ACCCOB3 - Chapter 11 [Responsibility]

1/43

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

44 Terms

When a company's owners (e.g., stockholders) delegate decision-making authority to top managers, they employ ___ systems to direct and control the actions of those managers. They ensure a company's board of directors and top managers pursue goals aligned with the owners' interests.

corporate governance

When a company's top managers delegate decision-making authority to subordinates, they employ ___ systems to direct and control the actions of those subordinates. They ensure a company's employees pursue goals aligned with its interests.

management control

An ___ organization is one in which decision-making authority is spread throughout the organization rather than being confined to a few top executives.

decentralized

Under ___, a manager should be held responsible for those items—and only those items—that the manager can actually control.

responsibility accounting

TRUE OR FALSE: Responsibility accounting personalizes accounting information by holding individuals responsible for revenues and costs.

TRUE

Any business segment whose manager has control over costs, revenues, or investments in operating assets.

responsibility center

A cost center manager has control over (cost/revenue/ investments in operating assets).

cost

A profit center manager has control over (cost/revenue/ investments in operating assets).

cost; revenue

An investment center manager has control over (cost/revenue/ investments in operating assets).

cost; revenue; investments in operating assets

The goal of a ___ center manager is to minimize costs while providing the level of products/services needed by other business segments.

cost

TRUE OR FALSE: Profit center managers are evaluated by comparing actual profit to budgeted profit.

TRUE

A financial measure commonly used to evaluate investment center performance. A high value indicates more profit is earned per dollar invested in operating assets.

return on investment

Cash, accounts receivable, inventory, PPE, and other assets held for operating purposes.

operating assets

TRUE OR FALSE: Land held for future use, an investment in another company, or a building rented to someone else are examples of operating assets.

FALSE

TRUE OR FALSE: Net book values are used to calculate average operating assets.

TRUE; i.e. net of depreciation

When average operating assets decreases, ROI (increases/decreases).

increases

(Margin/Turnover) is ordinarily improved by increasing selling prices, reducing operating expenses, or increasing unit sales.

margin

(Margin/Turnover) is concerned with the investment in operating assets.

turnover

The NOI an investment center earns above the minimum required return on its operating assets.

residual income

TRUE OR FALSE: The objective is to maximize ROI, not residual income.

FALSE

The price charged when one responsibility center provides goods or services to another responsibility center within the same firm.

transfer price

TRUE OR FALSE: Transfer prices are used to recognize revenues and expenses within/between responsibility centers.

TRUE

TRUE OR FALSE: Transfer prices impact the company's overall profit.

FALSE; bc its all happening in the same company, each transaction/transfer cancels each out. net effect of nada

____ occurs when responsibility center managers forgo additional companywide profits by making decisions not in the best interests of the company or even their own responsibility center.

suboptimization

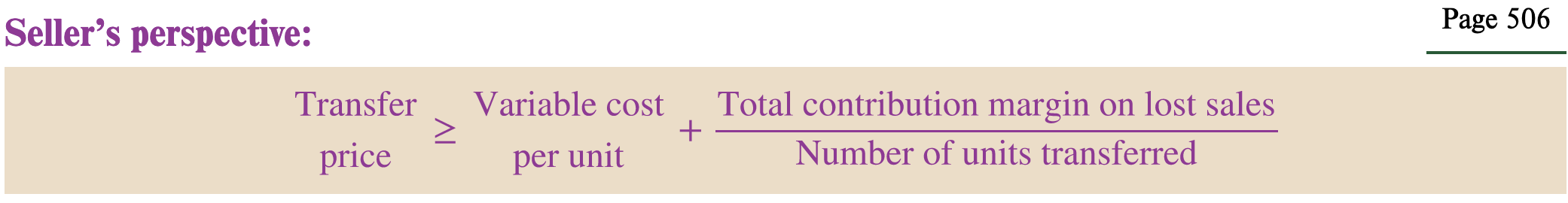

The lower limit for the range of acceptable transfer prices is determined by the (buyer/seller) while the upper limit is determined by the (buyer/seller).

seller; buyer

TRUE OR FALSE: An agreed-upon negotiated transfer price would increase divisional profits of both the seller and buyer.

TRUE

TRUE OR FALSE: An agreed-upon negotiated transfer price should be greater than or equal to the seller’s unit variable cost plus opportunity cost (i.e. forgone contribution margin per unit).

TRUE

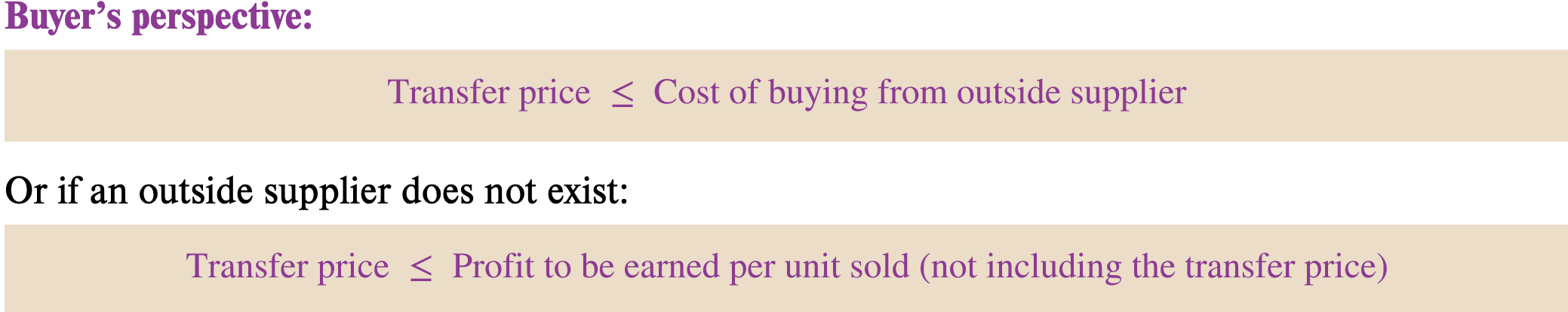

TRUE OR FALSE: An agreed-upon negotiated transfer price should be greater than or equal to the buyer’s 1) cost of buying from an outside source or 2) profits to be earned per unit sold.

FALSE; less than or equal to

Suppose the selling division has idle capacity, i.e. a number of units that are unused and are not sold to regular customers. How much is the total contribution margin to lost sales should a buying division emerge and negotiate a transfer price?

0 because the idle capacity means they don’t have to sacrifice any sales, therefore no contribution margin lost if sold to buying division

Suppose the buying division expects to earn a profit of $30 per unit using the inventory from the selling division. How much is the upper limit of the range of acceptable transfer prices assuming no outside supplier?

$30

Using a product or service’s ___ price as the transfer price is possible when an outside market of customers that routinely purchase the good exists.

market

TRUE OR FALSE: When a selling division has no idle capacity, the market price is the optimal transfer price.

TRUE

The ___ departments perform an organization’s central purposes while the ___ departments provide services to them.

operating; service

TRUE OR FALSE: Service department actual costs are charged to operating departments.

FALSE; budgeted costs only, to avoid passing on cost overruns & for service departments to remain responsible for explaining the discrepancy btwn actual and budgeted costs

TRUE OR FALSE: Variable service department costs depend on the actual activity level of the service department.

FALSE; it depends on the actual activity level of the operating department so the amount charged varies in direct proportion to the actual usage

TRUE OR FALSE: Fixed service department costs depends on the operating department’s peak-period service needs, even though this peak level of service is not needed every period.

TRUE; the idea is that the service department must be capable of reaching this peak level at any time, and the budgeted costs must be available for it

The difference between the total actual cost incurred by the service department and the total charges to the operating department is called the ___ and is the responsibility of the (service/operating) department.

spending variance; service

The fixed costs of service departments charged to operating departments are called ___ amounts.

predetermined lump-sum

TRUE OR FALSE: The concepts and tools used to measure the performance of people and departments are known as planning and control.

FALSE; responsibility accounting

TRUE OR FALSE: Controllable costs, as used in a responsibility accounting system, consist of fixed costs.

FALSE

Which of the following would have a low likelihood of being organized as a profit center?

A movie theater of a company that operates a chain of theaters.

A maintenance department that charges users for its services.

The billing department of an Internet Services Provider

The mayor's office in a large city.

Both "3" and "4"

#5 → Both "3" and "4"

TRUE OR FALSE: Controllable costs, as used in a responsibility accounting system, consist of those costs that a manager can influence in the time period under review.

TRUE

A company that has a profit can increase its return on investment by (increasing/decreasing) (sales/average operating assets/operating expenses) and (sales/average operating assets/operating expenses) by the same (percentage/dollar amount).

increasing; sales; operating expenses; percentage

Which of the following will not result in an increase in return on investment (ROI), assuming other factors remain the same?

A reduction in expenses.

An increase in net operating income.

An increase in operating assets.

An increase in sales.

3