W15: Money, central banks, quantity theory of money;influence of fiscal and monetary policy

1/11

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

12 Terms

money

set of assets in an economy that people regularly use to buy goods and services from other people

medium of exchange

an item that buyers give to sellers when they purchase goods and services

unit of account

measure people use to post prices and record debts

store of value

item that people can use to transfer purchasing power from the present to the future

Liquidity

money without intrinsic value that is used as money by government decree ( what we use around the globe )

role of central banks

institution designed to regulate the quantity of money in the economy

Functions: low inflation, avoid large fluctuations, stable economic growth

Monetary policy

set of actions taken by the central bank to affect the money supply

how banks create money

Reserves (deposits that banks have received but have not loaned out) Fractional reserve banking ( system holds fraction of deposits as cash )

Money growth and inflation

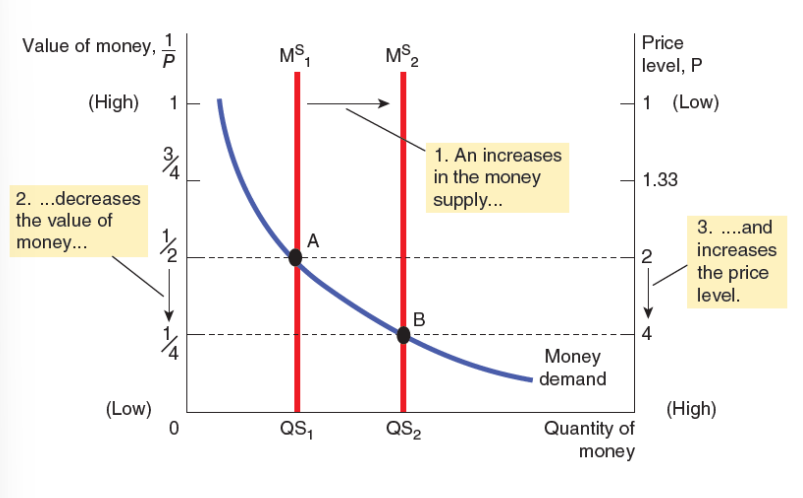

positive relationship between money growth and inflation. As the quantity of money in the economy grows, the price level will also grow. ( more money inflates prices)

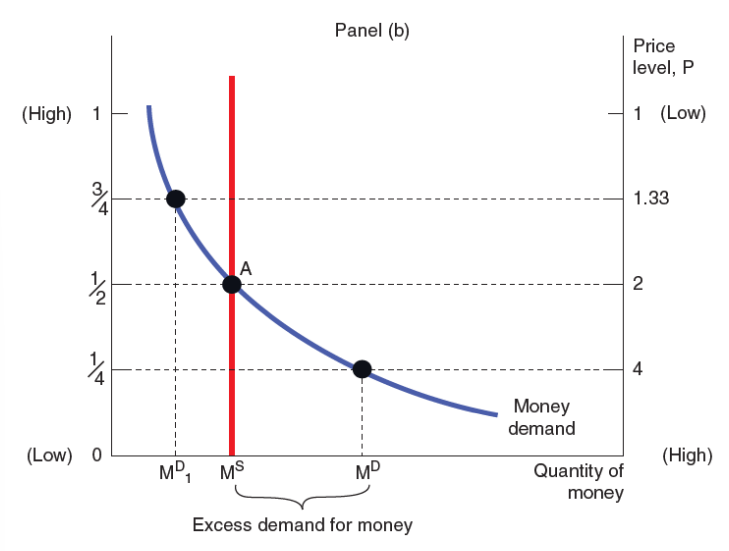

Equilibrium price level

Equilibrium price lvl ( increase in Supply )

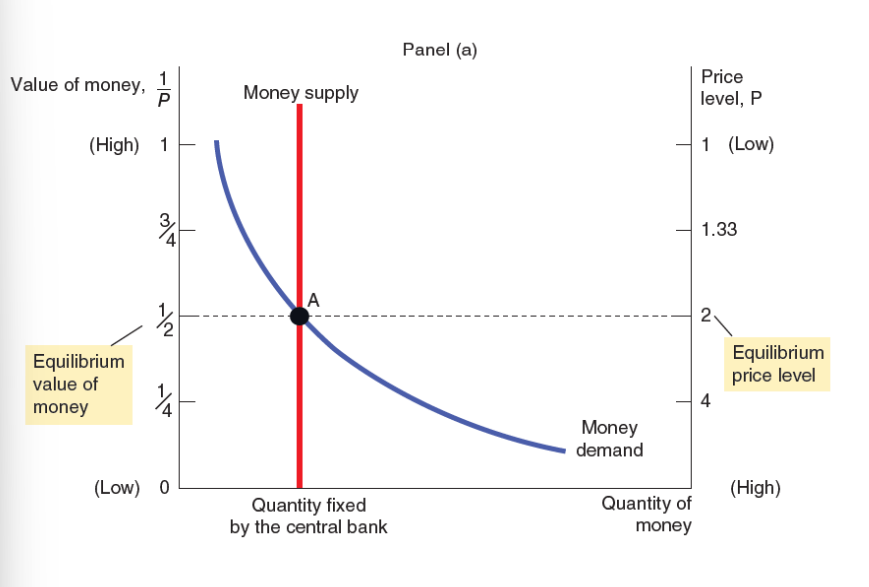

Equilibrium price lvl ( increase in demand )