Fruad Test 1

1/34

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

35 Terms

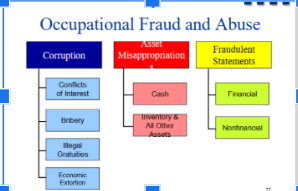

Occupational fraud and abuse

Occupational fraud and abuse: the use of one’s occupation for personal enrichment through the deliberate misuse or misapplication of the employing organization’s resources

Fraud Examination vs Forensic Accounting

Fraud Examination vs Forensic Accounting

Forensic accounting is the use of accounting knowledge for courtroom purposes, therefore could include bankruptcy, divorce, etc

Fraud examinations are usually performed by accountants

Fraud Examination vs Auditing

timing

scope

objective

relationship

methodology

presumption

why conduct both

Fraud Examination vs Auditing

Issue:

Timing

Audit: Recurring

Examination: nonrecurring

Scope:

Audit: General

Examination: Specific

Objective:

Audit: opinion

Examination: addix blame

Relationship:

Audit: Non-adversarial

Examination: adversarial

Methodology:

Audit: audit techniques

Examination: fraud examination techniques

Presumption:

Audit: Professional Skepticism

Examination: Proof

Why conduct an audit? - It is a recurring requirement

Why conduct a fraud examination?

Based on predication: a total of circumstances exist that whenever a reasonable person thinks a fraud has, is, or will occur

Fraud examinations encompass more than just the review of financial data they include interviews, record searching, and forensic document examinations

Predication

Predication

Totality of circumstances that would lead a reasonable, professionally trained and prudent individual to believe fraud has occurred, is occurring and/or will occur

Fraud examinations must be based on predication

How to conduct a fraud examination:

How to conduct a fraud examination:

Documentary evidence

Interviewing witnesses

Writing investigative reports

Testifying in court

This is where the forensic accountancy scope must get into the courtroom

Analyze available data

Create a hypothesis

Test the hypothesis

Refine and amend the hypothesis

Elements of Fraud

Elements of Fraud

A material false statement

Knowledge that the statement was false when it was uttered

Reliance on the false statement by teh victim

Damages resulting from teh victim’s reliance on the false statement

Researchers on occupational fraud and abuse

Researchers on occupational fraud and abuse

Edward Sutherland claims that white collar crime isn’t a bad person who set out to commit a crime, it is learned and developed

Donald Cressey created the fraud triangle

Cressey’s hypothesis

Steve Albrecht- created the Fraud Scale

Richard Hollinger looks at data, the workplace

Fraud Triangle

Fraud Triangle

Opportunity: mitigated by internal controls

General information vs technical skill

General: doors are always unlocked, everyone has access to the system

Technical: I have this specific asset and expertise

Pressure: something unique to me, something I need that I have pressure because of

Cressey found that these are the nonshareable problems that fall into 6 categories

Violation of ascribed obligations - people in trustworth positions feel like they are being held to higher standards and when they cannot maintain that(ie they get in debt because of a drug addiction) they feel the need to steal to maintain self-image (embarrassed they are in debt due to drugs)

Problem resulting from personal failure - this is a result of pride and not wanting to let people know you made a bad decision (ran your business into the ground)

Business Reversals - your business is failing due to factors outside of your control(interest rates, a poor economy, etc)(status still plays a role even though it is outside of their control)

Physical Isolation - someone has nobody to ask for help and feels stuck

Status- gaining - desire for a better lifestyle

Employer- employee relations -an employee resents thier status

However, all situations deal in some way with status seeking or status maintaining

Rationalization: can be shared amongst everyone

You think this is essentially noncriminal

Somehow justified

Part of general irresponsibility (they are asking for it)

Hollinger says there is a relationship to workplace dissatisfaction

Fraud scale

Fraud scale

Situational pressures

Opportunity

Integrity

Stats

Stats

Hard to quantify, may be close to 5% of all transactions

Most theft is done by employees, then managers, then owners/execs

However, owners/execs steal much more than managers do than employees do

Guys do it twice as often and twice the amount of $

The most common department a person is in is teh accounting/finance department

Most of the time ha never gotten charged with a crime

Usually frauds are detected by tips(external fraud only detects 3% of fraud)

Ussullay its an employee however and owenr/executive steals more

Usually male and men steal more

Usually in accounting

Teh hughet loss is by mangement/upper management

Most have never been charged

Usually detected by tips

Occupational fruad and abuse

Fraud Theroy Aproach

Fraud Theroy Aproach

Analayzed available data

Jeff skilling announced resignation

Create a hypotheses

WSJ says something seems shady

Test the hypothesis

Interview Jeff Skilling

Refine and amend the hypothesis

Jeff Skilling says the stock price impacted this decision so we go back to the related party section from teh 10Q adn then the 10K- they then relized that these arrangements have been around for awhile

Then we go public, and a whistleblower comes forward

Whistleblower confirms inappropriate structure and suggests broader significant concerns

who is responaible for the Fs

Company management is responsible for the financial statements

The company’s board of directors and senior management set the code of conduct

The CEO and CFO sit on both the board of directors and are responsible for the financial statements

who are teh users of fs

Users of fs

Transaction activity is captured in the accounting system, which then flows to fs and is communicated to users who make decisions on investments, loan terms, etc.

The decision aspect is where damages incur

Who commits FS fraud?

Who commits FS fraud?

Senior management

Mid and lower-level employees can do it, but are less incentivized

Organized criminals

Why do people commit fs fraud?

Why do people commit fs fraud?

To conceal true business performance

To preserve personal status/control

To maintain personal income/wealth

Overstate performance

To meet or exceed the earnings or revenue growth expectations of stock market analysts

To show a pattern of growth to support a planned securities offering or sale of the business

To comply with loans covenants or meet a lenders criteria for granting or extending loanfcitlites

To meet goals from parent companies

Satisfying analyst expectations

To meet personal performance criteria

To trigger performance related compensation or earn payouts

To support the stock price in an acquisition or merger

Understand performance

To take all possible write-offs in one “big bath” now so future earnings will be consistently higher

Have one giant impairment loss, rather than taking some in following periods

To defer surplus earnings to teh next accounting period

To reduce expencations

To preserve a trend of consisten growth avoiding volatile results

To come out on top in a divorce settlement

Missed one

How do people commit FS fraud

How do people commit FS fraud

Playing the accounting system - least egregious

Arguing LT assets have longer lives than they do, aggressive with BDE

There is a level of judgement you are taking advantage of

Beating the accounting system

False and fictitious information into the accounting system

Documents are forged to support claimed numbers

Going outside the entire system

Produces what ever fs you want

Don’t record something or make false JE

You may just change the FS themselves or leave sometime out

Change numbers directly on FS

how does a change in stock price relate to fs fruad

Damages in financial statement fraud are not changes in stock price

That does not fully capture the extent of damages(IE loan approval, fincncail investment decisions, etc.)

Conceptual framework for financial reporting

measurement assumptions

measuremnt principles

contratins

qualative characteristics

Conceptual framework for financial reporting

Recognition and measurement assumptions:

Economic entity

Going concern

Monetary unit

Periodicity

Recognition and measurement principles

Historical cost

Revenue recognition

Matching

False disclosure

Recognition and measurement contraints

Cost-benefit

Materiality

Industry practice

Conservatism

Recognition adn measurement of qualitative characteristics

Revlaence and reliability

Compariablity adn consistency

SOX Goals and 7 new rules

Sarbanes-Oxley Act

SOX GOALS:

Establishing higher standards for corporate governance and accountability

Create an independent regulatory framework for the accounting profession

Enhancing teh quality and transparency of financial reports

Developing severe civil and criminal penalties for corporate wrongdoesrs

Establish new protections for whistleblowers

SOX rules: 7 new sox rules are covered in depth below

Management must report on IC

Increase disclosures in management’s discussion

Conditions for use of Non-GAAP measures

Certification of disclosure by CEO and CFO of companies' quarterly adn annual reports

Disclosures for ethics

New standards for attorneys

Standards for audit committees

Audio independence

Retention of record and workpaper

what did the estpblishmen to fthe PCAOB do

PCAOB was established

Purpose: to oversee the audit of public companies that are subject to the sercuriteis laws, and related matters, in order to protect the interests of investors and further the public interest in the preparation informative, accurate, and independent audit reports for companies, the securities of which are sold to, and held by and for public investors

What do they do?

The registered public accounting firms that audit publicly traded companies

Establishing or adopting auditing, quality control, ethics, independence and other standards for public companies

Inspecting registered public accounting firms

Investigate registered public accounting firms adn their employees, conducting disciplinary hearings nad imposing sanctions where jsutfiied

Peroform other dutires necessary to improve the quality of audit services

Enforce compliance with sarbanes oaxley the rules of the board, professional standards and securities law

Certification obligations of CEOs and CFOs

Certification obligations of CEOs and CFOs

Criminal certification: teh have ot say they did not

knowing violates teh certification requirements is up to $1 million and up to 10yrs in prision

willfully(worse) violate teh cerfiticaiton is up $5 million and up to 20 years in prision

Civil certification, they have to say

They have personally reviewed teh report

Based on the knowledge, the report does not contain a material weakness

Based on management knowledge, there are no issues with teh financial conditions and internal controls

The disclosure to teh auditor of any material weaknesses in teh controls and any fraud

General Standards for audit committee independence

Standards for audit committee independence

The audit committee has increased responsibilities

There needs to be a financial expert

Changed teh composition of the audit committee

Established a whistleblowing structure

Standards for auditor independence

Standards for auditor independence

Restrictions(not necessarily never allowed) on non-audit activity:

Bookkeeping services

Financial information system design and implementation

Appraisal or valuation services, fairness opinion or contribution in kind reports

Acutalal services

Internal audit outsource services

Management function or HR

Legal services and expert services unrelated to the audit

Any other service that the PCAOB prescribes

Mandatory audit partner rotation

Conflict of interest provisions

Improper influence on audits

Auditor reports to audit committees

All critical accounting policies and procedures use

Aletnerative GAAP method

Communication of any material weakness

Improper influence on audits

Enhanced fincncail disclosure requirements

Enhanced fincncail disclosure requirements

Off-balance sheet transactions

Pro forma financial information

Prohibitions on personal loans to executives

Restrictions on insider trading

Code of ethics for senior fincnical officers

Enhanced review of periodic filings

Real time disclosures

Protections for whistleblowers

Protections for whistleblowers

Civil liability whistleblower protection: creates civil liability for a company that retaliates against whistleblowers

Protects only employees of publicly traded companies

Employees must report the suspected misconduct to a federal regulatory or law enforcement agency

Employees are protected against retaliation for filing, testifying in, participating in, or otherwise assisting in a proceeding

Protected even if there was no fraud, as long as it was a reasonable thought

The employee will also get compensatory damages if there was fraud to make the employee whole

Criminal: makes it a creim eot knowingly retaliate

Information must be provided to law enforcement

Broader than civil liability protections cover all individuals regardless of where the work is

Enhanced penalties for white collar crime

Enhanced penalties for white collar crime

White collar crime:

Attempt and conspircay

Mail fraud and wire fraud

Securities fraud

Document destruction

Bankruptcy loopholes

Repercussions:

Freezing of assets

Disgorgement of bonuses

Fraud Risk

Why be concerned about fraud risk?

Fraud Risk: vulnerability of an organization to overcoming the interrelated elements that enable someone to commit fraud

Why be concerned about fraud risk?

Awareness of risk is key to establishing a mechanism to reduce risk

Internally or externally

No organizatino is immune

Factors that influence fraud risk:

Factors that influence fraud risk:

Nature of business

Operating environment

Effectiveness of internal controls

Ethics and values

Fraud risk assessment:

Fraud risk assessment: a process aimed at proactively identifying and addressing an organization’s vulnerabilities to internal and external fraud

To help an organization recognize what makes it most vulnerable so that it can take proactive measures to reduce its exposure

Why conduct a fraud risk assessment:

Why conduct a fraud risk assessment:

Improve communication adn awareness of fraud

Identify what activities are most vulnerable to fraud

Develop plans/techniques to mitigate and identify fraud risk

Comply with regulations and professional standards

PCAOB AS 5 effectively requires a fraud risk assessment with the assessment of internal controls

A good risk assessment:

A good risk assessment:

Collaborative effort of management and auditors

Independence and objectivity of the people leading and conducting the work

A good working knowledge of the business

Access to all levels of the organization

Engendered trust

A plan to keep it alive and relevant

Packaging it right: the deliverable - an audit gives an opinion and an audit committee deck - tailor the communication approach to the organization

One size does not fit all - adapt the framework to the business model and culture

Keeping it simple - focus on areas that are most at risk for fraud

Assembling the right team -

Accounting adn finance personnel

Personnel who have knowledge of day-to-day operations

General counsel, compliance functions, internal audit, external consultants

Determing the best techniques:

Interviews

Focus groups

Surveys

Anonymous feedback mechanisms

Educating the organization and openly promoting the process

Obtaining the sponsor’s agreement on work

Scope, methods, participants, form of output

Execution of fraud assessment: 7 steps

Execution: 7 steps

Identify potential inherent fraud risks

Fraud risk triangle

Risk of management’s override of controls

Population of fraud risks:

fraudulent financial reporting

Asset misappropriation

Collusion opportunities

Regulatory and reputation risk

Information technology

Assessing the likelihood of the occurrence of the identified fraud risk

Past instances

Industry

Support of management

Unexplained losses

Complexity of risk

Complaints from vendors/customers

Assessing the significance of fraud risks

Fiancncail statement and monetary significance

Financial condition of the organization

Value of the threatened assets

Signifcaince to the organization’s operations, brand value and reputation

Evaluating which periole and departments are most likely to commit fraud and identifying the methods that they are likely to use

Identifying and mapping existing preventative and effective controls

Evaluating whether the identified controls are operating effectively and efficiently

Review accounting policies and procedures

Interview management and employees

Observe control activities

Perform sample control testing

Review past reports

Identifying and evaluation the residual fraud risks resulting from ineffective or nonexistent controls

Addressing fraud risk

Addressing fraud risk

Establishing an acceptable level of risk

Responding to residual fraud risk

Avoid the risk

Transfer the risk

Mitigate the risk

Assume the risk

Report the results objectively

Keep it simple

Identify clear and measurable objectives

Relationship with the audit process

Relationship with the audit process

Auditors should validate that the organization is managing the moderate-to-high risks

Evaluate internal controls

Assess management override of internal controls

Deliver reports that incorporate the results of testing controls