Midterm #2 retail buying and merchandising

1/48

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

49 Terms

Private Brands

Brands owned or controlled by a retailer as opposed to manufacturers.

House Brand

Another term for private brands, indicating products sold under the retailer's own name.

Exclusivity

A competitive advantage of private brands that fosters customer loyalty by providing unique products.

Target Costing

A pricing strategy where retailers determine the desired price and work backwards to create a product that meets that price.

Planogram

A diagram or model that indicates the placement of retail products on shelves to maximize sales.

Visual Merchandising

The practice of planning and designing product displays to attract customers and enhance their shopping experience.

Cross-Merchandising

The strategy of displaying complementary products together to encourage additional purchases.

Green Ocean Strategy

Creating opportunities from environmental risks and pressures, focusing on sustainability and eco-friendly practices in business.

Returns

The process of returning purchased items to the seller for a refund, exchange, or credit.

Corporate Social Responsibility (CSR)

A business model in which companies integrate social and environmental concerns in their operations and interactions with stakeholders.

first retailers to introduce private brands

originated in the 19th century

brooks brothers and macy’s

other terms for private brands

• House brand

• Store brand

• Own brand

• Control label

• X label

• Exclusive brand

PRIVATE BRANDS AND COVID-19

Nearly one in five consumers said they bought more private-brand

products during the pandemic than they did before the crisis.

TOP PRIVATE BRANDS

great value, equate, marketside, freshness guaranteed, dollar tree

PRIVATE BRAND STRATEGY

Private brands are typically more profitable for retailers.

select suppliers to create the Private Brand items with product attributes tailored to their customer base

Best practices for pricing and assortment

-Develop a process for rationalizing SKUs,

especially when value propositions overlap

• Determine which low share SKUs in the

assortment might be negatively affecting

the private brand’s value

• Create a process for regularly identifying

and addressing whitespace opportunities

(such as flavors and pack sizes) within the

category

-Decide the “reference” national brand for

price and quality benchmarking

• Define the price-gapping rules, and how

regularly to adjust prices for promotions or

competitor price changes

private brand communication and marketing

Traditionally, retailers have relied on price and shelf-space to expose their private brands

• More recently, retailers have begun communicating the story behind their store brands—for instance, how they source ingredients or where the products are made

4 primary areas of private brand sourcing

• Target Costing

• Advanced Analytics to Scale Cost Transparency

• Negotiation Approach

• Product Development

target costing

robust should-cost model that accounts for raw-material fluctuations, proper accounting on overheads, efficient packaging, and logistics, that can result in increased margins ex: walgreens peelable mango candy

Advanced Analytics to Scale Cost Transparency

Advanced analytics enables the development of parametric should-cost models which allows retailers to examine the costs of thousands of SKUs in a matter of weeks

negotiation approach

Evolving supplier negotiations from price-focused to fact-based negotiations based on a detailed understanding of material costs and supplemented by comprehensive

preparation.

why do companies pursue private brands

• Financial benefits (higher profit %!)

• Exclusivity, which drives loyalty and prevents “showrooming” effect

• Smoother inventory flow

• Control over design and product attributes

• Reduces information asymmetry with national brand suppliers (1Ps)

Private Brand Decisions and Transaction Costs Perspective

• Acknowledgement that markets are not

perfect and can break down.

• We as humans make decisions that are not

necessarily rational

value chain analysis + vertical integration analysis equals…

Boundaries of the Firm (including whether to make private brands or outsource)

assess if a firm should vertically integrate

how difficult is it to write contracts

how critical is the asset to the firms’ CA?

How difficult is it to write contract

1. Specificity. Is the asset only used for one

thing? Or many? If highly specific, then

contract is more difficult.

2. Uncertainty. The greater uncertainty, the

more difficult the transaction/contract.

3. Frequency. Greater transaction frequency

increases difficulty

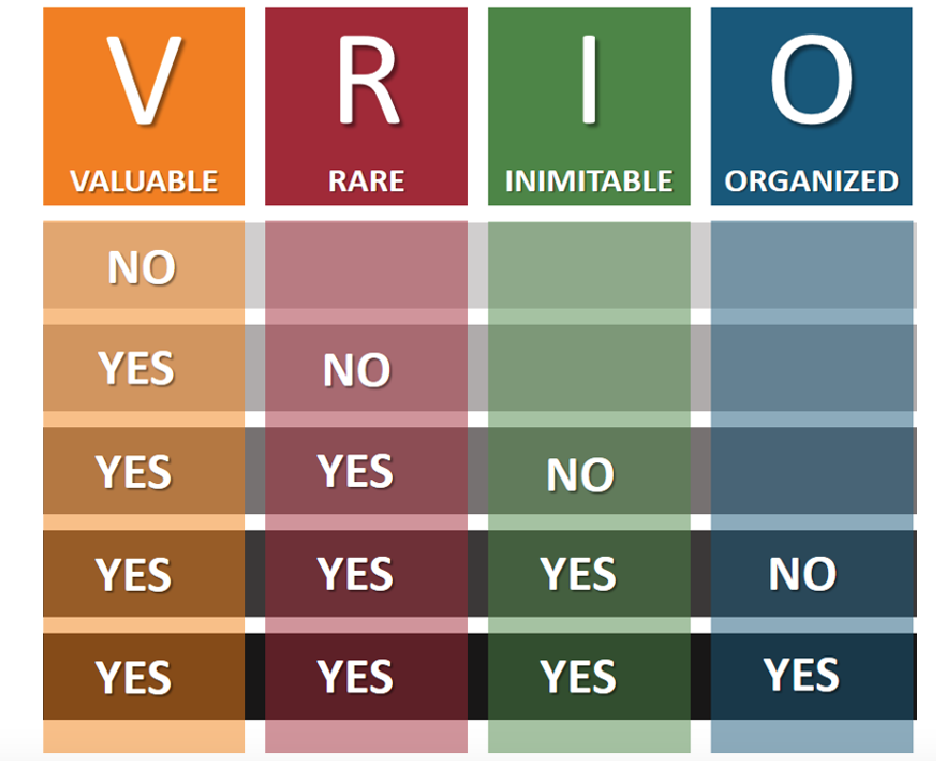

transaction cost economics

how crucial to competitive advantage?

valuable, rare, inimitable, organized

potential drawbacks of vertical integration

• Extended learning curve

• Reduced quality

• Increased costs

• Reduced flexibility

• Increased exit barriers

• Legal exposure

key tenets of visual merchandising

your brand

sensory marketing

displays

display

Merchandise displayed outside

of its home in aisle.

• Sometimes called a feature, the

display is used for temporary

product placement during a

promotional period or for

another strategic purpose.

display purpose

-Drive awareness and sell-through.

• Entice customers to shop the aisle.

• Set the tone for a holiday or special event

throughout the store.

display product types

store promotions

new launch items

display benefits

increased sales

cross merchandising

product awareness

display best practices

set a single price point

pricing to promote multiple purchases

creating a theme

planogram-modular

Depending on the category, you’ll likely have 1 or 2 full modular resets throughout the year (requires a lot of labor)

common permanent fixtures

• Gondolas

• Peg board

• Peg hooks

• Slat boards

• Flat brackets

• Shelves

• Kick boards

• Risers

• Various reefer cases

• Permanent bins

• Customized /

non-standard

science of shelf placement

1. Eye-level dominance

2. Shop as we read…L to R

3. Product grouping

4. Visual hierarchy

5. Promotions and seasonality

6. Product sizing and shelving

7. Ongoing data analytics

Trader Joe’s differentiation

• Their advertising (or lack thereof)

• Specific target market (unemployed

professors)

• Employees….who they are and how they’re

compensated!

• Physical footprint…have resisted supersized

American trend! Most locations 10k-15k sq ft

(only about 3-4x Walmart on Campus!)

• Definitely still have that laid back SoCal

vibe…example being that they don’t have

strict planograms!

• Actual human interaction! Very little tech.

basics of trader joe’s

-Privately-held by Aldi Nord

• Use a cost leadership AND differentiation

approach

• <600 stores in U.S.

• Approximately 4000 SKUs, rotate 10-15

new items in each week

• Apx. 80% of assortment is private brands!

four actions framework

1. Eliminate factors that companies in an industry have long competed on.

2. Determine whether products or services have been over-designed. If so, reduce those factors.

3. Has the industry forced compromises on the customers? Raise the bar!

4. Create new demand and shift the strategic pricing of the industry.

scintilla (luminate) approach

• Art + Science…

• Ethical Duties

• Organizational inertia is a reality, which creates an opportunity the buyer/decision maker!

• Supply Chain → Satellite/Data → Sustainability → Luminate

scintilla: basic v. charter data

Charter offers omnichannel sales, replenishment, OTIF, category reporting for advisors and non-advisors, basket analyses, and more.

Basic data is limited to a subset of channel

performance insights necessary for running a business.

scintilla: basic v. charter automation

Charter is API-based, allowing for automated data extraction, while Basic only allows manual data exports

scintilla: charter v. basic history

Basic offers one two years of weekly

historical data, while Charter offers three(?) years of historical data and dynamic restatements

scintilla offering

shopper behavior - the “what”

channel performance - the “where”

customer performance - the “why”

digital landscape - the “journey”

insights activation - ties data

where do customer returns go

1. Return to seller – can cost up to 66% of original item price

• Mail back

• Return to brick-and-mortar location of retailer

• Return to some third-party location (like Amazon’s Kohl’s return program)

2. Donation – a lot smaller than

3. Disposal – nearly 1/3 of all returns are incinerated

4. Liquidation

• Through companies like Bidfta.com

• As certified pre-owned, such as programs managed by Trove

5. Grade and Resell

recommerce

the selling of previously owned items through online marketplaces to buyers who reuse, recycle or resell them

benefit corporations - legal form

“best interest of the corporation” expanded to

include positive impacts on:

•Society/community

•Workers

•Environment

benefit corporations - certificate

• B Lab certification is the most prominent

• B Lab’s B Impact Assessment

• 3-year certification