FAR Chapter 19: Group accounts: consolidated statement of cash flows

1/20

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

21 Terms

What is the page in the OBT for cash flows?

B584

Does the acquisition of right of use assets result in a cash flow on initial recognition?

No

How are cash outflows arise after initial recognition with lease payments separated?

Payment of interest (operating activities)

Repayment of capital (financing activities)

What should happen if right-of-use (ROU) assets are included within property, plant and equipment (PPE) and acquired during the year?

they should be separated when calculating the cash paid for PPE

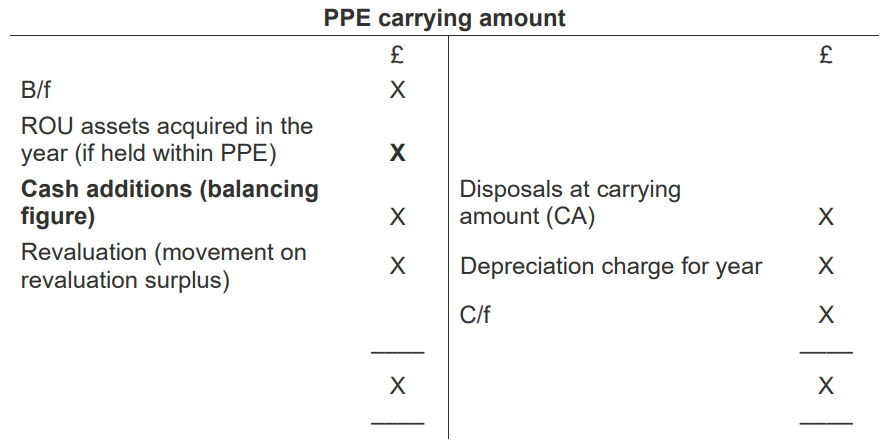

What is the PPE carrying amount ledger for consolidated statement of cash flows?

Balance b/f X

ROU assets acquired in the year (if held in PPE) X

Cash additions (balancing figure) X

Revaluation (movement on revaluation surplus) X

Disposals at carrying amount (CA) (X)

Depreciation charge for year (X)

C/f X

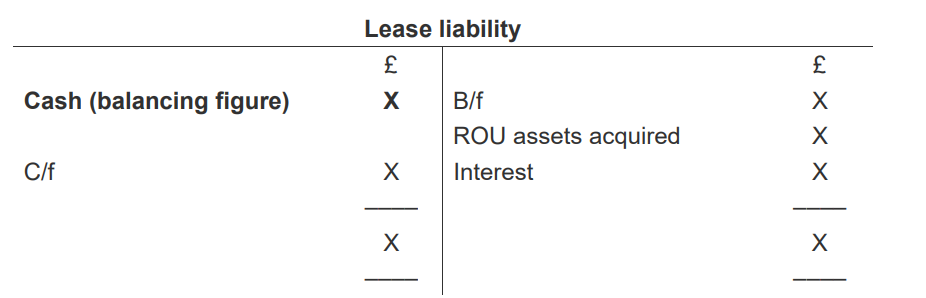

What is lease liability working for CSOCF for payment in arrears?

Balance b/f X

ROU assets acquired X

Interest X

Cash (balancing figure) (X)

C/f X

Balancing figure includes payment of interest and capital repayment, if interest expense is on the credit side

Where does the payment of interest go on the CSOCF in arrears?

Operating activities (finance cost is added back in cash generated from operations note)

Where does the repayment of capital go on the CSOCF in arrears?

To financing activities

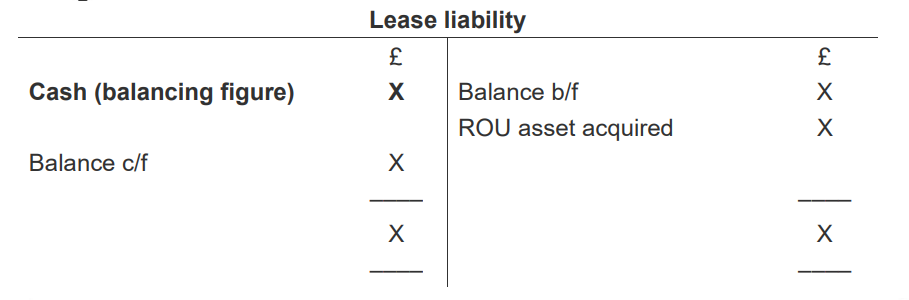

What is lease liability working for CSOCF for payment in advance?

Balance b/f X

ROU asset acquired X

Cash (balancing figure) (X)

Balance c/f X

The balancing figure is only the capital repayment which goes to financing activities

What are the 3 extra elements to a CSOCF?

Cash dividend paid by subsidiary to NCI (outflow)

Dividends received from associates (inflow)

The impact of the acquisition/ disposal of subsidiaries (outflow/inflow)

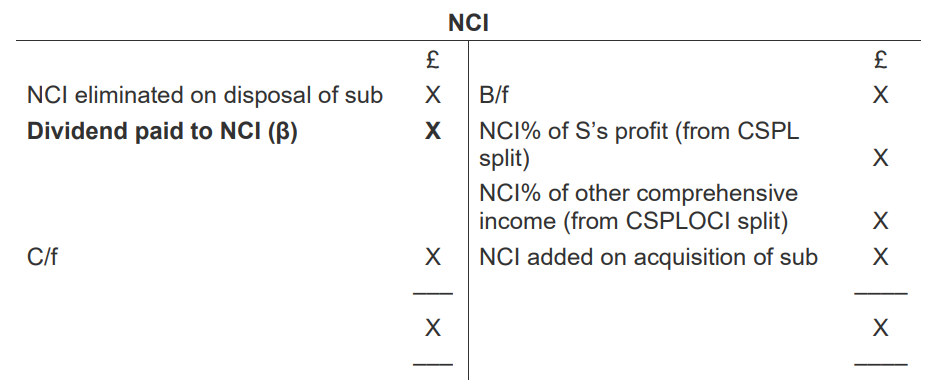

Where should any dividends paid by the subsidiary to noncontrolling interests should be disclosed?

separately in the statement of cash flows – usually under financing activities.

What is the ledger for dividends paid to the NCI by the subsidiary?

Balance b/f (credit balance) X

NCI% of S’s profit (from CSPL split) X

NCI% of other comprehensive income (from CSPLOCI split) X

NCI added on acquisition of sub X

NCI eliminated on disposal of sub (X)

Dividend paid to NCI (β) (X)

C/f X

What adjustment/reconciliation is needed for CSOCF regarding share profit of associate?

The group share of profit of associate must be deducted as an adjustment in the reconciliation of profit before tax to cash generated from operations.

Profit before tax X

Share of profit of associate (X)

Need for the indirect method only

Where are dividends received from associates usually included in the CSOCF?

Investing activities

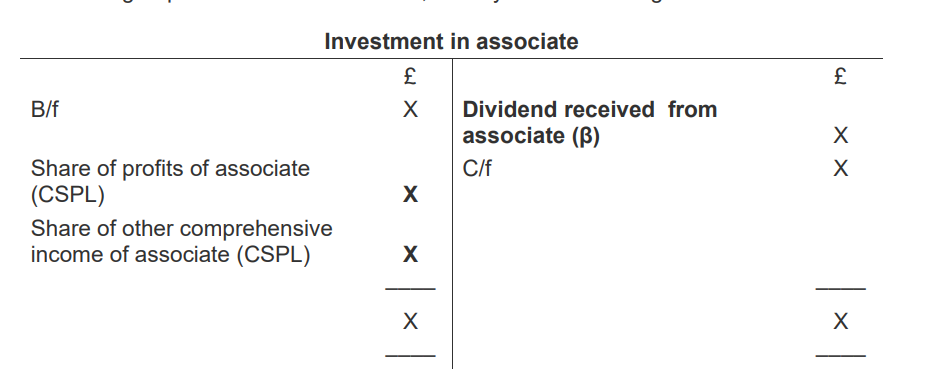

What is the ledger to calculate dividend received from associate?

B/f (investment is a debit balance) X

Share of profits of associate (CSPL) X

Share of other comprehensive income of associate (CSPL) X

Dividend received from associate (β) (X)

C/f

Dividend received from associate is a credit balance as they represent a decrease in investor’s investment

When would the associate’s share of OCI be needed?

if the associate had recorded gains or losses in OCI during the period e.g. from the revaluation of property, plant and equipment.

Where should cash h payments to acquire subsidiaries and cash receipts from disposals of subsidiaries be reported?

separately in the CSOCF under investing activities

What does net cash from the sale or purchase of the subsidiary include?

the gross payment or receipt less any cash held by the subsidiary on acquisition or disposal

How do we calculated cash movement for net cash to acquire subsidiary?

When calculating the movement between the opening and closing balance of an item, the assets and liabilities that have been acquired must be taken into account in order to calculate the correct cash figure

This applies to all assets and liabilities acquired including the noncontrolling interest and any goodwill on acquisition.

Add the sub’s figures to our b/f figures

How do we calculated cash movement for net cash from sale of subsidiary?

When calculating the movement between the opening and closing balance of an item, the assets and liabilities that have been disposed of must be taken into account in order to calculate the correct cash figure.

As with acquisitions, this applies to all assets and liabilities.

Deduct the sub’s figures from our b/f figures

What is the goodwill T account /column working that you may need?

Balance b/f X

Acquisition of sub X

Impairment (β) (X) - Add back to PBT in cash gen. from operations

C/f X