Chapter 8: Short-Term Business Decisions

1/27

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

28 Terms

how do managers make decisions

define business goals

identify alternative courses of action

gather and analyze relevant information: compare alternatives

choose the best alternative

relevant information

expected future data that differs among alternatives

relevant costs

costs that are relevant to a particular decision (opportunity costs)

relevant revenues

revenues that are relevant to a particular decision

irrelevant costs and irrelevant revenues

costs and revenues that do no affect a decision

not in the future or do not differ among alternatives

sunk costs

costs that were incurred in the past and cannot be changed, regardless of which future action is taken

example: depreciation, original purchase price of an asset

differential analysis

common approach to making short-term business decisions

method that looks at how operating income would differ under each decision alternative

short-term decisions include:

regular and special pricing

dropping unprofitable products and segments, product mix, and sales mix

outsourcing and processing further

two keys in analyzing short-term business decisions:

focus on relevant revenues, costs, and profits

use a contribution margin approach that separates variable costs from fixed costs

three questions managers must consider when setting regular prices:

what is the company’s target profit?

how much will customers pay?

is the company a price-taker or a price-setter for this product or service?

price-taker

company has little control over pricing

product lacks uniqueness

there is intense competition

pricing approach emphasizes target pricing

price-setter

company has more control over pricing

product is more unique

there is less competition

pricing approach emphasizes cost-plus pricing

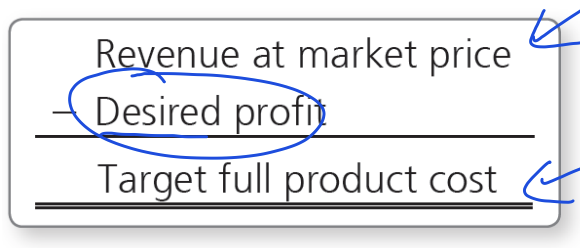

target pricing

starts with the market price of the product and then subtracts the company’s desired profit th determine the maximum allowed target full product cost

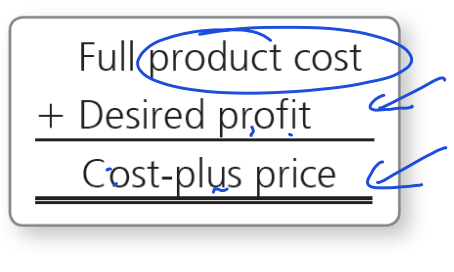

cost-plus pricing

starts with a company’s full product costs and adds its desired profit to determine a cost-plus price

special pricing decision occurs when

a customer requests a one-time order at a reduced sales price

things management must consider for special pricing:

does the company have the excess capacity available to fill the order?

will the reduced sales price be high enough to cover the differential costs of filling the order?

will the special order affect regular sales in the long run?

when to accept / reject special pricing orders

ACCEPT: if the expected increase in revenues exceeds the expected increase in variable and fixed costs

REJECT: if the expected increase in revenues is less than the expected increase in variable and fixed costs

short-term management decisions include how products are produced. Two questions are:

should the company outsource a component of the finished product or make it?

should a company sell a product as it is or process it further?

outsourcing

allows a company to take advantage of another company’s expertise, which allows it to focus on its core business functions

decisions are often called make-or-buy decisions because managers must decide wether to buy a component product or service it in-house

the heart of these decisions is how best to use available resources

in deciding whether to outsource, managers must assess fixed and variable costs separately. Management considers the following:

how do the company’s variable costs compare to the outsourcing costs?

are any fixed costs avoidable if the company outsources?

what could the company do with the freed manufacturing capacity?

decision rule: outsource?

OUTSOURCE: if the differential costs of making the product exceed the differential costs of outsourcing

DO NOT OUTSOURCE: if the differential costs of making the product are less than the differential costs of outsourcing

sell or process further? Managers must determine:

how much revenue will the company receive if it sells the product as is?

how much revenue will the company receive if it sells the product after processing it further?

how much will it cost to process the product further?

joint costs

costs of a production process that yields multiple products

decision rule: Sell or process further?

PROCESS FURTHER: if the additional revenue from processing further exceeds the additional cost of processing further

SELL AS IS: if the additional revenue from processing further is less than the additional cost of processing further