Money, Proces and the Role of Central Banks

1/50

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

51 Terms

Money in Economics

any asset that can be used in making purchases

e.g. coins and currency, checking account balances, and traveller's checks

Barter

trading goods directly

difficult to implement as it requires each party to want exactly what the other person has to offer

money makes it unnecessary

3 Principle uses of Money

Medium of exchange

Unit of account

Store of value

Money as a Medium of Exchange

an asset used in purchasing goods and services

Money as a Unit of Account

a basic measure of economic value (stocks, wages, current accounts, financial assets, goods, services)

e.g. are 1,000 litres of milk economically more valuable than a tonne of coal?

allows to make easy comparisons

Money as a Store of Value

an asset that serves as a means of holding wealth, and retain purchasing power into the future

saves purchasing power from the time we receive income until the time we spend it

e.g. keeping money in your chequing account, you are holding part of your wealth in the form of money

cash has the advantage of being anonymous and difficult to trace

Wealth

all property including not only money but also other assets such as bonds, stocks, land, houses, furniture, cars, art

Income

a flow of earnings per unit of time, whereas money is a stock

Why are people willing to exchange physical goods and services for a piece of paper whose intrinsic value is essentially zero?

confidence: intrinsically worthless money has value because people expect that they will be able to exchange it in the future for goods

today, virtually all currency is issued by governments and is not backed by any commodity like gold

people accept to hold and use money because they trust their government and its ability to maintain the value of money

Liquidity

the relative ease and speed with which an asset can be converted into a medium of exchange

highly desirable

What is the most Liquid Asset?

money as it is the medium of exchange - doesn’t have to be converted into anything else to make purchases

Other Reasons for Holding Money

Illegal activities, including drug and arms trafficking and tax evasion

Corruption

Fear of political and economic instability, banking crises

Fear of deflation and negative interest rates

2 Definitions for Measuring Money

M1

a relatively ‘narrow’ definition of the amount of money in the economy

the sum of currency outstanding and balances held in chequing accounts

M2

includes all the assets in M1 plus some additional assets that are usable in making payments, but at greater cost or inconvenience than the use of currency or cheques

Definitions of money range from narrow to broad

Demand for Money

the amount of wealth an individual chooses to hold in the form of money

Opportunity Cost of Holding Money

(i - π) - (0 - π) = i

real return on alternative assets (r = i - π) - real return to money (0 - π)

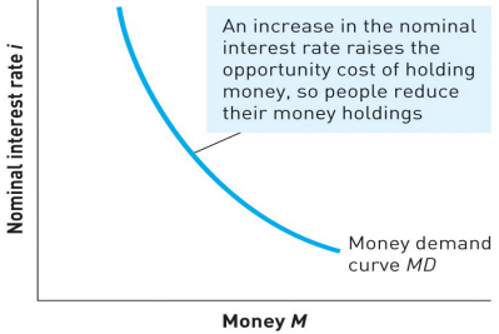

Money Demand Curve

Shows the relationship between the aggregate quantity of money demanded (M) and the nominal interest rate (i)

Because an increase in the nominal interest rate increases the opportunity cost of holding money, which reduces the quantity of money demanded, the money demand curve slopes down

Bank Reserves

Cash or similar assets held by commercial banks used for the purpose of meeting depositor withdrawals and payments

Is Cash in a Bank’s Vault part of the Money Supply?

no it is unavailable for payments

but, bank deposits available for use in transactions are part of the money supply

100% Reserve Banking

a situation where banks reserves equal 100% of their deposits

Fractional-Reserve Banking System

a banking system in which banks hold fewer reserves than deposits so the reserve-deposit ratio is less than 100%

Desired Reserve-Deposit Ratio

bank reserves/bank deposits

Money Supply

currency held by public + bank reserves/(desired reserve-deposit ratio)

Securitisation

A practice by which banks can pool existing loans and sell them to another financial institution

Advantage: increases the supply of credit

Drawback: depends on the creditworthiness of the mortgagees and of the willingness of capital markets to hold securitized debts

The Federal Reserve

central bank of the US

Does not attempt to maximize profit

Promotes public goals such as economic growth, low inflation, and smoothly functioning financial markets

Responsibilities of the Federal Reserve

Conduct monetary policy

Oversee and regulate financial markets

Central to solving financial crises

Open-Market Operations when the Fed Purchases a Bond from the Public

Fed pays bond holder with new money

The new money enters the economy

The bond, which wasn’t money, leaves the economy

Receipts are deposited and this leads to a multiple expansion of the money supply

Open-Market Operations when the Fed Sells a Bond to the Public

Bondholder pays with checking funds

The checking funds, which were money, leave the economy

The bond, which is not money, enters the economy

Bank reserves decrease and this leads to a multiple contraction of the money supply

Increasing the Money Supply Example

An economy has 1,000 shekels in currency and bank reserves of 200 shekels

Reserve-deposit ratio = 0.2

Money supply = 1,000 + (200 / 0.2) = 2,000 shekels

Central bank pays 100 shekels for a bond held by the public

Assume that all 100 shekels are deposited

Money supply = 1,000 + (300/ 0.2) = 2,500 shekels

100 shekel increase in reserves leads to a 500 shekel increase in the money supply

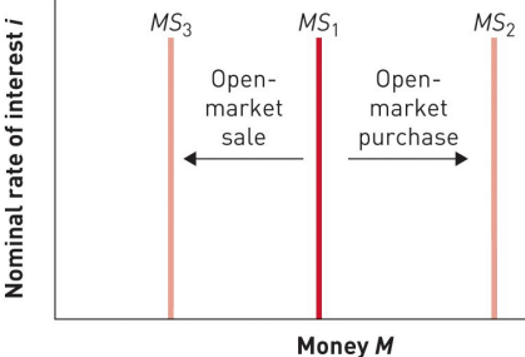

Money Supply Curve

Central Bank sets the money supply at MS1

An open-market purchase increases the money supply curve to MS2

An open-market sale reduces the money supply and shifts the money supply to MS3

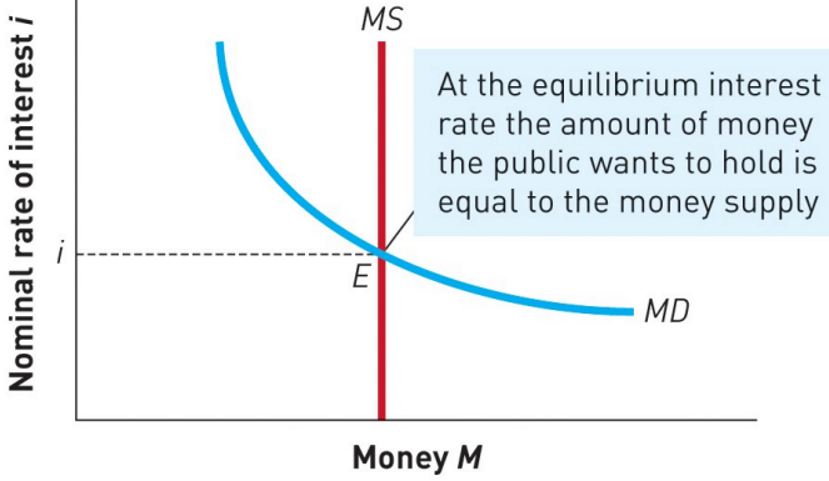

Equilibrium in the Market for Money

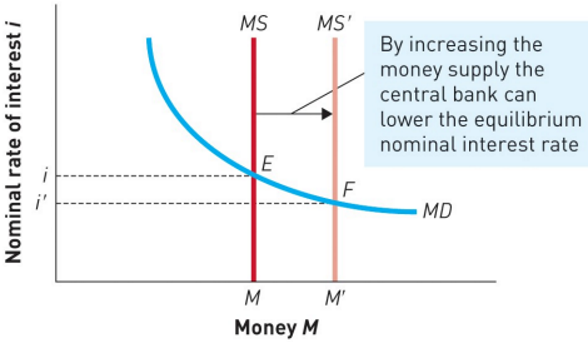

How the Central Bank Controls Nominal Interest Rate

Can lower it by increasing the money supply

For the given money demand curve, an increase in the money supply from MS to MS’ shifts the equilibrium point in the money market from E to F, lowering the nominal interest rate from i to i’

How does the Fed prevent Bank Panics?

Supervising and regulating banks

Loaning banks funds if needed

Deposit Insurance

Deposits of less than $250,000 will be repaid even if the bank is bankrupt

Decreases incentive to withdraw funds on rumours

Inflation

the price level increases rapidly, money loses value rapidly, and people become more reluctant to hold their wealth in this store of money

The Quantity Theory of Money

How the price level is determined and why it might change over time

The quantity of money available in the economy determines the value of money

The primary cause of inflation is the growth in the quantity of money

Inflation results when the money supply rises faster than the supply of goods and services

Nominal Variables

measured in monetary units

Real Variables

measured in physical units

The Quantity Equation

shows that an increase in the quantity of money in an economy must be reflected in one of three other variables:

The price level must rise,

the quantity of output must rise, or

the velocity of money must fall

What will happen if People start Hoarding Cash/Saving more Money than Spending it?

the velocity of money will decrease which can lead to a decrease in overall economic activity as fewer transactions are taking place

What happens when the Fed changes the Quantity of Money?

it causes proportionate changes in the nominal value of output (P x Y)

because it’s neutral, it doesn’t affect output

Monetary Neutrality

the irrelevance of monetary changes for real variables

changes in the money supply affect nominal variables but not real variables

Velocity of Money (V)

A measure of the speed at which money changes hands in transactions for final goods and services

Velocity of Money Formula

(P x Y) / M

P x Y = Nominal GDP (Price Level x Real GDP)

M = Money Stock

What is a Higher Velocity a sign of?

the same amount of money id being used for a number of transactions

indicates a high degree of inflation

What is Velocity Determined by?

a number of factors including technology such as ATMs and debit cards

these technologies allow people to conduct business while carrying less cash

The Inflation Tax

a tax on everyone who holds money caused by governments raising revenue by printing more money

in the form of a reduction in the value of money holding which erodes purchasing power

individuals and businesses need to pay more money to purchase the same amount of goods and services

Fiscal Theory of Price Level (FTPL)

Argues that the price level in an economy is ultimately determined by the government's budget decisions, rather than by the quantity of money in circulation, as in the quantity theory of money

According to the FTPL, fiscal policy dominates monetary policy in determining the price level

Changes in government spending and taxation have a greater impact on the price level than changes in the money supply

Deficits may cause governments to inflate away the debt as the real amount it must pay is smaller

Commodity Money

any money made up of precious metals or another valuable commodity

inconvenient - very hard and heavy to transport from one place to another

Fiat Money

paper currency that isn’t convertible into or tied to any commodity but that the government still declares as legal tender

can be printed and changed at will and its value becomes determined by market forces

Cryptocurrencies

a digital asset designed to be a medium of exchange

Central Bank Digital Currencies (CBDC)

inspired by Bitcoin

potential advantages - fast, secure, reduce transaction costs, reduce rents, provide information (tax collection), enable negative nominal interest rates

drawbacks - untested in periods of crisis, might affect monetary policy transmission, lots of power concentrated in the central bank