Ch.9- Accounting for Current Liabilities

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

25 Terms

Current Liabilities

Obligations due to be paid or settled within one year or the company’s operating cycle, whichever is longer.

Long-term Liabilities

Obligations not due to be paid within one year or the operating cycle, whichever is longer.

Known Liabilities

Obligations of a company with little uncertainty; set by agreements, contracts, or laws; also called definitely determinable liabilities.

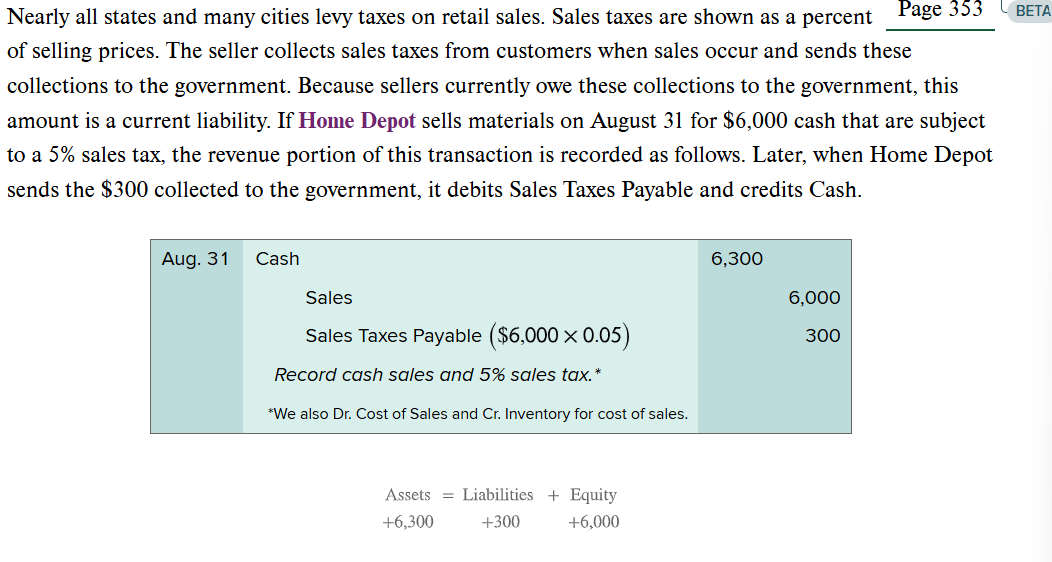

Sales Taxes Payable

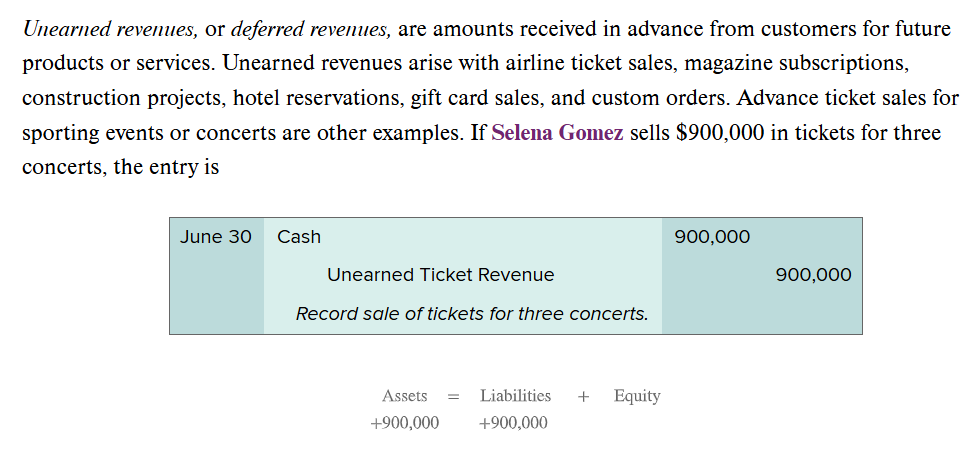

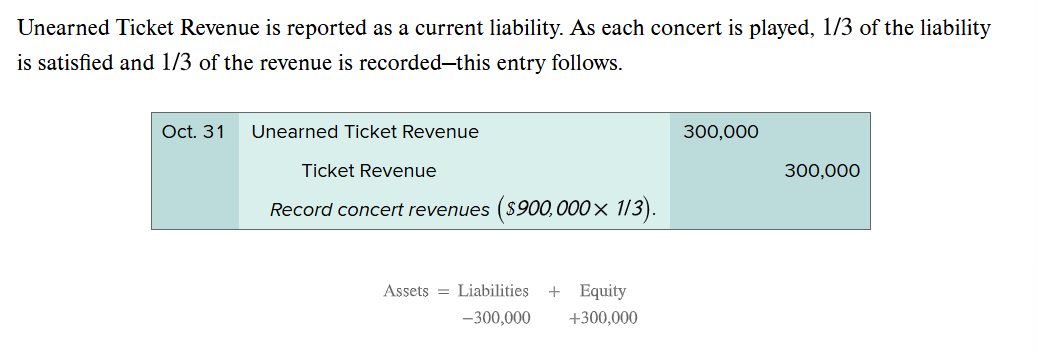

Unearned Revenues

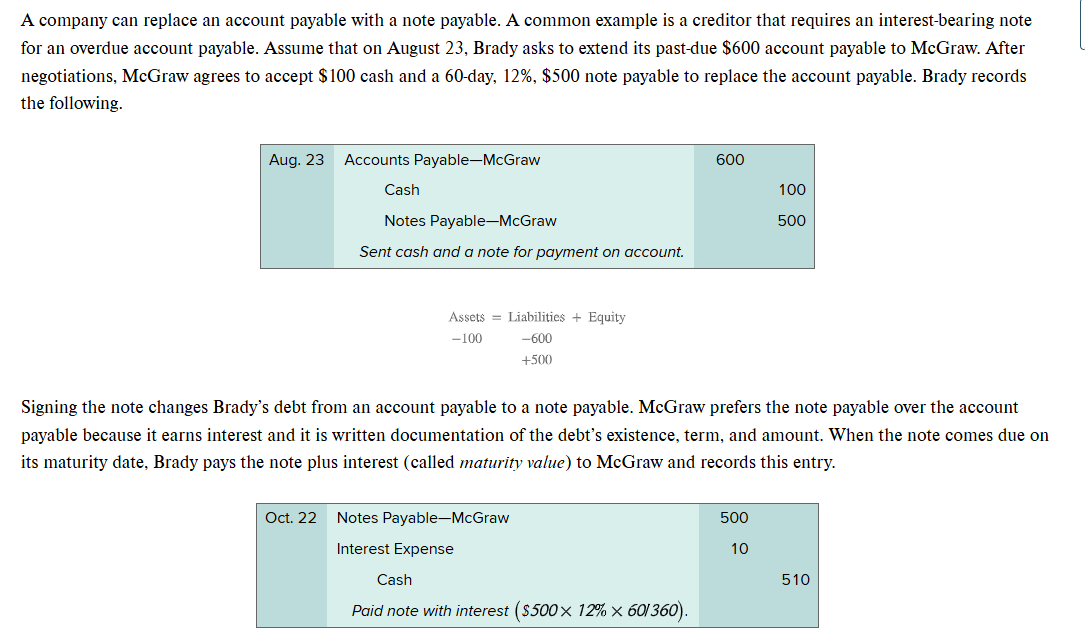

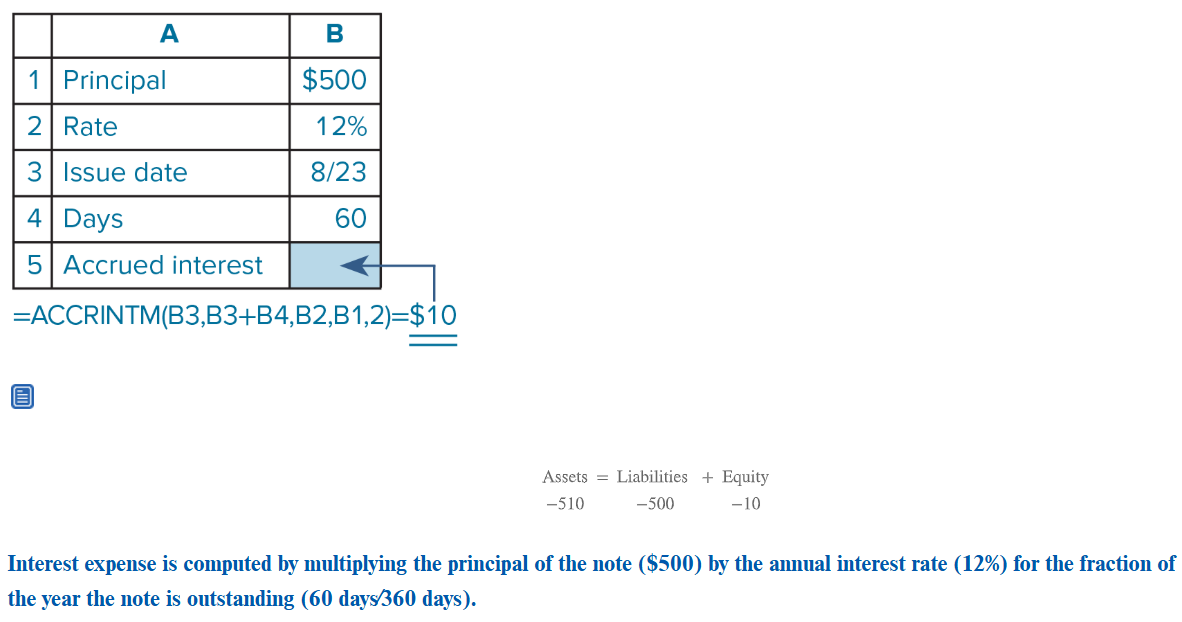

Short-term Note Payable

Current obligation in the form of a written promissory note.

Note Given to Extended Credit Period

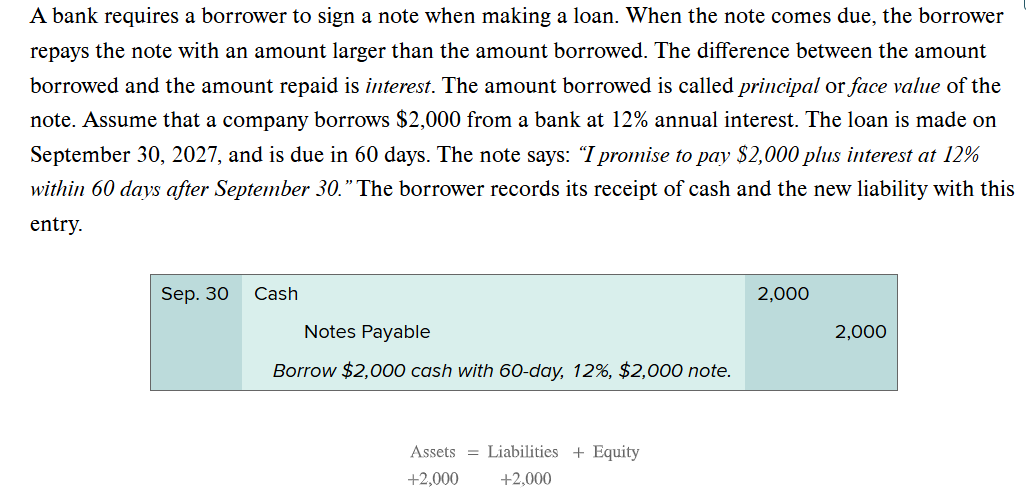

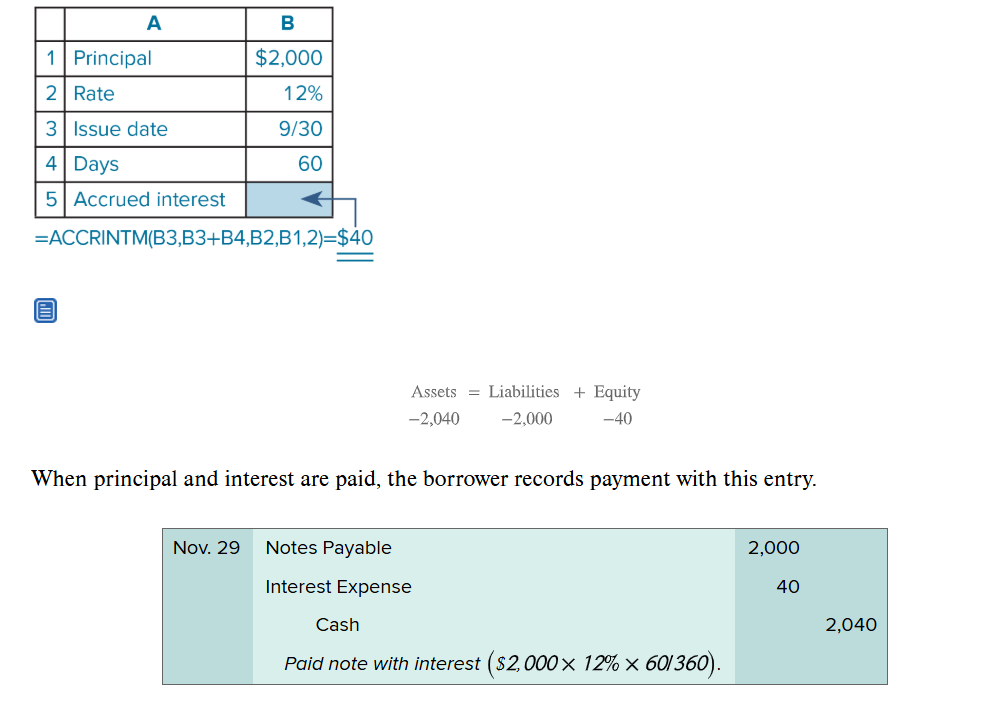

Note Given to Borrow from Bank

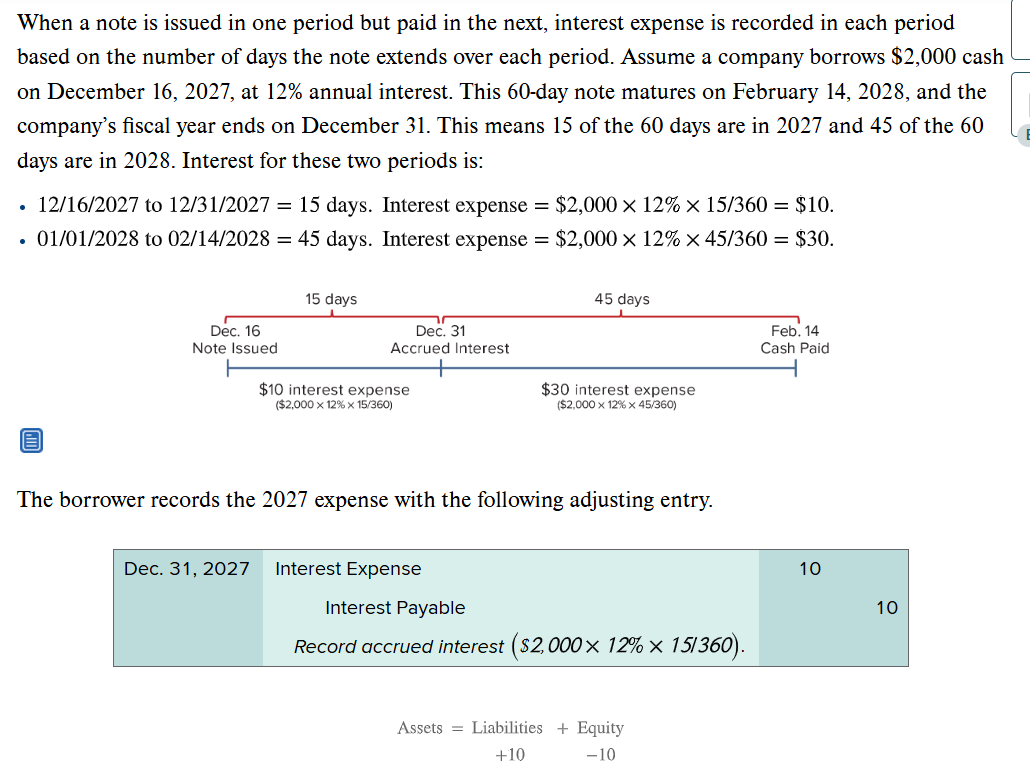

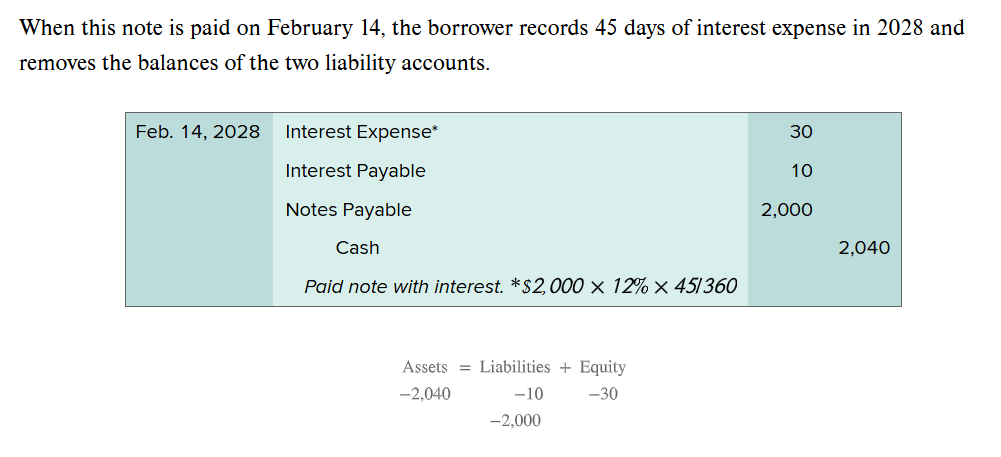

Note Extends over Two Periods

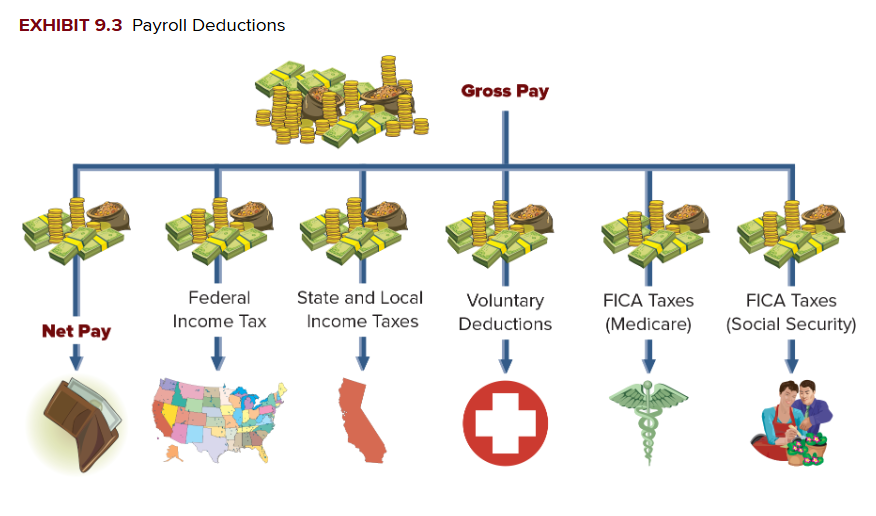

Gross Pay

Total compensation earned by an employee including wages, salaries, commissions, bonuses, and any compensation earned before deductions such as taxes.

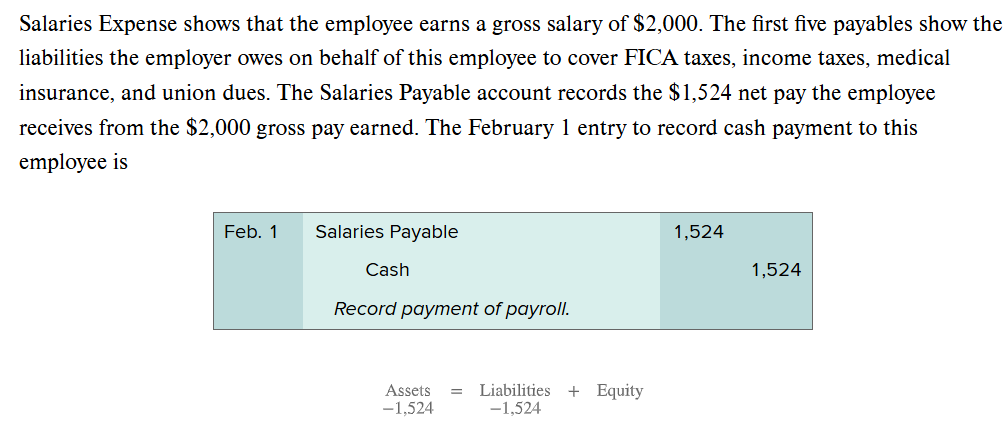

Net Pay

Gross pay minus all deductions; also called take-home pay.

Payroll Deductions

Amounts withheld from an employee’s gross pay; also called withholdings. Can be required or voluntary.

Required: taxes, social security.

Voluntary: pension, health contributions, life insurance, union dues, and donations.

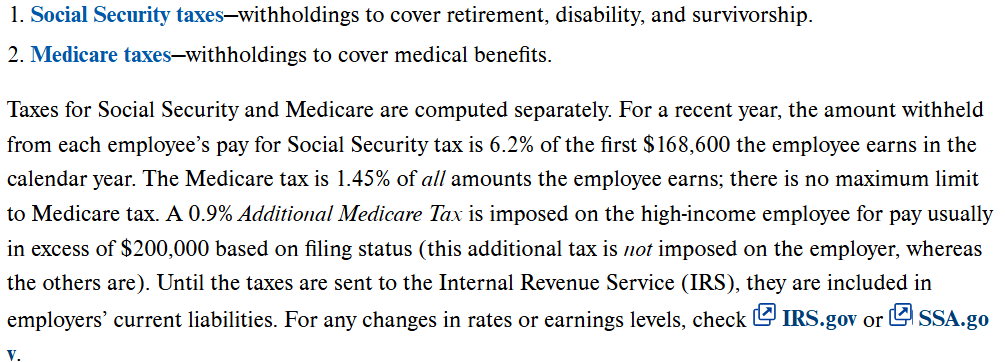

Federal Insurance Contributions Act (FICA) Taxes

Taxes assessed on both employers and employees; for Social Security and Medicare programs.

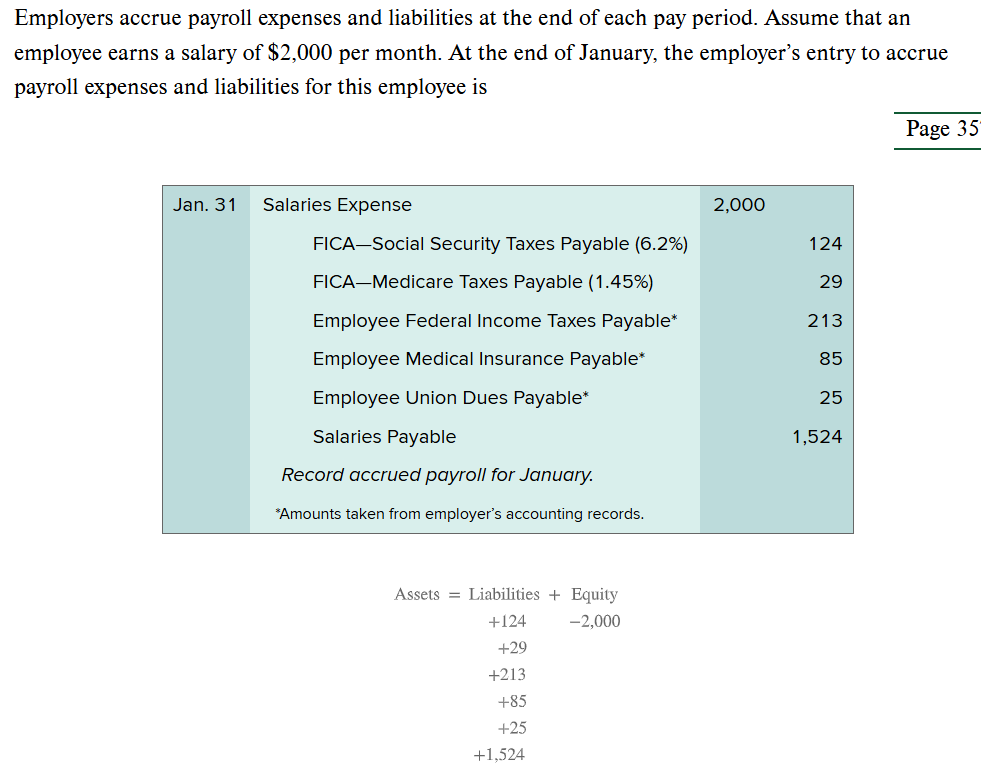

Employee Payroll

Merit Rating

Rating assigned to an employer by a state based on the employer’s record of employment.

Current Portion of Long-term Debt

Portion of long-term debt due within one year or the operating cycle, whichever is longer; reported under current liabilities.

Estimated Liability

Obligation of an uncertain amount that can be reasonably estimated.

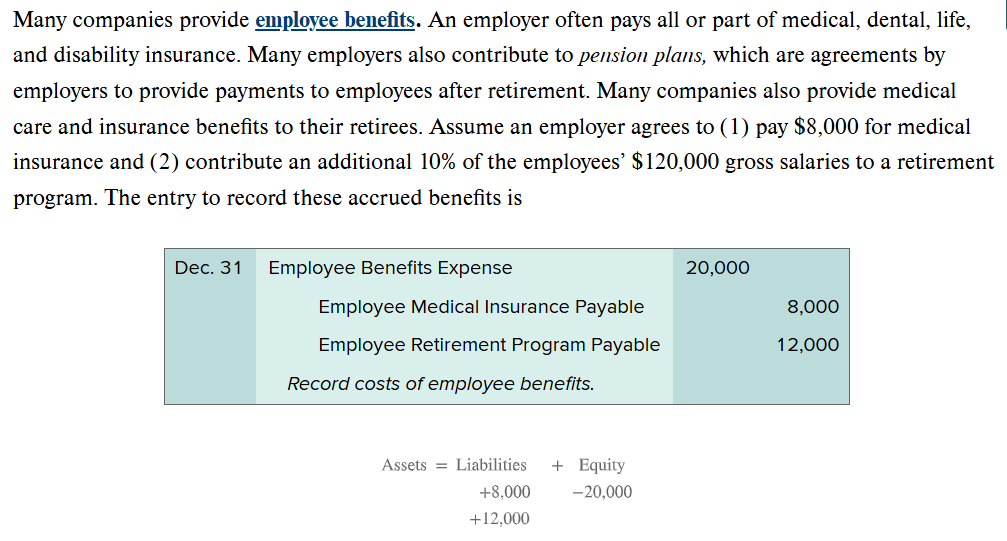

Employee Benefits

Additional compensation paid to or on behalf of employees, such as premiums for medical, dental, life, and disability insurance and contributions to pension plans.

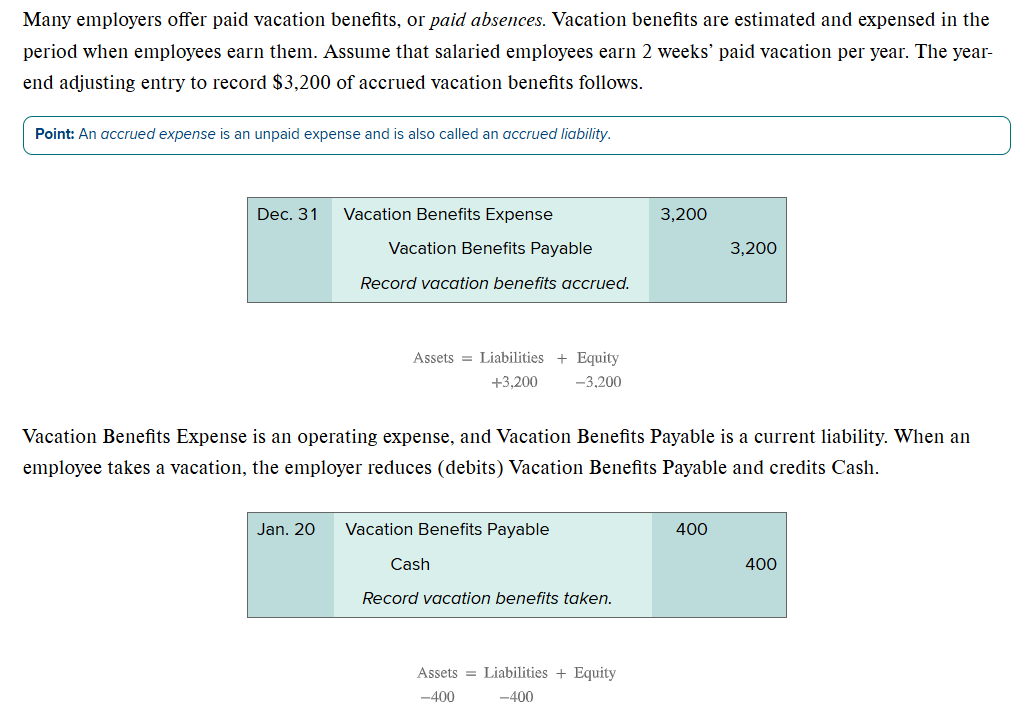

Vacation Benefits

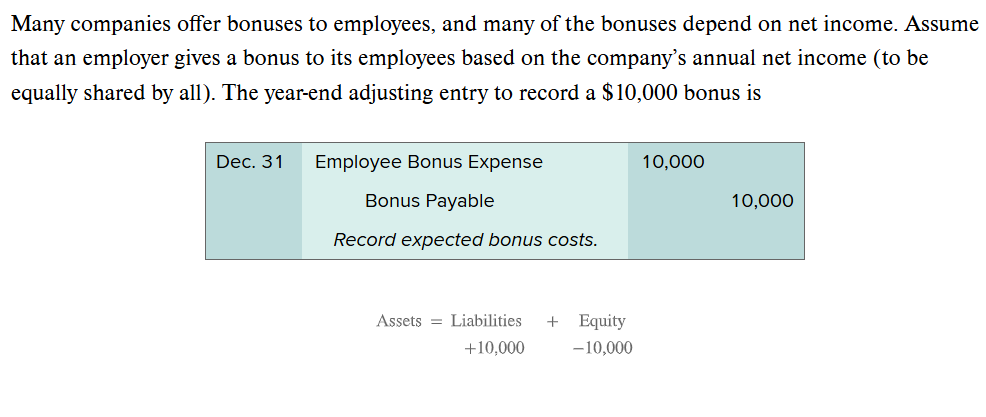

Bonus Plans

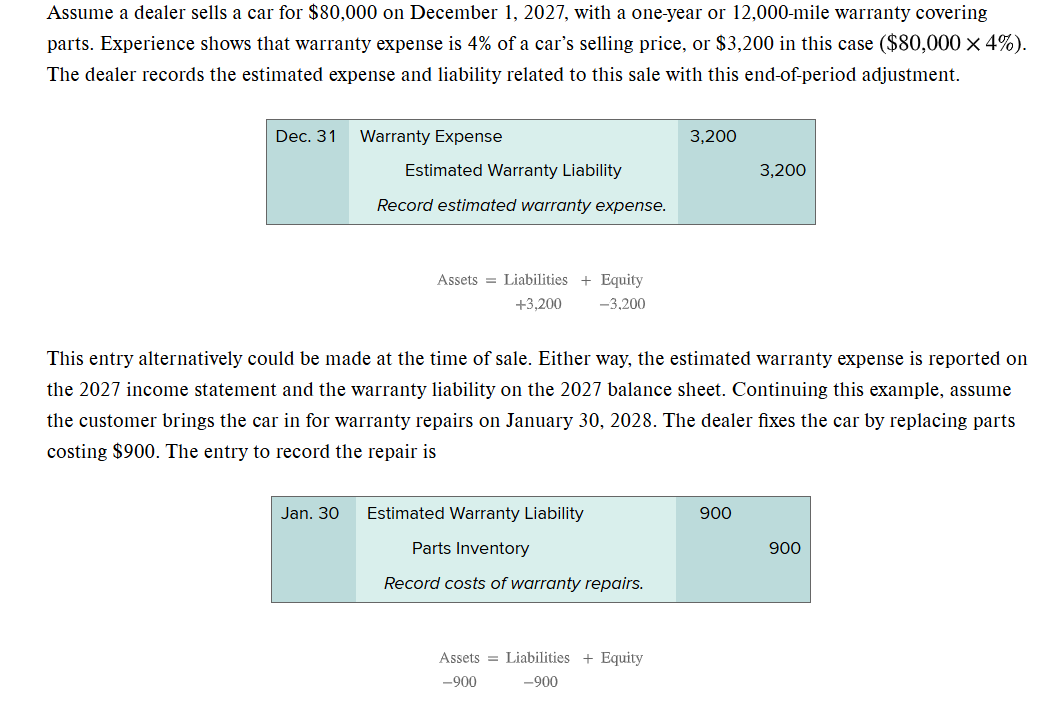

Warranty

Agreement that obligates the seller to correct or replace a product or service when it fails to perform properly within a specified period.

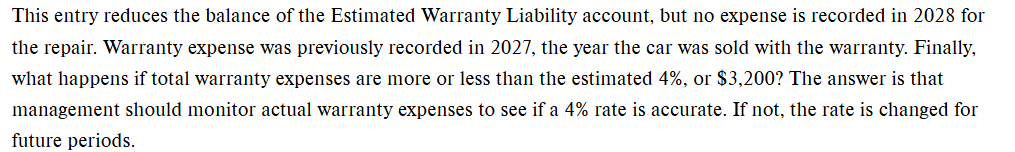

Contingent Liability

Obligation to make a future payment if, and only if, an uncertain future event occurs.

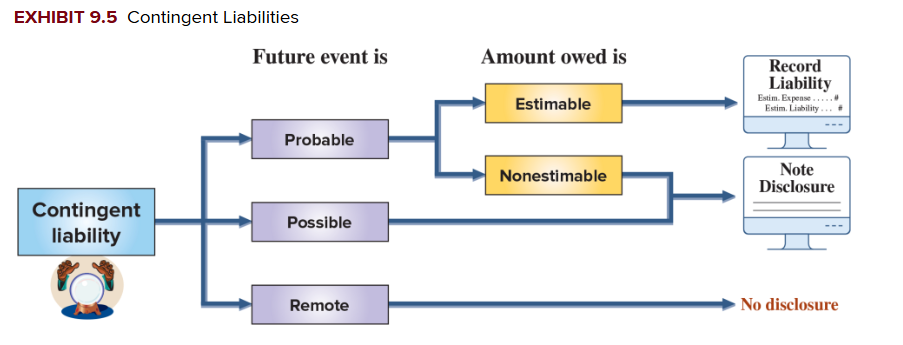

Times Interest Earned

Ratio of income before interest expense (and any income taxes) divided by interest expense; reflects risk of covering interest commitments when income varies.

Estimated Liability

Known obligation of an uncertain amount that can be reasonably estimated.

Ex: employee benefits; pension, health care, vacation pay, and warranties.

Employee Benefits

Additional compensation paid to or on behalf of employees, such as premiums for medical, dental, life, and disability insurance, and contributions to pension plans.