TOPIC 4 Non-current assets

1/18

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

19 Terms

What are non-current assets?

long life assets

Used in the business

Not bought with main purpose of reselling

Of material value

What are the 2 main categories of NCAs?

Tangible - NCAs you can see/touch e.g. land/plants/machinery/equipment

Intangible - those that don’t have a physical presence

What is spending on NCAs known as?

capital expenditure

( in this context meaning big)

When does Capital Expenditure occur?

buying NCAs

Adding to earning capacity of existing NCAs

What’s included in the cost of buying NCAs?

Delivery cost

Legal costs of buying land & buildings

Any initial costs needed to get the NCA ready before first use from which the business will benefit in the long-term

What does revenue expenditure mean?

spending incurred on the running costs of the business and on maintaining its NCAs

Give examples of capital and revenue expenditure

Capital:

Buying delivery van 8k

putting extra headlights on van

Paint outside of brand new building

Revenue Expenditure:

Buy petrol for van

Repainting building 3 years later

What is depreciation in terms of NCAs?

concept that NCAs don’t last forever

the cost of an NCA must be spread over its useful life

All tangible NCAs must be depreciated

What are the 2 ways of spreading the cost of an NCA over time?

straight-line deprecation

Reducing balance depreciation

Straight line depreciation formula

Annual depr’n expense = cost estimated residual value/ expected years of use

Straight-line depreciation example

1.Suppose Meg’s business buys a van for £10,000 on 1 Jan 20X1.

2.Meg expects it to last about three years, after which it should be worth about £1,000.

3.i.e. it is expected to depreciate by £9,000 over three years

4.Meg could assume that she’ll get equal benefit each year from using the van (‘straight-line depreciation’)

£3000 per year depreciation

What happens when no residual value is estimated? (Common)

straight line depreciation is expressed as a % of the cost of the asset

E.G. A computer bought for £1200 is expected to last for 4 years —→ 1200 X 0.25 of SL = £300 depreciation per year

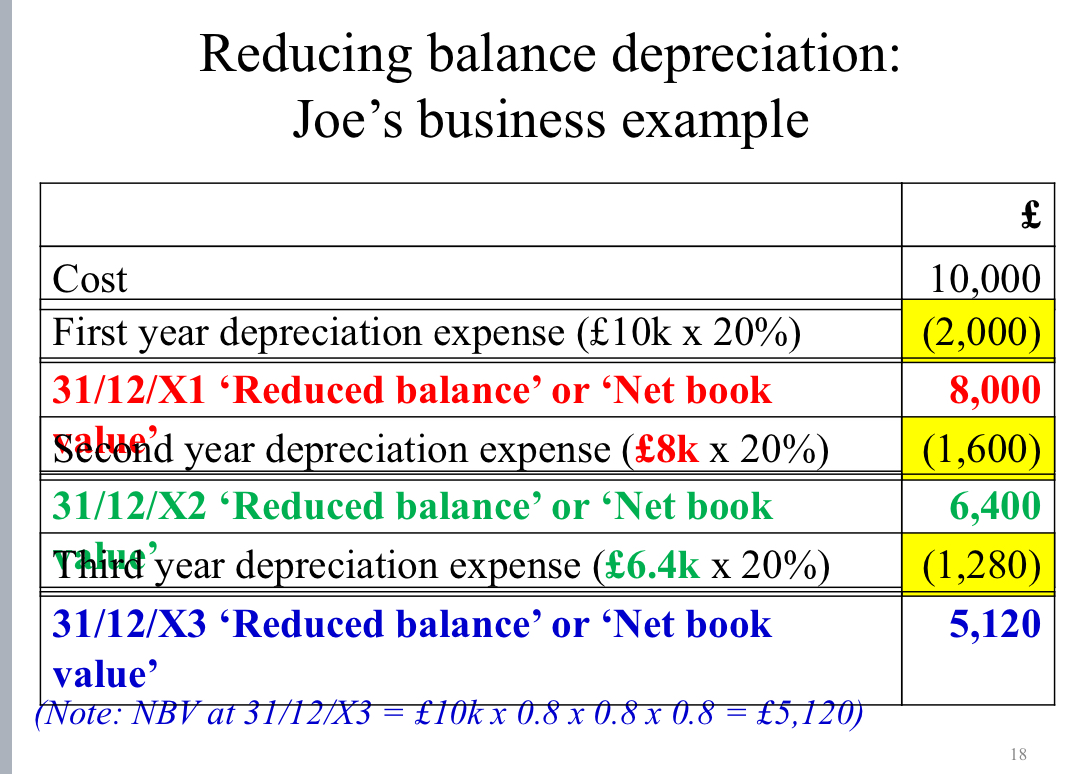

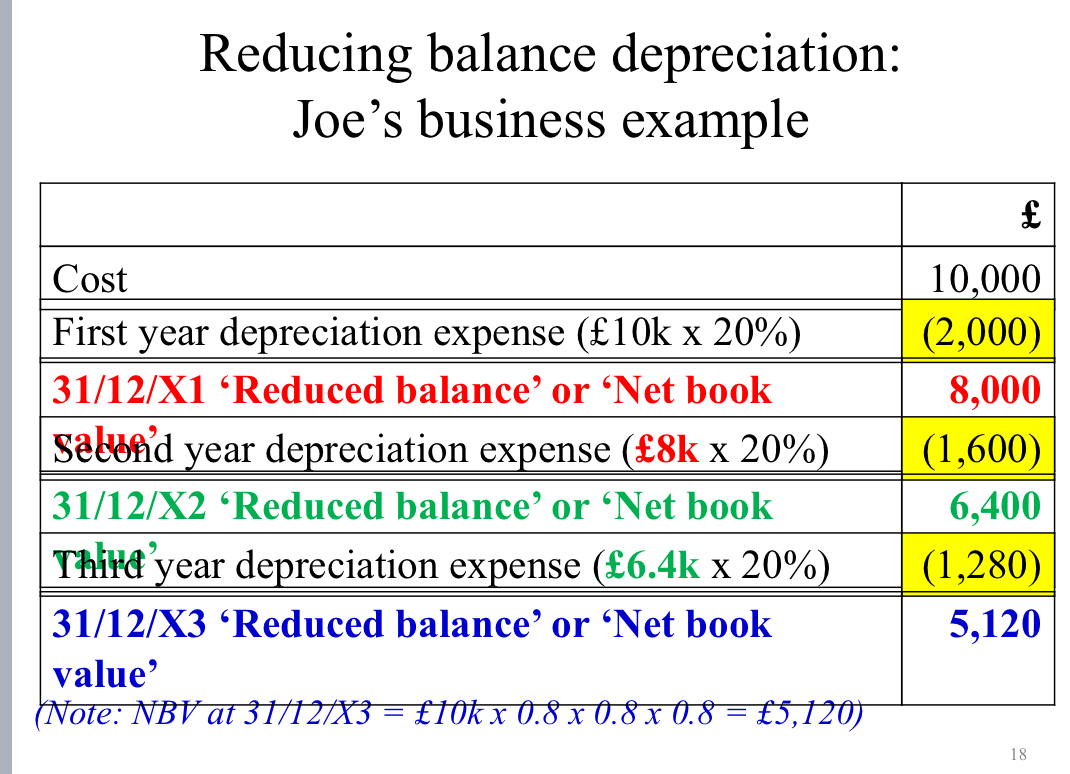

How does the reducing balance method work?

a fixed percentage is applied to the cost of the NCA in the first year it’s bought

the same percentage is applied to the reduced balance year after year

Why might a business choose the reducing balance method instead of straight line?

has a fixed percentage

What’s the double entry for depreciation?

Dr Depreciation expense (will appear as an expense in the SPL)

Cr Accumulated depreciation (balance will appear on the SFP, reflecting the amount of the of the original cost that is deemed to have been used up

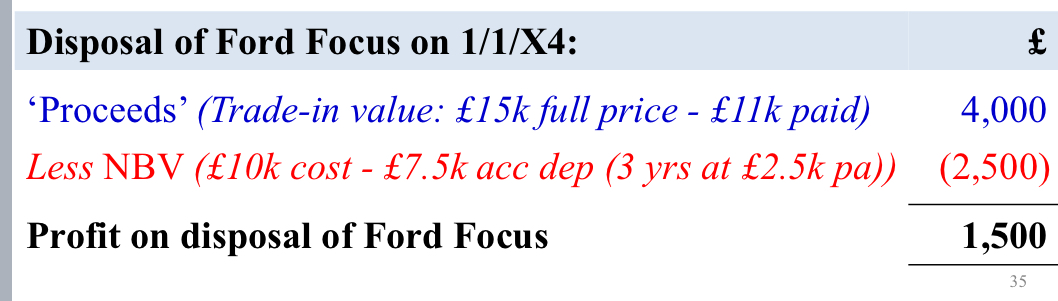

What is a part-exchange/trade-in in terms of an NCA?

disposal proceeds’ on the old asset part-exchanged are simply equal to the trade-in value

e.g. suppose a new van priced at £16,000 is bought by paying £12,000 cash plus the trade-in of an old van

In this case, the effective disposal ‘proceeds’ would be £4,000 for the old van

Part-exchange example

i.A Ford Focus was purchased for £10,000 on 1 January 20X1 and was depreciated at 25% p.a. straight line

ii.On 1 January 20X4, it was part-exchanged for a VW Golf priced at £15,000

iii.This purchase of the VW Golf was settled by making a bank transfer of £11,000