CHAPTER 1 AN INTRODUCTION TO TAXATION

1/85

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

86 Terms

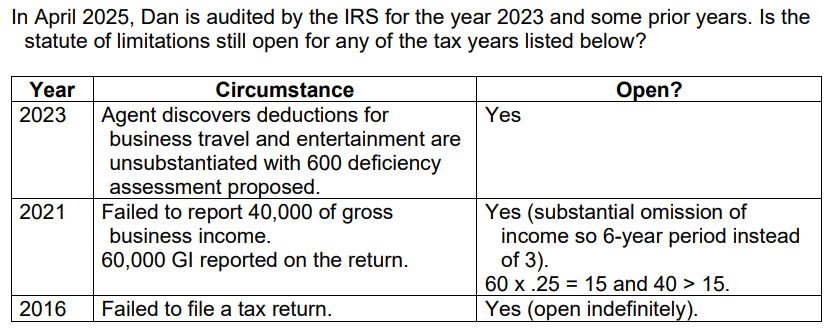

History of Taxation [2-3]

The one constant in federal income taxation is CHANGE, especially in recent years.

Some history that may be mentioned throughout the semester:

Internal Revenue Code of 1939: first attempt to accumulate all tax legislation in one concise document (previously scattered over 34 volumes and 65 years of legislation).

Current Tax Payment Act of 1943: implemented the “pay as you go” system of employee withholding and payment of estimated taxes for self-employed taxpayers.

Internal Revenue Code of 1954: recodification of tax law and change in filing deadline for individual TPs from March 15 to April 15.

Economic Recovery Tax Act of 1981 (ERTA): ACRS, relaxed rules for Subchapter S corporations, provided a large reduction in individual tax rates (70% to 50% for the top rates), tax brackets were indexed for inflation.

Tax Reform Act of 1986: third codification (and current one), kiddie tax, passive L rules, MACRS, repeal of General Utilities doctrine, just to name a few (largest tax act in history to that time).

Tax Cuts and Jobs Act of 2017 (TCJA): reduction in itemized deductions, increased SD, elimination of personal and dependency exemptions, substantial decrease in the corporate tax rate with only one rate now (instead of the previous progressive corporate tax rate schedule with phaseouts at various levels of TI), elimination of corporate AMT, and many more changes we will see throughout the semester.

CARES Act of 2020 (Coronavirus Aid, Relief and Economic Security Act): enacted numerous provisions to provide relief due to the COVID-19 pandemic including delaying some of the provisions enacted by the TCJA discussed just above.

Inflation Reduction Act (IRA, signed in August 2022): tax and climate bill which encourages conservation and cleaner sources of energy, increases IRS funding and contains a number of tax provisions.

One Big Beautiful Bill Act (OB3): signed on July 4, 2025, this is a comprehensive tax reform passed through budget reconciliation which extends and modifies key provisions of the TCJA, introduces new tax incentives, and adjusts certain IRA credits.

The federal individual income tax is the dominant form of taxation for the U.S. government [see Table 1-1, below] but look at the trends over the last 60 years (social insurance and contribution are up and corporate income tax revenues are down as a percentage of the total).

![<ul><li><p>The one constant in federal income taxation is CHANGE, especially in recent years.</p></li><li><p>Some history that may be mentioned throughout the semester:</p><ul><li><p><strong>Internal Revenue Code of 1939</strong>: first attempt to accumulate all tax legislation in one concise document (previously scattered over 34 volumes and 65 years of legislation).</p></li><li><p><strong>Current Tax Payment Act of 1943</strong>: implemented the “pay as you go” system of employee withholding and payment of estimated taxes for self-employed taxpayers.</p></li><li><p><strong>Internal Revenue Code of 1954</strong>: recodification of tax law and change in filing deadline for individual TPs from March 15 to April 15.</p></li><li><p><strong>Economic Recovery Tax Act of 1981 (ERTA)</strong>: ACRS, relaxed rules for Subchapter S corporations, provided a large reduction in individual tax rates (70% to 50% for the top rates), tax brackets were indexed for inflation.</p></li><li><p><strong>Tax Reform Act of 1986</strong>: third codification (and current one), kiddie tax, passive L rules, MACRS, repeal of General Utilities doctrine, just to name a few (largest tax act in history to that time).</p></li><li><p><strong>Tax Cuts and Jobs Act of 2017 (TCJA)</strong>: reduction in itemized deductions, increased SD, elimination of personal and dependency exemptions, substantial decrease in the corporate tax rate with only one rate now (instead of the previous progressive corporate tax rate schedule with phaseouts at various levels of TI), elimination of corporate AMT, and many more changes we will see throughout the semester.</p></li><li><p><strong>CARES Act of 2020 (Coronavirus Aid, Relief and Economic Security Act)</strong>: enacted numerous provisions to provide relief due to the COVID-19 pandemic including delaying some of the provisions enacted by the TCJA discussed just above.</p></li><li><p><strong>Inflation Reduction Act (IRA, signed in August 2022)</strong>: tax and climate bill which encourages conservation and cleaner sources of energy, increases IRS funding and contains a number of tax provisions.</p></li><li><p><strong>One Big Beautiful Bill Act (OB3)</strong>: signed on July 4, 2025, this is a comprehensive tax reform passed through budget reconciliation which extends and modifies key provisions of the TCJA, introduces new tax incentives, and adjusts certain IRA credits.</p></li></ul></li><li><p>The federal individual income tax is the dominant form of taxation for the U.S. government [see Table 1-1, below] but look at the trends over the last 60 years (social insurance and contribution are up and corporate income tax revenues are down as a percentage of the total).</p></li></ul><p></p>](https://knowt-user-attachments.s3.amazonaws.com/41da8e76-bac4-487e-a03f-983e2a534d03.png)

Types of Tax Rate Structures [4-5]

[Note that Tax (T) = Base (B) x Rate (R) so if T = B x R then R = T/B]

proportional

progressive

regressive

If T/B is constant as B increases or decreases then R is

proportional.

sales tax, property tax

If T/B increases as B increases and decreases as B decreases then R is

progressive.

federal individual income tax, wealth transfer tax

If T/B increases as B decreases and decreases as B increases then R is

regressive.

theoretically nothing, but in practicality the social security system is regressive

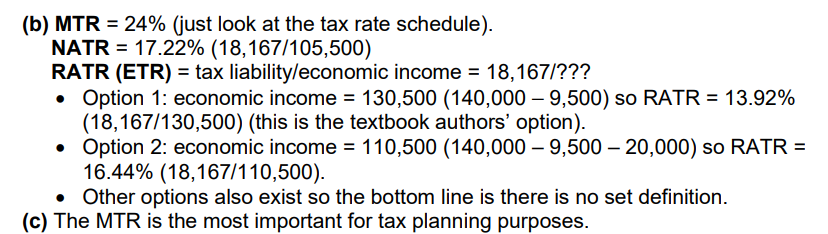

Tax Rate Measures for TPs [5-6]

Marginal tax rate (MTR)

Nominal average tax rate (NATR) =

(tax liability divided by taxable income).

Real average tax rate (RATR) [also known as the effective tax rate (ETR)] =

(tax liability divided by economic income).

Marginal tax rate (MTR)

It is defined as “the tax rate applied to the next dollar of income” and measures the tax effect of a proposed transaction.

To determine the MTR, simply look at the tax rate schedule, find TI and then slide over to the percentage listed on the line.

The value of a deduction (deduction X MTR) and the ATCF in a transaction (increase in income X [1-MTR]) both depend on the MTR.

Nominal average tax rate (NATR) =

(tax liability divided by taxable income).

Real average tax rate (RATR) [also known as the effective tax rate (ETR)] =

(tax liability divided by economic income).

Example: TP is single in 2025 with TI = 70,000, economic income = 85,000 and tax liability = 10,314 (rounded).

MTR = 22%

NATR = 10,314/70,000 = 14.73%

RATR = 10,314/85,000 = 12.13%

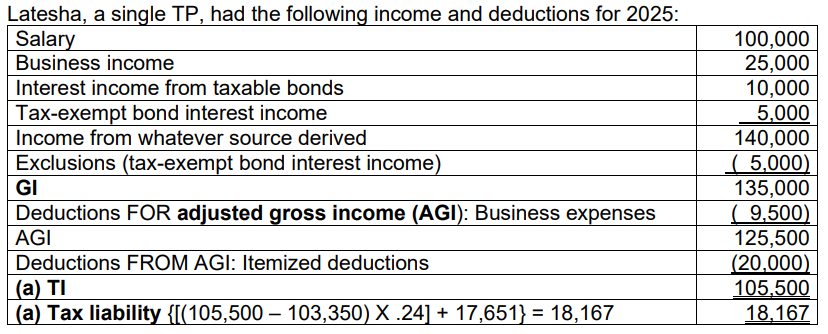

Using The MTR In Tax Planning

After-tax cash flow (ATCF) = cash left after paying taxes

[Note that these statements are true as long as the before and after TIs are within the

same bracket (see example 3).]

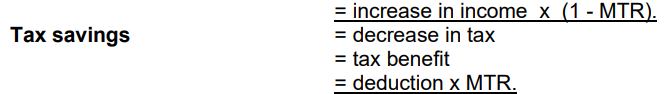

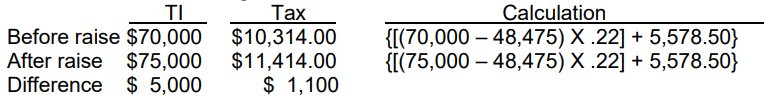

Example 1: TP is single with TI of $70,000 in 2025. He is given a raise of $5,000.

What is his ATCF with regard to the raise

Remaining cash (ATCF) = $5,000 (↑ in income) - $1,100 (tax) = $3,900

Shortcut: ATCF = ↑ in income x (1 - MTR) = $5,000 x (1 - .22) = $3,900

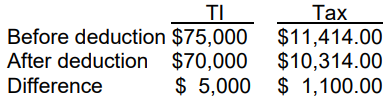

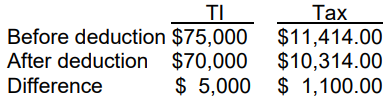

Example 2: TP is single with TI of $75,000 in 2025. He is contemplating making a charitable contribution of $5,000. What is the tax savings from this deduction?

Shortcut: Tax benefit = $5,000 x .22 = $ 1,100

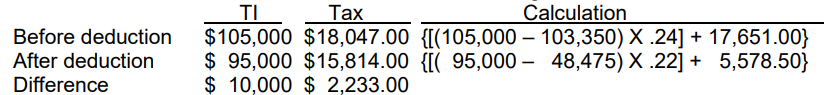

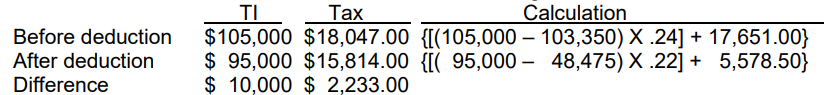

Example 3: TP is single with TI of $105,000 in 2025. He is contemplating making a charitable contribution of $10,000. What is the tax savings from this deduction?

Note that the shortcut cannot be used here since the deduction causes the before/after TI to span two different brackets. The actual MTR for this transaction is $2,233/$10,000 = 22.33%.

For another example of tax planning using the MTR see Example 4 below.

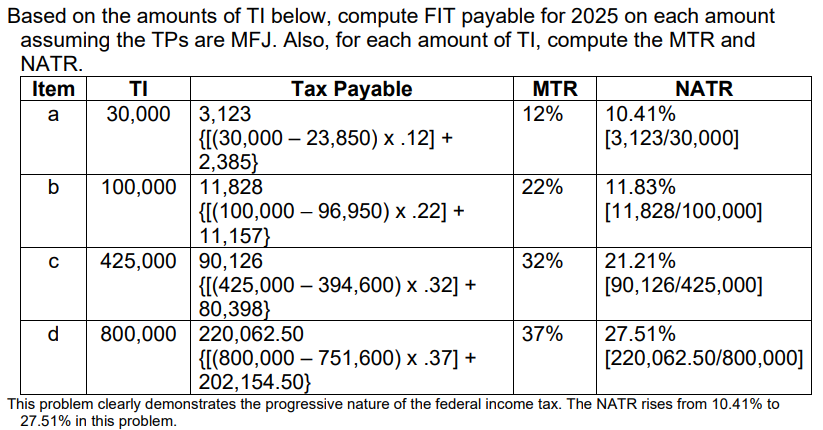

Example 4 [Stop and Think on p. 1-6]:

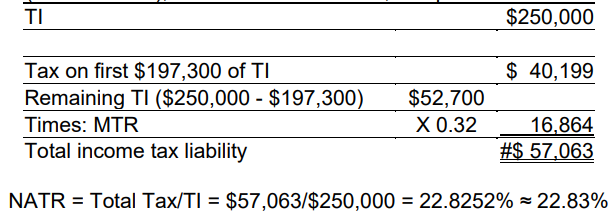

Gwen, a single TP, has seen her income climb to $250,000 in the current year (2025). She wants a tax planner to help her reduce her tax liability. In planning for tax clients, tax professionals almost exclusively use the MTR in their analysis rather than the average tax rate. Why is the MTR much more important in the tax planning process than the average tax rate?

Because tax planning is done at the margin, a single TP who has TI of $250,000 has a MTR of 32% (at 2025 rates), but a NATR of 22.83%, computed as follows:

NATR = Total Tax/TI = $57,063/$250,000 = 22.8252% ≈ 22.83%

If a tax planner could reduce Gwen's TI by $10,000, Gwen's tax liability would decrease by $3,200 ($10,000 X 0.32). When the TP wants to know how much she can save through tax planning, the appropriate MTR yields the answer.

#[(250,000 – 197,300) x .32] + 40,199 = 57,063

![<p>Because tax planning is done at the margin, a single TP who has TI of $250,000 has a MTR of 32% (at 2025 rates), but a NATR of 22.83%, computed as follows:</p><img src="https://knowt-user-attachments.s3.amazonaws.com/d3f607d9-0644-45e3-aa07-e9a55bff8f48.png" data-width="100%" data-align="center" alt="knowt flashcard image"><p></p><p>NATR = Total Tax/TI = $57,063/$250,000 = 22.8252% ≈ 22.83%</p><p>If a tax planner could reduce Gwen's TI by $10,000, Gwen's tax liability would decrease by $3,200 ($10,000 X 0.32). When the TP wants to know how much she can save through tax planning, the appropriate MTR yields the answer.</p><p>#[(250,000 – 197,300) x .32] + 40,199 = 57,063</p>](https://knowt-user-attachments.s3.amazonaws.com/d3f607d9-0644-45e3-aa07-e9a55bff8f48.png)

Total Income (income from whatever source derived) - Exclusions =

Gross Income (GI)

GI - Deductions (business expenses and itemized deductions) =

Taxable Income (TI)

TI x the Applicable Tax Rate =

Income Tax Before Credits

Income Tax Before Credits - Tax Credits =

Total Tax Liability

Total Tax Liability - Prepayments =

Balance Due or Refund

Other Types of Taxes [7-12] (see also Topic Review 1-1 on p. 1-12)

State and local income and franchise taxes

Wealth transfer taxes (federal gift tax, federal estate tax)

Other taxes (such as property taxes, federal excise taxes, sales taxes, employment taxes, etc.)

Criteria for a Tax Structure [12-14]

Equity

Certainty

Convenience

Economy

Simplicity

Equity:

fairness

Horizontal: equally situated TPs should be taxed equally.

Vertical: unequally situated TPs should be taxed differently (but what does “differently” mean?).

See the “Search for the Golden Mean” article (at the end of this packet).

Certainty

For the TP: to know the amount of tax due each year.

For the government: a stable revenue source.

Convenience:

easily assessed, collected and administered.

Economy:

minimal compliance and administrative costs.

Simplicity:

TPs should be able to understand and comply with any tax system within reasonable boundaries [see the quote below from the Report of the President’s Advisory Panel on Tax Reform (2005)].

In short, our current tax code is a complicated mess. Instead of clarity, we have opacity. Instead of simplicity, we have complexity.

Instead of fair principles, we have seemingly arbitrary rules. Instead of contributing to economic growth, it detracts from growth. Time and time again, witnesses told the Panel about these failings in the tax code.

Objectives of the Federal Income Tax Law [14-15] (see also Topic Review 1-2 on p. 1-16)

Economic objectives (such as to stimulate private investment, reduce unemployment, mitigate the effects of inflation on the economy).

Encouragement of certain activities and industries.

Social objectives (used either to encourage or discourage certain socially desirable or undesirable activities).

Income redistribution.

Entities in the Federal Tax System [16-24]

Taxpaying entities (such as Individuals and C corporations)

Flow-through entities (such as Sole proprietorships, PPs, S corporations, LLCs, LLPPs, etc.)

Other (such as trusts)

Tax Law Sources [24-26] (see also Topic Review 1-3 on p. 1-25 and skim pp. 15-7 to 15-24)

Legislative

Administrative

Judicial

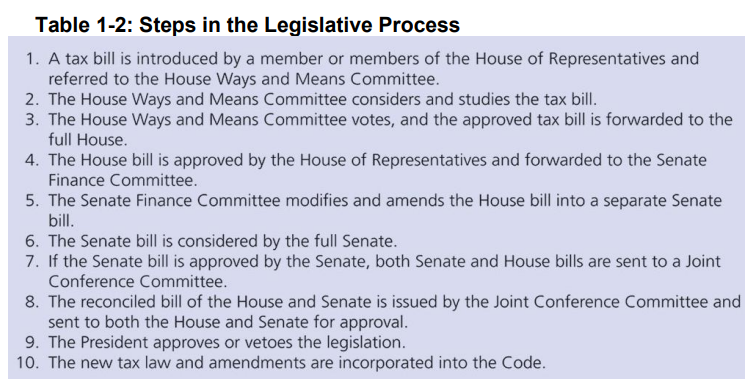

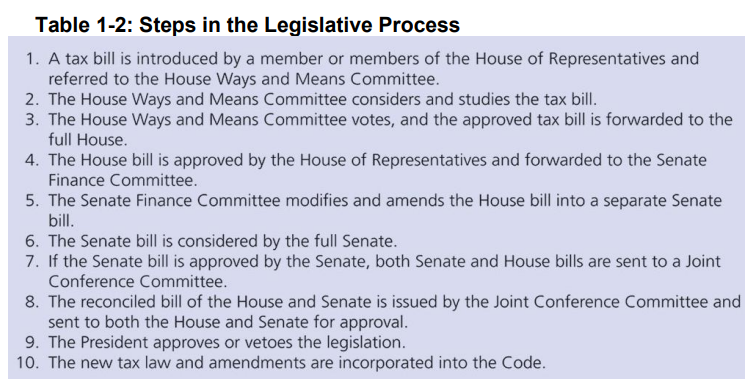

Legislative

Remember, this is a political process.

See the table below for the steps in this process.

The ultimate result is the Internal Revenue Code of 1986, as amended.

Administrative

Treasury regulations--principal administrative source of tax law.

Issued in one of three possible types:

Legislative

Interpretive

Procedural

Issued in one of three possible forms:

Proposed

Temporary

Final

Regulations are also less likely to be overturned if they have been issued for a long time; that is, if Congress thought they were contrary to law then they should have been changed at the time they were written.

Revenue rulings

Revenue procedures

Private letter rulings (PLR)

Legislative

Congress is effectively delegating its legislative powers to the Treasury Department.

Regulations issued pursuant to this type of authority possess the force and effect of law.

Are less likely to be overturned but may be if they exceed the scope of power delegated to the Treasury, are unreasonable or are contrary to the statute.

Interpretive

Rephrases and elaborates on what Congress stated in the Committee Reports that were issued when the tax legislation was enacted.

They are hard and solid and almost impossible to overturn unless they do not clearly reflect the intent of Congress (that is they must be unreasonable and plainly inconsistent with the statute).

Procedural

These neither establish tax laws nor attempt to explain tax laws.

They often include procedural instructions, indicating information that taxpayers should provide the IRS, as well as information about the internal management and conduct of the IRS itself.

Proposed

Issued by the Treasury Department.

Provides a preview of future final regulations.

Carries little weight.

Not precedent.

Not binding on the IRS or TPs.

Temporary

Issued by the Treasury Department.

Provides immediate guidance on the meaning and application of new law.

Has same weight as final regulations.

May be cited as precedent.

Note that temporary regulations are now applicable for only three years and must be issued concurrently in proposed form

Final

Issued by the Treasury Department.

Provides guidance on the meaning and application of the Code.

Has the force and effect of law and may be cited as precedent.

When looking at final regulations, legislative regulations are higher in authority than interpretive regulations.

Regulations are also less likely to be overturned if they have been issued for a long time; that is, if Congress thought they were contrary to law then they should have been changed at the time they were written.

Revenue rulings

Issued by the National Office of the IRS (but not approved by the Secretary of the Treasury).

Provides guidance to IRS personnel and TPs in handling routine tax matters.

Usually deals with more restricted problems than regulations.

Generally applies retroactively and may be revoked or modified by subsequent rulings, procedures, regulations, legislation or court decisions.

Does not carry the same legal force and effect of regulations and is not precedent.

Revenue procedures

Issued by the National Office of the IRS (but not approved by the Secretary of the Treasury).

Deals with the internal management practices and procedures of the IRS.

Generally applies retroactively and may be revoked or modified by subsequent rulings, procedures, regulations, legislation or court decisions.

Does not carry the same legal force and effect of regulations and is not precedent.

Private letter rulings (PLR)

Issued by the National Office of the IRS.

Issued for a fee upon a TP’s request and describes how the IRS will treat a proposed transaction for tax purposes.

Applicable only to the TP addressed and is not precedent

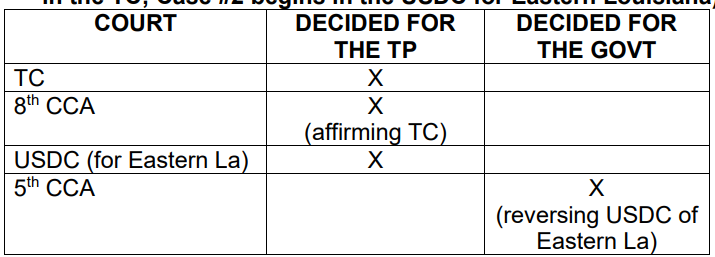

Judicial

Trial courts

U.S. Tax Court (USTC or TC)

U.S. District Court (USDC or DC)

U.S. Claims Court (USCC or CC)

Appellate courts

U.S. Court of Appeals (USCCA or CCA)

U.S. Court of Appeals for the Federal Circuit

Supreme Court (USSC or SC)

Small cases division of the TC

Other judicial considerations

Judicial doctrine:

The TC issues two types of decisions (although they carry the same authoritative weight)

Regular decision

Memo decision

Acquiescence

Golsen Rule

Trial courts

U.S. Tax Court (USTC or TC)

U.S. District Court (USDC or DC)

U.S. Claims Court (USCC or CC)

U.S. Tax Court (USTC or TC)

(hears only tax cases, no jury trial, do not pay tax first, national jurisdiction).

U.S. District Court (USDC or DC)

(pay tax and sue for refund, jury trial is available, limited jurisdiction, many types of cases are heard).

U.S. Claims Court (USCC or CC)

(pay tax first and sue for refund, no jury trial, national jurisdiction).

Appellate courts

U.S. Court of Appeals (USCCA or CCA)

U.S. Court of Appeals for the Federal Circuit

Supreme Court (USSC or SC)

U.S. Court of Appeals (USCCA or CCA)

(circuit depends on the TP’s residence on the date of appeal if an individual or principal place of business if a business, 11 geographical circuits, hears cases from USTC and USDC).

U.S. Court of Appeals for the Federal Circuit

(national jurisdiction, hears appeals from USCC)

Supreme Court (USSC or SC)

Hears cases from all courts of appeal.

Does not have to hear every appeal so it generally chooses those cases with conflicts among circuits or dealing with unclear law.

Decisions are the law of the land and take precedence over all other court decisions, including the Supreme Court’s earlier decisions (and, as a practical matter, a Supreme Court interpretation of the IRC is almost as authoritative as an act of Congress).

If Congress does not agree with the Court’s interpretation, it can amend the IRC to achieve a different result (and has done so).

If the Supreme Court declares a tax statute to be unconstitutional, the statute is invalid.

Small cases division of the TC—

available to all TPs but the assessment can be no more than $50,000 (including penalties, excluding interest) but there is no appeal and cases have no precedential value.

Judicial doctrine:

law formulated by the courts (the court is making law instead of just interpreting it) which may (or may not) later be codified (passed by Congress and thus put in the IRC) with examples including constructive receipt, assignment of income, recovery of basis, step transaction, business purpose, sham transaction, economic substance, etc.

The TC issues two types of decisions (although they carry the same authoritative weight):

Regular decision:

Memo decision:

Regular decision:

issued the first time the TC decides a legal issue.

Memo decision:

shorter and usually deals with factual variations of previously decided cases (so instead of arguing law you are referred to previous regular decisions where the law is argued).

Acquiescence:

the IRS announces it will agree or not agree with a TC decision.

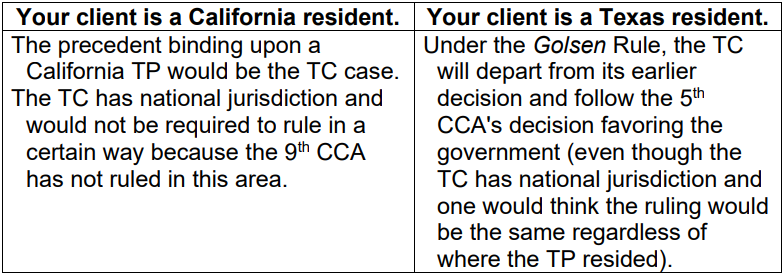

Golsen Rule:

the TC departs from its general policy of adjudicating uniformly for all TPs and instead follows the decisions of the court of appeals to which the case in question is appealable (that is, the Golsen Rule mandates that the TC rule consistently with decisions of the court for the circuit where the TP resides or does business).

Self-study question (p. 15-21, in the sidebar):

Question: Is it possible for the TC to intentionally issue conflicting decisions?

Answer: Yes. If the TC issues two decisions that are appealable to different circuit courts and these courts have previously reached different conclusions on the issue, the TC follows the respective precedent in each circuit and issues conflicting decisions. This is a result of the Golsen Rule.

TE 15-8 (p. 15-21):

In the year in which an issue was first litigated, the TC decided that an expenditure was deductible. The government appealed the decision to the 10th CCA and won a reversal. This is the only appellate decision regarding the issue. If and when the TC addresses this issue again, it will hold, with one exception, that the expenditure is deductible. The exception applies to TPs in the 10th Circuit. Under the Golsen Rule,

these TPs will be denied the deduction.

Discussion Question 15-21 (p. 15-35):

Note that there are two cases with identical facts (Case #1 begins in the TC; Case #2 begins in the USDC for Eastern Louisiana).

Enforcement Procedures [27]

Math check

Information return check

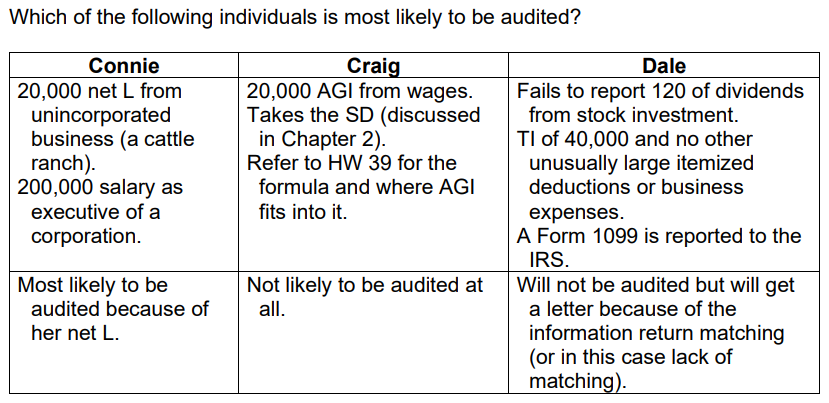

Selection of Returns for Audit [27]

The U.S. tax system is based on self-assessment and voluntary compliance.

The Discriminant Function System is used to classify returns to be selected for audit by generating a score for a return based on the potential for the return to generate additional tax revenue.

Less than 1% of all individual returns are selected for audit but some regions and types of returns are more likely to be audited than others (states with higher numbers of self-employed TPs for example).

Audits are conducted in the IRS office and in the field (client’s office).

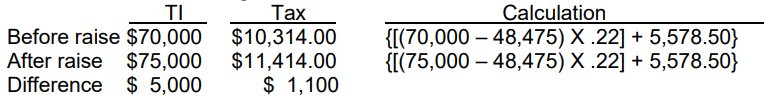

Statute of limitations [28] [Note that the due date for an individual tax return is normally April 15 of the year following the end of the tax year being reported (that is, if the tax year is calendar year 2025 the due date is April 15, 2026)].

• Normal return:

• Substantial omission of income:

• Fraudulent return or no return filed:

Normal return:

3 years from later of due date of return or date return is filed.

Substantial omission of income:

omission of GI which is in excess of 25% of the income on the return (3 years becomes 6 years).

Fraudulent return or no return filed:

remains open indefinitely.

Interest, Penalties and Appeals [28-29]

Interest accrues on both assessments of additional tax due and on refunds that the TP receives from the government.

No interest is paid on a tax refund if the amount is refunded by the IRS within 45 days of the later of the due date for the return (without regard to extensions) or the date the return was filed.

Various penalties are imposed for failure to file, failure to pay, inaccuracy, fraud, etc. (in fact, more than 150 penalties can be imposed on the TP).

If an IRS agent issues a deficiency assessment the TP may make an appeal to the IRS Appeals Division where the TP may be able to negotiate a compromise settlement.

Components of a tax practice [29-31]

Tax compliance

Tax procedure

Tax research

Tax planning and consulting

Personal financial planning

Tax compliance:

preparation of tax returns.

Tax procedure:

assisting the client in negotiations with the IRS.

Tax research:

searching for the best possible defensibly correct solution to a problem involving either a completed or a proposed transaction.

Tax planning and consulting:

structuring the client’s affairs so as to minimize the amount of taxes and maximize the after-tax return.

Personal financial planning:

reviewing the client’s financial goals and objectives and recommending an investment strategy to meet those goals while keeping the tax consequences in mind

Computer Applications in Tax Practice [31-32]

Tax return preparation

Tax planning applications

Tax research applications

Studying taxation

Don’t get lost in the detail (think in terms of doing the conceptual then the calculation then the compliance) because even tax experts can get lost in the forest as the following quotation from Judge Learned Hand (a very famous judge living from 1872 to 1961) shows as he agonized over the difficulty in deciding tax cases fairly:

“[T]he words of such an act as the Income Tax, for example, merely dance before my eyes in a meaningless procession: cross-reference to cross-reference, exception upon exception— couched in abstract terms that offer no handle to seize hold of— leave in my mind only a confused sense of some vitally important but successfully concealed (purpose), which it is my duty to extract, but which is within my power, if at all, only after the most inordinate expenditure of time.”

Know the following:

Primary tax law sources

Secondary tax law sources

The distinction is important because a penalty is imposed for substantial understatements of tax except where the TP has “substantial authority” for the position taken on the return (and substantial authority is generally defined as those primary tax law sources listed above but not the secondary tax law sources).

Pay close attention to the wording of the law (and versus or, etc.).

Be sure that every transaction has a business purpose (something other than tax avoidance).

The role of taxes in decision-making

Decision-making is a process of evaluating alternatives.

The goal is generally (but not always) to maximize after-tax profit.

Primary tax law sources:

IRC, administrative pronouncements (regulations, etc.), judicial cases (TC, DC, CC, CCA, SC, etc.), treaties, committee reports (Senate Finance, House Ways and Means, etc.), etc.

Secondary tax law sources:

conclusions reached in treatises, legal periodicals, opinions rendered by tax professionals, etc. (all of which are useful in finding, analyzing and evaluating primary authorities).

Avoidance (tax planning):

The process of controlling your actions so as to avoid undesirable tax consequences (it is completely legal to do so).

The most celebrated reflection about income tax avoidance, which has become a common law of U.S. tax policy, was written by Judge Learned Hand:

“Anyone may so arrange his affairs that his taxes shall be as low as possible; he is not bound to choose that pattern which will best pay the Treasury; there is not even a patriotic duty to increase one's taxes.”

Evasion is

the reduction of tax by illegal methods such as backdating a document, omitting income from the return, etc.

• The value of a credit versus the value of a deduction

o A deduction reduces the tax base while a credit is a dollar-for-dollar reduction in tax.

o Should the taxpayer take a $400 credit or a $1,000 deduction?

39

40

41

47

48