Market Failure 2-8-2.10 Microeconomcs

1/76

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

77 Terms

Markets are efficient because, when in equilibrium, they are

allocativelly efficient

When governments intervene in free markets (indirect taxes, subsidies, price controls), resources become misallocated and there

is a loss of total welfare

Market failure refers to the market’s inability to

allocate resources efficiently

markets themselves may not be

naturally efficient

both consumers and producers do not always act in a

rational or efficient way

government intervention may be necessary in a market to

maximize marginal social benefit (MSB)

government intervention can help improve

community surplus and allocative efficiency

an externality is

an effect on a third party resulting from consumption/production of a good or service

harmful effects are known as

negative externalities

beneficial effects are known as

positive externalities

marginal social cost (MSC)

refers to the cost to society of producing one additional unit of good

marginal private benefit (MPB)

refers to the cost to producers producing one additional unit of a good

marginal social benefit (MSB)

refers to the benefits to society from consuming one additional unit of a good

marginal private benefit (MPB)

refers to the benefits to consumers from consuming one additional unit of a good

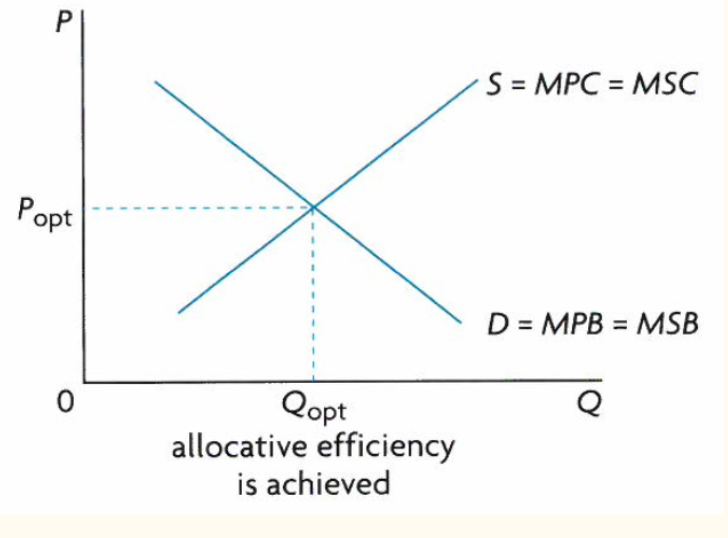

if no externalities exist,

then MSC=MSB and maximum community surplus exists (allocative efficiency)

this diagram displays

there are no externalities of production or consumption

when externalities do occur there are 4 types

Negative externalities of consumption

Negative externalities of production

Positive externalities of consumption

Positive externalities of production

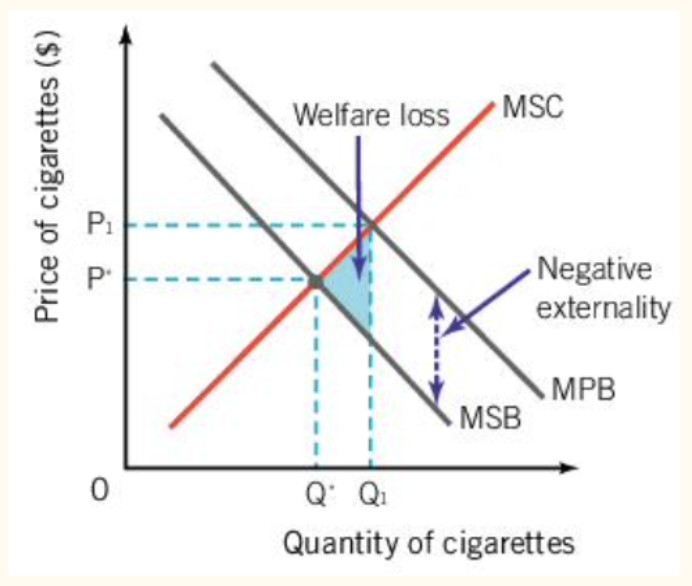

this is a

negative externality of consumption

negative externalities of consumption are when

an individual’s consumption adversly affects third parties (often through demerit goods)

examples of negative consumption externalities are

cigarette smoking (second hand smoke, use of healthcare to treat smoking related health issues)

alcohol consumption (drunk driving, domestic violence)

car driiing (car exhausts create pollution)

when MPB exceeds the MSB—individuals gain more benefits from consumption than society this is a

negative consumption externality

when the MPB curve lies to the right of the MSB curve on a negative consumption externality it creates

welfare loss

in negative consumption externalities, the social cost of individual consumption is higher than

the socially optimal level of consumption

welfare loss in real terms represents

The costs paid by/damage to society for individual consumption of the good or service

there are four ways negative externalities of consumption can be reduced or eliminated

Indirect taxes (affects MSC curve)

Legislation/regulation (may affect MSC or MPB curve)

Education/increasing awareness (affects MPB curve)

“Nudges” (HL ONLY; affects MPB curve)

Indirect taxes (affects MSC curve)

Taxes can raise revenue for the government and discourage consumption (remember, elasticity can affect efficacy of indirect taxes)

Indirect taxes are regressive (takes up a larger proportion of income from lower income individuals)

Higher prices and costs for consumers and producers; can create unemployment

Legislation/regulation (may affect MSC or MPB curve)

Laws may be passed to reduce consumption

Regulation may be difficult or costly to enforce

Banning may lead to parallel or black markets

Education/increasing awareness (affects MPB curve)

Advertising or public awareness campaigns can encourage reduced consumption of demerit goods

May be costly and efficacy may be questionable

“Nudges” (HL ONLY; affects MPB curve)

Strategies with the goal of encouraging reduced consumption voluntarily and without taking away the freedom to choose

Example: Cigarette packages plainly decorated, or decorated with shocking images of the effects of smoking

Negative Externalities of Production are when there is

production that adversely affects third parties

negative externalities of production are often associated with

common pool resources

examples of negative externalities of production are

energy production or manufacturing that causes enviromental damage (air/soil/water/pollution)

Overfishing

in a negative externality of production the MSC exceeds the MPC resulting in

producers gaining more benefit from production than society

in negative externalities of production, the MPC curve lies to

the right of the MSC curve and this creates welfare loss

with negative externalities of production society

bears the greater cost of production than the producer

common pool resources also known as “gifts of nature” have no

private ownership and way to regulate use of the resource

examples of common pool resources are

fish in the sea

trees in the forest

common pastureland

fresh water in aquifers or in rivers

overuse of common pool resources is based on

the tragedy of the commons

the tragedy of the commons is when the

Lack of ownership over the resources creates an incentive for potential users to exploit them to the fullest extent possible,

to extract as much benefit as possible before other users extract and exploit the resource

negative externalities of production can be reduced or eliminated by three ideas

Producer taxes (affects MPC curve)

Tradable Permits (affects MPC curve on NEP diagram)

Legislation and Regulation (“command and control” solutions)

Producer taxes (affects MPC curve)

Increases MPC of producers in order to reduce welfare loss and a more socially optimal level of production, but results in higher prices, lower quantity supplied, and increased unemployment

Example: Carbon taxes

Tradable Permits (affects MPC curve on NEP diagram)

Government sets number of permits and these are auctioned off

Some firms pollute more than others, so they must buy surplus permits from others

Creates incentive to reduce pollution because polluting more becomes more expensive, and polluting less allows them to sell surplus permits, thereby making a profit

Legislation and Regulation (“command and control” solutions)

Examples include laws, bans, regulatory standards & controls, government management, international agreements, privatization, subsidies, etc.

Can affect MPC or MSB curves

the advantage of tradeable permits is it

Creates a strong incentive to pollute less and a clear price and allowable quantity of pollution

this disadvantages of tradeable permits are

Free market price of permits may be too low to create an incentive to pollute less

Costly and difficult to monitor

the advantages of legislation and regulation is it

Can reduce negative production externalities and reduce pollution, conserve wildlife, make the population healthier, etc.

the disadvantages of legislations and regulations are

Can be costly and difficult to enforce

Can raise prices and harm industry competitiveness

Often subject to special interest lobbying (regulatory capture)

Can lead to over-regulation and inefficiency

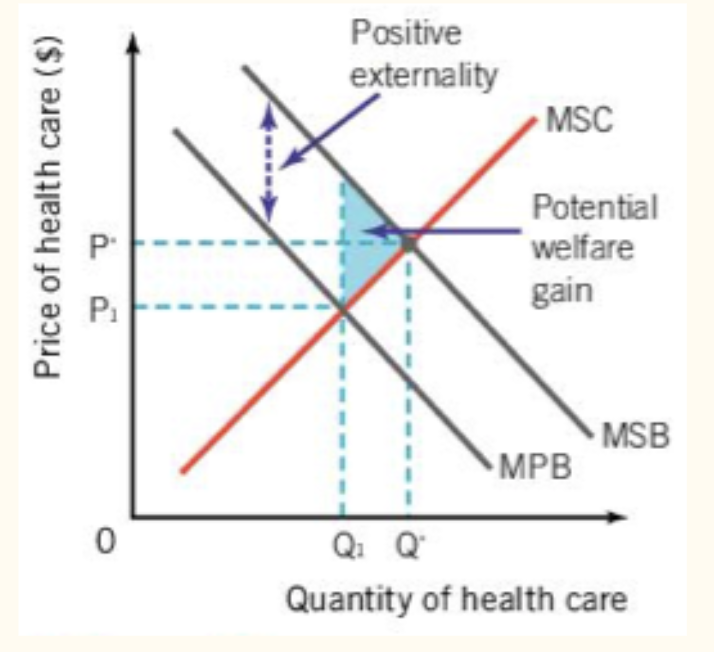

this is a§

positive externality of consumption

positive externalities of consumption are when

consumption has spillover benefit on third parties (often society as a whole)

in positive externalities of consumption the MSB

exceeds the MPB—society gains more benefit from consumption than the individual

in a positive consumption externality the MSB curve lies

to the right of the MPB curve and creates potential welfare

positive externalities of consumption are often associated with

merit goods

examples of positive externalities

Education

Public Heath Care

positive externalities of consumption can occur through 3 ways

Subsidies (affects MSC curve)

Advertising/public awareness campaigns (affects MPB curve)

Legislation (affects MPB curve)

Subsidies (affects MSC curve)

Subsidies can be granted to producers to encourage production of a beneficial good or service, or to consumers to encourage consumption

E.g., Educational grants for students or educational institutions

Subsidies always come with an opportunity cost!

Advertising/public awareness campaigns (affects MPB curve)

Encourage public consumption of goods or services (e.g., public health campaigns)

Legislation (affects MPB curve)

Often includes mandatory consumption (e.g., compulsory education)

positive externalities of production are when

production has a spillover benefit on third parties (often society as a whole)

in positive externalities of production the MPC

exceeds the MSC society gains more benefit from production than the producer

in positive externalities of production the MPC curve

lies to the left of the MSC curve, the producer pays a higher cost, and society reaps the benefit

the examples of positive externalities of production are

Fruit orchards (increased honey production)

The Nabisco cookie factory in Fair Lawn, NJ

Open source software

On-the-job training

Ecotourism

positive externalities of production can occur from two ways

Subsidies (affects MPC curve)

Direct provision by government (affects MPC curve)

Example: Government can provide work training programs

for positive externality graphs the welfare gain triangle points to the

right

for negative externality graphs the welfare gain triangle points to the

left

production externality diagrams have two

cost/supply curves

consumption externality diagrams gave two

demand/benefit curves

if a market produces none of a good it is considered a

public good

public goods are

Non-rivalrous (enjoyment by one consumer does not diminish other consumers’ enjoyment of the same good)

Non-excludable (it is impossible to exclude individuals from enjoying its benefits)

Subject to the free-rider problem because of these characteristics--people will gain benefit from it without paying for it, and that is why the good is not provided by the free market and hence a type of market failure (no profit can be made!)

examples of common public goods are

Public parks & trash disposal

Lighthouses & street lights

Fire & police services

there are no purely public except for maybe

public national defense

there are some goods provided by the government that have public good characteristics such as

roads

legal systems

education

whether a good is more private or public depends on the degree of

excludability and rivalry in consumption

public goods are provided through

Government (direct) provision using taxpayer money

Public goods such as emergency services, national defense, and infrastructure (sewer systems, street lighting, public parks, etc.)

Public-private partnerships

Governments provide funds to create the good, then a private company manages it

Examples include railroads, toll roads, power infrastructure, etc.

“Quasi-public goods” have some but not all characteristics of public goods

E.g., a park bench is free to use for everyone, but it is partly rivalrous and excludable (only so many people can fit on the bench)

Public parks/spaces, roads, and highways may be considered quasi-public goods

no participants in the market have

perfect information or perfect knowledge

The most common example of imperfect information is

asymmetric information--when one party has more or better information than others

Example: Mr. Winters sells Mr. Helke a “lemon” (a car that is likely to break). Mr. Winters knows the car is faulty, but Mr. Helke doesn’t. Mr Helke thinks the car is a good deal and buys it, only to have it break the next week.

Adverse Selection is when

One party in an economic transaction has better information than the other, resulting in poor choices

often occurs before the economic transaction is made

Example: Health insurance customers being dishonest about their health leads to higher insurance premiums for all buyers of health insurance; as a result, fewer people purchase health insurance (which can result in negative externalities on society)

Moral Hazard Occurs when

people have an incentive to engage in riskier behavior because they know that the negative consequences of their risks are more likely to be borne by others

Often occurs after an economic transaction has been made

Example: I buy full insurance on a rental car, and then drive carelessly; any damage I incur will be covered by the insurance I purchased