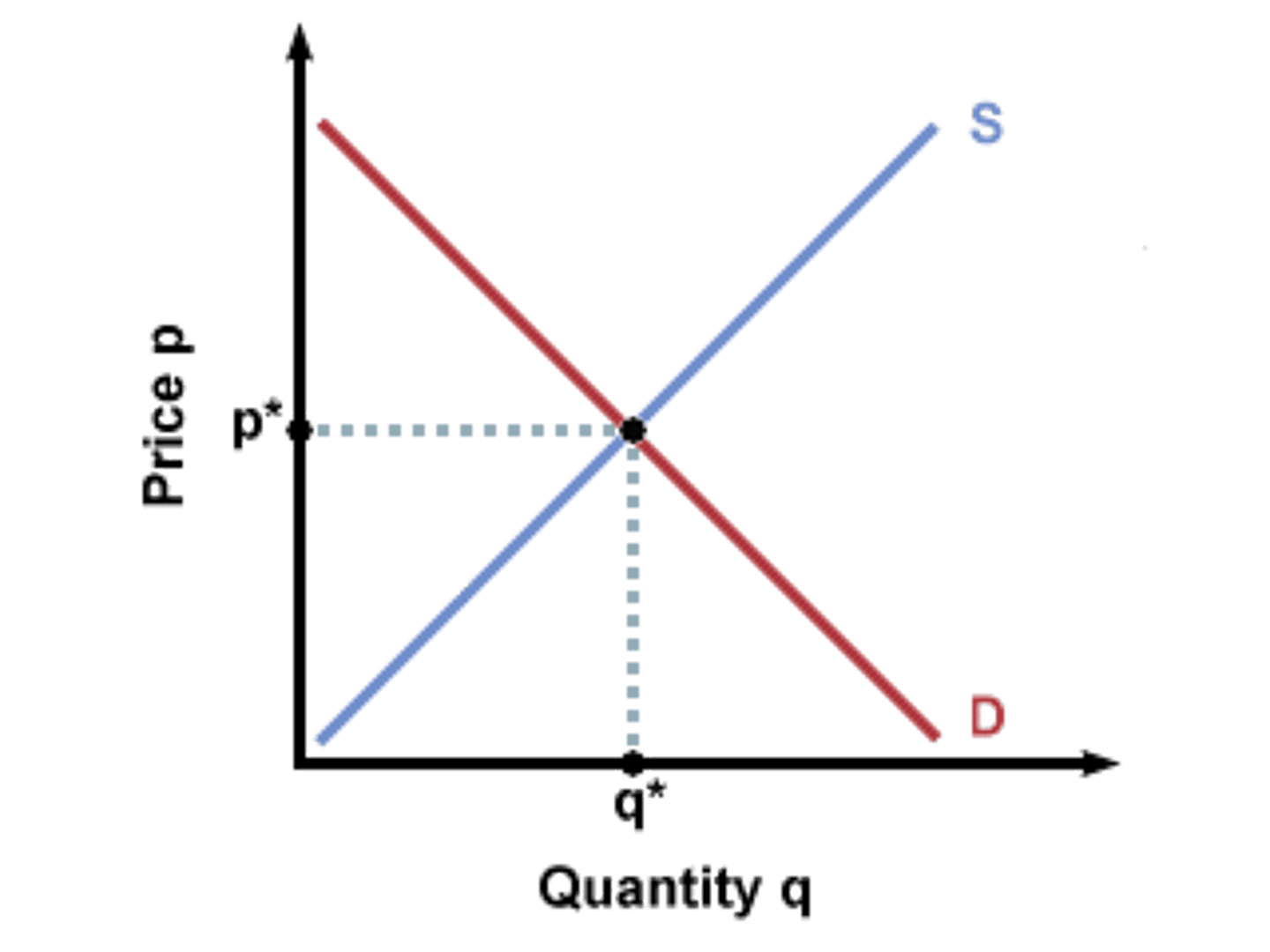

Demand and Supply Graph

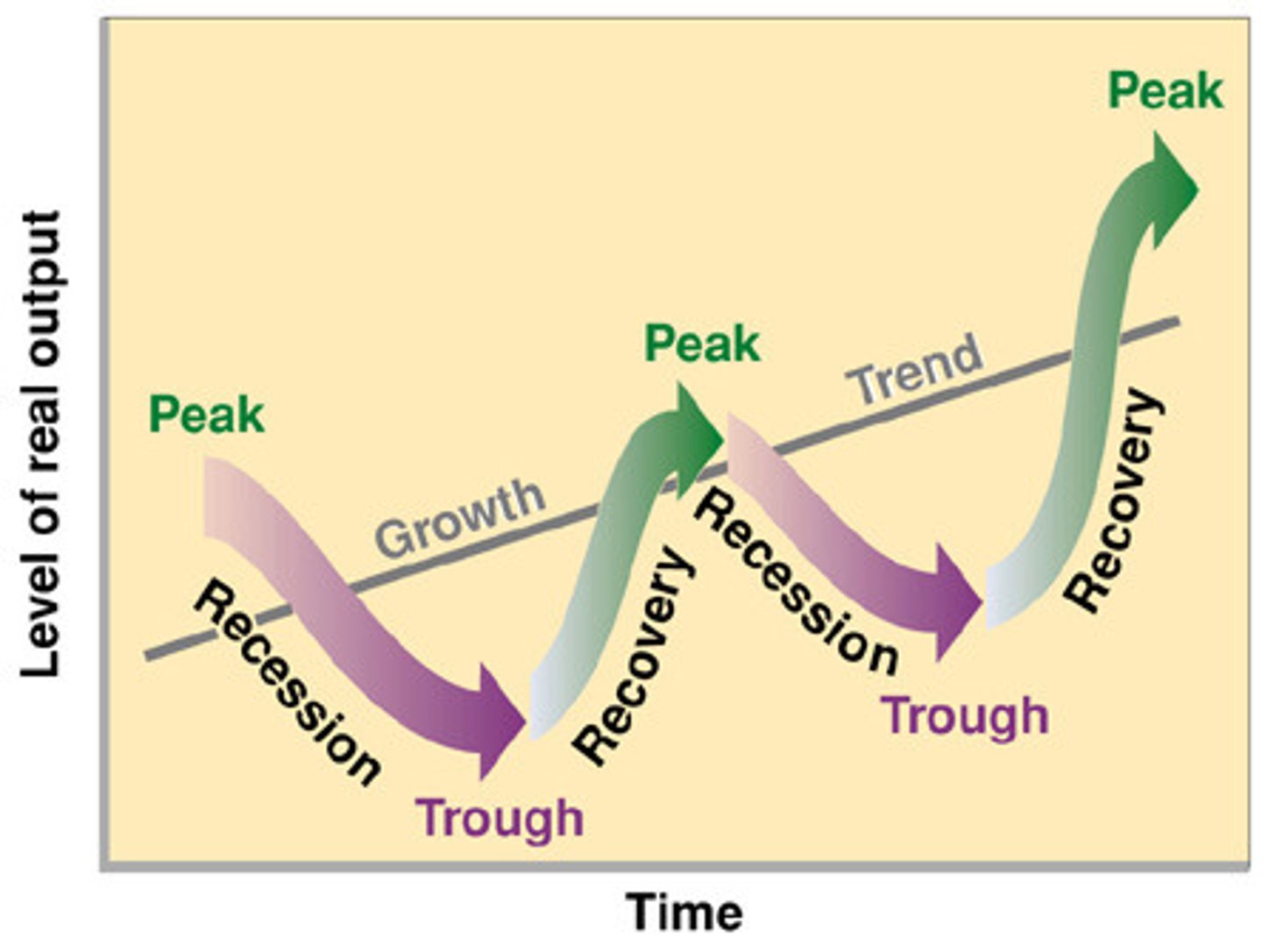

Business Cycle

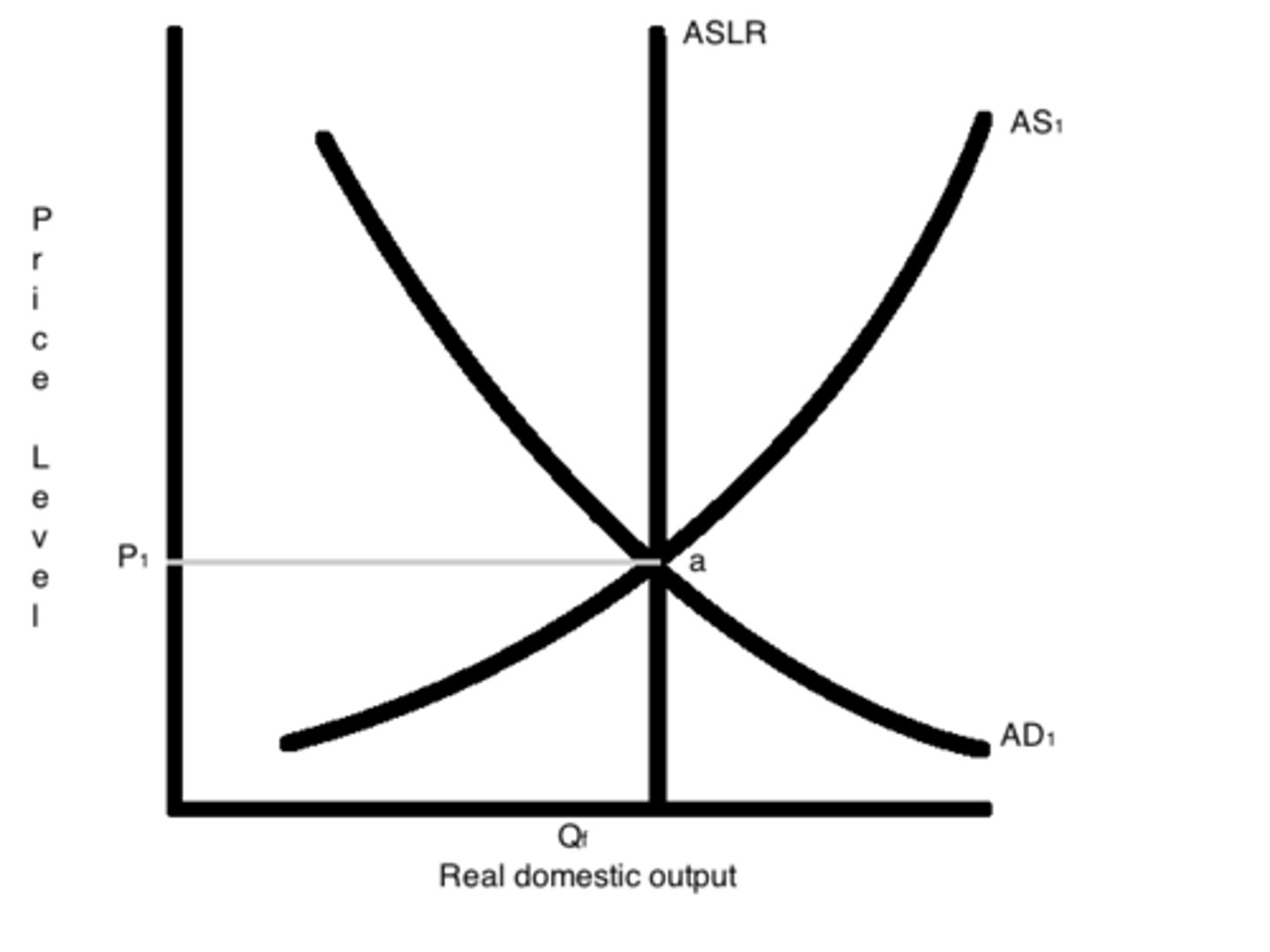

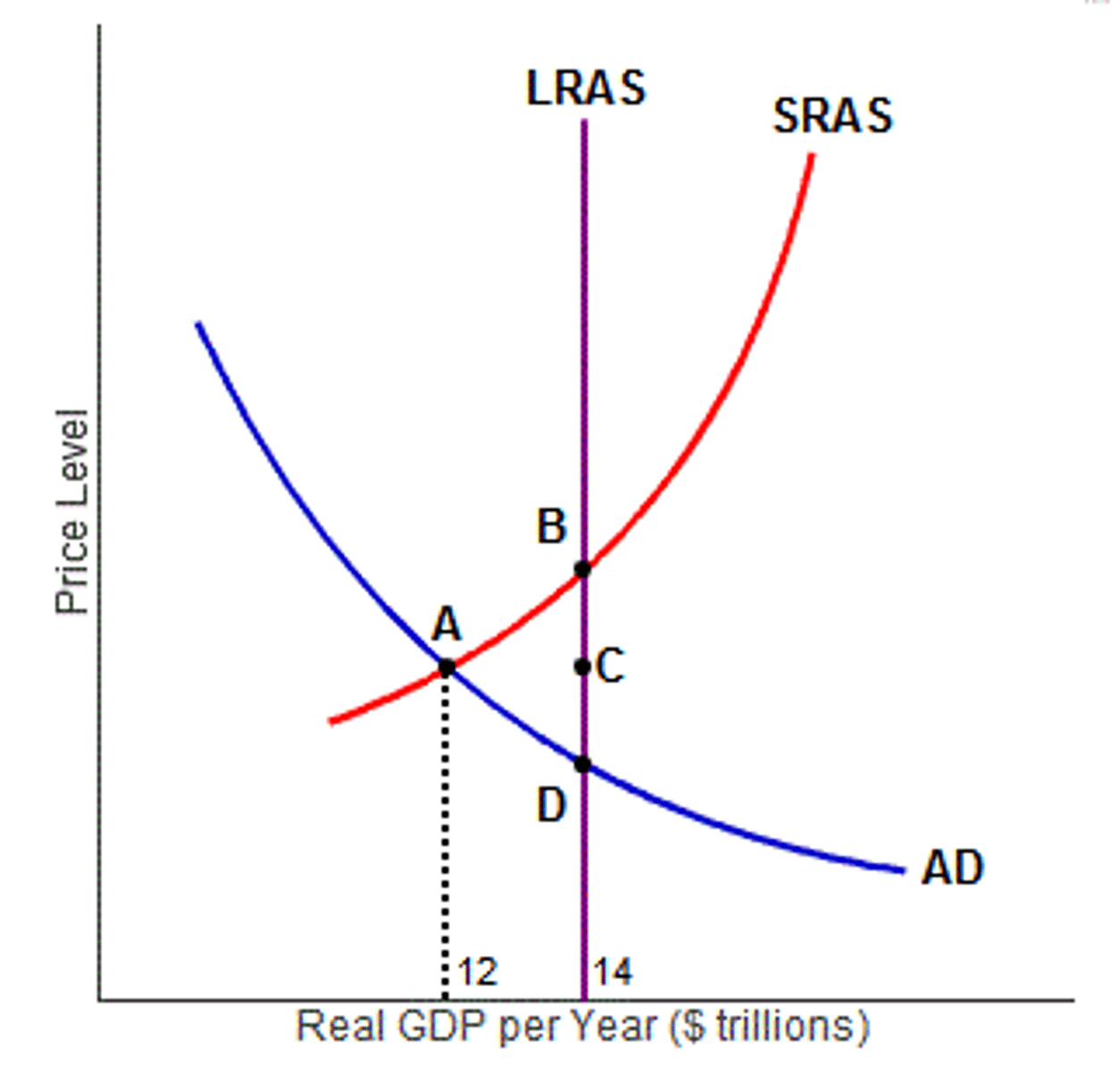

AD/AS Graph

Money Market Graph

Loanable Funds Graph

GDP = C + I + G + Xn

The expenditure approach to measuring GDP correlates well with aggregate demand (AD)

GDP = W + I + R + P

The income approach to measuring GDP correlates well with aggregate supply

Calculating Nominal GDP

The quantity of various goods produced in a nation times their current prices, added together.

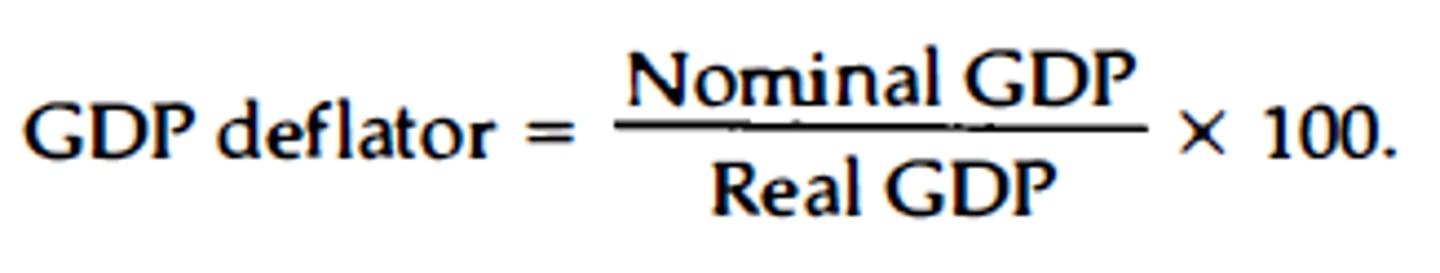

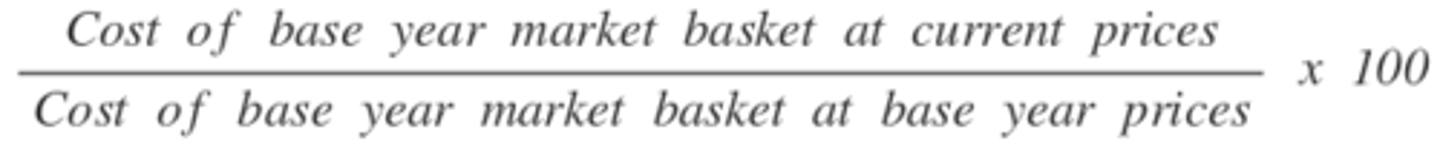

GDP Deflator

Price index used to measure inflation

Inflation Rate via the CPI

(This year's CPI - Last year's CPI)/(Last year's CPI) x 100.

The inflation rate is the percentage change in the CPI from one period to the next.

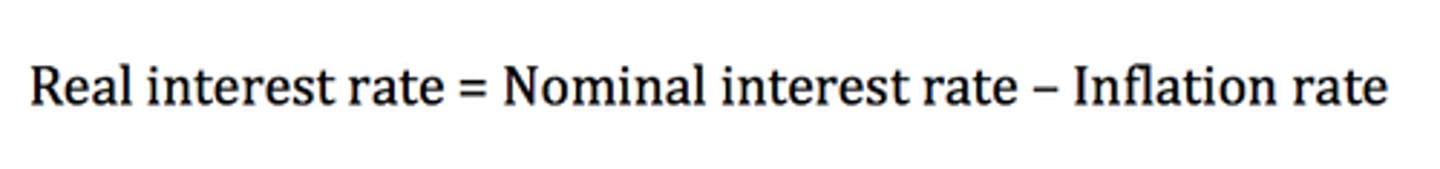

Real Interest Rate

the interest rate corrected for the effects of inflation;

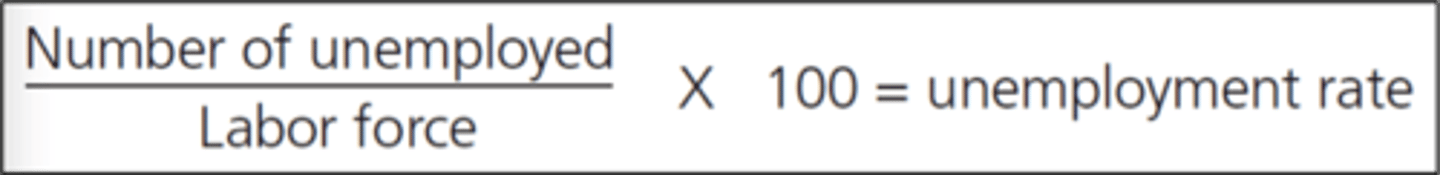

Unemployment Rate

16 or older, actively seeking employment.

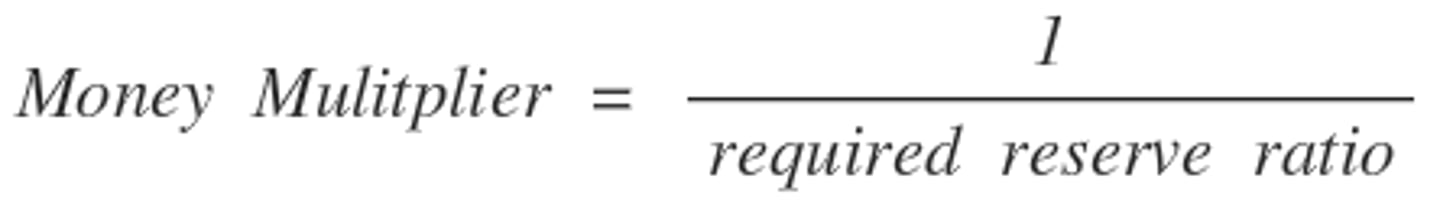

Money Multiplier

1/RR where RR equals the required reserve ratio. Application: an initial injection of $1,000 of new money into a banking system with a reserve ratio of 0.1 will generate up to $1,000 x (10) = $10,000 in total money.

Quantity Theory Of Money

MV = PQ = Y. A monetarist's view that explains how changes in the money supply (M) will affect the price level (P) and/or real output assuming the velocity of money (V) is fixed in the short run.

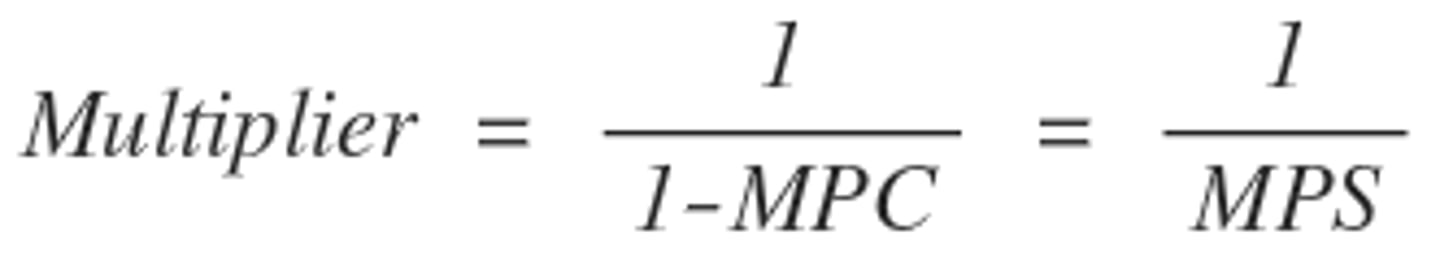

MPC + MPS = 1

The fraction of an increase in disposable income that is spent (MPC) plus the fraction that is saved (MPS) must equal 1.

Spending Multiplier

= 1/(1-MPC) or 1/MPS. This tells you how much total spending an initial interjection of spending in the economy will generate. For example, if the MPC = .8 and the government spends $100 million, then the total increase in spending in the economy = $100 x 5 = $500 million.

Tax Multiplier = MPC/MPS X Tax decrease

This tells you how much total spending will result from an initial change in the level of taxation. It is negative because when taxes decrease, spending increases, and vice versa. The tax multiplier will always be smaller than the spending multiplier.

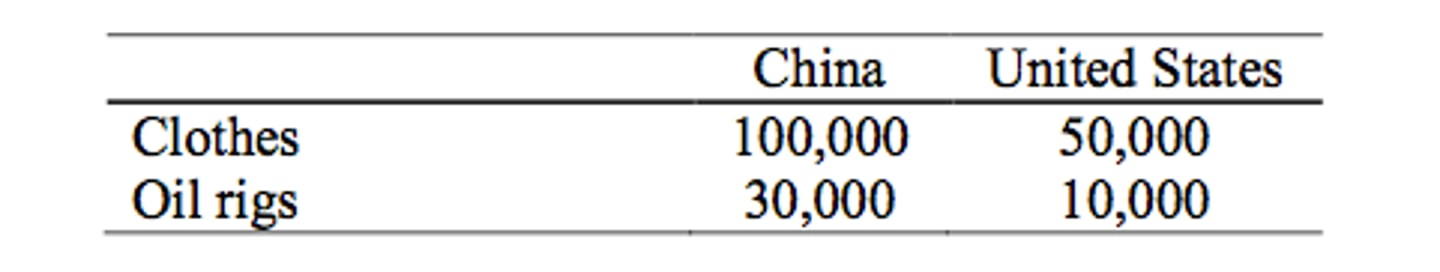

Absolute Advantage

Produces more than the other guy or when the country/individual can produce the good using fewer resources (inputs) than another country/individual.

Appreciation

An increase in the value of one currency relative to another, resulting from an increase in demand for or a decrease in supply of the currency on the foreign exchange market.

Balance Of Payments

Measures all the monetary exchanges between one nation and all other nations. Includes the current account and the capital account.

Bonds

A certificate of debt issued by a company or government to an investor.

Budget Deficit

When a government spends more than it collects in tax revenues in a given year.

Physical Capital

Human-made resources (machinery and equipment) used to produce goods and services;

Capital Account (AKA Financial Account)

Measures the flow of funds for investment in real assets (such as factories or office buildings) or financial assets (such as stocks and bonds) between a nation and the rest of the world.

Ceteris Paribus

"Other things being equal"; used as a reminder that all variables other than the ones being studied are assumed to be constant.

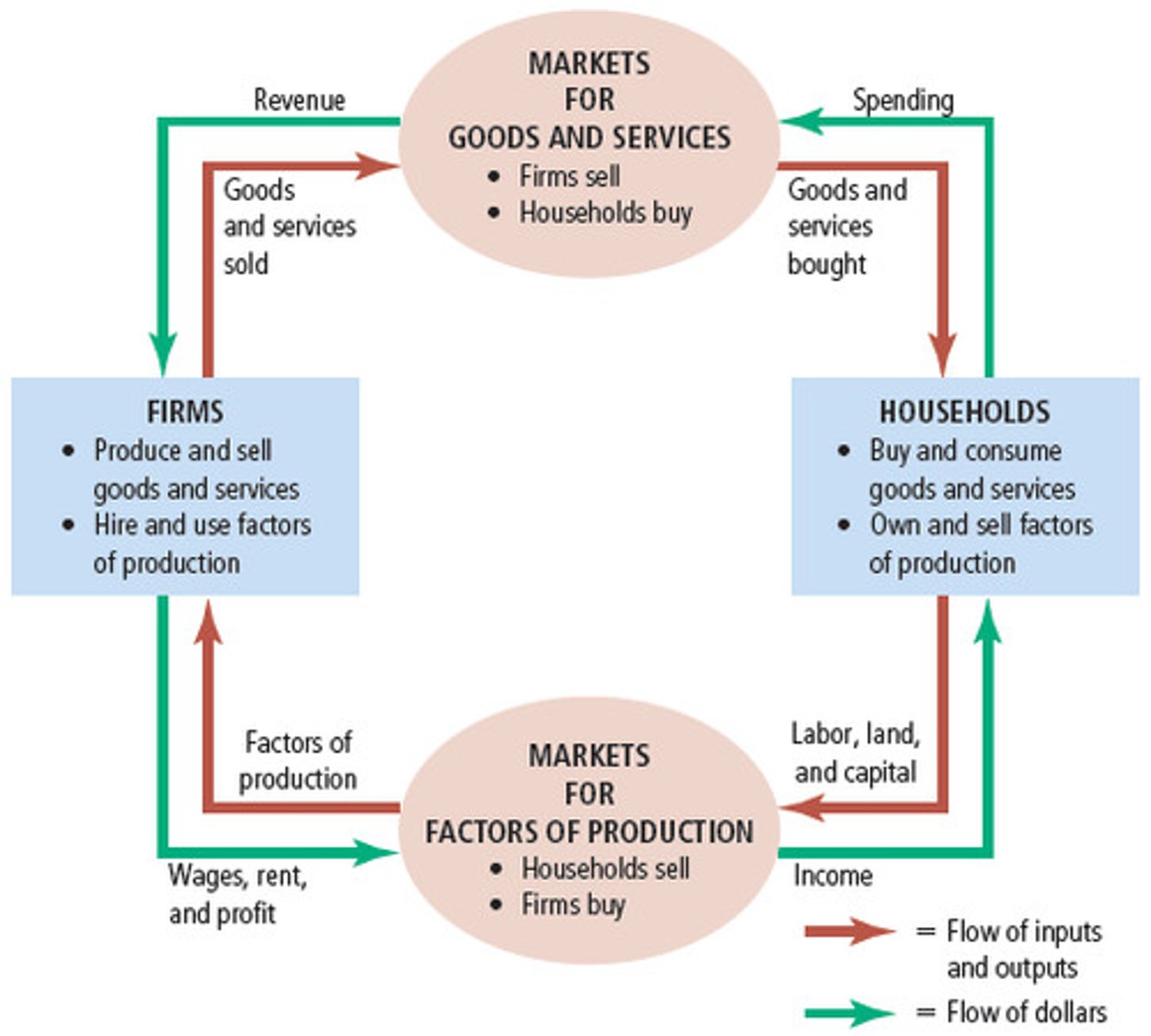

Circular Flow Diagram

A model of the macroeconomy that shows the interconnectedness of businesses, households, government, banks, and the foreign sectors. Money flows in a circular direction, and goods, services, and resources flow in the opposite circular direction.

Classical Economic Theory

The view that an economy will self-correct from periods of economic shock if left alone. AKA "laissez-faire"

Comparative Advantage

When an individual, a firm, or a nation is able to produce a particular product at a lower opportunity cost than another individual, firm, or nation. Comparative advantage is the basis on which nations trade with one another.

Consumer Price Index (CPI)

An index that measures the price of a fixed market basket of consumer goods bought by a typical consumer. The CPI is used to calculate the inflation rate in a nation.

Consumption.

A component of a nation's aggregate demand; measures the total spending by domestic households of goods and services.

Contractionary Fiscal Policy

A policy whereby government increases taxes or decreases its spending in order to reduce aggregate demand.

Could be used in a period of high inflation to bring down the inflation rate.

Contractionary Monetary Policy

A demand-side policy whereby the central bank

1. Increase Reserve Requirements

2. Decrease Discount Rates

3. Sell Open-Market Operations (Government Bonds/Securities)reduces the supply of money, increase interest rates and reducing aggregate demand. Could be used to bring down high inflation rates.

Cost-Push Inflation

Inflation resulting from a decrease in AS (from higher wage rates and raw material prices, such as the price of oil) and accompanied by a decrease in real output and employment. Also reffered to as "stagflation" or "adverse aggregate supply shock".

Crowding-Out Effect

The rise in interest rates and the resulting decrease in investment spending in the economy caused by increased government borrowing in the loanable funds market. Seen as a disadvantageous side effect of expansionary fiscal policy.

Current Account

Measures the balance of trade in goods and services and the flow on income between one nation and all other nations.

Equal to a country's net exports (its exports minus its imports).

Cyclical Unemployment

Unemployment caused by a fall in aggregate demand in a nation. Not included in the natural rate of unemployment. When a nation is in a recession, there will be cyclical unemployment.

Demand Deposit

A deposit in a commercial bank against which checks may be written. Also known as a "checkable deposit".

Depreciation

A decrease in the value of one currency relative to another, resulting from a decrase in demand for or an increase in the supply of the currency on the foreign exchange market.

Devaluation

When a government intervenes in the market for its own currency to weaken it relative to another currency.

Discount Rate

One of the three tools of monetary policy, it is the interest rate that the federal government charges on the loans it makes to commercial banks.

Economic Growth

An increase in the potential output of goods and services in a nation over time.

Economic Resources

Land, labor, capital, and entrepreneurial ability that are used in the production of goods and services. They are "economic" resources because they are scarce (limited in supply and desired). Also known as "factors of production".

Excess Reserves

The amount by which a bank's actual reserves exceed its required reserves. Banks can lend excess reserves; when they do, they expand the money supply. The amount of excess reserves in the banking system determines equilibrium interest rate.

Exchange Rate:

The price of one currency in terms of another currency, determined in the forex market.

Exports

The spending by foreigners on domestically produced goods and services. Counts as an injection into a nation's circular flow of income.

Federal Funds Rate

The interest rate banks charge one another on overnight loans made out of their excess reserves. The FFR is the interest rate targeted by the Fed Res Bank through it's open market operations.

Fiscal Policy

Changes in government spending and tax collections implemented by government with the aim of either increasing or decreasing aggregate demand to achieve the macroeconomic objectives of full employment and price-level stability.

Floating Exchange Rate System:

When a currency's exchange rate is determined by the free interaction of supply and demand in international forex markets.

Forex Markets (Foreign Exchange Market)

The market in which international buyers and sellers exchange foreign currencies for one another to buy and sell goods, services, and assets from various countries. It is where a currency's exchange rate relative to other currencies is determined.

Fractional Reserve Banking

A banking system in which banks hold only a fraction of deposits as required reserves and can lend some of the money deposited by their customers to other borrowers

Full Employment

When an economy is producing at a level of output at which almost all the nation's resources are employed. The unemployment rate when an economy is at full employment equals the natural rate, and includes only frictional and structural unemployment. Full-employment output is also referred to as "potential output".

GDP (Gross Domestic Product)

The total market value of all final goods and services produced during a given time period within a country's borders.

Human Capital

The value skills integrated into labor through education, training, knowledge, and health. An important determinant of aggregate supply and the level of economic growth in a nation.

Imports

Spending on goods and services produced in foreign nations. Counts as a leakage from a nation's circular flow of income.

Inflation

A rise in the average level of prices in the economy over time (percentage change in the CPI)

Interest Rate

The opportunity cost of money. Either the cost of borrowing money or the cost of spending money (e.g., the interest rate is what would be given up by not saving money). Conversely, this is the price a lender is paid for allowing someone else to use money for time.

Investment

A component of aggregate demand, it includes all spending on capital equipment, inventories, and technology by firms. Also includes household purchasing of newly constructed residences.

Law of Increased Opportunity Cost

As more of particular product is produced, the opportunity cost, in terms of what must be given up of other goods to produce each unit of the product, increases. Explains the convex shape of a nation's production possibilities curve.

Loanable Funds Market

The market in which the demand for private investment and the supply of household savings intersect to determine the equilibrium real interest rate.

Long Run

The period of time over which the wage rate and price level of inputs in a nation are flexible. In the long run, any changes in AD are cancelled out due to flexibility of wages and prices and an economy will return to its full employment level of output. Sometimes referred to as the "flexible wage period".

Long Run Aggregate Supply (LRAS)

The level of output to which an economy will always return in the long run. The LRAS curve intersects the horizontal axis at the full employment or potential level of output.

M1

A component of money supply including currency and checkable deposits

M2

A more broadly defined component of money supply, equal to M1 plus savings deposits, money-market deposits, mutual funds, and small-time deposits.

Macroeconomics

The study of entire nations economies and the interactions between households, firms, government, and the foreigners

Macroeconomics Equilibrium

The level of output at which a nation is producing at any particular period of time. May be below its full employment level (if the economy is in a recession) or beyond its full employment level (if economy is overheating).

Managed or Fixed Exchange Rate System

When a government or central bank takes action to manage or fix the value of its currency relative to another currency on the forex market

Marginal Propensity To Consume (MPC)

The fraction (percentage) of any change in income spent on domestically produced goods and services; equal to the change in consumption divided by the change in disposable income.

Marginal Propensity To Save (MPS)

The fraction of any change in income that is saved, equal to the change in savings divided by the change in disposable income.

Monetary Policy

The central bank's manipulation of the supply of money aimed at raising or lowering interest rates to stimulate or contract the level of aggregate demand to promote the macroeconomic objectives of price-level stability and full employment

Money

Any object that can be used to facilitate the exchange of goods and services in a market.

Money Demand

The sum of the transaction demand and the asset demand for money. Inversely related to the nominal interest rate.

Money Market

The market where the supply of money is set by the central bank; includes the downward sloping money-demand curve and a vertical money-supply curve. The "price" of money is the nominal interest rate.

Money Supply

The vertical curve representing the total supply of excess reserves in a nation's banking system. Determined by the monetary policy actions of the central bank.

Multiplier Effect

The increase in total spending in an economy resulting from an initial interjection of new spending. The size of the multiplier effect depends upon the spending multiplier.

Natural Rate of Unemployment (NRU)

The level of unemployment that prevails in an economy that is producing at a full employment level of output. Includes structural and frictional unemployment. While countries NRUs can vary, the NRUs in the US tend to be close to 5 percent.

Official Reserves

To balance the two accounts in the balance of payments (current and financial accounts), a country's official foreign exchange reserves measures the net effect of all the money flows from the other accounts.

Open-Market Operations

The central bank's buying and selling of government bonds on the open market from commercial banks and the public.

Opportunity Cost

What must be given up to have anything else. Opportunity costs are not neccesarily monetary costs, but rather include what you could do with the resources you use to undertake any activity or exchange.

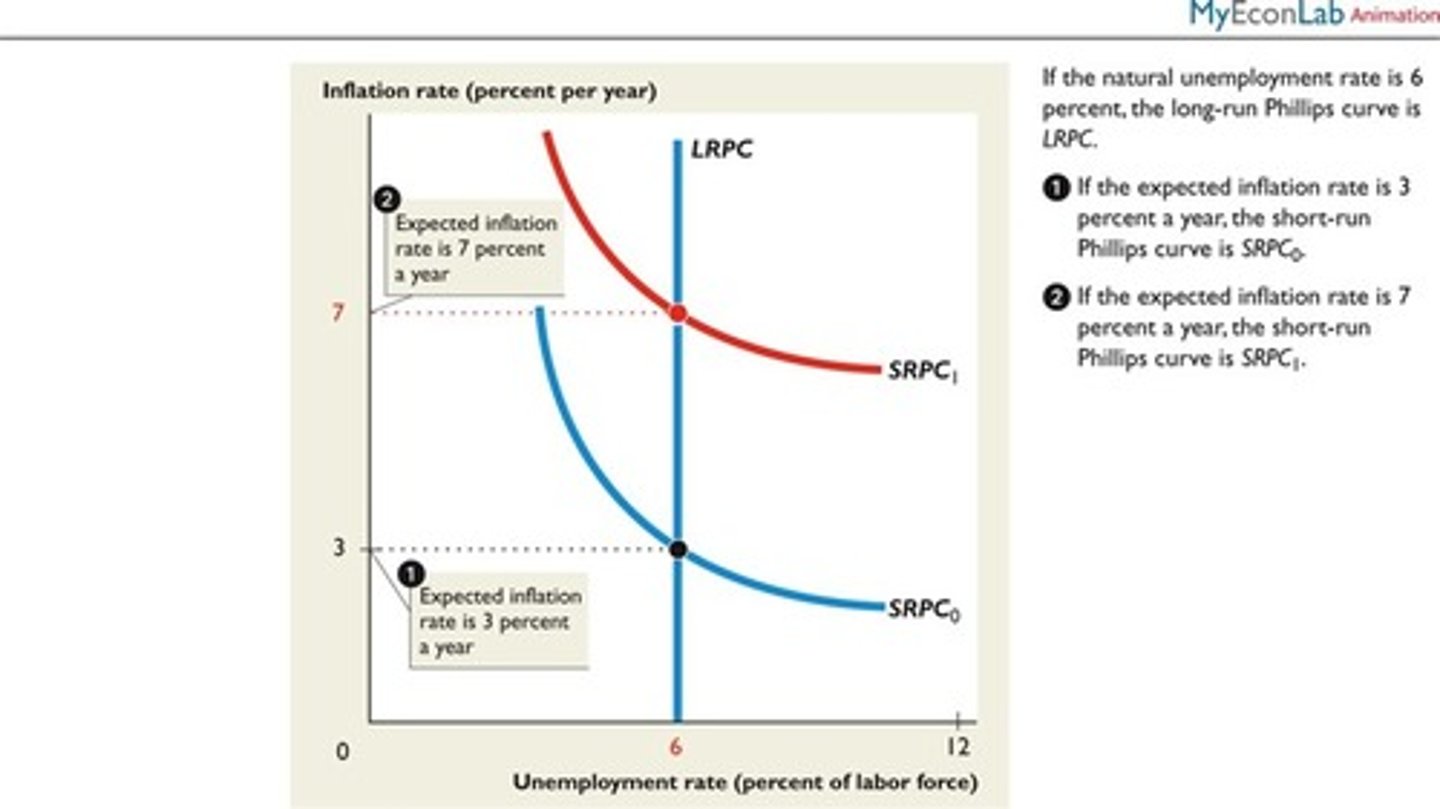

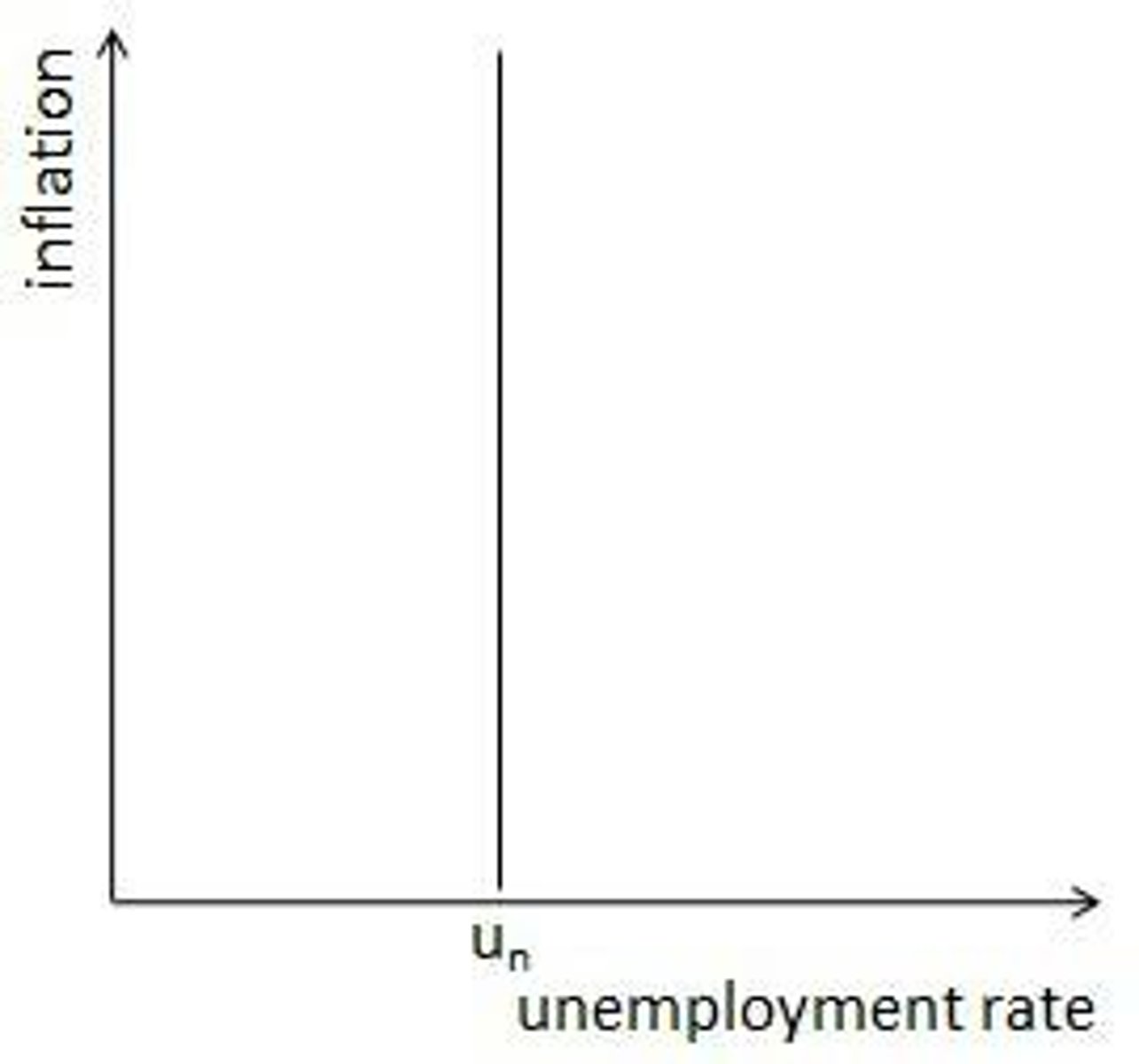

Phillips Curve (long run)

A curve vertical at the NRU showing that in the long run there is no trade-off between the price level and level of unemployment in an economy.

Phillips Curve (short run)

A downward-sloping curve showing the short-run inverse relationship between the level of inflation and the level of unemployment.

Production Possibilities Curve (PPC)

A graph that shows the various combinations of output that the economy can produce given the available factors of production and the available production technology.

Productivity

The output per unit of input of a resource. An important determinant of the level of aggregate supply in a nation.

Protectionism

The use of tariffs, quotas, or subsidies to give domestic producers a competitive advantage over foreign producers. Meant to protect domestic production and employment from foreign competition.

Recession

A contraction in total output of goods and services in a nation between two periods of time. Could be caused by a decrease in aggregate demand or in aggregate supply.

Recessionary Gap

The difference between an economy's equilibrium level of output and its full employment level of output when an economy is in a recession.

Self-Correction

The idea that an economy producing at an equilibrium level of output that is below or above its full employment will return on its own to its full employment level left to its own devices. Requires flexible wages and prices and is associated with classical economic views.

Stagflation

A macroeconomic situation in which both inflation and unemployment increase. Caused by a negative supply shock.

Sticky Wage and Sticky Price Model

The short run Aggregate-Supply Curve is sometimes referred to as the "sticky wage and price model", because worker's wage demands take time to adjust to changes in the overall price level, and therefore, in the short run an economy may produce well below or beyond its full employment level of output.

Structural Unemployment

Unemployment caused by changes in the structure of demand for goods and in technology; workers who are unemployed because they do not match what is in demand by producers in the economy or whose skills have been left behind by economic advancement