econ chapter 8 + 9

1/16

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

17 Terms

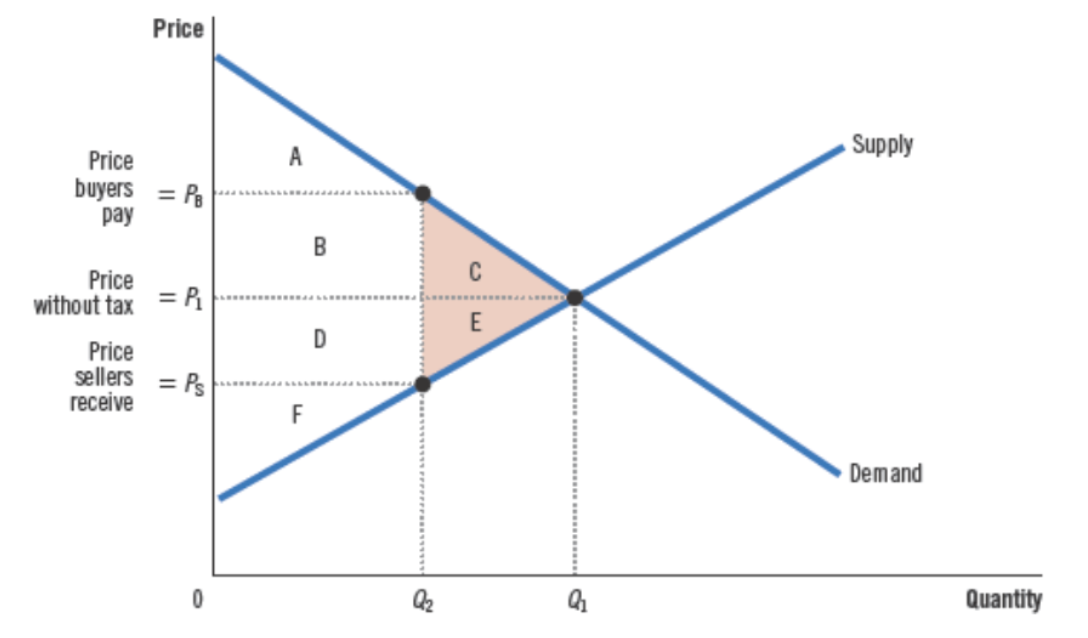

how does a tax affect market participants?

Welfare of buyers measured by consumer surplus

Welfare of sellers measured by producer surplus

Government takes in tax revenue: size of tax (T) * quantity of the good sold (Q)

label each part of this graph with and without tax:

What determines whether the deadweight loss from a tax is large or small?

The deadweight loss is larger when the supply curve is more elastic

The deadweight loss is larger when the demand curve is more elastic

how does deadweight loss vary as tax revenue vary

As the size of taxes rise, the deadweight loss grows exponentially larger and larger

The last two panels of Figure 6 summarize these results. In panel (d), we see that as the size of a tax increases, its deadweight loss quickly gets larger. By contrast, panel (e) shows that tax revenue first rises with the size of the tax, but as the tax increases further, the market shrinks so much that tax revenue starts to fall.

what is world price?

comparing the price of a good with the price of the same good in other countries

the price of a good that prevails in the world market for that good

when do you export a good?

If the world price of textiles exceeds the domestic price, then the country will export textiles

They want to sell at a higher price

when do you import a good?

If the world price is lower than the domestic price, the country will import textiles

People want to buy at a lower price

what does the domestic price tell us?

opportunity cost:

If the domestic price is low, the cost of producing textiles in Isoland is low, suggesting that Isoland has a comparative advantage in producing textiles relative to the rest of the world.

If the domestic price is high, then the cost of producing textiles in Isoland is high, suggesting that foreign countries have a comparative advantage in producing textiles.

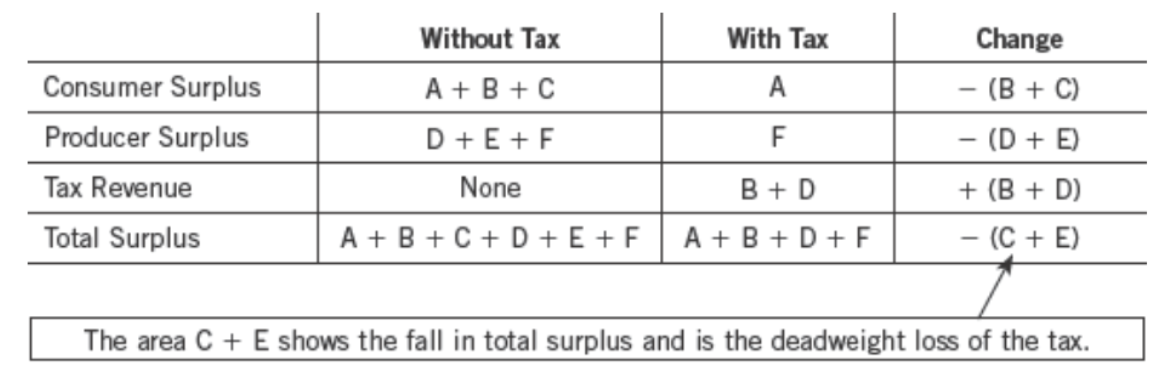

label all the parts in this graph before and after trade:

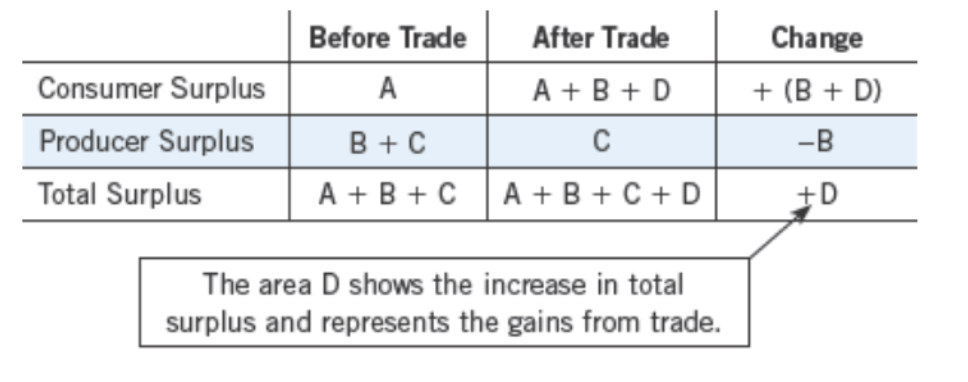

what happens when a country allows trade and becomes an exporter of a good?

Once trade is allowed, domestic prices rises equal to the world price

Sellers are better off, and buyers are worse off

Total surplus rises by an amount equal to area D – trade raises the economic well-being of the country as a whole

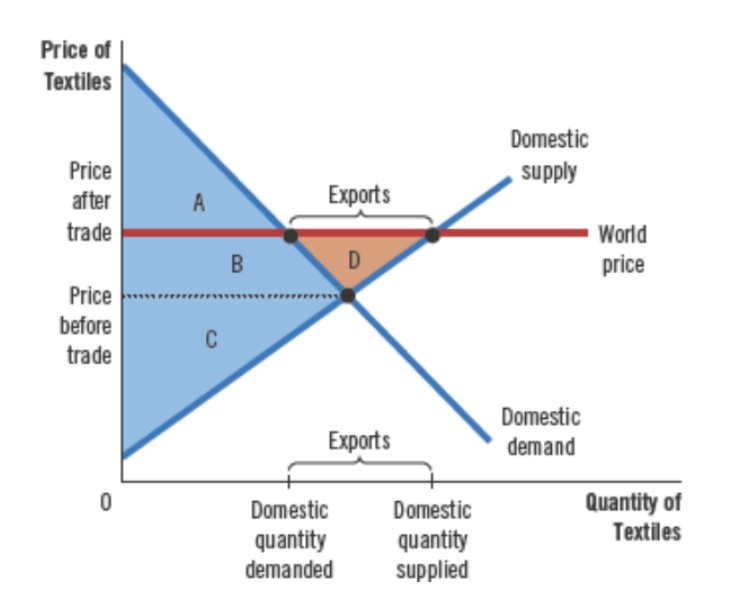

label each part of this graph before and after trade:

what happens when a country allows trade and they become an importer of a good?

Buyers are better off and sellers are worse off

Total surplus rises by an amount equal to area D – trade rises the economic well-being of the country as a whole

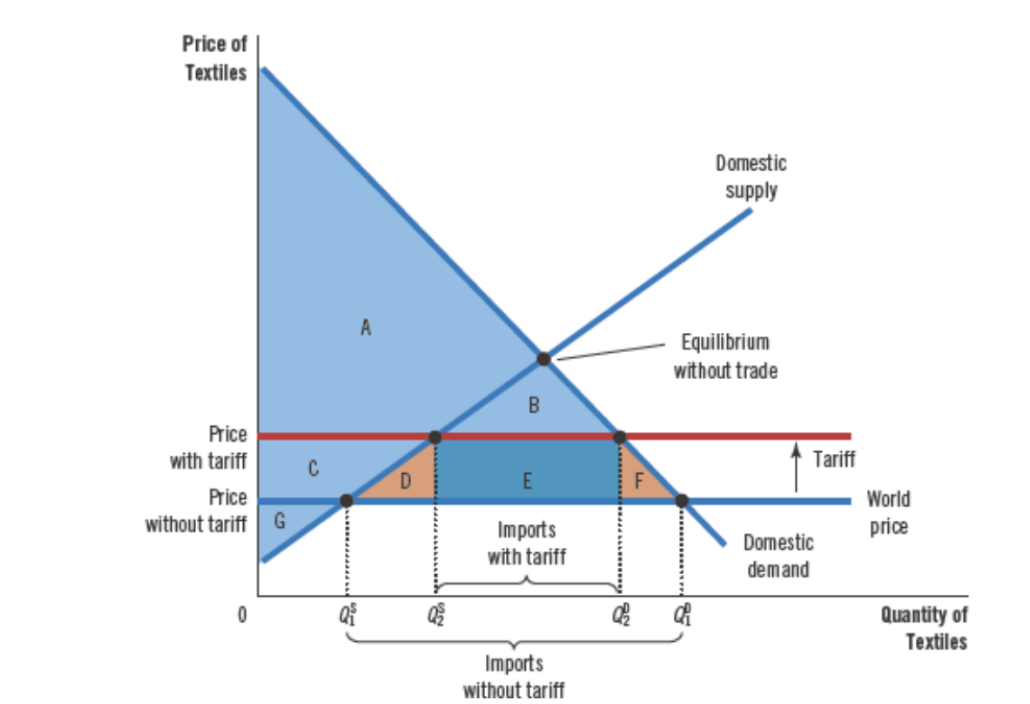

what is a tariff? and what effect will they have?

Tariff – a tax on imported goods

Tariffs have no effect if the country is exporting goods (only importing goods)

label this graph before and after tariffs:

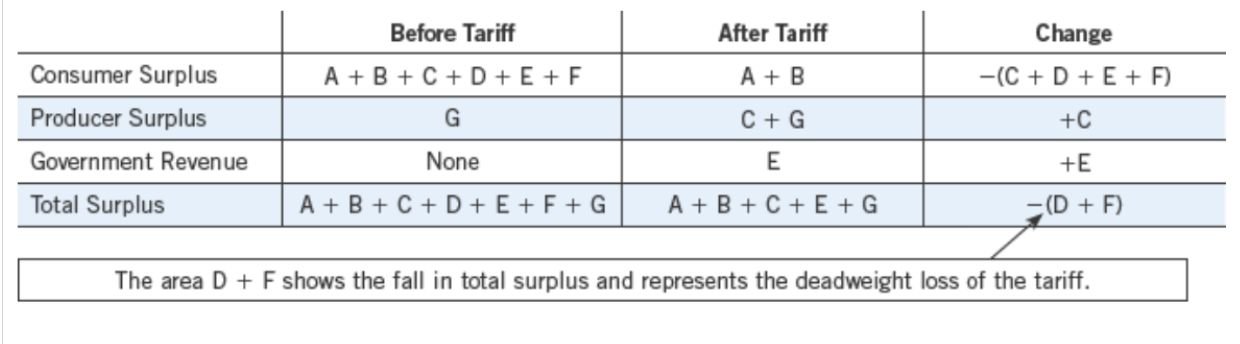

how do tariffs impact an economy?

The tariff reduces the quantity of imports and moves the domestic market closer to its equilibrium without trade.

Domestic sellers are better off

Domestic buyers are worse off

Government gets the tariff revenue

creates deadweight loss

what are some benefits of international trade?

free trade increases variety for consumers, allows firms to take advantage of economies of scale, makes markets more competitive, makes the economy more productive, and fosters the spread of technology. I

what are the arguments for restricting trade?

The jobs argument: “trade with other countries destroys domestic jobs”

Free trade creates new jobs even as it destroys some old ones

Total unemployment does not rise as imports rise, because job losses from imports are offset by job gains in export industries

The national security argument: “the industry is vital to national security”

Protecting key industries may be appropriate when there are legitimate concerns over national security

Companies have a financial incentive to exaggerate their role in national defense

Protection from foreign competition can be lucrative

The infant-industry argument: “new industries need temporary trade restriction to help them get started. Older industries need temporary protection to help them adjust to new conditions”

Difficult to implement in practice

The temp policy is hard to remove

Protection is not necessary for an infant industry to grow

The unfair-competition argument: “free trade is desirable only if all countries play by the same rules”

Importing from a country that subsidizes production:

Increase in total surplus for importing country

Imports of low-cost products subsidized by the other country’s taxpayers

The gains to our consumers will exceed the losses to our producers

The protection-as-a-bargaining-chip argument: “trade restrictions can be useful in obtaining concessions from our trading partners. The threat of a trade restriction can help remove a trade restriction already imposed by a foreign government”

The threat may not work