CMA FORMULAS

1/74

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

75 Terms

Liquidity

Short term, pay current liabilities

Net working capital

Current assets - current liabilities

Current ratio

Current assets / current liabilities

Low —> solvency problem

Quick ratio

Cash + marketable Securities + net receivables / current liabilities

No inventories

Cash ratio

Cash + marketable securities / current liabilities

Cash flow ratio

Cashflow from operations / current liabilities

Net working capital ratio

current assets - current liabilities / total assets

Solvency

Long term obligations

Capital structure (equity and debt)

Total debt to total capital ratio

Total debt / total capital

Low ratio

Debt to equity ratio

Total debt / stockholders equity

Low

Long term debt to equity ratio

Long term debt / stockholders equity

Low —> easier to raise new debt

Debt ratio / debt to total asset ratio

Total liabilities / total assets

Earnings coverage ratio

Generate earnings to service debt

Times interest earned ratio

EBIT / interest expense

Ability to pay interest on debt

Earnings to fixed charges ratio

Earnings before fixed charges and taxes / fixed charges

Cash flow to fixed charges ratio

Cash flow + fixed charges + tax payments / fixed charges

Leverage

Relative amount of fixed costs in a firms overall cost structure

Operating leverage

Arises from use of long lived assets

Degree of operating Leverage (single period)

Contribution margin / operating income or EBIT

Contribution margin = net sales - variable costs

Degree of operating leverage (%)

%delta in operating income or EBIT / %delta in sales

Financial leverage

Arises from use of high level of debt

High level —> more debt

DFL (single period)

EBIT / EBT

Interest as only fixed costst

DFL (%)

% delta in net income / %delta in EBIT

Gross profit margin percentage

Net sales - COGS / net sales

Should remain constant

Income statement

Profitability

Operating profit margin percentage

Operating income / net sales

After s&a expense

Income statement

Profitability

Net profit margin percentage

Net income / net sales

EBITDA margin percentage

EBITDA / net sales

Shows how company is performing if fixed costs are ignored

Overstates income

Return on assets (ROA)

Net income / average total assets

Average tot assets = current year + prior year / 2

How well management deploys assets to get profit

Return on equity

Net income / average total equity

Return per owner dollar invested

What is higher ROE OR ROA

ROE > ROA when ther are liabilities

Relationship ROE and ROA

ROA = ROE x (1- debt ratio)

Sustainable growth rate

ROE x ( 1 - dividend payout ratio)

Retention rate

Potential growth without borrowing more

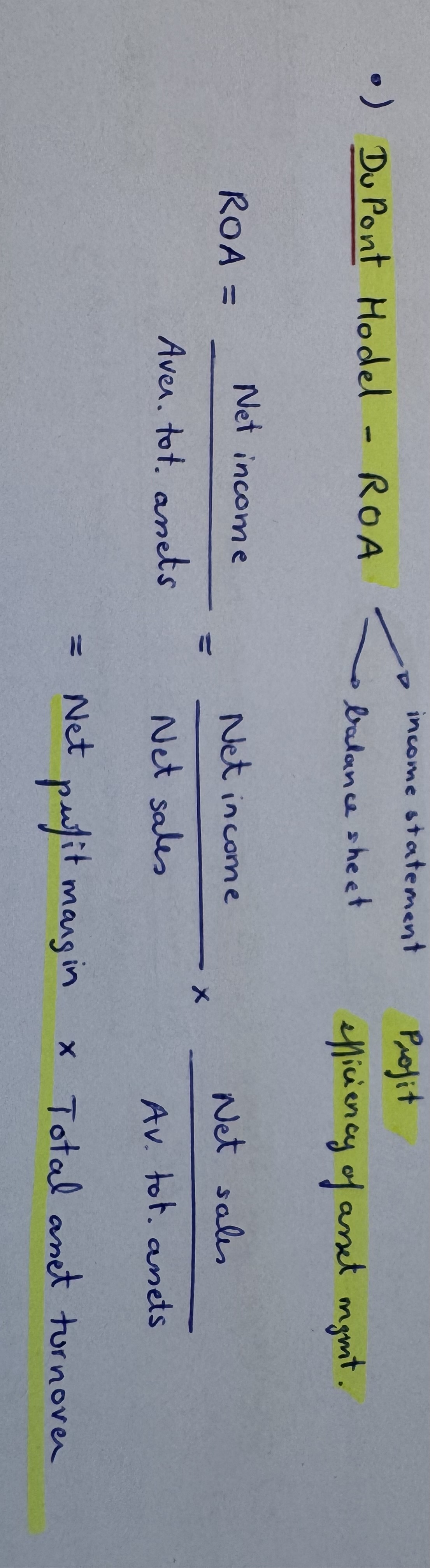

Du Pont Model ROA

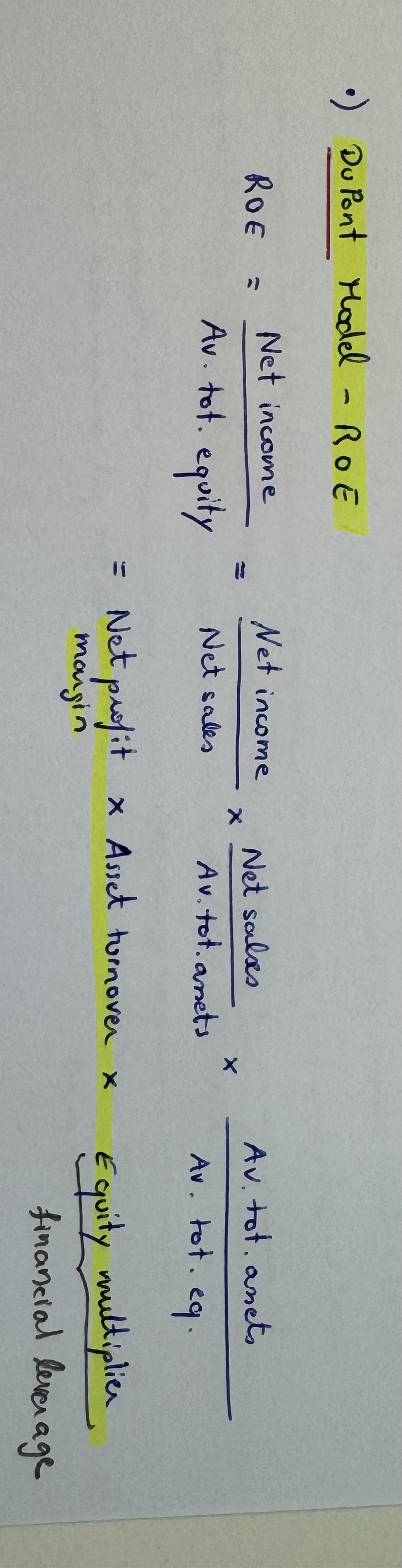

Du Pont ROE

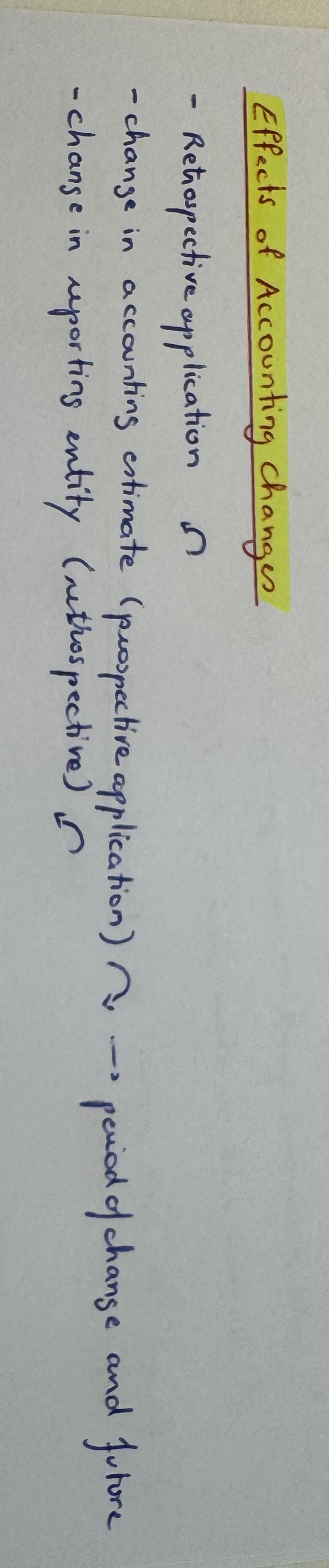

Accounting changes

Earnings per Share EPS basic

Net income available to common shareholders / average number of common stock

Net income available ––> net income - preferred dividend

Book value per share

Total stockholders equity - preferred equity / number of shares

P/E ratio

Market price / EPS

Market to book ratio (price book ratio)

Market price per share / book value per share

Price sales ratio

Market price per share / sales per share

Sales least manipulation

Earnings yield

Earnings per share / market price per share

Dividend payout ratio

Dividend per share / income available to common shareholders

Dividend yield

Dividend per share / market price per share

Shareholder return

(Ending stock price - beginning stock price + dividend) / beginning stock price

Speeding up cash collections —> annual benefit

(Daily cash receipts x days of reduced float) x opportunity cost of funds

Increased investment in receivables

Incremental variable costs x (incremental average collection period / 365)

Cost of change in credit terms

Increased investment in receivables x opportunity cost

Cost of carrying safety stock

Expected stockout cost + carrying cost

Activity ratios

How quickly acc receivables and inventory can be converted to cash

Accounts receivable turnover

Net credit sales / average acc receivable

Days sales outstanding in receivables / cash collection period

365 / acc receivable turnover

Inventory turnover

COGS / average inventory

Days sales in inventory

365 / inventory turnover

Accounts payable turnover

Purchases / average acc payable

Days purchases in acc payable

365 / acc payable turnover

Operating cycle

Days sales outstanding in receivables + days sales in inventory

Cash cycle

Operating cycle - days purchase in acc payable

Fixed asset turnover ratio

Net sales / average PPE

Total asset turnover ratio

Net sales / average total asset

Valuation of bonds

Forward premium or discount

Cross rate

DC per USD / FC per USD

Breakeven point

Revenue = expenses

BEP in units = fixed costs / unit contribution margin

BEP in dollar = fixed costs / contribution margin ratio

Contribution margin ratio

Total contribution margin / total sales

Unit contribution margin / sales per unit

Margin of safety

Excess of budgeted sales over breakeven sales

Margin of safety = planned sales - breakeven sales

Margin of safety ratio = margin of safety / planned sales

Target income in units

Fixed costs + target income / unit contribution margin

Multi product breakeven point

Total fixed costs / weighted average selling price - weighted average variable cost (cm)

weighetd average CMR for multi product

weighetd average CMR = weighted average UCM / weighted average unit selling price

Profit maximization

Marginal revenue = marginal cost

Keep or drop

Lost contribution margin vs fixed cost savings

Price elasticity of demand

Ed = percentage change in quantity demanded / percentage change in price

Midpoint formula

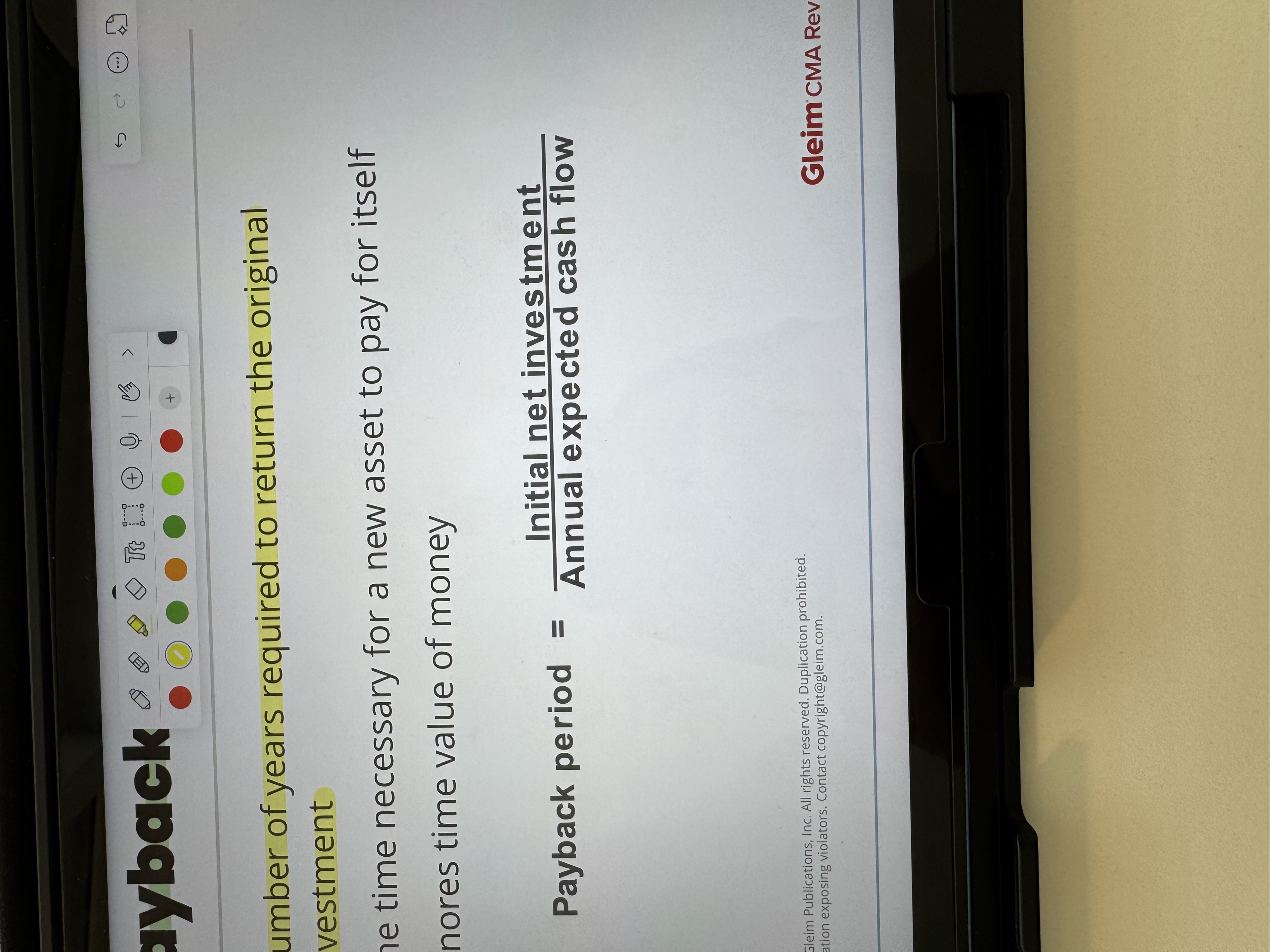

Payback period