Economics & Business Topic Test

4.7(7)

Card Sorting

1/59

Earn XP

Last updated 11:38 PM on 6/13/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

60 Terms

1

New cards

Why do we measure the economy

to see if we are on the right track, to compare with other countries (influence trade, currencies, power relationships), visualising where to make improvements (budgeting and redirecting money)

2

New cards

What are economic indicators for

measure people’s consumption of goods and services and gather data

3

New cards

What does the economy need to do?

To grow at a sustainable rate to meet the needs of its growing population and their changing life stages

4

New cards

What are the 3 economic growth indicators

GDP, inflation, unemployment

5

New cards

Outline what GDP is

Gross Domestic Product - total value of all goods and services of a country over a year, measured quarterly (ever 3 months), sustainable growth is 2-3% annually

6

New cards

What is a recession

if quarterly GDP figures record negative growth for two consecutive quarters (6 months)

7

New cards

What are some reasons for growth in an economy

mining sector (abundance of material, trading), spending money, labour force, injection of money from government (stimulus money), greater education

8

New cards

What is the difference between a recession and depression?

Depressions are a much greater severity and lasts for over 8 quarters (2+ years)

9

New cards

Outline the Global Financial Crisis

between 2007-2008. referring to extreme pressure in global financial markets and banking systems. the crashing of the US housing market and spread globally through leakages in the global financial system

10

New cards

What are some effects of a depression

unemployment, decline in industrial production, deflation, increase of poverty

11

New cards

Outline inflation

inflation measures the increase in the general level of prices paid for goods and services over a certain period of time.

12

New cards

What is the sustainable range of inflation

2-3%

13

New cards

Define cost pull factors

cost pull inflation is caused by the producers putting additional cost on the consumers to cover their extra expenses

14

New cards

Define demand pull factors

an increase in prices due to an increase in the demand for goods and services

15

New cards

Define cost of living

referring to how much it costs to purchase necessities

16

New cards

How is inflation an economic indicator

* high inflation can signal an overheated economy

* moderate inflation is associated with economic growth

* if economic growth accelerates very rapidly, demand grows even faster and producers raise prices continually

* moderate inflation is associated with economic growth

* if economic growth accelerates very rapidly, demand grows even faster and producers raise prices continually

17

New cards

Why can’t we just print more money?

printing money increases inflation

18

New cards

How can an increase in supply of money occur?

* government can print more notes

* the currency in circulation can be devalued

* government bonds can be purchased, loaning new money into existence through the banking system

* the currency in circulation can be devalued

* government bonds can be purchased, loaning new money into existence through the banking system

19

New cards

Outline CPI

CPI measure the price change of a typical basket of goods and service purchased by Australian household every quarter. The change in prices in each quarter is the inflation rate

20

New cards

What are the groups in a CPI basket

87 categories, 11 groups weighted differently on how likely they are used by the average Australian family

* transport

* alcohol and tobacco

* clothing and footwear

* communication

* recreation and culture

* education

* insurance and financial services

* food and non-alcoholic beverages

* housing

* health

* furnishing, household equipment and services

* transport

* alcohol and tobacco

* clothing and footwear

* communication

* recreation and culture

* education

* insurance and financial services

* food and non-alcoholic beverages

* housing

* health

* furnishing, household equipment and services

21

New cards

Define unemployment

the percentage of people in the labour force who are unemployed.

22

New cards

What are the types of unemployment

Structural, Cyclical, Frictional, Frictional, Seasonal

23

New cards

Define structural unemployment

is a type of unemployment that can last for many years due to changes in technology or changing demographics

24

New cards

Define cyclical unemployment

caused by economic downturns or is relates to changes in business conditions that affect the demand for workers

25

New cards

Define frictional unemployment

when people move between jobs in the labour market, as well as when people transition into and out of the labour force

26

New cards

Define seasonal unemployment

occurs at different points over the year because of seasonal patterns that affect jobs

27

New cards

List some causes of unemployment

* When production or GDP is weak/decreased spending in the economy - business cutback on employment to save money

* Increased competition overseas

* Businesses may take their operations offshore or close down

* Labour saving technology introduced

\

* Increased competition overseas

* Businesses may take their operations offshore or close down

* Labour saving technology introduced

\

28

New cards

Define labour force

total number of people in Australia working and willing and able to work

29

New cards

Consequences of high unemployment

Economic spending is low, government collects less revenue from tax and must pay more to direct it towards social benefits, reduced standard of living, loss of skills from workforce, possible psychological effects

30

New cards

Define material living standards w/ examples

Refers to access to physical goods and services and is assessed or measured by the GDP - groceries, transport, maintenance

31

New cards

Define non-material living standards w/ examples

Refers to things that cannot be measured in dollar terms and are intangible, but affect enjoyment of life

* freedom of speech

* free elections

* low levels of crime and discrimination

* preservation of the environment

* adequate leisure time

* freedom of speech

* free elections

* low levels of crime and discrimination

* preservation of the environment

* adequate leisure time

32

New cards

5 policies uses to increase living standard by government

Budgetary (gov budget)

Monetary (bank)

Microeconomics (company)

Productivity (improvement)

Training and Workforce

Migration (migrant criteria - age, skills, education, language, family, humanitarian)

Monetary (bank)

Microeconomics (company)

Productivity (improvement)

Training and Workforce

Migration (migrant criteria - age, skills, education, language, family, humanitarian)

33

New cards

Define macroeconomic policy

economic policy that focuses on an industry or market segment, focuses on improving production over the medium to long term.

34

New cards

Define monetary policy

actions by the Reserve Bank of Australia that affect the money supply and interest rates

35

New cards

What is the trend of a business cycle over time

follows a wave like pattern

36

New cards

What do the expansions of an economy signify

economic growth is growing

unemployment is falling

inflation is likely rising

unemployment is falling

inflation is likely rising

37

New cards

What do contractions of an economy signify

economic growth is too low

unemployment is too high

inflation is low

unemployment is too high

inflation is low

38

New cards

Define fiscal policy

is the use of government revenue collection and expenditure to influence a country's economy

39

New cards

Define budget surplus

revenue minus spending is positive number - government collected more money than spent

40

New cards

Define budget deficit

if government revenue minus spending creates a negative number - spent more than collected

41

New cards

What type of budget should the government use during a economic boom? Why?

budget surplus. a boom will have an unsustainable inflation rate >3%. they can reduce this by lowering spending and raising taxes

42

New cards

What type of budget should the government use during economic trough? Why?

budget deficit. The government should spend more money towards stimulating the economy through injections (social benefits) and lowering taxes, as spending is low during this time

43

New cards

Define disposable income

income remaining after the deduction of taxes and social security charges, available to be spent or saved as one wishes

44

New cards

Define income

money received, especially on a regular basis, for work or through investments

45

New cards

Define equity

equity is impartiality, fairness and justice for all people in social policy. Social equity takes into account systemic inequalities to ensure everyone in a community has access to the same opportunities and outcomes

46

New cards

Define taxation

compulsory payment to the government (from current income or consumption) from the private sector to finance government spending

47

New cards

Outline tax

* tax is money charged by the government on items such as wages, goods and services you provide money to government services

* in a time of the strong economics business cycle, the government can try reduce inflation by lowering spending and raising taxes

* taxes go towards education, infrastructure, transport, health, etc.

* in a time of the strong economics business cycle, the government can try reduce inflation by lowering spending and raising taxes

* taxes go towards education, infrastructure, transport, health, etc.

48

New cards

Outline direct taxes

* direct taxes are tax you pay directly to the government

* direct taxes cannot be paid by anyone else

* the amount of tax you pay depends on how much money you earn

* other factors also include

* whether you have children or other dependents

* whether you are single or married

* direct taxes cannot be paid by anyone else

* the amount of tax you pay depends on how much money you earn

* other factors also include

* whether you have children or other dependents

* whether you are single or married

49

New cards

Outline indirect taxes

* indirect taxes are taxes on goods and services

* this is because tax has been imposed on producers and is then shifted to the consumer

* they are usually included in the price of the item, making them less visible to consumers

* examples of indirect taxes include sales tax and value added tax (VAT)

* indirect taxes can be regressive, meaning they take a larger percentage of income from low-income individuals than from high-income individuals

* this is because tax has been imposed on producers and is then shifted to the consumer

* they are usually included in the price of the item, making them less visible to consumers

* examples of indirect taxes include sales tax and value added tax (VAT)

* indirect taxes can be regressive, meaning they take a larger percentage of income from low-income individuals than from high-income individuals

50

New cards

List purposes of taxes

raise revenue - money for government services

* e.g. welfare, hospitals, school

redistribute income - people who earn more money pay more tax

resources allocation - used to encourage or discourage the use of certain resources

* e.g. carbon tax, cigarette tax

stabilise economic activity - reducing fluctuations

* e.g. welfare, hospitals, school

redistribute income - people who earn more money pay more tax

resources allocation - used to encourage or discourage the use of certain resources

* e.g. carbon tax, cigarette tax

stabilise economic activity - reducing fluctuations

51

New cards

List examples of government spending

* investing on infrastructure (roads, bridges, public transport, power, water)

* providing healthcare services and funding medical research

* supporting education through funding schools and university

* providing social welfare programs (unemployment benefits and food assistance)

* funding scientific research and development

* supporting environmental protection and conservation efforts

* providing public safety services (police and fire departments)

* funding public parks and recreation facilities

* maintain defense and military services

* providing healthcare services and funding medical research

* supporting education through funding schools and university

* providing social welfare programs (unemployment benefits and food assistance)

* funding scientific research and development

* supporting environmental protection and conservation efforts

* providing public safety services (police and fire departments)

* funding public parks and recreation facilities

* maintain defense and military services

52

New cards

define externalities

a consequence of an industrial or commercial activity which affects other parties not directly related to the activity, without this being reflected in market prices. can either have positive or negative effects

53

New cards

How can the government increase positive externalities

promoting policies (walking to school - reduces traffic congestions)

54

New cards

How can the government reduce negative externalities

increasing taxes on items or practices to deter people from buying or engaging in action - cigarettes, mining

55

New cards

Define income

money received, especially on a regular basis, for work or through investments

56

New cards

Define wealth

an abundance of valuable possessions or money

57

New cards

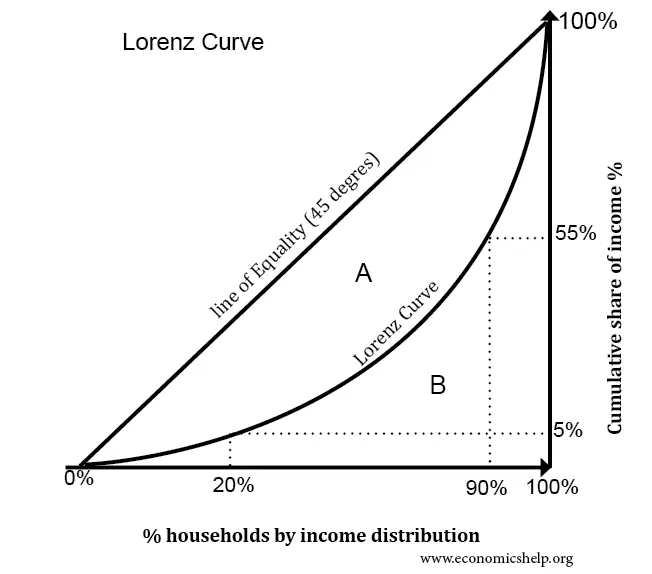

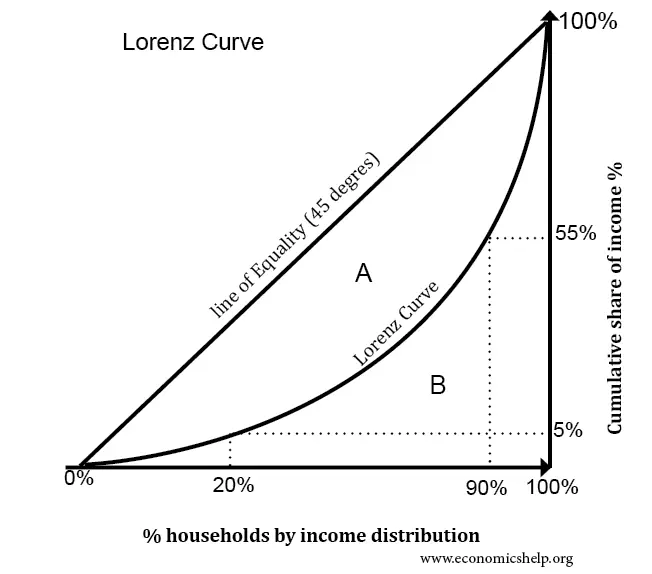

Outline the Lorenz Curve

* the Lorenz curve is a way of showing the distribution of income (or wealth) within an economy

* the Lorenz curve shows the **cumulative** share of income from different sections of the population

* if there was perfect equality (everyone has same salary) the poorest 20% of the population would gain 20% of the total income; the poorest 60% of the population would get 60% of the income

* the Lorenz curve shows the **cumulative** share of income from different sections of the population

* if there was perfect equality (everyone has same salary) the poorest 20% of the population would gain 20% of the total income; the poorest 60% of the population would get 60% of the income

58

New cards

What is the realistic income distribution in comparison to the cumulative share of income (probs don’t need remember, given graph)

\

* the poorest 90% of the population holds 55% of the total income; the richest 10% of income earners gain 45% of total income

\

* the poorest 90% of the population holds 55% of the total income; the richest 10% of income earners gain 45% of total income

\

59

New cards

Outline the Gini coefficient

it is between 0 and 1 - the closer the number is to 0, the more income is distributed amongst the population; the closer to 1 the more inequitable the distribution of income

* the closer the Lorenz curve is to the line of equality, the smaller area A is - the Gini coefficient will be low

* if there is high degree of inequality, then area A will be a bigger percentage of the total area

* **a rise in the Gini coefficient shows a rise in equality - it shows the Lorenz curve is further away from the line of equality**

* the closer the Lorenz curve is to the line of equality, the smaller area A is - the Gini coefficient will be low

* if there is high degree of inequality, then area A will be a bigger percentage of the total area

* **a rise in the Gini coefficient shows a rise in equality - it shows the Lorenz curve is further away from the line of equality**

60

New cards

How do you calculate the Gini Coefficient

***G = A/(A+B)***

the area **above** the Lorenz curve but below the line of perfect equality is **A,** the remaining area is **B**

we divide A by (A+B) to determine the Gini coefficient

the area **above** the Lorenz curve but below the line of perfect equality is **A,** the remaining area is **B**

we divide A by (A+B) to determine the Gini coefficient