Securities Industry Essentials (SIE) Unit 3

1/60

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

61 Terms

annual interest rate (nominal yield) assigned to a bond at issuance; though, most bonds pay semiannually

coupon rate

price of par

$1000

premium to par

above $1000

discount to par

below $1000

interest assigned to a bond at issue

nominal yield

measure of a bond’s annual interest relative to its current market price; annual coupon payment / market price

current yield

annualized return of the bond if held to maturity taking into account the price paid; if bought at a discount, the yield is higher and the holder makes money at maturity; if bought at a premium, the yield is lower as the holder loses money at maturity

yield to maturity (basis)

allows a bond issuer to pay the principal of the bond prior to the maturity date; generally issued at a discount

call feature

allows investor to receive principal from the issuer prior to the maturity date; generally issued at a premium

put feature

bonds sold at deep discount paying no interest but maturing at par

zero-coupon bonds

true or false: owners of zero-coupon bonds are taxed on the year’s accumulated interest (phantom income)

true

AAA, AA, A, BBB

Standard & Poor’s four highest bond ratings (investment grade)

Aaa, Aa, A, Baa

Moody’s four highest bond ratings (investment grade)

high yield (junk bonds)

bonds with a rating of BB or Ba and lower

time to maturity

interest rates

coupon rate

these all contribute to a bond’s volatility measured by duration; a higher duration means more volatility

safest investment for US investors

treasury-backed securities

corporate debt securities pay interest based on this calendar:

7 days/week, 52 weeks/year

30 days/month, 360 days/year

30 days/month, 365 days/year

5 days/week, 52 weeks/year

30 days/month, 360 days/year

bonds backed by the corporation’s real estate assets

mortgage bonds

used to purchase large pieces of equipment; until debt is paid in full, equipment is collateral

equipment trust certificates

corporation deposits marketable securities it owns as collateral for a debt issue

collateral trust bonds

debt issue secured only by the word of the corporation; written promises to pay back the debt

debenture

these bonds are backed by a second corporation, such as a parent company; only as good as the word of the issuer and its backer

guaranteed bonds

these are issued by companies coming out of bankruptcy and only pay interest if they are profitable and the board declares interest is to be paid; they do NOT regularly pay interest and are not suitable for a bond investor seeking income

income bond

lowest level of unsecured debt; still senior to a stockholder

subordinated debt

Order of Liquidation

Secured Debtholders

Unsecured Debtholders and General Creditors (wages & taxes)

Subordinated Debtholders

Preferred stockholders

Common stockholders

A 6% bond trading on a 7% basis is trading

a. at a discount

b. with coupon rate below 6%

c. at a premium

d. with current yield above 7%

a. at a discount (when YTM is higher than coupon, the bond is trading at a discount)

True or False: Interest on Municipal bonds is tax free on a federal level

True

True or False: Interest earned from municipal bonds is tax free on the state level but only if the investor lives in the state of issuance

True

True of False: Municipal bonds accrue interest based on a 30-day month, 360-day year

True

these municipal bonds benefit the entire community and do not produce their own revenues; principal and interest are paid using taxes

general obligation (GO) bonds

these municipal bonds are used to finance a facility that generates its own income such as water, electric, sewer, toll roads

revenue bonds

True or False: interest from bonds by or from a territory of the US is tax free at ALL levels; territory meaning Guam, US Virgin Islands, and Puerto Rico

True

municipal bonds to tide a city or town over for a short while until anticipated revenues arrive; mature in less than 12 months

Short-Term Municipal Obligations or Municipal Anticipation Notes

Tax Equivalent Yield

used to determine municipal bond investment’s tax benefit; divide the tax-free yield by 100% less the investor’s tax rate

30% tax bracket; mun bond at 7%; what must a corp bond yield to be equivalent?

7% / (100% - 30%) = 10%

30% tax bracket; corp bond yields 11%; what is equivalent mun yield?

11% x (100% - 30%) = 7.7%

True or False: the yield of a municipal bond will always be higher than that of an equivalent corporate bond

False: the yield of a municipal bond will always be lower than that of its corporate equivalent because of its tax advantages

these treasury securities are issued with maturities of 4 weeks, 8 weeks, 13 weeks, 26 weeks, and (monthly) 52 weeks; issued at discount paying par at maturity;

Treasury Bills

the only treasury securities issued without a stated interest rate

Treasury bills and STRIPS

the only treasury securities issued at a discount

treasury bills and STRIPS

used in market analysis as the stereotypical risk-free investment

13-week treasury bill

treasury notes

direct debt obligation of the US government; pay semiannual interest as a % of stated par value; mature at par value; maturities of 2 - 10 years

treasury bonds

direct debt obligations of US government; pay semiuannual interest as % of stated par value and mature at par; maturities greater than 10 years up to 30 years

type of bond created by brokerage firms made up of treasury securities; NOT backed by the US government

treasury receipts

issued with maturities of 5, 10, or 20 years having a fixed coupon rate and paying interest every 6 months; principal value is adjusted every 6 months based on inflation rate; interest rate payments adjust accordingly

Treasury Inflation-Protected Securities (TIPS)

Agency Securities (asset backed securities)

securities issued by federal agencies

Farm Credit Administration

Government National Mortgage Association (GNMA)

Federal Home Loan Mortgage Association (Freddie Mac)

Federal National Mortgage Association (Fannie Mae)

Student Loan Marketing Association (Allie Mae)

provide very short-term funds to corporations, banks, BDs, municipalities, and federal government

money market securities

has a fixed interest rate and minimum face value of $100,000 though values of $1 million or more are common; longer maturities pay interest every 6 months

Jumbo Certificate of Deposit

postdated check or line of credit issued by a bank and provided to certain corporations in import-export business; payment date never more than 270 days; may be referred to as bill of exchange or letter of credit

Bankers’ Acceptances

promissory notes used to raise cash; 270 days or less

Commercial Paper, Prime Paper, Promissory Notes

True or False: once a federal treasury note or bond with longer maturities has only 1 year left to maturity, it is considered a money market instrument

True

Characteristics of money market securities:

highly liquid

hard to sell

very safe

very volatile

short-term

long-term

low rate of return

high rate of return

highly liquid, very safe, short-term, low rate of return

True or False: Interest on treasury bonds is tax-free at the federal, state, and local levels

False: interest on treasury bonds is taxed at the federal level but not the state nor local levels

True or False: Interest owned from Agency Securities such as Fannie Mae and Freddie Mac is tax-free

False; interest for these securities is taxed at both the federal and state levels

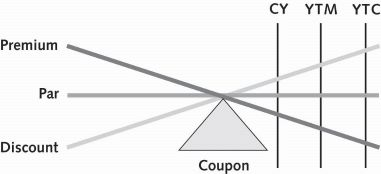

For a callable bond trading at a discount, the yields in ascending order are:

coupon (nominal), current, yield to maturity, yield to call

For a bond trading at par, the yields will be the same but will fall in this order:

coupon, current, ytm, and yield to call

when trading at a premium, bond yields will descend in this order

coupon, current, ytm, and yield to call

unsecured promissory note issued by banks

negotiable CD

unsecured promissory notes issued by corporations

commercial or prime paper

an issuer in default would be rated this by Moody’s

C

an issuer in default would be rated this by S&P

D

True or False: GNMA securities are backed by the full faith and credit of the US government

True

True or False: FNMA and FHLMC securities are backed by the full faith and credit of the US government

False; they are backed by the implied backing but not full faith and credit