Express Trusts: Constitution of Trusts

1/13

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

14 Terms

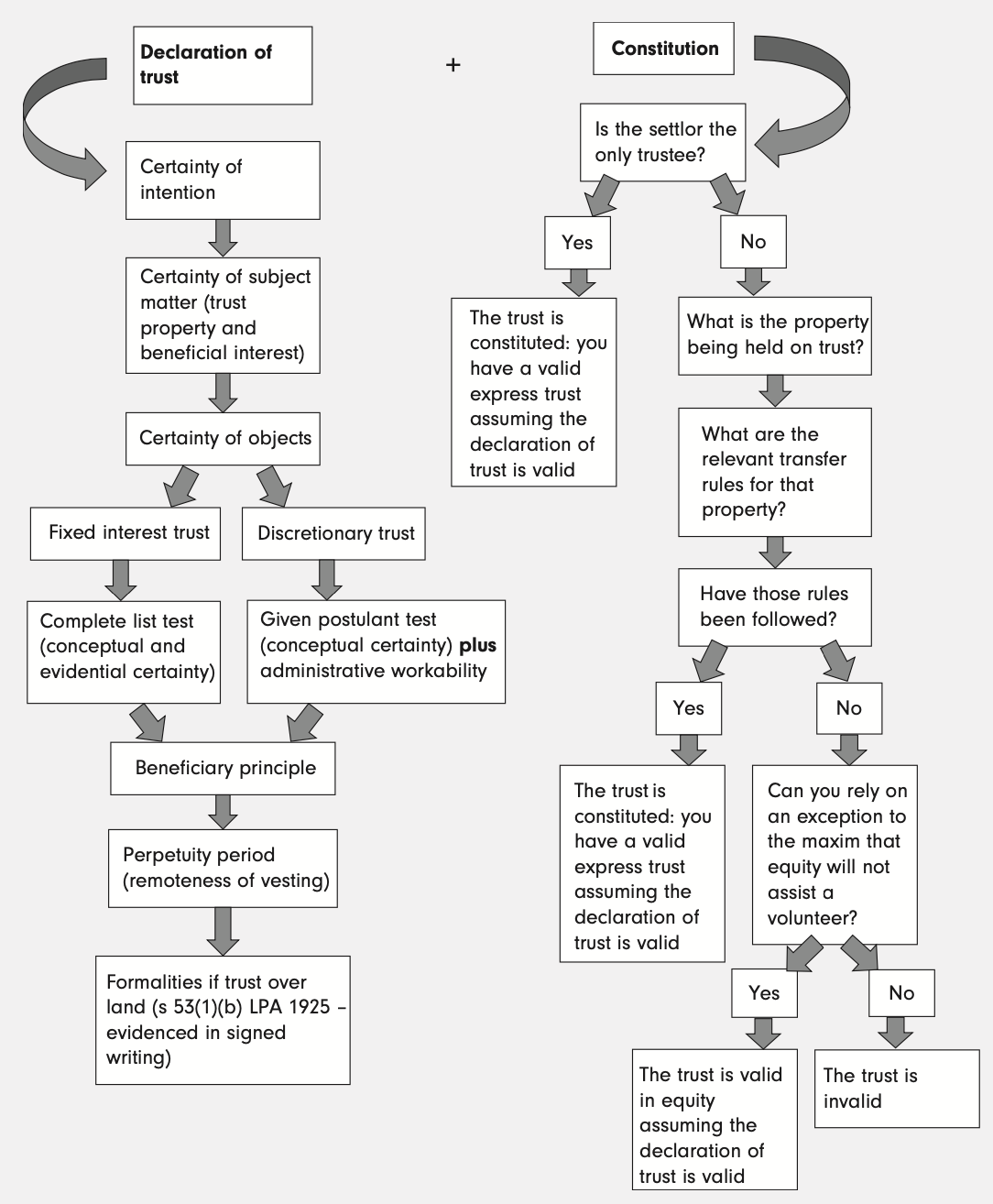

Can a settlor declare themselves to be trustee? If so, how does this affect the ownership of the property?

Yes - Provided satisfy 3 certainties.

Before trust? Held legal and equitable interest.

After trust? Holds legal and beneficiary holds equitable interest.

If the settlor appoints a 3rd party as trustee must they undertake additional steps?

Yes.

Valid declaration of trust and transfer legal ownership.

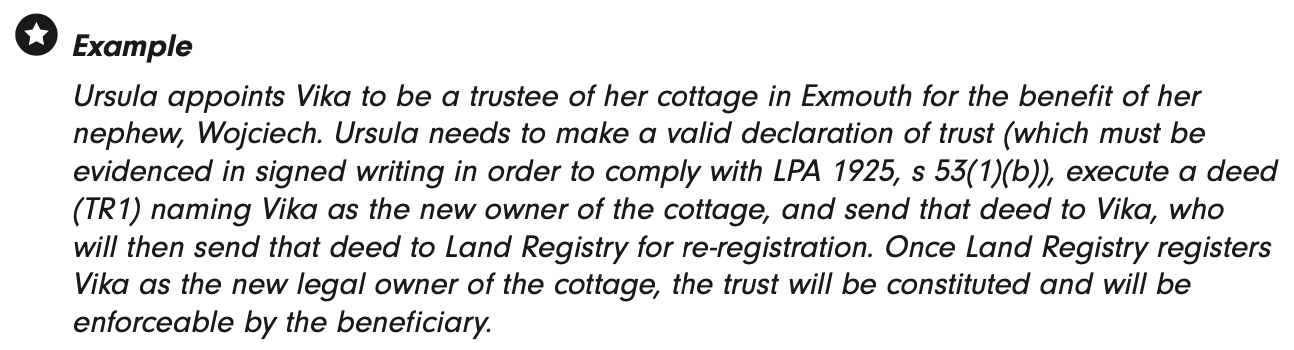

How does a settlor transfer legal title in land to a 3rd party trustee?

Execute a deed (comply formalities).

Give executed deed to Tee.

Tee passes it to LR who registers them as new owner.

How do you transfer legal title to company shares?

CREST system for PLC shares.

Outside CREST system (i.e. private limited co).

How do you transfer shares outside of the CREST system?

Execute stock transfer form.

Give executed form and share certificate to Tee.

Tee passes it to company.

Company register Tee as new shareholder.

How do you transfer legal title in money?

Physical cash - Title passed on delivery.

Electronic transfer - Title passed on receipt in account.

Cheque - Title passed once cheque clears. Dies before this? No longer possible to cash.

How do you transfer legal title in personal chattels?

Passed on physical delivery of item.

Example: Jewellery, furniture, paintings.

What is the rule that ‘equity will not perfect an imperfect gift’?

Settlor failed to follow transfer rules?

Equity won’t assist volunteer (i.e. recipient) because provided no consideration.

Some exceptions apply.

What is the ‘every effort’ exception to ‘equity will not assist a volunteer’?

Settlor must complete all steps required to take.

Property must be beyond their control.

NOTE - Identify where transfer documents are.

If within settlor’s possession then fail test.

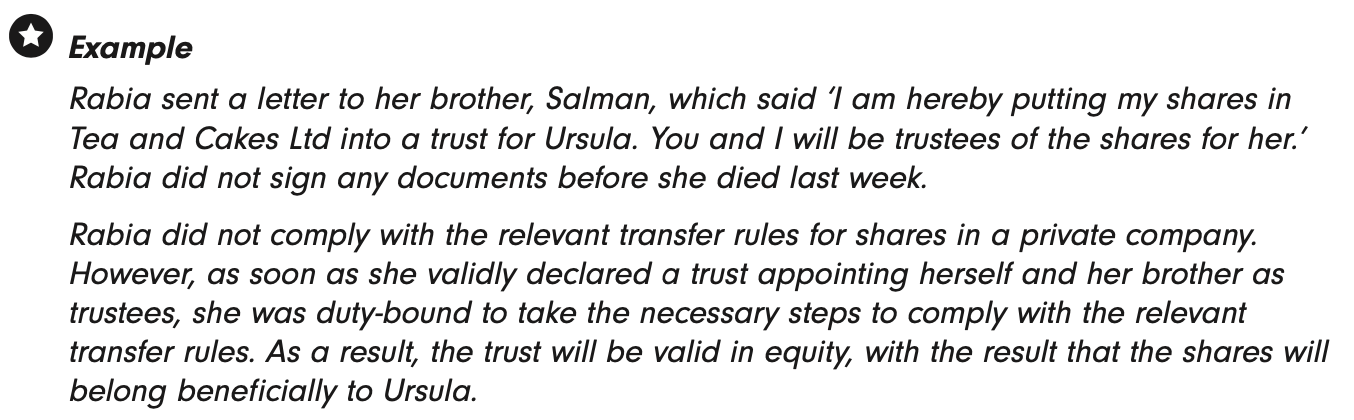

What is the rule in Strong v Bird?

Settlor intend to create immediate trust with 3rd party as Tee.

Trust not immediately created due to failure relevant transfer rule.

Settlor’s intention continue until death.

Intended Tee acquire legal title by becoming settlor’s executor / administrator.

‘Megan, who was ill and unable to leave her house, said to Natalie, ‘I want you to hold my wedding ring on trust for my granddaughter, Olivia. I will give you the ring the next time you visit.’ Natalie was unable to visit Megan, and a week later, Megan died. In her valid will that she had executed some time earlier, she appointed Natalie as her executor (a female executor is often referred to as an ‘executrix’) and gave her entire estate to Oxfam.’

Will the rule in Strong v Bird apply?

Most likely yes.

Megan intent immediate trust with Natalie as Tee.

Trust no immediately created. Failed to deliver ring to Natalie.

Megan did not change her mind before death.

Natalie acquired legal title be becoming Megan’s executrix.

What must you do if you declare a trust with yourself and another as a 3rd party trustee?

Transfer property into your joint names.

Follow relevant transfer rules.

What if I fail to follow through on transferring the legal title into joint names after a declaration of trust? Can equity intervene?

[Choithram SA v Pagarani]

Trust is created.

Why? Because unconscionable for you to resile promise.