Chapter 18: Saving, Investment, and the Financial System

1/45

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

46 Terms

Financial System

The group of insrtitutions that help match one person’s savings with another person’s investment

What is the key to long run economic growth?

Saving and investment are the key to long term economic growth

When a country saves a large portion of its GDP, more resources are available for investmnet in capital, thus, thus this increase in capital, allows for increased productivity and living standard

What does the financial system do at the broadest level?

At the broadest level, the financial system moves the economy’s scarce resources from savers ( people who spend less than they earn) to borrowers (people who spend more than they earn)

Why do savers supply their money to the financial system?

Savers supply their money to the financial system with the expectation that they will get their original amount of money with interest later on

What are the two types of financial institutions?

The two types of financial institutions are:

Financial markets

Financial intermediaries

Financial Markets

Financial institutions through which savers can directly provide funds to borrowers

Institutions where a person who wants to save can directly supply funds to someone who wants to borrow

Examples: Bond market and stock market

Bond

Certificate of indebtedness (owning money) that specifies what the borrower owes to the holder of the bond

An IOU

Identifies the time at which the loan will be repaid (date of maturity)

Rate of interest that will be paid periodically until the loan matures

Promise of interest and the eventual repayment of the amount borrowed (principal)

What are the three different characteristics of bonds?

The different characteristics of bonds are:

Bond’s term (Length of time until the bond matures)

Credit risk (Probability that the borrower will fail to pay some of the interest or principal)

Tax treatment (The way that the tax laws treat the interest earned on the bond, some bonds are taxable, others aren’t)

Stock

A claim to partial ownership in a firm

Claim to the profits that the firm makes

What is the risk of stocks compared to bonds?

Compared to bonds, stocks offer the holder a higher risk and potentially higher return

When a company is profitable, the stockholders enjoy the benefits of the profits, where the bondholders onlys get the interest paid on their bonds

If a company runs into financial difficulty, the bondholders are paid what they are due, before the stockholders are even considered

Financial intermediaries

Financial institutions through which savers can indirectly provide funds to borrowers

Ex. Banks and mutual funds

Banks

Financial intermediary that takes deposits from people who want to save and use these deposits to make loans to people who want to borrow

Banks pay depositors interest on their deposits and charge borrowers slightly higher interest on their loans

Difference between these 2 interests covers the bank’s costs and gives owners some profit

Mutual Fund

An institution that sells shares to the public and uses the proceeds to buy a portfolio of stocks and bonds

Shareholder accepts all risks and returns associated with the portfolio

Allow people with small amounts of money to diversify their holdings

GDP Formula

Y= C + I + G + NX

Y= GDP

C= Consumption

I= Investment

G= Government Purchases

NX= Net Exports

What is the GDP Formula for a closed economy?

GDP for closed economy is Y= C+ I + G

NX = 0

What is the formula for investment?

The formula for investment is

I = Y- C- G

What is the formula for national saving (saving)?

Formula for national saving is:

S= ( Y- T- C) + ( T-G)

Y= GDP (total income)

T= Tax

C= Consumption

G= Government purchases

National Saving (Saving)

The total income in the economy that remains after paying for consumption and government purchases

Private Saving Equation

(Y- T -C)

Private Saving

The income that households have left after paying for taxes and consumption

Public Saving Equation

T- G

Taxes

Government Purchases

Public Saving

The tax revenue that the government has left after paying for its spending

What is national saving formula wise?

National saving = private saving + public saving

Budget Surplus

An excess of tax revenue over government spending

When T> G

Government receives more money than it spends

Budget surplus represents public saving

Budget Deficit

A shortage of tax revenue compared to government spending

Government spends more than it recives in tax revenue

G > T

Public Savings is a negative number

What is true about savings and investments in an economy?

Savings= investments in the economy

The financial system takes the nation’s savings and direct it to the nation’s investments

Market for loanable funds

The market in which those who want to save supply funds and those who want to borrow to invest demand funds

Loanable funds = all the income that people have chosen to save and lend out rather than use for their own consumption and the amount that investors have chosen to borrow to fund new projects

One interest rate

Loanable funds

The total amount of money available for lending and borrowing in an economy

Where does the supply of loanable funds come from?

The supply of loanable funds comes from people who have some extra income they want to save and lend out

Lending can be direct, ex. bond or indirect, ex. household makes a deposit in a bank, which then uses the funds to make loans

What is saving the source of?

Saving is the source of loanable funds

Where does the demand for loanable funds come from?

The demand for loanable funds comes from households and firms who wish to borrow to make investments

Ex. Families taking out mortages to make new homes, firms borrowing to buy equipment

What is the source of demand for loanable funds?

Saving is the source of demand for loanable funds

What does the interest rate represent?

The interest rate represents the amount that borrowers pay for loans and the amount that lenders receive on their saving

What happens when there is a high interest rate for demand of loanable funds?

A high interest rate makes borrowing more expensive and the quantity of loanable funds demanded falls as interest rate rises

Increase in interest rate, QD of loanable funds decreases

Decrease in interest rate, QD of loanable funds increases

What happens when there is a high interest rate for supply of loanable funds?

A high interest rate increases savings and the QS of loanable funds increases

Lower interest rate decreases savings and QS of LF decreases

How do the supply and demand curve for loanable funds look like?

The supply curve for loanable funds slopes upwards, and the demand curve for loanable funds slopes downwards

Market for Loanable Funds as a whole

The interest rate in the economy adjusts to balance the supply and demand for loanable funds

The supply of loanable funds comes from national savings (private + public savings)

The demand for loanable funds comes from firms and households who want to borrow to invest

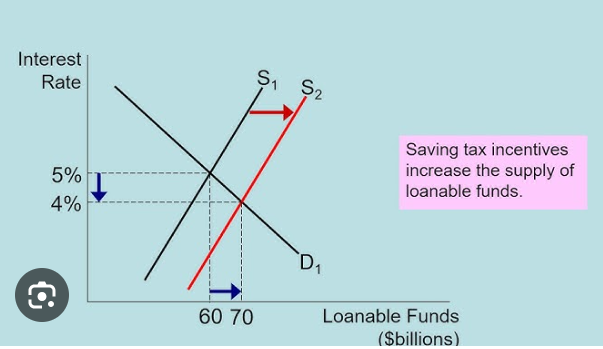

How would a change in the tax laws that encouraged savings change the market for loanable funds?

If tax decreased on savings and loanable funds, then the supply of loanable funds would shift right

The equilibrium interest rate would fall

Lower interest rate would raise the equilibrium quantity of loanable funds

What would happen if more investment tax credits were passed to the market for loanable funds?

If investment tax credits encouraged firms to invest more:

the QD for loanable funds would increase and shift right

the equilibrium interest rate would increase

The equilibrium quantity of loanable funds would increase

What would occur if a reform of tax laws encouraged greater investment?

If tax laws were reformed and encouraged greater investment, the result would be higher interest rates and greater saving

How does a budget deficit affect the market for loanable funds?

When a governmetn spends more than it receives in tax revenue,

The budget deficit lowers national savings, since public savings decrease

Supply of loanable funds decreases and shifts left

Equilibrium interest rates increases

Reduces the equilibrium quantity of loanable funds

Elle wants to buy and operate an ice cream truck, but doesn’t have the financial resources to start the business. She borrows $10 k from her friend George, who she promises an interest rate of 7 percent and gets another $20 k from Jerry who she promises a third of profits? What best describes the situation?

George is a bondholder, has an IOU promised back interest

Jerry is a stockholder, has a share of the profits and partial ownership of her truck

If the government collects more in tax revenue than it spends and households consume more than they get in after tax income, then?

Public Savings = T- G

Private Savings = Y- T- C

If more T than G, budget surplus and public saving is positive

If C is more than Y after T, the private savings is negative

Private savings is negative, but public saving is positive

A closed economy has an income of $1,000, government spending of $200, taxes of $150, and investment of $250. What is private saving?

Y= C + I + G

Real GDP or spending= income

1,000 = C + 250 + 200

C = 550

Private Saving = Y - T - C

Private Saving= 1,000- 150 -550

Private Saving= 300

Private Saving= $300

If a popular TV show convinces Americans to save more for retirement, the ______ curve for loanable funds would shift, driving the equilibrium interest rate ________.

Increase in saving, supply curve for loanable funds would shift up, driving the equilibrium interest rate down

supply, down

If the community becomes more optismistic about the profitbaility of capital (wants to invest more), the ________ curve for loanable funds would shift, driving the equilibrium interest rate _________.

Demand curve for loanable funds would shift up, driving the equilibrium interest rate up

Demand, up