Institutions Ch 13 (Done)

1/66

Earn XP

Description and Tags

Regulation of Commercial Banks

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

67 Terms

FIs provide many vital services to important sectors of the economy, such as the following:

Information services

Liquidity services

Price-risk reduction services

Failure to provide these services or a breakdown in their efficient provision can be costly to both the ultimate providers (households) and users (firms) of funds

Accordingly, commercial banks (CBs) are regulated at the federal (and sometimes state) level

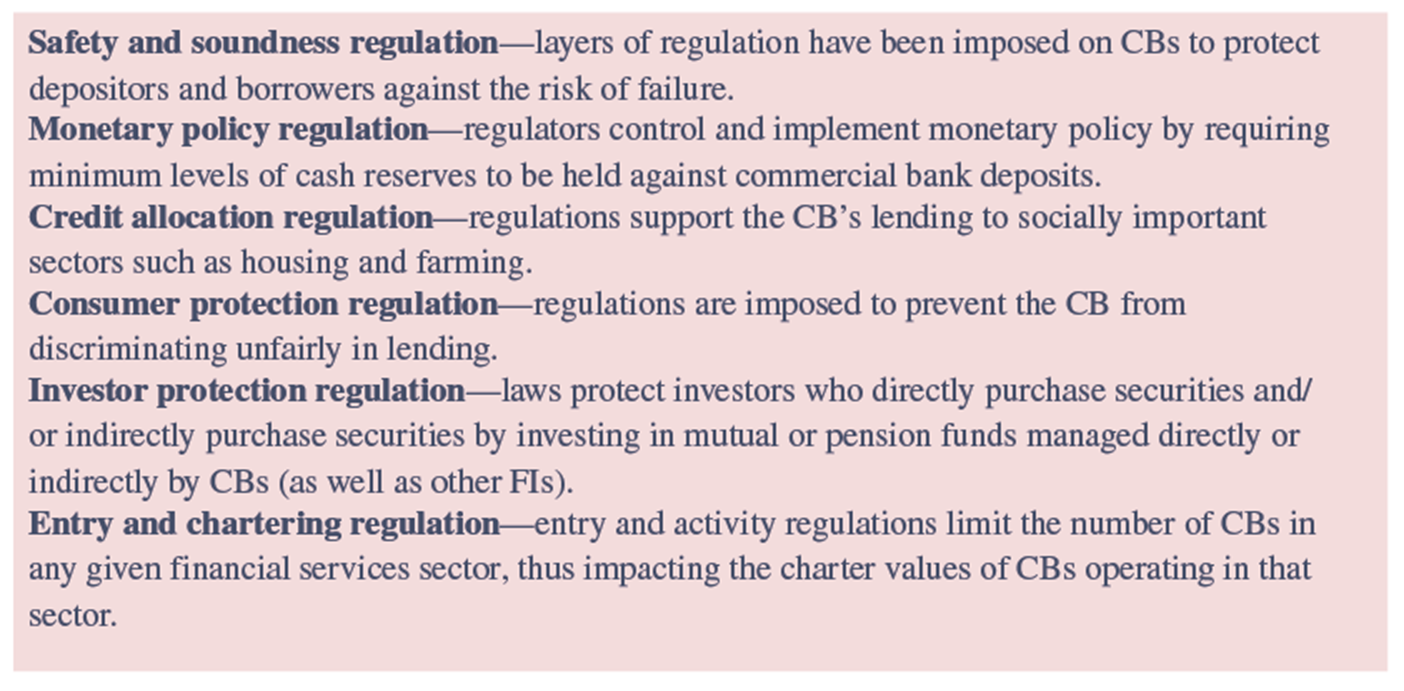

Six types of regulations seek to enhance the net social benefits of commercial banks’ services to the economy:

Safety and soundness regulation

Monetary policy regulation

Credit allocation regulation

Consumer protection regulation

Investor protection regulation

Entry and chartering regulation

Regulations

_____________ can be imposed at the federal or the state level and occasionally at the international level, as in the case of bank capital requirements

Areas of CB Specialness in Regulation

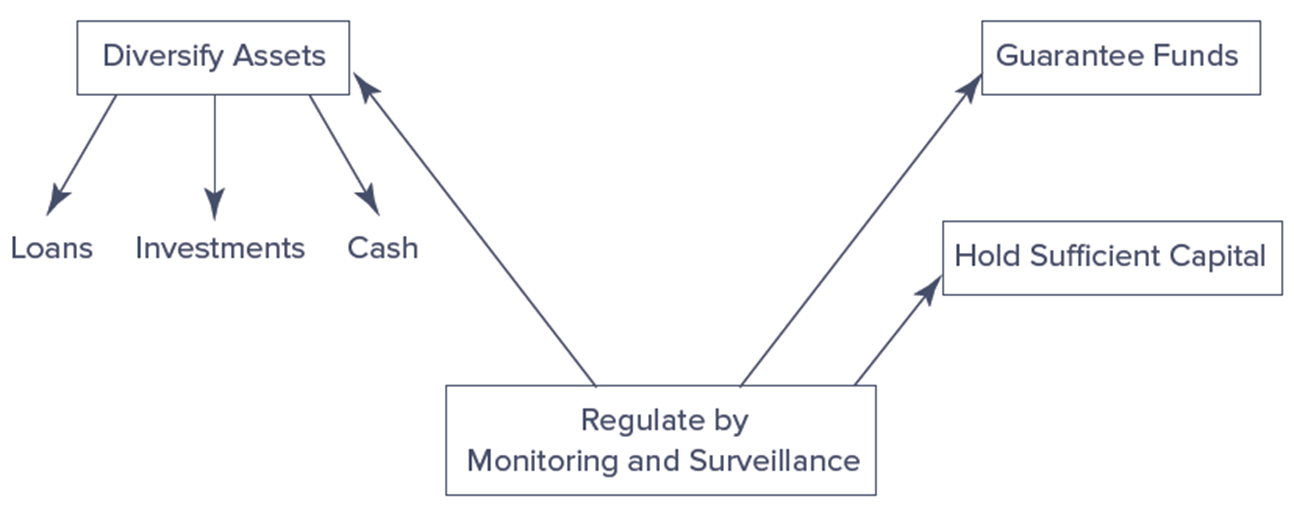

lLayers of protective mechanisms balance a CB’s profitability against its solvency, liquidity, and other types of risks

First layer

__________ of protection is the diversification of assets

Second layer

___________ of protection concerns the minimum level of stockholder capital or equity funds that the owners of a CB need to contribute to the funding of its operations

Third layer

__________ of protection is the provision of guarantee funds such as the Depositors Insurance Fund (DIF) for banks

Mitigates a rational incentive depositors otherwise have to withdraw their fund at the first hint of trouble

Fourth layer

____________ of regulation involves monitoring and surveillance

Involves on-site examination of the CB by regulators as well as the CB’s production of accounting statements and reports on a timely basis for off-site evaluation

without costs

Regulation is not __________ for those regulated

Difference between the private benefits to a CB from being regulated (e.g., insurance fund guarantees) and the private costs it faces from adhering to regulation (e.g., examinations) is its net regulatory burden

Higher the net regulatory burden on CBs, the smaller are the benefits of being regulated compared to the costs of adhering to regulations from a private (CB) owner’s perspective

net regulatory burden

Difference between the private benefits to a CB from being regulated (e.g., insurance fund guarantees) and the private costs it faces from adhering to regulation (e.g., examinations) is its ______________________

2010 Wall Street Reform and Consumer Protection Act

Signed into law by President Obama in July 2010

2010 Wall Street Reform and Consumer Protection Act

Set forth reforms to meet five key objectives:

Promote robust supervision and regulation of financial firms

Establish comprehensive supervision of financial markets

Protect consumers and investors from financial abuse

Provide the government with the tools it needs to manage financial crises

Raise international regulatory standards and improve international cooperation

Dodd-Frank rules

On May 22, 2018, Congress passed the Economic Growth, Regulatory Relief, and Consumer Protection Act (EGRRCPA), a partial rollback of some of the ____________

Monetary policy regulation

Regulators commonly impose a minimum level of required cash reserves to be held against deposits, or inside money

CBs often view required reserves as similar to a tax and as a positive cost of undertaking financial intermediation

Credit allocation regulation

Regulations support the CB’s lending to socially important sectors, such as housing and farming

May require a CB to hold a minimum amount of assets in one particular sector of the economy or to set maximum interest rates, prices, or fees to subsidize certain sectors

Qualified thrift lender (QTL) test requires savings institutions to hold 65 percent of their assets in residential mortgage-related assets to retain a thrift charter

discriminating unfairly

Regulations are imposed to prevent the CB from ______________ in lending

Community Reinvestment Act (CRA) of 1977

CRA ratings range from outstanding to substantial noncompliance, and examinations for compliance have become increasingly rigorous

Home Mortgage Disclosure Act (HMDA) of 1975

Especially concerned about discrimination on the basis of age, race, sex, or income

Consumer Financial Protection Bureau (CFPB)

Created as part of the financial services overhaul bill passed in 2010 to protect consumers from unfair, deceptive and abusive practices

Example of CFPB oversight occurred in September 2016 when Wells Fargo Bank was ordered to pay $185 million in fines and penalties to settle “the widespread illegal practice of secretly opening unauthorized deposit and credit card accounts”

Considerable number of laws protect investors who use commercial banks directly to purchase securities and/or indirectly to access securities markets through investing in mutual or pension funds managed by CBs

Various laws protect investors against abuses such as insider trading, lack of disclosure, outright malfeasance, and breach of fiduciary responsibilities

Securities Act of 1933 and 1934

Investment Company Act of 1940

Wall Street Reform and Consumer Protection Act of 2010

Entry into commercial banking is regulated, as are activities once a CB has been established

Increasing/decreasing the cost of entry into a financial sector affects the profitability of firms already competing in that industry

Regulations define the scope of permitted activities under a given charter

For example, current regulations allow commercial banks to perform activities traditionally performed only by insurance companies and investment banks

charter value

Barriers to entry and regulations pertaining to the scope of permitted activities affect a CB’s ___________ and the size of its net regulatory burden

U.S. commercial banks may be subject to the supervision and regulations of as many as four separate regulators

Federal Deposit Insurance Corporation (FDIC)

Office of the Comptroller of the Currency (OCC)

Federal Reserve (FR)

State bank regulators

Facets of regulatory structure

Regulation of the overall operations

Regulation of product and geographic expansions

Provision and regulation of deposit insurance

Balance sheet regulations

U.S. financial system has traditionally been segmented along product lines

Commercial banking involves deposit taking and lending

Investment banking involves underwriting, issuing, and distributing securities

Commercial banking

____________________ involves deposit taking and lending

Investment banking

_____________________ involves underwriting, issuing, and distributing securities

Glass-Steagall Act

The __________________ imposed a rigid separation between commercial and investment banks

Act defined three major exceptions to this separation

By 1987, commercial banks could engage in limited investment banking activity through Section 20 affiliates

In 1999, the Financial Services Modernization Act (FSMA) repealed Glass-Steagall barriers between commercial banking and investment banking

Banking and insurance

Bank Holding Company Act (BHCA) of 1956 and the Garn-St. Germain Depository Institutions Act of 1982 restricted insurance companies from owning or being affiliated with full-service banks

FSMA of 1999 allowed bank holding companies to open insurance underwriting affiliates and permitted insurance companies to open banks and securities firm affiliates

Commercial banking and commerce

BHCA of 1956 required BHCs to divest themselves of nonbank-related subsidiaries over a 10-year period and effectively restricted acquisitions of banks by commercial firms

FSMA of 1999 changed restrictions on ownership limits imposed on financial services holding companies

Nonbank financial service firms and banking

Relative to the barriers separating banking and either securities, insurance, or commercial sector activities, the barriers among nonbank financial service firms and banking are generally much weaker

Activities of nonbank financial institutions (NBFIs) have been termed shadow banking

December 2022 report put assets of shadow banks worldwide at $152 trillion, at the end of 2021

These shadow banks continue to be unregulated by the federal government

FSOC final interpretive guidance give priority to identifying activities that present systemic risks and seek to control risks by making recommendations to primary regulators

shadow banking

Relative to the barriers separating banking and either securities, insurance, or commercial sector activities, the barriers among nonbank financial service firms and banking are generally much weaker

Activities of nonbank financial institutions (NBFIs) have been termed ______________

December 2022 report put assets of shadow banks worldwide at $152 trillion, at the end of 2021

These shadow banks continue to be unregulated by the federal government

FSOC final interpretive guidance give priority to identifying activities that present systemic risks and seek to control risks by making recommendations to primary regulators

Geographic expansions can have several dimensions:

Domestic

Within a state or region

International (participating in a foreign market)

Regulatory factors impacting geographic expansion

Restrictions on intrastate banking by commercial banks

By 1994, only one state (Iowa) had not deregulated intrastate banking

Restrictions on interstate banking by commercial banks

McFadden Act, passed in 1927 and amended in 1933

Douglas Amendment to the Bank Holding Company Act, 1956

By 1994, all states but Hawaii had passed some form of interstate banking law or pact

Regulatory factors impacting geographic expansion

Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994

Allowed U.S. and foreign banks to branch interstate by consolidating out-of-state bank subsidiaries into a branch network and/or by acquiring banks of individual branches of banks through acquisitions or merger

Result of this is that full interstate banking is a reality in the U.S.

Relaxation of the branching restrictions, along with recognition of the potential cost, revenue, and risk benefits from geographic expansions, are major reasons for the recent merger wave (and increased consolidation) in U.S. banking

Federal Deposit Insurance Corporation (FDIC)

Created in 1933 in the wake of the banking panics of 1930-1933 to maintain the stability of, and public confidence in, the U.S. financial system

System worked well until 1979; from October 1979 to October 1982, the Fed changed its monetary policy strategy by targeting bank reserves rather than interest rates to lower the underlying rate of inflation (FDIC Slide)

Led to a sudden and dramatic rise in interest rates, with T-bill rates rising as high as 16 percent

Resulted in DIs facing negative interest spreads and being forced to pay more competitive interest rates on savings deposits to avoid disintermediation

Partly to overcome the effects of rising interest rates and disintermediation on the DIs, Congress passed regulations that expanded DIs deposit-taking and asset investment powers

For a small, but significant, group, this gave them the opportunity to take more risks in an attempt to return to profitability

Problems were exacerbated by a policy of regulatory forbearance, a policy of not closing economically insolvent depository institutions, but allowing their continued operation

regulatory forbearance

Problems were exacerbated by a policy of ___________________, a policy of not closing economically insolvent depository institutions, but allowing their continued operation

potential insolvency

FDIC Improvement Act (FDICIA) was passed in December 1991 to restructure the bank insurance fund and to prevent its ______________

However, the financial market crisis hit the banking industry very badly

During the worst of the crisis (2008-2011), 355 DIs failed at a total cost to the FDIC of $81.7 billion

FDIC and the federal government took several steps to ensure the fund would have sufficient resources to deal with any and all DI failures

From 2013 to 2019 the number of bank failures continued to drop with FDIC reserves becoming positive in the second quarter of 2011 and rose to $128.2 billion by December 31, 2022

Federal Savings and Loan Insurance Corporation (FSLIC) insured the deposits of savings institutions from 1934 to 1989

Savings institution failures in the 1980s led to an insolvent FSLIC by 1989

Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA) of 1989

Restructured savings association fund and transferred management to the FDIC

Restructured savings association insurance fund was renamed the Savings Association Insurance Fund (SAIF) and restructured bank insurance fund was renamed the Bank Insurance Fund (BIF)

FDIC introduced risk-based deposit insurance program on January 1, 1993

In 1996 (for BIF-insured DIs) and 1997 (for SAIF-insured DIs) the fee structure for deposit insurance was changed so that the healthiest institutions paid 0 cents per $100 deposits, while the riskiest paid 27 cents per $100 of deposits

By December 2005, 94.6% of all BIF-insured DIs (and 93.9% of all SAIF-insured DIs) paid the statutory minimum premium

In January 2007, FDIC began calculating deposit insurance premiums based on a more aggressive, risk-based system

A restoration plan for the DIF requires the FDIC to restore DIF reserve ratio to 1.35 percent under Dodd-Frank Act

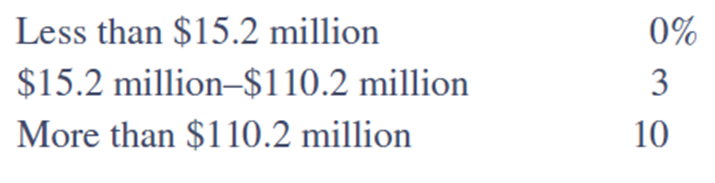

Regulations on commercial bank liquidity

Holding relatively small amounts of liquid assets exposes a CB to increased illiquidity and insolvency risk

Regulators impose minimum liquid asset reserve requirements on CBs

Requirements depend on the illiquidity risk exposure perceived for the CB’s type and other regulatory objectives that relate to minimum liquid asset requirements

Banks in the U.S. must hold the following “target” minimum reserves against net transaction accounts:

Regulations on capital adequacy (leverage)

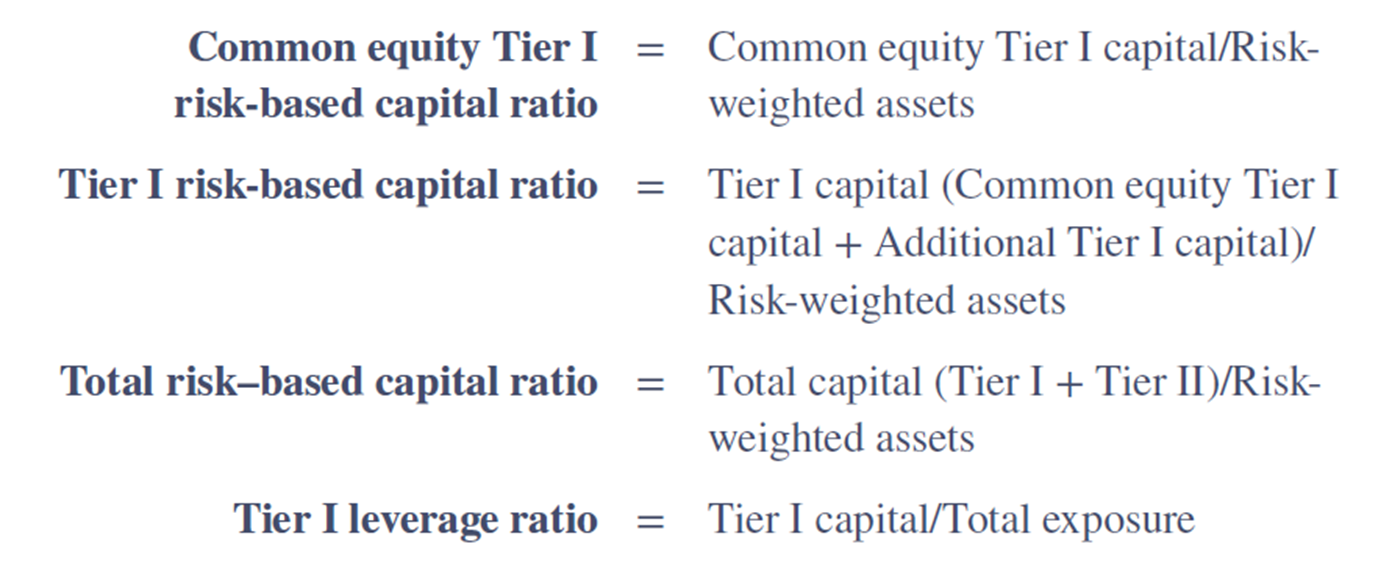

Basel Agreement (i.e., Basel I) imposed risk-based capital ratios on banks in major industrialized countries

Basel II of 2006 allowed for a range of options for addressing both credit risk and operational risk, but the financial crisis of 2008-2009 revealed weaknesses with Basel II

Basel 2.5 was passed in 2009 (effective 2013) and updated capital requirements on market risk from banks’ trading operations

Basel III was passed in 2010 (fully effective in 2019) and the goal is to raise the quality, consistency, and transparency of the capital base of banks to withstand credit risk and to strengthen the risk coverage of the capital framework

Basel Agreement

_______________ (i.e., Basel I) imposed risk-based capital ratios on banks in major industrialized countries

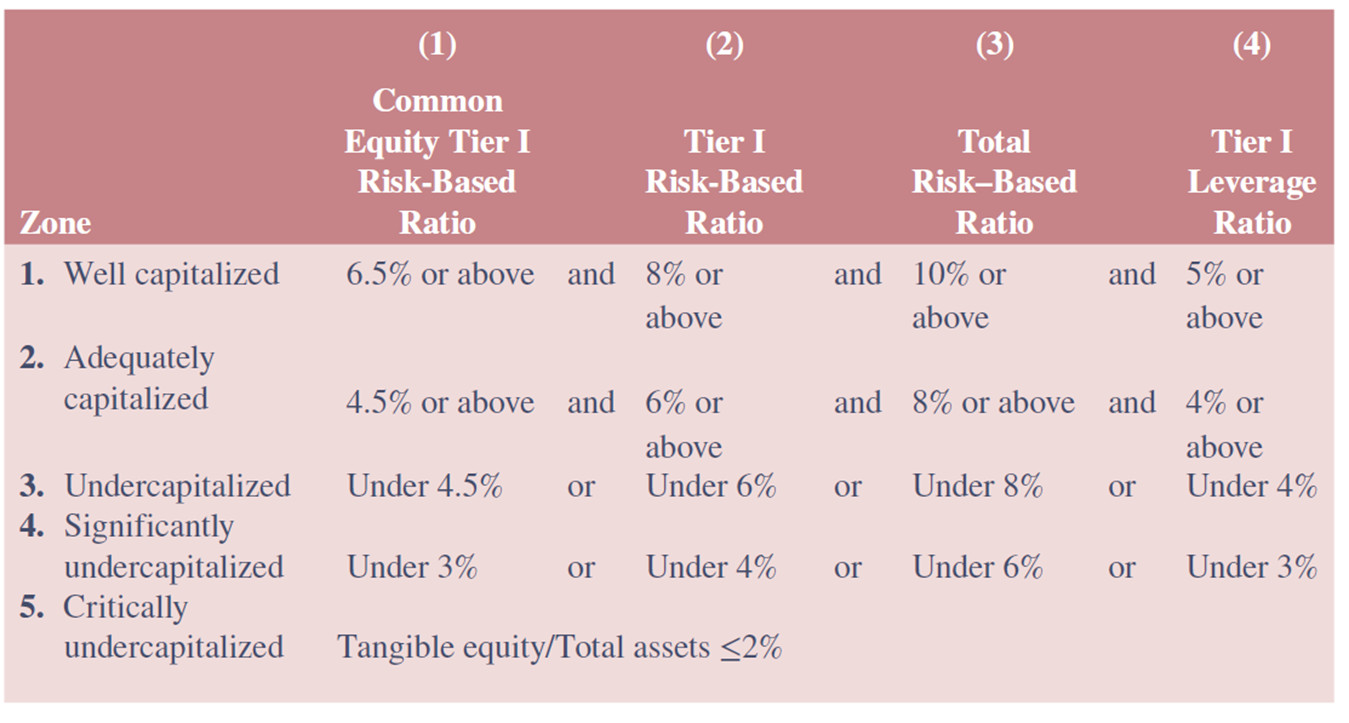

Under Basel III, DIs must calculate and monitor four capital ratios:

Specifications of Capital Categories for Prompt Corrective Action

risks

In measuring a DI’s capital adequacy, its capital is the standard by which each of these ________ is measured

Risk-weighted assets

____________________ are made up of risk-weighted on- and off-balance sheet assets

capital conservation buffer

Basel III introduced a __________________ designed to ensure DIs build up a capital surplus

countercyclical capital buffer

Basel III also introduced a ________________________ that may be declared by any country experiencing excess aggregate credit growth

global systemically important banks

BIS imposed an additional common equity Tier I surcharge on ___________________________

Overseas Direct Investment Control Act of 1964

_______________________________________ restricted U.S. banks’ ability to lend to U.S. corporations that wanted to make foreign investments

Eurodollar market

Offshore funding and lending in dollars created the beginning of the _____________

USA Patriot Act of 2001

__________________________ amended the Bank Secrecy Act in establishing standards for screening customers who open accounts at financial institutions

International Banking Act (IBA) of 1978 declared foreign banks are to be regulated the same as national domestic banks

Foreign banks were required to hold Federal Reserve-specified reserve requirements if their worldwide assets exceeded $1 billion

Foreign banks were subject to Federal Reserve examinations, as well as the McFadden and Glass-Steagall Acts

Foreign Bank Supervision Enhancement Act (FBSEA) of 1991 extended federal regulatory authority over foreign banking organizations in the U.S.; five main features of the act:

Entry

Closure

Examination

Deposit taking

Activity powers