Econ Test 2

1/86

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

87 Terms

True or False

Tax incidence is determined entirely by the legal assignment of the tax burden?

False

When supply is more elastic than demand, which group bears the larger share of the tax burden?

Buyers

Sellers

The tax incidence is equal

The government

Buyers

If demand for a good is more elastic than supply, the majority of the tax burden falls on:

Buyers

The government

Sellers

Neither, as both share it equally

Sellers

If a tax is imposed on buyers of a good, the demand curve will:

Shift right (increase in demand)

Become steeper

Remain unchanged

Shift left (decrease in demand)

Shift left (decrease in demand)

When a tax is imposed on sellers, what happens to the supply curve?

It becomes horizontal

It remains unchanged

It shifts left (decrease in supply)

It shifts right (increase in supply)

It shifts left (decrease in supply)

True/False

A price floor set below equilibrium has no effect on the market.

True

A common unintended consequence of rent control (a price ceiling) is:

Housing shortages and longer wait times for apartments

Increased quality of rental apartments

Increased supply of rental housing

Higher rental prices

Housing shortages and longer wait times for apartments

True or False

A tax imposed on a good will always reduce the equilibrium quantity of the good.

True

A price ceiling is a:

Minimum legal price a seller can charge

Maximum legal price a seller can charge

Government-mandated minimum wage

Tax imposed on consumers

Maximum legal price a seller can charge

A binding price floor leads to:

A shortage

More demand than supply

No change in the market

A surplus

A surplus

If a tax is imposed on a good, who bears the burden of the tax?

Only buyers

Only the government

Both buyers and sellers

Only sellers

Both buyers and sellers

Which of the following is an example of a price floor?

The price of gasoline being subsidized

A cap on interest rates for student loans

Rent control in New York City

The federal minimum wage

The federal minimum wage

If a price ceiling is set above the equilibrium price, it is:

Binding and causes a shortage

Not binding and has no effect

Binding and causes a surplus

Not binding and still changes the market

Not binding and has no effect

Which of the following correctly describes willingness to pay (WTP)?

The maximum price a consumer is willing to pay for a good

The price that maximizes total revenue

The price a seller is willing to accept for a good

The lowest price a consumer is willing to pay for a good

The maximum price a consumer is willing to pay for a good.

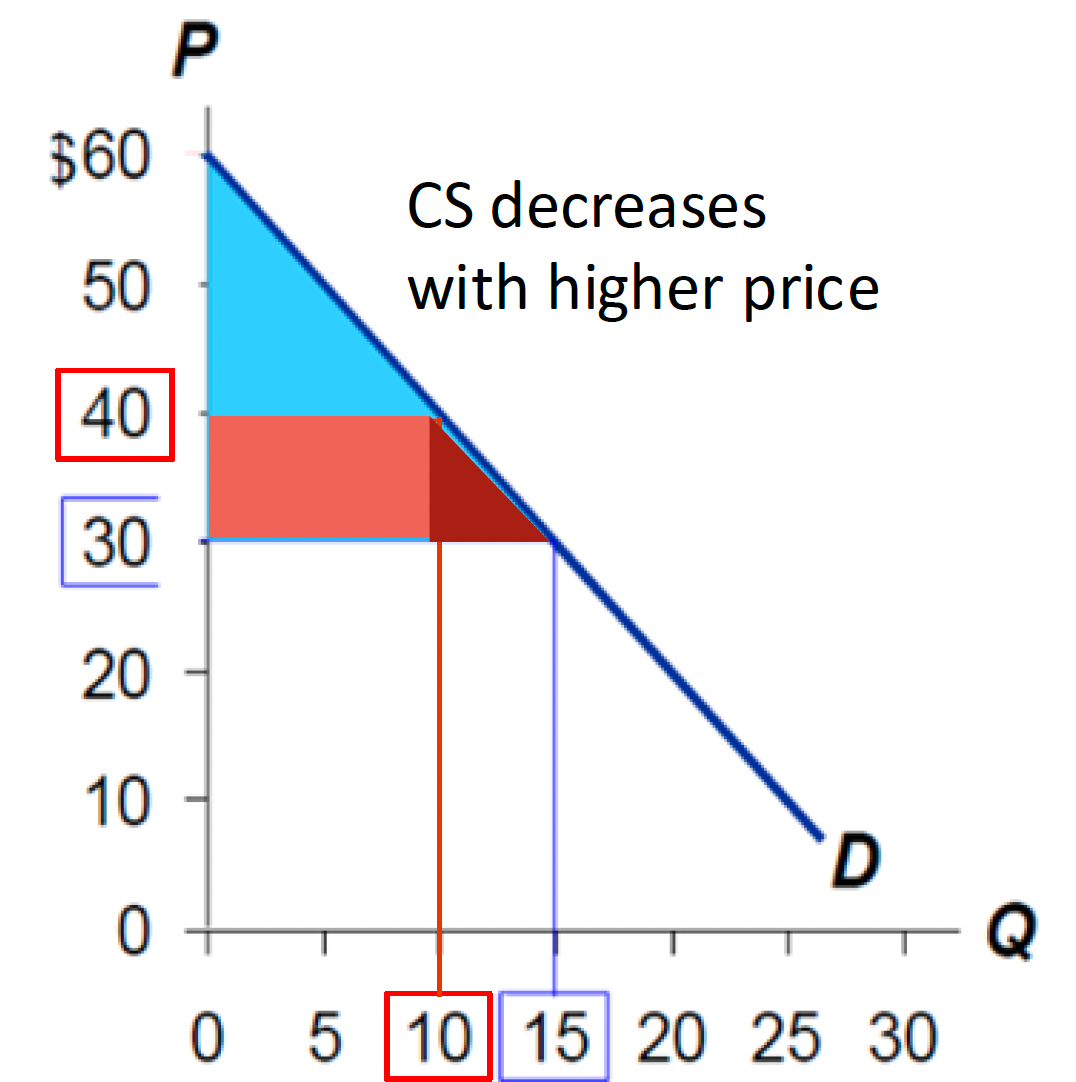

If price increases, what happens to consumer surplus?

It depends on the elasticity of demand

It stays the same

It increases

It decreases

It decreases

How much do we lose in Consumer Surplus if Price goes up from $30 to $40 and Quantity fall from 15 to 10?

$125

$175

$150

$100

$125

If market price equals WTP for all buyers, consumer surplus is:

Infinite

Negative

Maximized

Zero

Zero

If demand for a good is more elastic than supply, the majority of the tax burden falls on:

Buyers

The government

Sellers

Neither, as both share it equally

Sellers

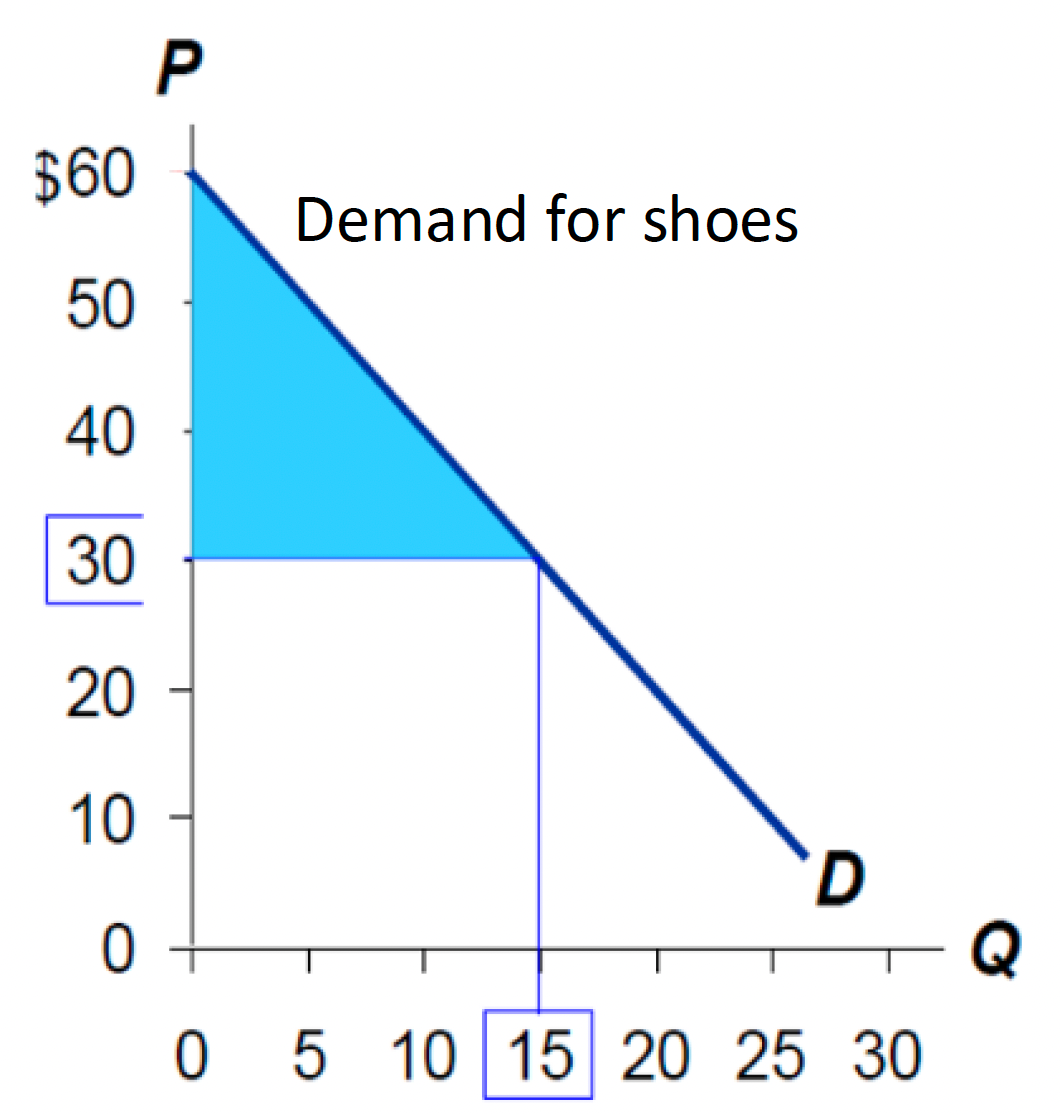

Calculate Consumer Surplus from this diagram if market equilibrium price is $30 and market equilibrium quantity is 15.

$200

$275

$250

$225

$225

Which of the following best represents consumer surplus on a demand curve?

The area below the demand curve but above the price line

The area above the supply curve but below the price line

The area above the price line but below the supply curve

The area below both the demand and supply curves

The area below the demand curve but above the price line.

Consumer surplus is defined as:

The total amount paid by consumers for a good

The price consumers are willing to pay minus the price they actually pay

The difference between total revenue and total cost

The total benefit that producers receive

The price consumers are willing to pay minus the price they actually pay.

If Anthony’s WTP for a concert ticket is $250, but he buys it for $200, what is his consumer surplus?

$200

$0

$50

$250

$50

When supply is more elastic than demand, which group bears the larger share of the tax burden?

Sellers

The tax incidence is equal

The government

Buyers

Buyers

If the market price of a good is higher than a consumer’s WTP, then the consumer will:

Not purchase the good

Demand more of the good

Increase their WTP

Purchase the good anyway

Not purchase the good

Which market would likely experience the largest deadweight loss from a tax?

A market with a perfectly inelastic supply curve

A market where both supply and demand are elastic

A market where supply and demand are both inelastic

A market where supply is elastic and demand is inelastic

A market where both supply and demand are elastic

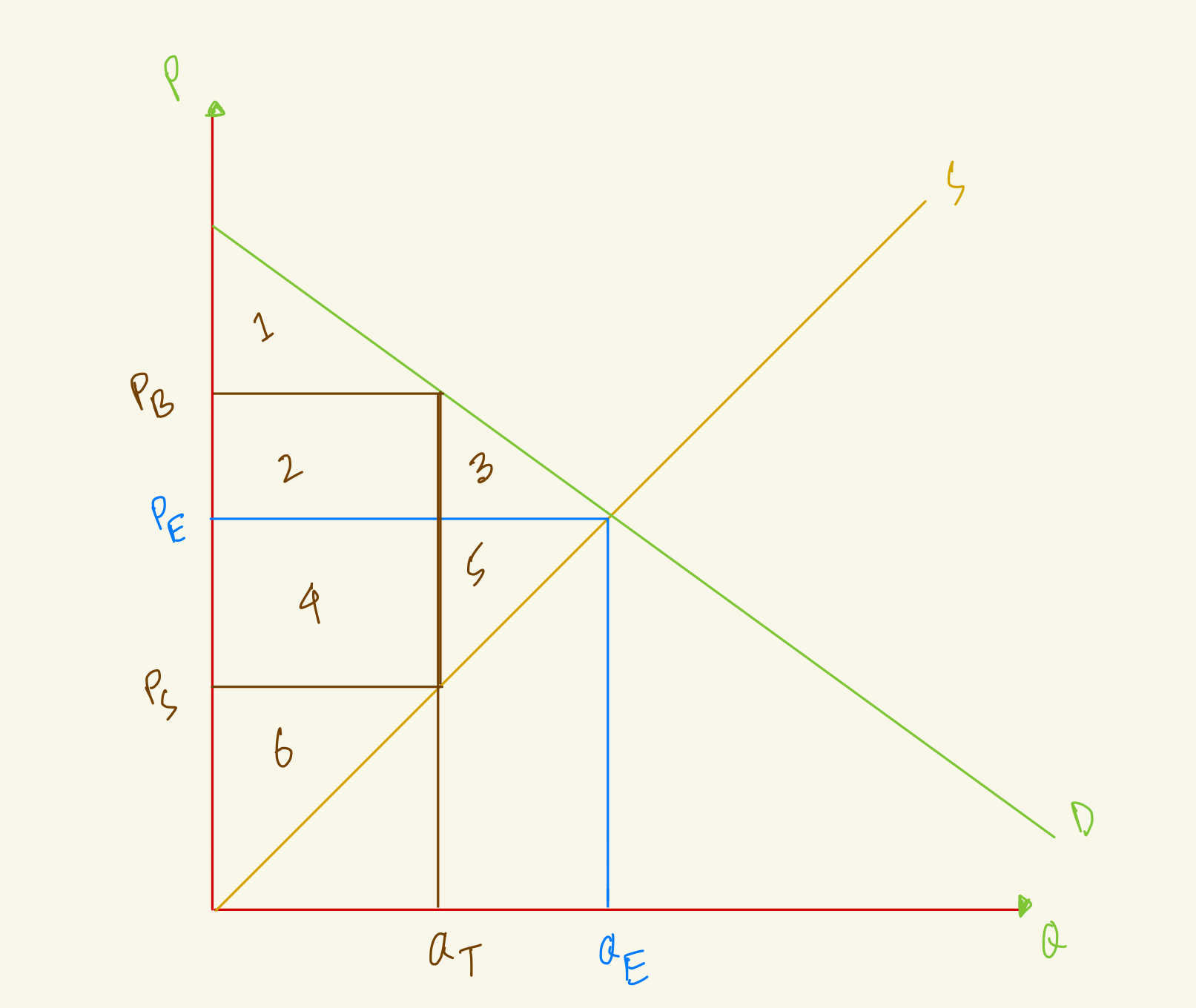

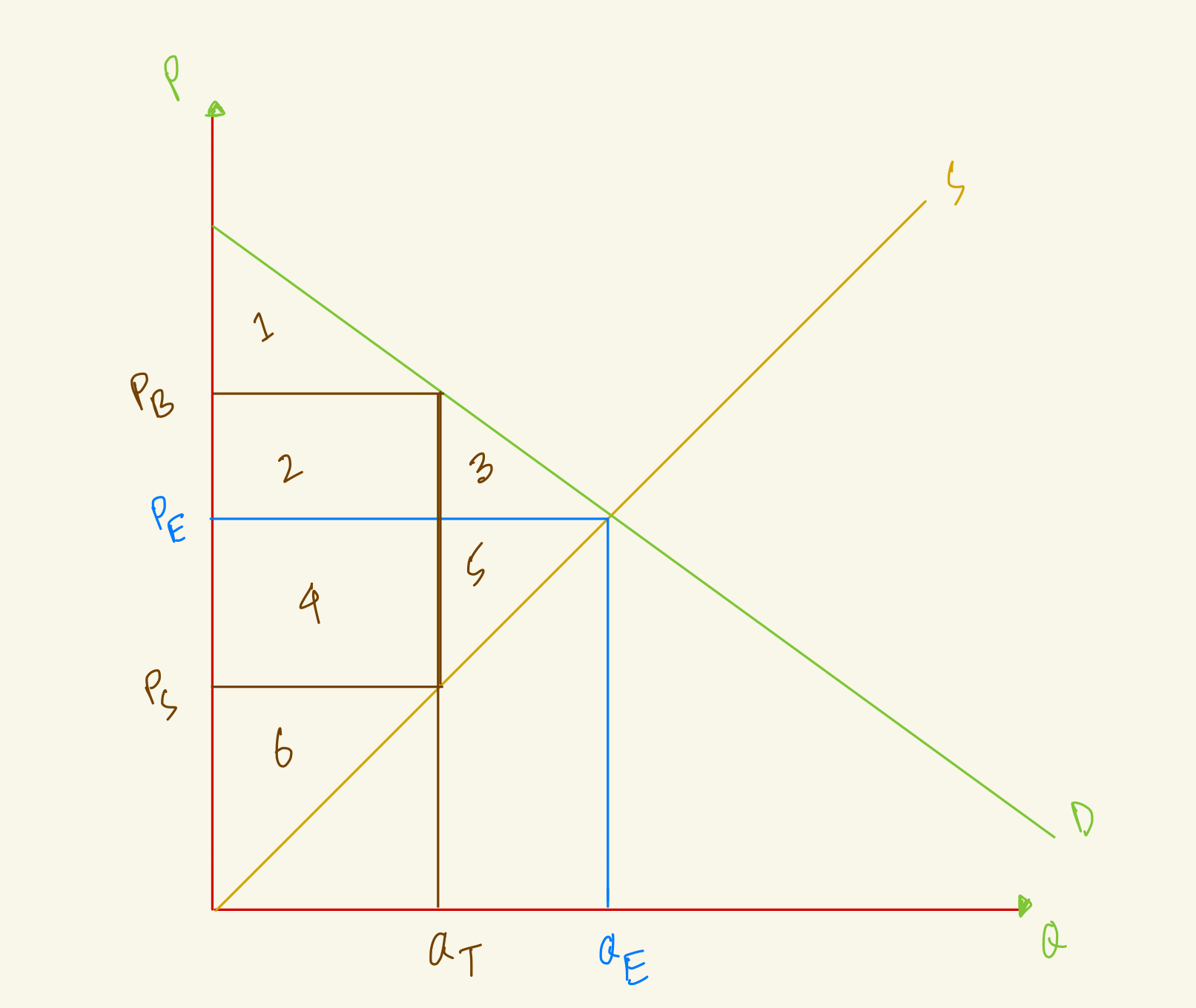

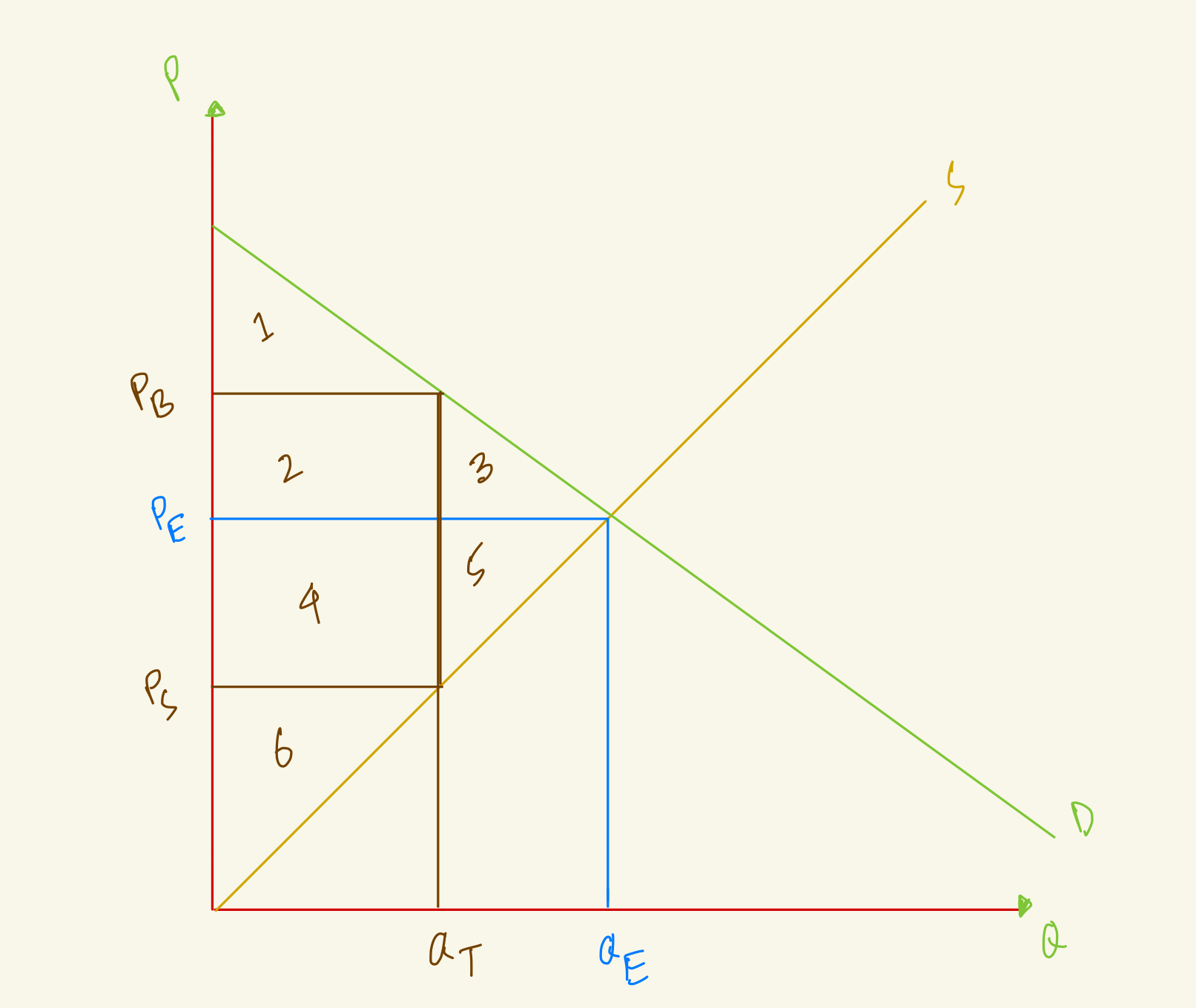

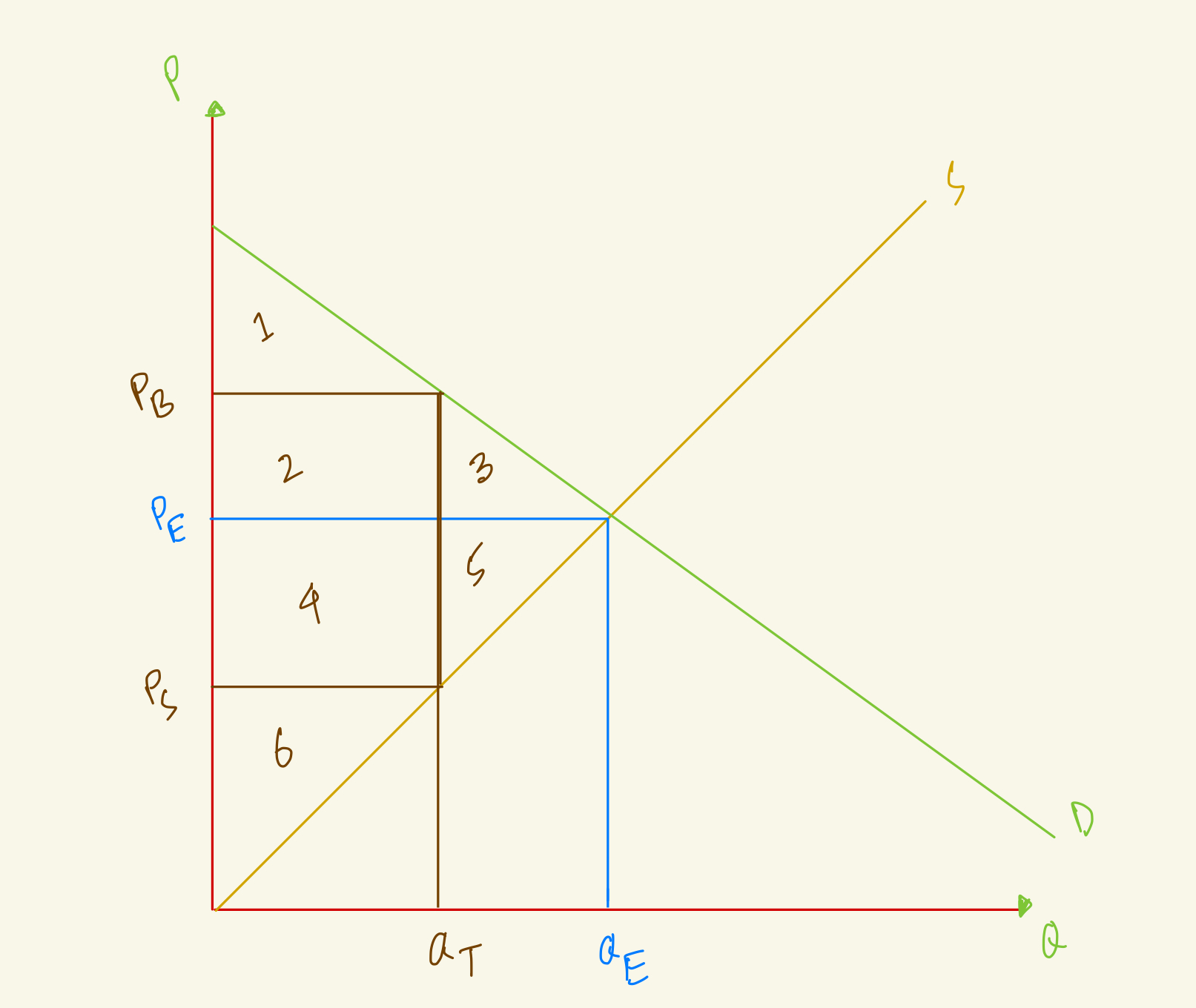

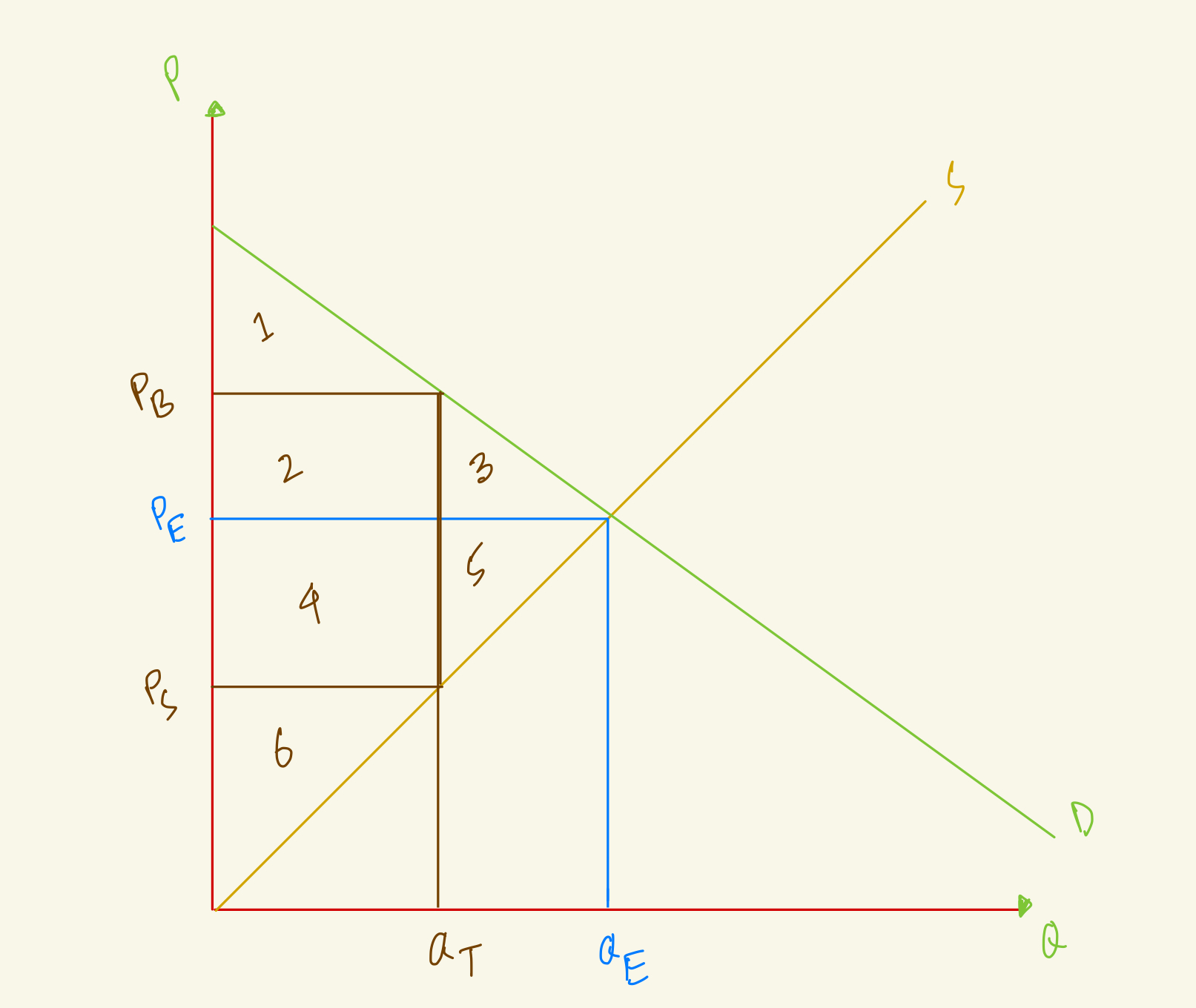

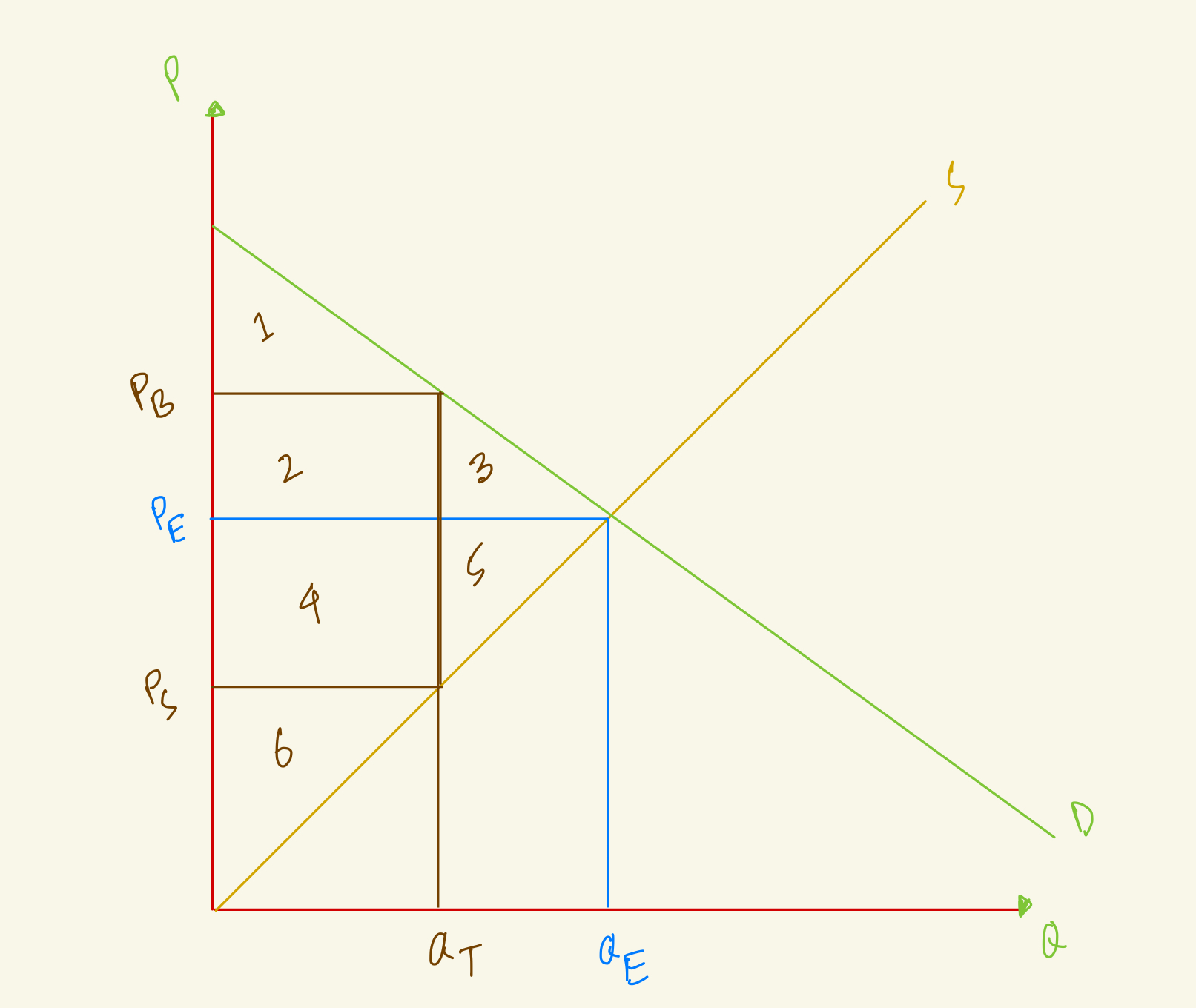

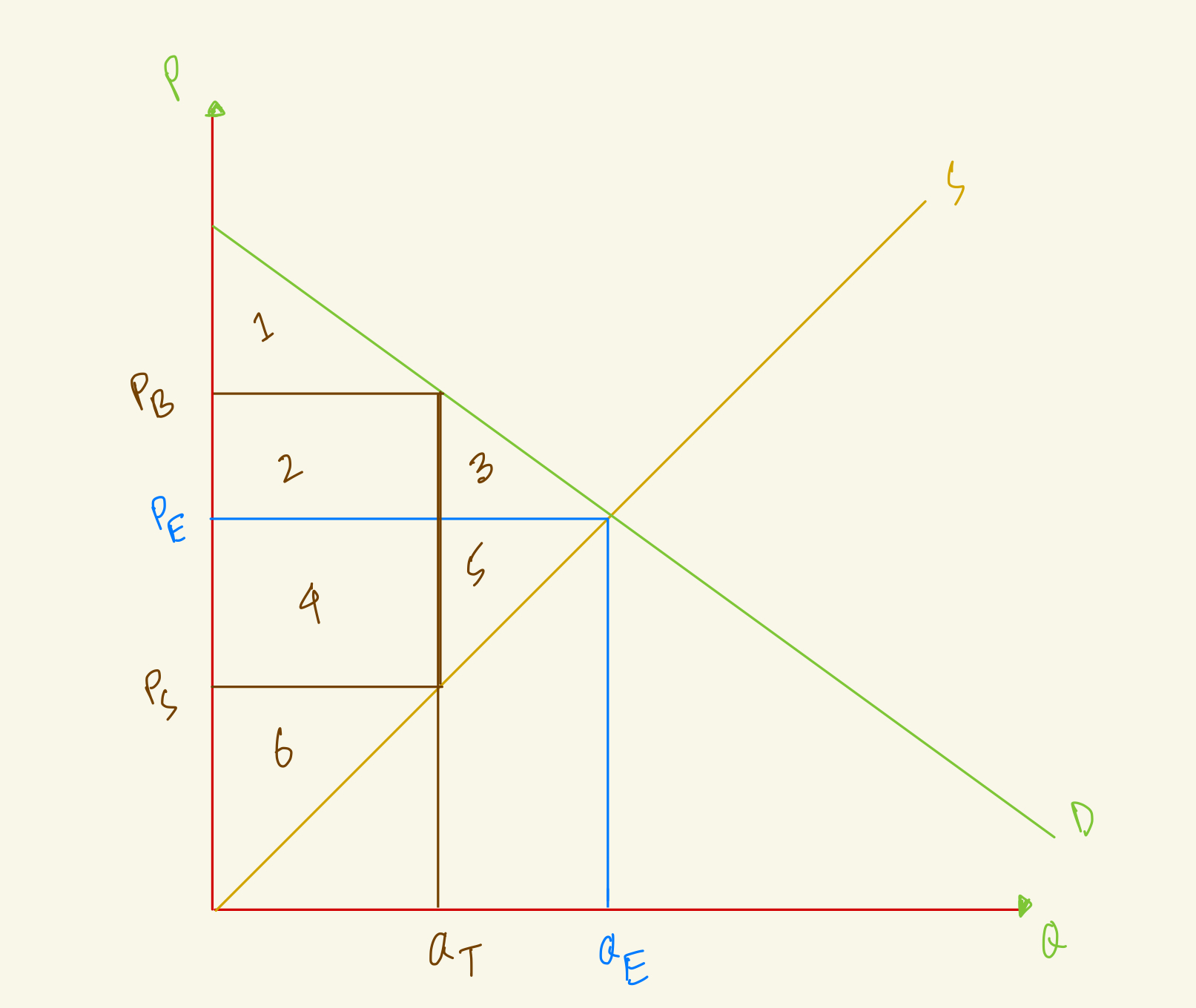

At the equilibrium, price is PE and quantity is QE. After tax, quantity in the market falls to QT, the amount that buyers pay rises to PB and the amount that sellers receive falls to PS. What's the deadweight loss in this market with tax?

2+4

3+5

1+2

4+6

3+5

What determines the size of deadweight loss in a market?

The number of buyers and sellers

The price level of the good

The elasticity of supply and demand

The government’s budget deficit

The elasticity of supply and demand.

What is deadweight loss (DWL)?

A reduction in total surplus due to a tax

Government revenue collected from a tax

An increase in consumer surplus from lower prices

The additional surplus gained from taxation

A reduction in total surplus due to a tax

What happens to consumer surplus when a tax is imposed?

It decreases

It turns into producer surplus

It remains unchanged

It increases

It decreases

At the equilibrium, price is PE and quantity is QE, what's the consumer surplus in this market?

1+2

1+2+3

1+4

1

1+2+3

At the equilibrium, price is PE and quantity is QE. After tax, quantity in the market falls to QT, the amount that buyers pay rises to PB and the amount that sellers receive falls to PS. What's the total surplus in this market with tax?

1+2+4+6

1+3+4+5

1+3+5+6

1+2+3+4

1+2+4+6

At the equilibrium, price is PE and quantity is QE. After tax, quantity in the market falls to QT, the amount that buyers pay rises to PB and the amount that sellers receive falls to PS. What's the producer surplus in this market with tax?

5

3

6

4

6

At the equilibrium, price is PE and quantity is QE, what's the producer surplus in this market?

4+5

2+3

2+4+6

4+5+6

4+5+6

If a $5 per unit tax is imposed and the new quantity sold is 200 units, what is the total tax revenue?

$500

$2000

$1500

$1000

$1000

At the equilibrium, price is PE and quantity is QE, what's the total surplus in this market?

1+2+3+4+5

3+4+5+6

1+2+3+4

1+2+3+4+5+6

1+2+3+4+5+6

At the equilibrium, price is PE and quantity is QE. After tax, quantity in the market falls to QT, the amount that buyers pay rises to PB and the amount that sellers receive falls to PS. What's the consumer surplus in this market with tax?

2

1

1+2+3

1+2

1

At the equilibrium, price is PE and quantity is QE. After tax, quantity in the market falls to QT, the amount that buyers pay rises to PB and the amount that sellers receive falls to PS. What's the government revenue in this market with tax?

2+4

4+6

1+2

3+5

2+4

When a tax is imposed on a good, what happens to total surplus?

It decreases

It becomes negative

It remains unchanged

It increases

It decreases

A producer’s surplus is:

The total revenue received from selling goods

The equilibrium price multiplied by quantity

The area between the supply and demand curves

The amount a seller is paid minus their cost of production

The amount a seller is paid minus their cost of production

If a consumer is willing to pay $200 for a good but buys it for $150, their consumer surplus is:

$50

$0

$200

$150

$50

Consumer surplus is maximized when:

Price is low

There are few buyers in the market

Demand is perfectly inelastic

Price is high

Price is low

If price increases, what happens to consumer surplus?

It depends on the elasticity of demand

It increases

It stays the same

It decreases

It decreases

If the price of a good increases, producer surplus generally:

Remains unchanged

Becomes zero

Decreases

Increases

Increases

Suppose Stanley’s willingness to pay for a good is $250, and the price is $220. Darryl’s willingness to pay is $300, and the price remains $220. What is the total consumer surplus for Stanley and Darryl combined?

$190

$250

$110

$80

$110

When the price of a good rises from $100 to $150, how does producer surplus change assuming the cost of production remains constant at $90?

It decreases by $50 for each unit sold

It cannot be determined from the given information

It increases by $50 for each unit sold

It remains constant because the cost of production does not change

It increases by $50 for each unit sold

If the demand curve is a straight downward-sloping line, the consumer surplus at equilibrium is represented by:

A circle

A trapezoid

A triangle

A rectangle

A triangle

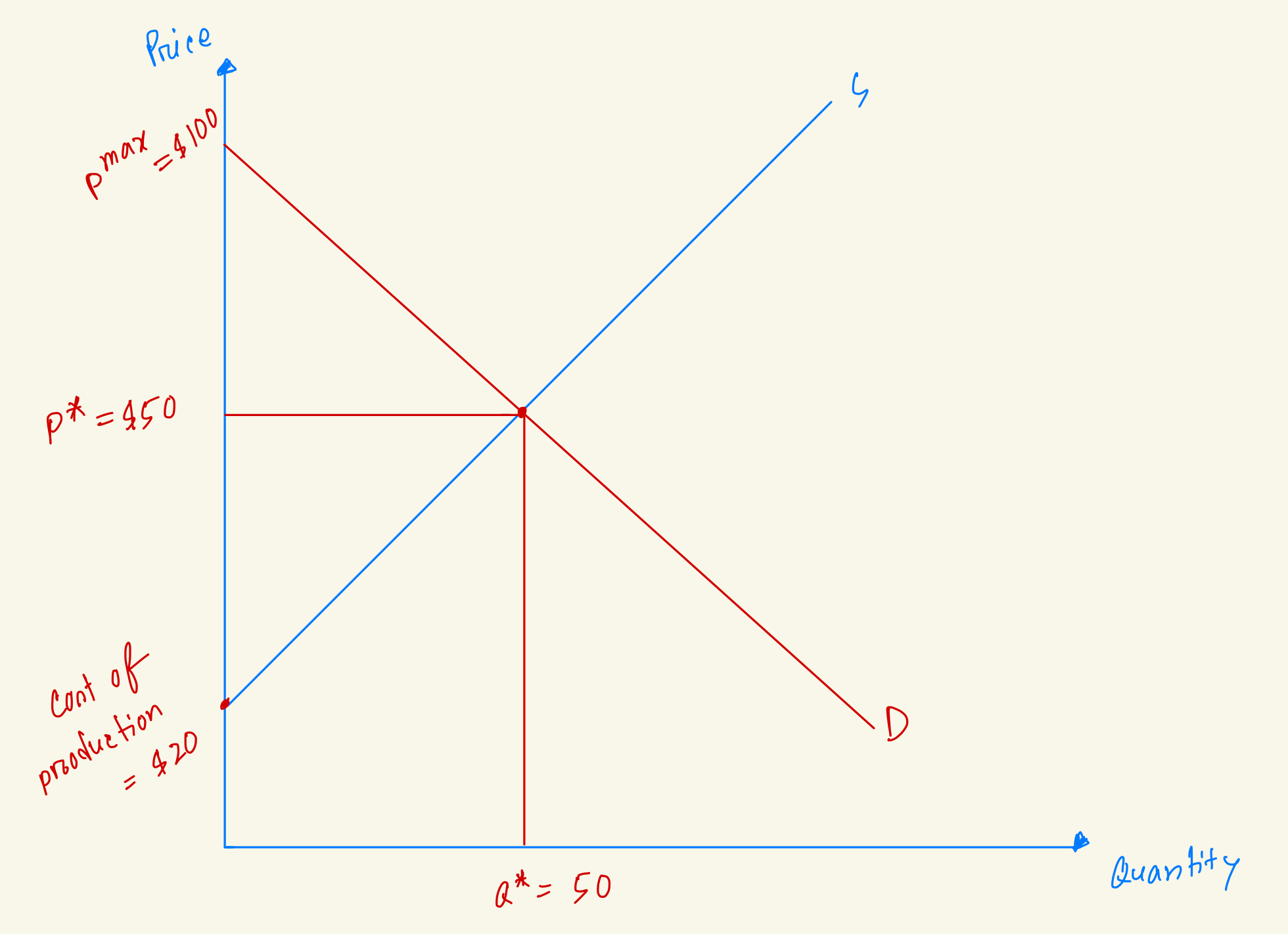

Calculate Consumer Surplus in the market from this diagram.

$1000

$1500

$1250

$2500

$1250

True or False

When price decreases, consumer surplus always decreases.

False

Market efficiency occurs when:

Total surplus is maximized

Only producers benefit from the market

Producer surplus is maximized at the expense of consumers

Consumer surplus is minimized

Total surplus is maximized.

If Michael’s cost of cutting lawns is $10, Jim’s is $20, and Dwight's is $35, and the market price for cutting lawns is $25, how much is the total producer surplus?

$20

$15

$25

$5

$20

Which of the following best represents consumer surplus on a demand curve?

The area above the price line but below the supply curve

The area below the demand curve but above the price line

The area below both the demand and supply curves

The area above the supply curve but below the price line

The area below the demand curve but above the price line.

Calculate Total Surplus in the market from this diagram.

$2500

$1750

$4000

$2000

$2000

Calculate Producer Surplus in the market from this diagram.

$1250

$1500

$1000

$750

$750

True or False

Accounting profit always exceeds economic profit.

True

Which of the following is an example of an implicit cost?

Utilities paid monthly

Rent for office space

Wages paid to employees

Foregone salary by owner

Foregone salary by owner

If explicit costs are $37,000 and implicit costs are $28,000, and total revenue is $75,000, what is economic profit?

$10000

$28000

$47000

$38000

$10000

Angel’s fixed cost is $18. If she produces 6 scarves, what is her AFC?

$3.2

$2.8

$3.6

$3.0

$3.0

Jelani’s gelato shop makes 15,000 pints per year at $5 each. Her costs are $65,000. What’s her profit?

$15000

$75000

$60000

$10000

$10000

In the short run, which cost is always fixed?

VC

MC

FC

OC

FC

Kurt invested $80,000 in the factory and equipment to start the business last year: $30,000 from savings and borrowed $50,000 (interest 10% for saving and borrowing). Calculate the explicit costs.

$5000

$6000

$3000

$8000

$5000

Jelani owns a small gelato shop on campus. Jelani pays $20,000 a year for raw materials, and $12,000 in rent. Jelani can work at the local coffee shop for $25,000 a year. What's Jelani's implicit costs?

$57000

$25000

$32000

$60000

$25000

In the long run:

Fixed costs dominate

No cost curves exist

Firms cannot exit

All costs are variable

All costs are variable

Jelani owns a small gelato shop on campus. Jelani pays $20,000 a year for raw materials, and $12,000 in rent. Jelani can work at the local coffee shop for $25,000 a year. What's Jelani's explicit costs?

$25000

$32000

$60000

$57000

$32000

If ATC = $10 and AFC = $2, what is AVC?

$20

$2

$8

$12

$8

A firm’s total revenue is $60,000 and accounting profit is $10,000. If implicit costs are $12,000, what are explicit costs?

$38000

$22000

$48000

$50000

$50000

True or False

If marginal cost exceeds average total cost, ATC is falling.

False

When marginal cost is less than average total cost:

ATC is falling

Marginal product is zero

ATC is rising

ATC is constant

ATC is falling

True or False

In the long run, there are no fixed costs.

True

Total cost equals:

Accounting profit plus economic profit

Fixed cost plus variable cost

Implicit cost only

Total revenue minus fixed cost

Fixed cost plus variable cost.

Which curve always intersects ATC at its minimum?

MC

AVC

AFC

TC

MC

Kurt invested $80,000 in the factory and equipment to start the business last year: $30,000 from savings and borrowed $50,000 (interest 10% for saving and borrowing). Calculate the implicit costs.

$3000

$8000

$2000

$5000

$3000

True or False

In long-run equilibrium, P = MC = min ATC.

True

A competitive firm shuts down in the short run if:

Price < AVC

TR > TC

PRICE = MR

Price > ATC

Price < AVC

In a perfectly competitive market, individual firms:

Take prices as given

Set their own prices

Face downward-sloping demand

Can influence market supply

Take prices as given

Why is the long-run market supply curve horizontal in perfect competition?

Sunk costs dominate

Decreasing returns to scale

Firms face downward-sloping demand

Identical cost structures among firms

Identical cost structures among firms

For a competitive firm, which of the following is true?

MR = Price = AR

MR < Price

AR < Price

MR > Price

MR = Price = AR

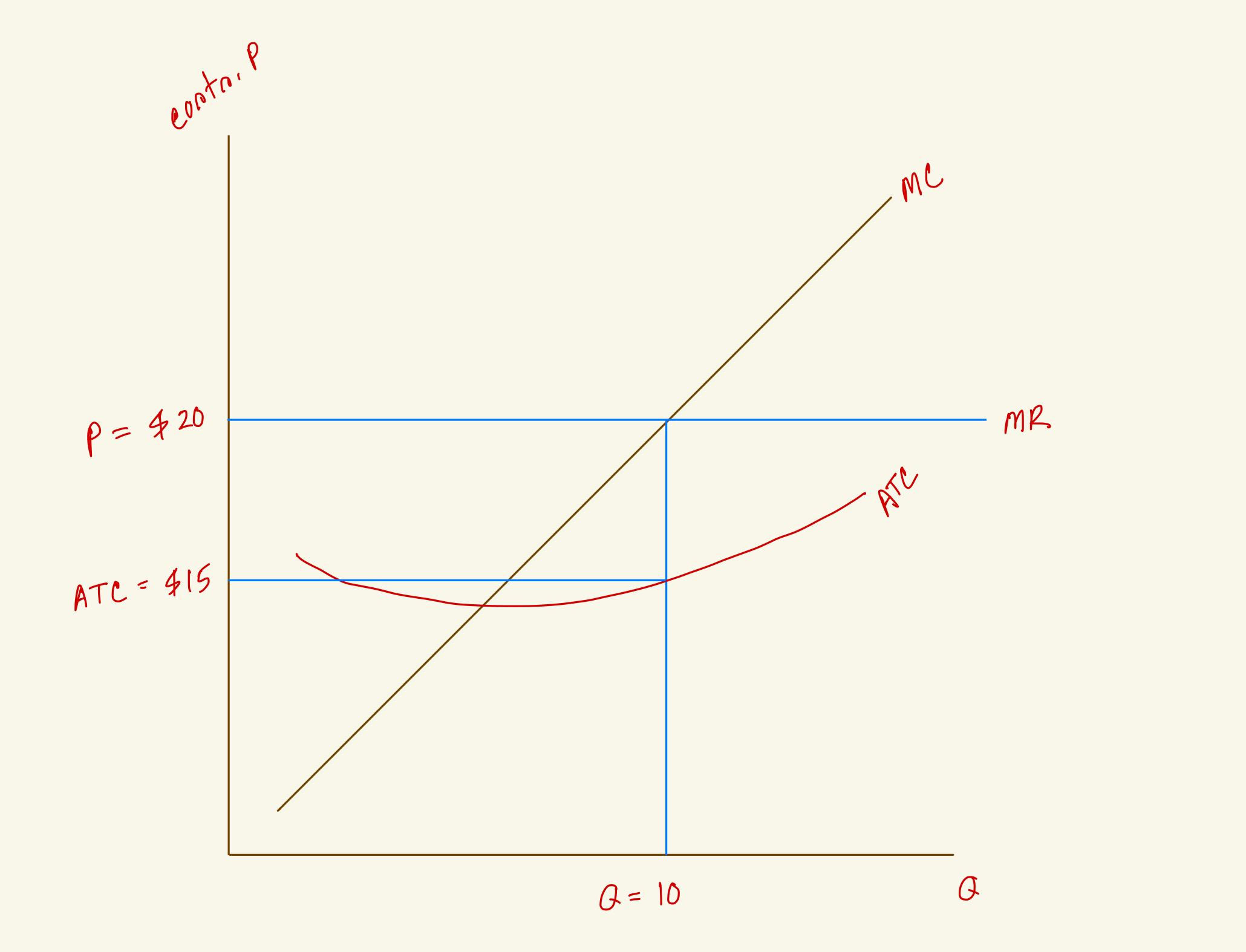

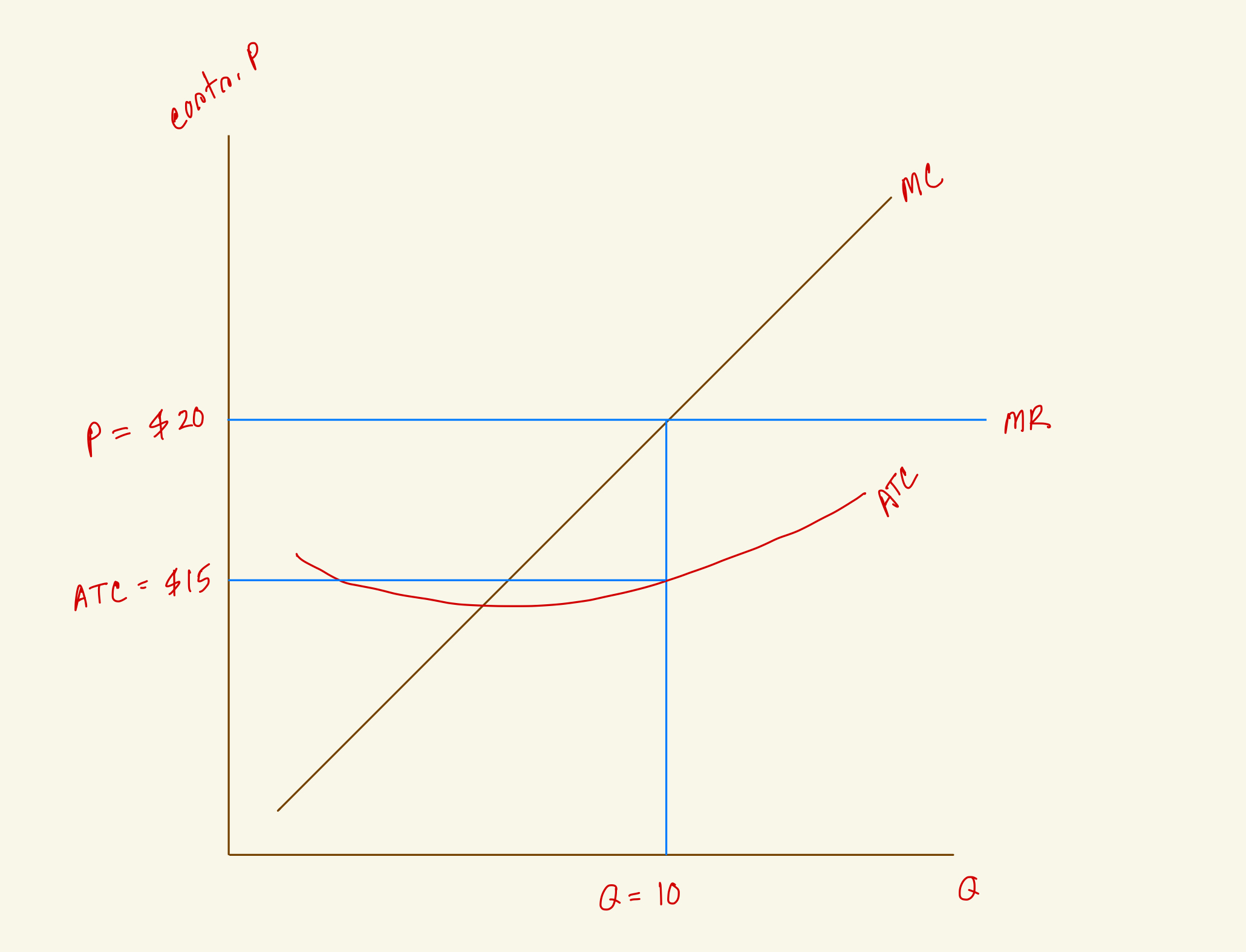

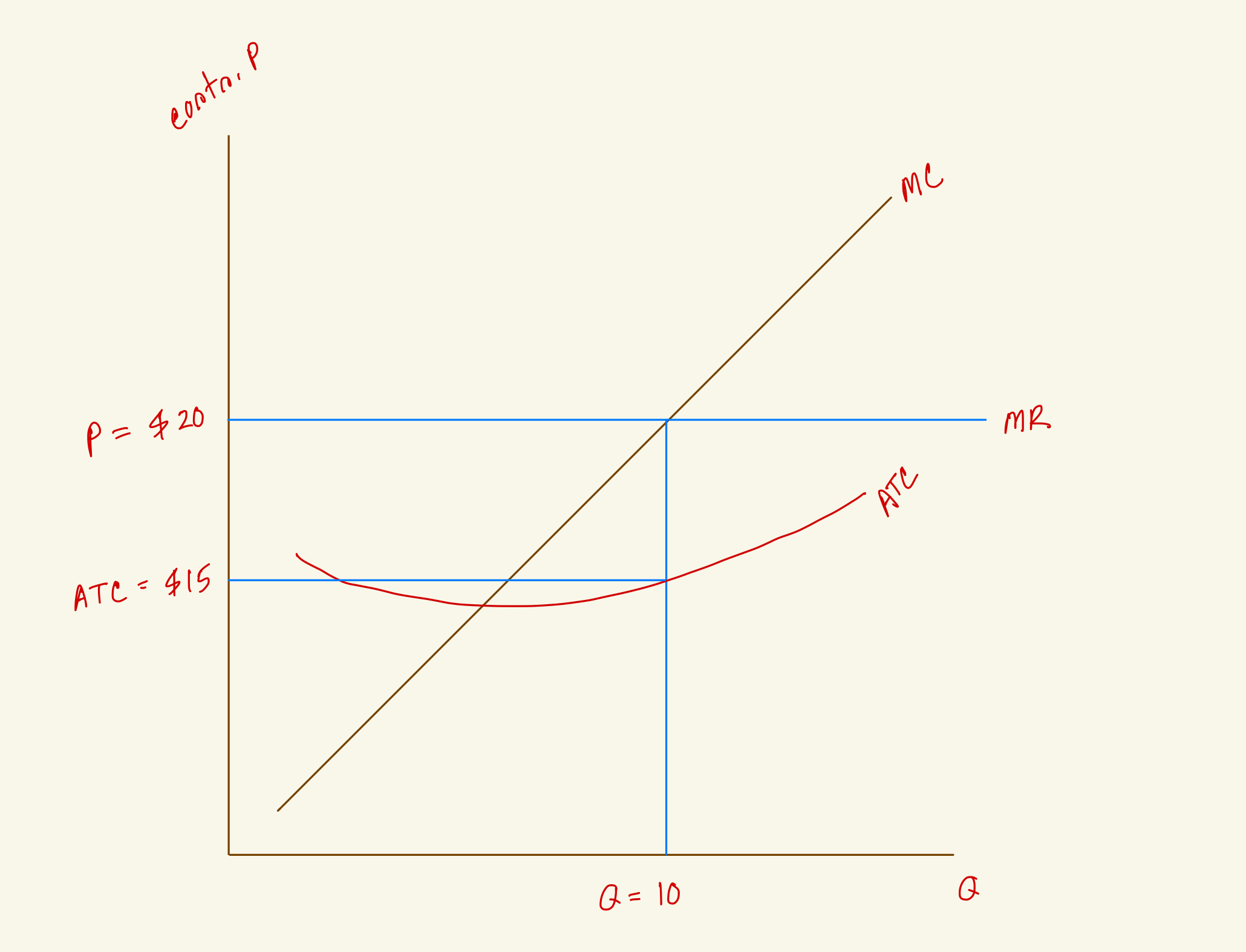

What's the profit for this firm in the diagram?

$150

$50

$75

$100

$50

If P = min ATC and firms earn zero economic profit:

Entry continues

Firms exit

Long-run equilibrium is reached

AVC is maximized

Long-run equilibrium is reached

True or False

Firms can avoid paying fixed costs by shutting down in the short run.

False

A firm exits the market in the long run when:

P > ATC

TR < TC

TR > VC

P = MR

TR < TC

A firm’s supply curve in the short run is the portion of its:

AVC above AFC

ATC above MR

MC below ATC

MC above AVC

MC above AVC

The profit-maximizing condition for a competitive firm is:

MR = MC

P = AFC

MR = AVC

MC = ATC

MR = MC

Which of the following is a sunk cost?

Lease that can be canceled anytime

Past advertising expense

Interest on a loan

Future wage payments

Past advertising expense

The firm’s MC curve intersects ATC at:

Its maximum

Maximum TR

Minimum AVC

Its lowest point

Its lowest point

If marginal cost is less than marginal revenue:

Raise price

Increase output

Shut down

Decrease output

Increase output

What's the total cost for this firm in the diagram?

$200

$150

$120

$100

$150

What's the total revenue for this firm in the diagram?

$170

$200

$100

$150

$200