ECO 202 Module 8: Consumer Choice and Behavioral Economics

1/22

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

23 Terms

utility

the enjoyment or satisfaction that people receive from consuming goods and services

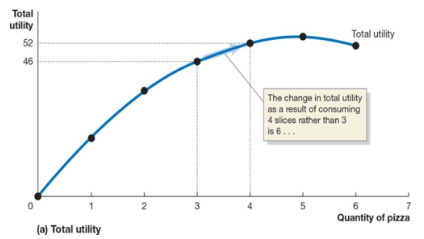

marginal utility

the change in total utility a person receives when consuming one additional good or sevice

law of dimishing utility

the principle that consumers experience diminishing additional satisfaction as they consumer more of a good or service during a given period of time

budget constraint

limited amount of income available to consumers to spend on goods and services

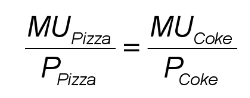

marginal utility per dollar spent

rate at which that item allows the consumer to transform money into utility, MU/price of item

rule of marginal utility per dollar spent

customers should seek to equalize the “bang for their buck,” you should buy products up to the point where the last unit X and the last unit Y purchased give you equal increases in utility per dollar

satisfy the rule of marginal utility per dollar spent and exhaust your budget

income effect

the price of X drops, you have more purchasing power, will result in an increase in demand. you can afford more X than before, so it functinos like an income increase

if X is a normal good, the price decrease will cause you to consume more X

if X is an inferior good, the price decrease will cause you to consume less X

substitution effect

when price of X falls, X becomes cheaper relative to Y and marginal utility per dollar of X increase

lower price X reduces opportunity cost of X because now you have to give up less Y to consume X

Giffen good

a good with an upward-sloping demadn curve, has a larger income effect than substitution effect

social influences on demand

celebrity endorsements: firms use celebrity endorsements regularly because consumers might believe the celebrity knows more about the product or using the product will make them more like a celebrity

network externalities: situations in which the usefulness of a product increases with the number of consumers who use it

may result in market failure if enough people become locked into inferior products

ultimatum game

Person A decides how to split $20 between them and person B. If B accepts, both players receive the split, if B reject, neither receives anything

dictator game

ultimatum game where person B cannot reject, person A most often offered a $10/$10 split over an $18/$2

as the dollar amount incerases, people tend to be less generous with their offers and reject unfari offers less

people are less likely to give away money they feel entitled to

behavioral economics

the study of situations in which people make choices that do not appear economically rational

1) taking into account monetary costs but ignoring nonmonetary opportunity costs

2) failing to ignore sunk costs

3) being unrealistic about their own future behavior

ignoring nonmonetary costs

if you own something you could sell, you incur opportunity costs if you use it youself. if you have a super bowl ticket and use the ticket, you incur the opportunity cost of the profit you would make from selling the ticket

endowment effect: the tendency of people to be unwilling to sell a good they already own, even if they are offered a price that is greater than the price they would be willing to pay to buy the good if they didn’t already own it

failing to ignore sunk costs

sunk cost: a cost that has already been paid and can’t be recovered

once you have paid money and can’t get it back, you should ignore that money in future decisions you make

ex) if you lost a $20 movie ticket, another ticket is $20 but you think $40 is too much - you are mistakenly allowing sunk costs to influence your decision

being unrealistic about future behavior

people make decisions that are inconsistent with their long-run intentions

ex) you smoke today but say you’ll quit some time in the future

rule of thumb

making general rules that often, but not always, product optimal results. can save decision-making time

ex) shopping at a store because it is cheaper but not continually checking to see if this is still true

anchoring

“irrelevant” information can often influence behavior. if uncertain about a value/price, people will anchor it to another known value, even if that value is irrelevant

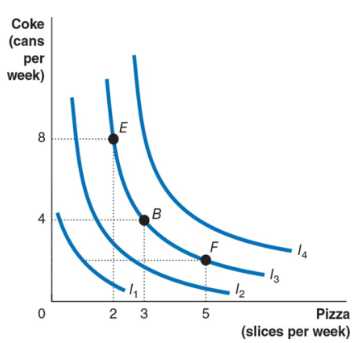

indifference curve

a curve showing the combinations of consumption bundles that give the consumer the same utility

points along a line have equal preference

lower indifference curves represent lower utility levels, and vice versa

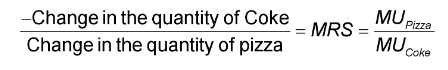

marginal rate of substitution

the rate at which the consumer is willing to trade off one product for another while keeping the consumer’s utility constant

the slope of the indifference curve

tends to decrease as we move to the right, giving ICs a convex shape

finding optimal consumption

to maximize utility, a consumer needs to be on the highest IC, given their budget constraints

IC is tangent to the budget line and slopes are equal

when price falls, the budget constraint line moves outward

substitution effect is represented by a new point on the original IC and income effect is represented by a point on the new IC

at the optimal point of consumption, the IC is just tangent to the budget line and their slopes are equal

at optimum, MRS = Pricex/Pricey

relating MRS and marginal utility