1.4 Government intervention

1/12

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

13 Terms

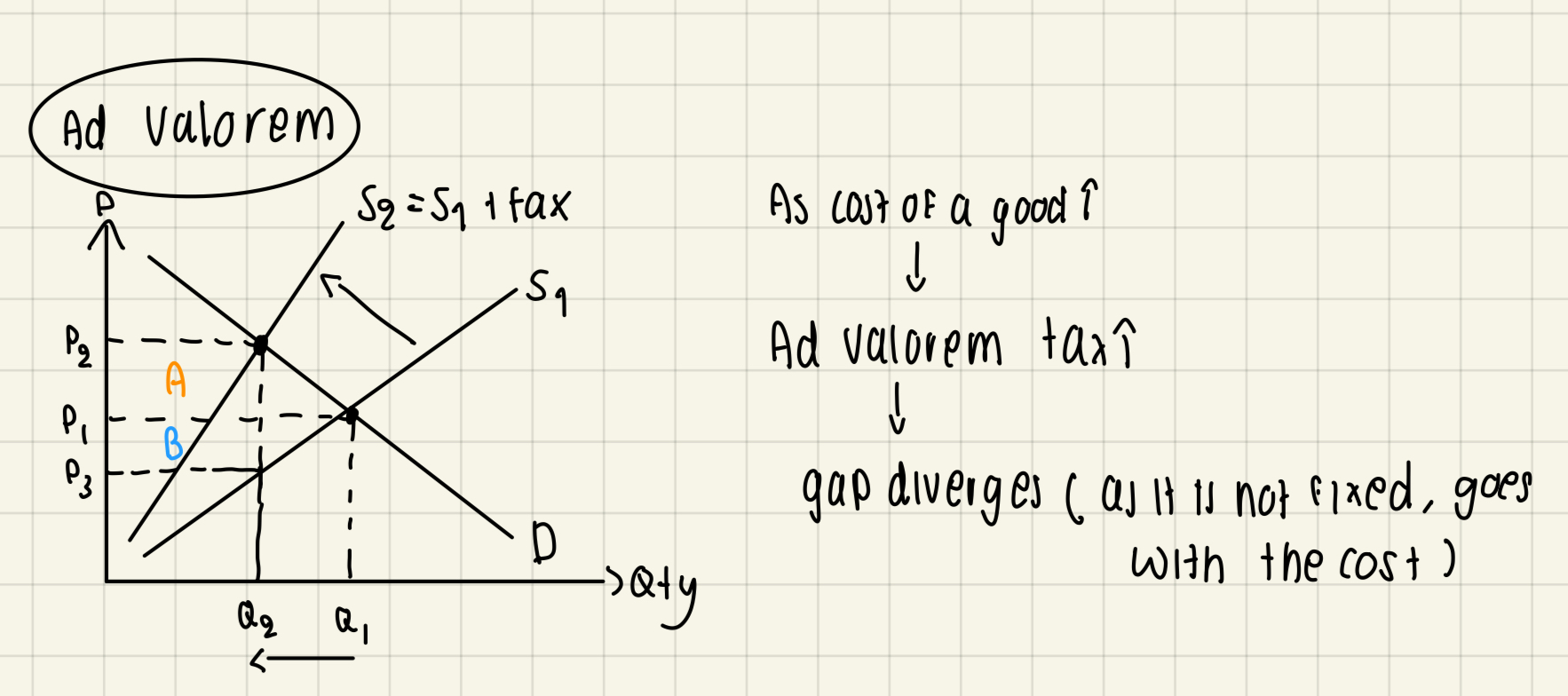

Purpose of intervention with reference to market failure & using diagrams in various contexts: Indirect taxation - ad valorem

Ad valorem tax = tax set as a percentage of the price of a good

Increases cost of production

supply curve pivot inwards

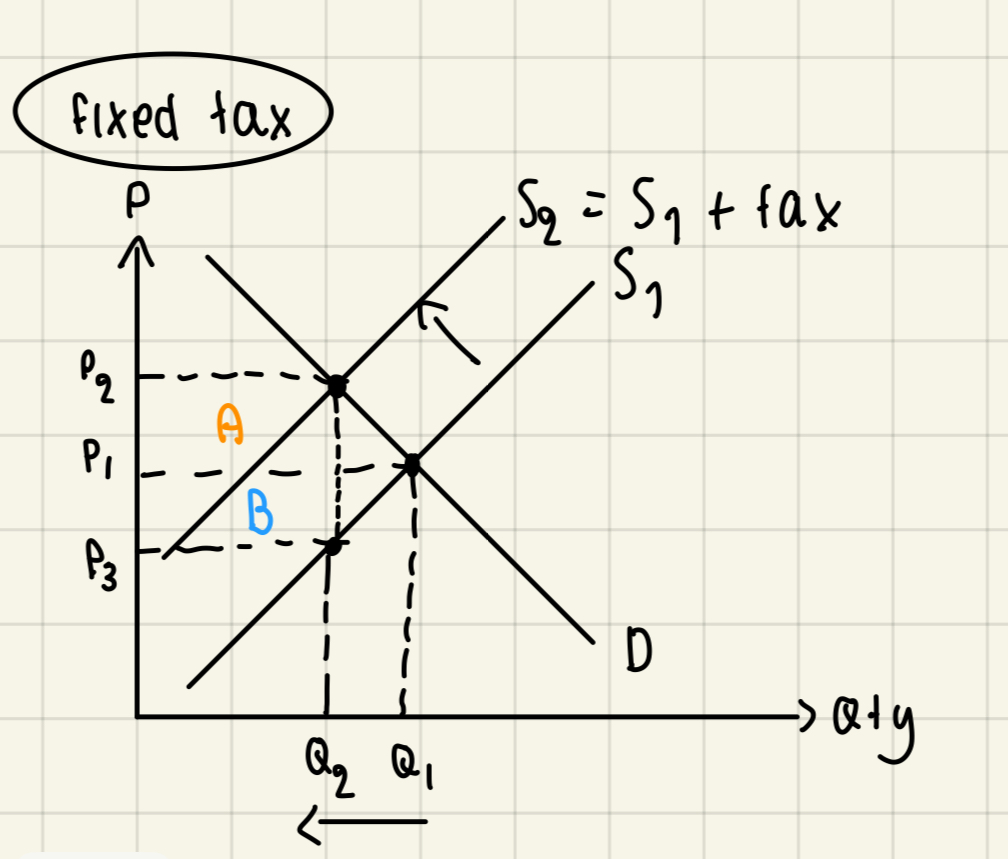

Purpose of intervention with reference to market failure & using diagrams in various contexts: Indirect taxation - specific

Specific tax = a fixed charged imposed per unit of a good

Example: alcohol & tobacco duty

to reduce the external costs caused by consuming more of products with negative externalities

Increases cost of production

parallel shift inwards of supply curve

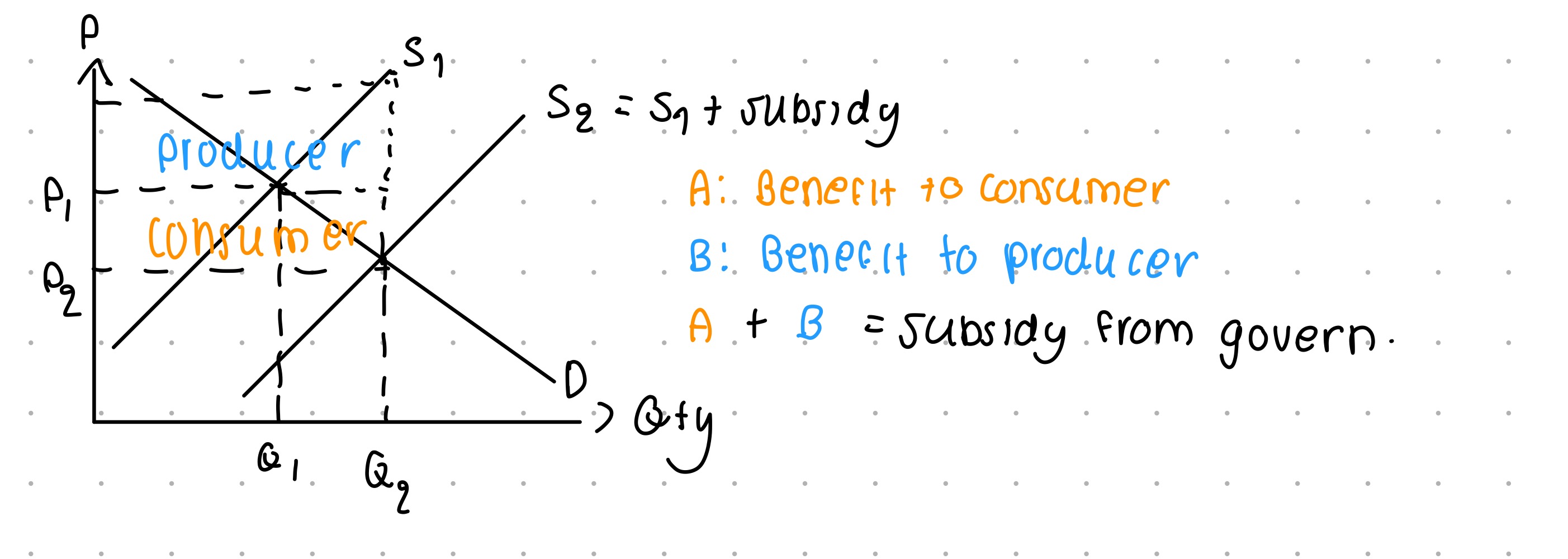

Purpose of intervention with reference to market failure & using diagrams in various contexts: Subsidies

Encourages consumption/production of goods with positive externality

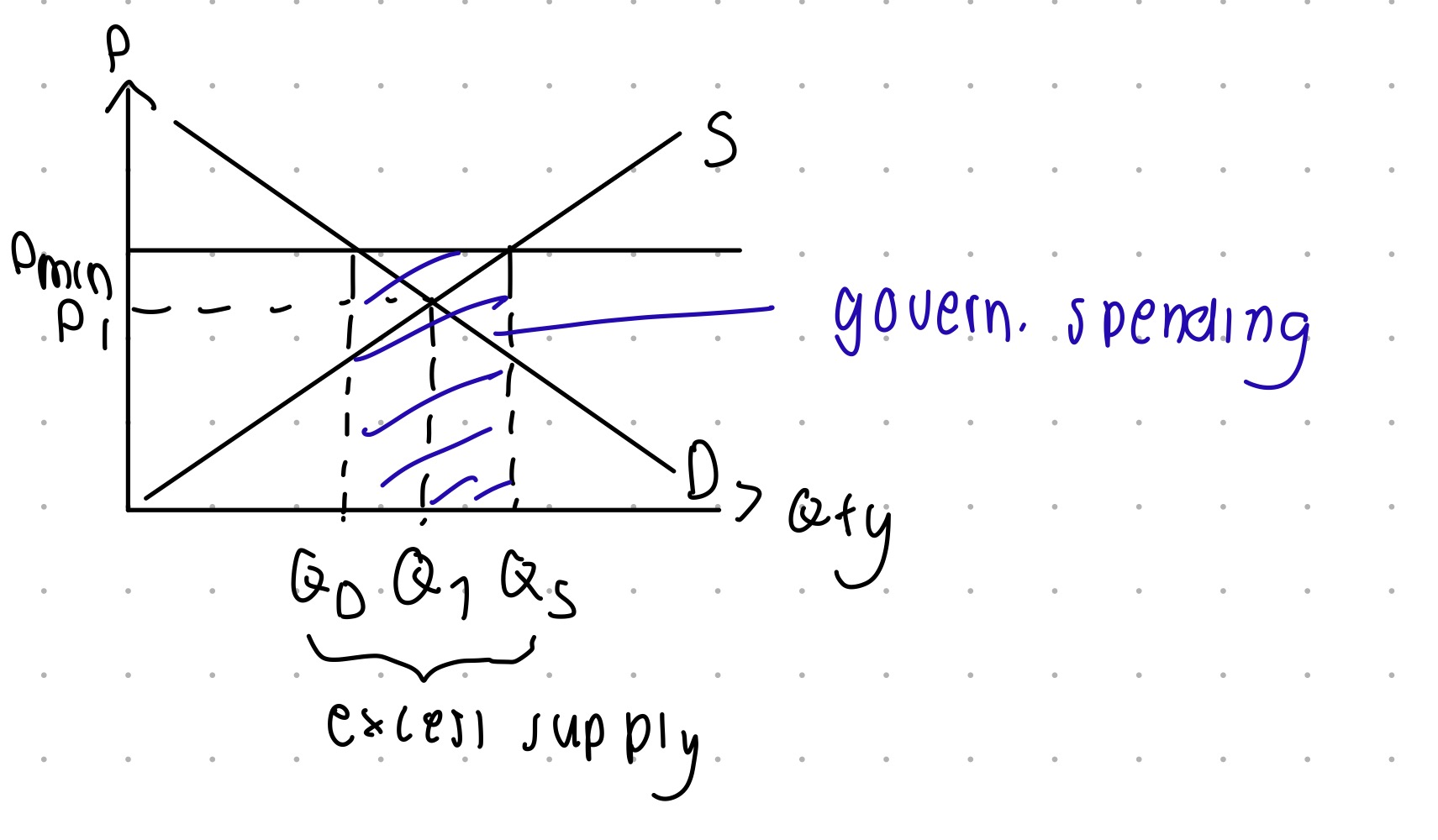

Purpose of intervention with reference to market failure & using diagrams in various contexts: Minimum price

alcohol

Definition: the lowest price a good is allowed to be sold at / floor price

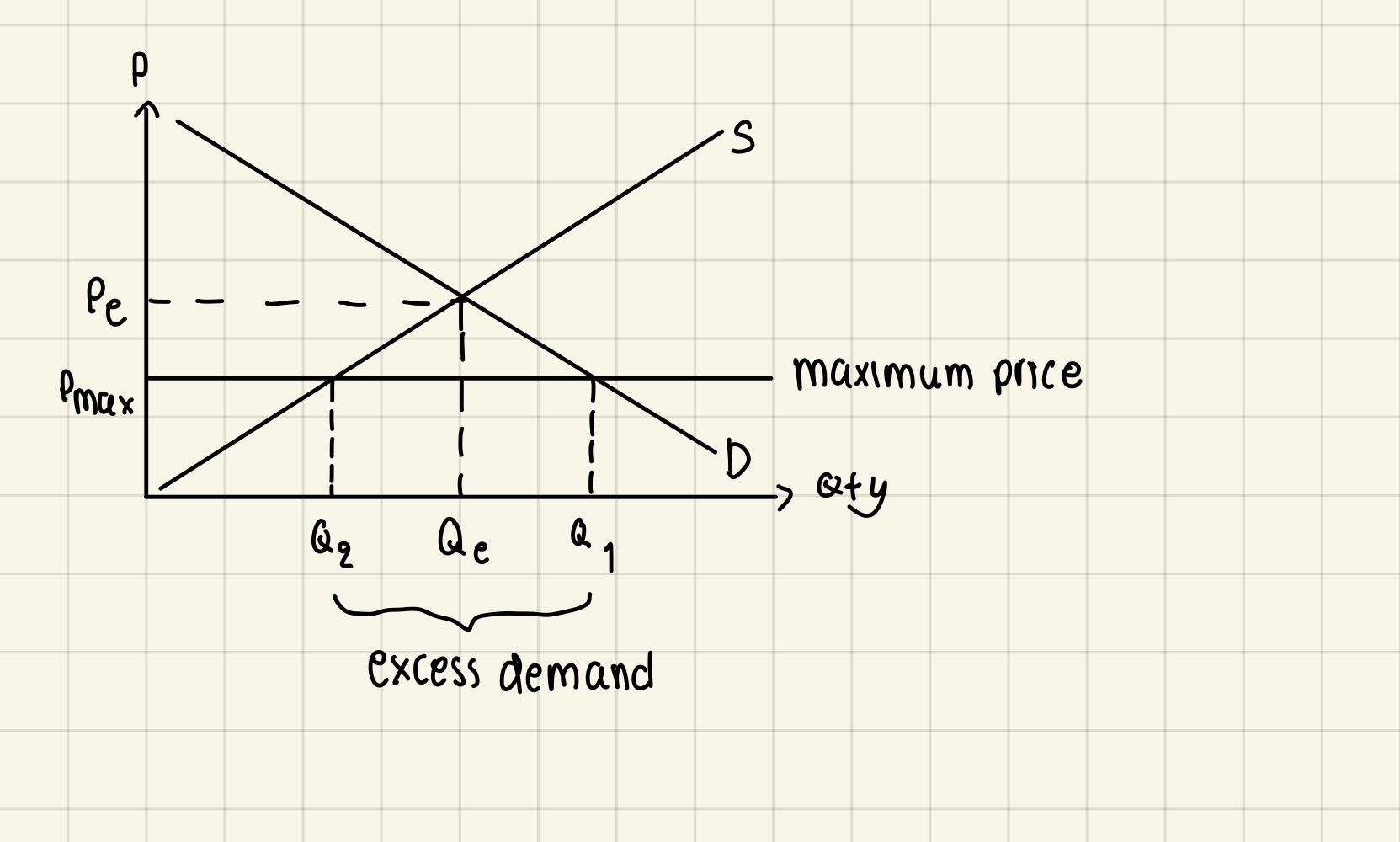

Purpose of intervention with reference to market failure & using diagrams in various contexts: Maximum price

Rent control - impose maximum rents to make housing more affordable for low-income residents

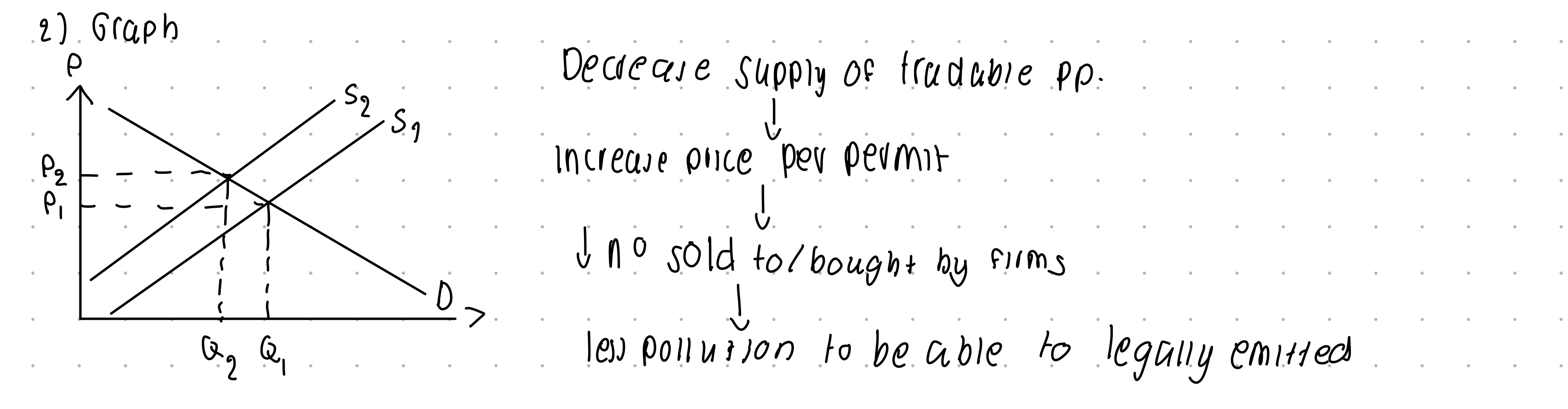

Other methods of government intervention: trade pollution permits (definition)

It’s an allowance of the amount of pollution firms may emit which can be bought & sold in the market

Other methods of government intervention:

State provision of public goods

Provision of information regulation

What is government failure

Occurs when government intervention in the economy causes more inefficient allocation of resources leading to a loss in economic welfare

Evals for this topic:

Causes of government failure

OR

Other factors

Causes of government failure

Unintended consequences - policies aimed at addressing one problem may inadvertently create new problems/unintended consequences

Excessive administrative costs

Information gaps

Other factors

Magnitude of policy

Price elasticity of demand

Short run / long run

What is indirect taxation (tax on g/s)

Imposed on producers by the government

Definition of consumer surplus

The difference between the price a consumer is prepared to pay for a good and the market price

Definition of subsidy

Government grant to firms to increase production & lower the price of a good

This is achieved as subsidy allows a decrease in the cost of production which encourages firms to increase supply

What is government intervention

Used to correct market failure