Market structures (micro)

1/46

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

47 Terms

Perfect Competition assumptions

- Many buyers and sellers (agents are price takers)

- Homogeneous products

No price discrimination

- Perfect knowledge (symmetric information)

- Free entry / exit of firms

- Firms aim to maximise profit

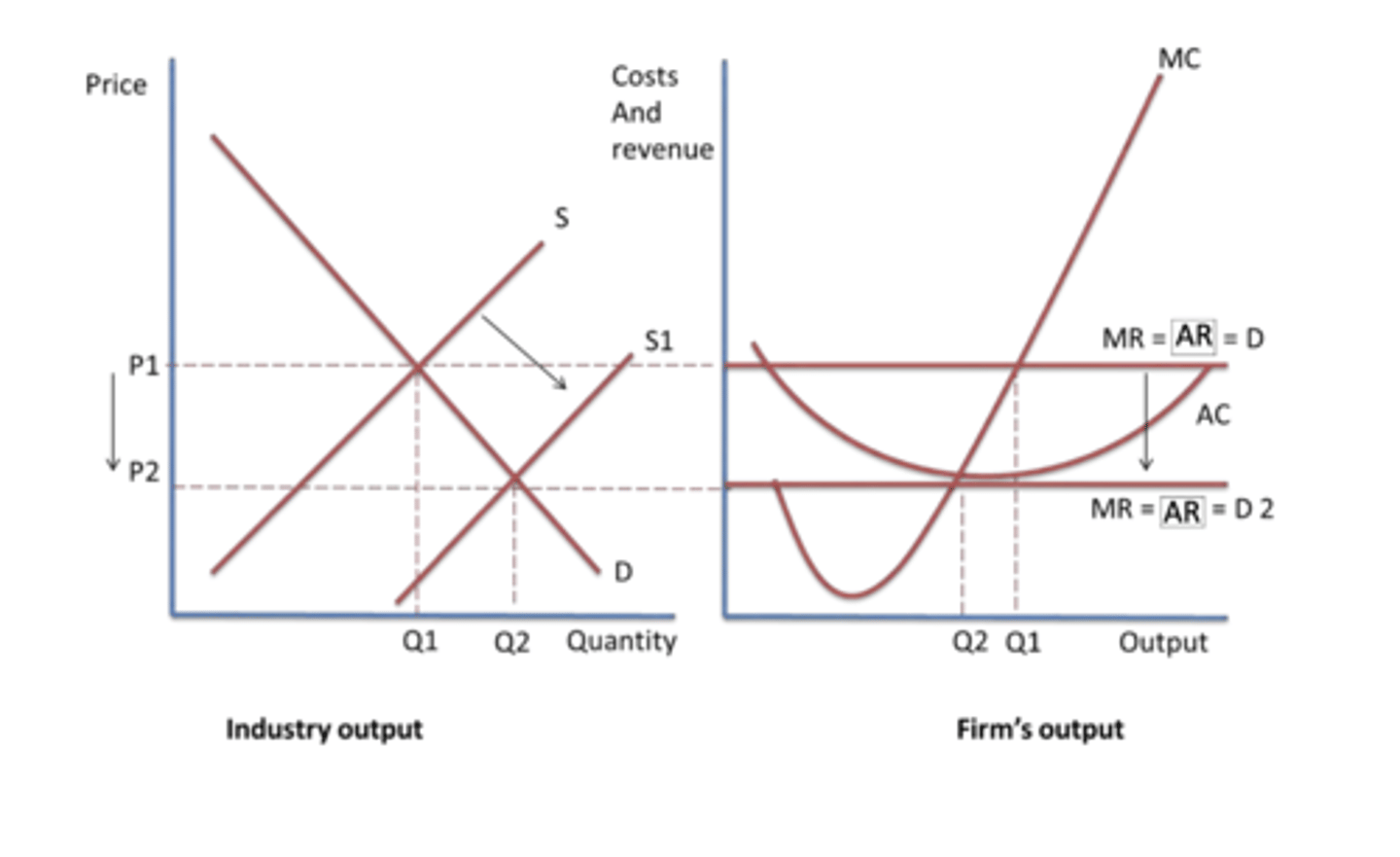

what happens when a firm is making a profit in a perfectly competitive market in the short run?

- if firms make a profit, new firms will enter the market due to low barriers to entry, because the market seems profitable. The new firms mean that supply will increase and shift to the right, causing a decrease in the average price, meaning that existing firms' profits will be depleted away

what happens in the short run and long run in terms of profit for firms in perfectly competitive markets ?

what does the graph look like for long run and short run?

- in the short run, firm scan makr supernormal profits, but in the long run, profits are competed away and only normal profits are made

adv and disadv of perfect competiton

advantages:

- in the long run, P=MC, so there is allocative efficiency but not in the short run

- since firms produce at the bottom of the AC curve, so there is productive efficiency

- the supernormal profit in the short run might increase dynamic efficiency through investment

disadvantage:

- in the long run, dynamic efficiency is limited due to the lack of supernormal profits

- since firms are small, there are few or no economies of scale

- the assumptions rarely apply in real life as in reality, branding product differentiation, adverts, positive and negative externalities mean that competition is imperfect

what is monopolisitcally competitive market?

firms directly compete but each firm sells a slightly differentiated product, giving some degree of market power

monopolistic competition assumptions

1. large number of firms

2. slight product differentation

3. no barriers to entry or exit

4. non-price competition

monopolistic competition in the SR:

are supernormal profits made?

if so, what happens?

in SR, supernormal profits achieved which signals new firms to enter the market, which can happen due to low barriers entry and exit

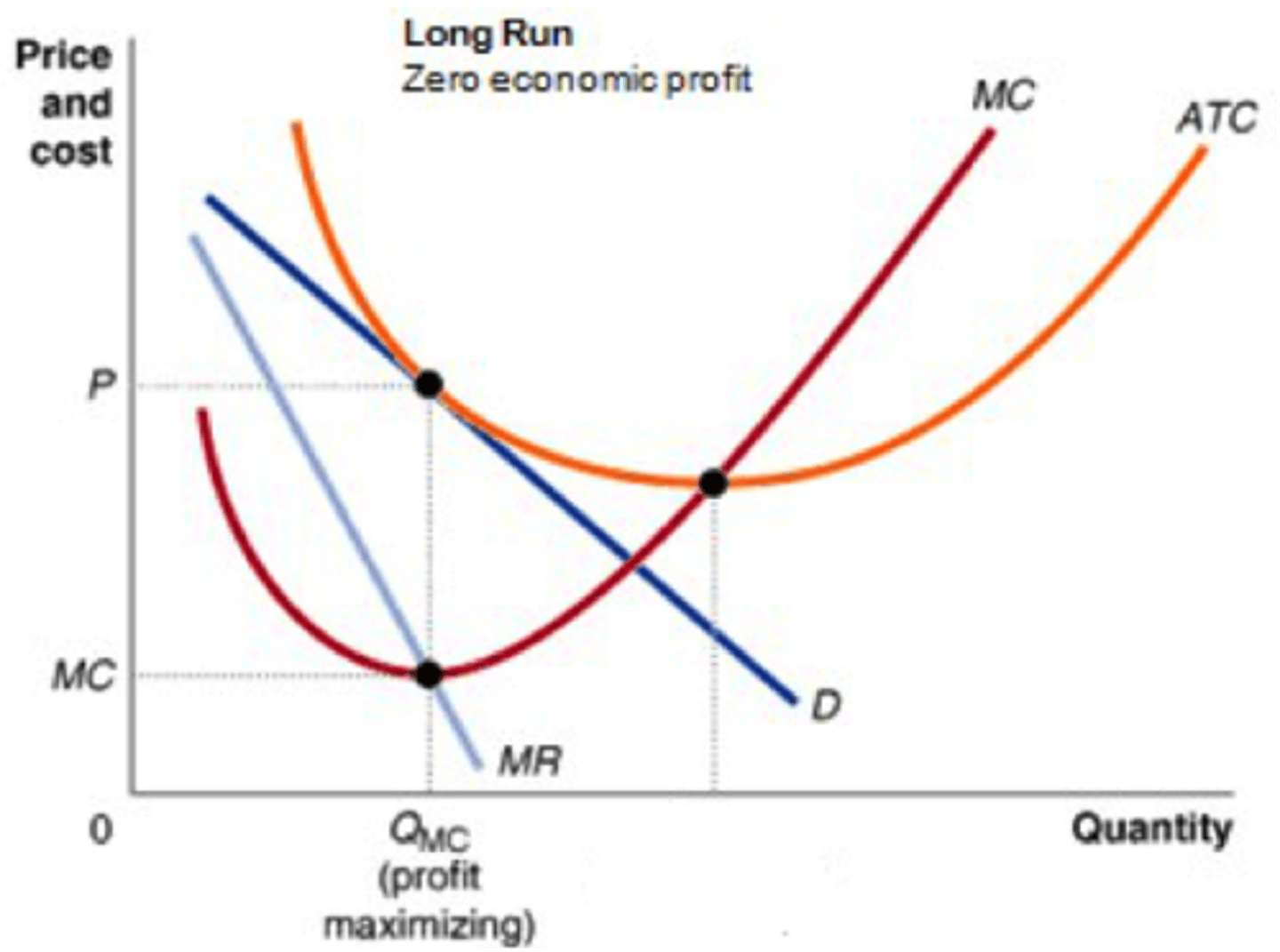

monopolistic competition in the LR:

what does the graph look like?

why does the graph end up the way it does from SR to LR?

what does this mean for firms in the long run?

when firms enter due to supernomal profits signalling entry, the demand (AR curve) will shift left for any single firm

- continues to shift left unitl tangential to AC

- due to freedom of entry & exit, supernomal profits in SR are eroded in the LR

in the LR for monopolisitcally competitive markets, is allocative, productive and dynamic efficiency achieved or not?

why?

in LR for monopolistic markets

allocative efficiency (P=MC) - not achieved

productive efficiency (AC=MC) - not achieved

dynamic efficiency (reinvesting supernormal profits) - not achieved

as firms operate at profit max (MC=MR)

characteristics of oligopoly

High barriers to entry and exit

High concentration ratio

Interdependence of firms

Product differentiation, so firms are price makers

define interdependance in oligopoly

interdependance - firms base their decision-making on the decisions of other firms in the market

what type of competition do oligopolies engage in

non-price competition due to sticky prices

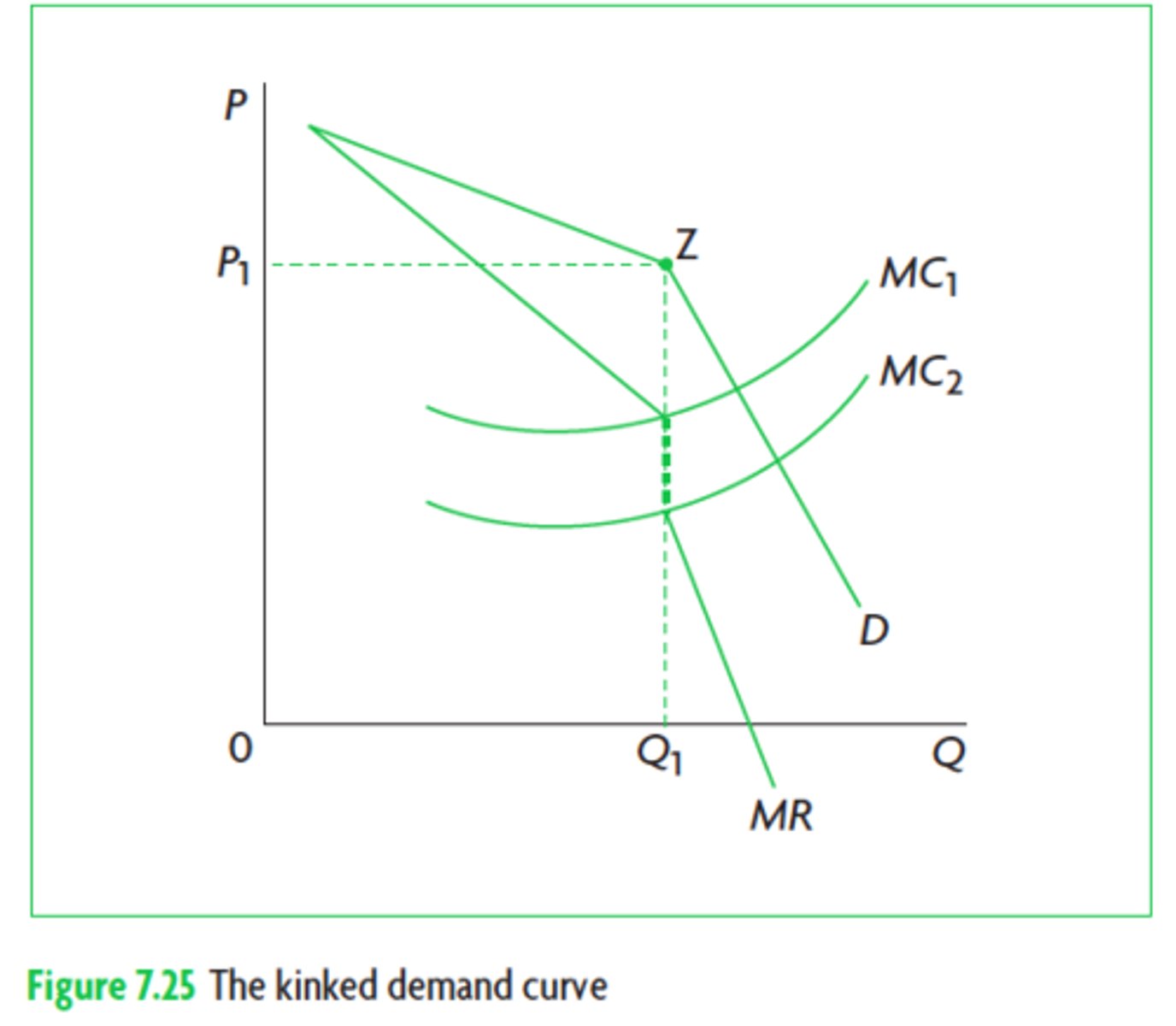

what graph models oligopolistic markets ?

what does it show about prices and why ?

kinked demand curve

there is a sticky price or price rigidity due to the different types of elasticity on either side of the kink

define overt collusion

define tacit collusion

overt collusion - when firms formally agree not to compete on price, illegal when done through price fixing

tacit collusion - when firms work together without a formal agreement, by observing other firms in the market

what are some ways of product differentiation by oligopolies

ways of product differentiation:

branding

after-sales service

extra features

performance and reliability

location

what are some advantages of oligoplies to firms, and consumers

advantages:

- firms can be dynamically efficient

- price stability in the market increasing consumer confidence

- firms gain economies of scale reducing average costs

- supernormal profits can be reinvested

what are disadvantages of oligopolies for consumers, and firms in terms of achieving objectives and maximisation?

disadvantages:

high prices for comsumers due to sticky prices

firms may not be incentivised to reduce costs so leads to X-inefficiency

firms may suffer from diseconomies of scale

likely to be allocatively inefficient

likely to be productively inefficient

characteristics of a monopoly

-A single producer

-No close substitutes

-Barriers to entry & exit

-Price maker

-Supernormal profit in SR & LR

What is a monopoly?

single seller in the market with no competitors

what is a price maker?

a firm possessing the power to set the price within the market

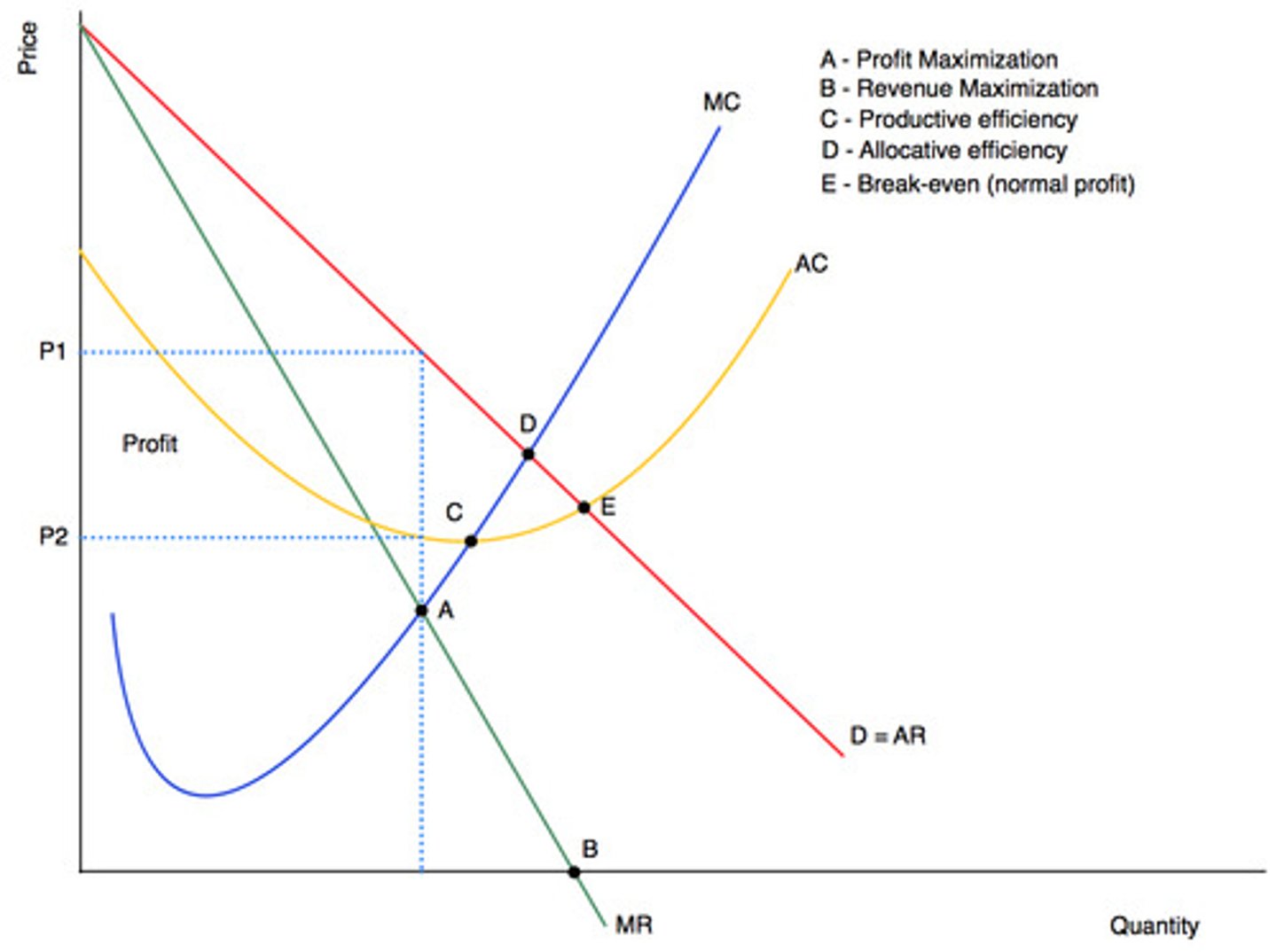

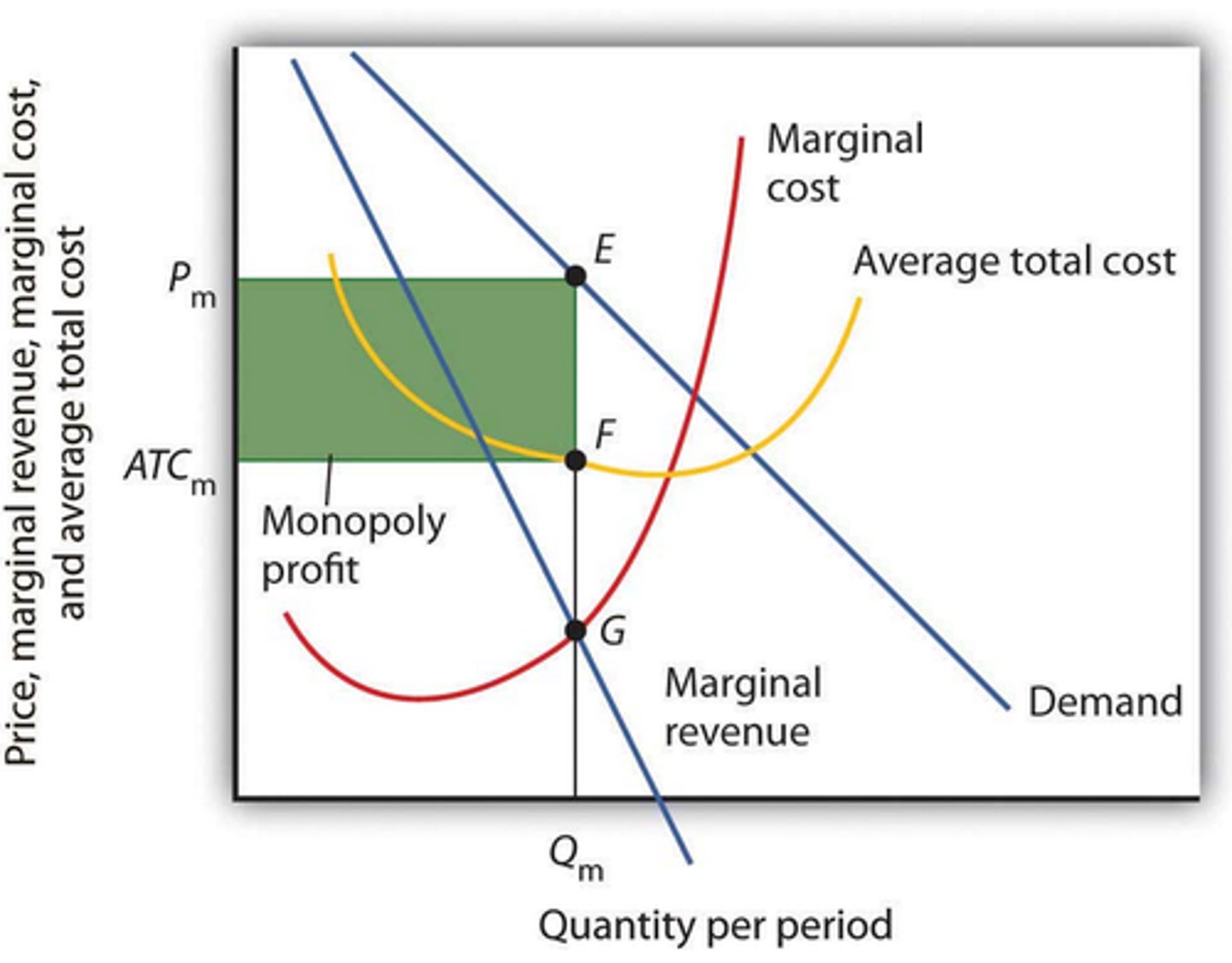

monopoly diagram

what do we assume is their main objective?

what point does a monopoly operate in the diagram?

is it different in the short run and long run?

assume that their objective is profit max

monopoly operates at profit maximisation MR=MC

same in SR & LR

what is productive efficiency

a situation in which a good or service is produced at the lowest possible cost

what is allocative efficiency

refers to a situation in which resources are allocated such that the last unit of output produced provides a marginal benefit to consumers equal to the marginal cost of producing it.

P = MC

is a monopoly likely to be productively or allocatively efficient

why not?

no

Productive efficiency is when a good or service is produced at the lowest average cost, but this is not the point a profit-maximising monopoly would operate at

- Allocative efficiency is when the price of the produce = marginal cost, but a monopolist would have a P>MC

is a monopoly possibly dynamically efficient?

explain how?

In a monopoly, the firm has price-setting power due to high barriers to entry, allowing the firm to make supernormal profits

this is an incentive for a monopoly to then innovate products and processes allowing them to be dynamically efficient

what is dynamic efficiency

Incentives to innovate products and processes to become productively efficient in the long term

what is x-inefficiency

what market structures can this happen in?

A firm is x-inefficient when it is producing within the AC boundary - AC is higher than the lowest possible AC - firm operates above its AC curve.

Costs are higher than they would be with competition in the market.

This can happen in highly concentrated markets such as MONOPOLY and OLIGOPOLY, where firms are able to make supernormal profits and have an AR that is greater than their AC - reducing the need or desire to lower AC and decrease X-in-efficiency.

what is x-inefficiency

lack of incentive to reduce costs

what is price discrimination

selling the same good at different prices to different buyers

can price discrimination happen in competitive markets?

explain why

what affect does this have on consumer surplus?

no, in competitive markets, every customer pays the market price because a customer would go somewhere else to buy the product if the prices were higher at a specific firm

this leads to consumer surplus for some customers who would have been willing to pay a higher price

Can a monopoly use price discrimination?

What impact does this have on producer surplus?

- A monopoly is one single seller, so customers do not have a choice to go elsewhere

Therefore, a monopoly can use price discrimination

- this leads to higher producer surplus

What are some advantages of a monopoly

- dynamic efficiency

- gain economies of scale

- compete internationally

- supernormal profits reinvested, creating more jobs & products

what are some disadvantages of a monopoly

- Higher prices for consumers

- X-inefficiency leading to higher AC

- can suffer from diseconomies of scale

-decline in consumer surplus

- Fewer choices for consumers

- allocative inefficient

- productively inefficient

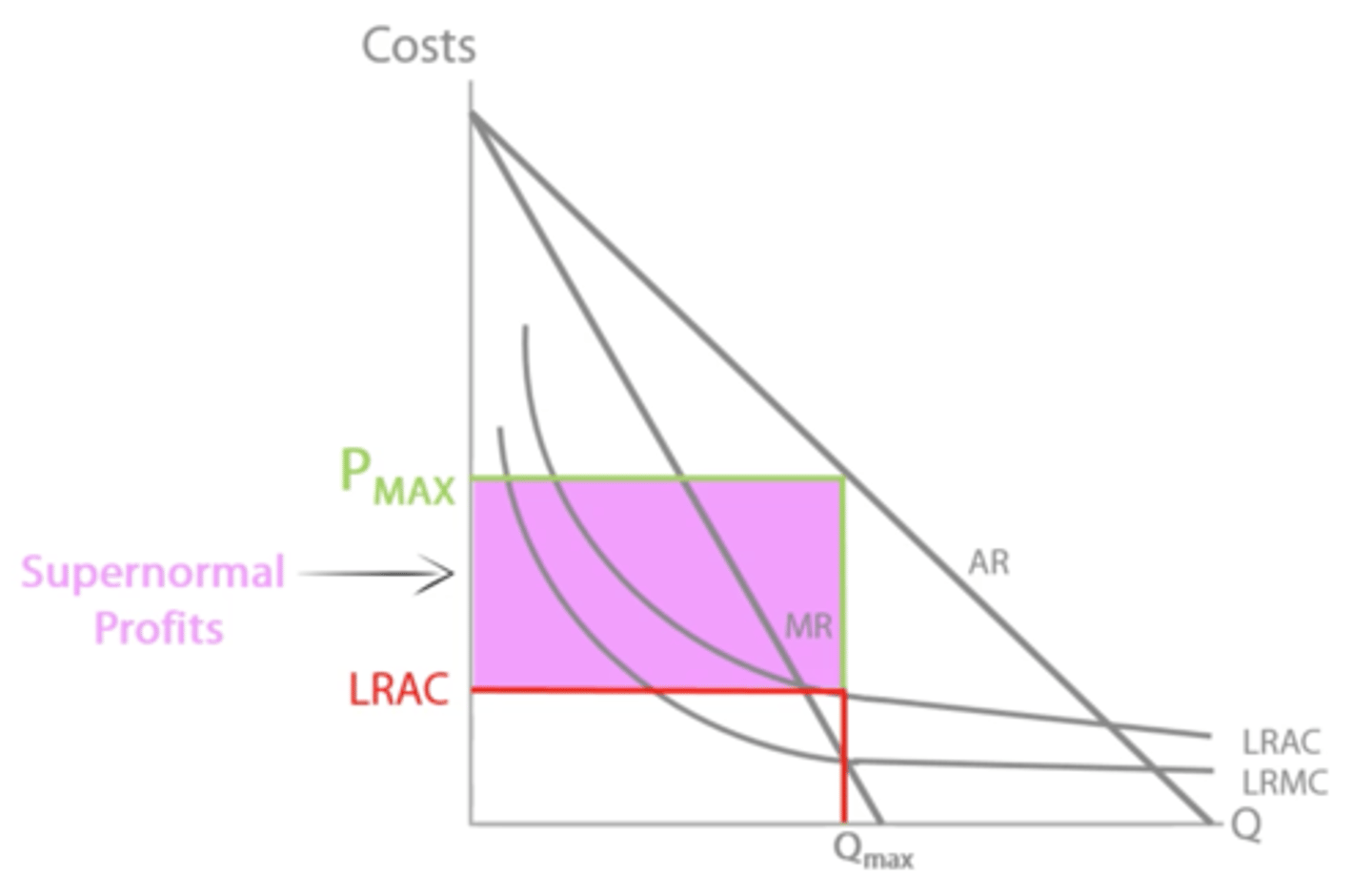

what is a natural monopoly

a market structure where it makes economic sense for there to be a single sole supplier of a good or service, as it is more efficient for one firm to supply the entire market due to signnificant economies of scale

what is an example of a natural monopoly

public water system

power system

diagram for natural monopoly

explain the LRMC and LRAC

- Economists of scale are so beneficial that the LRMC remains below the LRAC

what is the major disadvantage of a natural monoply

- Government regulation may not allow them to gain full advantage of the vast economies of scale

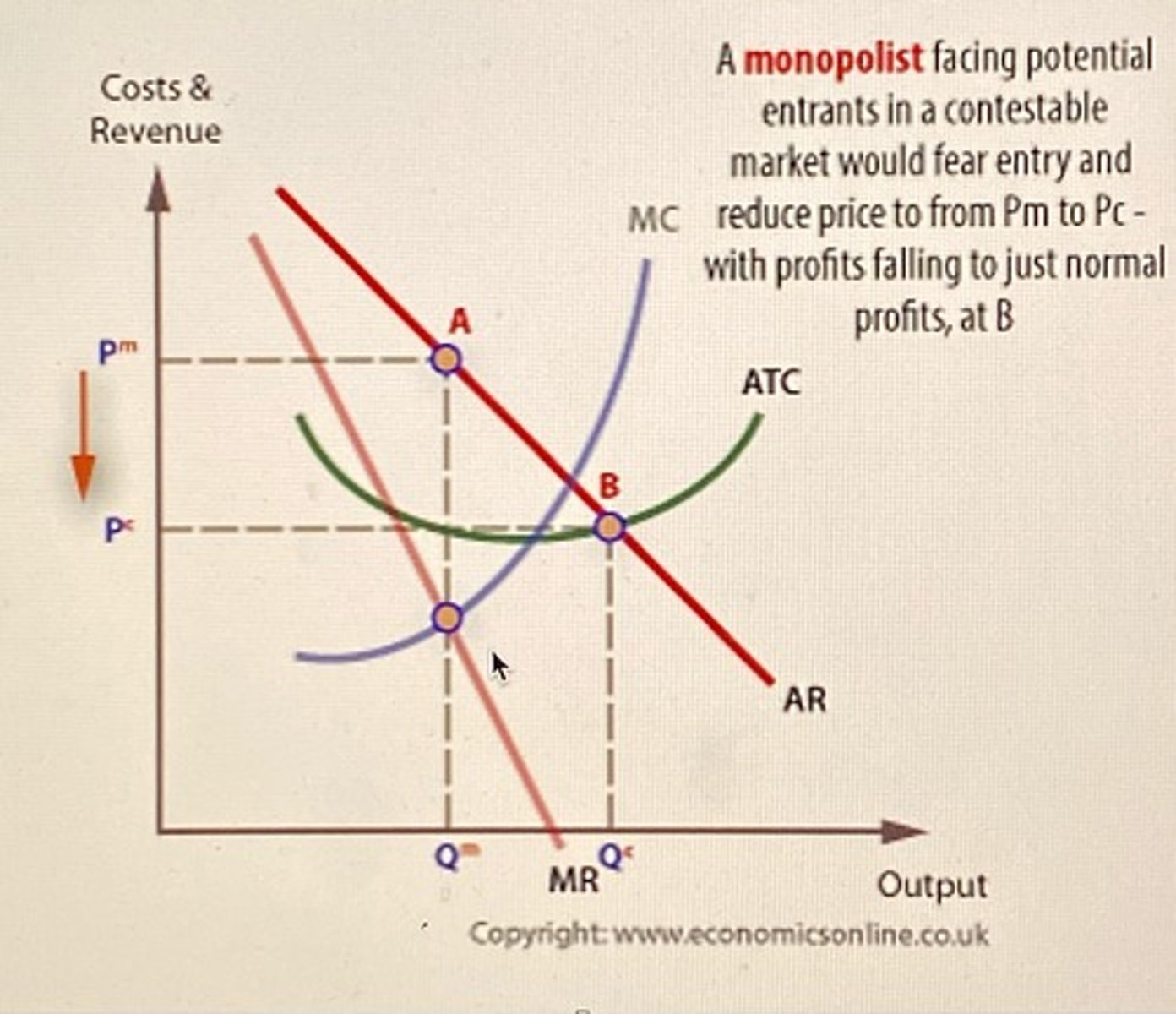

what is a contestable market?

market in which no firm can dominate enough to make supernormal profits

what are the characteristics of a contestable market?

- no barriers to entry or exit

- no sunk costs preventing a firm form entering or exiting

- all firms have access to new technology

- there is little or no consumer loyalty

- firms are able to enter and exit the market quickly (hit and run)

What is hit and run competition?

in contestable markets, where new entrants take a share of the supernormal profits and then exit the industry

explain whether each market structure can be considered contestable or not

perfect competition is fully contestable - no barriers to entry or exit

monopolistic competition has some degree of contestability - low barriers of entry & exit but branding & product differentiation make it less contestable

An oligopoly can be contestable if there are low sunk costs and no artificial barriers - new firms like Ryanair and EasyJet have entered due to deregulation. but oligopolies often have high barriers to entry and price wars and even collusion to keep high prices

A Monopoly is not usually contestable due to high barriers to entry, single seller and high sunk costs unless barriers are reduced artificially (deregulation from government)

in a contestable market, what efficiencies are achieved and not achieved?

- allocative efficiency as firms will need to set prices closer to marginal cost to avoid new competition P=MC

- Firms must be cost-efficient to avoid being undercut by new entrants so they can achieve productive efficiency by operating at lowest point on AC

- Dynamic efficiency is not achieved as firms will fear that new entrants will copy innovations from R&D without bearing the costs

What are some types of barriers to entry making a market less contestable?

(economies of scale, patents, loyalty)

- the greater the economies of scale that a firm exploits, the less likely a new firm will enter the market

- Legal barriers like patents can act as a barrier to entry

- consumer loyalty and branding as demand for these firms become inelastic

what are the price competition techniques

predatory pricing

limit pricing

what is predatory pricing

the practice of charging a very low price for a product with the intent of driving competitors out of business or out of a market

In the short run, it leads to them making a loss but not in the long-run when they raise their prices

What is limit pricing?

reducing the price of a good to just above average cost to deter the entry of new firms into the market. Prices are set at levels which are likely to make it unprofitable for potential entrants who might consider coming into the market

how would a monopolist react when there is threat to entry in its market making it contestable?

move form profit maximising point to AC=AR to just make normal profit