Economics Unit 3 Exam

5.0(2)

Card Sorting

1/43

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

44 Terms

1

New cards

Circular Flow

a model showing how money moves through society.

\

Ex. money flows from producers to workers as wages and flows back to producers as payments for producers.

\

Ex. money flows from producers to workers as wages and flows back to producers as payments for producers.

2

New cards

GDP Equation

C+I+G (X-IM)

3

New cards

Aggregate Demand

the sum of all goods for all goods and services in the economy at all prices for one year.

4

New cards

(A.D) Slopping Downwards; Wealth Effect

when prices rise people buy less stuff so they feel less wealthy.

5

New cards

(A.D) Slopping Downwards; Inflation Rate Effect

as price levels increase, interest rate will increase.

Ex. people spend more, thus there is less left over to loan out.

Ex. people spend more, thus there is less left over to loan out.

6

New cards

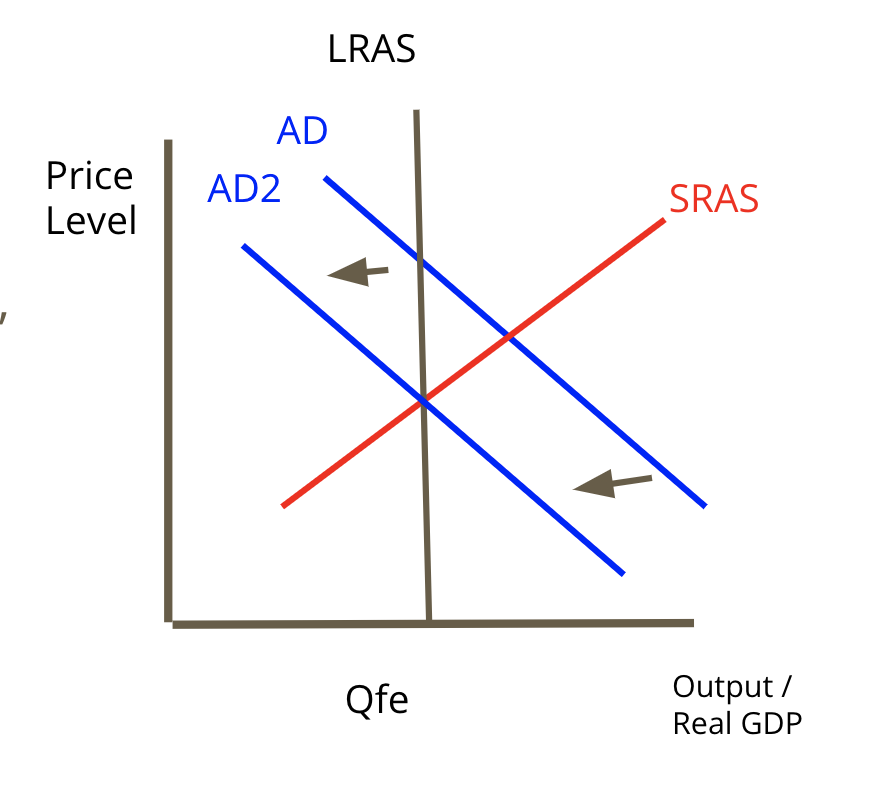

(A.D) Shift to the left

LEFT=BAD

* a reduction in demand at all price levels.

\

Reminder:

* any change in the GDP equation will cause a shift

* a reduction in demand at all price levels.

\

Reminder:

* any change in the GDP equation will cause a shift

7

New cards

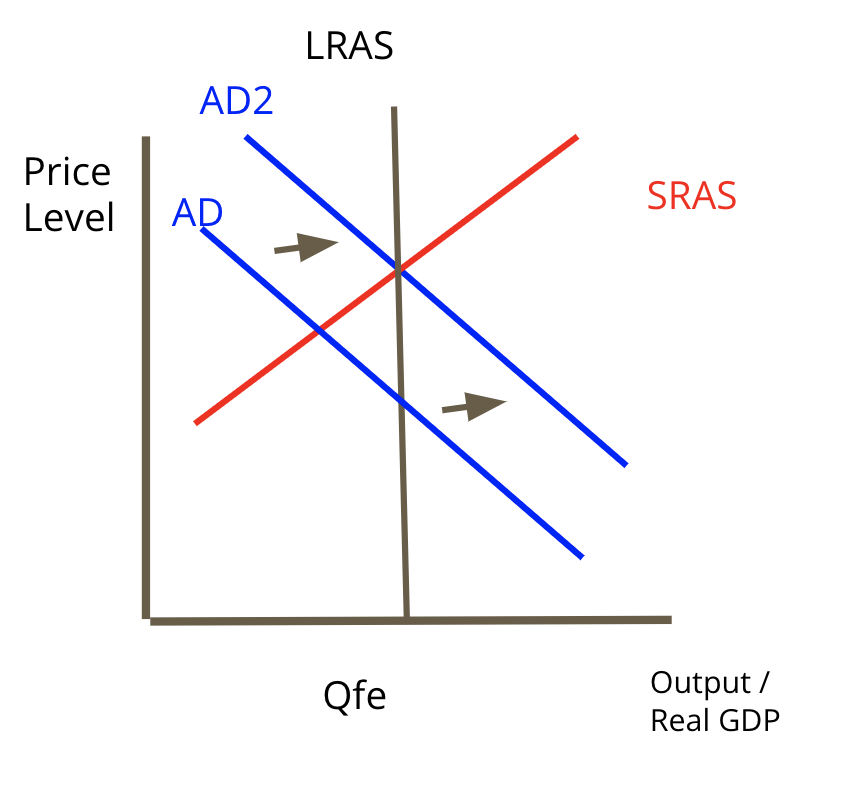

(A.D) Shift to the right

RIGHT=GOOD

* an increase in demand at all price levels

Reminder:

* any change in the GDP equation will cause a shift

* an increase in demand at all price levels

Reminder:

* any change in the GDP equation will cause a shift

8

New cards

Aggregate Supply

is the total of all goods supplied in the economy

9

New cards

Short Run Aggregate Supply (SRAS)

when there is a change in quantity supplied less than 1 year

10

New cards

What shifts (AS)

Key resources

* oil/gas

* energy products (electricity)

* transportations

* Government intervention

* taxes

* laws

* subsides

* oil/gas

* energy products (electricity)

* transportations

* Government intervention

* taxes

* laws

* subsides

11

New cards

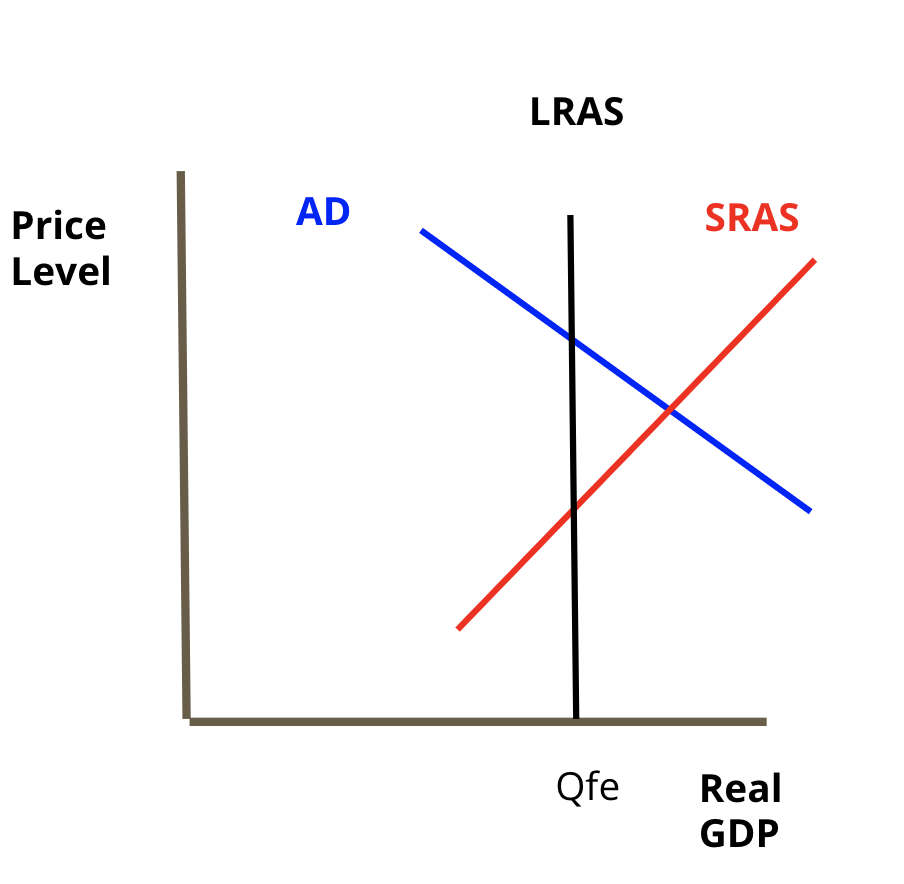

Long Run Aggregate Supply (LRAS)

represents how much an economy is capable of producing when using its resources fully. The level is also known as Quantity Full Employment (QFE)

12

New cards

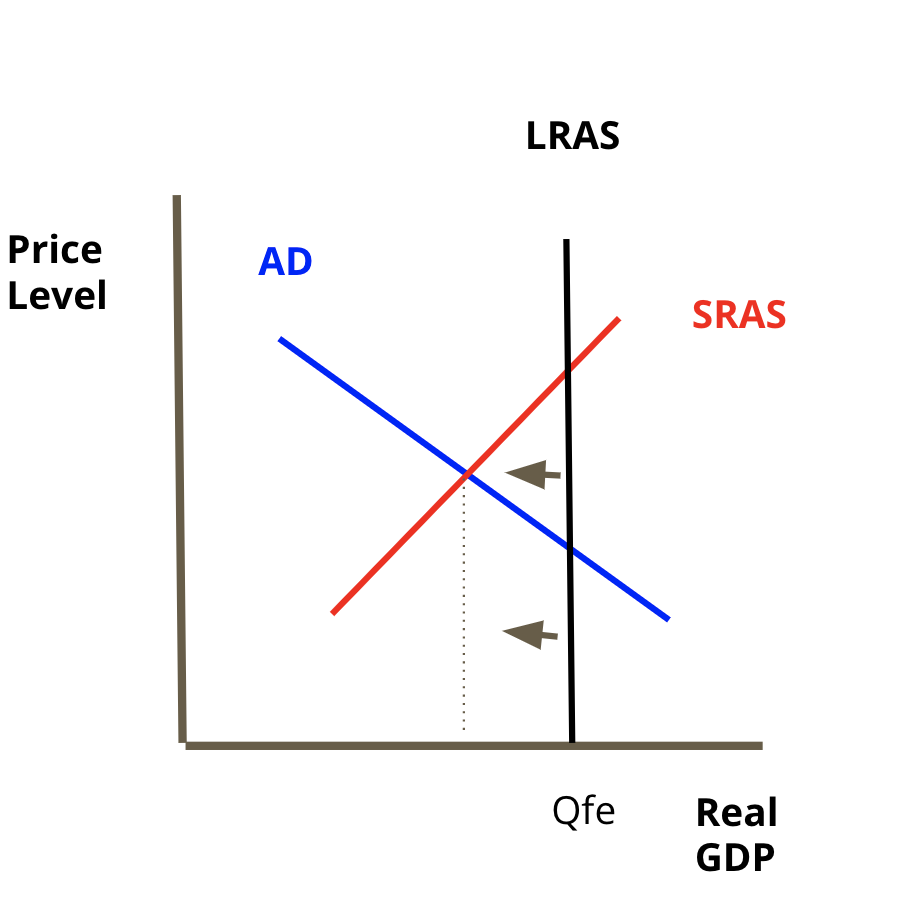

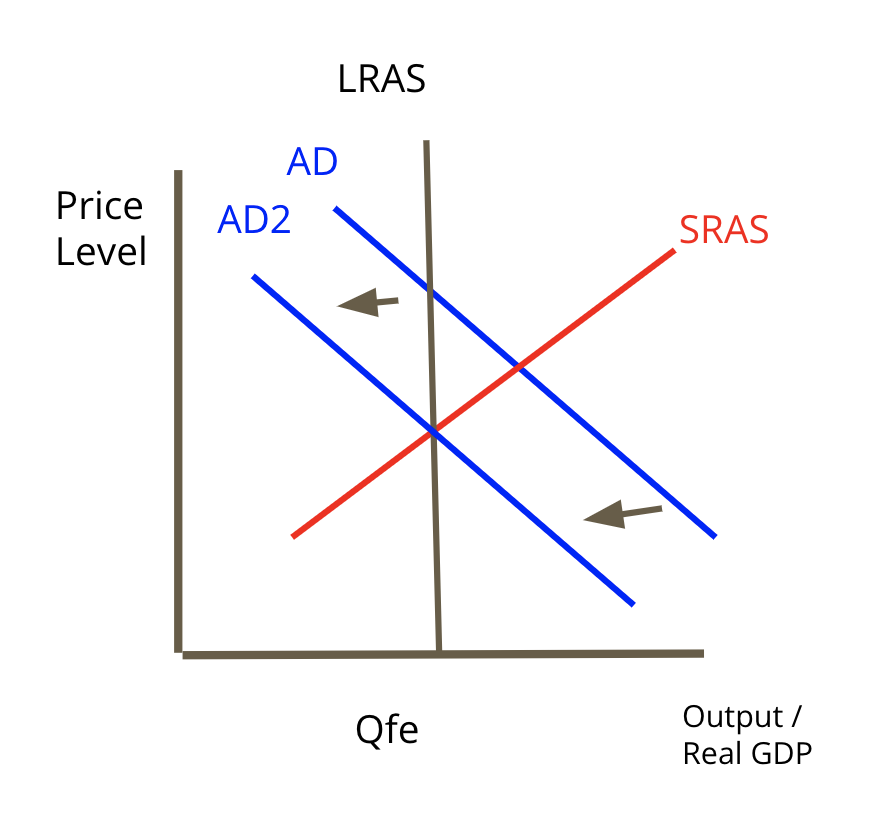

Recession Gap

when the equilibrium of AD and SRAS is to the ==left== of LRAS the economy is in a recessionary gap.

* A recessionary gap looks like a decline in spending, employment, and production.

* A recessionary gap looks like a decline in spending, employment, and production.

13

New cards

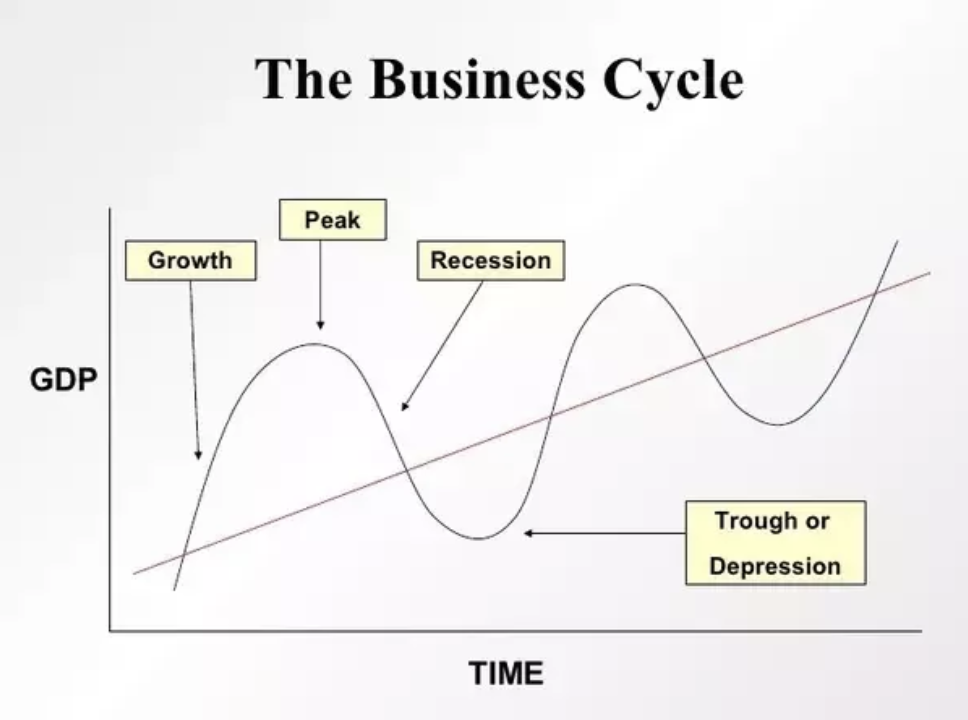

The Business Cycle

Growth: 7-10yrs

Peak: when economic activity reaches its highest point

Recession: (6months- 2 years)

Trough/Depression: 3 years +

Peak: when economic activity reaches its highest point

Recession: (6months- 2 years)

Trough/Depression: 3 years +

14

New cards

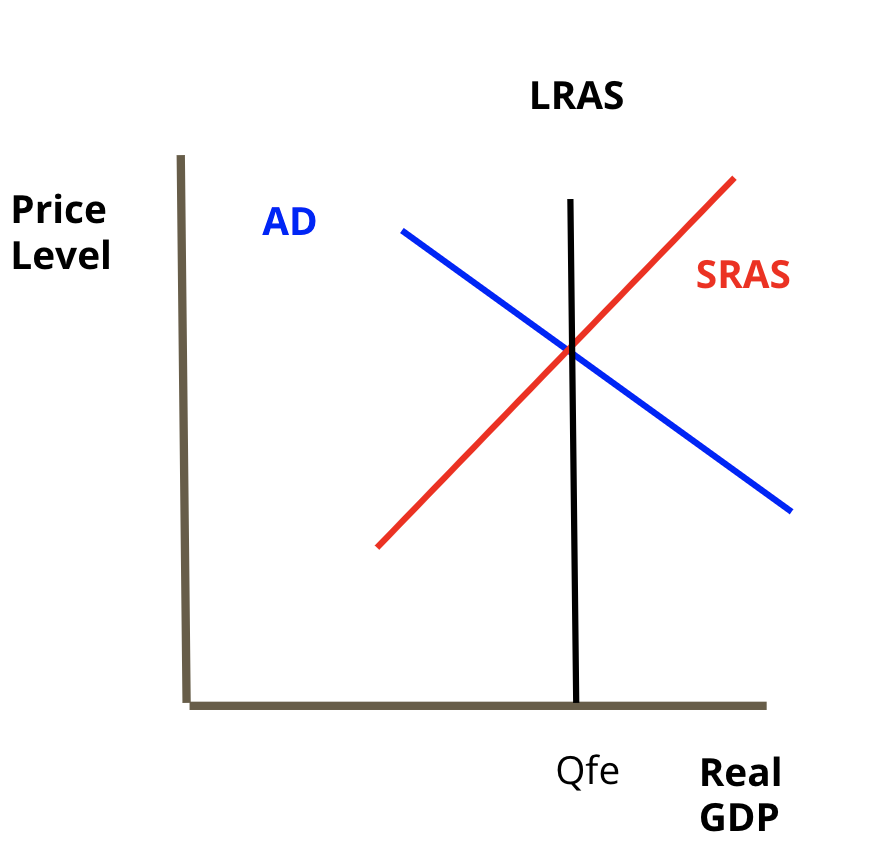

Equilibrium

When AD and SRAS ==cross== at the LRAS for macroeconomics crosses at its LRAS.

* This means we are at our natural rate of output and at full employment, both good economic indicators.

* This means we are at our natural rate of output and at full employment, both good economic indicators.

15

New cards

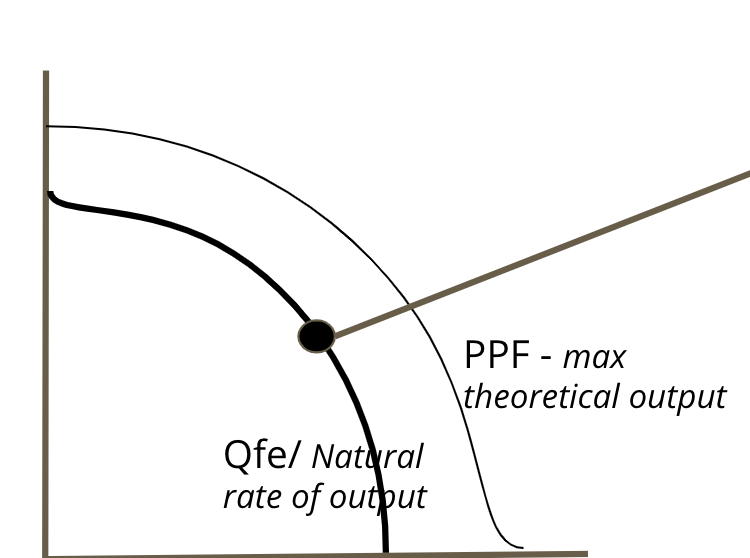

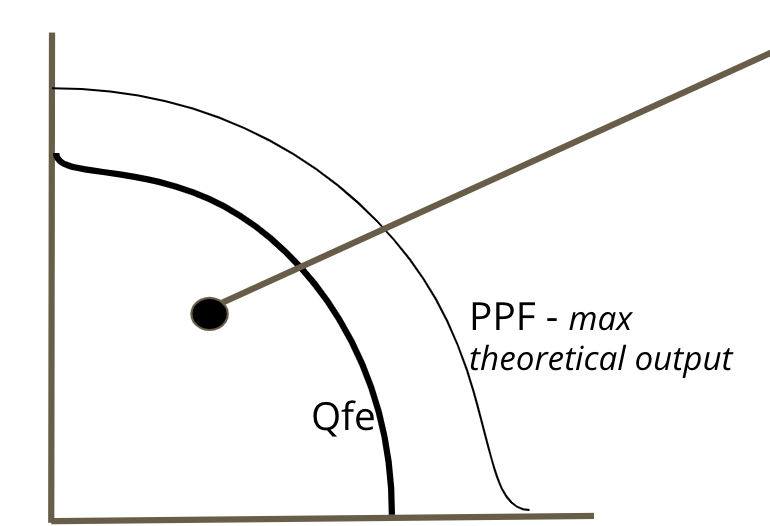

Equilibrium on PPC Curve

When we are at a natural rate of output

16

New cards

Recessionary Gap on the PPC Curve

We are BELOW are natural rate of output

17

New cards

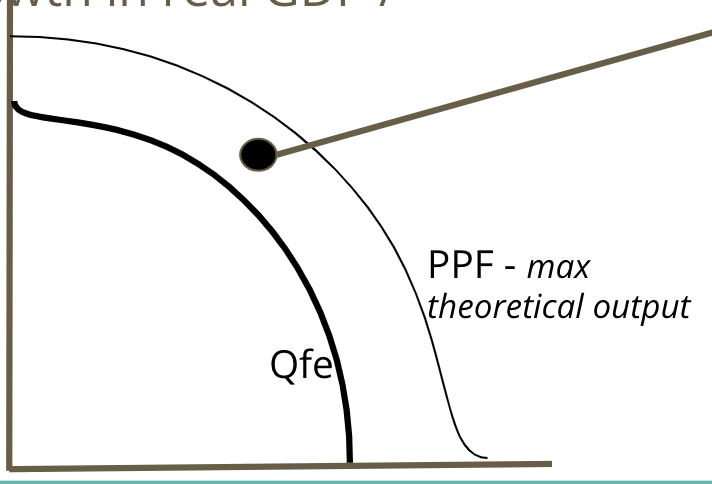

Inflationary Gap

when AD and SRAS are on the ==right== side of LRAS.

* we are experiencing higher inflation (beyond 3%) leading to price increases.

* very high consumer spending, and very less unemployment causing wages to rise.

* we are experiencing higher inflation (beyond 3%) leading to price increases.

* very high consumer spending, and very less unemployment causing wages to rise.

18

New cards

Inflationary Gap on the PPC Curve

When we are ==beyond== our natural rate of output (QFE).

19

New cards

Fiscal Policy

the use of government taxation and spending to alter macroeconomics outcomes.

20

New cards

Spending (direct) affects

Government Spending (G)

21

New cards

Taxation (indirect) affects

Consumer Spending and Investments (C+I)

22

New cards

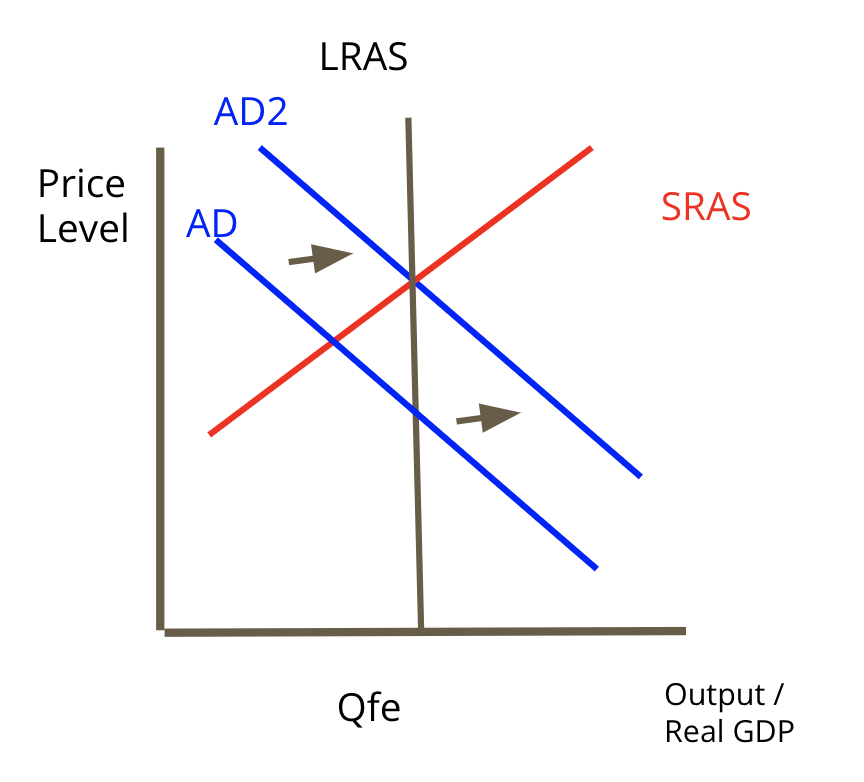

Expansionary Policy

when the economy is in a recessionary gap and we want to speed up GDP.

23

New cards

What happens when we use Expansionary fiscal policy?

Government Spending goes up and lower taxes.

Decrease Taxes:

* sales

* income

Increase Government Spending:

* health

* education

* Infrastructure

Decrease Taxes:

* sales

* income

Increase Government Spending:

* health

* education

* Infrastructure

24

New cards

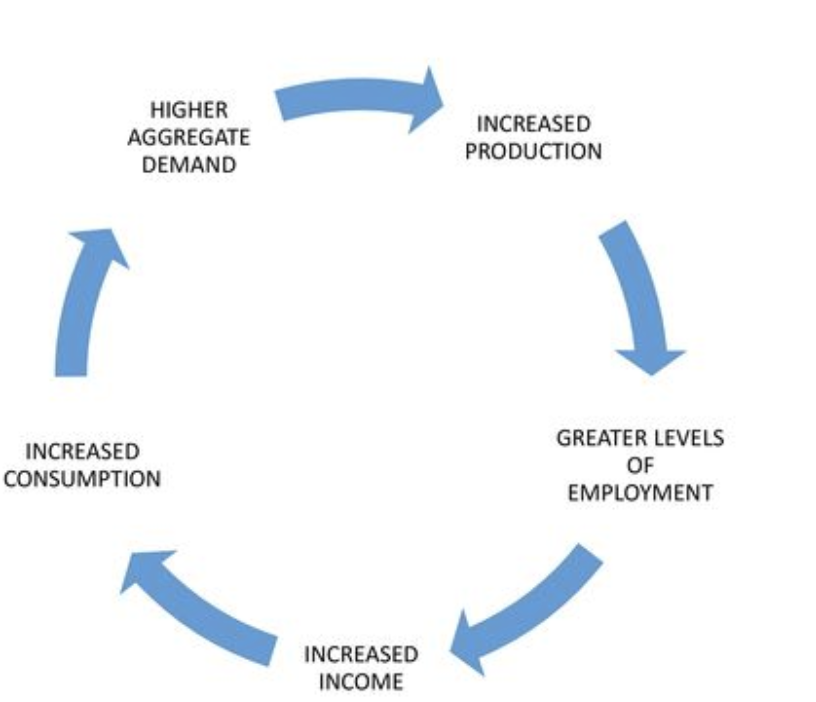

The prosperity Cycle

1. higher aggregate demand

2. increased production

3. greater levels of employment

4. increased income

5. increased consumption

25

New cards

Contractionary Fiscal Policy

when the economy is in a inflationary gap, we want to slow down GDP.

26

New cards

What happens when we use Contractionary Fiscal Policy?

Government Spending goes down and increases taxes.

Increase Taxes:

* sales

* income

Decrease Government Spending:

* health

* education

* Infrastructure

Increase Taxes:

* sales

* income

Decrease Government Spending:

* health

* education

* Infrastructure

27

New cards

MPC

Marginal Propensity to Consume (express as %)

* the higher the MPC, the better for the economic growth

* the higher the MPC, the better for the economic growth

28

New cards

MPS

Marginal Propensity to Save (express as %)

29

New cards

Recognition Lag

hard to see the changes as GDP data is only reported monthly and quarterly.

30

New cards

Decision Lag

slow to create or change a fiscal policy.

31

New cards

Implementation Lag

slow to actually roll out the new policy, hand out the new money, ect.

32

New cards

Impact Lag

takes time to see if the policy you created actually worked.

33

New cards

The multiplier effect

an effect where a change in government spending cause a larger change in GDP.

34

New cards

The Bank of Canada (BOC)

Is the nation’s central bank. Its principal role is to promote the economic and financial welfare of Canada.

* The BOC provides banking services to the federal government

* The BOC provides banking services to the federal government

35

New cards

Easy/Loose money policy

the goal is to speed up economic growth.

* you are trying to create jobs by increasing the money supply (lower interest rates)

* shift AD right

* you are trying to create jobs by increasing the money supply (lower interest rates)

* shift AD right

36

New cards

Tight Money Policy

the goal is to slow down the economy in order to fight inflation or prevent the economy from collapsing. The BOC will reduce money supply

shift AD left

shift AD left

37

New cards

Bank Rate

rate of interest that the BOC charges charted banks and other financial institutions.

38

New cards

Overnight Rate

the rate at which major financial institutions borrow and lend one-day (overnight) funds to and from each other

39

New cards

Prime Rate

the interest rate commercial banks charge their most credit-worthy business customers

40

New cards

Moral Persuassion

basically asking people nice (trying to encourage and persuade them)

41

New cards

CPI (consumer price index)

a way to measure inflation

42

New cards

Role of Bank of Canada

controls the money supply:

* how much money is in the economy (useful for controlling inflation)

setting the interest rate (bank rate):

* at which it will loan funds to chartered banks and other banking institutions

currency

* issuing new bills, printing new money and destroying old money.

* how much money is in the economy (useful for controlling inflation)

setting the interest rate (bank rate):

* at which it will loan funds to chartered banks and other banking institutions

currency

* issuing new bills, printing new money and destroying old money.

43

New cards

Money Supply

controlling how much money is in the economy

44

New cards

Which tool is uses to control the price of money directly?

Interest Rates