Welfare state

1/136

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

137 Terms

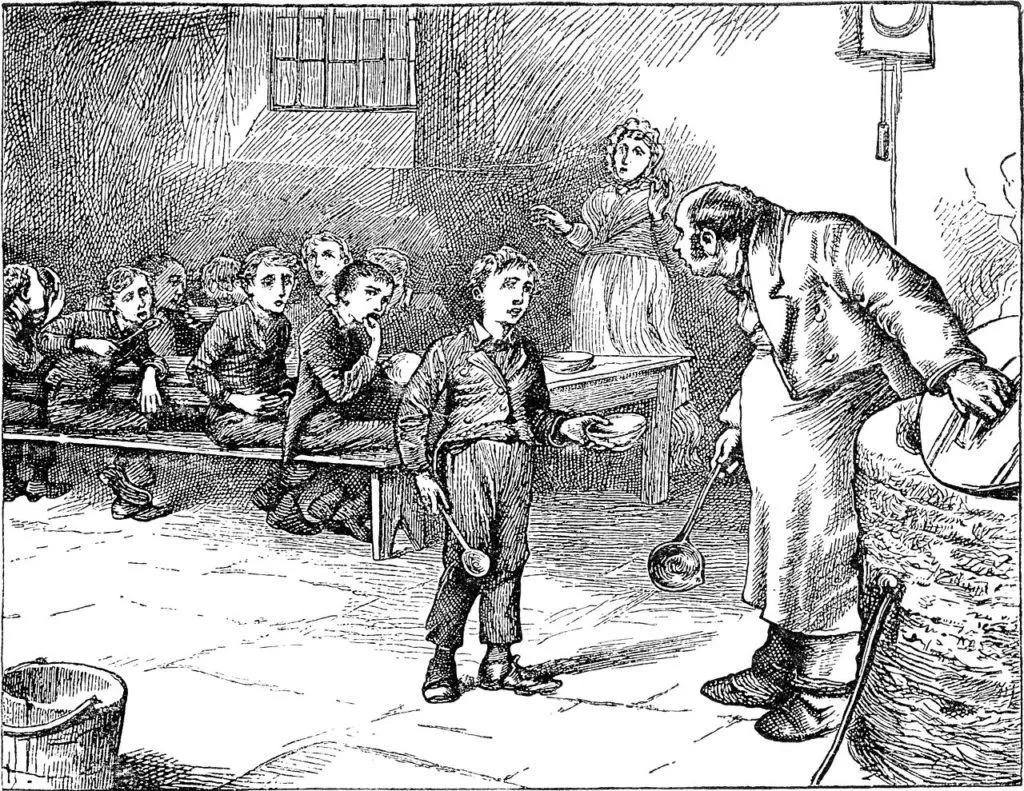

What was welfare to Britain?

Given in the form of money or necessities to those in need, usually the old, the young, the sick and the poor. The first three were usually seen as the 'deserving' poor, rightly cared for by relatives, the Church, private organisations, and increasingly, the state. Yet until the 1900's, healthy people of working age who fell into poverty were seen as morally at fault, therefore the 'undeserving' poor. The process of having to prove you were a 'deserved' poor person was hated, humiliating experience

Unemployment during interwar (1918-39)

Never below 1 million in interwar period (10% of the workforce).

1918-39: Self-funding National Insurance scheme

Was seen as the ideal solution.

1918-39: a short-term solution to welfare provision

Issue dole money, but under the name: the 'out-of-work donation'.

The extent and nature of welfare provision, 1918-39: Long-term solution

New Unemployment Act was developed to offer a longer term solution Idea was that increasing the number of workers covered by insurance would make the scheme self-funding But, the Act was passed in 1920 and the slump after the war meant the funds drained

The extent and nature of welfare provision, 1918-39: 1921 'Seeking Work Test'

March 1921 and by March 1930 three million claims had been rejected due to this test

The extent and nature of welfare provision, 1918-39: Local Government Act 1929

Major changes in the provision now took place.

County and borough councils had to set up Public Assistance Committees (PACs). Centrally funded and replaced the Poor Law guardians who administrated funds under the old Poor Law

Due to the 1931 financial crisis, the PACs were given the power to investigate into household incomes to check eligibility. This was hated due to invasion of privacy and how some PACs were stricter than others

By 1931, 400,000 people had suffered rejection

The extent and nature of welfare provision, 1918-39: Unemployment Act 1934

Separated the treatment of 'insurable' from long-term unemployment. Part I of the Act provided 26 weeks of benefit payments to the 14.5mn workers who paid into the scheme.

Part II created a National Unemployment Assistance Board (UAB) to help those with no insurance benefits

Why by 1939 had the government not been able to solve unemployment?

Prevailing wisdom of contractionary policies (spending cuts and increasing taxes) could not stimulate growth.

Only when the huge state spending was poured

The extent and nature of welfare provision, 1918-39: 1908 Pensions Act plus's and minus's

State pensions had been introduced by the 1908 Pensions Act.

Good for the eligible 70+

Criticisms that they were means-tested and did not support the widows and children of the deceased

The extent and nature of welfare provision, 1918-39: 1908 Pensions Act, what did Neville do to change this?

Minister of Health: Neville Chamberlain addressed these concerns with his 1925 Widows', Orphans' and Old Age Contributory Pensions Act.

Provided a pension of 10 shillings a week for those ages 65-70 and for widows and their children. Funded by compulsory contributions instead of taxation.

The extent and nature of welfare provision, 1918-39: Labour party and public opinion on 1925 Widows', Orphans' and Old Age Contributory Pensions Act.

Initially unpopular within the Labour party who thought this targetted the poor, but with the tough economic decisions, alongside the aging population led to its general acceptance. Self-employed workers of both sexes were allowed to join the scheme in 1937

1919 Housing and Town Planning Act

Gov. promised returning soldiers 'a home fit for heros'

1919 Housing and Town Planning Act aimed to get local authorities to use central gov. funds to meet housing needs.

Said to be 600,000 houses created, however only just over 200,000 due to the recession and the Geddes Axe.

Conservative and Labour Housing Acts in 1923 and 1924

Sought to use subsidies to encourage construction of private and state-owned housing. These Acts, alongside a Labour Housing Act in 1930, promoted a great deal of housebuilding.

1919-1940: 4 million houses were built in total, with one million built by the public sector

how was the 1930 housing act funded?

Used state funds to rehouse people living in overcrowded areas

Most of the public sector houses were built in large cities: Birmingham, Manchester, Liverpool, Sheffield

1924-1939: 20 cottage estates were created on the outskirts of London: new suburbs connected to the centre by rail

1918-39: Housing welfare negatives

Although the quality of housing was much improved thanks to state subsidies per house, some projects were not thoroughly thought through.

Huge Becontree estate (25,800 houses and flats) meant there was a lack of local jobs that was only avoided by the construction of a new Ford car factory in 1931 nearby.

1918-39 Housing welfare positives

With new homes came a new demand for certain goods such as furniture, indoor plumbing, and gardens.

All raised the standard of living

Impact of 'total war' on social welfare provision

WW2 led to a wide consensus that welfare provision needed radical change. A political will developed to iron out the unfairness and inconsistency of a system that had evolved.

Reasons why there was a shift in attitude among politicians and the general public: Total War

Affected the rich and the poor

Prompted 'total solutions' such as universal rationing and the provision of communal bomb shelters

Success of such policies gave a boost to universalist (concerned with all people rather than a particular group) as opposed to selective solutions

Public sacrifice endured by the whole nation gave people the belief in a just reward.

Evacuation of city kids to the countryside shone light onto poverty in the black spots of Britain

Reasons why there was a shift in attitude among politicians and the general public: The success of a state-directed war economy

Increase political and popular belief in the potential of state intervention to improve peoples' lives after the war.

The gov. borrowed and spent huge amounts of money in order to gain victory, why couldn't the same be done to improve the well-being of the nation?

The Beveridge Report 1942 was written by?

William Beveridge, who had a great interest in social reform

Committee was set up at Churchill's request after failure to deliver 'home fit for heros' after WW1

Sold 635,000 copies

Copies were even dropped over Germany to encourage the civilian population to demand peace

The Beveridge Report 1942: 5 giants

Want (poverty), Disease (healthcare), ignorance (education), Squalor (housing), and idleness (employment)

Disease: through national health service

Ignorance: through better education

Squalor: through re-housing

Idleness: maintenance of full employment

- Provision of state welfare to be centralised, regulated and systematically organised

- Funded entirely by a compulsory single insurance payment (no gov. spending or means tests or Santa Claus state (giving for nothing))

How far did Labour deliver on its promise to implement the Beveridge Report?

Labour rejected his call for welfare payments to be met solely by universal insurance.

Contributions, as compulsory, must be at a set affordable level for everyone

Labour clearly implemented Beverage's key ideas on social insurance: The Family Allowances Act of 1945

Provided mothers with a non-means-tested Payment of 5 shillings a week for each child apart from her first

MP Eleanor Rathbone successfully challenged the original plan to give the money to fathers

Mothers received their first family allowance payment in March 1946, although the final payment was less than Beveridge recommended

Labour clearly implemented Beverage's key ideas on social insurance: The National Insurance Act of 1946

Created a compulsory, universal contributory system to help pay for pensions (women aged 60 and over, 65 for men) and benefits for unemployment, sickness, funeral expenses and maternity benefits

Labour clearly implemented Beverage's key ideas on social insurance: The Industrial Accidents Act 1948

Additional cover for workplace injuries

Labour clearly implemented Beverage's key ideas on social insurance: National Assistance Act 1948

Established the National assistance board (NAB) to provide financial help to the most vulnerable poor, e.g. single mothers, blind and deaf, who were not covered by the 1946 Insurance act

More popular than the old UAB due to less rigorous form of means-testing

250,000 were able to claim a higher rate of benefits after 1948.

What and when was the NAB of 1948 renamed

the Benefits Commission in 1966

Labour clearly implemented Beverage's key ideas on social insurance: public awareness of the new welfare system

'Family Guide to National Insurance' was a free pamphlet sent to 14 million homes

50 million had been sent out by 1949

88% of those entitled to family allowance by 1949

Stigma towards outdoor relief started to go

Absolute poverty went, yet relative poverty still was an issue

Reasons for increasing challenges to welfare state provision, 1964-79: Why was it challenged by 1979?

Right-wing criticisms grew about the cost and impact of more generous benefits

While on the left wing people were complaining not enough was being done

Reasons for increasing challenges to welfare state provision, 1964-79: Unemployment benefits

Unemployment grew from:

0.6% of GNP in 1939

5.6% of GNP in 1950

8.8% of GNP in 1970

Reasons for increasing challenges to welfare state provision, 1964-79: 1959 National insurance act

Top-scheme based on earnings known as the graduated pension

Reasons for increasing challenges to welfare state provision, 1964-79: 1975 Social Security Act

Set up State-Earnings-Related Pension scheme; allowing workers to opt out of all or part of the state pension in return for lower NI payments

Reasons for increasing challenges to welfare state provision, 1964-79: Conservative spending, just as much as the Labour government, 1971 Family Income Support programme

1971 Family Income Support programme- allowed family allowance for a first child

Reasons for increasing challenges to welfare state provision, 1964-79: Costs increased for a range of reasons for Conservatives

- Baby booms in the late 1940s and 1960s meant more care and education costs for children

- ^ avr. life expenctancy between 1941-70 for 64 to 74 for women and 59 to 69 for men

- New social groups of need of support emerged who had not been considered before (i.e. single mothers and low-wage earning families)

4.^ standard of living then ^ demand for higher minimum standard of life for the poorest

- Growing size of the welfare state required even more bureaucracy to make it work

Reasons for increasing challenges to welfare state provision, 1964-79: Relative poverty replacing absolute poverty and left-wing viewpoint

Several studies in 60s and 70s show how C were attacked for the inadequate actions on welfare provision at a time when relative poverty replaced absolute poverty

NHS 1948: before 1911

Extent of healthcare provision depended entirely on the wealth of the individual

Poor - ineffective self-medication

Rich - private doctors coming to their home or in private hospitals

The NHS: Friendly societies

Small regular payment and when they needed financial help on illness, unemployment or a funeral the Friendly Society paid out a lump sum

However, these were unregulated and non-compulsory so in areas where there was no workhouse infirmary to provide safety net the Friendly Societies would collapse

1911 National insurance act

Free medical healthcare and 13 weeks sick pay for members of the Friendly Society

Yet only applied to workers and not their families

Party viewpoints on greater provision of healthcare

Labour agreed for more state provision

Liberal was partly persuaded by warnings on the 'national efficiency'

Still a political reluctance to accept and deal with the healthcare problem

National Health Service 1948: why and criticisms

Within three years of the end of the war a NHS was made

Criticisms did emerge over the persistence of private healthcare and over the management and cost of the NHS

Limited NHS reforms in the 70s, 90s was big overhaul

Health provision 1918-45

Role of the gov. in healthcare after WW1 increased hugely

Provision was however, uneven. i.e. employees were covered by the NI but their families were not included

Health provision 1918-45: Ministry of Health, 1919

The government established a new Ministry of Health responsible for coordinating health at a regional level and administrating funds raised by the National Health Insurance Scheme

Health provision 1918-45: Local Government Act, 1929

By Neville Chamberlain and was the most important medical reform of the 1920s:

-passed responsibilty for Poor Law hospitals to local authorities