Financial Sector

1/40

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

41 Terms

Financial Sector definition

The financial sector is the inter-connected area of the economy what deals with financial businesses who act as intermediaries that connect savers and borrowers(e.g. Commercial bank, Credit Unions).

Functions of financial sector:

Connect savers and borrowers by providing financial services(mostly saving, borrowing, and invstment)

Provide means to store wealth.

Provide means to earn interest on wealth.

Provide government with source of funds(through purchase of government securities[mostly debt securities]).

Provide means to get funds for borrowing and investment

Barter definition

Barter is an old system of exchange of goods and services wherein one good is exchanged for the other.

Trade VS Exchange

Exchange is the voluntary giving of something for the receipt of something else. Trade is voluntary exchange of goods and services within an economy.

Problems with barter:

Need for double-coincidence of wants

Creating agreed-upon exchange rate

Divisibility of goods

Storage of wealth

Money definitiion

Money is anything agreed-upon by buyers and sellers to be a means for settling debts.

Commodity money

Commodity money is anything used as a means for settling debt that has actual value i and of itself(e.g. gold, or cigars).

Fiat money

Anything used for settling debt that has little to no value itself but is allowed to represent value(e.g. paper bills).

Functions of money:

Medium of exchange

Measure of value and therefore wealth

Store of value and therefore wealth

Means for standard of deferred payment

Features of money:

Legal tender

Acceptable(by buyers and sellers as means to settle debts)

Homogenous

Divisible

Durable

Portable

Relatively Scarce

Money supply

Money supply is the total quantity of money available in an economy at a point in time.

Categories of money in modern economy:

M0/Narrowest form of Money: Physical notes and coins in circulation.

M1/Narrow Money: Can be used directly for transactions. e.g. N0 + checkable(demand) deposits

M2/Broard Money: Can be converted into item for direct use in transactions. e.g. M2 + savings accounts, money market accounts in financial institutions, time deposits

Time deposits

Funds the saver agrees to deposit in bank and not withdraw for an agreed-upon period(usually a few months to years) in exchange for higher interst rates.

An example if ‘Certificates of Deposits(CD)’.

Demand for money

Total amount of money that people desire to hold at a particular point in time.

Motives for demanding money:

Transitionary motive

Precautionary motive

Speculative motive

Central Bank

The Central Bank is the head of the financial sector that enacts the government’s policies (through monetary policy) and oversees other financial institutions.

Functions of Central Bank:

Banker of government (holds government’s funds and enacts government’s policies).

Has the sole responsibility to issue legal tender(notes and coins).

Oversees financial institutions’ operations.

Is the bank for other financial institutions(reserve requirement).

Monetary Policy

Monetary policies are policies enacted by the Central Bank on behalf of the government to influence the actions of entities within the financial sector.

Forms of monetary policy:

Repo/interest rate (interest rate charged for liquidity to banks)

Reserve requirement

Open market operations (buying and selling government securities)

Moral suasion (advice not mandate)

Commercial Bank

Commercial banks are profit-making businesses within the financial sector that provides financial services.

Functions of Commercial Banks:

Provides means to store wealth for businesses and private individuals

Provides means to earn interest on stored wealth

Provides funds for borrowing and investment

Credit creation through fractional reserve banking

Payment services(e.g. debit and credit cards)

Source of funds for government through banks’ purchase of government securities

Share VS Stock

A share is a single unit of equity security (ownership) of a company. A stock is a collection of shares.

Share/ Stock Market

A share/ stock market is a mechanism(market) that facilitates the trading of companies’ shares.

Stock Exchange

A stock exchange is an organized and regulated company that facilitates the trading of companies’ shares by stock brokers.

Stockbroker VS Trader

A stockbroker is a trained and licensed professional who trades companies’ shares and other securities of behalf of his/her clients.

A (stock)trader is a trained and licensed professional who trades companies’ stocks and other securities within a firm and so usually doesn’t interact with individual clients.

Credit Unions

Credit Unions are co-operative financial institutions owned and operated by its members to provide for its members’ economic well-being(e.g. through financial services-savings accounts, or education programs).

Development Banks

Development Banks are financial institutions founded to aid in the growth of a specific industry or sector. It therefore only offers often more-competitive services to entities within that industry.

Insurance Companies

Insurance Companies are businesses within the financial sector that guarantees compensation to the beneficiaries of insurance agreements when a condition is met(e.g. death or loss of property) in exchange for routine payments (premiums) by the benefactor.

Mutual Funds

A mutual fund is an open-ended financial institution that uses funds pooled together from its investors to engage in profit-generating ventures(e.g. trading securities). Persons invest in the fund by buying shares and receiving regular dividends(fixed or fluctuating according to fund’s profits) based on the number of shares. It is open-ended so shares are issued based on investors’ demand.

Building Societies

A building society is a financial institution owned and funded by its member that offers financial services (like mortgages and low-interest loans) to its members to aid in home acquisition(buying or building). Some building societies are subsidized by governments.

Investment Trust Companies

An investment trust company is a closed-ended fund that pools funds from its investors to engage in profit-generating ventures(often trading securities). It is closed-ended so it issues a fixed amount of shares that are traded on stock exchanges independent of the value of the trust’s underlying investment.

Informal Credit Institutions

Informal credit institutions are entities operating outside of regulatory oversight that provide financial services, particularly credit.

Examples of Informal Credit Institutions:

Sou-sou, Box Hand, Partner, Syndicatos, Meeting Turns are all variations of group-based informal institutions usually found in developing countries where members regularly contribute to a pooled fund and each member takes terns receiving the pooled fund on agreed-upon dates.

Money lenders/usurers are persons, often found in developing countries who provide credit(often loans) to persons at high interest rates and conditions that are abnormally advantageous to the lender.

A syndicate/cartel is a group of people or companies(e.g. in oligopoly market) that agree to collaborate on a mutually-beneficial venture, usually where more funds than they could’ve each supplied is necessary.

Financial Instruments

Financial instruments are assets that can be traded.

Securities

Securities are tradeable assets that represent value.

Equity Securities

Equity securities are assets that represent ownership, often shares of a company.

Debt Securities

Debt securities are assets that represent a guarantee of deferred payment, often in the form of bills, notes, and bonds. Therefore, the debt security holder has given a loan to the entity and has a debt claim against it.

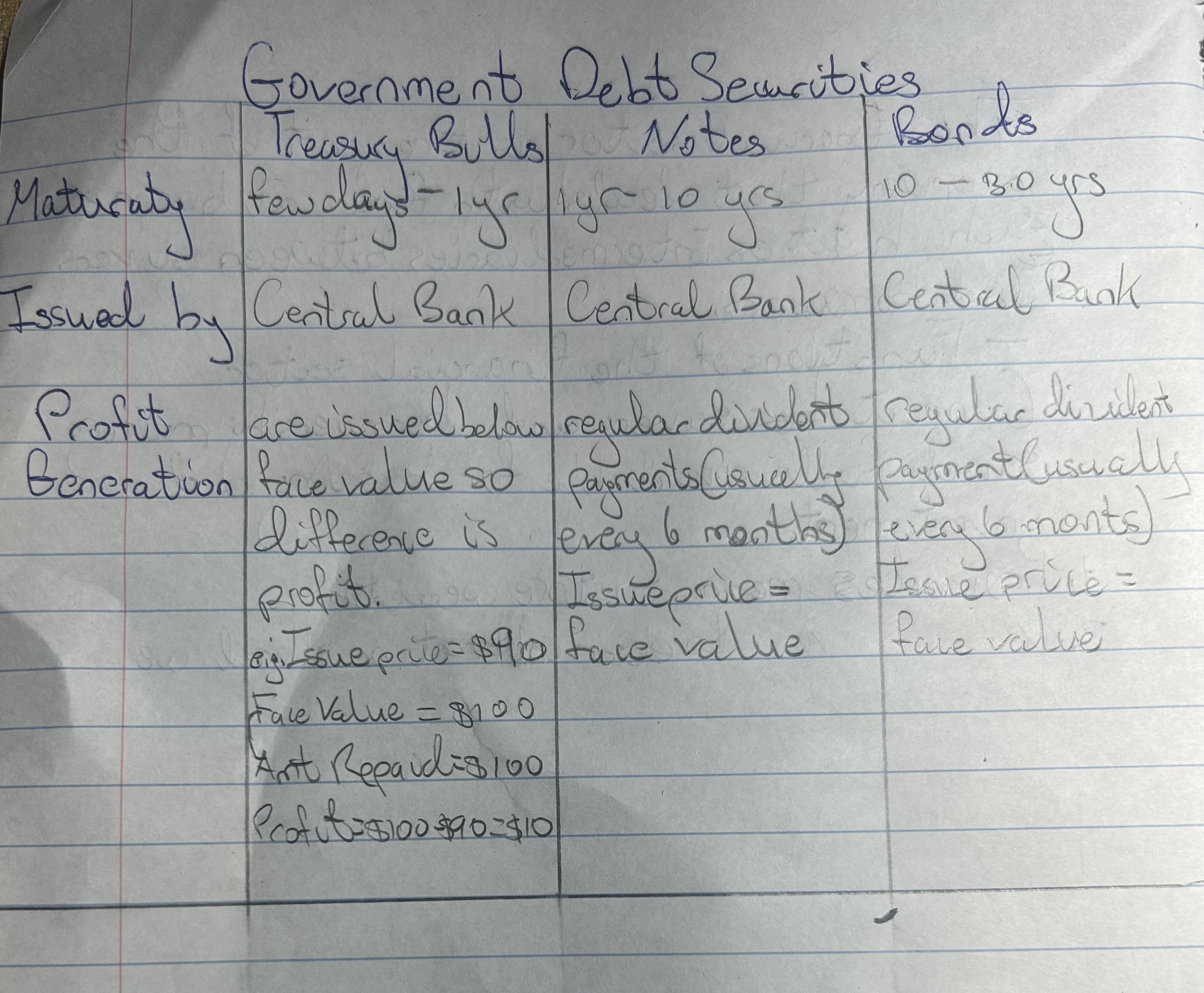

Examples of Government Debt Securities(only treasury):

Examples of Government Debt Securities cont.: Municipal Bonds

Municipal bonds are debt securities issued by municipalities (e.g. cities or towns) to raise funds for expenditure. These securities are sometimes accompanied with tax credits and special privileges(e.g. parking pass) to incentivize their purchase.

Corporate Bonds

Corporate bonds are debt securities offered by companies to raise funds.

Derivative Securities

Derivative securities are assets that represent a guarantee to sell or buy at a future time (e.g. call or put options for shares on stock exchanges).