Finance Int Final

1/71

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

72 Terms

Prepayment

The exporter will not ship the products until it has received payment from the importer. Payment is usually made in the form of an international wire transfer to the exporter’s bank account or a foreign bank draft. Most protection.

Letter of Credit

is a financial document issued by a bank guaranteeing payment to an exporter, provided that the conditions specified in the letter are met.

In the usual procedure, the exporter’s bank (also referred to as the “advising bank”) sends the shipping documents to the importer’s bank to verify that the products have been shipped. The importer benefits from the L/C because it does not have to make payment until the exporter has shipped the products, and because it may trust the exporter’s bank more than the exporter itself to verify shipment of the products.

L/C - Bill of Lading

A legal document issued by a carrier to acknowledge receipt of cargo for shipment. It serves as a shipment receipt and a document of title, outlining the terms and conditions of transportation.

Ocean Bill of Lading

A specific type of bill of lading used for shipping goods by sea, incorporating details about the cargo and shipping instructions. It acts as both a receipt for the goods and a contract between the shipper and the carrier.

Airway Bill

A document issued by an airline that serves as a receipt for the cargo and a contract for the carriage of goods by air. It includes details about the shipment and outlines the terms of transportation.

Irrevocable Letters of Credit

are financial instruments issued by a bank guaranteeing payment to a seller once specific conditions are met. They provide security to both buyers and sellers in international trade. Cannot be cancelled without exporter’s consent.

Commercial Invoice

A document provided by a seller to a buyer that outlines the goods or services sold, including quantities, prices, and terms of sale. It serves as a fundamental document in international trade for customs and payment processing.

Draft / Bill of Exchange

A written order from one party to another to pay a specified sum of money at a predetermined time. It is commonly used in international trade for securing payment between buyers and sellers.

Documentary collections

trade transactions handled on a draft basis.

Documents against payment

shipping documents that are released to the buyer once the buyer has paid for the draft.

Documents against acceptance

situation in which the buyer’s bank does not release shipping documents to the buyer until the buyer has accepted (signed) the draft.

Tenor

the time period allowed for payment or acceptance of a draft.

Trade Acceptance

a short-term financial instrument used in international trade where the buyer agrees to pay a draft at a future date, typically after receiving goods. It is accepted by the buyer's bank and assures the seller of payment once the draft matures.

Cosignment

a shipping arrangement where the seller sends goods to a buyer but retains ownership until sold, allowing the buyer to pay only once the goods are sold.

Open Account

a payment arrangement where goods are shipped and delivered before payment is due, typically used in trusted business relationships.

Impact of Credit Crisis on Payment Methods

The credit crisis significantly altered payment methods, leading to tighter credit conditions and increased reliance on cash and secured transactions. Businesses became more cautious, preferring payment methods that reduced risk, such as letters of credit or advance payments. High reliant on trust.

Supplier Credit

a short-term financing arrangement where a supplier allows a buyer to purchase goods or services on credit, delaying payment until a later date.

AR Financing

Accounts receivable financing, a method for businesses to borrow money against the amounts due from customers. If the importer fails to pay the exporter for any reason, the exporter is still responsible for repaying the bank.

Factoring

purchase of receivables of an exporter by a factor without recourse to the exporter.

Factor

firm specializing in collection of accounts receivable; exporters sometimes sell their accounts receivable to a factor at a discount.

Cross-Border Factoring

process in which the exporter’s factor contacts a correspondent factor in the importer’s country to assess the importer’s creditworthiness and handle the collection of the receivable.

Standby Letter of Credit

a guarantee issued by a bank on behalf of a client, ensuring payment to a beneficiary in the event that the client fails to fulfill contractual obligations.

Bankers Acceptances

short-term debt instruments issued by a firm that are guaranteed by a bank and used to finance international trade transactions.

The exporter does not need to worry about the credit risk of the importer and, therefore, can penetrate new foreign markets without concern about the credit risk of potential customers

The importer benefits from a banker’s acceptance by obtaining greater access to foreign markets when purchasing supplies and other products

all-in-rate

the total interest rate charged on a loan, including fees and additional costs.

Medium - Term Capital Goods Financing (Forfating)

is a financing method where a bank provides funds to an exporter against future receivables, allowing them to sell goods without waiting for payment from the importer.

The forfaiter (or factor) assumes responsibility for the collection of payment from the importer, the underlying credit risk, and the risk pertaining to the countries involved.

Countertrade

sale of goods to one country that is linked to the purchase or exchange of goods from that same country.

Barter

is the exchange of products between two parties without the use of any currency as a medium of exchange.

Compensation

arrangement in which the delivery of goods to a party is compensated for by buying back a certain amount of the product from that same party.

Counter Purchase

exchange of goods between two parties under two distinct contracts expressed in monetary terms.

Agencies that Help Trade

The Export-Import Bank of the United States

The Private Export Funding Corporation

The Overseas Private Investment Corporation

Export-import Bank

Today, its missions are to finance and facilitate the export of American products and services and to maintain the competitiveness of American companies in overseas markets.

Guarantee Program

The Working Capital Loan Guarantee Program encourages commercial banks to extend short-term export financing to eligible exporters by providing a comprehensive guarantee

The Medium- and Long-Term Guarantee Program encourages commercial lenders to finance the sale of U.S. capital equipment and services to approved importers.

Loan Program

Under the Direct Loan Program, the Ex-Im Bank offers fixed rate loans directly to importers to purchase U.S. capital equipment and services on a medium-term or long-term basis.

The Project Finance Loan Program allows banks, the Ex-Im Bank, or a combination of both to extend long-term financing for capital equipment and related services for major projects.

Bank Insurance

The most widely used is the Bank Letter of Credit Policy, which enables banks to confirm L/Cs issued by foreign banks supporting a purchase of U.S. exports

The Financial Institution Buyer Credit Insurance Policy is issued in the name of the bank.

Export Credit Insurance

The Small Business Policy provides enhanced coverage to new exporters and small businesses

The Multi-buyer Policy is used primarily by experienced exporters. It provides insurance coverage on short-term export sales to many different buyers

The Single-Buyer Policy allows an exporter to selectively insure certain short-term transactions to preapproved importers.

PEFCO

The Private Export Funding Corporation (PEFCO) is a private corporation owned by a consortium of commercial banks and industrial companies. In cooperation with the Ex-Im Bank, PEFCO provides medium- and long-term fixed rate financing to importers.

OPIC

The Overseas Private Investment Corporation (OPIC) was formed in 1971 as a self-sustaining federal agency responsible for insuring direct U.S. investments in foreign countries against the risks of currency inconvertibility, expropriation, and other political risks. Through the direct loan or guaranty program, OPIC will provide medium- to long-term financing to U.S. investors undertaking an overseas venture

Internal Short Term Financing

Before an MNC or subsidiary in need of funds searches for outside funding, it should check other subsidiaries’ cash flow positions to determine whether any internal funds are available.

Internal Control Over Funds

An MNC should have an internal system that constantly monitors the amount of short-term financing undertaken by all of its subsidiaries. This system may allow the MNC to readily recognize which subsidiaries have cash available in the same currency that another subsidiary needs to borrow

Short Term Notes

Euronotes. The interest rates on these notes are based on the London Interbank Offer Rate (LIBOR), the interest rate charged on interbank loans among European and other countries. Short-term notes typically have maturities of one, three, or six months.

Commercial Paper

debt securities issued by MNCs for short-term financing.

Bank Loans

Direct loans from banks, which are often used to maintain bank relationships, are another popular source of short-term funds for MNCs. If alternative sources of short-term funds become unavailable, MNCs may rely more heavily on direct loans from banks.

Motive for Finance w/ Foreign Currency

it may still consider borrowing a foreign currency if the interest rate on the currency is relatively low.The interest rates in many developing countries are usually higher than the interest rates in developed countries

Cost Savings From Finance

Although the interest rate is known before the loan period begins, the movement in the borrowed currency’s value over the life of the loan is uncertain. Thus, the effective financing rate from financing with a foreign currency is not known until the end of the loan period.

The preceding example shows how the effective financing rate is reduced if the currency depreciates over the loan period

Risk of Finance w/ Foregin Currency

Although an MNC can benefit from financing in a currency with a low interest rate that differs from the currency that it needs, the strategy could backfire if the currency that is borrowed substantially appreciates over the loan period.

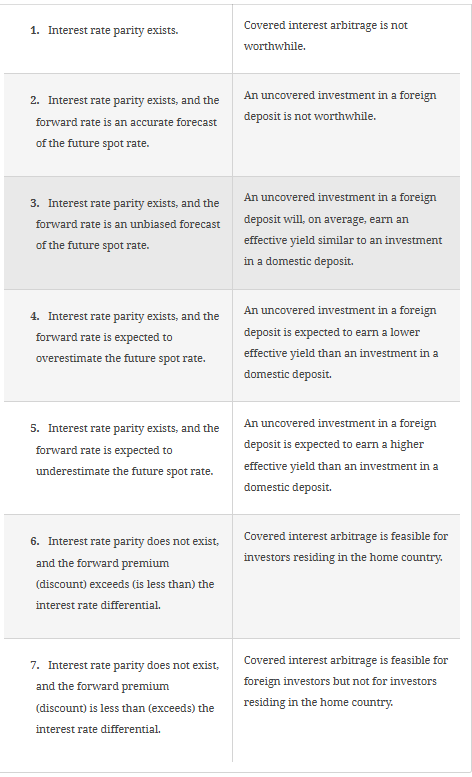

Interest Rate Partiy w/ Foreign Financing

In reality, the forward rate does not forecast the future spot rate with perfect accuracy. However, if it represents an unbiased forecast of the future spot rate, the forward rate premium potentially represents an unbiased forecast of the percentage change in the foreign currency over the life of a loan

Probability Distributions

Using the probability distribution of possible percentage changes in the currency’s value along with the currency’s interest rate, an MNC can determine the probability distribution of the possible effective financing rates for the currency. It can then compare this distribution to the known financing rate of the home currency so as to make its financing decision.

Financing w/ Portfolio of Currencies

Multinational corporations may be able to achieve lower financing costs without excessive risk by financing with a portfolio of foreign currencies instead of a single foreign currency, as demonstrated in the following example.

If the two currencies are not highly correlated, they are less likely to appreciate simultaneously to that extent. Thus, the chances that the portfolio’s effective financing rate will exceed the U.S. rate are reduced when the currencies included in the portfolio are not correlated.

cash management

optimization of cash flows and investment of excess cash.

centralized cash management

Instead, MNCs typically use centralized cash management to monitor and manage the parent–subsidiary and intersubsidiary cash flows

The centralized cash management division of an MNC cannot always accurately forecast cash flows of the parent or each subsidiary. It should, however, be ready to react whenever the parent or a subsidiary experiences a shortage of funds by determining whether any subsidiary has excess funds that can be transferred to cover the shortage and by facilitating that transfer.

4 ways of optimizing cash flows

Accelerating cash inflows

Minimizing currency conversion costs

Managing blocked funds

Managing intersubsidiary cash transfers

Lockboxes

post office boxes to which customers are instructed to send payment.

mail float

mailing time involved in sending payments by mail.

preauthorized payments

method of accelerating cash inflows by receiving authorization to charge a customer’s bank account.

netting

optimizing cash flows by reducing the administrative and transaction costs that result from currency conversion.

netting benefits

First, it reduces the number of cross-border transactions between subsidiaries, thereby reducing the overall administrative cost of such cash transfers. Second, because transactions occur less frequently, MNCs have less need for foreign exchange conversion, which in turn reduces their transaction costs associated with such conversions. Third, the netting process imposes tight control over information on transactions between subsidiaries.

bilateral netting system

netting method used for transactions between two units.

multi-lateral netting system

complex interchange for netting between a parent and several subsidiaries.

managing blocked funds

To deal with funds blockage, the MNC may instruct the subsidiary to set up a research and development division, which incurs costs and may potentially generate revenues for other subsidiaries.

Overall, most methods of managing blocked funds are intended to make efficient use of the funds by using them to cover expenses that are transferred to that country.

leading / lagging

Texas, Inc., has two foreign subsidiaries called Short Sub and Long Sub. Short Sub needs funds, whereas Long Sub has excess funds. If Long Sub purchases supplies from Short Sub, it can provide financing by paying for its supplies earlier than necessary. This technique is often called leading. Alternatively, if Long Sub sells supplies to Short Sub, it can provide financing by allowing Short Sub to delay its payments. This technique is called lagging.

invest excess cash

Multinational corporations typically invest in large deposits at commercial banks, but also purchase foreign Treasury securities and commercial paper.

benefit of investing

effective yield can have high int rate + appreciate dollar to get more value

risk of investing

if currency deprecation than the effective yield is less, could hedge

hedge investment on foreign currency

new yield formula is related to percentage difference between spot rate at initial investment and forward rate at which it sells

break - even point in investing

forward rate, if its accurate then the domestic = foreign yield

international fisher effect

Recall that the IFE suggests that the exchange rate of a foreign currency is expected to change by an amount reflecting the difference between its interest rate and the U.S. interest rate. The rationale behind this theory is that a high nominal interest rate reflects an expectation of high inflation, which could weaken the currency (according to purchasing power parity).

scenarios when investing excess cash

probability distribution of investing

aust interest rate = 7

rate | occurences

+4 | 70%

-5 | 30

(1.07) (1 + 0.04) - 1 = 0.1128

(1.07) ( 1 - 0.05) - 1 = 0.0165

E = 0.70(0.1128) + 0.30(0.0165) = 0.08391

invest in portfolio of countries

same formula (int rate) ( 1 ± percnt diff of spot rate) - 1

invest in two foreign currency

use the yield percent + the prob of it happening mutually of the two to get

a. comp of joint prob

b. comp of effective yield

dynamic hedging

applying a hedge when the currencies held are expected to depreciate and removing any hedge when the currencies held are expected to appreciate.