W16: short run buisness cycles ...agreggate demand &supply; debates over government’s role in managing the cycle

1/30

Earn XP

Description and Tags

NEED TO LOOK AT GRAPHS ->

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

31 Terms

Business cycle

the irregular and largely unpredictable fluctuations in economic activity, as measured by the production of goods and services or the number of people employed

Recession

period of declining real incomes and rising unemployment.( depression is severe recession

Non stationary data -

time series data where the mean value can either rise or fall over time ( in the picture GDP regularly rises )

Stationary data

time-series data that has a constant mean value over time

buissness cycle 2 ?

Most macroeconomic quantities fluctuate together (procyclical) Real GDP falls in a recession ;GDP falls ⇨ Unemployment rises (countercyclical)

Cyclical indicators

leading indicators change before the change in the GDP trend. They can be used to foretell future changes in economic activity

Lagging indicators change after

changes in economic activity have occurred

coincident indicators change at

the same time as changes in economic activity

In the long run the increase in productivity

determines the increase in real GDP

why does economy fluctuate in short run:

money supply matters - real GDP may deviate bc of this

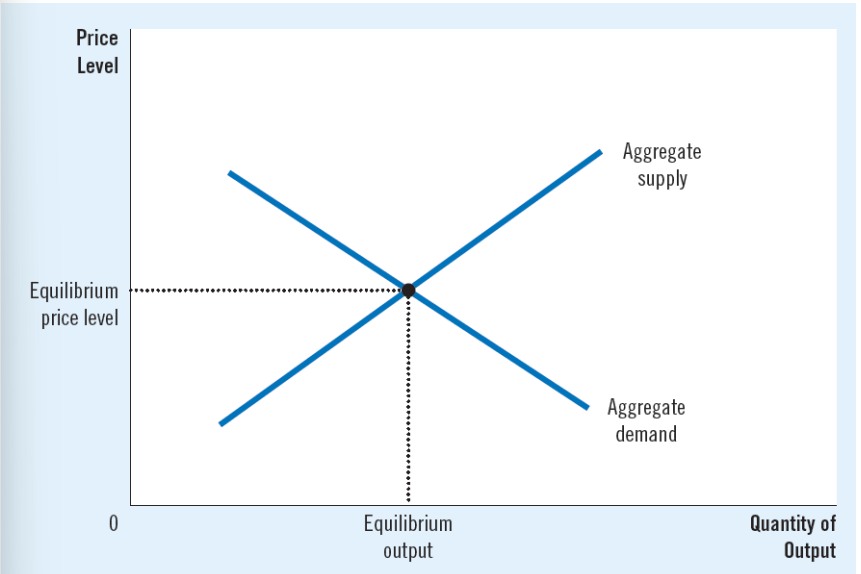

Aggregate-demand curve

curve that shows the quantity of goods and services that households, firms, the government and customers abroad want to buy at each price level

Aggregate-supply curve

a curve that shows the quantity of goods and services that firms choose to produce and sell at each price level

Output and the price level adjust

to the point at which the aggregate-supply and aggregate demand curves intersect

Aggregate demand as model

Equillibrum output X Equillburim price level = GDP

diffrence from micro economic model:

In market demand and supply model the customers may move into/from another market (for another product) and the suppliers may move resources from/to another market (for input)

( consumers and suppliers move around)

reasons for downward sloping Aggregate demand curve:

wealth effect, intrest rate effect, exchange rate effect

The price level and consumption (C) wealth effect

people spend more as the value of their assets rise

The price level and investment (I): the Interest rate effect

movement along the Aggregate Demand curve due to change in Price Level. Price level affects how much people spend and save, which affects the interest rate.

The price level and net exports (NX): the Exchange rate effect

prices of imported goods will change in value, including domestic products that rely on imported parts and raw materials

reasons for shift in Agg demand curve

changes in… consumption, investment, government spending, net exports & disasters

aggregate supply curve is vertical in long run

In the long run, price level has no impact,

Shifts of Agg supply in long run:

changes in labor, capital, natural resources, technical knowledge

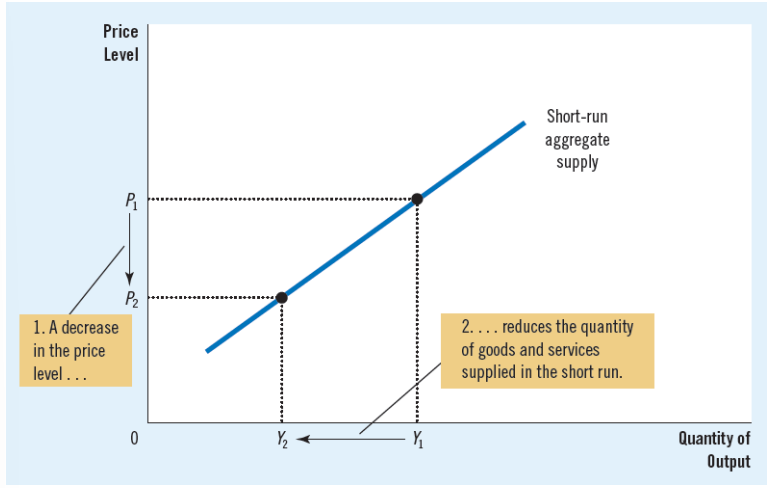

A-S curve slopes upward in short run

in short run, price level does affect the economy’s output→

increase in the overall level of prices in the economy tends to raise the quantity of goods and services supplied (short run!)

decrease in the level of prices tends to reduce the quantity of goods and services supplied (short run!)

why does short run A-S curve slope upward

sticky wage theory, sticky price theory, misperceptions theory

Sticky-Wage theory

nominal wages are slow to adjust to changing economic conditions

Sticky-Price theory

prices of some goods and services also adjust sluggishly in response to changing economic conditions

Misperceptions theory

changes in the overall price level can temporarily mislead suppliers about what is happening in the individual markets in which they sell their output ( suppliers respond to changes in lvl of prices )

Sifts of A-S in short run

changes in … labor, capital, natural resourses, technical knowlege, expected price level

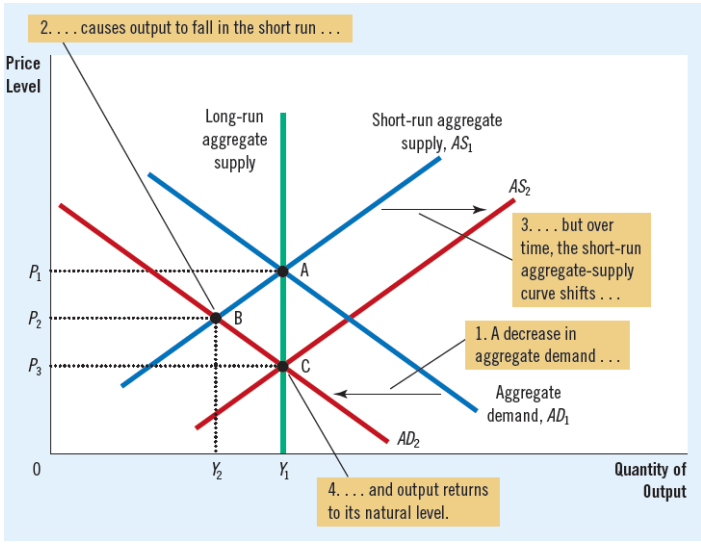

Contraction in aggregate demand

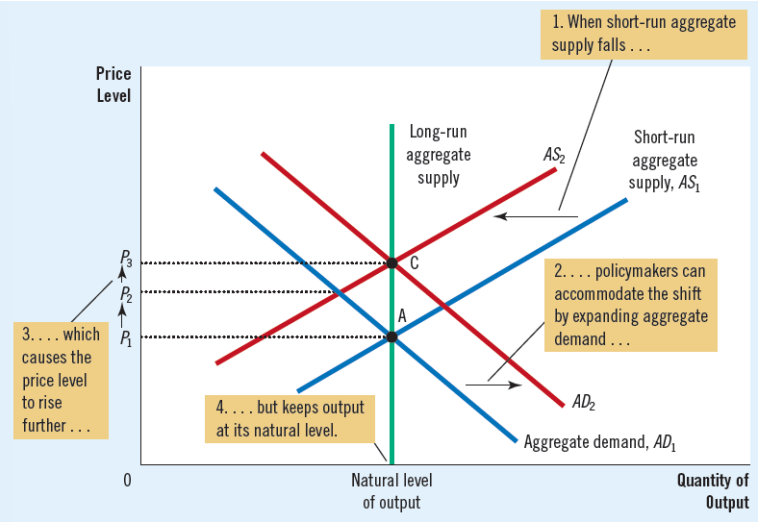

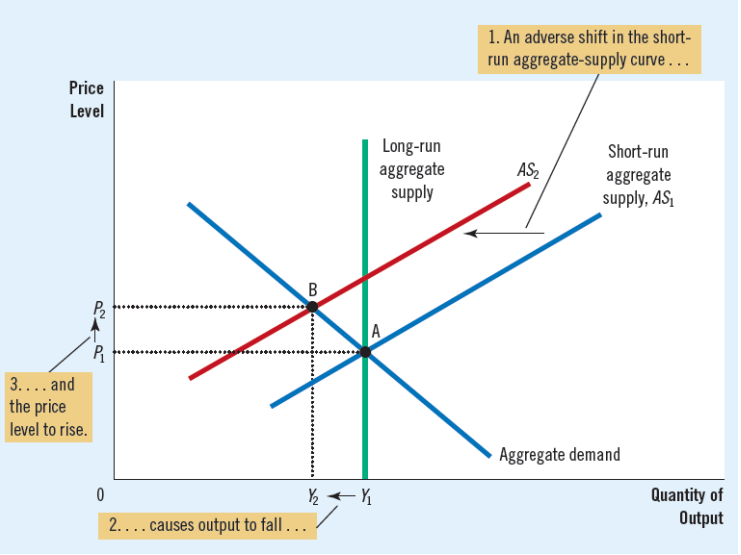

Contraction in aggregate supply

A-D reaction to adverse shift of A-S