Employment & Taxes

1/49

Earn XP

Description and Tags

Economy & Finances Text Practice

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

50 Terms

Progressive

Taxes that take a larger share of income as the amount of income grows. ex. income tax

refund

The money given back to the tax-payer if they have over paid taxes for the year is known as the tax:

proportional tax

Social Security and Medicare are an example of a:

tax evasion

Willful failure to pay taxes is a crime known as:

Hourly earnings

Wages are:

One-time lump sum payments.

Stipends are:

child support

Which of the following is not part of taxable income?

Divorced

Which of the following is NOT an income tax filing status?

Regressive

The Sales Tax is an example of which type of tax?

Excise Tax

Tax on specific goods, like gasoline, alcohol, and tobacco.

Salary, tips, wages

Which is a type of EARNED income?

1040

What form do you use to file a tax return with the IRS?

Kelly, who has worked for the same department store for the last 15 years.

Who should expect to receive a W-2 form from their employer by January 31, 2023.

Not enough money was withheld from his paychecks.

Jay filed his taxes and found out he owed money. What is the most reasonable explanation as to why he owes money in taxes?

Audit

An examination of tax returns by the IRS is called:

Capital Gains Tax

What is the name of the tax on earnings made from the sale of assets such as stock and real estate.

Estate Tax

What is the name of the tax on the transfer of the estate from a deceased person.

social security and Medicare

Which of the following deductions from an employee's paycheck is mandatory?

property tax

What is tax paid on the assessed value of an asset such as a house or car

social security

Billy is a 16-year-old high school student who recently lost a parent. What will help Billy?

gross income

What type of income is used to look up your "tax" in the tax table?

teacher’s salary

What is an example of earned income?

W-2 forms

What do you need to fill out a 1040 form?

April 15th

When is tax day?

Religious Affiliation

All of the following are factors that impact the amount someone may pay in taxes EXCEPT

Tariff

____________ is a tax on products imported from foreign countries.

All of the above

Your W-2

Your routing and bank account number

A record of any other supplemental income

What do you need in order to fill out your 1040?

Social Security Tax

Medicare Tax

Payroll tax consists of which taxes? (Check all that apply.)

Net pay

The amount of money you're paid, after all taxes and deductions are taken out of your paycheck is called

All of the above

Taxes are often used at the federal, state, and local levels.

Taxes pay for roads and emergency services.

Taxes pay for schools and government departments.

Which of the following statements is true about taxes?

True

True or False: "Taxes pay for schools first responders and roads"

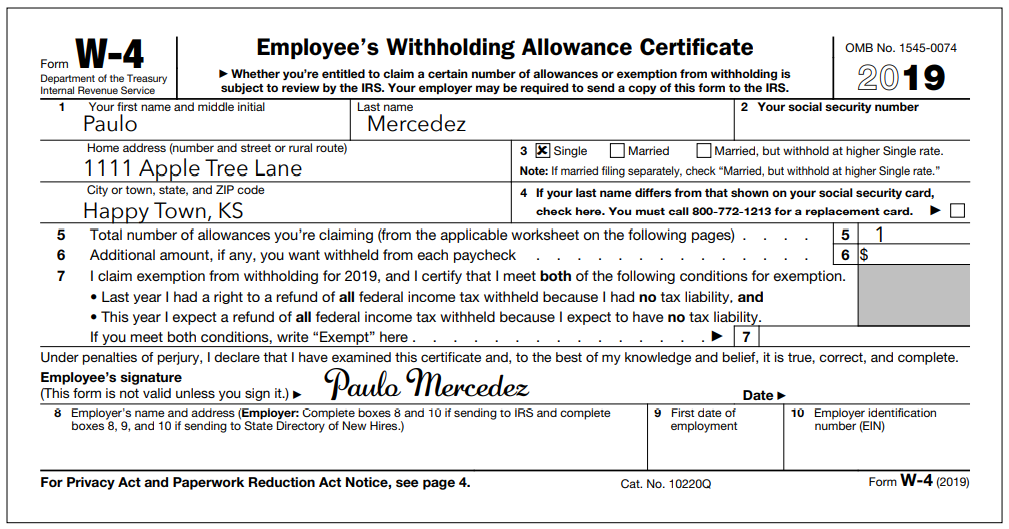

Inform employer how much federal income tax to withhold from your paychecks

What is the purpose of the W-4 form?

Income Tax

__________ is federal, state, and local taxes on income

Sales tax

Which of the following is NOT a possible tax or deduction that could show up on your paycheck?

Overtime pay

Which of the following is NOT a possible tax or deduction that could come out of your paycheck?

Property Tax

___________ is taxes on property, especially realestate, but also can be on boats,automobiles, etc...

How much money you make

The amount of federal income tax you pay is based on

1

What is the holding allowance on this W-4?

All of the above

FICA

Contributions to retirement savings

Federal income tax

Which of the following is a possible tax or deduction that they may show up on your paycheck?

Overtime pay

Which of the following is NOT a possible tax or deduction that could come out of your paycheck?

Payroll Tax

Taxes taken from your paycheck, including Social Security and Medicare taxes.

Gross Income

_________ is your total pay before taxes and other deductions are taken out.

True

True or False: "The more education your receive the higher your lifetime earnings will be."

True

True or False: "When considering a job offer, you should only consider how much you're being paid before you accept the offer."

benefits

Healthcare, paid time off, disability insurance, and matching contributions to a retirement account are all

Bachelor's Degree

For most careers, which degree will most likely result in the highest lifetime earnings?

The amount of money you're paid after all taxes and deductions are taken

What is net pay?

W-2

An employer sends you a _______ form that shows how much you've made and how much you've paid in taxes in the last year.

Net Income

____________ is the amount of money you bring home in your paycheck after taxes and other deductions are taken out

W-2

Your employer sends you a __ form that tells you how much you've made and how much you've paid in taxes in the last year