E100 Topic 1 - Online and Digital Markets

1/51

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

52 Terms

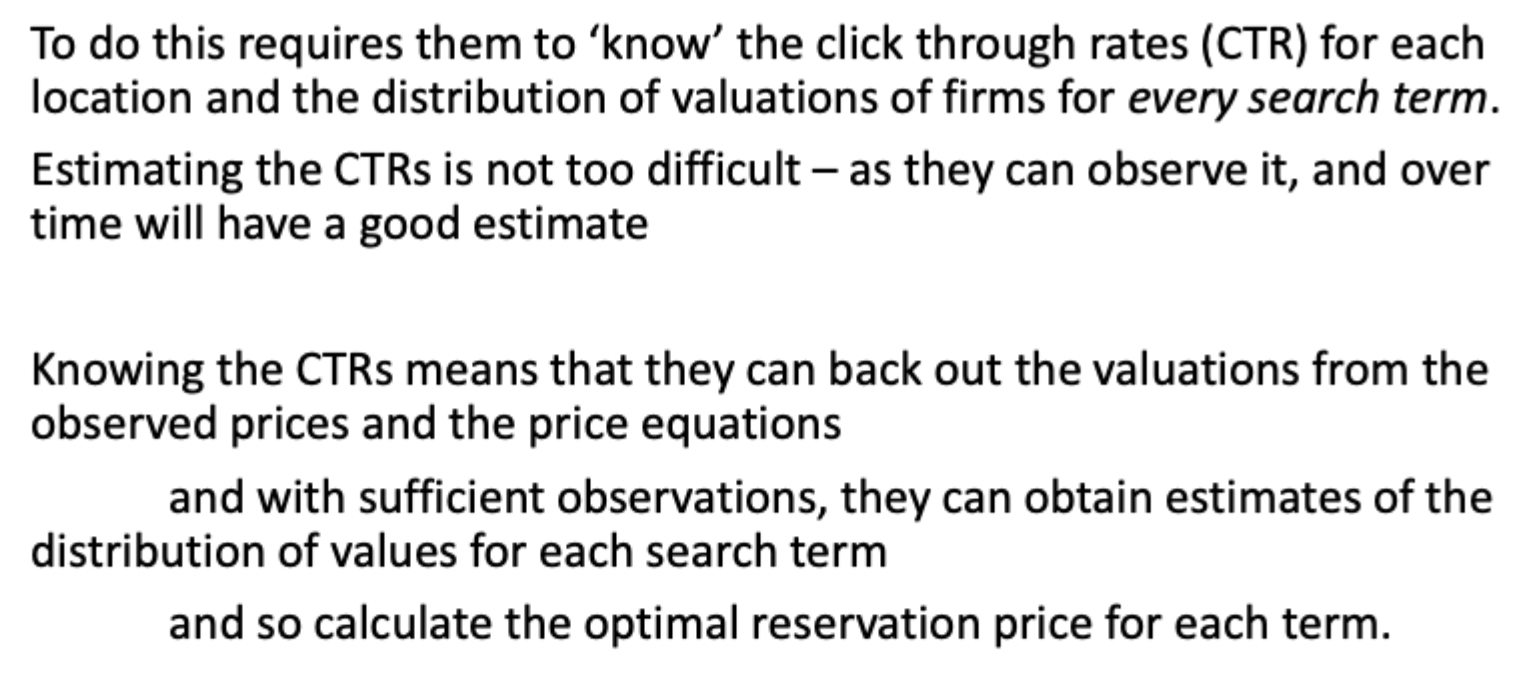

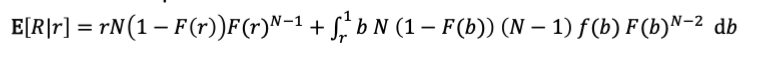

Posted price expected revenue

English auction + bidding strategy

An auction type starting at a low price then raising until one person remains, who then pays that price.

Bidding strategy is to bid slightly higher than the known highest bid unless it is greater than the utility gained from doing so. If everyone follows this strategy, the winner will be the buyer with the highest valuation and will pay approximately the second highest valuation as the price.

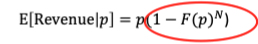

Expected revenue for English + Second Price Sealed Bid auctions

Second Price Sealed Bid auction

Buyers submit secret bids, and the person with the highest bid wins and pays the second highest bid as the price. An example of a Vickrey auction

Vickrey auction

Truthful bidding of your valuation, winner is the agent with the highest valuation, and the winner pays the opportunity cost to others incurred by participating in the auction.

First price sealed bid + Dutch auctions

FPSB: Secret bids, where the highest valuation wins and pays that bid

Dutch: Price starts high and then descends until someone is willing to pay it

Both of these are strategically equivalent

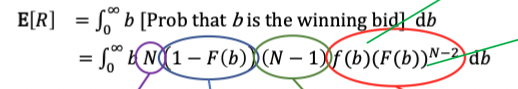

Bidding strategy for Dutch + FPSB auctions

Buyers will not want to pay their full valuation so will shave their bids. Attached is the bidding strategy under symmetric EQ when utilities are UNIFORMLY DISTRIBUTED.

Revenue Equivalence Theorem Conditions

Valuations are drawn from the same continuous and straitly increasing distribution

All buyers are risk neutral

The bidder with the highest valuation always wins the auction and the bidder with 0 valuation will pay 0.

Formula for a SPSB auction with a reserve price

Differentiate wrt. r to find the optimal reserve price

Optimal selling mechanism conditions

Maximises expected revenue

Must be incentive compatible (everyone is prepared to declare their true valuation if everyone else does)

Must be individually rational (i.e. not participating must always be an option)

Revelation Principle

Given a mechanism with an EQ outcome, there exists a direct mechanism in which:

It is an EQ for all agents to truthfully reveal their valuation

The outcome is the same as in the original EQ

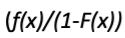

Conditions for SPSB with optimal reserve to be an optimal mechanism

Buyers’ valuations are symmetric: they all come from the same distribution

Buyers’ valuations are regular: they have a hazard rate function that is increasing in x

Not efficient though: although it maximises sellers’ expected revenue, it is possible that the item remains unsold even though someone would have been prepared to pay a positive price for it. If efficiency matters, a Vickrey auction (SPSB no reserve) is the best you can do.

Costs of auctions (hence the prevalence of posted prices)

Sellers:

Need to coordinate buyers to engage simultaneously

Requires communication between all buyers

More costly to implement

Competition between sellers for sale of identical product

Buyers:

Impatience waiting for auction to complete

Requires more direct engagement int eh bidding process

Uncertainty of outcome

Desirable alternative may become available before the auction completes

Optimal strategy in a position auction with public vs private valuations

Public: backward induction - bottom firm (outside of the positions) bids their valuation (though could generate same EQ with any bid between their valuation and next firm’s bid). Each next firm then will set their bid at the level that equalises payoff between the position they take off the firm below them and the position they could take off the firm above them.

Private: don’t know their position re valuations, so bid for the position that grants the maximum payoff (i.e. when price is taken into consideration - (valuation per click - price) * quantity of clicks)

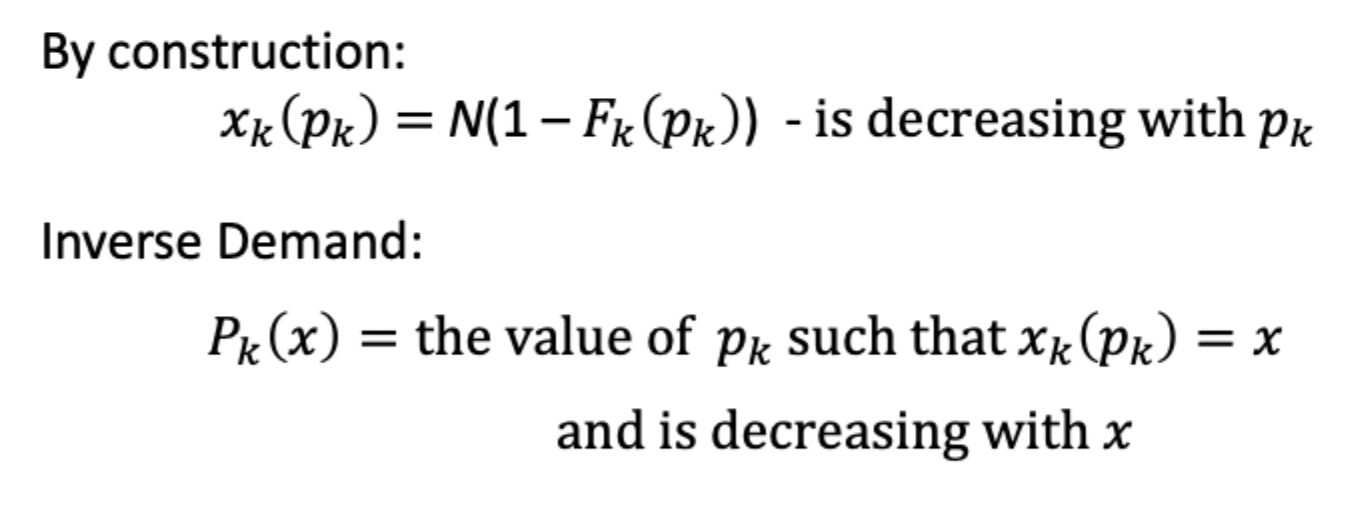

Calculating a demand function where willingness to pay is an RV

i.e. it is all consumers that have a willingness to pay greater than or equal to the products’ price

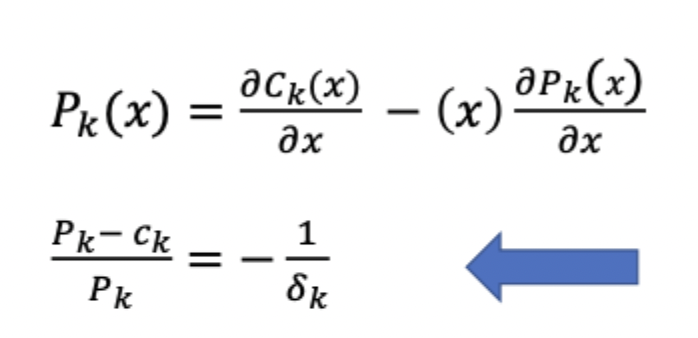

Lerner Index

Picture attached shows how to convert the firm’s FOC into the Lerner index (you know the formula for elasticity)

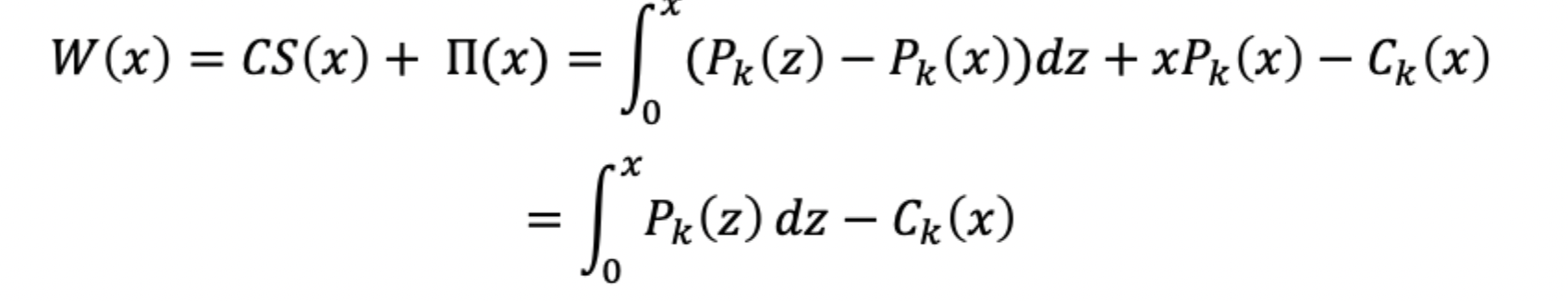

Total welfare formula

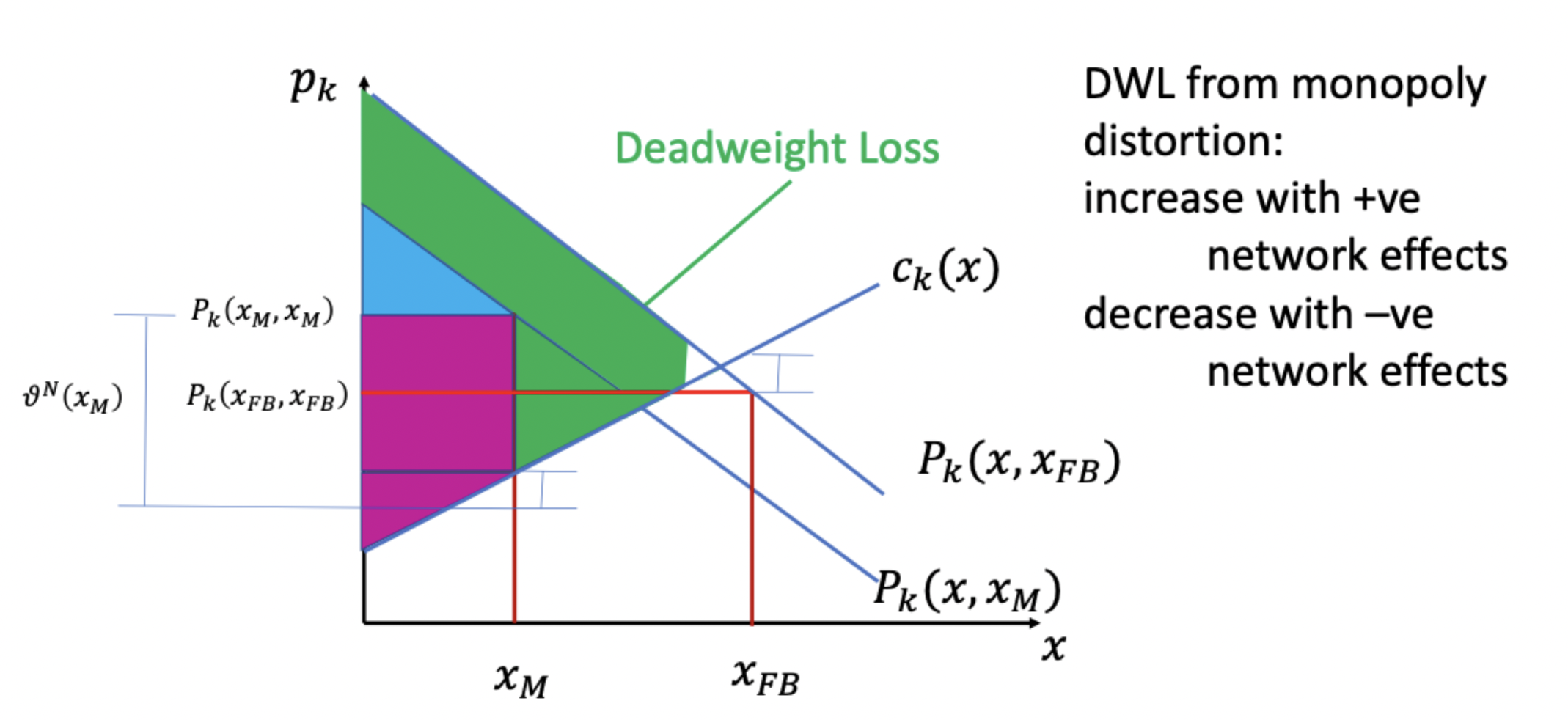

Standard monopoly price distortion and DWL

Price distortion: difference in markup over MC between monopolist and FB outcome

DWL: difference in welfare between monopoly and FB outcome

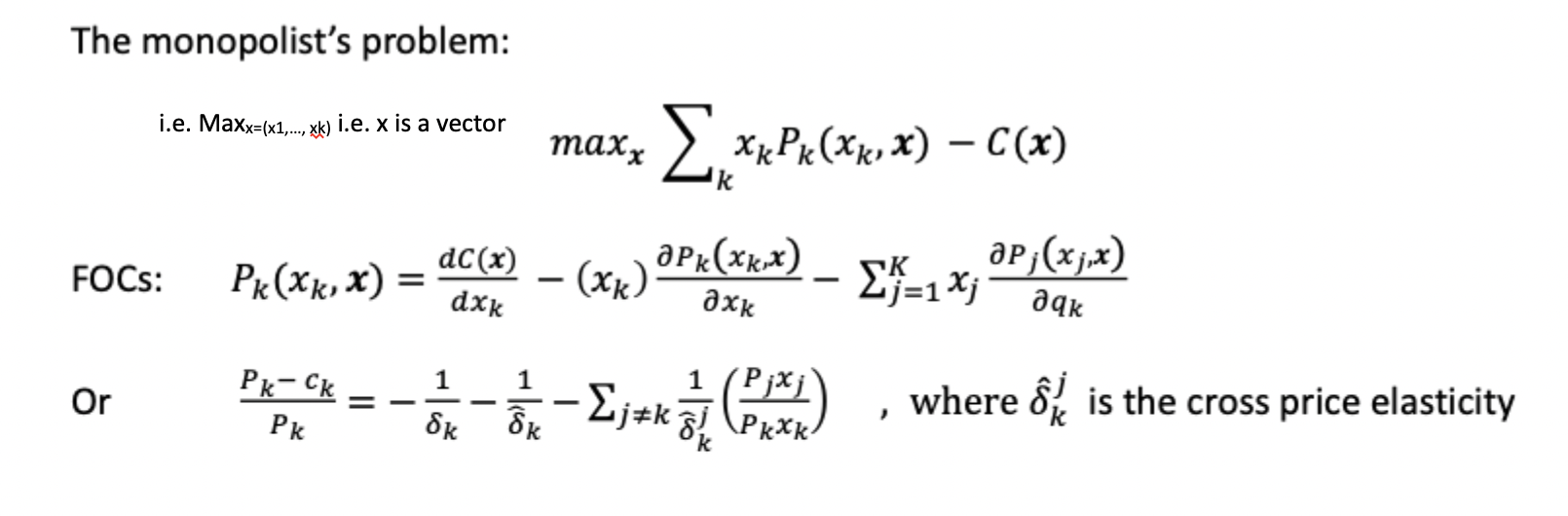

Monopolist problem in a market with network effects

Insulating tariff

The price that ensures that participating in the market is always the best response only for the the top x consumers, where x is the expected participation ratethe price above which only the most willing consumers participate, creating a barrier for others due to the tariff's effect.

When might there be monopoly pricing below marginal cost

In the case of sufficiently positive network effects (zero profit condition for the firm ensures that the monopoly price is always above 0)

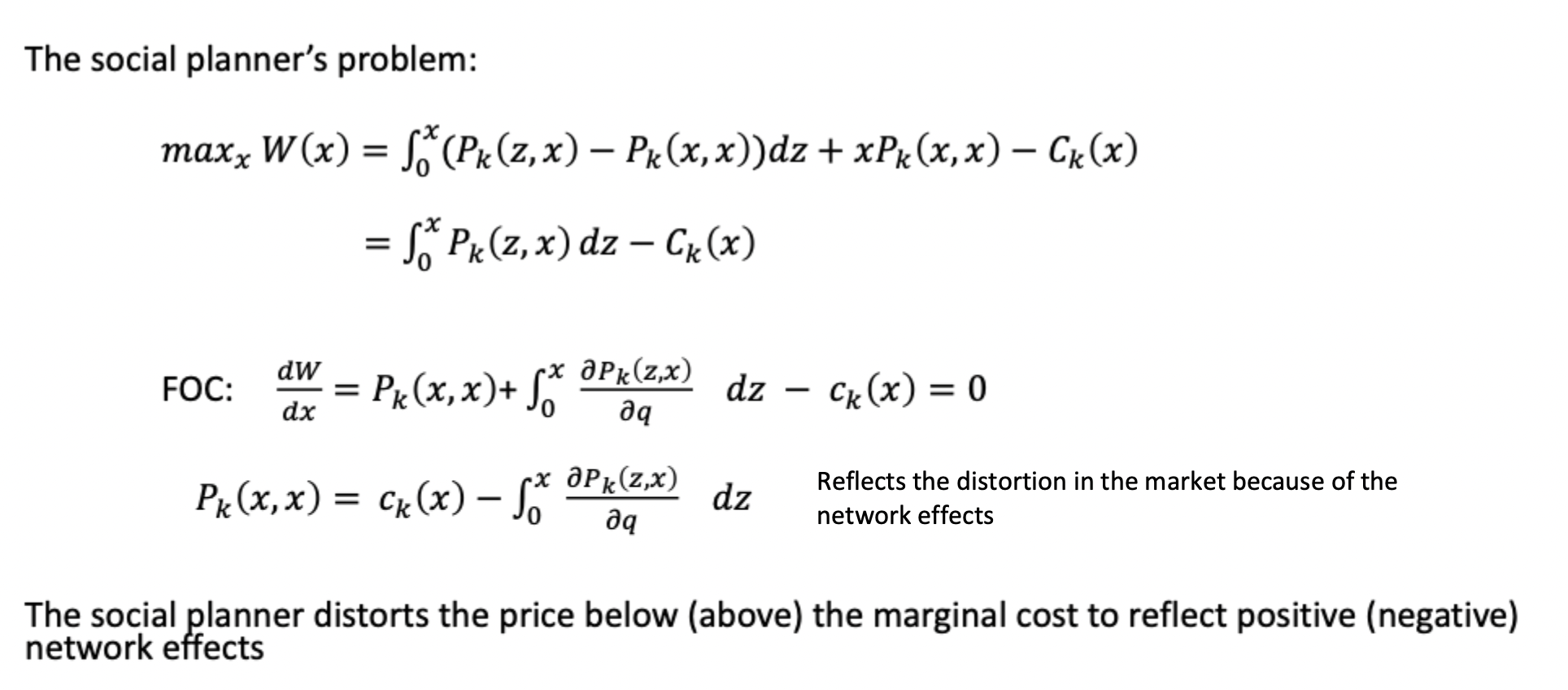

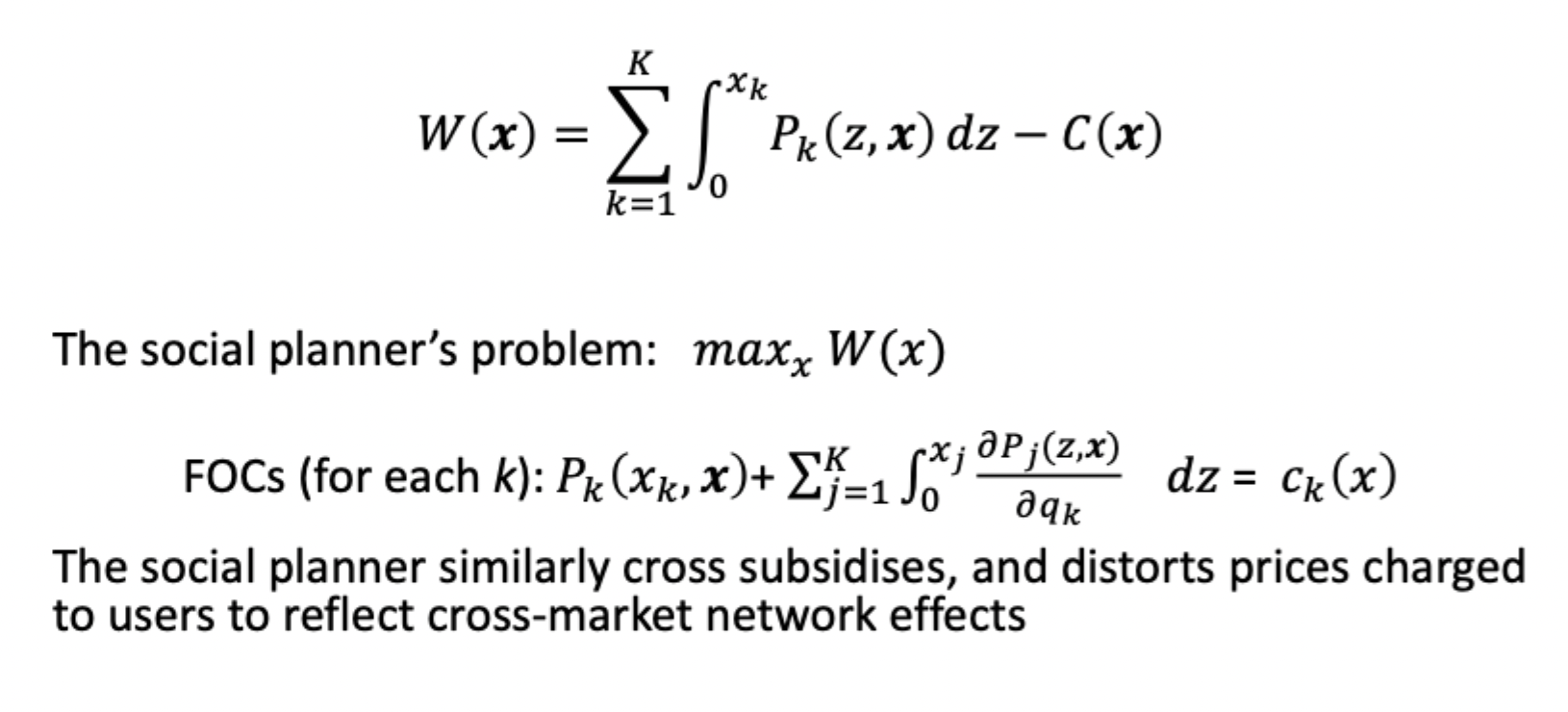

Social planner’s problem for single sided market with network effects

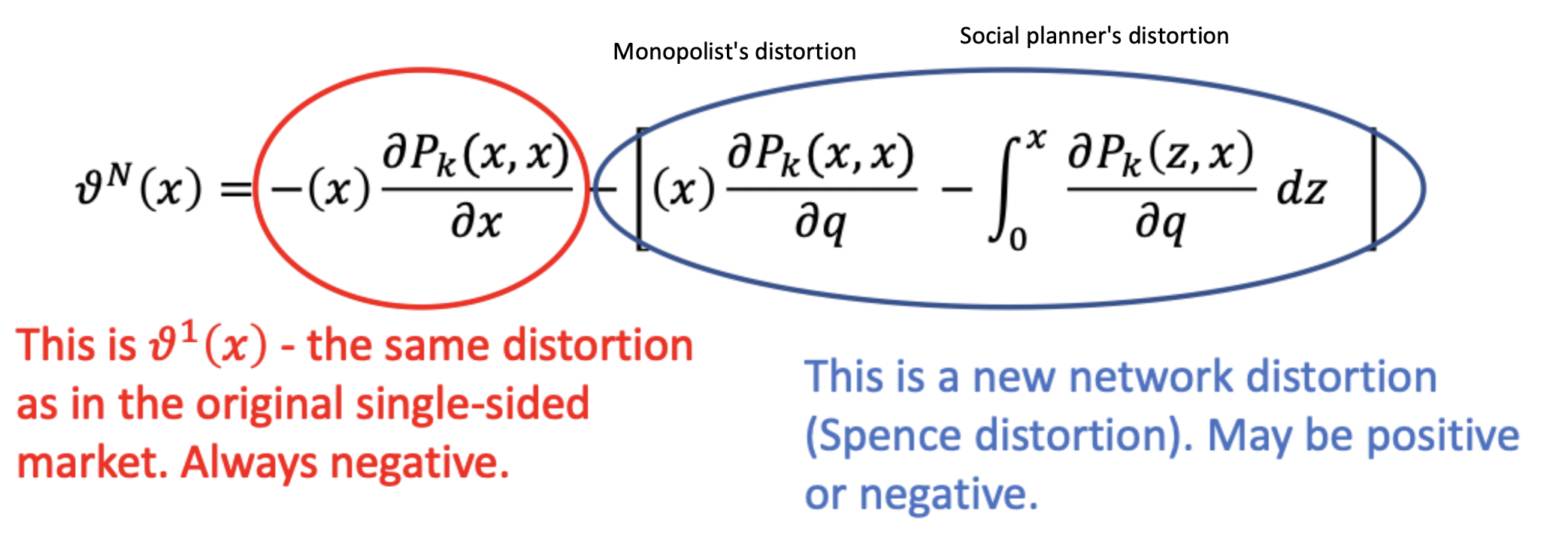

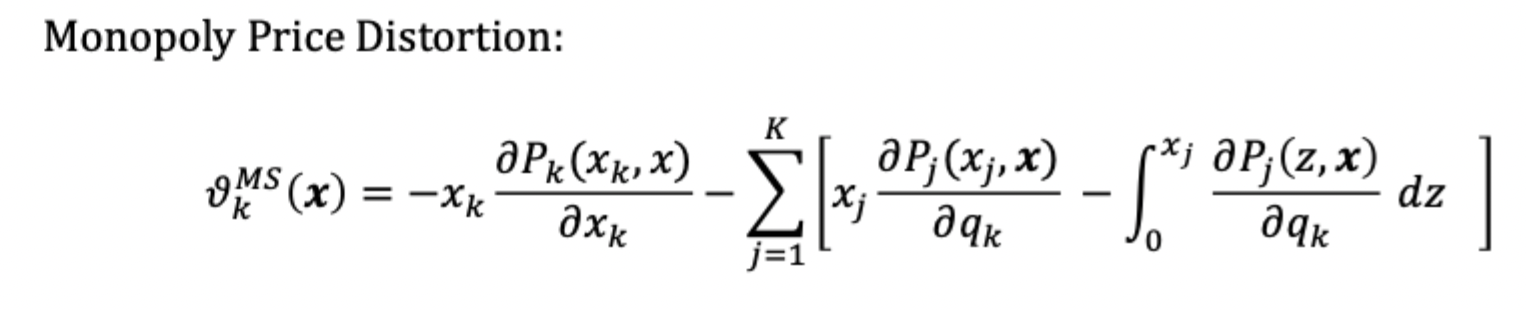

Spence distortion

The additional price deviation from MC that arises due to network effects. Consists of the distortion from the monopolist wanting to internalise externalities imposed by new entrants onto the marginal consumer, as well as the distortion from the social planner wanting to do so for the average consumer.

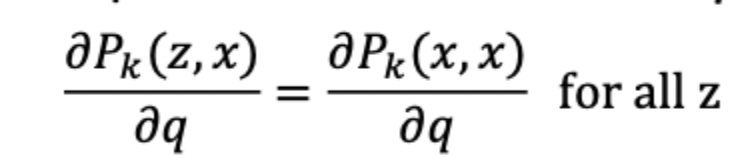

Situations that can cause 0 Spence distortion

If the individual’s willingness to pay for k changes by the same amount as the amount that the network size grows by (independent of their position in the willingness to pay distribution), you get the given formula. The Spence distortion is 0 and the monopoly price distortion is unchanged in a network market.

When is the monopoly price distortion greater than in markets without network effects

When positive network effects are larger for those consumers who value the product the most (i.e. the marginal users)

Implications of network effects for regulators

Lerner index is no longer a good measure of market power or welfare loss

Be more concerned of monopolist pricing when network effects are positive and high value users value additional network users the most

Be less concerned when network effects are negative and high value users value additional network users the least

Monopoly DWL diagram (single sided with network effects)

How do network effects differ in multi-sided markets

Increased participation of other user types (e.g. advertisers) may have positive or negative network effects (advertisers like more users, but users tend not to like more ads)

In many cases there are negative effects for increased participation of users of the same type

Monopolist problem for multi-sided markets

Cross-market subsidisation

Lower the price for user types that are valued by other users, and increase the price for users who are viewed negatively by other users, sometimes to the effect of charging a negative or 0 price on certain user types (for example, search engines are free but charge advertisers)

Social planner’s problem for multi-sided markets

Monopoly Price Distortion in multi-sided markets

Remember that network effects can be ignored when the Spence distortion is 0

Difference between price discrimination in multi vs single sided markets

If two groups of users within type k value the platform differently, single sided markets would charge different prices accordingly based on willingness to pay.

In a multi-sided market, even if the two groups value the platform identically, the platform may wish to charge them differently if users in type j value the two groups differently. Additionally, if the two groups within k value users of type j differently, the platform may wish to change the price charged to side j users.

Dynamics of platform growth

Create network-size sensitive pricing for all participants (participation rate can always theoretically be controlled via insulation tariffs). Incentivise early adopters through low / subsidised pricing, then focus on exploiting ‘local’ network effects before growing geographically.

Examples: Uber expands from city to city, after aggressively incentivising early adopter drivers through guaranteed incomes, loans for vehicles etc., incentives which unwaind as the local market grows. Facebook grew by one university campus at a time.

Effects of competing platforms

Network effects can be larger than in monopoly analysis.

Positive effects with direct competition reduces price markups as the benefit to platforms of attracting marginal users indifferent between two platforms is bigger.

However, it can lead to tipping (i..e winner takes all - get a PS because everyone else has one, and no-one has an Xbox), which is more likely with single homing agents or positive network effects are more pronounced.

Single-homing and multi-homing agents

Single homing agents are valuable to platforms as they provide monopoly access to these agents, and then can sell these agents to attracting multi-homing agents on the other side of the market.

(e.g. search engines are free and constantly improving, so that they can attract more multi-homing advertisers that pay)

Effects of interoperability with multi-homing agents

Dominant platforms can restrict interoperability, small ones less so.

With interoperability and multi-homing agents on one side of the market, agents on the other side can access the same users and products irrespective of the platform they select, so competing platforms must differentiate themselves by other characteristics to attract single-homing users. This make multiple platforms easier to sustain in the long run, and tempers tipping dynamics.

Interoperability for single homers and the ability of multi-homers to operate (or not) on either platform limits the market power than either platform can maintain over multi-homers.

Characteristics of an information platform

Platform needs to be able to tag / track / identify users in different markets

Platform needs a way to monetise user information

Advertising, facilitating price differentiation in other markets, improving strategic decision making, identifying new market opportunities.

If user info is valuable, the price for user participation is likely to be low

There are scale effects to user info - the more you have, the better you can distinguish between users and the more valuable that info is to others.

How might a network impact market structure

The existence of a single platform may well increase competition between retailers. This may change retailer behaviour and the market structure.

A large platform may either increase or decrease barriers to entry for a newcomer in the market - and so allow increased / decreased market power by incumbents.

Antitrust consideration in multi-sided markets: Gatekeeping

Controlling access to markets

i.e. home pages, picking ‘winners’, controlling which information is given (like Alexa)

High access prices / restrictive contracts

App store is a key example

Prioritising ‘own’ products

Amazon selling on their marketplace, and google with vertical search

Strategic use of rivals’ information

Use information gained rom rivals’ activities to benefit own activities, identifying and responding to competition early.

Example of non-horizontal big tech acquisition: Google purchases Android for $50m

Acquisition wasn’t seriously investigated, google had no market present in the market for operating systems

Google did not directly monetise the OS through selling proprietary hardware or demanding licence fees, instead providing a suite of free applications (all the google stuff), requiring mobile phone manufacturers to include Google Play services as default. Third party apps are therefore developed around these products, and to avoid these users have to download a completely different suite of alternatives.

Effect: Google Play services embedded into all Android phones - embedding / protecting key Google products / markets in transition to mobile OS.

Example: Google purchases Fitbit (approved for 10 years with option to renew)

Concerns: use of health data in targeted advertising, reducing accessibility of Fitbit data for development of competing health service, also degrading the interaction between Android phones and cloud services for other developers of wrist-worn devices

Conditions for approval

Google couldn’t use the health data from Fitbit for Google Ads

Access to fitness data through the Fitbit Web API had to be maintained without charge and subject to user consent.

Google had to continue to licence for free all of the public APIs that allowed wrist worn devices to interoperate with their full core functionalities with Android smartphones

Example: Facebook purchases GIPHY for $400m

CMA’s case

Market power: GIPHY’s dominant position in provision of gifs combined with Facebook’s dominant position as social media platform and in display advertising

Horizontal unilateral effects: GIPHY’s novel form of display advertising could have created competition for Facebook, but was shut down on acquisition

Vertical effects: GIPHY used by many platforms, so Facebook has incentives to make it more difficult for competing platforms and more favourable for Facebook to use it.

Remedial action: behavioural restrictions like in Google / Fitbit were considered but did not address SLC issues, so Facebook had to divest.

GIPHY’s response: timeline important, process took 2 years, by which time gifs weren’t as valuable. GIPHY weren’t wanted, and couldn’t regain revenue on their own; it had also lost staff to changed employment contracts with Facebook on acquisition. In the end GIPHY was sold for 1/8 of its acquisition cost.

Example: Microsoft and Activision Blizzard

CMA’s case:

Growth in cloud gaming, with Microsoft able to make AB’s games exclusive to Xbox and its own cloud gaming service.

Microsoft would dominate future development of cloud gaming, due to its existing 60-70% share of the global market, as well as owning much of the infrastructure in gaming and cloud gaming (Windows, Azure, Xbox Cloud Gaming)

AB would have developed their own cloud gaming which would have provided realistic

Behavioural solutions rejected: they don’t address anti-competitive actions over emerging players and arrangements so likely to prevent dynamic innovation expected without the merger.

Decision:

Merger allowed without cloud gaming rights, which would have to be sold to Ubisoft (all non EEA distribution rights for all AB games (existing and developed) for the next 15 years), with non-exclusive distribution rights in the EEA (relating to an earlier EU agreement).

CMA to monitor final agreement and Ubisoft and Microsoft not to hold each other’s shares over the period

Ex ante vs ex-post regulation

UK & EU: create a set of rules within which digital platforms are required to operate

US: rely more on anti-trust regulation - assessing behaviour after the fact through the judiciary

Key regulatory concerns from multi-sided markets

Rules designed specifically for largest platforms (big 5)

Non-discrimination between own products and third parties

No restrictions platform products for us by third parties

No use of non-public data generated on platform for benefit of own product / service

No interference in pricing of firms

No restriction son interoperability with other suppliers

Data portability for businesses and users

No data sharing between services without user consent (EU & UK)

Strategic impact of merger for the platform, not just single markets, to be considered (US & UK)

Stylised facts of the decline in proportion of auction listings on eBay

Fallen consistently since 2003, with sharp drop when eBay introduced the ‘good till cancelled’ posted price listing

Posted prices more commonly used for ‘new items’ or when a seller has multiple listings

Sale rate is higher for auctions, but all sales rates falling over time (and fewer bidders)

Sale price is lower for auctions - with the difference growing over time

Both sale rate and sale price falling means auctions are becoming less attractive to sellers.

Possible explanations for the reduction in auction listings on eBay

Product composition:

Over time eBay is selling more new vs second hand items, for which posted prices are favoured

Seller composition

More traditional retailers selling on eBay who don’t have expertise or experience in auctions or who don’t want to upset / cannibalise their existing customers

Consumer composition / behaviour (Einev et al. say evidence supports this as the true explanation, rather than the other possible explanations)

Consumers have increasing alternatives for online shopping, with general fall in demand which has disproportionately affected auctions.

Consumers dislike waiting for auctions to complete (impatience) and become disillusioned by a past failure to win (dissuasion)

So consumer preference for immediate purchase has increased (disutility of participation in auctions has grown)

More on consumption composition / behaviour for eBay auctions

Auctions attract a higher proportion of professional buyers who can obtain bigger discounts

Many sellers list the same item as both auction and ‘buy it now’ simultaneously.

Experimentation and market segmentation - exploiting differences between impatient buyers and (more price sensitive) patient buyers.

Why may auctions still be prevalent on eBay

Very low marginal cost of inclusion, and their inclusion allows sellers to break up the market between more and less patient buyers when they use both mechanisms simultaneously

eBay as a platform, so there are benefits beyond p&l for sellers, such as people staying on the site for longer due to auctions, so potentially buying more / seeing more adverts - increases profitability through other sellers.

Auction prevalence is still high for second hand items, and may be a feature that attracts people to the site, or maybe just brings people back to the site regularly to check auction status.

Agents may be single homing, so the issue of dissuasion may not be as important if they are likely to move to posted price mechanisms still on eBay.

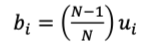

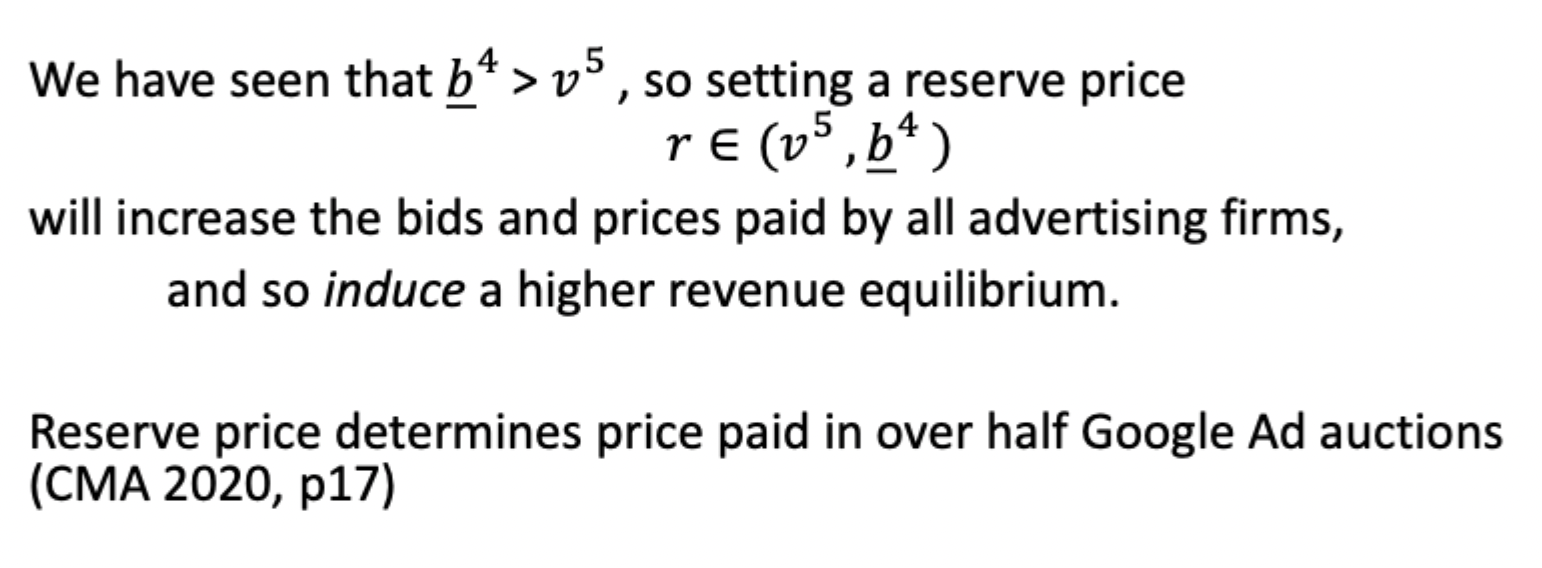

Effect of introducing a reserve price to a position auction

Difficulties in estimating an optimal reserve price in a position auction