Ch 10

1/49

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

50 Terms

what is a bond

a security that obligates the issuer to make specified payments to

the holder over a period of time.

what is face value/par value

the final payment to the bondholder at the maturity.

what is coupon rate?

a bond’s annual interest payment per dollar of par value.

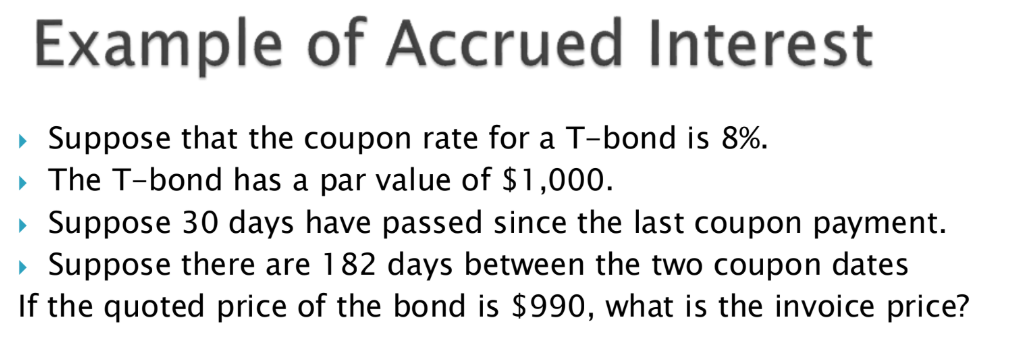

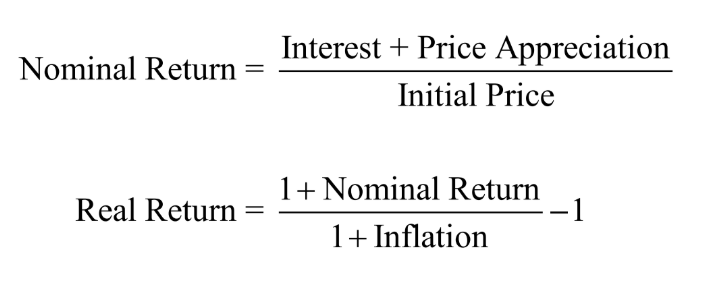

invoice price formula

invoice price = quoted price + accrued interest

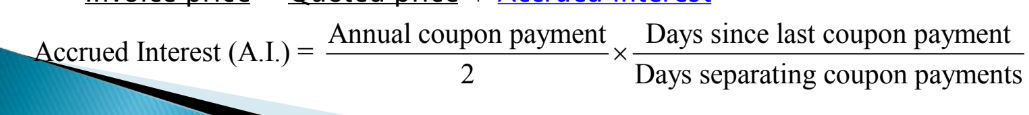

accrued interest formula

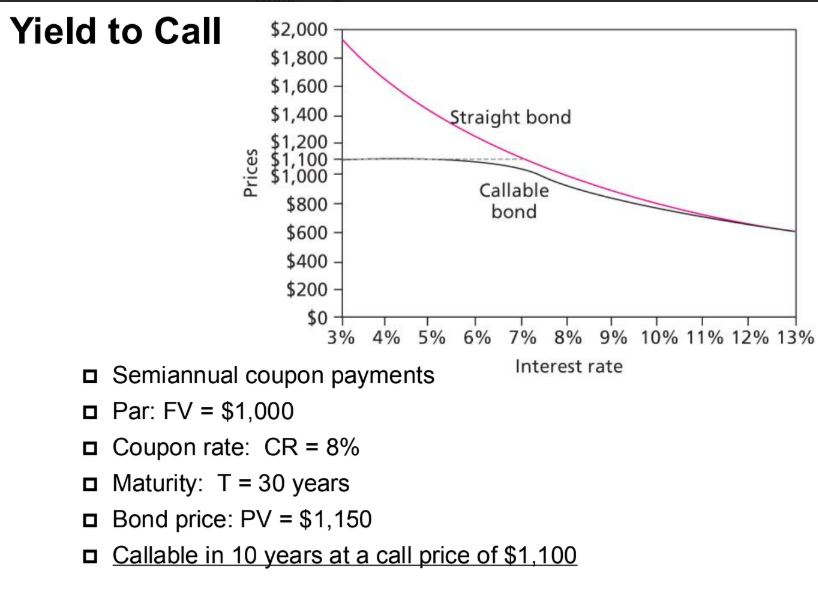

what is a callable bond

the firm has an option to call back bonds.

does callable bonds have a higher coupon rate than regular bonds?

yes

what are convertible bonds

do they have a lower or high coupon rate than nonconvertible bonds

the buyer has an option to convert bonds into stocks.

lower coupon rate than nonconvertible bonds.

what are puttable bonds

does the bond have lower or higher rate

the buyer has an option to convert bonds into stocks.

lower coupon rate than nonconvertible bonds.

what is flating-rate bonds

coupon rates periodically reset according to some

market rates

what are yankee bonds

Dollar-denominated bonds sold in the U.S. by

non-U.S. issuers

what are samurai bonds

Yen-denominated bonds sold in Japan by non-

Japanese issuers

what are bulldog bond?

Pound-denominated bonds sold in the U.K. by

non-U.K. issuers

what are euroyen?

Yen-denominated bonds selling outside Japan

what are eurosterling

Pound-denominated bonds selling outside the U.K.

what are inverse floaters?

Coupon rate falls when interest rates rise

what are asset-backed bonds

Income from specified assets used to service debt

what are pay-in-kind bonds

Issuers can pay interest in cash or additional bonds

what are catastrophe bonds

Higher coupon rates to investors for taking on risk

what are index bonds

Payments tied to general price index or price of a

particular commodity

what are TIPS

Par value

of bond increases with consumer price index

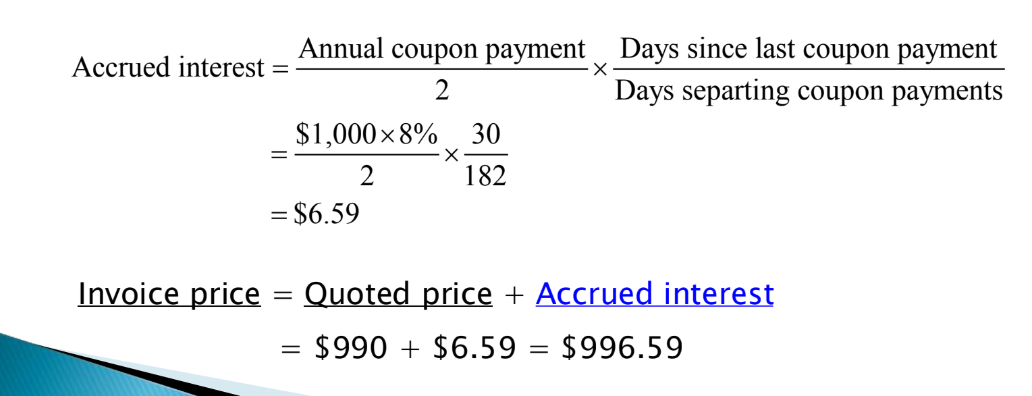

Nominal Return and Real Return formula

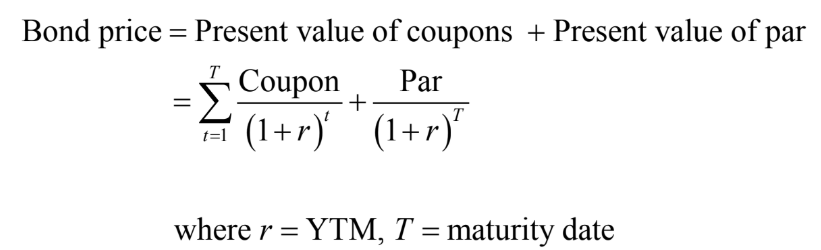

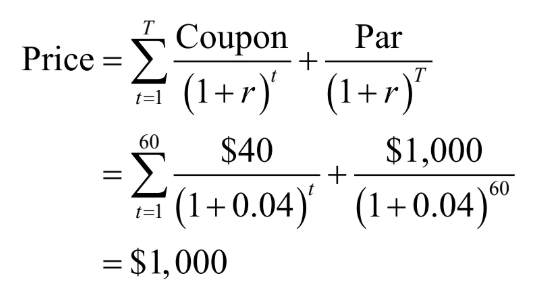

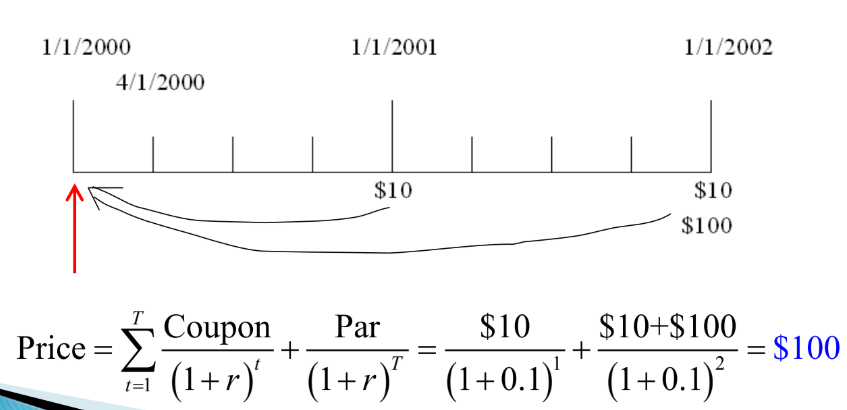

what is bond pricing

calculating the pv of all future cash flow at YTM

what is ytm

universal discount rate for cash flows of any horizons.

bond price formula

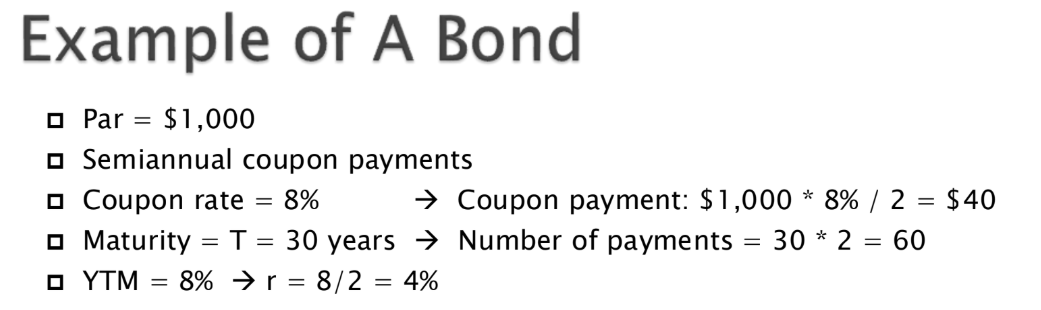

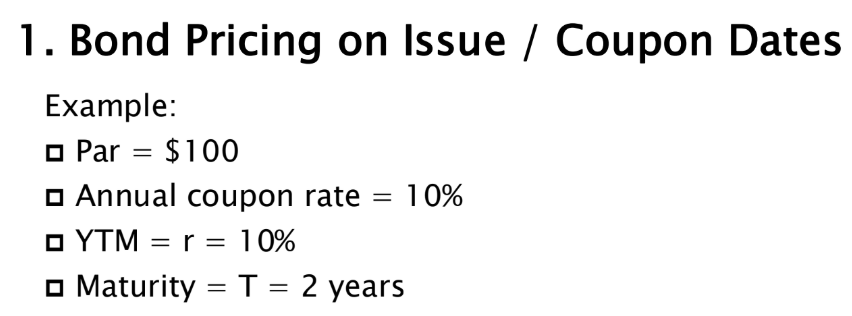

find the price

slide 22 - 24

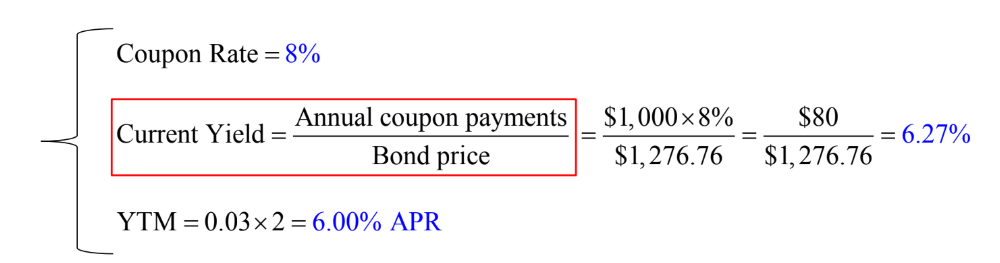

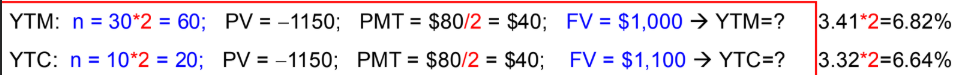

Par= $1,000

Semiannual coupon payments

Annual coupon rate = 8%

Maturity = T = 30 years

Bond price = PV = $1,276.76

Find Current YIeld

Find APR

if the interest rate (YTM) is constant over the life of the bond,

would the bond price still varies over time?

Answer: the bond price still

varies over time unless it’s

sold at the par (CR=YTM).

Separate Trading of Registered Interest and

Principal of Securities (STRIPS)

• Oversees creation of zero-coupon bonds from

coupon-bearing notes and bonds

Determinants of Bond Safety

coverage ratios

leverage ratios

liquidity ratios

profitability ratios

cash flow to debt ration

what is a bond indenture

contract between issuer and holder

what is a sinking fund

periodic repayment of bonds

what is a subordination clause (bond indenture)?

restric additional borrowing

senior bondholder get paid first

what is collateral

asset for possible default

what is debenture

not backed by collateral

what is credit default swaps

Insurance policy on default risk of corporate

bond or loan

(Designed to allow lenders to buy protection

against losses on large loans)

what is term structure of interest rates

YTM and term to maturity relationship

what is expectations hypothesis

YTM based on future short-term interst rates

what are the three explaination of the yield curve

expectations theory

liquidity prefernce throry

synthesis

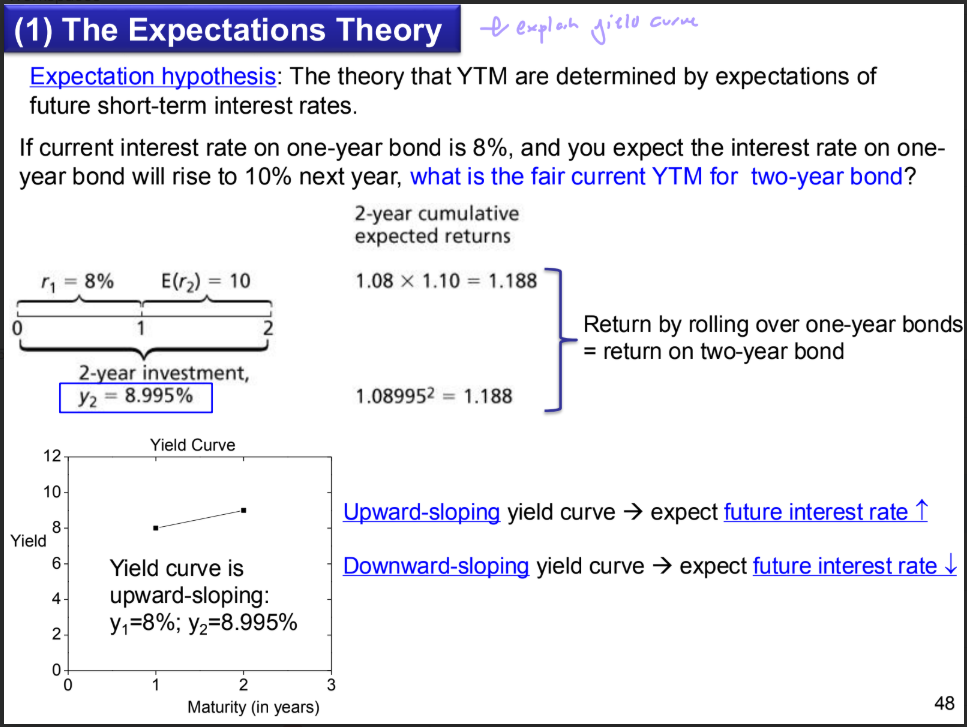

what is the expectation hypothesis

The theory that YTM are determined by expectations of

future short-term interest rates.

If current interest rate on one-year bond is 8%, and you expect the interest rate on one-year bond will rise to 10% next year, what is the fair current YTM for two-year bond?

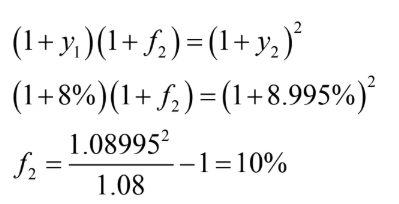

what is forward rate

Inferred short-term ROI for future period,

makes expected total return of long-term bond

equal to that of rolling over short-term bonds

We observe y1=8% and y2=8.995%, we can infer one-year forward rate:

what is the liquity preference theory

The theory that investors demand a risk premium

on long-term bonds.

The yield curve will be upward-sloping even in the absence of any expectation

of future increases in interest rates.