Financial Accounting 1 chapter 1,2,3 review

1/38

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

39 Terms

External Users

Shareholders, Lenders, External Auditors, Nonmanagerial Employees, Regulators (People outside the company)

Internal Users

Purchasing managers, Human resource managers, Production managers, Research and development managers, Marketing managers

(People inside the company that use accounting info to make decisions for the company)

3 Factors of Fraud Triangle

Oppurtunity

Rationalization

Pressure

Generally Accepted Accounting Principles (GAAP)

The set of accounting rules and practices used in the United States to prepare financial statements.

Financial Accounting Standards Board (FASB)

FASB sets GAAP, was given authory by SEC and works closely with them

International Accounting Standards Board (IASB)

Issues International Financial Reporting Standards(IFRS).

• Standards identify preferred accounting practices.

• Standards are similar to, but sometimes different from U.S. GAAP.

General Principles

the assumptions, concepts, and guidelines for preparing financial statements.

Specific Principles

detailed rules used in reporting business transactions and events.

Measurement Principle (Cost principle)

Accounting information is based on actual cost. Actual cost is considered objective.

Revenue Recognition Principle

1. Recognize revenue when goods or services are provided to customers and

2. at an amount expected to be

received from the customer.

Expense Recognition Principle (Matching Principle)

A company has to record its expenses when incurred to generate the revenue reported

Full Disclosure Principle

A company reports the details behind financial statements that would impact users’ decisions in the notes to the financial statements (includes information about assets, liabilities, revenues, expenses, pending lawsuits, and incomplete transactions)

Going-Concern Assumption

The business is presumed to continue operating instead of being closed or sold

Monetary Unit Assumption

Transactions and events are expressed in monetary, or money, units

Time Period Assumption

The life of a company can be divided into time periods, such as months and years

Business Entity Assumption

A business is accounted for separately from other business entities, including its owner

Cost-Benefit Constraint

Only information with benefits of disclosure greater than the cost need to be disclosed

Materiality Constraint

Only information that would influence the decisions of a reasonable person need to be disclosed

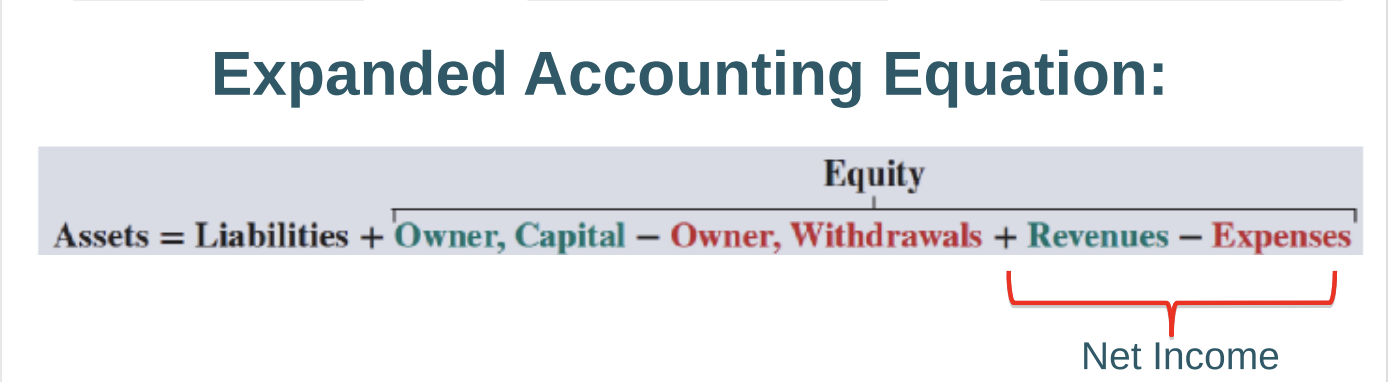

The accounting equation

Assets=liabilities+ equity

Assets

Resources a company owns or controls that are expected to carry future benefit

Liabilities

Creditors’ claims on assets; claims reflect obligations to transfer assets or provide products or services to others

Owners Capital (Equity 1/4)

Owner investments are inflows of cash and other net assets from owner contributions; increases equity (Credit)

Revenues (Equity 2/4)

Total amount of money business earns from completing sales or services in a period of time; increases equity (Credit)

Owner Withdrawals (Equity 3/4)

Outflows of cash and other assets to owners for personal use; decrease equity (Debit)

Expenses (Equity 4/4)

Cost of assets or services used to earn revenues; decreases equity (Debit)

Equity

Owner’s claim on assets; assets- liabilities; also called net assets or residual equity (Equity is made up of 4 parts; Owners capital, Revenues, Owner Withdrawals, Expenses)

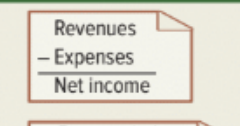

Income Statement

Describes a company’s revenue and expenses and computes net income or loss over a period of time (First financial statement)

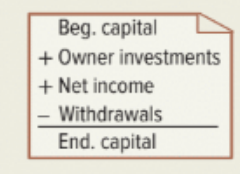

Statement of Owner’s equity

Explains changes in owner’s equity from owner investments, net income (or loss), and any withdrawals over a period of time (2nd financial Statement)

Balance Sheet

Describes a company’s financial Position (Types and amounts of assets, liabilities, and equity) at a single specific point in time (3rd financial statement)

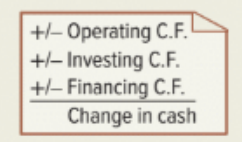

Statement of Cash Flows

Identifies cash inflows (receipts) and cash outflows (payments) over a period of time

Return on assets (ROA)

Net income divided by the average total assets invested

Accrual basis

Revenues are recorded when products or services are delivered, and records expenses when incurred; most companies use this and is compliant with GAAP

Cash basis

Revenues are recorded when cash is received and expenses are recorded when cash is paid (barely used; only some small companies use it; not compliant with GAAP)

depreciation

Instead of expensing the cost of a plant asset (equipment, building, cars, etc.) in the year it is purchased we allocate, or spread out, the cost over their expected useful lives

Straight line depreciation formula

Unearned revenue

Cash received in advance of providing products or services

Accrued expense

costs incurred in a period that are both unpaid and unrecorded

Accrued revenue

revenues earned in a period that are both unrecorded and not yet received in cash or other assets

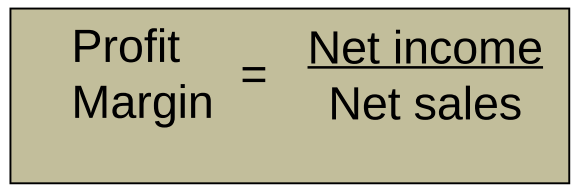

Profit margin

The profit margin ratio measures the company’s net income to net sales