2.3 - government interventions, price floor/ceilling, subsidies, taxes

1/26

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

27 Terms

reasons for government interventions into the market

to support firms

to promote equity

to collect government revenue

to support poorer households

to correct market failures

methods of government interventions

indirect taxes

subsidies

price controls

price ceilling

price floor

taxes types

direct

income tax

indirect

goods and services tax

direct taxes types

progressive (more you earn more you pay, tax brackets)

flat/ fixed

regressive (more you earn less you pay)

indirect taxes types

general taxes (on all goods and services)

excise taxes

on alcohol

tobacco

sugar

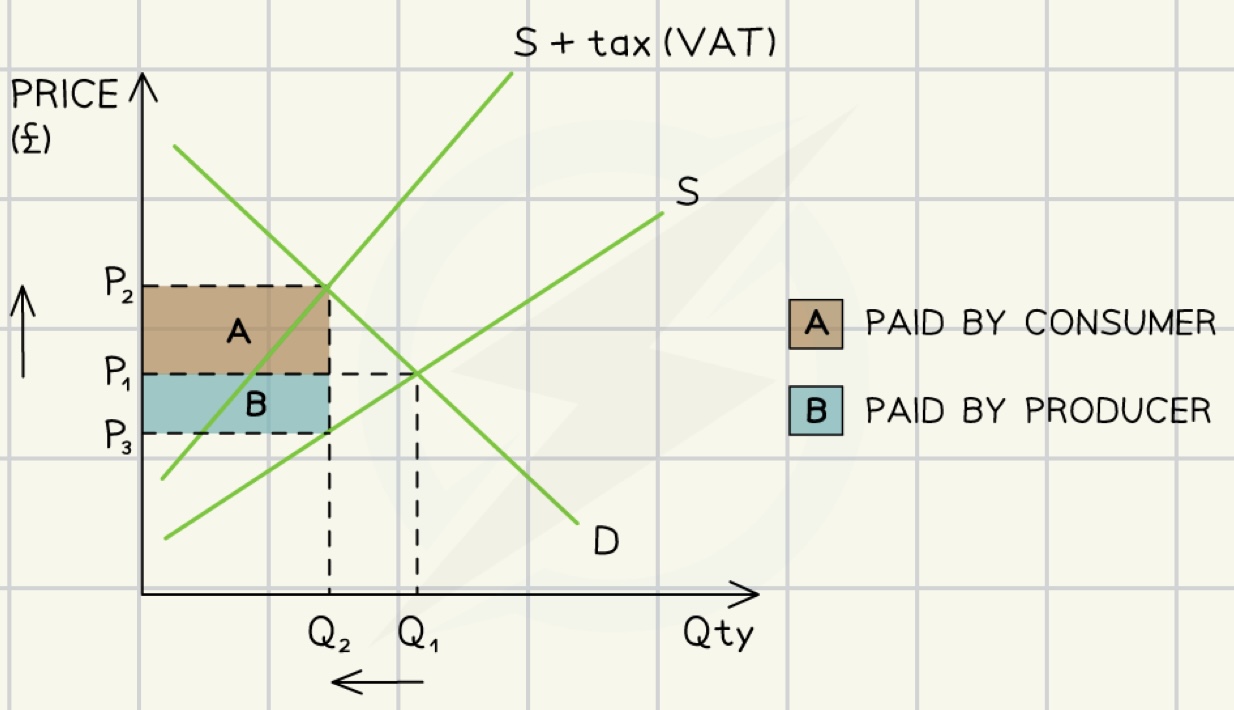

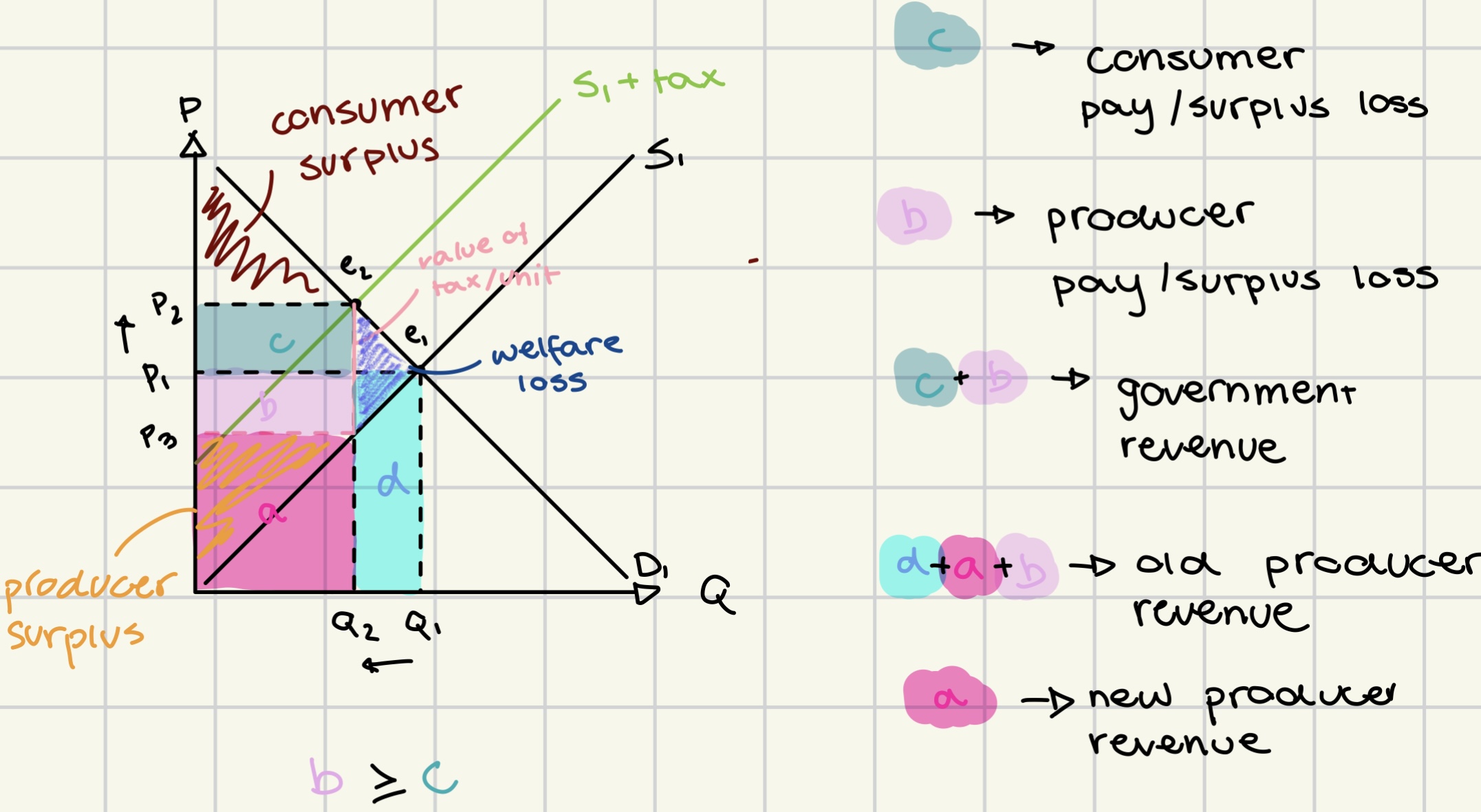

indirect taxes

imposed on government causing supply curve to shift left

ad valorem VAT indirect tax

amount of good/service↑ = tax↑

specific indirect tax

fixed tax per unit of output

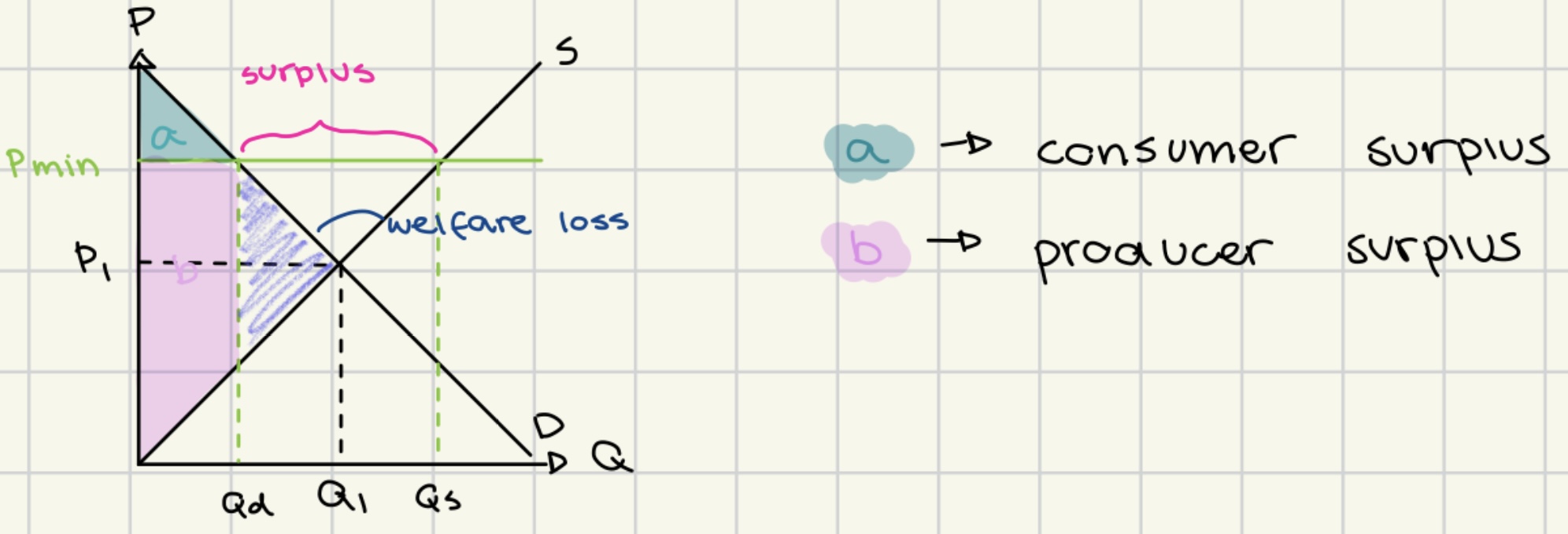

welfare loss

cost to society caused by the lack of efficiency in the allocation of resources

advantages of indirect taxes

raises price and lowers demand for demerit goods

raises revenue for government

disadvantages of indirect taxes

tax may be ineffective on demerit goods

helps develop illegal/ grey markets

may lead to staff layover due to lower demand

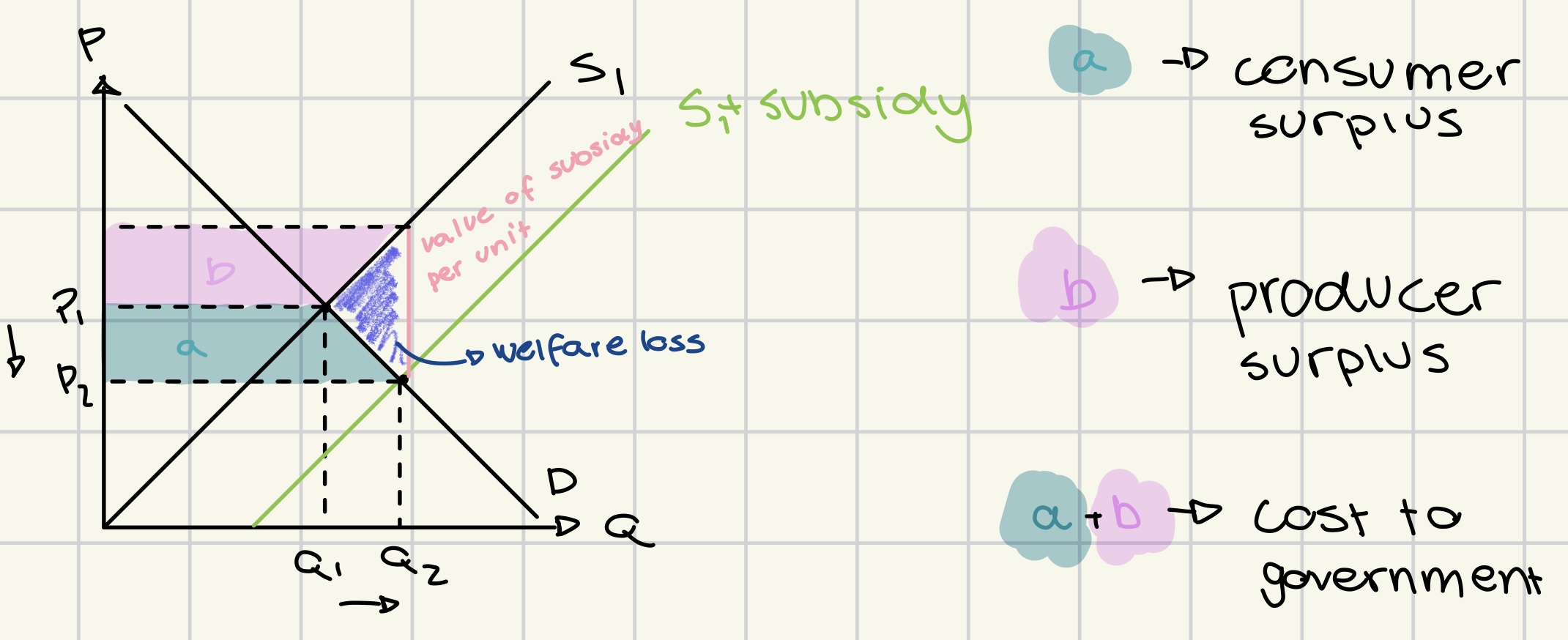

subsidies

financial assistance given by the government

to increase production

to increase provision of merit goods

to reduce costs

to support employment

advantages of subsidies

financial benefits for producers

lowers prices for consumers

increases supply of merit goods

wealth redistribution

may benefit lower-income individuals

encourages economic growth.

disadvantages of subsidies

opportunity cost

over-dependency

stifle innovation

stifle improvements

fairness concerns

mis-allocation of resources

fossil fuel subsidy may discourage investment in green energy

environmental and social impacts

price controls

government regulations that set maximum or minimum prices for goods and services to stabilize the economy.

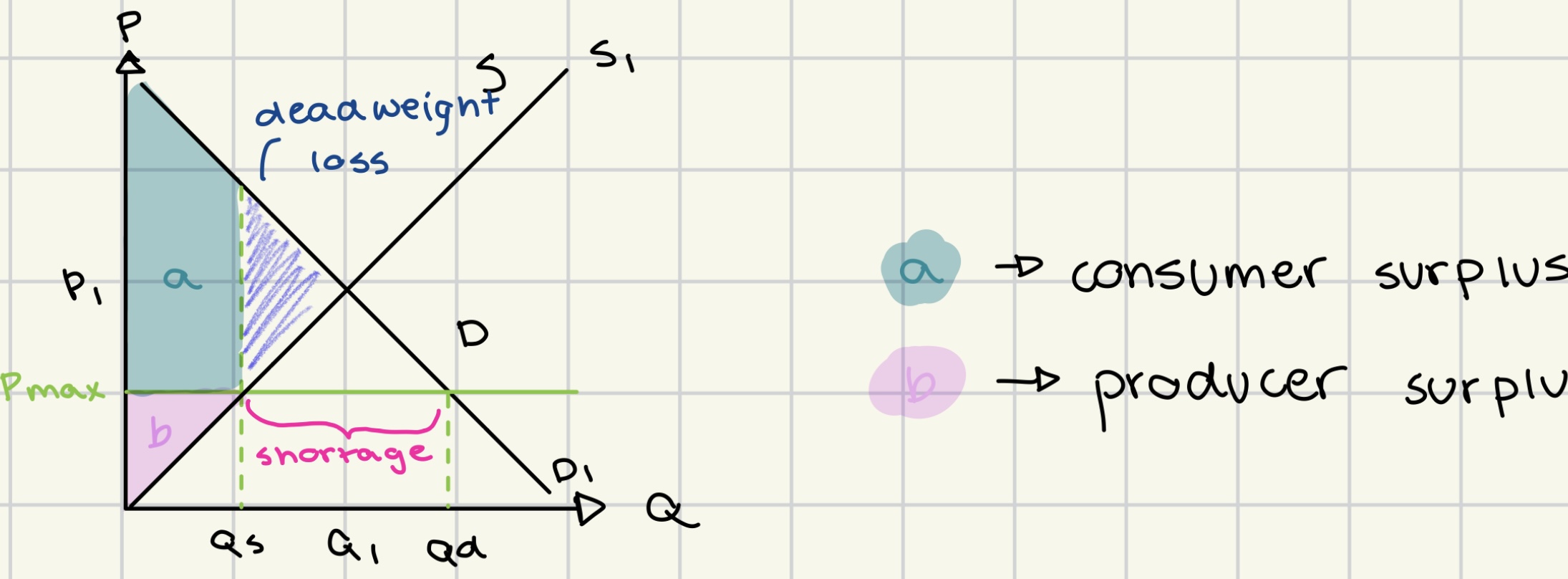

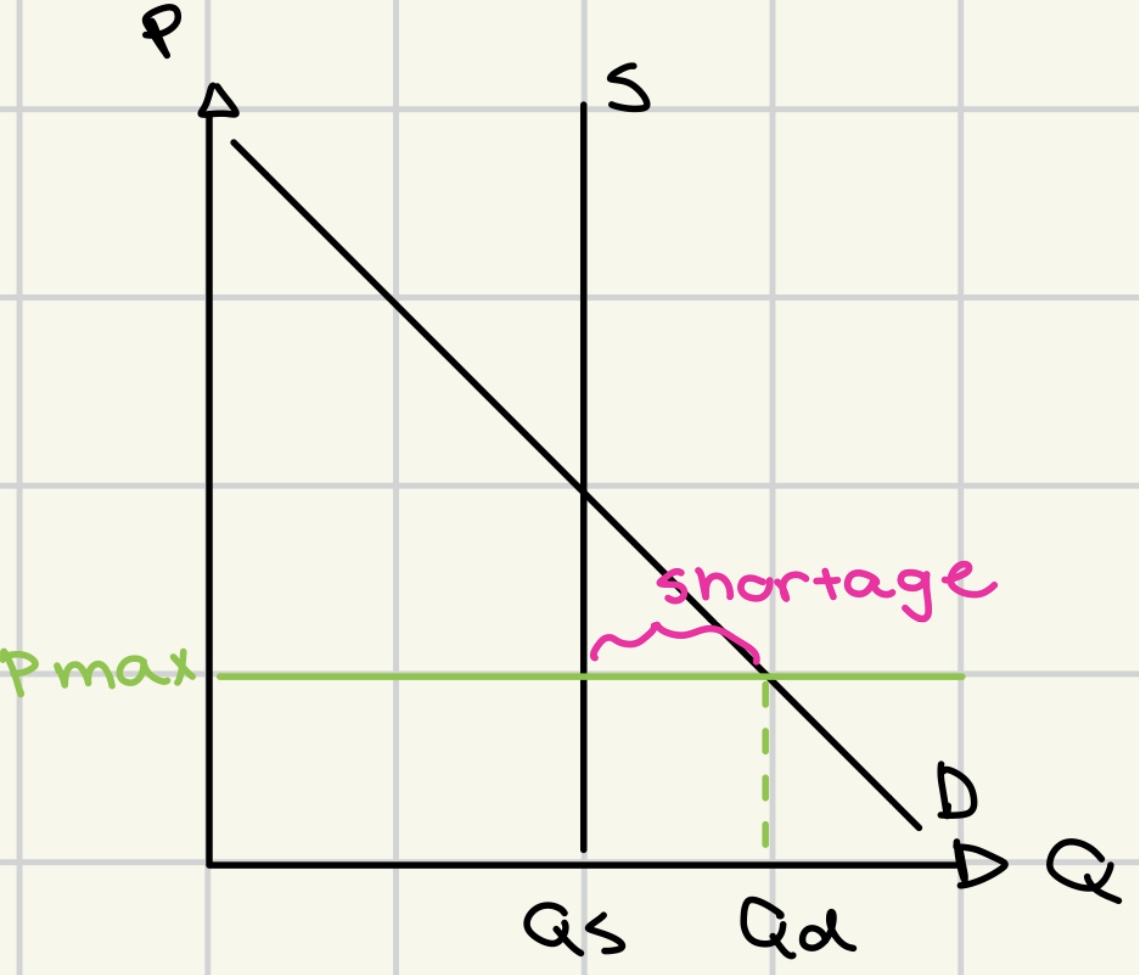

price ceiling

government-set maximum price that can be charged for a good or service

to protect consumers from excessively high prices.

government use of price ceiling

long period of time

rent control

medicine for chronic conditions

short period of time

to stabilize markets that have increased prices due to unusual context

advantages of price ceiling

increased consumer surplus

benefit from lower prices

can protect vulnerable consumers during disasters

can prevent monopolies from setting excessively high prices

disadvantages of price ceiling

shortages

decreased producer surplus

reduces quality

wastage/ over-consumption/

inefficient allocation of scarce resources

creation of illegal/ grey markets

government provision

fixed supply and price ceiling (concert tickets)

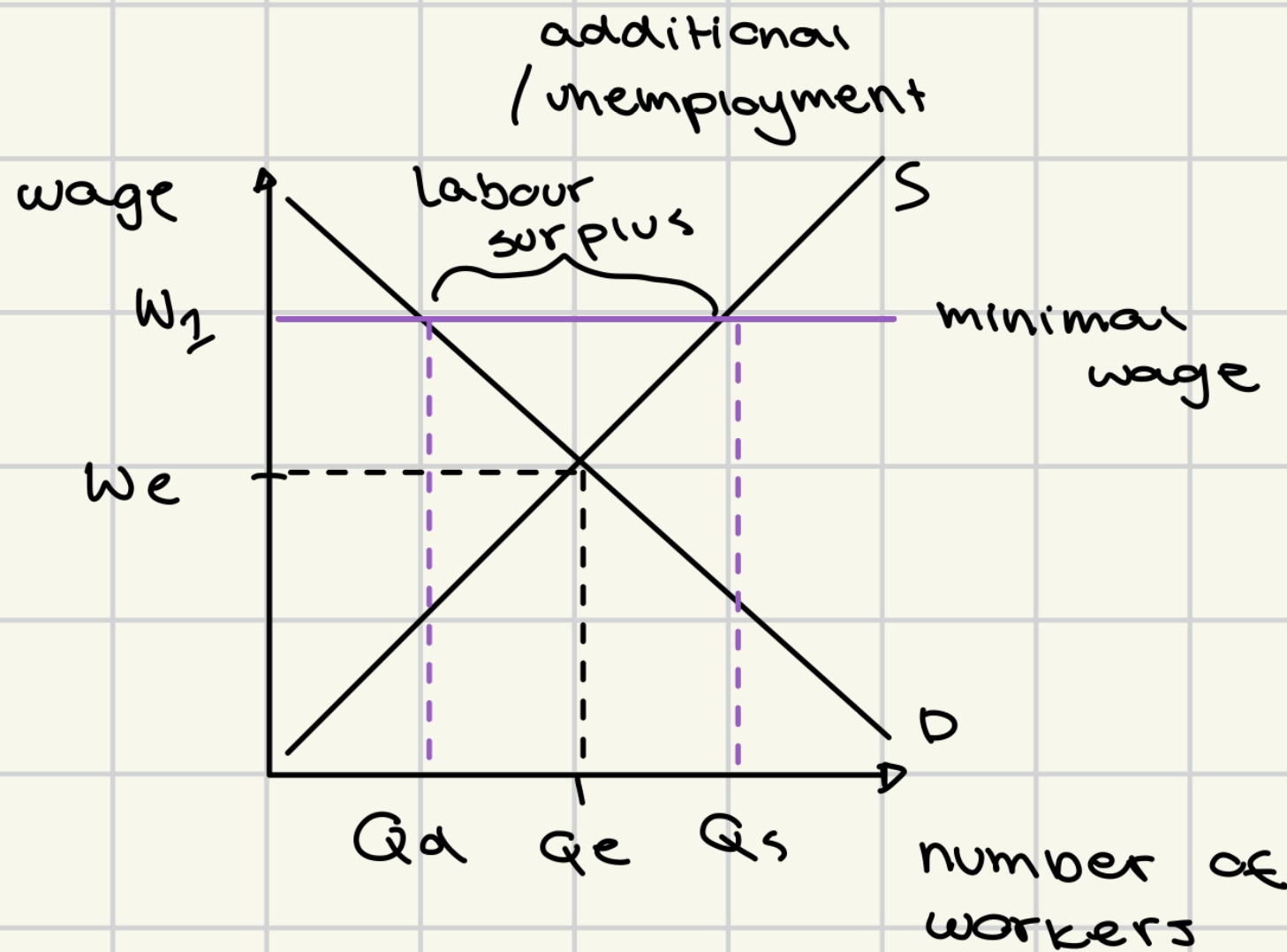

price floor

a minimum price set by the government to prevent prices from being too low

to ensure producers have a fair price

often applied in agricultural markets

government use of price floor

help producers earn more in times of crisis

decrease consumption of a demerit good

to protect workers from wage exploitation

minimal wage

advantages of price floor

increased producer surplus

minimal compensation secured for suppliers

prevention of price fluctuations and market stability

disadvantages of price floor

supply surplus

decreased consumer surplus

potential unemployment

increased prices for consumers

black markets may emerge.

minimum wage

advantages of minimum wage

increased income for workers

reduction of poverty

improved worker productivity and morale.

disadvantages of minimum wage

potential job loss

higher costs od production

reduced demand for low-skilled labor